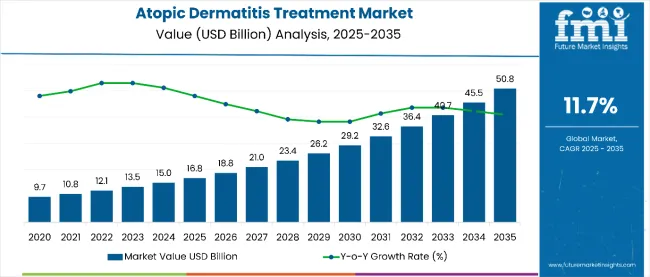

The atopic dermatitis treatment market is estimated to be valued at USD 16.8 billion in 2025. It is projected to reach USD 50.8 billion by 2035, registering a compound annual growth rate (CAGR) of 11.7% over the forecast period.

The market is projected to add an absolute dollar opportunity of USD 34.0 billion over the forecast period. This reflects 3.0 times growth at a compound annual growth rate of 11.7%. The evolution of the market is expected to be shaped by the rising prevalence of moderate-to-severe atopic dermatitis, breakthrough biologic therapies, advanced targeted treatments, and growing demand for specialty pharmacy services, particularly where personalized medicine and patient-centric care are required.

By 2030, the market is likely to reach USD 29.2 billion, adding USD 14.1 billion in incremental value over the first half of the decade. The remaining USD 21.6 billion is expected to be realized during the second half, suggesting a moderately accelerated growth pattern. Product innovation in JAK inhibitors, monoclonal antibodies, and next-generation biologics is gaining traction.

Companies such as Sanofi S.A. and Regeneron Pharmaceuticals are advancing their competitive positions through investment in biologics development, clinical trial programs, and specialty distribution networks. Rising healthcare awareness, expanding access to dermatology specialists, and improved insurance coverage are supporting expansion into hospital pharmacies, specialty clinics, and retail pharmacy applications. Market performance will remain anchored in clinical efficacy, safety profiles, and patient access optimization.

The market holds a significant and rapidly growing share across its parent markets. Within the global dermatology therapeutics market, it accounts for 18.5% due to its specialized treatment requirements. In the biologics segment, it commands a 12.8% share, supported by breakthrough therapies like dupilumab. It contributes nearly 15.2% to the immunology treatments market and 8.7% to the specialty pharmacy segment. In injectable therapeutics, atopic dermatitis treatments hold around 7.4% share, driven by biologic administration requirements. Across the chronic inflammatory disease market, its share is close to 9.8%, owing to its position as a leading inflammatory skin condition requiring long-term management.

The market is undergoing a strategic transformation driven by rising demand for targeted biologic therapies, personalized treatment approaches, and comprehensive patient management solutions. Advanced therapeutic technologies using monoclonal antibodies, JAK inhibitors, and innovative topical formulations have enhanced treatment efficacy, safety profiles, and patient quality of life, positioning atopic dermatitis biologics as superior options to traditional immunosuppressive therapies. Manufacturers are introducing specialized formulations, including pediatric-specific dosing and combination therapies tailored for different severity levels, expanding their role beyond symptom management to disease modification. Strategic collaborations between pharmaceutical companies and dermatology research centers have accelerated innovation in treatment development and market penetration.

| Metric | Value |

|---|---|

| Estimated Size (2025E) | USD 16.8 billion |

| Projected Value (2035F) | USD 50.8 billion |

| CAGR (2025 to 2035) | 11.7% |

The atopic dermatitis treatment market's exceptional growth is driven by increasing disease prevalence, breakthrough biologic therapies, and expanding specialty care access, making it an attractive therapeutic area for pharmaceutical companies and healthcare providers seeking innovative treatment solutions. The rising incidence of moderate-to-severe atopic dermatitis, improved diagnostic capabilities, and growing awareness of treatment options appeal to patients and healthcare providers prioritizing long-term disease control and quality of life improvements.

A growing understanding of disease pathophysiology, personalized medicine approaches, and patient-centric care models is further propelling adoption, particularly in specialty dermatology, hospital settings, and integrated care systems. Rising healthcare expenditure, expanding insurance coverage, and regulatory approvals for innovative therapies are also enhancing treatment accessibility and market penetration.

As precision medicine and targeted therapies accelerate across healthcare systems and specialty care becomes increasingly important, the market outlook remains highly favorable. With patients and providers prioritizing treatment efficacy, safety profiles, and long-term outcomes, atopic dermatitis treatments are well-positioned to expand across various therapeutic, hospital, and specialty pharmacy applications.

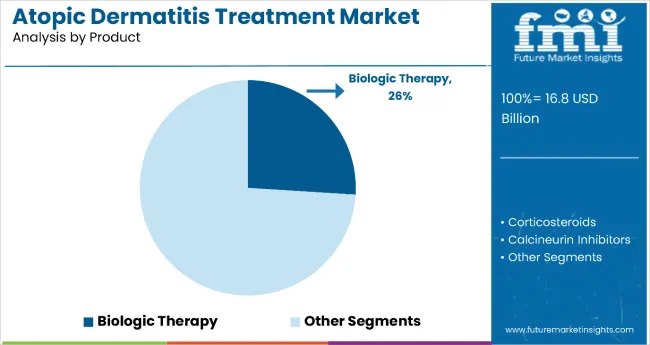

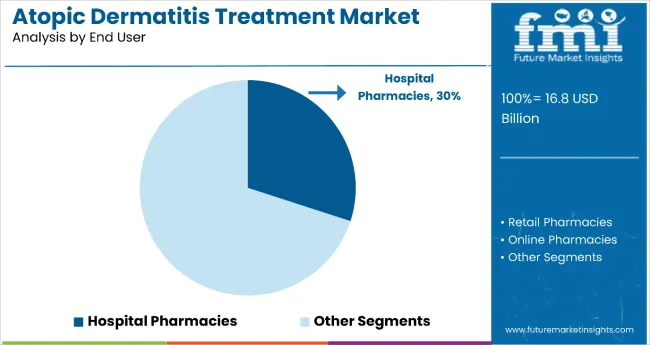

The market is segmented by product, indication, end user, and region. By product, the market is divided into corticosteroids, calcineurin inhibitors, immunosuppressants, biologic therapy, PDE-4 inhibitors, antibiotics, antihistamines, and emollients. Based on indication, the market is categorized into topical, oral, and injectable. In terms of end user, the market is divided into hospital pharmacies, retail pharmacies, online pharmacies, drugstores, mail-order pharmacies, and dermatology clinics. Regionally, the market is classified into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

The biologic therapy segment holds a dominant position with 26% of the market share in the product category, owing to its superior efficacy in moderate-to-severe cases, targeted mechanism of action, and ability to achieve sustained remission in previously treatment-resistant patients. Biologics like dupilumab are widely used across dermatology and specialty care settings due to their disease-modifying properties, improved safety profiles compared to systemic immunosuppressants, and ability to significantly improve patient quality of life.

It enables healthcare providers and patients to achieve long-term disease control while maintaining excellent safety standards and treatment tolerability in chronic management scenarios. As demand for precision medicine, targeted therapies, and personalized treatment approaches grows, the biologics segment continues to gain preference in both adult and pediatric atopic dermatitis management.

Manufacturers are investing in advanced biologic development, combination therapy research, and expanded indication studies to enhance efficacy, broaden patient eligibility, and improve long-term outcomes. The segment is poised to grow further as global treatment guidelines favor biologic interventions and insurance coverage improves for specialty therapies.

Hospital pharmacies remain a core distribution channel with 30% share in 2025, as they provide specialized handling, administration support, and comprehensive patient monitoring for complex biologic therapies and severe atopic dermatitis cases. Their functional expertise supports treatment initiation, dose optimization, and safety monitoring in patients requiring intensive dermatologic care and multidisciplinary management.

Hospital pharmacies also ensure proper storage conditions, injection training, and adverse event management for biologic treatments, while offering integrated care coordination with dermatology specialists. This makes them indispensable in modern specialty care and tertiary treatment environments.

Ongoing demand for biologic therapies and the specialization required for complex atopic dermatitis management are key trends driving the sustained relevance of hospital pharmacies in this therapeutic area.

In 2025, adoption of global atopic dermatitis treatments grew by 18% year-on-year, with North America taking a 42% share. Applications include biologic therapies, topical treatments, and integrated care management. Manufacturers are introducing specialized formulations and personalized treatment protocols that deliver superior efficacy profiles and patient-centered outcomes. Biologic formulations now support precision medicine positioning. Evidence-based treatment guidelines and patient advocacy initiatives support healthcare provider confidence. Technology providers increasingly supply ready-to-use injection systems with integrated patient support programs to reduce treatment complexity.

Biologic Innovation Accelerates Atopic Dermatitis Treatment Demand

Pharmaceutical companies and healthcare systems are choosing biologic therapies to achieve superior disease control, enhance patient outcomes, and meet growing demands for targeted, effective treatment solutions. In clinical trials, dupilumab and other biologics deliver up to 75% improvement in disease severity scores compared to conventional treatments at 35-45%. Treatments formulated with biologics maintain efficacy throughout long-term therapy cycles and extended treatment periods. In specialty care settings, integrated biologic programs help reduce treatment complexity while maintaining safety standards by up to 65%. Biologic therapies are now increasingly adopted for pediatric indications, increasing adoption in sectors demanding comprehensive age-appropriate care. These advantages help explain why biologic adoption rates in dermatology rose 32% in 2024 across North America and Europe.

Cost Pressures, Access Barriers and Specialty Requirements Limit Growth

Market expansion faces constraints due to high biologic costs, insurance coverage limitations, and specialized administration infrastructure needs. Biologic treatment costs can range from $30,000 to $60,000 annually, depending on therapy selection and dosing requirements, impacting patient access and leading to treatment delays of up to 6 months in some healthcare systems. Specialty pharmacy requirements and prior authorization processes can add 4 to 12 weeks to treatment initiation timelines. Specialized storage conditions and administration training extend healthcare system costs by 35-45% compared to conventional topical treatments. Limited availability of dermatology specialists restricts scalable treatment access, especially for pediatric and complex cases. These constraints make biologic adoption challenging in cost-sensitive healthcare systems despite growing clinical evidence and treatment demand.

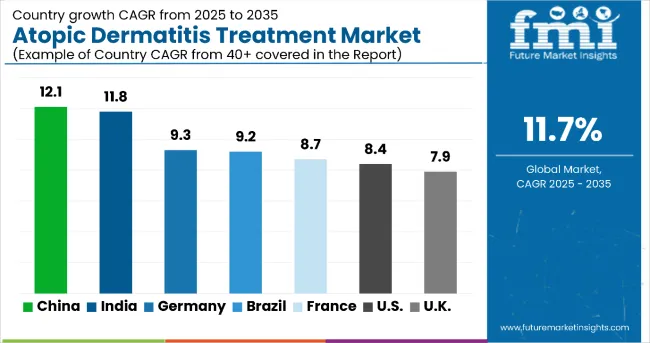

| Countries | CAGR (2025 to 2035) |

| China | 12.1% |

| India | 11.8% |

| Brazil | 9.2% |

| Germany | 9.3% |

| France | 8.7% |

| USA | 8.4% |

| UK | 7.9% |

In the atopic dermatitis treatment market, China leads with the highest projected CAGR of 12.1% from 2025 to 2035, driven by rapid healthcare infrastructure development, increasing disease awareness, and expanding access to biologic therapies. India follows with a CAGR of 11.8%, supported by growing dermatology specialization and rising healthcare investments. Germany shows strong growth at 9.3%, benefiting from advanced healthcare systems and robust pharmaceutical research. Brazil, France, and the USA demonstrate consistent growth at 9.2%, 8.7%, and 8.4% respectively, supported by established treatment protocols and specialty care networks. The UK, with a CAGR of 7.9%, experiences steady expansion, supported by NHS coverage and established dermatology services, which reflect regional differences in healthcare infrastructure and treatment accessibility patterns.

The report covers an in-depth analysis of 40+ countries; seven top-performing OECD countries are highlighted below.

Revenue from atopic dermatitis treatments in China is projected to grow at a CAGR of 12.1% from 2025 to 2035, significantly exceeding the global average. Growth is fueled by rising disease prevalence, expanding healthcare infrastructure, and increasing access to biologic therapies across major urban centers, including Beijing, Shanghai, and Guangzhou. China’s healthcare system is adopting advanced treatment protocols, supported by broader insurance coverage and expansion of specialty dermatology services.

Sales of atopic dermatitis treatments in India are slated to flourish at a CAGR of 11.8% from 2025 to 2035, approaching global leadership levels. Growth has been concentrated in urban healthcare expansion and specialty care development in Mumbai, Delhi, and Bangalore regions. Treatment adoption is shifting from basic topical management toward comprehensive biologic and targeted therapy approaches. Local healthcare infrastructure improvements and international pharmaceutical partnerships are leading commercial deployment strategies.

Demand for atopic dermatitis treatments in Germany is expected to increase at a CAGR of 9.3% from 2025 to 2035, exceeding the mature market average. Demand is driven by advanced healthcare systems, robust research infrastructure, and comprehensive insurance coverage in Berlin, Munich, and Hamburg markets. Evidence-based treatment protocols and specialized dermatology centers are increasingly adopting biologic therapies for optimal patient outcomes.

Demand for atopic dermatitis treatments in Brazil is projected to expand at a CAGR of 9.2% from 2025 to 2035, driven by healthcare system improvements and expanding access to specialty care. Growth is concentrated in urban healthcare markets, including São Paulo, Rio de Janeiro, and Brasília, where dermatology services and treatment accessibility are expanding. Healthcare infrastructure investments and international pharmaceutical partnerships are gradually building comprehensive treatment capabilities.

Revenue from atopic dermatitis treatments in France is projected to rise at a CAGR of 8.7% from 2025 to 2035, supported by strong demand for biologic therapies and integrated care management. Healthcare systems in Paris, Lyon, and Marseille are experiencing expansion in specialty dermatology services, evidence-based treatment protocols, and patient-centered care approaches. French healthcare institutions are leveraging advanced treatment options to meet quality expectations for comprehensive atopic dermatitis management.

The atopic dermatitis treatment market in the USA is anticipated to expand at a CAGR of 8.4% from 2025 to 2035, reflecting mature market dynamics with a focus on treatment optimization. Growth is centered on biologic adoption and specialty care expansion in California, Texas, and New York regions. Advanced treatment protocols and insurance coverage improvements are being deployed for severe cases, pediatric populations, and comprehensive disease management. FDA regulatory frameworks and clinical guidelines support practical treatment application development across diverse healthcare settings.

Sales of atopic dermatitis treatment in the UK are expected to grow at a CAGR of 7.9% from 2025 to 2035, reflecting steady mature market expansion. Growth is driven by NHS coverage improvements and specialty care optimization in the London, Manchester, and Edinburgh regions. Integrated treatment pathways and dermatology specialist networks are expanding treatment accessibility, while healthcare providers incorporate evidence-based protocols into comprehensive care programs.

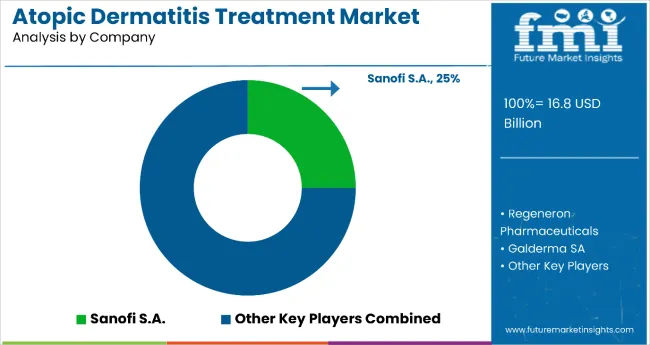

The market is moderately concentrated, encompassing a combination of major pharmaceutical companies, biotechnology innovators, and niche therapy developers that compete on the basis of clinical efficacy, patient outcomes, and global reach. Sanofi S.A. leads the market with an estimated 25% share, propelled by the continued success of Dupixent (dupilumab) in treating atopic dermatitis, asthma, and chronic rhinosinusitis. Regeneron Pharmaceuticals, as the co-developer of Dupixent, maintains a strong position supported by robust R&D capabilities, clinical trial expertise, and long-term partnerships with specialty healthcare providers.

Galderma SA, Novartis AG, and Bristol-Myers Squibb stand out through diversified dermatology and immunology portfolios, with targeted biologics and small-molecule therapies addressing varying disease severity levels. These companies also emphasize patient adherence programs and digital support initiatives that enhance treatment continuity.

Bayer AG and Astellas Pharma Inc. focus on specialized dermatological formulations and regional expansion strategies, while Pfizer Inc., AbbVie Inc., and Allergan Plc. strengthen competitiveness with their expertise in inflammatory and aesthetic dermatology segments.

The market faces high entry barriers due to stringent regulatory pathways and substantial clinical validation requirements. Future competitiveness will depend on clinical differentiation, cost-effective biologic manufacturing, and strategic market access frameworks that align with evolving global dermatology care standards.

| Items | Value |

| Quantitative Units (2025) | USD 16.8 Billion |

| Product | Corticosteroids, Calcineurin Inhibitors, Immunosuppressants, Biologic Therapy, PDE-4 Inhibitor, Antibiotics, Antihistamines, Emollients |

| Indication | Topical, Oral, Injectable |

| End User | Hospital Pharmacies, Retail Pharmacies, Online Pharmacies, Drug Stores, Mail Order Pharmacies, Dermatology Clinics |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, Brazil, Australia, India and 40+ Countries |

| Key Companies Profiled |

Sanofi S.A., Galderma SA, Allergan Plc., Novartis AG, Bristol-Myers Squibb, Bayer AG, Astellas Pharma Inc., Regeneron Pharmaceuticals, Pfizer Inc., AbbVie Inc. |

| Additional Attributes | Dollar sales by application and purity grade, biologic therapy adoption patterns, regional demand trends, competitive landscape, patient access programs, and insurance coverage shifts , patient access programs, and insurance coverage shifts influencing treatment uptake |

The global atopic dermatitis treatment market is estimated to be valued at USD 16.8 billion in 2025.

The market size for atopic dermatitis treatment is projected to reach USD 50.8 billion by 2035.

The atopic dermatitis treatment market is expected to grow at an 11.7% CAGR between 2025 and 2035.

Biologic therapy is projected to lead in the atopic dermatitis treatment market with 26% share in 2025.

In terms of end user, hospital pharmacies are projected to command 30% share in the atopic dermatitis treatment market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Feline Atopic Dermatitis Treatment Market Size and Share Forecast Outlook 2025 to 2035

Canine Atopic Dermatitis Treatment Market Growth – Demand & Forecast 2024-2034

Treatment-Resistant Hypertension Management Market Size and Share Forecast Outlook 2025 to 2035

Treatment-Resistant Depression Treatment Market Size and Share Forecast Outlook 2025 to 2035

Treatment Pumps Market Insights Growth & Demand Forecast 2025 to 2035

Pretreatment Coatings Market Size and Share Forecast Outlook 2025 to 2035

Air Treatment Ozone Generator Market Size and Share Forecast Outlook 2025 to 2035

CNS Treatment and Therapy Market Insights - Trends & Growth Forecast 2025 to 2035

Seed Treatment Materials Market Size and Share Forecast Outlook 2025 to 2035

Acne Treatment Solutions Market Size and Share Forecast Outlook 2025 to 2035

Scar Treatment Market Overview - Growth & Demand Forecast 2025 to 2035

Soil Treatment Chemicals Market

Water Treatment System Market Size and Share Forecast Outlook 2025 to 2035

Water Treatment Chemical Market Size and Share Forecast Outlook 2025 to 2035

Algae Treatment Chemical Market Forecast and Outlook 2025 to 2035

Water Treatment Market Size and Share Forecast Outlook 2025 to 2035

Water Treatment Ozone Generator Market Size and Share Forecast Outlook 2025 to 2035

Water Treatment Equipment Market Size and Share Forecast Outlook 2025 to 2035

Burns Treatment Market Overview – Growth, Demand & Forecast 2025 to 2035

CRBSI Treatment Market Insights - Growth, Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA