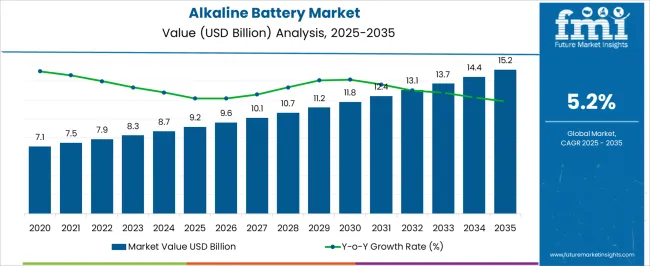

The alkaline battery market is estimated to be valued at USD 9.2 billion in 2025 and is projected to reach USD 15.2 billion by 2035, registering a compound annual growth rate (CAGR) of 5.2% over the forecast period.

From 2020 to 2024, the market progresses from USD 7.1 billion to USD 8.7 billion, highlighting steady growth as disposable alkaline batteries remain widely used in consumer electronics, toys, remote controls, and household devices. Annual increments such as USD 7.5 billion in 2021, USD 7.9 billion in 2022, and USD 8.3 billion in 2023 underscore consistent demand driven by affordability, long shelf life, and compatibility with low- to medium-drain applications. Entering 2025, the market stands at USD 9.2 billion, reflecting the continued reliance on primary battery formats despite the rising penetration of rechargeables. Between 2026 and 2030, the market advances from USD 9.6 billion to USD 12.4 billion, contributing nearly 40% of the total projected increase.

Growth during this stage is fueled by expanding demand in emerging economies, retail penetration in rural markets, and improvements in battery chemistry that enhance capacity and reduce leakage risks. From 2031 to 2035, the market climbs from USD 13.1 billion to USD 15.2 billion, adding about 31% of gains. This period reflects stable replacement demand, growing usage in backup systems, and consistent sales through e-commerce channels. Overall, the alkaline battery market demonstrates resilient growth, supported by consumer preference, reliability, and expanding global distribution networks.

| Metric | Value |

|---|---|

| Alkaline Battery Market Estimated Value in (2025 E) | USD 9.2 billion |

| Alkaline Battery Market Forecast Value in (2035 F) | USD 15.2 billion |

| Forecast CAGR (2025 to 2035) | 5.2% |

The alkaline battery market holds a crucial position within the global primary battery ecosystem, representing nearly 35–37% share of the broader battery segment due to its widespread use, long shelf life, and reliability in consumer and industrial devices. Within the household electronics category, alkaline batteries account for around 28–30% share, supported by their use in remote controls, flashlights, cameras, and portable audio devices. In the industrial and commercial equipment segment, their share stands at approximately 18–20%, driven by applications in sensors, medical instruments, and safety devices where consistent power output is critical. Within the portable energy storage and emergency power domain, alkaline batteries capture close to 12–14% share, owing to the preference for cost-effective, easily replaceable power solutions in off-grid and backup scenarios.

Growth is being fueled by rising global electrification of low-power devices, expansion of e-commerce channels for consumer batteries, and steady replacement cycles in both mature and emerging markets. Leading manufacturers are focusing on performance optimization, longer shelf life, and environmentally safer disposal methods to enhance market acceptance. While competition from lithium and rechargeable alternatives presents challenges, the simplicity, availability, and affordability of alkaline chemistry ensure continued relevance. Collaborations between OEMs, retailers, and distributors are further strengthening supply chain reach, positioning alkaline batteries as a dominant choice in everyday portable power solutions worldwide.

The alkaline battery market is experiencing robust growth driven by widespread use in portable electronic devices, increased urbanization, and strong consumer preference for long-lasting, disposable power sources. High energy density, affordable pricing, and consistent voltage output make alkaline batteries a top choice across multiple end-use verticals.

Advancements in zinc and manganese dioxide chemistry have enhanced battery performance, shelf life, and safety profiles. Moreover, improved distribution infrastructure and the growing demand for reliable, non-rechargeable power in remote and emergency applications are further supporting market expansion.

With rising environmental awareness, manufacturers are also introducing mercury-free and recyclable variants to align with sustainability goals, making the market both dynamic and competitive.

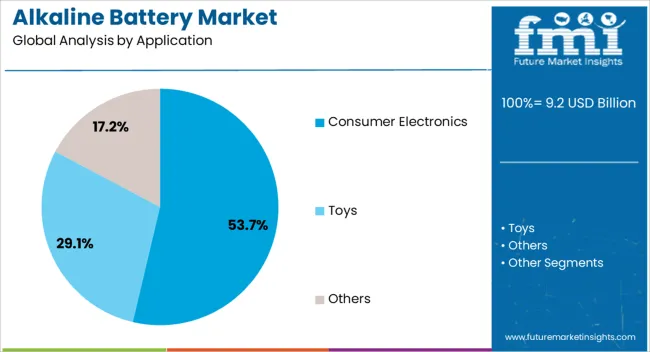

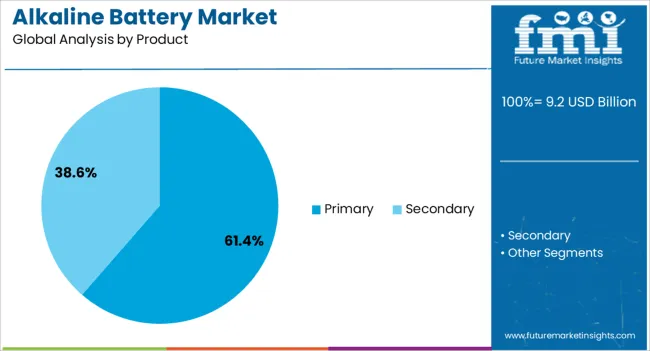

The alkaline battery market is segmented by application, product, and geographic regions. By application, alkaline battery market is divided into consumer electronics, toys, and others. In terms of product, alkaline battery market is classified into primary and secondary. Regionally, the alkaline battery industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Consumer electronics is projected to dominate the application landscape of the alkaline battery market in 2025, accounting for 53.70% of the total share. This leadership stems from the growing global reliance on battery-operated devices such as remote controls, wireless peripherals, toys, and portable audio equipment. Alkaline batteries offer a convenient power source for these devices due to their affordability and availability in standardized sizes. Rising disposable incomes and technological innovation in consumer gadgets continue to spur replacement demand, contributing to high-volume sales. The long shelf life and ease of storage of alkaline batteries further reinforce their suitability for everyday household electronics, securing their position in the top application segment.

Primary batteries are expected to lead the market by product type in 2025, holding a 61.40% share. Their dominance is driven by their single-use nature, which aligns well with applications requiring intermittent but consistent power output. Primary alkaline batteries are especially favored in settings where recharging is impractical, such as in emergency kits, wall clocks, and low-drain devices. The simplicity of use, zero maintenance, and superior leak resistance offered by modern primary alkaline variants also contribute to their popularity. Despite the rise of rechargeable alternatives, the reliability and cost-effectiveness of primary alkaline batteries ensure sustained demand across both household and industrial use cases.

Alkaline batteries remain crucial across household, industrial, and portable power segments due to reliability, long shelf life, and affordability. Market growth is driven by performance optimization, broad distribution networks, and strategic partnerships ensuring continued adoption worldwide.

Alkaline batteries are increasingly utilized in household electronics such as remote controls, flashlights, toys, and cameras, where stable power output and long shelf life are critical. Growing reliance on portable, low-power devices has prompted manufacturers to optimize capacity, longevity, and safety features. Seasonal peaks, such as during holidays or festive periods, boost demand as consumer gifting and toy usage rises. Regional adoption patterns are influenced by access to retail and e-commerce channels, with online sales providing consistent supply and convenience. Product differentiation through brand recognition, packaging, and localized marketing strategies strengthens competitive positioning. Manufacturers continue to innovate in electrode materials and electrolyte formulations to enhance energy retention and reduce leakage risks.

Alkaline batteries hold notable share in industrial and commercial equipment such as sensors, medical instruments, and small-scale safety devices, where reliable and predictable energy delivery is crucial. The demand is supported by sectors requiring maintenance-free, long-lasting batteries with minimal downtime. Equipment manufacturers often standardize alkaline chemistries due to their proven performance, availability, and low operating costs. Rising adoption in remote monitoring, security systems, and handheld measurement tools further supports market expansion. Custom packaging solutions and bulk supply agreements with B2B clients ensure consistent revenue streams for manufacturers. Continuous improvements in energy density, operational temperature tolerance, and regulatory compliance strengthen adoption across industrial segments while maintaining affordability.

Alkaline batteries are widely used in portable energy and emergency power applications due to their ease of replacement, affordability, and long shelf life. Increasing reliance on off-grid solutions, camping gear, and battery-operated emergency equipment has boosted sales globally. Demand is reinforced by healthcare devices, small lighting solutions, and backup power systems where rechargeable alternatives are impractical. Manufacturers leverage innovations in packaging and labeling to extend shelf life and minimize leakage, enhancing user trust and repeat usage. Distribution networks, both retail and online, play a pivotal role in ensuring market penetration in remote and urban areas. Brand loyalty and consistent performance further support adoption, ensuring sustained presence in the portable power segment.

Key players in the alkaline battery market focus on brand positioning, product differentiation, and global distribution networks to maintain leadership. Dollar sales are supported by economies of scale, while share is strengthened through marketing, R&D in improved chemistries, and supply chain efficiency. Strategic partnerships with OEMs, retailers, and e-commerce platforms ensure broader reach and consistent availability. Product portfolios are diversified by offering various sizes, voltages, and performance ratings tailored to consumer, industrial, and portable power needs. Regional expansion into emerging markets leverages affordability and reliability. Continuous improvements in manufacturing processes, quality control, and environmental compliance reinforce competitiveness and maintain revenue growth in a crowded marketplace.

| Country | CAGR |

|---|---|

| China | 7.0% |

| India | 6.5% |

| Germany | 6.0% |

| France | 5.5% |

| UK | 4.9% |

| USA | 4.4% |

| Brazil | 3.9% |

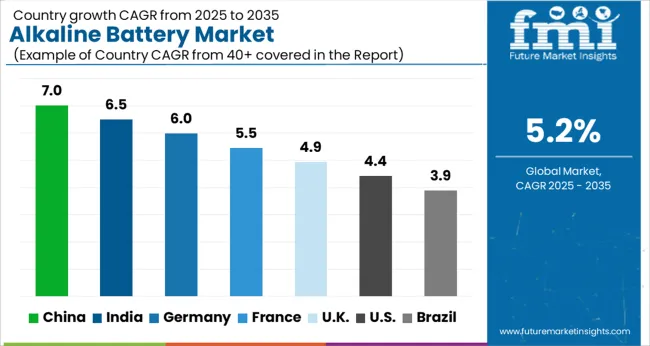

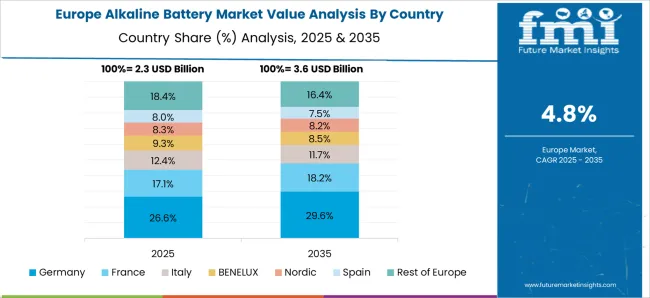

The alkaline battery market is projected to grow globally at a CAGR of 5.2% from 2025 to 2035, driven by increasing demand across household electronics, industrial equipment, and portable power applications. China leads with a CAGR of 7.0%, supported by high consumption of consumer electronics, expanding e-commerce penetration, and adoption in industrial devices requiring reliable power. India follows at 6.5%, fueled by growing demand for toys, remote controls, healthcare devices, and small-scale renewable systems. France posts 5.5%, with growth shaped by regulatory compliance in electronics, steady consumer adoption, and replacement cycles in household devices. The United Kingdom achieves 4.9%, reflecting moderate uptake in retail and emergency power applications. The United States registers 4.4%, characterized by a mature market with slower growth, driven primarily by industrial, healthcare, and portable electronics demand. The regional outlook indicates Asia-Pacific as the fastest-growing segment due to large population and rising device penetration, Europe as a regulation- and compliance-driven market, and North America as a mature region where incremental adoption sustains steady dollar sales and share growth.

China is projected to record a CAGR of 7.0% for 2025–2035, slightly above the 6.3% observed between 2020–2024, outperforming the global average of 5.2%. Early growth was driven by rising adoption of household electronics, increasing industrial automation, and widespread use in toys, remote controls, and portable devices. The stronger increase in 2025–2035 reflects expanded e-commerce penetration, government support for domestic electronics manufacturing, and higher replacement cycles in consumer and industrial products. Manufacturers have scaled up production and distribution networks, while urban and semi-urban households continue to adopt battery-powered devices. China’s market is expected to maintain leadership due to large-scale device penetration and steady industrial demand.

India is forecasted to achieve a CAGR of 6.5% for 2025–2035, up from 5.9% during 2020–2024, exceeding the global 5.2% benchmark. Early growth was limited to metro-based regions, concentrated on toys, flashlights, and small electronic devices. The higher 2025–2035 CAGR reflects expanded rural electrification, increasing adoption of medical devices, and rising consumer awareness of backup power needs. Local manufacturers are expanding production, while imports supplement demand for specialized high-capacity alkaline cells. Government incentives for small-scale energy storage and portable electronics also contributed to the faster growth. India is positioned to be a major growth hub for alkaline batteries due to rising device penetration and affordability of domestic products.

France is expected to record a CAGR of 5.5% for 2025–2035, slightly higher than 5.0% observed between 2020–2024, on par with European standards. Initial growth was supported by replacement cycles in consumer electronics, toys, and small household appliances. The rise in the later period is fueled by regulatory compliance in electronics, steady consumer replacement demand, and gradual adoption in industrial monitoring devices. European manufacturers have focused on producing reliable, long-lasting alkaline batteries that meet safety and environmental standards. Retail and e-commerce channels have expanded distribution, ensuring availability across urban and suburban households. France remains a mature market, with incremental growth driven by replacement and industrial applications.

The United Kingdom is projected to achieve a CAGR of 4.9% for 2025–2035, up from 4.5% during 2020–2024, below China and India but slightly above the global average of 5.2%. Early growth between 2020–2024 was driven by household electronics, emergency lighting, and personal care devices, constrained by a mature consumer base. The higher CAGR from 2025–2035 reflects increased adoption in healthcare devices, industrial sensors, and portable instrumentation. Domestic and imported batteries have supported steady dollar sales, while recycling and environmental compliance initiatives have improved supply reliability. The UK market demonstrates moderate growth, driven primarily by replacement demand and selective industrial applications.

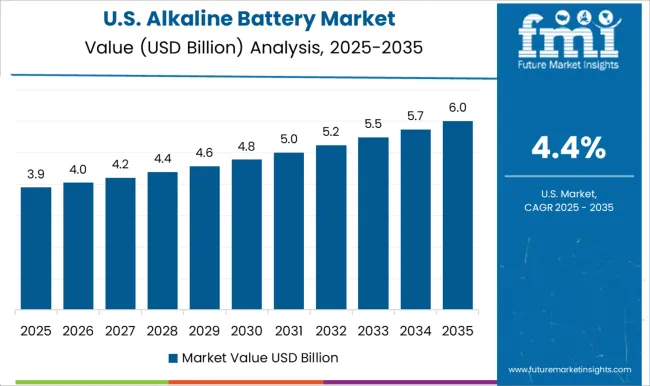

The United States is expected to post a CAGR of 4.4% for 2025–2035, following a 4.0% CAGR between 2020–2024, reflecting a mature market with slower growth. Early demand was concentrated in toys, remote controls, and portable electronics, while industrial applications supported incremental volume. Growth in the later period is fueled by medical devices, backup power solutions, and increased replacement cycles for high-drain electronics. Retail expansion and e-commerce availability have sustained dollar sales, while domestic and international manufacturers continue to compete for market share. The US market remains mature, with steady but gradual growth driven by replacement demand and specialized high-performance batteries.

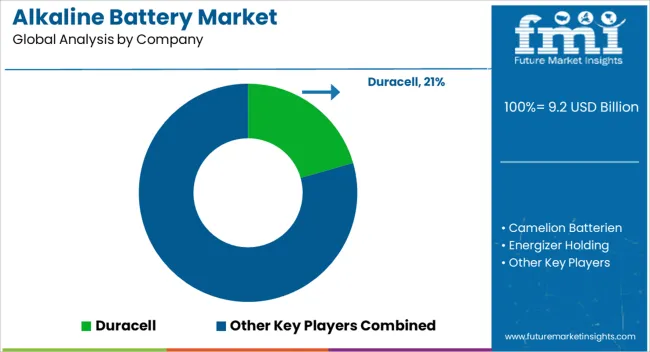

The alkaline battery market is shaped by leading global manufacturers, regional producers, and specialty technology providers including Duracell, Camelion Batterien, Energizer Holding, Eveready Industries, FDK Corporation, GPB International Limited, Maxell Holdings, Panasonic Corporation, Toshiba International, Urban Electric Power, VARTA Consumer Batteries, and Zhejiang Mustang Battery. These companies compete on product reliability, energy density, cost efficiency, and distribution reach across consumer electronics, industrial tools, and medical devices. Duracell maintains a dominant position through brand recognition, extensive retail presence, and high-performance battery offerings. Energizer Holding leverages a diversified product portfolio and global distribution network to capture both household and commercial segments. Camelion Batterien and VARTA Consumer Batteries emphasize Europe-focused strategies with innovative packaging, long shelf-life products, and compliance with environmental regulations. Panasonic, Maxell, and Toshiba International bring advanced electrochemical expertise, catering to premium consumer and industrial applications requiring consistent energy output.

Eveready Industries and GPB International Limited focus on emerging markets with affordable solutions and wide availability. Urban Electric Power targets niche applications including high-capacity and rechargeable alkaline solutions, while Zhejiang Mustang Battery expands production for cost-competitive domestic and export markets. Competition is shaped by investments in product innovation, regional expansion, brand loyalty, and strategic partnerships with OEMs and distributors. Companies also prioritize dollar sales growth, market share expansion, and enhanced consumer awareness through marketing campaigns. Future competitiveness will hinge on balancing cost, energy performance, compliance with safety regulations, and meeting growing demand in portable electronics, industrial tools, and emergency power applications.

| Item | Value |

|---|---|

| Quantitative Units | USD 9.2 billion |

| Application | Consumer Electronics, Toys, and Others |

| Product | Primary and Secondary |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Duracell, Camelion Batterien, Energizer Holding, Eveready Industries, FDK Corporation, GPB International Limited, Maxell Holdings, Panasonic Corporation, Toshiba International, Urban Electric Power, VARTA Consumer Batteries, and Zhejiang Mustang Battery |

| Additional Attributes | Dollar sales by type and region, share by application and geography, consumer adoption trends, pricing dynamics, distribution channels, regulatory compliance, emerging markets potential, competitive landscape, production capacity, and raw material sourcing. |

The global alkaline battery market is estimated to be valued at USD 9.2 billion in 2025.

The market size for the alkaline battery market is projected to reach USD 15.2 billion by 2035.

The alkaline battery market is expected to grow at a 5.2% CAGR between 2025 and 2035.

The key product types in alkaline battery market are consumer electronics, toys and others.

In terms of product, primary segment to command 61.4% share in the alkaline battery market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Battery Operated Light Market Forecast and Outlook 2025 to 2035

Battery Voltage Recorder Market Size and Share Forecast Outlook 2025 to 2035

Battery Resistance Tester Market Size and Share Forecast Outlook 2025 to 2035

Battery Technology Market Size and Share Forecast Outlook 2025 to 2035

Battery Electric Vehicle (BEV) Market Size and Share Forecast Outlook 2025 to 2035

Battery Separator Paper Market Size and Share Forecast Outlook 2025 to 2035

Battery Cyclers Market Size and Share Forecast Outlook 2025 to 2035

Battery Voltage Supervisor Market Size and Share Forecast Outlook 2025 to 2035

Battery Platforms Market Analysis Size and Share Forecast Outlook 2025 to 2035

Battery Management System Market Report – Growth & Forecast 2025-2035

Battery Binders Market Size and Share Forecast Outlook 2025 to 2035

Battery Materials Recycling Market Size and Share Forecast Outlook 2025 to 2035

Battery Packaging Material Market Size and Share Forecast Outlook 2025 to 2035

Battery Energy Storage System Industry Analysis by Battery Type, Connection Type, Ownership, Energy Capacity, Storage System, Application, and Region through 2025 to 2035

Battery Materials Market: Growth, Trends, and Future Opportunities

Battery Electrolytes Market Analysis & Forecast by Type, End-Use, and Region through 2035

Battery Testing Equipment Market Growth – Trends & Forecast 2025 to 2035

Battery Swapping Charging Infrastructure Market Trends and Forecast 2025 to 2035

Battery Leasing Service Market Analysis & Forecast by Business Model, Battery Type, Vehicle Type, and Region Through 2025 to 2035

Battery-Free Sensors Market Insights - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA