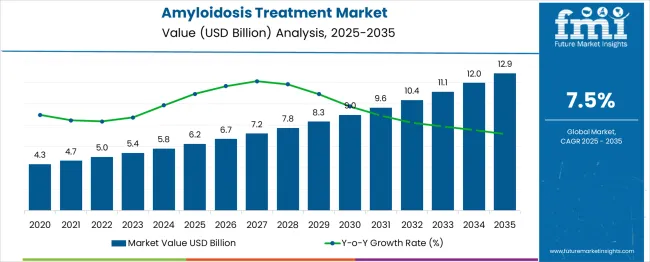

The treatment market is expected to rise from USD 6.2 billion in 2025 to USD 12.9 billion in 2035, reflecting a CAGR of 7.5%. Sensitivity analysis shows that market growth depends heavily on the pace of diagnostic advancements, patient awareness, and approval timelines for novel therapies. Any delays in drug development could reduce projected gains between 2027 and 2030, when revenues are expected to climb from USD 6.7 billion to USD 9.0 billion. Risk factors include high treatment costs, stringent regulatory pathways, and reimbursement uncertainties, which could significantly impact the anticipated surge from USD 12.0 billion to USD 12.9 billion by 2035.

| Item | Value |

|---|---|

| Market Value (2025) | USD 6.2 billion |

| Market Forecast Value (2035) | USD 12.9 billion |

| Market Forecast CAGR | 7.5% |

A ratio and proportion analysis of the Amyloidosis treatment market reveals a progressive expansion pattern, showing how revenue scales relative to base years. In 2025, the market is expected to reach USD 6.2 billion from USD 4.3 billion in 2020, marking about 44% growth in just five years. By 2030, the market is projected at USD 9 billion, which is nearly 110% higher than the 2020 level. The ratio of 2030 to 2025 values is around 1.45, indicating accelerating growth momentum. This rise shows increasing acceptance of therapies and wider patient coverage, strengthening revenue concentration in the mid-term phase.

From 2030 to 2035, growth becomes more pronounced as market size expands from USD 9.0 billion to USD 12.9 billion, translating to a 43% surge within five years. The ratio of 2035 to 2020 stands close to 3, showing that the market will have tripled in size over 15 years. Yearly proportional gains also increase, with increments of about USD 0.5 to 0.7 billion during 2025–2029, then nearly USD 1 billion annually from 2030 onwards.

Market expansion is being supported by the increasing recognition of amyloidosis as a complex multi-system disorder that requires specialized treatment approaches and multidisciplinary care coordination. Modern healthcare systems are developing comprehensive amyloidosis programs that combine advanced diagnostic capabilities with targeted therapeutic interventions. The growing understanding of disease pathophysiology and the development of specific biomarkers are enabling earlier diagnosis and more effective treatment strategies that improve patient survival and quality of life.

The advancing therapeutic landscape and the emergence of breakthrough treatments, including gene silencing therapies, immunotherapies, and organ-specific interventions, are driving substantial market growth. Regulatory agencies are providing expedited review pathways for amyloidosis treatments, encouraging pharmaceutical investment and accelerating drug development timelines. Additionally, the growing patient advocacy efforts and increased healthcare provider education are improving disease awareness and treatment access, particularly for rare amyloidosis subtypes that were previously underdiagnosed and undertreated.

The market is segmented by treatment outlook, end use outlook, and region. By treatment outlook, the market is divided into chemotherapy, immunosuppressive drugs, transplantation, supportive care, surgery, and others. Based on end use outlook, the market is categorized into hospitals and clinics, ambulatory surgical centers, home care settings, and others. Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and Middle East & Africa.

The chemotherapy segment is projected to account for 27% of the amyloidosis treatment market in 2025, reinforcing its position as a primary therapeutic approach. Chemotherapy continues to serve as the frontline intervention for managing AL amyloidosis, which remains the most prevalent form of systemic amyloidosis. Regimens incorporating agents such as melphalan, bortezomib, and dexamethasone demonstrate consistent efficacy in reducing abnormal plasma cell activity and halting amyloid protein deposition. The segment benefits from well-established treatment frameworks, decades of clinical application, and strong physician confidence in its ability to stabilize disease progression and improve patient survival outcomes across varied clinical presentations.

The hospitals and clinics segment is expected to account for 49% of amyloidosis treatment delivery in 2025, emphasizing their central role in managing this complex condition. Treatment of amyloidosis requires multidisciplinary care involving hematologists, cardiologists, nephrologists, and supportive care specialists, which is best delivered in advanced healthcare settings. Hospitals offer integrated services including chemotherapy infusion, stem cell transplantation preparation, cardiac monitoring, and renal support therapies. The segment benefits from the concentration of amyloidosis expertise in specialized tertiary centers and the necessity of continuous monitoring to manage treatment-related complications and disease progression effectively.

The amyloidosis treatment market is advancing rapidly due to improved disease understanding and expanding therapeutic options. However, the market faces challenges including high treatment costs, limited treatment access in developing regions, and complexity of disease management requiring specialized expertise. Diagnostic delays and treatment complications continue to influence patient outcomes and healthcare delivery patterns while driving demand for improved therapeutic approaches.

The growing advancement in gene silencing technologies is enabling targeted suppression of amyloidogenic protein production at the source, representing a paradigm shift from symptom management to disease modification. RNA interference therapies and antisense oligonucleotides provide unprecedented opportunities to reduce amyloid precursor protein synthesis while preserving normal cellular function. These approaches are particularly promising for hereditary amyloidosis variants where genetic targets are well-defined and therapeutic intervention can prevent disease progression.

Modern amyloidosis management is evolving toward comprehensive care models that integrate cardiology, nephrology, neurology, and hematology expertise in specialized treatment centers. These multidisciplinary approaches enable coordinated care planning, optimized treatment sequencing, and comprehensive monitoring that addresses the multi-system nature of amyloidosis. Advanced treatment centers also facilitate access to clinical trials and novel therapeutic options while providing specialized expertise in managing complex cases and treatment complications.

| Countries | CAGR (2025-2035) |

|---|---|

| China | 10.1% |

| India | 9.4% |

| Germany | 8.6% |

| France | 7.9% |

| United Kingdom | 7.1% |

| United States | 6.4% |

| Brazil | 5.6% |

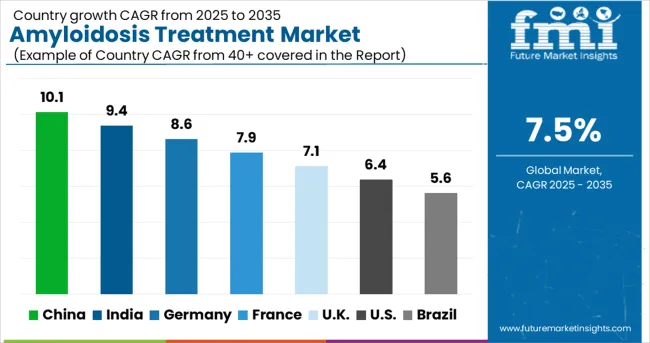

The amyloidosis treatment market is experiencing robust growth globally, with China leading at a 10.1% CAGR through 2035, driven by increasing disease awareness, expanding healthcare infrastructure, and growing access to advanced therapeutic options. India follows at 9.4%, supported by rising healthcare investment and improving diagnostic capabilities. Germany records 8.6% growth, emphasizing specialized treatment centers and comprehensive care programs. France shows 7.9% expansion, focusing on research excellence and therapeutic innovation. The UK demonstrates 7.1% growth, driven by NHS specialized services and clinical research programs. The USA maintains 6.4% growth with established treatment infrastructure, while Brazil achieves 5.6% expansion through healthcare system development and increasing disease recognition.

The report covers an in-depth analysis of 40+ countries top-performing countries are highlighted below.

Amyloidosis treatment in China is projected to exhibit the highest growth rate with a CAGR of 10.1% through 2035, driven by rapidly expanding healthcare infrastructure and increasing recognition of amyloidosis as a treatable condition requiring specialized medical intervention. The country's growing investment in rare disease programs and specialty healthcare services is creating advanced treatment capabilities for complex conditions including amyloidosis. Government healthcare initiatives and medical insurance expansion are improving treatment accessibility and affordability for patients with rare diseases. Rising physician awareness and improving diagnostic capabilities are leading to increased case identification and treatment initiation. The expanding network of tertiary medical centers and specialized hematology departments is building comprehensive amyloidosis treatment expertise.

Revenue from amyloidosis treatment in India is expanding at a CAGR of 9.4%, supported by increasing healthcare investment and growing awareness of rare disease management among medical professionals and healthcare institutions. The country's expanding middle class and improving healthcare access are creating opportunities for comprehensive amyloidosis diagnosis and treatment programs. Government initiatives promoting rare disease recognition and treatment access are facilitating development of specialized care capabilities. Rising medical education standards and international collaboration programs are building local expertise in complex disease management including amyloidosis. The growing pharmaceutical industry and clinical research participation are improving access to innovative treatments and therapeutic options.

Demand for amyloidosis treatment in Germany is projected to grow at a CAGR of 8.6%, supported by advanced healthcare infrastructure and comprehensive specialized treatment centers that provide world-class amyloidosis care and research capabilities. The German healthcare system's emphasis on quality and precision is creating sophisticated amyloidosis management programs that integrate cutting-edge diagnostic techniques with personalized therapeutic approaches. The country's leadership in medical research and clinical trial participation is contributing to the development of breakthrough treatments and access to innovative therapeutic options. Professional medical training and continuing education programs are maintaining high standards of expertise in amyloidosis across diverse healthcare settings. Specialized treatment center development is creating comprehensive amyloidosis care capabilities through multidisciplinary team coordination and advanced diagnostic technologies.

Demand for amyloidosis treatment in France is expanding at a CAGR of 7.9%, driven by research excellence and strategic emphasis on therapeutic innovation that positions the country as a leader in amyloidosis treatment development. French medical research institutions and pharmaceutical companies are developing breakthrough therapeutic approaches including gene therapy and immunotherapy applications for amyloidosis treatment. The country's comprehensive healthcare system and specialized rare disease programs are ensuring broad access to advanced amyloidosis treatments and clinical trial participation. Professional medical expertise and clinical research capabilities are contributing to treatment protocol development and outcome improvement initiatives. France's commitment to personalized medicine and precision healthcare is driving adoption of targeted therapeutic approaches that address specific amyloidosis subtypes. International collaboration programs and research partnerships are facilitating access to cutting-edge treatments and therapeutic development opportunities.

Demand for amyloidosis treatment in the United Kingdom is projected to grow at a CAGR of 7.1%, supported by NHS specialized commissioning services and comprehensive clinical research programs that provide equitable access to advanced amyloidosis treatments. The British healthcare system focuses on evidence-based medicine and clinical effectiveness, which is driving the adoption of proven therapeutic approaches while facilitating access to innovative treatments through clinical trial participation. The country's leadership in medical research and pharmaceutical development is contributing to breakthrough treatment options and therapeutic innovation. Professional medical training and specialist certification programs are maintaining high standards of amyloidosis expertise across NHS trusts and private healthcare providers.

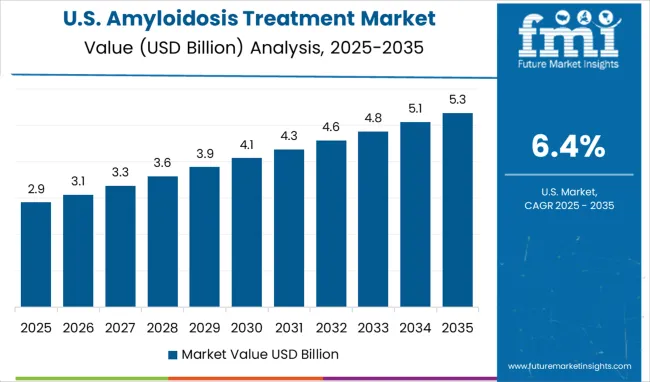

Demand for amyloidosis treatment in the United States is expanding at a CAGR of 6.4%, driven by advanced healthcare infrastructure and comprehensive treatment capabilities that provide access to cutting-edge therapeutic options and specialized care programs. American leadership in pharmaceutical development and clinical research is creating breakthrough treatment opportunities and facilitating rapid access to innovative therapies through expedited regulatory pathways. The country's extensive network of specialized medical centers and amyloidosis treatment programs are providing comprehensive care that addresses the complex multi-system nature of the disease. Advanced diagnostic capabilities and precision medicine approaches are enabling personalized treatment strategies that optimize outcomes for diverse patient populations. Professional medical expertise and continuing education programs are maintaining high standards of amyloidosis care across diverse healthcare settings. Strategic research funding and pharmaceutical investment are supporting continued treatment innovation and therapeutic development.

Revenue from amyloidosis treatment in Brazil is growing at a CAGR of 5.6%, driven by healthcare system modernization and increasing recognition of the importance of rare disease management among medical professionals and healthcare administrators. The country's expanding healthcare infrastructure and growing medical education capabilities are creating opportunities for amyloidosis diagnosis and treatment program development. Government initiatives promoting rare disease awareness and treatment access are facilitating the establishment of specialized care capabilities in major medical centers. Rising healthcare investment and international collaboration programs are improving access to advanced diagnostic techniques and therapeutic options. The growing pharmaceutical market and clinical research participation are enhancing availability of innovative treatments and clinical trial opportunities

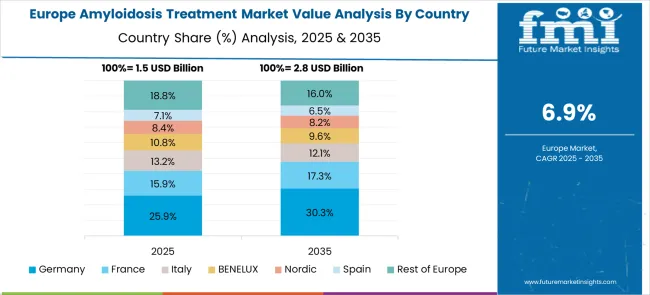

The Amyloidosis Treatment market in Europe is projected to grow from USD 1.8 billion in 2025 to USD 3.6 billion by 2035, registering a CAGR of 7.2% over the forecast period. Germany is expected to maintain its leadership with a 25.4% share in 2025, supported by advanced healthcare infrastructure and specialized amyloidosis treatment centers. France holds 23.1% market share, followed by the UK at 20.9%, Italy at 13.8%, and Spain at 9.2%. Nordic countries contribute 4.9% to the regional market, while BENELUX accounts for 2.4%. The Rest of Europe region represents 0.3% of the market, driven by emerging specialized care programs in Eastern European countries.

Companies are investing in novel therapeutic development, clinical trial programs, patient access initiatives, and comprehensive care solutions to deliver superior treatment outcomes that address the complex needs of amyloidosis patients. Strategic partnerships, research collaboration, and regulatory engagement are central to advancing treatment options and expanding market access in this specialized rare disease therapeutic area.

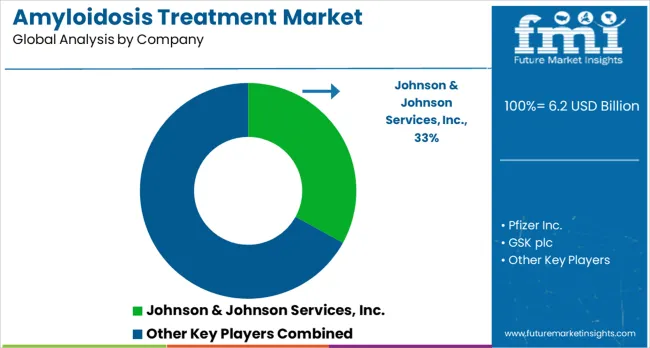

Johnson & Johnson Services Inc., USA-based, offers comprehensive amyloidosis treatment solutions with emphasis on innovative therapeutic development, clinical research programs, and patient access initiatives. Pfizer Inc., USA, provides advanced pharmaceutical treatments with focus on precision medicine approaches and personalized therapy development. GSK plc, UK, delivers specialized treatment options with emphasis on rare disease expertise and comprehensive patient support programs. Takeda Pharmaceutical Company Limited, Japan, offers innovative therapeutic solutions with focus on breakthrough treatment development and global market access.

Amgen Inc., USA, provides biotechnology-based treatments with emphasis on targeted therapy approaches and clinical research excellence. Bristol-Myers Squibb Company, USA, delivers comprehensive pharmaceutical solutions with focus on immunotherapy and precision medicine applications. Novartis AG, Switzerland, F. Hoffmann-La Roche Ltd., Switzerland, and Merck KGaA, Germany, offer specialized treatment platforms with emphasis on therapeutic innovation and patient outcomes improvement. Sanofi, France, and Alnylam Pharmaceuticals Inc., USA, provide advanced therapeutic solutions including gene therapy and RNA-targeted approaches that represent the cutting edge of amyloidosis treatment development.

| Item | Value |

|---|---|

| Quantitative Units | USD 6.2 billion |

| Treatment Outlook | Chemotherapy, Immunosuppressive Drugs, Transplantation, Supportive Care, Surgery, Others |

| End Use Outlook | Hospitals & Clinics, Ambulatory Surgical Centers, Home Care Settings, Others |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Germany, India, China, United Kingdom, Japan, Brazil, France |

| Key Companies Profiled | Johnson & Johnson Services Inc., Pfizer Inc., GSK plc, Takeda Pharmaceuticals, Amgen, Bristol-Myers Squibb, Novartis AG, F. Hoffmann-La Roche Ltd., Merck KGaA, Sanofi, Alnylam Pharmaceuticals Inc. |

| Additional Attributes | Revenue analysis by treatment type and end use segments, regional prevalence patterns across major healthcare markets, competitive positioning with established pharmaceutical companies and specialized biotechnology firms, healthcare provider preferences for different treatment protocols and care delivery models, integration with precision medicine and personalized therapy approaches, innovations in gene therapy and RNA-targeted treatment development, and adoption of multidisciplinary care models and specialized treatment center programs for improved patient outcomes and quality of life. |

North America:

Europe:

East Asia:

South Asia & Pacific:

Latin America:

Middle East & Africa:

The global amyloidosis treatment market is estimated to be valued at USD 6.2 billion in 2025.

The market size for the amyloidosis treatment market is projected to reach USD 12.9 billion by 2035.

The amyloidosis treatment market is expected to grow at a 7.5% CAGR between 2025 and 2035.

The key product types in amyloidosis treatment market are chemotherapy, immunosuppressive drugs, transplantation, supportive care, surgery and others.

In terms of end use outlook , hospitals & clinics segment to command 49.4% share in the amyloidosis treatment market in 2025.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA