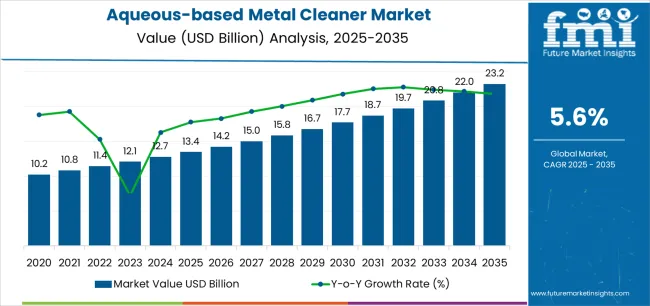

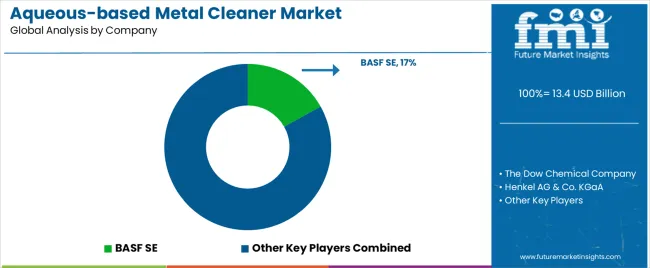

The Aqueous-based Metal Cleaner Market is estimated to be valued at USD 13.4 billion in 2025 and is projected to reach USD 23.2 billion by 2035, registering a compound annual growth rate (CAGR) of 5.6% over the forecast period.

The aqueous-based metal cleaner market is expanding steadily, supported by the global transition toward environmentally friendly cleaning technologies and stricter industrial emission regulations. These cleaners, which rely on water-based formulations rather than solvent-based compounds, are gaining traction due to their non-flammable and low-toxicity properties.

Demand growth is reinforced by their increasing use in precision cleaning, component degreasing, and pre-treatment applications across manufacturing industries. Market participants are focusing on formulating products that balance high cleaning efficiency with corrosion protection and material compatibility.

The adoption of automated cleaning systems and ultrasonic technology has further improved process consistency and operational safety. With regulatory pressure encouraging the replacement of hazardous solvents, the aqueous-based metal cleaner market is projected to experience sustained expansion across industrial applications.

| Metric | Value |

|---|---|

| Aqueous-based Metal Cleaner Market Estimated Value in (2025 E) | USD 13.4 billion |

| Aqueous-based Metal Cleaner Market Forecast Value in (2035 F) | USD 23.2 billion |

| Forecast CAGR (2025 to 2035) | 5.6% |

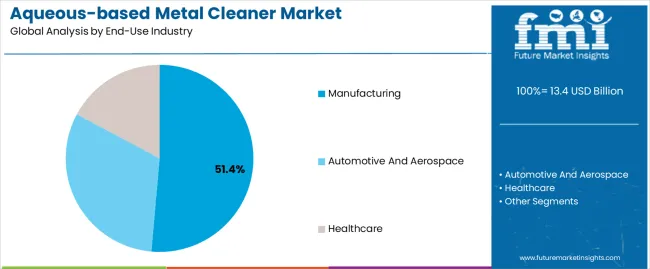

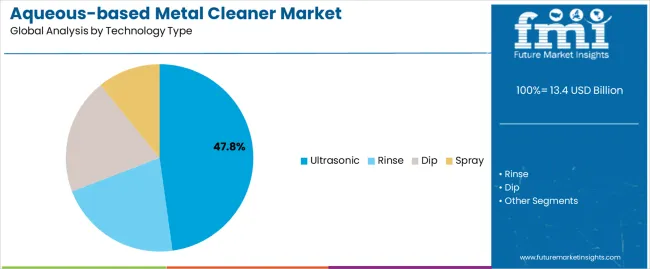

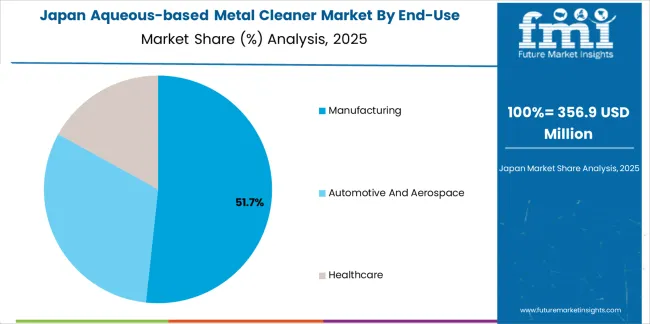

The market is segmented by End-Use Industry and Technology Type and region. By End-Use Industry, the market is divided into Manufacturing, Automotive And Aerospace, and Healthcare. In terms of Technology Type, the market is classified into Ultrasonic, Rinse, Dip, and Spray. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The manufacturing segment leads the end-use industry category with approximately 51.4% share, driven by widespread application in machinery maintenance, automotive part cleaning, and metal surface preparation. The shift toward water-based cleaning systems is supported by compliance requirements in industrial environments emphasizing worker safety and environmental sustainability.

Manufacturers benefit from reduced disposal costs, improved workplace air quality, and enhanced process automation. The segment’s growth is reinforced by expanding production capacity in automotive, aerospace, and electronics industries where precision and contamination control are critical.

With industrial modernization and sustainable practices becoming standard, the manufacturing segment is expected to remain dominant in the foreseeable future.

The ultrasonic segment holds approximately 47.8% share in the technology type category, driven by its superior cleaning efficiency and compatibility with aqueous formulations. Ultrasonic technology employs high-frequency sound waves to generate microscopic bubbles that dislodge contaminants, offering deep cleaning even in complex geometries.

This non-abrasive method reduces manual intervention while improving consistency and throughput. The technology’s ability to clean delicate components without surface damage has made it a preferred choice in high-precision industries such as electronics and automotive manufacturing.

With advancements in energy efficiency and automation integration, ultrasonic cleaning systems are expected to remain integral to aqueous-based metal cleaning operations.

The market is anticipated to surpass a global valuation of USD 23.20 billion by the year 2035, expanding at a 5.90% CAGR. While the market is expected to experience remarkable growth, several restraining factors could adversely affect its development:

| Attributes | Details |

|---|---|

| Top End-use Industry | Manufacturing |

| CAGR (2025 to 2035) | 5.70% |

Depending on the end-users, the aqueous-based metal cleaner market is bifurcated into automotive and aerospace, manufacturing, and healthcare. The manufacturing segment is anticipated to grow at a 5.70% CAGR through 2035.

| Attributes | Details |

|---|---|

| Top Technology Type | Ultrasonic |

| CAGR (2025 to 2035) | 5.50% |

The aqueous-based metal cleaner market is categorized by technology type into ultrasonic, rinse, dip, and spray. The ultrasonic segment dominates the market and is anticipated to grow at a CAGR of 5.50% through 2035.

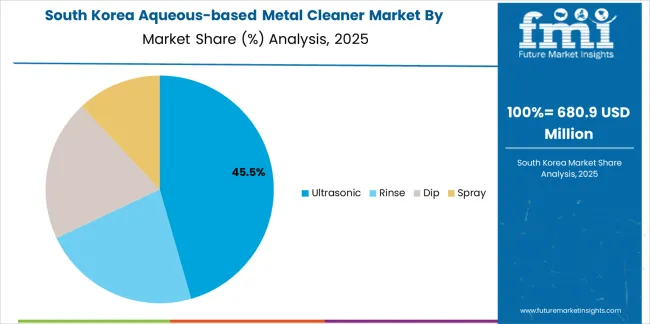

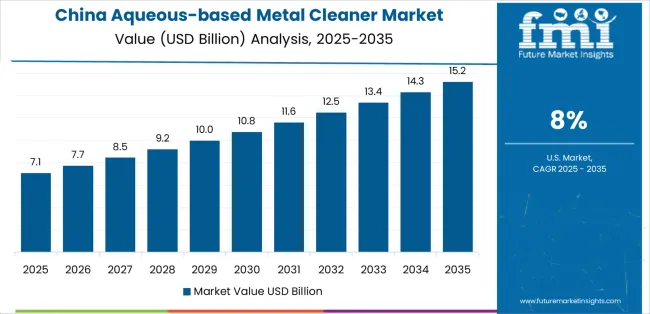

The section provides an analysis of the aqueous-based metal cleaner market by country, including Japan, China, the United States, the United Kingdom, and South Korea. The table presents the CAGRs for each country, indicating the expected growth of the market in that country through 2035.

| Countries | CAGR (2025 to 2035) |

|---|---|

| South Korea | 8.00% |

| Japan | 7.40% |

| The United Kingdom | 7.00% |

| China | 6.50% |

| The United States | 6.10% |

South Korea is one of the leading countries in this market. The South Korean market is anticipated to retain its dominance by progressing at an annual growth rate of 8.00% till 2035.

Japan is another Asian country that leads the aqueous-based metal cleaner market. The Japanese market is anticipated to retain its dominance by progressing at an annual growth rate of 7.40% till 2035.

The United Kingdom dominates the market in the European region. The United Kingdom's aqueous-based metal cleaner market is anticipated to exhibit an annual growth rate of 7.00% through 2035.

China, too, is one of the leading countries in the aqueous-based metal cleaner market, which is anticipated to register a CAGR of 6.50% through 2035.

The United States leads the market in the North American region. Over the next ten years, the demand for aqueous-based metal cleaners is projected to rise at a 6.10% CAGR.

The market for aqueous-based metal cleaners is highly fragmented and is filled with numerous companies that not only cater to regional consumers but also international ones.

BASF SE, The Dow Chemical Company, Henkel AG & Co., KGaA, 3M Company, PG Industries, Inc., Quaker Houghton, etc., are some of the most prominent companies that emphasize the development and promotion of environmentally sustainable cleaning solutions.

These companies are also expanding their consumer base by strategically marketing their products in underdeveloped and developing countries.

Recent Developments

The global aqueous-based metal cleaner market is estimated to be valued at USD 13.4 billion in 2025.

The market size for the aqueous-based metal cleaner market is projected to reach USD 23.2 billion by 2035.

The aqueous-based metal cleaner market is expected to grow at a 5.6% CAGR between 2025 and 2035.

The key product types in aqueous-based metal cleaner market are manufacturing, automotive and aerospace and healthcare.

In terms of technology type, ultrasonic segment to command 47.8% share in the aqueous-based metal cleaner market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Metal Pallet Market Size and Share Forecast Outlook 2025 to 2035

Metal Oxide Varistor (MOV) Surge Arresters Market Size and Share Forecast Outlook 2025 to 2035

Metal Straw Market Size and Share Forecast Outlook 2025 to 2035

Metal Can Market Size and Share Forecast Outlook 2025 to 2035

Metal IBC Market Forecast and Outlook 2025 to 2035

Metalized Barrier Film Market Forecast and Outlook 2025 to 2035

Metal Packaging Market Size and Share Forecast Outlook 2025 to 2035

Metal Bellow Market Size and Share Forecast Outlook 2025 to 2035

Metal based Safety Gratings Market Size and Share Forecast Outlook 2025 to 2035

Metal Modifiers Market Size and Share Forecast Outlook 2025 to 2035

Metallic Stearate Market Size and Share Forecast Outlook 2025 to 2035

Metallic Labels Market Size and Share Forecast Outlook 2025 to 2035

Metal Recycling Market Size and Share Forecast Outlook 2025 to 2035

Metal Forming Fluids Market Size and Share Forecast Outlook 2025 to 2035

Metal Removal Fluids Market Size and Share Forecast Outlook 2025 to 2035

Metal Deactivators Market Size and Share Forecast Outlook 2025 to 2035

Metal Film Analog Potentiometers Market Size and Share Forecast Outlook 2025 to 2035

Metal Oxide Film Fixed Resistor Market Size and Share Forecast Outlook 2025 to 2035

Metal Membrane Ammonia Cracker Market Size and Share Forecast Outlook 2025 to 2035

Metal Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA