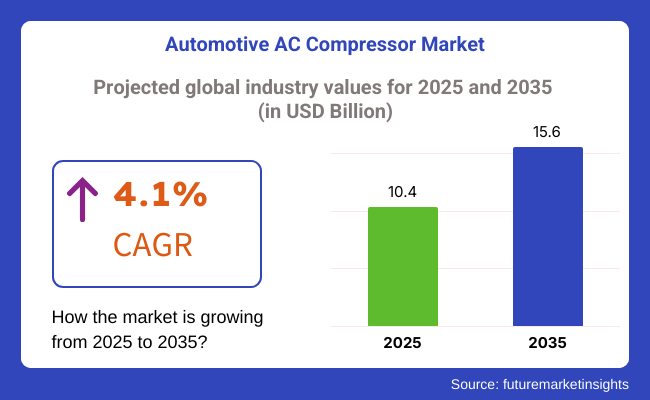

The global automotive AC compressor market was valued at USD 8.7 billion in 2020 and is estimated to reach USD 10.4 billion by 2025. Between 2025 and 2035, the market is projected to expand at a compound annual growth rate (CAGR) of 4.1%, reaching USD 15.6 billion by the end of the forecast period. This growth is expected to be driven by advancements in vehicle thermal management systems and the increasing adoption of electrified air conditioning technologies in hybrid and electric vehicles.

A prominent role in the market has been played by Toyota Industries Group. As stated on the company’s official website, “On average, 4.6 million automobile air-conditioning compressors are produced each year for North America’s 10 top automobile manufacturers.” This production volume underscores the company’s significance as a major supplier of critical HVAC components to global OEMs.

A widespread shift toward variable displacement and electric compressors has been observed across the industry. These systems are being adopted by leading Tier-1 suppliers-including Denso, Hanon Systems, and MAHLE-to improve energy efficiency and reduce parasitic engine losses. Compact, high-performance e-compressors are being developed to meet the evolving thermal demands of battery electric and hybrid vehicles.

A major challenge has been encountered in optimizing the coefficient of performance (COP) under low-voltage operating conditions. To address this, AC compressor control functions are increasingly being integrated with vehicle battery management and thermal control systems. Through this integration, optimized load distribution and improved EV range are being achieved.

The Asia-Pacific region, particularly China, has been identified as a leading market for electric compressors. By 2025, over 60% of newly produced electric vehicles in China are projected to feature electric compressor systems, driven by regulatory mandates and rapid EV adoption.

Future market growth is expected to be shaped by the emergence of smart HVAC modules, predictive diagnostics, and AI-enabled thermal control systems. As these technologies are adopted, the role of AC compressors in connected and autonomous vehicle platforms is anticipated to be redefined.

Scroll type compressors are anticipated to hold a dominant share of approximately 57% in the global automotive AC compressor market by 2025. Over the forecast period from 2025 to 2035, this segment is projected to grow at a CAGR of 4.6%, surpassing the average market growth.

Their compact design, lower noise levels, and high energy efficiency have positioned scroll compressors as the preferred choice for hybrid and battery electric vehicles (BEVs). As OEMs shift toward electrification, demand for electrically driven compressors with reduced mechanical losses has increased substantially.

Integration of scroll compressors is being accelerated by their compatibility with variable-speed operation and minimal impact on engine load, contributing to improved vehicle efficiency. These systems are also being favored for their ability to support cabin cooling while vehicles are stationary, a feature critical for EVs.

Tier-1 suppliers have responded by launching dedicated scroll-type units engineered for next-generation EV platforms. Partnerships between automakers and component suppliers have led to customized HVAC modules built around scroll compressor technology, further consolidating its market position.

Passenger cars are projected to contribute 68% of the global automotive AC compressor market by 2025, with the segment expected to expand at a CAGR of 4.4% through 2035. AC compressor integration in passenger vehicles has become standard, driven by consumer demand for comfort and regulatory mandates related to thermal system efficiency. Electrification of the passenger vehicle fleet is reinforcing this trend, as thermal management systems play a key role in both occupant comfort and battery performance.

Automakers are prioritizing compressor technologies that align with reduced emissions and better fuel economy. This is evident in the rise of compact electric SUVs and sedans outfitted with high-efficiency AC modules. In emerging economies, rising disposable incomes and growing adoption of air-conditioned vehicles have significantly supported the passenger car segment. Additionally, product differentiation in mid-range vehicles is being achieved through improved climate control systems, further enhancing compressor demand in this category.

Challenges

Fluctuations in Raw Material Prices

The Automotive AC Compressor Market is the most affected by the volatility of raw material prices, especially the aluminium, steel, and copper used in the process of manufacture. The root causes of the price change are mostly global supply chain disruptions, geopolitical tensions, and persistent inflation. If raw material costs increase, that will lead to increased production costs, and decreased manufacturer profits, consequently vehicle prices for the end-users will become costlier.

Apart from that, the shortage of semiconductors and electronic components which are very crucial for the new line of electric compressors aggravates the supply constraints more. The auto-manufacturers and suppliers will have to apply proper sourcing strategies and seek alternate materials to defuse the situation.

Stringent Environmental Regulations on Refrigerants

Environmental concerns and government legislation on refrigeration are some of the key challenges currently affecting Automotive AC Compressor Market. Many of the traditional refrigerants on the market, such as R-134A, have been outlawed in parts of the world because of their high GWP, resulting in much of the industry moving towards low-GWP alternatives such as R-134yf.

Furthermore, using eco-friendly refrigerants requires additional investments as it requires the redesigning of the entire compressor and producing new technologies. Moreover, the use of eco-friendly refrigerants entails more investments since it includes the redesigning of the whole compressor and the manufacturing of new technologies.

Moreover, the adherence to the strict regulations like the F-Gas Regulation within the EU and the guidelines of the USA EPA make it thus uncommon. Companies are put under pressure to get the right mix of environment and social governance that is cost-efficient yet at the same time beneficial for their business like producing next-generation sustainable AC compressors.

Opportunities

Growth in Electric and Hybrid Vehicle Adoption

The presence of electric and hybrid vehicles in the automotive market forces the automotive AC compressor market to evolve, therefore, this is a big opportunity. Instead of the traditional belt-driven compressors found in ICE vehicles, hybrid and EVs need electric-driven compressors that, for a part, are operated separately from the engine. Electric vehicles have high demand among the consumers, and this is a reason why local manufacturers are producing smaller energy-saving AC compressors.

The companies that deal with the manufacturing of high-voltage electric compressors and intelligent climate controls are likely to achieve considerable profits from the project. In the course of time, as the production of EVs increases, the suppliers, who will be applying the compressor technologies in innovative ways, will gain the competitive gain in the market

Advancements in Smart and Energy-Efficient Climate Control Systems

The advent of intelligent and energy-efficient climate control systems, namely the Automotive AC Compressor Market has initiated radical changes. Car manufacturers are acquiescent to the will of technologies that include variable displacement compressors, heat pump technology, and AI-managed climate control systems, thereby enhancing passenger comfort and diverting from the mainstream energy consumption. These changes mean a lot for the electric cars, where heat management is the major factor affecting battery longevity and the overall performance of the vehicle.

The introduction of IoT and connected car technologies makes it possible to monitor in real-time and adapt the climate effectively thus improving the energy efficiency. The firms where the compressor designs will be next-generation with predictive climate control algorithms set are the ones that will take advantage of the movement to the smart automotive HVAC systems.

The USA automotive AC compressor scene is on the path to reach a notable market capitalization and is speculated to grow at a compound annual growth rate of 3.8% (2025 to 2035). The factors which are initiating this skyrocket rise are strong automotive production, increasing demand for electric & hybrid vehicles alongside consumer choices for sophisticated climate controls. The presence of major automakers and HVAC component manufacturers, in turn, is solid evidence of the strong performance of this market.

In addition, the changes in the compressor design that are caused by the shift in the refrigerant to eco-friendly ones like R-1234yf are also a factor. The electric compressors for EVs changing from the standard to the green paradigm is a hallmark trend. Aftermarket sales are coming in too eye-catching numbers due to factors like total vehicle longevity and the new requirement for replacements.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 3.8% |

The UK platform is projected to rise at a compound of 3.5% annually and reach a considerable market size between 2025 and 2035 if we consider the primary factor that is the soaring penetration of electric vehicles along with the government’s support for carbon neutrality by 2035. Cars manufacturers have to some extent changed to the adoption of lightweight and compressing energy-efficient machines to realize their plans for better car efficiency.

The move towards electric AC compressors in hybrid and electric vehicles, together with the need for complex climate controls, is spurring innovation. Apart from that, the very strict emission laws and consumers’ preferences for the thermal comfort have played an important role in the market expansion. Furthermore, the post-Brexit auto policies probably will have an impact on the component imports and manufacturing trends.

| Country | CAGR (2025 to 2035) |

|---|---|

| United kingdom | 3.5% |

The EU automotive AC compressor market is unequivocally set to witness a phenomenal CAGR of 3.9% (2025 to 2035) as a result of new regulations regarding CO₂ emissions, the growing demand for EVs, and the massive presence of an automotive industry in Europe.

Manufacturers leading the charge in this field like Bosch and Valeo are turning their attention to the engineering of energy-efficient and sustainable HVAC technology. The move to the use of refrigerants and the development of electric compressors fits right into the mandates of the EU's Green Deal.

The major markets for Germany, France, and Italy are massively in demand for luxury cars having implemented the climate of conflict with high-tech solutions. The government's promotion of the purchase of hybrid and electric cars is expected to result in a turnaround in the market.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 3.9% |

Japan's market has been proven to be the site of the next stage of development of math-entertainment robots which was predicted to grow at a CAGR of 4.2% (2025 to 2035).

The reason for it is investor funds to R&D, the joint effort of researchers & engineers, and the expertise of local and foreign companies in these subjects. Local Industry Leaders such as Denso and Mitsubishi Heavy Industries drive the results of innovation in the innovation of portable AC compressors betting on better efficiency.

The need for electric AC compressors has increased as Japan is stepping up EV manufacturing due to the aims of reaching carbon neutrality by 2050. Also, Japan's harsh seasonal weather conditions require sophisticated climate control systems thereby benefitting sales even more.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.2% |

The CNC machine tool market in South Korea is predicted to have the highest growth rate in the PALs area with a projected CAGR of 4.5% (2025 to 2035). The latest two segments of the fast-growing automaker industry: Hyundai and Kia are rapidly expanding their electric and hybrid vehicle line-ups, thus, increasing the demand for high-efficiency AC compressors.

Further, the fight against climate change is accompanied by grants for the manufacturing of EVs and further progress in green automotive technology which is the initiative from the government.

In order to generate significant interest in their products, the Korean manufacturers are including AI in smart climate control technology. The automotive component exports to other countries such as the USA and the EU which is expected to fuel the growth process are marketing.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.5% |

The Automotive AC Compressor Market is a key element in vehicle climate control systems by the cooling process these units achieve. Markets are driven by rising car production, the growing use of electric vehicles (EVs), and the latest development in energy-efficient compressor technology.

The main factors present are replacing the use of electric compressors in EVs, switching to lightweight and compact compressor models, and the increase in the lifespan of the components used in extreme weather conditions.

The most important companies dominating the market include Denso Corporation, Hanon Systems, Valeo, Sanden Corporation, and MAHLE GmbH, among others. The landscape is defined by strong competition, technological advancement, and strategic alliances to improve measures of energy efficiency and sustainability.

Denso Corporation

Denso Corporation is a global major in automotive air conditioning systems and their solution includes supplying high efficiency, energy-saving vehicle climate control compressors. In a bid to improve energy usage and reduce the ecological footprint, the group engages in significant R&D efforts. With sustainable development in mind Denso produces CO2-based refrigerants and electric compressors for hybrid and electric vehicles.

With a great number of manufacturing plants across the globe and holds partnerships with various popular automakers, Denso expands a plant in the North American region as well as in Asia. It focuses on providing technologies and regulatory frameworks to keep up with the latest market trends.

Hanon Systems

Hanon Systems has established itself as a principal player in the automotive thermal management industry with a special focus on electric compressors for hybrid and battery electric vehicles. The business uses a lightweight content and smart control technology to improve energy efficiency and return of the car. Hanon is forming sustainable solutions by bringing forth eco-friendly refrigerants and lowered emission components.

As its footprint grows in the Asia-Pacific and European markets, the company is restructuring its relationship with car manufacturers worldwide. The continuous STAGE research & development, and innovative thermal solutions that keep Hanon Systems at the forefront of the rapidly evolving automotive industry.

Valeo

Valeo is one of the leading manufacturers of compact and energy-efficient automotive compressors, which are also designed for sustainability and efficiency. They have been a leader in developing refrigerants based on CO2, which contribute significantly to reducing the environmental footprint. Valeo's lightweight and energy-efficient compressors reflect the growing popularity of electric and hybrid vehicles.

The firm is rapidly raising its stakes within Europe as well as opening itself up to the world. Valeo's research into high-tech cooling is a sign of its ambitions to comply with ever-defining regulations. It is precisely these collaborations with the automobile industry, as well as its R&D funding, that position Valeo as a friend to the biggest names in the automotive climate control market.

Sanden Corporation

Sanden Corporation is a well-known supplier of variable and fixed displacement compressors. The company has developed a product range that caters to both passenger and commercial vehicles. Sanden has set its sights on the electric vehicle segment of the market by developing new technologies that will increase electric compressor's efficiency.

The company also encourages product durability and performance as it ensures their products can withstand extreme climate conditions. Sanden is a global company and a lot of its suppliers are based in North America and Asia. The shift towards EV sector along with the introduction of new technologies has made Sanden a strong industry player in the automotive AC compressor market.

MAHLE GmbH

MAHLE GmbH is a company pioneering the thermal management technology of tomorrow, by emphasizing reducing emissions and achieving better fuel economy. The firm is actively developing next-generation compressors that lose the least amount of energy in cooling systems in vehicles. MAHLE's innovative cooling technologies are designed for the ever-growing market of electrified powertrains in hybrid and battery electric vehicles.

By investing in eco-friendly refrigerants and lightweight components, the company has placed a strong emphasis on the sustainability drive. MAHLE has, through the expansion of its R&D division, rightfully appointed itself as a future market leader in automotive climate control technology.

In terms of Configuration, the industry is divided into Scroll Type Compressor, Rotary Type Compressor.

In terms of Vehicle type, the industry is divided into Passenger Cars, Light Commercial Vehicle, Heavy Commercial Vehicle.

The report covers key regions, including North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia, and the Middle East and Africa (MEA).

The global Automotive AC Compressor market is projected to reach USD 10.4 billion by the end of 2025.

The market is anticipated to grow at a CAGR of 4.1% over the forecast period.

By 2035, the Automotive AC Compressor market is expected to reach USD 15.6 billion.

The Scroll Type Compressor segment is expected to dominate the market, due to their high efficiency, compact design, low noise, durability, and smooth operation, making them ideal for modern vehicles requiring reliable and energy-efficient cooling solutions.

Key players in the Automotive AC Compressor market include Denso Corporation, Hanon Systems, Valeo, Sanden Corporation, MAHLE GmbH.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Configuration, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Configuration, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by Vehicle Type, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 8: Global Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 9: Global Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 10: Global Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Configuration, 2018 to 2033

Table 14: North America Market Volume (Units) Forecast by Configuration, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 16: North America Market Volume (Units) Forecast by Vehicle Type, 2018 to 2033

Table 17: North America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 18: North America Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 19: North America Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 20: North America Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Configuration, 2018 to 2033

Table 24: Latin America Market Volume (Units) Forecast by Configuration, 2018 to 2033

Table 25: Latin America Market Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 26: Latin America Market Volume (Units) Forecast by Vehicle Type, 2018 to 2033

Table 27: Latin America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 28: Latin America Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 29: Latin America Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 30: Latin America Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 31: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: Western Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 33: Western Europe Market Value (US$ Million) Forecast by Configuration, 2018 to 2033

Table 34: Western Europe Market Volume (Units) Forecast by Configuration, 2018 to 2033

Table 35: Western Europe Market Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 36: Western Europe Market Volume (Units) Forecast by Vehicle Type, 2018 to 2033

Table 37: Western Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 38: Western Europe Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 39: Western Europe Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 40: Western Europe Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 41: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: Eastern Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 43: Eastern Europe Market Value (US$ Million) Forecast by Configuration, 2018 to 2033

Table 44: Eastern Europe Market Volume (Units) Forecast by Configuration, 2018 to 2033

Table 45: Eastern Europe Market Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 46: Eastern Europe Market Volume (Units) Forecast by Vehicle Type, 2018 to 2033

Table 47: Eastern Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 48: Eastern Europe Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 49: Eastern Europe Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 50: Eastern Europe Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 51: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 52: South Asia and Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 53: South Asia and Pacific Market Value (US$ Million) Forecast by Configuration, 2018 to 2033

Table 54: South Asia and Pacific Market Volume (Units) Forecast by Configuration, 2018 to 2033

Table 55: South Asia and Pacific Market Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 56: South Asia and Pacific Market Volume (Units) Forecast by Vehicle Type, 2018 to 2033

Table 57: South Asia and Pacific Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 58: South Asia and Pacific Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 59: South Asia and Pacific Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 60: South Asia and Pacific Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 61: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 62: East Asia Market Volume (Units) Forecast by Country, 2018 to 2033

Table 63: East Asia Market Value (US$ Million) Forecast by Configuration, 2018 to 2033

Table 64: East Asia Market Volume (Units) Forecast by Configuration, 2018 to 2033

Table 65: East Asia Market Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 66: East Asia Market Volume (Units) Forecast by Vehicle Type, 2018 to 2033

Table 67: East Asia Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 68: East Asia Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 69: East Asia Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 70: East Asia Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 71: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 72: Middle East and Africa Market Volume (Units) Forecast by Country, 2018 to 2033

Table 73: Middle East and Africa Market Value (US$ Million) Forecast by Configuration, 2018 to 2033

Table 74: Middle East and Africa Market Volume (Units) Forecast by Configuration, 2018 to 2033

Table 75: Middle East and Africa Market Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 76: Middle East and Africa Market Volume (Units) Forecast by Vehicle Type, 2018 to 2033

Table 77: Middle East and Africa Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 78: Middle East and Africa Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 79: Middle East and Africa Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 80: Middle East and Africa Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Configuration, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 6: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 7: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 8: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 9: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 10: Global Market Value (US$ Million) Analysis by Configuration, 2018 to 2033

Figure 11: Global Market Volume (Units) Analysis by Configuration, 2018 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Configuration, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Configuration, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 15: Global Market Volume (Units) Analysis by Vehicle Type, 2018 to 2033

Figure 16: Global Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 17: Global Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 18: Global Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 19: Global Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 20: Global Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 21: Global Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 22: Global Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 23: Global Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 24: Global Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 25: Global Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 26: Global Market Attractiveness by Configuration, 2023 to 2033

Figure 27: Global Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 28: Global Market Attractiveness by Product Type, 2023 to 2033

Figure 29: Global Market Attractiveness by Sales Channel, 2023 to 2033

Figure 30: Global Market Attractiveness by Region, 2023 to 2033

Figure 31: North America Market Value (US$ Million) by Configuration, 2023 to 2033

Figure 32: North America Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 33: North America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 34: North America Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 35: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 36: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 37: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 38: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 39: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 40: North America Market Value (US$ Million) Analysis by Configuration, 2018 to 2033

Figure 41: North America Market Volume (Units) Analysis by Configuration, 2018 to 2033

Figure 42: North America Market Value Share (%) and BPS Analysis by Configuration, 2023 to 2033

Figure 43: North America Market Y-o-Y Growth (%) Projections by Configuration, 2023 to 2033

Figure 44: North America Market Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 45: North America Market Volume (Units) Analysis by Vehicle Type, 2018 to 2033

Figure 46: North America Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 47: North America Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 48: North America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 49: North America Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 50: North America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 51: North America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 52: North America Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 53: North America Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 54: North America Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 55: North America Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 56: North America Market Attractiveness by Configuration, 2023 to 2033

Figure 57: North America Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 58: North America Market Attractiveness by Product Type, 2023 to 2033

Figure 59: North America Market Attractiveness by Sales Channel, 2023 to 2033

Figure 60: North America Market Attractiveness by Country, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) by Configuration, 2023 to 2033

Figure 62: Latin America Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 63: Latin America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 64: Latin America Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 66: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 67: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 68: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 69: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 70: Latin America Market Value (US$ Million) Analysis by Configuration, 2018 to 2033

Figure 71: Latin America Market Volume (Units) Analysis by Configuration, 2018 to 2033

Figure 72: Latin America Market Value Share (%) and BPS Analysis by Configuration, 2023 to 2033

Figure 73: Latin America Market Y-o-Y Growth (%) Projections by Configuration, 2023 to 2033

Figure 74: Latin America Market Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 75: Latin America Market Volume (Units) Analysis by Vehicle Type, 2018 to 2033

Figure 76: Latin America Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 77: Latin America Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 78: Latin America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 79: Latin America Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 80: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 81: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 82: Latin America Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 83: Latin America Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 84: Latin America Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 85: Latin America Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 86: Latin America Market Attractiveness by Configuration, 2023 to 2033

Figure 87: Latin America Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 88: Latin America Market Attractiveness by Product Type, 2023 to 2033

Figure 89: Latin America Market Attractiveness by Sales Channel, 2023 to 2033

Figure 90: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 91: Western Europe Market Value (US$ Million) by Configuration, 2023 to 2033

Figure 92: Western Europe Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 93: Western Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 94: Western Europe Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 95: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 96: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 97: Western Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 98: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 99: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 100: Western Europe Market Value (US$ Million) Analysis by Configuration, 2018 to 2033

Figure 101: Western Europe Market Volume (Units) Analysis by Configuration, 2018 to 2033

Figure 102: Western Europe Market Value Share (%) and BPS Analysis by Configuration, 2023 to 2033

Figure 103: Western Europe Market Y-o-Y Growth (%) Projections by Configuration, 2023 to 2033

Figure 104: Western Europe Market Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 105: Western Europe Market Volume (Units) Analysis by Vehicle Type, 2018 to 2033

Figure 106: Western Europe Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 107: Western Europe Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 108: Western Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 109: Western Europe Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 110: Western Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 111: Western Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 112: Western Europe Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 113: Western Europe Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 114: Western Europe Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 115: Western Europe Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 116: Western Europe Market Attractiveness by Configuration, 2023 to 2033

Figure 117: Western Europe Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 118: Western Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 119: Western Europe Market Attractiveness by Sales Channel, 2023 to 2033

Figure 120: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: Eastern Europe Market Value (US$ Million) by Configuration, 2023 to 2033

Figure 122: Eastern Europe Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 123: Eastern Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 124: Eastern Europe Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 125: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 126: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 127: Eastern Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 128: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 129: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 130: Eastern Europe Market Value (US$ Million) Analysis by Configuration, 2018 to 2033

Figure 131: Eastern Europe Market Volume (Units) Analysis by Configuration, 2018 to 2033

Figure 132: Eastern Europe Market Value Share (%) and BPS Analysis by Configuration, 2023 to 2033

Figure 133: Eastern Europe Market Y-o-Y Growth (%) Projections by Configuration, 2023 to 2033

Figure 134: Eastern Europe Market Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 135: Eastern Europe Market Volume (Units) Analysis by Vehicle Type, 2018 to 2033

Figure 136: Eastern Europe Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 137: Eastern Europe Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 138: Eastern Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 139: Eastern Europe Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 140: Eastern Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 141: Eastern Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 142: Eastern Europe Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 143: Eastern Europe Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 144: Eastern Europe Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 145: Eastern Europe Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 146: Eastern Europe Market Attractiveness by Configuration, 2023 to 2033

Figure 147: Eastern Europe Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 148: Eastern Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 149: Eastern Europe Market Attractiveness by Sales Channel, 2023 to 2033

Figure 150: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 151: South Asia and Pacific Market Value (US$ Million) by Configuration, 2023 to 2033

Figure 152: South Asia and Pacific Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 153: South Asia and Pacific Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 154: South Asia and Pacific Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 155: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 156: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 157: South Asia and Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 158: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 159: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 160: South Asia and Pacific Market Value (US$ Million) Analysis by Configuration, 2018 to 2033

Figure 161: South Asia and Pacific Market Volume (Units) Analysis by Configuration, 2018 to 2033

Figure 162: South Asia and Pacific Market Value Share (%) and BPS Analysis by Configuration, 2023 to 2033

Figure 163: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Configuration, 2023 to 2033

Figure 164: South Asia and Pacific Market Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 165: South Asia and Pacific Market Volume (Units) Analysis by Vehicle Type, 2018 to 2033

Figure 166: South Asia and Pacific Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 167: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 168: South Asia and Pacific Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 169: South Asia and Pacific Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 170: South Asia and Pacific Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 171: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 172: South Asia and Pacific Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 173: South Asia and Pacific Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 174: South Asia and Pacific Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 175: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 176: South Asia and Pacific Market Attractiveness by Configuration, 2023 to 2033

Figure 177: South Asia and Pacific Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 178: South Asia and Pacific Market Attractiveness by Product Type, 2023 to 2033

Figure 179: South Asia and Pacific Market Attractiveness by Sales Channel, 2023 to 2033

Figure 180: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 181: East Asia Market Value (US$ Million) by Configuration, 2023 to 2033

Figure 182: East Asia Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 183: East Asia Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 184: East Asia Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 185: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 186: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 187: East Asia Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 188: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 189: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 190: East Asia Market Value (US$ Million) Analysis by Configuration, 2018 to 2033

Figure 191: East Asia Market Volume (Units) Analysis by Configuration, 2018 to 2033

Figure 192: East Asia Market Value Share (%) and BPS Analysis by Configuration, 2023 to 2033

Figure 193: East Asia Market Y-o-Y Growth (%) Projections by Configuration, 2023 to 2033

Figure 194: East Asia Market Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 195: East Asia Market Volume (Units) Analysis by Vehicle Type, 2018 to 2033

Figure 196: East Asia Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 197: East Asia Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 198: East Asia Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 199: East Asia Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 200: East Asia Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 201: East Asia Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 202: East Asia Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 203: East Asia Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 204: East Asia Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 205: East Asia Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 206: East Asia Market Attractiveness by Configuration, 2023 to 2033

Figure 207: East Asia Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 208: East Asia Market Attractiveness by Product Type, 2023 to 2033

Figure 209: East Asia Market Attractiveness by Sales Channel, 2023 to 2033

Figure 210: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 211: Middle East and Africa Market Value (US$ Million) by Configuration, 2023 to 2033

Figure 212: Middle East and Africa Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 213: Middle East and Africa Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 214: Middle East and Africa Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 215: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 216: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 217: Middle East and Africa Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 218: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 219: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 220: Middle East and Africa Market Value (US$ Million) Analysis by Configuration, 2018 to 2033

Figure 221: Middle East and Africa Market Volume (Units) Analysis by Configuration, 2018 to 2033

Figure 222: Middle East and Africa Market Value Share (%) and BPS Analysis by Configuration, 2023 to 2033

Figure 223: Middle East and Africa Market Y-o-Y Growth (%) Projections by Configuration, 2023 to 2033

Figure 224: Middle East and Africa Market Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 225: Middle East and Africa Market Volume (Units) Analysis by Vehicle Type, 2018 to 2033

Figure 226: Middle East and Africa Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 227: Middle East and Africa Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 228: Middle East and Africa Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 229: Middle East and Africa Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 230: Middle East and Africa Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 231: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 232: Middle East and Africa Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 233: Middle East and Africa Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 234: Middle East and Africa Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 235: Middle East and Africa Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 236: Middle East and Africa Market Attractiveness by Configuration, 2023 to 2033

Figure 237: Middle East and Africa Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 238: Middle East and Africa Market Attractiveness by Product Type, 2023 to 2033

Figure 239: Middle East and Africa Market Attractiveness by Sales Channel, 2023 to 2033

Figure 240: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automotive Carbon Ceramic Brake Market Size and Share Forecast Outlook 2025 to 2035

Automotive Camshaft Market Size and Share Forecast Outlook 2025 to 2035

Automotive Stamping Industry Analysis in India Size and Share Forecast Outlook 2025 to 2035

Automotive Cylinder Liner Market Size and Share Forecast Outlook 2025 to 2035

Automotive Microcontroller Market Size and Share Forecast Outlook 2025 to 2035

Automotive Roof Rails Market Size and Share Forecast Outlook 2025 to 2035

Automotive Diagnostic Scan Tool Market Size and Share Forecast Outlook 2025 to 2035

Automotive Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Automotive Dynamic Map Data Market Size and Share Forecast Outlook 2025 to 2035

Automotive Green Tires Market Size and Share Forecast Outlook 2025 to 2035

Automotive E-Tailing Market Size and Share Forecast Outlook 2025 to 2035

Automotive Interior Market Forecast Outlook 2025 to 2035

Automotive Key Market Size and Share Forecast Outlook 2025 to 2035

Automotive Appearance Chemical Market Forecast and Outlook 2025 to 2035

Automotive Seating Market Forecast and Outlook 2025 to 2035

Automotive Domain Control Module Market Forecast and Outlook 2025 to 2035

Automotive Remote Diagnostic Market Forecast and Outlook 2025 to 2035

Automotive-grade Inertial Navigation System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Thin IGBT Module Market Size and Share Forecast Outlook 2025 to 2035

Automotive Hydrogen Leak Detection Sensors Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA