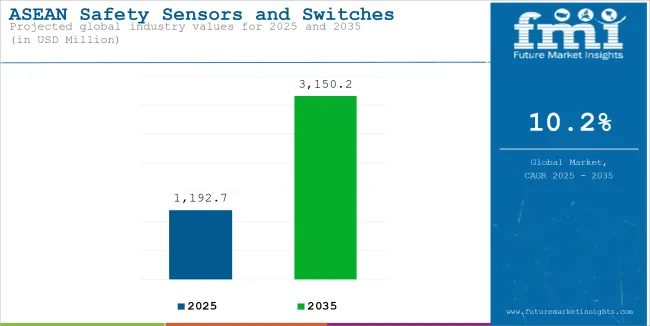

The ASEAN safety sensors and switches market reached USD 1,082.3 million in 2024. ASEAN demand for safety sensors and switches recorded 9.3% year-over-year growth in 2024, and thus, the market is expected to reach USD 1,192.7 million in 2025. Over the projection period (2025 to 2035), ASEAN safety sensors and switches sales are predicted to rise swiftly at 10.2% CAGR and climb to a market size of USD 3,150.2 million by 2035's end.

Rapid industrialization across ASEAN countries such as Indonesia and Singapore is creating demand for better safety equipment. Adoption of safety sensors and switches is on the rise, thereby boosting the market.

| Attributes | Key Insights |

|---|---|

| Estimated Size, 2025 | USD 1,192.7 million |

| Projected Size, 2035 | USD 3,150.2 million |

| Value-based CAGR (2025 to 2035) | 10.2% |

The ASEAN Safety Sensors and Switches Market is set to grow steadily in the coming years due to several factors. The region is witnessing rapid industrial growth, with countries like Indonesia, Thailand, and Vietnam increasing their manufacturing capacities.

This rise in industrial activities drives the need for safety systems that protect workers and equipment. Governments in the ASEAN region are also enforcing stricter safety regulations, ensuring that businesses comply with safety standards, which increases the demand for safety sensors and switches.

Technological improvements, especially in automation and the Internet of Things, further facilitate market growth. As industries move toward automation, there will be increased demand for higher-end safety solutions such as proximity sensors, pressure sensors, and emergency stop switches.

In light of these demands, the manufacturer will try to develop cost-effective and reliable solutions. In general, innovative solutions will continue from companies as industry demands continue toward smart solutions that have easy facilitation: wireless sensors for integrated safety within industries.

The section explains the Value Share of the leading segments in the industry. In terms of Product Type, the Pressure Sensors will likely dominate and generate a share of around 28.9% in 2024.

| Segment | Value Share (2024) |

|---|---|

| Pressure Sensors (product type) | 28.9% |

Pressure sensors dominate the market due to their versatility, critical role in safety, and widespread use across various industries. These sensors are integral in applications ranging from automotive systems, where they monitor tire pressure and engine performance, to industrial processes, such as fluid and gas monitoring. Their ability to function in diverse environments makes them essential in many sectors.

One of the primary reasons for the widespread adoption of pressure sensors is their importance in ensuring safety. They monitor pressure levels in critical systems, preventing overpressure or underpressure conditions that could lead to accidents. This is especially crucial in industries like oil & gas, chemical processing, and manufacturing, where such risks can be catastrophic.

Also, pressure sensors are required by many regulatory standards, making them indispensable in industries where compliance with safety regulations is mandatory. Advances in sensor technology, such as wireless and smart pressure sensors, have also boosted their market share by offering greater reliability, accuracy, and cost-efficiency, making them a top choice for modern automation and safety systems.

| Segment | Value Share (2024) |

|---|---|

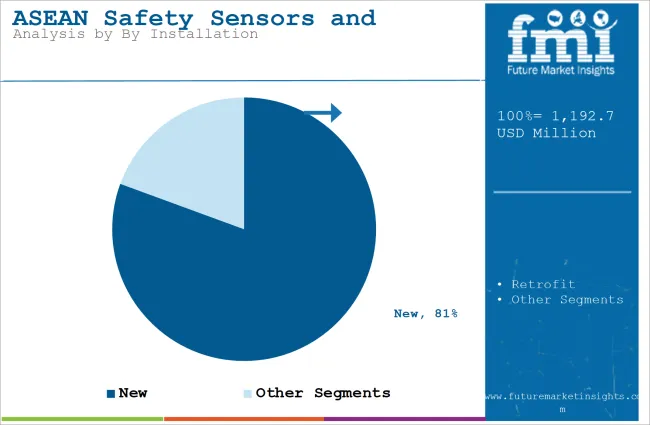

| New Installation (Installation) | 80.6% |

On the basis of installation, ASEAN safety sensors and switches is segmented into new and retrofit. Among these segments, the new installations segment is projected to account for a lion’s share in the ASEAN safety sensors and switches market in 2024.

Industrialists usually prefer to install new safety solutions to save time and money, as well as to improve the performance. Retrofitting safety solutions is expensive and usually takes more time, as the experts have to first modify the structure in order to retrofit these products.

New systems are typically more reliable and require less maintenance compared to retrofitting older systems. Retrofitting may lead to unforeseen challenges due to compatibility issues, making maintenance and repairs more expensive in the long run.

New installations are designed to meet the latest industry standards and regulations, ensuring greater safety, efficiency, and compliance, while retrofitting older systems may involve additional costs to meet these standards.

With a new installation, businesses have more flexibility to customize the system to meet current needs and future growth. Retrofitting may limit this flexibility, as older equipment might not accommodate newer features or scaling requirements.

The table below presents the annual growth rates of the ASEAN safety sensors and switches market from 2025 to 2035. With a base of 2024 and extended to the current year 2025, the report studied how the industry growth trajectory moves from the first half of the year-that is, January to June, (H1)-to the second half comprising July to December, (H2). This is an absolute comparison to offering the stakeholder's idea of how the sector has performed over time, with hints on developments that may emerge.

These figures indicate the sector's growth in each half-year between 2024 and 2025. The market is expected to grow at a CAGR of 9.4% in H1-2024, and in H2, the growth rate will increase to 9.7%.

| Particular | Value CAGR |

|---|---|

| H1 2024 | 9.4% (2024 to 2034) |

| H2 2024 | 9.7% (2024 to 2034) |

| H1 2025 | 9.8% (2025 to 2035) |

| H2 2025 | 10.2% (2025 to 2035) |

Moving into the subsequent period, from H1 2025 to H2 2025, the CAGR is projected to slightly decrease to 9.8% in the first half and relatively increase to 10.2% in the second half. In the first half (H1), the sector saw an increase of 40 BPS while in the second half (H2), there was a slight increase of 50 BPS.

Reducing Workplace Accidents Drives Demand for Safety Sensors in ASEAN Manufacturing

The push for reduced workplace accidents and ensuring safety for workers in high-risk industries is a significant factor driving the demand for safety sensors and switches in the ASEAN region. This trend is most in demand from the region's high-growth manufacturing sector, which is considered to be among the largest growing sectors globally, comprising over 200,000 manufacturing units across countries like Vietnam, Thailand, and Indonesia.

These sensors are vital in such high-risk environments as factories producing heavy machinery or electronic goods. They can detect overheating, pressure surges, or even toxic gas leaks and send out an early warning to avoid disasters. Safety switches, such as the stop button in an emergency, play a vital role in quickly stopping machinery to protect workers from injury. Safety systems in modern times become increasingly important: with the increase in manufacturing units and complication in them. As these industries grow, so does the demand for safety sensors and switches that offer protection to workers and help in avoiding accidents.

Growing Industrialization Driving Safety Sensor Demand in ASEAN

Rapid industrial growth in ASEAN countries like Vietnam, Indonesia, and Thailand is increasing the need for advanced safety systems. As these countries expand their manufacturing, automotive, and oil & gas sectors, industries are facing higher risks and greater demand for safety solutions. This growth pushes businesses to adopt more effective safety measures, such as safety sensors and switches, to protect workers and machinery.

Manufacturing requires sensors that can make sure machines operate within a safe envelope to prevent accidents. Safety sensors in the automotive industry ensure the protection of workers on assembly lines, while in the oil and gas sector, sensors are used to detect gas leakage or changes in pressure to avoid disasters.

Safety becomes the first concern with increasing automation in industries. This, in turn, raises the demand for safety sensors and switches that are reliable in risk detection, accident prevention, and smooth operations-skills integral to industrial expansion in the region.

Increased Focus on Workplace Safety Drives Demand for Sensors and Switches

As workplace safety awareness grows, industries are taking more steps to protect workers from dangerous environments. With the rise in workplace accidents and injuries, there is a stronger push for safety solutions that can minimize risks. Businesses are increasingly turning to safety sensors and switches to safeguard employees and ensure smooth operations.

Safety sensors detect hazardous situations, such as excessive heat or pressure, and even dangerous gases, by sending out early warnings to help avoid accidents. Within so-called high-risk industries-manufacturing, oil and gas, and construction play a critical role in monitoring both machinery and the environment for dangerous situations. Apart from safety sensors, switches also exist, like emergency stop buttons, that allow workers to turn equipment off right away in emergencies.

Adopting these safety-focused solutions will help industries not only save their workforce but also prevent or reduce downtime and costly accidents. All of these factors make safety awareness crucial, thereby increasing the demand for this technology in developing safer work environments across different sectors.

High Initial Costs Challenge SMEs in Adopting Safety Sensors

One of the key challenges faced by small- and medium-sized enterprises (SMEs) in ASEAN is the high initial cost of implementing safety sensors and switches. For many SMEs, especially in industries like manufacturing or construction, the cost of purchasing and installing these safety systems can be a significant barrier.

Safety sensors, switches, and their installation generally require high upfront investment, which may be difficult to justify for SMEs, especially on tight budgets. Besides, the maintenance and calibration costs for such systems might further add to the financial burden. Most of the smaller companies, while prioritizing immediate operational needs over long-term safety improvements, delay the adoption of these critical technologies.

While safety and the prevention of work-site accidents have turned into more vital issues these days, such costs hinder some SMEs from updating their systems. Later in the future, however, stricter safety regulations along with better awareness of a safe environment will encourage all such firms to be on board regarding investments in the above type of solutions.

The ASEAN Safety Sensors and Switches industry recorded a CAGR of 9.3% between 2020 and 2024. The industry's growth was positive, as it reached a value of USD 1,082.3 million in 2024 from USD 746.0 million in 2020.

The ASEAN safety sensors and switches Industry has experienced significant growth from 2020 to 2024. This growth is attributed to the increasing demand across various industries, such as manufacturing, automotive, oil & gas, and construction. As these sectors expand, the need for advanced safety systems to protect workers and equipment becomes more critical.

Looking ahead from 2025 to 2035, the market is expected to see even more rapid expansion. This growth will be fueled by the increased adoption of industrial automation through Industry 4.0, which will create a higher demand for advanced, smart safety solutions. Additionally, stricter safety regulations across ASEAN countries will compel businesses to implement more robust safety systems.

The integration of emerging technologies like IoT, AI, and predictive maintenance will further boost demand for connected and real-time safety monitoring. As the focus on worker safety intensifies, especially in high-risk sectors, the market will experience a significant surge in demand for safety sensors and switches.

while the 2020 to 2024 period saw moderate growth driven by industrial expansion and regulatory compliance, the 2025 to 2035 period is expected to experience accelerated demand, driven by automation, stricter regulations, and technological advancements in safety systems.

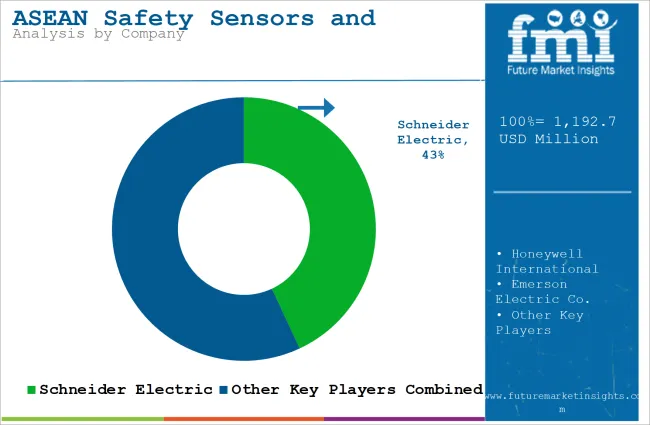

Tier 1 companies include industry leaders with annual revenues exceeding USD 100 – 200 million. These companies are currently capturing a significant share of 45-55% ASEAN. These frontrunners are characterized by high production capacity and a wide product portfolio.

Tier 1 companies are distinguished by extensive manufacturing expertise and a broad geographical reach, underpinned by a robust consumer base. They provide a wide range of products to meet regulatory standards. Prominent companies within Tier 1 include Schneider Electric, Honeywell International, Emerson Electric Co., Eaton, and others.

Tier 2 companies encompass mid-sized participants with revenues ranging from USD 50- 100 million. They hold a presence in specific regions and exert significant influence in local economies. These firms are distinguished by their robust presence overseas and in-depth industry expertise.

They possess strong technology capabilities and adhere strictly to regulatory requirements. However, they may not always possess the latest cutting-edge technologies or maintain an extensive global reach. Noteworthy entities in Tier 2 include Carlo Gavazzi Automation S.p.A., OMRON Corporation, OMEGA Engineering

Tier 3 encompasses most small-scale enterprises operating within the regional sphere, catering to specialized needs with revenues below USD 10 – 30 million. These businesses are notably focused on meeting local demand and are hence categorized within the Tier 3 segment.

They are small-scale participants with limited geographical presence. In this context, Tier 3 is acknowledged as an informal sector, indicating a segment distinguished by a lack of extensive organization and formal structure compared to the structured one. Tier 3 WIKA Alexander Wiegand SE & Co. KG, TE Connectivity, VEGA Instruments Co., Ltd., and others.

The section below covers assessments of Safety Sensors and Switches sales across key countries. Countries from ASEAN, are anticipated to exhibit promising double-digit growth over the forecast period. All the below-listed countries are collectively set to reflect a CAGR of around 10.2% through the forecast period.

| Countries | Value CAGR (2025 to 2035) |

|---|---|

| Thailand | 10.6% |

| Indonesia | 10.4% |

| Vietnam | 10.2% |

Thailand is a key manufacturing hub in Southeast Asia, known for its strong automotive, electronics, and industrial sectors. The country hosts numerous global manufacturing plants, especially from automotive giants and electronics firms, which rely heavily on safety sensors and switches to ensure the safety and efficiency of their operations.

As Thailand's manufacturing capabilities grow, so does the need for advanced safety systems to mitigate workplace risks and enhance automation processes.

The country’s consumption of safety sensors and switches is also on the rise, driven by industrial expansion and the rapid adoption of automation technologies. With increasing investments in smart factories and Industry 4.0 initiatives, Thailand's industries are increasingly implementing cutting-edge safety solutions.

These systems help ensure compliance with strict safety standards, improve operational efficiency, and minimize downtime. As Thailand continues to lead in industrial growth, the demand for safety sensors and switches will remain strong, making it a crucial market for the region’s industrial automation and safety sectors.

Indonesia, the largest economy in Southeast Asia, is witnessing significant growth in its manufacturing sector. Key industries such as mining, automotive, oil and gas, and electronics are expanding rapidly, fueling the need for advanced safety solutions. As these sectors evolve, the demand for safety equipment, including sensors and switches, has surged to maintain safe operations and meet regulatory standards.

The mining and oil sectors, in particular, require highly reliable safety systems to mitigate risks in hazardous environments. In the automotive and electronics industries, automation is on the rise, and advanced safety solutions are essential to optimize production lines while ensuring worker safety. Additionally, the Indonesian government has implemented stricter safety regulations, which further drives the adoption of these technologies across industries.

As Indonesia continues to develop its industrial infrastructure, the demand for safety sensors and switches is expected to grow. This makes Indonesia a key market for manufacturers of safety equipment, supporting the country’s industrial expansion and commitment to safe operational practices.

Malaysia is emerging as one of the most lucrative markets for safety sensors and switches across ASEAN region, accounting for around 19.2% share in 2024. Growth in the country is attributed to the increasing adoption of safety equipment across various sectors, along with growing awareness regarding workplace accidents.

The national IoT Strategic Roadmap launched by Ministry of Science, Technology, and Innovation, has facilitated the adoption of safety sensors and switches across the country. Currently, the country is in a phase of transition with industries increasingly moving towards automation.

Growing prevalence of workplace accidents is playing a crucial role in fueling the adoption of these products. According to the Department of Occupational Safety and Health (DOSH), there were 6933 occupational accidents reported in Malaysia from January 2020 to December 2020.

The section provides comprehensive assessments and insights that highlight current opportunities and emerging trends for companies in developed and developing countries. It analyzes advancements in manufacturing and identifies the latest trends poised to drive new applications in the industry.

A few key players in the Safety Sensors and Switches industry are actively enhancing capabilities and resources to cater to the growing demand for the compound across diverse applications. Leading companies also leverage partnership and joint venture strategies to co-develop innovative products and bolster resource base.

Significant players are also introducing new products to address the increasing need for cutting-edge solutions in various end-use sectors. Geographic expansion is another important strategy being embraced by reputed companies. Start-ups are likely to emerge in the sector through 2035, thereby making it more competitive.

Industry Updates

In terms of Product Type, the industry is divided into Basic Switches, Limit Switches, Pressure Sensors and Transducers, Hall-Effect and Magneto resistive sensors, Electro-magnetic relays, Barcode Scan Engines

In terms of Installation, the industry is divided into New, Retrofit

In terms of End Use, the industry is divided into Industrial, (Automotive, Power Generation, Mining & Metal, Food & Beverage, Packaging, Pharmaceutical), Commercial, (Office, Defense & Government Establishments, Hotels & Hospitals, Airports & Stations, Others (Private/ Academic Institutes, Commercial Shopping Complexes)), Residential

Key countries of Malaysia, Thailand, Vietnam, The Philippines, Singapore, Indonesia, Rest of ASEAN, have been covered in the report.

The ASEAN market was valued at USD 1,082.3 million in 2024.

The ASEAN market is set to reach USD 1,192.7 million in 2025.

ASEAN demand is anticipated to rise at 10.2% CAGR.

The industry is projected to reach USD 3,150.2 million by 2035.

Schneider Electric, Honeywell International, Emerson Electric Co., Eaton Carlo Gavazzi Automation S.p.A., OMRON Corporation, OMEGA Engineering, WIKA Alexander Wiegand SE & Co. KG, TE Connectivity, VEGA Instruments Co., Ltd

Table 01: ASEAN Safety Sensors & Switches Market Value (US$ Mn) and Volume ('000 Units) Historical Data 2013 – 2021 and Forecast 2022 – 2028 by Category

Table 02: ASEAN Safety Sensors & Switches Market Value (US$ Mn) and Volume ('000 Units) Historical Data 2013 – 2021 and Forecast 2022 – 2028 by Installation

Table 03: ASEAN Safety Sensors & Switches Market Value (US$ Mn) and Volume ('000 Units) Historical Data 2013 – 2021 and Forecast 2022 – 2028 by End Use

Table 04: ASEAN Safety Sensors & Switches Market Value (US$ Mn) and Volume ('000 Units) Historical Data 2013 – 2021 and Forecast 2022 – 2028 by End Use

Table 05: ASEAN Safety Sensors & Switches Market Value (US$ Mn) and Volume (Units) Historical Data 2013 – 2021 and Forecast 2022 – 2028 by Country

Table 06: Indonesia Safety Sensors & Switches Market Value (US$ Mn) and Volume ('000 Units) Historical Data 2013 – 2021 and Forecast 2022 – 2028 by Category

Table 07: Indonesia Safety Sensors & Switches Market Value (US$ Mn) and Volume ('000 Units) Historical Data 2013 – 2021 and Forecast 2022 – 2028 by Installation

Table 08: Indonesia Safety Sensors & Switches Market Value (US$ Mn) and Volume ('000 Units) Historical Data 2013 – 2021 and Forecast 2022 – 2028 by End Use

Table 09: Indonesia Safety Sensors & Switches Market Value (US$ Mn) and Volume ('000 Units) Historical Data 2013 – 2021 and Forecast 2022 – 2028 by End Use

Table 10: Malaysia Safety Sensors & Switches Market Value (US$ Mn) and Volume ('000 Units) Historical Data 2013 – 2021 and Forecast 2022 – 2028 by Category

Table 11: Malaysia Safety Sensors & Switches Market Value (US$ Mn) and Volume ('000 Units) Historical Data 2013 – 2021 and Forecast 2022 – 2028 by Installation

Table 12: Malaysia Safety Sensors & Switches Market Value (US$ Mn) and Volume ('000 Units) Historical Data 2013 – 2021 and Forecast 2022 – 2028 by End Use

Table 13: Malaysia Safety Sensors & Switches Market Value (US$ Mn) and Volume ('000 Units) Historical Data 2013 – 2021 and Forecast 2022 – 2028 by End Use

Table 14: Philippines Safety Sensors & Switches Market Value (US$ Mn) and Volume ('000 Units) Historical Data 2013 – 2021 and Forecast 2022 – 2028 by Category

Table 15: Philippines Safety Sensors & Switches Market Value (US$ Mn) and Volume ('000 Units) Historical Data 2013 – 2021 and Forecast 2022 – 2028 by Installation

Table 16: Philippines Safety Sensors & Switches Market Value (US$ Mn) and Volume ('000 Units) Historical Data 2013 – 2021 and Forecast 2022 – 2028 by End Use

Table 17: Philippines Safety Sensors & Switches Market Value (US$ Mn) and Volume ('000 Units) Historical Data 2013 – 2021 and Forecast 2022 – 2028 by End Use

Table 18: Singapore Safety Sensors & Switches Market Value (US$ Mn) and Volume ('000 Units) Historical Data 2013 – 2021 and Forecast 2022 – 2028 by Category

Table 19: Singapore Safety Sensors & Switches Market Value (US$ Mn) and Volume ('000 Units) Historical Data 2013 – 2021 and Forecast 2022 – 2028 by Installation

Table 20: Singapore Safety Sensors & Switches Market Value (US$ Mn) and Volume ('000 Units) Historical Data 2013 – 2021 and Forecast 2022 – 2028 by End Use

Table 21: Singapore Safety Sensors & Switches Market Value (US$ Mn) and Volume ('000 Units) Historical Data 2013 – 2021 and Forecast 2022 – 2028 by End Use

Table 22: Thailand Safety Sensors & Switches Market Value (US$ Mn) and Volume ('000 Units) Historical Data 2013 – 2021 and Forecast 2022 – 2028 by Category

Table 23: Thailand Safety Sensors & Switches Market Value (US$ Mn) and Volume ('000 Units) Historical Data 2013 – 2021 and Forecast 2022 – 2028 by Installation

Table 24: Thailand Safety Sensors & Switches Market Value (US$ Mn) and Volume ('000 Units) Historical Data 2013 – 2021 and Forecast 2022 – 2028 by End Use

Table 25: Thailand Safety Sensors & Switches Market Value (US$ Mn) and Volume ('000 Units) Historical Data 2013 – 2021 and Forecast 2022 – 2028 by End Use

Table 26: Vietnam Safety Sensors & Switches Market Value (US$ Mn) and Volume ('000 Units) Historical Data 2013 – 2021 and Forecast 2022 – 2028 by Category

Table 27: Vietnam Safety Sensors & Switches Market Value (US$ Mn) and Volume ('000 Units) Historical Data 2013 – 2021 and Forecast 2022 – 2028 by Installation

Table 28: Vietnam Safety Sensors & Switches Market Value (US$ Mn) and Volume ('000 Units) Historical Data 2013 – 2021 and Forecast 2022 – 2028 by End Use

Table 29: Vietnam Safety Sensors & Switches Market Value (US$ Mn) and Volume ('000 Units) Historical Data 2013 – 2021 and Forecast 2022 – 2028 by End Use

Figure 01: ASEAN Safety Sensors & Switches Market Share and BPS Analysis by Category – 2022 & 2028

Figure 02: ASEAN Safety Sensors & Switches Market Y-o-Y Growth Projections by Category, 2022-2028

Figure 03: ASEAN Safety Sensors & Switches Market Attractiveness by Category, 2022-2028

Figure 04: ASEAN Safety Sensors & Switches Market Absolute $ Opportunity by Basic Switches Segment

Figure 05: ASEAN Safety Sensors & Switches Market Absolute $ Opportunity by Limit Switches Segment

Figure 06: ASEAN Safety Sensors & Switches Market Absolute $ Opportunity by Pressure Sensor & Transducer Segment

Figure 07: ASEAN Safety Sensors & Switches Market Absolute $ Opportunity by Hall Effect & Magnetoresistive Sensor Segment

Figure 08: ASEAN Safety Sensors & Switches Market Absolute $ Opportunity by Electromagnetic Relay Segment

Figure 09: ASEAN Safety Sensors & Switches Market Absolute $ Opportunity by Barcode Scan Engine Segment

Figure 10: ASEAN Safety Sensors & Switches Market Share and BPS Analysis by Installation – 2022 & 2028

Figure 11: ASEAN Safety Sensors & Switches Market Y-o-Y Growth Projections by Installation, 2022-2028

Figure 12: ASEAN Safety Sensors & Switches Market Attractiveness by Installation, 2022-2028

Figure 13: ASEAN Safety Sensors & Switches Market Absolute $ Opportunity by New Segment

Figure 14: ASEAN Safety Sensors & Switches Market Absolute $ Opportunity by Retrofit Segment

Figure 15: ASEAN Safety Sensors & Switches Market Share and BPS Analysis by End Use – 2022 & 2028

Figure 16: ASEAN Safety Sensors & Switches Market Y-o-Y Growth Projections by End Use, 2022-2028

Figure 17: ASEAN Safety Sensors & Switches Market Attractiveness by End Use, 2022-2028

Figure 18: ASEAN Safety Sensors & Switches Market Absolute $ Opportunity by Industrial Segment

Figure 19: ASEAN Safety Sensors & Switches Market Absolute $ Opportunity by Commercial Segment

Figure 20: ASEAN Safety Sensors & Switches Market Absolute $ Opportunity by Residential Segment

Figure 21: ASEAN Safety Sensors & Switches Market Share and BPS Analysis by Country – 2022 & 2028

Figure 22: ASEAN Safety Sensors & Switches Market Y-o-Y Growth Projections by Country, 2022-2028

Figure 23: ASEAN Safety Sensors & Switches Market Attractiveness by Country, 2022-2028

Figure 24: Indonesia Safety Sensors & Switches Market Absolute $ Opportunity, 2013 – 2028

Figure 25: Malaysia Safety Sensors & Switches Market Absolute $ Opportunity, 2013 – 2028

Figure 26: Philippines Safety Sensors & Switches Market Absolute $ Opportunity, 2013 – 2028

Figure 27: Singapore Safety Sensors & Switches Market Absolute $ Opportunity, 2013 – 2028

Figure 28: Thailand Safety Sensors & Switches Market Absolute $ Opportunity, 2013 – 2028

Figure 29: Vietnam Safety Sensors & Switches Market Absolute $ Opportunity, 2013 – 2028

Figure 30: Indonesia Safety Sensors & Switches Market Share and BPS Analysis by Category – 2022 & 2028

Figure 31: Indonesia Safety Sensors & Switches Market Y-o-Y Growth Projections by Category, 2022-2028

Figure 32: Indonesia Safety Sensors & Switches Market Attractiveness by Category, 2022-2028

Figure 33: Indonesia Safety Sensors & Switches Market Share and BPS Analysis by Installation – 2022 & 2028

Figure 34: Indonesia Safety Sensors & Switches Market Y-o-Y Growth Projections by Installation, 2022-2028

Figure 35: Indonesia Safety Sensors & Switches Market Attractiveness by Installation, 2022-2028

Figure 36: Indonesia Safety Sensors & Switches Market Share and BPS Analysis by End Use – 2022 & 2028

Figure 37: Indonesia Safety Sensors & Switches Market Y-o-Y Growth Projections by End Use, 2022-2028

Figure 38: Indonesia Safety Sensors & Switches Market Attractiveness by End Use, 2022-2028

Figure 39: Malaysia Safety Sensors & Switches Market Share and BPS Analysis by Category – 2022 & 2028

Figure 40: Malaysia Safety Sensors & Switches Market Y-o-Y Growth Projections by Category, 2022-2028

Figure 41: Malaysia Safety Sensors & Switches Market Attractiveness by Category, 2022-2028

Figure 42: Malaysia Safety Sensors & Switches Market Share and BPS Analysis by Installation – 2022 & 2028

Figure 43: Malaysia Safety Sensors & Switches Market Y-o-Y Growth Projections by Installation, 2022-2028

Figure 44: Malaysia Safety Sensors & Switches Market Attractiveness by Installation, 2022-2028

Figure 45: Malaysia Safety Sensors & Switches Market Share and BPS Analysis by End Use – 2022 & 2028

Figure 46: Malaysia Safety Sensors & Switches Market Y-o-Y Growth Projections by End Use, 2022-2028

Figure 47: Malaysia Safety Sensors & Switches Market Attractiveness by End Use, 2022-2028

Figure 48: Philippines Safety Sensors & Switches Market Share and BPS Analysis by Category – 2022 & 2028

Figure 49: Philippines Safety Sensors & Switches Market Y-o-Y Growth Projections by Category, 2022-2028

Figure 50: Philippines Safety Sensors & Switches Market Attractiveness by Category, 2022-2028

Figure 51: Philippines Safety Sensors & Switches Market Share and BPS Analysis by Installation – 2022 & 2028

Figure 52: Philippines Safety Sensors & Switches Market Y-o-Y Growth Projections by Installation, 2022-2028

Figure 53: Philippines Safety Sensors & Switches Market Attractiveness by Installation, 2022-2028

Figure 54: Philippines Safety Sensors & Switches Market Share and BPS Analysis by End Use – 2022 & 2028

Figure 55: Philippines Safety Sensors & Switches Market Y-o-Y Growth Projections by End Use, 2022-2028

Figure 56: Philippines Safety Sensors & Switches Market Attractiveness by End Use, 2022-2028

Figure 57: Singapore Safety Sensors & Switches Market Share and BPS Analysis by Category – 2022 & 2028

Figure 58: Singapore Safety Sensors & Switches Market Y-o-Y Growth Projections by Category, 2022-2028

Figure 59: Singapore Safety Sensors & Switches Market Attractiveness by Category, 2022-2028

Figure 60: Singapore Safety Sensors & Switches Market Share and BPS Analysis by Installation – 2022 & 2028

Figure 61: Singapore Safety Sensors & Switches Market Y-o-Y Growth Projections by Installation, 2022-2028

Figure 62: Singapore Safety Sensors & Switches Market Attractiveness by Installation, 2022-2028

Figure 63: Singapore Safety Sensors & Switches Market Share and BPS Analysis by End Use – 2022 & 2028

Figure 64: Singapore Safety Sensors & Switches Market Y-o-Y Growth Projections by End Use, 2022-2028

Figure 65: Singapore Safety Sensors & Switches Market Attractiveness by End Use, 2022-2028

Figure 66: Thailand Safety Sensors & Switches Market Share and BPS Analysis by Category – 2022 & 2028

Figure 67: Thailand Safety Sensors & Switches Market Y-o-Y Growth Projections by Category, 2022-2028

Figure 68: Thailand Safety Sensors & Switches Market Attractiveness by Category, 2022-2028

Figure 69: Thailand Safety Sensors & Switches Market Share and BPS Analysis by Installation – 2022 & 2028

Figure 70: Thailand Safety Sensors & Switches Market Y-o-Y Growth Projections by Installation, 2022-2028

Figure 71: Thailand Safety Sensors & Switches Market Attractiveness by Installation, 2022-2028

Figure 72: Thailand Safety Sensors & Switches Market Share and BPS Analysis by End Use – 2022 & 2028

Figure 73: Thailand Safety Sensors & Switches Market Y-o-Y Growth Projections by End Use, 2022-2028

Figure 74: Thailand Safety Sensors & Switches Market Attractiveness by End Use, 2022-2028

Figure 75: Vietnam Safety Sensors & Switches Market Share and BPS Analysis by Category – 2022 & 2028

Figure 76: Vietnam Safety Sensors & Switches Market Y-o-Y Growth Projections by Category, 2022-2028

Figure 77: Vietnam Safety Sensors & Switches Market Attractiveness by Category, 2022-2028

Figure 78: Vietnam Safety Sensors & Switches Market Share and BPS Analysis by Installation – 2022 & 2028

Figure 79: Vietnam Safety Sensors & Switches Market Y-o-Y Growth Projections by Installation, 2022-2028

Figure 80: Vietnam Safety Sensors & Switches Market Attractiveness by Installation, 2022-2028

Figure 81: Vietnam Safety Sensors & Switches Market Share and BPS Analysis by End Use – 2022 & 2028

Figure 82: Vietnam Safety Sensors & Switches Market Y-o-Y Growth Projections by End Use, 2022-2028

Figure 83: Vietnam Safety Sensors & Switches Market Attractiveness by End Use, 2022-2028

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

ASEAN Automotive Bearings Market Size and Share Forecast Outlook 2025 to 2035

ASEAN Automotive Aftermarket Analysis - Size, Share, and Forecast Outlook 2025 to 2035

ASEAN Flexible Plastic Packaging Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

ASEAN Human Milk Oligosaccharides Market Report – Size, Demand & Growth 2025–2035

ASEAN Probiotic Ingredients Market Outlook – Growth, Size & Forecast 2025–2035

ASEAN Food Additives Market Insights – Growth, Demand & Forecast 2025–2035

ASEAN Chitin Market Analysis – Trends, Demand & Forecast 2025–2035

ASEAN Bakery Mixes Market Outlook – Size, Share & Forecast 2025–2035

ASEAN Non-Alcoholic Malt Beverages Market Trends – Demand & Forecast 2025–2035

ASEAN Animal Feed Alternative Protein Market Insights – Demand, Size & Industry Trends 2025–2035

ASEAN Chickpea Protein Market Trends – Growth, Demand & Forecast 2025–2035

ASEAN Automotive Turbocharger Market Outlook – Share, Growth & Forecast 2025–2035

ASEAN Food Testing Services Market Analysis – Size, Share & Forecast 2025–2035

ASEAN Food Emulsifier Market Report – Trends, Demand & Industry Forecast 2025–2035

ASEAN Yeast Market Report – Trends, Demand & Industry Forecast 2025–2035

ASEAN Natural Food Color Market Outlook – Share, Growth & Forecast 2025–2035

ASEAN Coated Fabrics Market Insights – Demand, Size & Industry Trends 2025–2035

ASEAN Barite Market Analysis – Size, Share & Forecast 2025–2035

ASEAN Shrimp Market Trends – Growth, Demand & Forecast 2025–2035

ASEAN Pulses Market Analysis – Size, Share & Forecast 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA