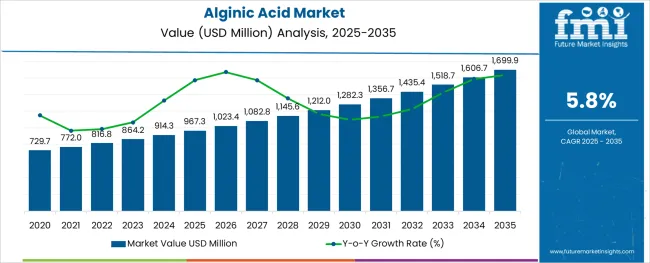

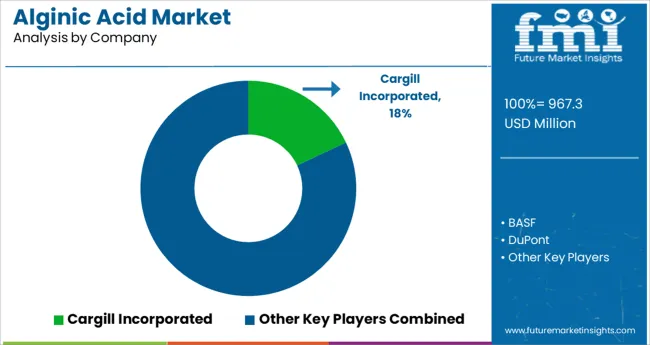

The Alginic Acid Market is estimated to be valued at USD 967.3 million in 2025 and is projected to reach USD 1699.9 million by 2035, registering a compound annual growth rate (CAGR) of 5.8% over the forecast period.

The alginic acid market is undergoing consistent growth, propelled by rising demand from food processing, pharmaceutical formulations, and cosmetic applications. A growing focus on natural and sustainable ingredients in manufacturing processes has positioned alginic acid as a preferred biopolymer across industries.

The market is further supported by its diverse functional benefits, including water retention, gelling, and stabilizing properties, which make it indispensable in high-performance formulations. Increased regulatory acceptance of alginates as safe additives and the push towards cleaner labeling in food and personal care products have reinforced their adoption.

Ongoing innovation in extraction technologies and the utilization of algae as a renewable resource are paving the way for cost-effective production and expanded applications, ensuring sustained market expansion in the coming years.

The market is segmented by Salts, End-user Industry, Functionality, and Sales Channel and region. By Salts, the market is divided into Sodium Alginate, Potassium Alginate, Ammonium Alginate, Calcium Alginate, Propylene Glycol Alginate, Magnesium, and Lithium. In terms of End-user Industry, the market is classified into Food Industry, Pharmaceutical, Cosmetics, Textile and Paper Industry, Leisure Industry, Industries and Technical, Air fresher, Fertilizer, Art and Crafts, and Other.

Based on Functionality, the market is segmented into Thickening agent, Moisture Retainer, Adhesive, A gelling agent, Foaming and emulsifying agent, Stabilizer, and Coating. By Sales Channel, the market is divided into Offline and Online. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

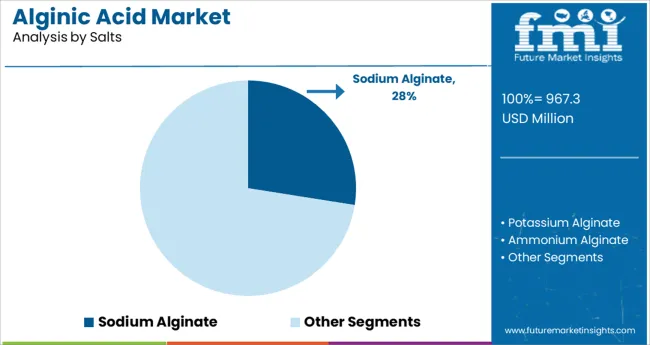

When segmented by salts, sodium alginate is expected to command 27.5% of the market revenue in 2025, marking it as the leading subsegment in this category. This leadership has been driven by its superior solubility, ease of incorporation into formulations, and versatility in a wide range of applications.

Its ability to form stable gels and maintain viscosity under varying conditions has made it highly sought after in both food and pharmaceutical sectors. Manufacturers have prioritized sodium alginate due to its consistent performance, cost-effectiveness, and regulatory acceptance, which have collectively strengthened its position.

The segment’s prominence has also been enhanced by its adaptability to evolving consumer preferences for plant-derived and sustainable ingredients, reinforcing its market share.

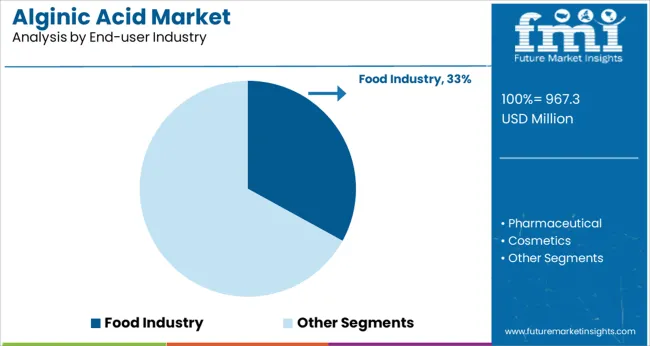

Segmented by end user industry, the food industry is projected to hold 33.0% of the market revenue in 2025, positioning it as the most prominent sector. This dominance has been shaped by the industry’s increasing reliance on alginic acid and its derivatives to deliver desirable textures, stabilize emulsions, and improve shelf life of processed foods.

As consumer demand for clean label and natural additives has intensified, the food sector has responded by integrating alginates into bakery, dairy, and confectionery products. Enhanced production efficiency and compliance with food safety standards have further encouraged widespread use.

The segment’s leadership has also been supported by product differentiation strategies where alginates contribute to premium quality and innovation, securing their role in modern food formulations.

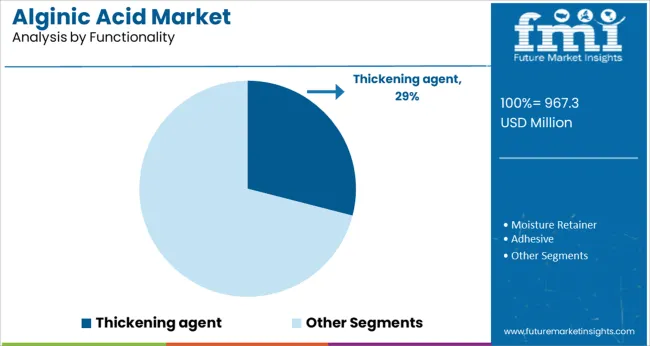

When analyzed by functionality, thickening agents are forecast to account for 29.0% of the market revenue in 2025, establishing themselves as the dominant functional category. This preeminence has been underpinned by the growing need for consistent texture and viscosity in a wide array of end products.

Alginic acid’s natural origin and high efficiency in creating uniform, stable thickness without altering taste or color have solidified its appeal. The demand for thickeners in both edible and topical applications has expanded, with manufacturers leveraging its rheological properties to meet performance and regulatory requirements.

The functionality’s leading share has also been reinforced by the ability to deliver cost savings through lower dosages and its compatibility with other ingredients, securing its position as an indispensable component in formulation strategies.

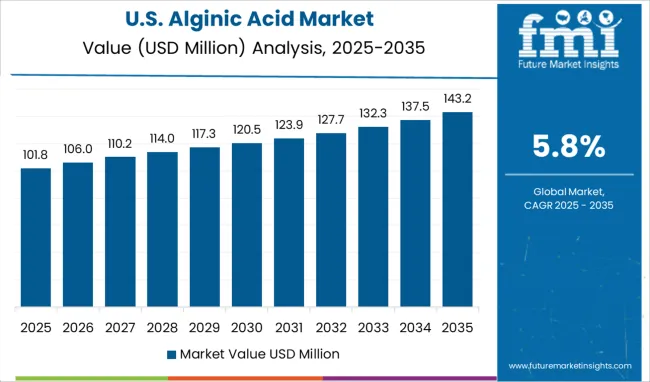

In the Historical outlook of the Alginic Acid market, the value increased from USD 729.7 million in 2020 to USD 914.3 million in 2024. The CAGR (2020 to 2024) is observed to be 3.5%.

The food industry is the main driver of the global alginic acid market. The need for processed foods, meat, and dairy products in the food and beverage industries is one of the many drivers driving the alginic acid market. Alginic acid and its salts have a wide range of medical uses, including treating illnesses, eradicating infections, and dressing wounds.

Additionally, alginic acid and its salts' ability to absorb water make them popular on the market for use in dehydrated goods like paper and textiles. The widespread industrial and commercial application of alginic acid draws potential market participants to the substance and its salts, which help the market expansion.

For the Future projection of the Alginic Acid market, the value increased from USD 967.3 million in 2025 to USD 1,435.4 million in 2035. The CAGR (2025 to 2035) is estimated to be 5.8%.

The Europe Alginic Acid market is growing rapidly and is expected to continue to grow in the coming years. The market is driven by the increasing demand for natural and organic products, as well as the rising health consciousness of consumers. The market is also being supported by the growing number of healthcare facilities and the availability of raw materials.

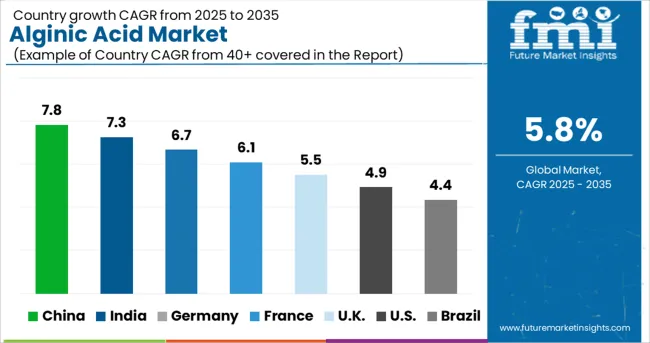

Germany contributes 29.9% to Alginic Acid market and United Kingdom CAGR for the forecast period is 3.8%.

The Asia Pacific region is the largest market for alginates, followed by North America and Europe. The region is expected to grow at the highest CAGR during the forecast period. The growth of the Asia Pacific market is driven by the increasing demand from end-use industries such as food & beverage, pharmaceuticals, and cosmetics in countries such as China and India.

Japan contribution to Alginic Acid market is 10.8% of the total market share, India and China are market drivers in the Asia Pacific and their latest CAGR in Alginic Acid market is 6.3% and 4.6% respectively.

The Latin American region is expected to be one of the fastest-growing markets for alginic acid. The Latin American market for alginic acid is driven by the growing food and beverage industry in the region.

In recent years, the North American alginic acid market has seen significant growth. This is due to the growing demand for natural and organic products, as well as the increase in health consciousness among consumers. The market is expected to continue to grow at a steady pace over the next few years.

The USA contributes 33.4% of total revenue for Alginic Acid Market.

The market is driven by factors such as the growing demand for processed food and beverages, rising health consciousness among consumers, and the increasing use of alginates in the pharmaceutical industry.

From the Oceania region, Australia is contributing 2.2% of the total revenue of Alginic Acid market.

The salts of alginic acid are used to segment the market. Alginate made of sodium, calcium, and potassium are divided up. Sodium alginate, having the chemical formula NaC6H7O6, is the sodium salt of alginic acid. It's taken out of brown seaweed. The chemical formula of potassium alginate salt, which is derived from seaweed, is KC6H7O6.

Calcium is added to sodium alginate salt in order to create calcium alginate. Chemically, it is C12H14CaO12. Magnesium, lithium, and propylene glycol alginate are further divisions.

Alginic acid is utilized in the textile and paper industries to waterproof and fireproof materials. It serves as a thickening agent in drinks and jellies. Alginic acid is utilized in technical and industrial settings for casting, welding rods, textile screen printing, dyes, and paints. It is frequently utilized in face masks in the leisure industry.

It functions as preserves, frozen seafood, and meat binder in cuisine and beverages. Alginic acid is utilized in the arts and crafts industry for taxidermy, fine art castings, and craft castings.

The market for alginic acid is highly competitive, with a large number of manufacturers vying for market share. The leading manufacturers are BASF, DuPont, and Cargill, which together account for more than 50% of the global market.

The competitive landscape is driven by factors such as the increasing use of alginates in the food and beverage industry and the growing demand for alginates from the pharmaceutical industry. The leading players in the market are constantly innovating and introducing new products to stay ahead of their competitors.

| Attribute | Details |

|---|---|

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | USD million for Value and Units for Volume |

| Key Regions Covered |

North America; Latin America; Europe; Asia Pacific; Middle East and Africa (MEA); RoW |

| Key Countries Covered |

The USA, Canada, Mexico, Germany, The United Kingdom, France, Russia, Brazil, Argentina, Japan, Australia, China, India |

| Key Segments Covered |

Salts, End-user Industry, Functionality, Sales Channel, Region |

| Key Companies Profiled |

BASF; DuPont; Cargill; SNAP Natural & Alginate Products; KIMICA Corporation; Protan AS; IRO Alginate; Qingdao Group of Companies; AlgaTech; Marine Ingredients; Lianyungang huanyu seaweed Co. Ltd. |

| Report Coverage | DROT Analysis, Market Forecast, Company Share Analysis, Market Dynamics and Challenges, Competitive Landscape, and Strategic Growth Initiatives |

| Customization & Pricing | Available upon Request |

The global alginic acid market is estimated to be valued at USD 967.3 USD million in 2025.

It is projected to reach USD 1,699.9 USD million by 2035.

The market is expected to grow at a 5.8% CAGR between 2025 and 2035.

The key product types are sodium alginate, potassium alginate, ammonium alginate, calcium alginate, propylene glycol alginate, magnesium and lithium.

food industry segment is expected to dominate with a 33.0% industry share in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Acid Resistant Pipe Market Forecast and Outlook 2025 to 2035

Acid Coil Cleaner Market Size and Share Forecast Outlook 2025 to 2035

Acid Filling and Leveling Machine Market Size and Share Forecast Outlook 2025 to 2035

Acid Chlorides Market Size and Share Forecast Outlook 2025 to 2035

Acid-Sensitive APIs Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Acidified Whey Protein Market Analysis - Size, Share & Trends 2025 to 2035

Acid Dyes Market Growth - Trends & Forecast 2025 to 2035

Acidity Regulator Market Growth - Trends & Forecast 2025 to 2035

Acid Proof Lining Market Trends 2025 to 2035

Acid Citrate Dextrose Tube Market Trends – Growth & Industry Outlook 2024-2034

Acid Orange Market

Antacids Market Analysis – Size, Trends & Forecast 2025 to 2035

Lead Acid Battery Market Size and Share Forecast Outlook 2025 to 2035

Lead Acid Battery Recycling Market Size and Share Forecast Outlook 2025 to 2035

Feed Acidifier Market Analysis Size Share and Forecast Outlook 2025 to 2035

Food Acidulants Market Growth - Key Trends, Size & Forecast 2024 to 2034

Boric Acid Market Forecast and Outlook 2025 to 2035

Folic Acid Market Size and Share Forecast Outlook 2025 to 2035

Oleic Acid Market Size and Share Forecast Outlook 2025 to 2035

Dimer Acid-based (DABa) Polyamide Resin Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA