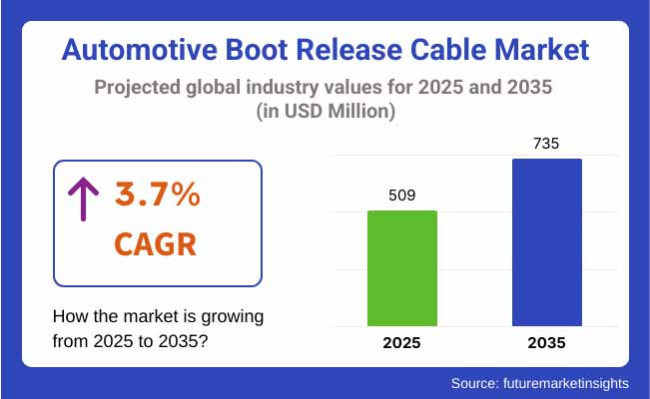

The global Automotive Boot Release Cable Market is valued at USD 509 million in 2025. It is expected to grow at a CAGR of 3.7% and reach USD 735 million by 2035.

The automotive boot release cable market is poised for steady growth, driven by rising vehicle production, increasing aftermarket replacement demand, and advancements in cable technology.

As the industry evolves with the shift towards electric vehicles and enhanced automotive features, manufacturers focusing on durable, high-quality components stand to benefit. However, those failing to innovate or adapt to new vehicle technologies may struggle to maintain market relevance.

The automotive boot release cable market is poised for steady growth, driven by rising vehicle production, increasing aftermarket replacement demand, and advancements in cable technology.

As the industry evolves with the shift towards electric vehicles and enhanced automotive features, manufacturers focusing on durable, high-quality components stand to benefit. However, those failing to innovate or adapt to new vehicle technologies may struggle to maintain market relevance.

Manual cables are still used because they’re simple and dependable. They work well in many vehicles, especially entry-level ones. More vehicles now use electrical release systems. These offer better control and fit well with electric and hybrid vehicles. As more cars become automated, demand for electrical cables is growing.

That said, manual systems won’t disappear. They’ll stay relevant in low-cost models. Companies that build strong, adaptable systems-both manual and electrical-will be better positioned. The key is to design cables that work across different vehicle types and tech platforms.

Passenger cars, which make up most of the global auto market, will drive most of the demand. Buyers want cars that are easy to use, efficient, and built to last-and boot release systems are part of that.

Commercial vehicles will grow too. More demand for delivery vans and service fleets means more need for durable components. These vehicles often face rougher use, so they need heavy-duty cables that can handle wear and tear.

Both types of vehicles will benefit from tech upgrades. But passenger cars will shift faster toward electrical systems since they already use more automation and electrification.

To keep up, manufacturers will start making more specialized products-tailored to the specific needs of each vehicle type.

OEMs will play a major role. Car makers will keep using boot release cables in new models, especially as they focus more on quality and long-term reliability. As boot systems become more advanced, OEMs will supply these parts not just to factories, but also to authorized service centers.

At the same time, the aftermarket will grow steadily. Older cars need replacements, and more drivers are upgrading their vehicles instead of buying new ones. As vehicles stay on the road longer, the need for cost-effective, durable replacement cables will rise.

Aftermarket players will also push innovation-offering better performance at lower costs to attract a wider set of customers.

Both channels matter. OEMs will lead with tech improvements, while aftermarket suppliers will scale to meet everyday needs.

The type of material segment of the car boot release cable market will experience significant changes between 2025 and 2035, with steel remaining dominant because of its strength and affordability.

Steel cables have remained the most sought-after for decades, providing endurance and resistance to wear and tear in challenging environments.

But aluminum is set to catch up in the forecast period with its lightweight nature and cost advantage, particularly as the industry focuses more on fuel efficiency and lightweight materials to enhance vehicle performance.

Other metals, such as high-strength alloys, will also gain increasing applications in high-performance and premium vehicles that need enhanced durability and corrosion resistance. As car manufacturers continue to look for materials that maximize performance and minimize overall weight, the use of advanced materials will grow.

This trend will spur innovation in material science so that manufacturers can supply a wider variety of cars while complying with changing safety and performance requirements.

Embrace Technological Advancements in Cable Systems

Stakeholders should invest in research and development for innovative boot release cable technologies, focusing on electrical systems that cater to the growing demand for automation in vehicles.

With the rise of electric and hybrid vehicles, adopting electrical release systems that offer better performance and integration will be key. Manufacturers must also ensure the development of lightweight, durable materials to align with evolving vehicle requirements.

Align with EV and Vehicle Electrification Trends

As electric vehicles (EVs) become more prominent, stakeholders must focus on designing boot release cables that are compatible with EVs and their unique operational requirements.

Collaboration with OEMs to integrate these systems into the latest vehicle models will be crucial.

Moreover, ensuring that cables are optimized for long-lasting performance in electric vehicles should be a priority, given the increasing emphasis on sustainability.

Strengthen Distribution Channels and Form Strategic Partnerships

Stakeholders should enhance partnerships with OEMs and aftermarket suppliers to strengthen their market presence. Expanding into emerging markets where automotive sales are growing rapidly could unlock significant revenue streams.

Additionally, fostering strong collaborations with key distribution channels and service providers will allow stakeholders to address evolving customer demands efficiently, ensuring product accessibility and faster response times in aftermarket services.

| Risk | Technological obsolescence in cables |

|---|---|

| Probability | High |

| Impact | High |

| Risk | Supply chain disruptions |

|---|---|

| Probability | Medium |

| Impact | High |

| Risk | Technological obsolescence in cables |

|---|---|

| Probability | Medium |

| Impact | Medium |

1 Year Executive Watchlist

| Priority | Immediate Action |

|---|---|

| Priority Item 1 | Run feasibility on integrating electrical boot release systems into new models. |

| Priority Item 2 | Initiate collaboration discussions with EV manufacturers on cable compatibility. |

| Priority Item 3 | Launch OEM feedback loop on cable performance in hybrid and electric vehicles. |

Stakeholders must adapt to the rapidly evolving automotive landscape by focusing on innovation in boot release cables, particularly those suitable for electric and hybrid vehicles.

As the shift towards vehicle electrification continues, investing in technological advancements, securing strong OEM partnerships, and expanding into key global markets will be critical to staying competitive. This intelligence should shape the strategic roadmap to prioritize sustainable materials, digital technologies, and customer-centric distribution strategies, positioning stakeholders for long-term growth and industry leadership.

Surveyed Q4 2024, n=450 stakeholder participants evenly distributed across manufacturers, distributors, automotive OEMs, and aftermarket suppliers in the USA, Western Europe, Japan, and South Korea

Compliance with Regulatory Standards

80% of stakeholders globally identified compliance with safety standards and environmental regulations as a "critical" priority. Durability and Performance: 74% highlighted the need for long-lasting, high-performance materials (steel/aluminum) to justify investments, ensuring product reliability over the vehicle's lifespan.

Regional Variance

High Variance

Convergent and Divergent Perspectives on ROI

69% of USA stakeholders determined that automation and new materials were worth the investment, while 32% of Japanese stakeholders still rely on traditional manual systems, focusing on cost-effectiveness.

Consensus:Steel: 67% of stakeholders overall selected steel due to its durability and cost-effectiveness for high-traffic vehicles.

Variance

Shared Challenges

85% cited rising material costs (steel up 30%, aluminum up 18%) as a major issue impacting profitability.

Regional Differences

Manufacturers

Distributors

End-Users (Automotive OEMs/Aftermarket Suppliers)

Alignment

71% of global manufacturers plan to invest in automation and advanced cable technologies to meet evolving vehicle demands.

Divergence

High Consensus

Safety compliance, durability, and price sensitivity are universal concerns across all regions.

Key Variances

Strategic Insight

A region-specific strategy is crucial for market entry and growth. Manufacturers should tailor solutions based on regional preferences for material types (steel in the USA, aluminum in Europe, hybrids in Asia), technological integration, and price sensitivity to ensure long-term success in this growing market.

| Countries | Impact of Policies and Regulations |

|---|---|

| United States | Stringent safety regulations such as FMVSS (Federal Motor Vehicle Safety Standards) require boot release cables to meet high durability and performance standards. Additionally, the California Air Resources Board (CARB) enforces stricter environmental regulations, prompting manufacturers to focus on sustainable materials and emission reductions. Certifications like ISO 9001 (quality management) and ISO 14001 (environmental management) are mandatory for compliance. |

| Western Europe | The EU's General Safety Regulation (EU 2019/2144) imposes standards for vehicle components, including cables, to enhance road safety. Stringent environmental regulations such as EU REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) force companies to adopt eco- friendly materials in boot release cables. Additionally, CE certification is mandatory for automotive parts, ensuring compliance with EU safety and environmental standards. |

| Japan | Japan's Automobile Safety Standards require that automotive parts, including boot release cables, meet specific safety performance requirements. The country has been slow to adopt EU-style sustainability standards but is pushing forward with stricter compliance for eco-friendly materials in vehicle manufacturing under initiatives like Japan's Top Runner Program. Certification for product quality and durability, such as JIS (Japanese Industrial Standards), is necessary for local market access. |

| South Korea | South Korea enforces vehicle safety regulations under KSA (Korea Safety Authority), which requires that automotive components, including boot release cables, meet specific crash-test safety criteria. Environmental regulations are less stringent than in the EU but are evolving. South Korea is also adopting ISO 14001 certifications to ensure sustainable production processes. Manufacturers need to comply with these standards to secure domestic market share and exports. |

| Company | Market Share |

|---|---|

| Magna International | 25% |

| Aisin Corporation | 20% |

| Vitesco Technologies | 15% |

| DURA Automotive Systems | 12% |

| Kongsberg Automotive | 10% |

| Other Players | 18% |

Key Developments

The United States automotive boot release cable market is forecast to expand at a consistent rate between 2025 and 2035, with a CAGR of 4.0%. The growth of the market is fueled by the rising need for high-performance and durable automobile components, especially as the nation continues to experience major transitions towards electric and hybrid car manufacturing.

The increasing number of vehicles in service and the need for replacement aftermarket parts will be among the prime drivers of this growth. Also, the USA automotive industry's emphasis on sophisticated technologies, including electrical release systems, is a key driver of the demand for boot release cables.

The USA automotive sector is highly competitive, and the manufacturers are concentrating on achieving tough regulatory norms for safety and environmental standards, which has spurred the adoption of sustainable materials in cable manufacturing.

In addition, the market will continue to expand through growing cooperation between OEMs and after-market suppliers for both the new vehicle production and replacement vehicle sectors. With strong R&D investment, the USA auto market will continue to be a leader in boot release cable technology innovation.

The automotive boot release cable market in the United Kingdom is projected to grow steadily between 2025 and 2035, with a CAGR of 3.5%. This growth will be driven by the shift toward electric vehicles and increasing consumer demand for advanced automotive parts. The UK has been quick to adopt sustainability initiatives, including the government's push toward net-zero emissions by 2030.

As a result, there is growing interest in automotive components that support these objectives, including lightweight and recyclable materials for boot release cables. Additionally, the UK automotive sector is focused on innovations in safety, which is expected to drive the demand for higher-performing cables. The market is also supported by strong automotive manufacturing activity, particularly in the production of premium vehicles, which require specialized cable systems for both OEMs and the aftermarket.

As regulations regarding vehicle safety and emissions tighten, manufacturers will be increasingly pressured to adopt advanced technologies, including automation in cable systems. The UK is also witnessing an increase in electric vehicle sales, which will likely drive the adoption of more sophisticated boot release cable technologies tailored for EVs.

In France, the automotive boot release cable market is anticipated to grow at a CAGR of 3.8% from 2025 to 2035. France, as one of the largest automotive manufacturing hubs in Europe, continues to see significant demand for high-quality automotive components, including boot release cables. The French automotive industry is increasingly shifting toward electric and hybrid vehicles, which is expected to influence the demand for innovative cable systems.

Additionally, the French government’s strong environmental policies, including its ambitious targets for reducing carbon emissions, are likely to drive the adoption of sustainable and lightweight materials in automotive parts.

Manufacturers in France are focused on adhering to both domestic and EU-wide regulations that ensure product safety and environmental sustainability. This focus on sustainability and technological innovation will likely lead to the development of more advanced cable systems, capable of meeting the needs of next-generation vehicles.

Moreover, the growing interest in the aftermarket sector for electric vehicle parts and components will provide a significant opportunity for boot release cable manufacturers. The robust support for green manufacturing initiatives in France will likely position the country as a key player in the European market for boot release cables.

Germany's automotive boot release cable market will grow at a CAGR of 4.2% from 2025 to 2035. Germany is renowned for its strong automotive industry, and it remains one of the world's leading producers and exporters of vehicles. As electric vehicles are being taken up rapidly, the German automotive industry is witnessing a paradigm shift that demands efficient and innovative solutions for vehicle parts, such as boot release cables.

Germany's dedication to environmental standards and sustainability, backed up by EU regulation, has led manufacturers to pay attention to materials and technologies minimizing the carbon footprint and maximizing cable performance. The demand for durable and high-quality components is most pronounced in the premium vehicle segment, which propels most demand for boot release cables.

Moreover, Germany's dominance in automobile innovation and R&D spending will be instrumental in determining the advanced release cable technology market. As a country with a robust export market, German manufacturers are positioned to capture increasing global demand for environmentally friendly and high-performance car components, especially in the light of increasing trends towards electric mobility.

The Italian market for automotive boot release cables will grow at a CAGR of 3.2% from 2025 to 2035. Italy, which houses established auto companies such as Fiat and Ferrari, continues to see stable demand for auto parts such as boot release cables, particularly in the luxury vehicle segment.

The transition towards electric mobility in Italy, together with the initiatives of the government to encourage greener technologies, is likely to impact the automotive parts market. Italian producers are increasingly turning towards developing components compatible with these green initiatives by utilizing sustainable materials and production methods. Additionally, as Italy further evolves its EV industry, the demand for dedicated release cable systems for these vehicles is likely to increase.

Moreover, Italy's automotive industry enjoys a reputation for innovative design, which will boost the demand for high-function and state-of-the-art boot release cables. The market, therefore, will expand in the aftermarket market because of the increasing number of vehicles in use. Italy's robust automotive manufacturing base and its commitment to incorporating new technologies into production ranks it as a crucial player in the European boot release cable market.

In New Zealand, the automotive boot release cable market is projected to grow at a CAGR of 3.0% from 2025 to 2035. While New Zealand is a smaller market compared to other countries, the automotive sector in the region continues to experience growth, particularly in the demand for parts related to the country’s growing fleet of electric and hybrid vehicles. The market is expected to expand as more vehicles require replacement cables for boot release systems, driven by an increase in vehicle ownership and an expanding automotive aftermarket sector.

The adoption of EVs in New Zealand is increasing, with the government offering incentives to encourage the purchase of electric vehicles. This transition to electric vehicles is expected to drive demand for more advanced boot release cables, particularly those designed to meet the specific needs of electric mobility.

Furthermore, New Zealand’s commitment to sustainability and carbon neutrality will encourage the use of lightweight and recyclable materials in automotive components, including boot release cables. The automotive market is also benefiting from strong import activities, which will increase the availability of advanced vehicle components in the country.

South Korea’s automotive boot release cable market is expected to grow at a CAGR of 4.1% from 2025 to 2035. As one of the leading manufacturers of vehicles in Asia, South Korea continues to be a strong player in the global automotive market. With its focus on electric vehicle production, South Korea is shifting towards the integration of advanced technologies in its vehicles, including boot release cables.

The country’s automotive market is highly innovative, with companies like Hyundai and Kia leading the charge in electric mobility. The government is strongly supporting the transition to electric vehicles through various incentives, which are expected to drive demand for new components, including boot release cables that are optimized for electric and hybrid vehicles.

Additionally, South Korea has a highly efficient manufacturing sector, which allows for competitive production costs and faster adaptation to technological advancements. As safety regulations become stricter and environmental concerns grow, South Korean manufacturers will focus on developing durable, eco-friendly cables that comply with both domestic and international standards.

Japan’s automotive boot release cable market is projected to grow at a CAGR of 3.4% from 2025 to 2035. Japan has long been a dominant force in the global automotive industry, with a strong emphasis on high-tech innovations, particularly in the electric vehicle (EV) sector. The growing adoption of EVs is expected to create substantial demand for automotive components, including boot release cables.

However, Japan’s market is unique, as its focus is not only on the high-volume production of standard vehicles but also on specialized, high-performance vehicles. Japanese manufacturers are expected to push for advanced, compact, and efficient cable systems that meet the technical demands of electric and hybrid vehicles. Japan’s focus on environmental sustainability and energy efficiency has driven manufacturers to adopt lightweight and recyclable materials in automotive parts, including boot release cables.

Despite the shift to EVs, the traditional automotive market in Japan remains strong, with many vehicles in operation, continuing the need for aftermarket cable replacements. Manufacturers will need to balance innovation with cost-efficiency to stay competitive in both domestic and global markets.

China's automotive boot release cable market is anticipated to grow at a CAGR of 4.5% from 2025 to 2035. China, as the largest automotive market globally, presents significant opportunities for automotive part manufacturers. The country is witnessing rapid growth in its electric vehicle (EV) sector, which is expected to significantly influence the demand for advanced automotive components, including boot release cables.

China's government is actively promoting EV adoption through various incentives, which will create a growing need for specialized cables suited to electric and hybrid vehicles. Additionally, China's push for sustainability is encouraging the adoption of eco-friendly materials and manufacturing processes, which will have a direct impact on the automotive parts market. The large-scale production of vehicles and the expansion of the aftermarket industry will continue to drive demand for boot release cables in the country.

Chinese manufacturers are expected to focus on creating cost-effective, high-performance cables to cater to both the domestic and global automotive markets. As China continues to dominate the global EV market, the need for advanced release cable systems is likely to increase, presenting opportunities for manufacturers to innovate and capture a larger share of the market.

The automotive boot release cable market in Australia is expected to grow at a CAGR of 3.2% from 2025 to 2035. Australia’s automotive industry, although smaller compared to other regions, continues to show steady growth, especially in the demand for replacement parts for the growing vehicle fleet. The increase in vehicle ownership and the rising number of electric and hybrid vehicles on the roads are expected to fuel the demand for automotive components like boot release cables.

Australia's automotive sector is gradually embracing green technologies, aligning with the government’s focus on reducing carbon emissions and promoting EV adoption. The transition to electric vehicles will likely increase demand for advanced boot release cable systems that are designed to meet the unique needs of electric and hybrid models.

As the market for EVs grows, so too will the need for specialized cables capable of withstanding the unique performance demands of these vehicles. Australia’s reliance on imports for automotive parts further drives the availability of advanced cable solutions. The market is poised for growth as OEMs and aftermarket suppliers expand their offerings to meet the evolving needs of the Australian automotive market.

Manual, Electrical

Passenger Vehicles, Commercial Vehicles

OEM, Aftermarket

Steel, Aluminum, Other metals

North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia, Middle East & Africa

The growing adoption of electric and hybrid vehicles, along with advancements in vehicle technologies, is a key factor driving the demand for boot release cables. Additionally, the increase in vehicle production, rising vehicle ownership, and the need for durable and high-performance components in the automotive industry contribute to the growing need for these cables.

The material used in the manufacturing of boot release cables, such as steel, aluminum, or other metals, plays a crucial role in durability, weight, and resistance to environmental factors like corrosion. Steel is commonly chosen for its strength, while aluminum is preferred for lightweight applications and sustainability goals.

The aftermarket segment plays a significant role as vehicle owners look to replace aging or damaged components with high-quality boot release cables. As the vehicle fleet expands, the need for replacement parts continues to rise, driving demand in the aftermarket channel, particularly for older vehicles and those outside of warranty.

As the automotive industry transitions to electric vehicles, there is an increased focus on developing more advanced, efficient, and eco-friendly components. Boot release cables for electric vehicles need to meet specific technical requirements such as high durability, resistance to electromagnetic interference, and compatibility with the unique needs of electric powertrains.

Regulatory standards ensure the safety, reliability, and environmental compliance of automotive components. For boot release cables, adhering to these regulations is critical to meet safety requirements and ensure that cables perform effectively in various driving conditions, helping to avoid accidents and damage.

Table 1: Global Value (US$ Million) Forecast by Region, 2023 & 2033

Table 2: Global Volume (Units) Forecast by Region, 2023 & 2033

Table 3: Global Value (US$ Million) Forecast by Type, 2023 & 2033

Table 4: Global Volume (Units) Forecast by Type, 2023 & 2033

Table 5: Global Value (US$ Million) Forecast by Vehicles, 2023 & 2033

Table 6: Global Volume (Units) Forecast by Vehicles, 2023 & 2033

Table 7: Global Value (US$ Million) Forecast by Distribution Channel, 2023 & 2033

Table 8: Global Volume (Units) Forecast by Distribution Channel, 2023 & 2033

Table 9: Global Value (US$ Million) Forecast by Material, 2023 & 2033

Table 10: Global Volume (Units) Forecast by Material, 2023 & 2033

Table 11: North America Value (US$ Million) Forecast by Country, 2023 & 2033

Table 12: North America Volume (Units) Forecast by Country, 2023 & 2033

Table 13: North America Value (US$ Million) Forecast by Type, 2023 & 2033

Table 14: North America Volume (Units) Forecast by Type, 2023 & 2033

Table 15: North America Value (US$ Million) Forecast by Vehicles, 2023 & 2033

Table 16: North America Volume (Units) Forecast by Vehicles, 2023 & 2033

Table 17: North America Value (US$ Million) Forecast by Distribution Channel, 2023 & 2033

Table 18: North America Volume (Units) Forecast by Distribution Channel, 2023 & 2033

Table 19: North America Value (US$ Million) Forecast by Material, 2023 & 2033

Table 20: North America Volume (Units) Forecast by Material, 2023 & 2033

Table 21: Latin America Value (US$ Million) Forecast by Country, 2023 & 2033

Table 22: Latin America Volume (Units) Forecast by Country, 2023 & 2033

Table 23: Latin America Value (US$ Million) Forecast by Type, 2023 & 2033

Table 24: Latin America Volume (Units) Forecast by Type, 2023 & 2033

Table 25: Latin America Value (US$ Million) Forecast by Vehicles, 2023 & 2033

Table 26: Latin America Volume (Units) Forecast by Vehicles, 2023 & 2033

Table 27: Latin America Value (US$ Million) Forecast by Distribution Channel, 2023 & 2033

Table 28: Latin America Volume (Units) Forecast by Distribution Channel, 2023 & 2033

Table 29: Latin America Value (US$ Million) Forecast by Material, 2023 & 2033

Table 30: Latin America Volume (Units) Forecast by Material, 2023 & 2033

Table 31: Western Europe Value (US$ Million) Forecast by Country, 2023 & 2033

Table 32: Western Europe Volume (Units) Forecast by Country, 2023 & 2033

Table 33: Western Europe Value (US$ Million) Forecast by Type, 2023 & 2033

Table 34: Western Europe Volume (Units) Forecast by Type, 2023 & 2033

Table 35: Western Europe Value (US$ Million) Forecast by Vehicles, 2023 & 2033

Table 36: Western Europe Volume (Units) Forecast by Vehicles, 2023 & 2033

Table 37: Western Europe Value (US$ Million) Forecast by Distribution Channel, 2023 & 2033

Table 38: Western Europe Volume (Units) Forecast by Distribution Channel, 2023 & 2033

Table 39: Western Europe Value (US$ Million) Forecast by Material, 2023 & 2033

Table 40: Western Europe Volume (Units) Forecast by Material, 2023 & 2033

Table 41: Eastern Europe Value (US$ Million) Forecast by Country, 2023 & 2033

Table 42: Eastern Europe Volume (Units) Forecast by Country, 2023 & 2033

Table 43: Eastern Europe Value (US$ Million) Forecast by Type, 2023 & 2033

Table 44: Eastern Europe Volume (Units) Forecast by Type, 2023 & 2033

Table 45: Eastern Europe Value (US$ Million) Forecast by Vehicles, 2023 & 2033

Table 46: Eastern Europe Volume (Units) Forecast by Vehicles, 2023 & 2033

Table 47: Eastern Europe Value (US$ Million) Forecast by Distribution Channel, 2023 & 2033

Table 48: Eastern Europe Volume (Units) Forecast by Distribution Channel, 2023 & 2033

Table 49: Eastern Europe Value (US$ Million) Forecast by Material, 2023 & 2033

Table 50: Eastern Europe Volume (Units) Forecast by Material, 2023 & 2033

Table 51: East Asia Value (US$ Million) Forecast by Country, 2023 & 2033

Table 52: East Asia Volume (Units) Forecast by Country, 2023 & 2033

Table 53: East Asia Value (US$ Million) Forecast by Type, 2023 & 2033

Table 54: East Asia Volume (Units) Forecast by Type, 2023 & 2033

Table 55: East Asia Value (US$ Million) Forecast by Vehicles, 2023 & 2033

Table 56: East Asia Volume (Units) Forecast by Vehicles, 2023 & 2033

Table 57: East Asia Value (US$ Million) Forecast by Distribution Channel, 2023 & 2033

Table 58: East Asia Volume (Units) Forecast by Distribution Channel, 2023 & 2033

Table 59: East Asia Value (US$ Million) Forecast by Material, 2023 & 2033

Table 60: East Asia Volume (Units) Forecast by Material, 2023 & 2033

Table 61: South Asia Value (US$ Million) Forecast by Country, 2023 & 2033

Table 62: South Asia Volume (Units) Forecast by Country, 2023 & 2033

Table 63: South Asia Value (US$ Million) Forecast by Type, 2023 & 2033

Table 64: South Asia Volume (Units) Forecast by Type, 2023 & 2033

Table 65: South Asia Value (US$ Million) Forecast by Vehicles, 2023 & 2033

Table 66: South Asia Volume (Units) Forecast by Vehicles, 2023 & 2033

Table 67: South Asia Value (US$ Million) Forecast by Distribution Channel, 2023 & 2033

Table 68: South Asia Volume (Units) Forecast by Distribution Channel, 2023 & 2033

Table 69: South Asia Value (US$ Million) Forecast by Material, 2023 & 2033

Table 70: South Asia Volume (Units) Forecast by Material, 2023 & 2033

Table 71: MEA Value (US$ Million) Forecast by Country, 2023 & 2033

Table 72: MEA Volume (Units) Forecast by Country, 2023 & 2033

Table 73: MEA Value (US$ Million) Forecast by Type, 2023 & 2033

Table 74: MEA Volume (Units) Forecast by Type, 2023 & 2033

Table 75: MEA Value (US$ Million) Forecast by Vehicles, 2023 & 2033

Table 76: MEA Volume (Units) Forecast by Vehicles, 2023 & 2033

Table 77: MEA Value (US$ Million) Forecast by Distribution Channel, 2023 & 2033

Table 78: MEA Volume (Units) Forecast by Distribution Channel, 2023 & 2033

Table 79: MEA Value (US$ Million) Forecast by Material, 2023 & 2033

Figure 1: Global Value (US$ Million) by Type, 2022 & 2033

Figure 2: Global Value (US$ Million) by Vehicles, 2022 & 2033

Figure 3: Global Value (US$ Million) by Distribution Channel, 2022 & 2033

Figure 4: Global Value (US$ Million) by Material, 2022 & 2033

Figure 5: Global Value (US$ Million) by Region, 2022 & 2033

Figure 6: Global Value (US$ Million) Analysis by Region, 2023 & 2033

Figure 7: Global Volume (Units) Analysis by Region, 2023 & 2033

Figure 8: Global Value Share (%) and BPS Analysis by Region, 2022 & 2033

Figure 9: Global Y-o-Y Growth (%) Projections by Region, 2022 to 2033

Figure 10: Global Value (US$ Million) Analysis by Type, 2023 & 2033

Figure 11: Global Volume (Units) Analysis by Type, 2023 & 2033

Figure 12: Global Value Share (%) and BPS Analysis by Type, 2022 & 2033

Figure 13: Global Y-o-Y Growth (%) Projections by Type, 2022 to 2033

Figure 14: Global Value (US$ Million) Analysis by Vehicles, 2023 & 2033

Figure 15: Global Volume (Units) Analysis by Vehicles, 2023 & 2033

Figure 16: Global Value Share (%) and BPS Analysis by Vehicles, 2022 & 2033

Figure 17: Global Y-o-Y Growth (%) Projections by Vehicles, 2022 to 2033

Figure 18: Global Value (US$ Million) Analysis by Distribution Channel, 2023 & 2033

Figure 19: Global Volume (Units) Analysis by Distribution Channel, 2023 & 2033

Figure 20: Global Value Share (%) and BPS Analysis by Distribution Channel, 2022 & 2033

Figure 21: Global Y-o-Y Growth (%) Projections by Distribution Channel, 2022 to 2033

Figure 22: Global Value (US$ Million) Analysis by Material, 2023 & 2033

Figure 23: Global Volume (Units) Analysis by Material, 2023 & 2033

Figure 24: Global Value Share (%) and BPS Analysis by Material, 2022 & 2033

Figure 25: Global Y-o-Y Growth (%) Projections by Material, 2022 to 2033

Figure 26: Global Attractiveness by Type, 2022 to 2033

Figure 27: Global Attractiveness by Vehicles, 2022 to 2033

Figure 28: Global Attractiveness by Distribution Channel, 2022 to 2033

Figure 29: Global Attractiveness by Material, 2022 to 2033

Figure 30: Global Attractiveness by Region, 2022 to 2033

Figure 31: North America Value (US$ Million) by Type, 2022 & 2033

Figure 32: North America Value (US$ Million) by Vehicles, 2022 & 2033

Figure 33: North America Value (US$ Million) by Distribution Channel, 2022 & 2033

Figure 34: North America Value (US$ Million) by Material, 2022 & 2033

Figure 35: North America Value (US$ Million) by Country, 2022 & 2033

Figure 36: North America Value (US$ Million) Analysis by Country, 2023 & 2033

Figure 37: North America Volume (Units) Analysis by Country, 2023 & 2033

Figure 38: North America Value Share (%) and BPS Analysis by Country, 2022 & 2033

Figure 39: North America Y-o-Y Growth (%) Projections by Country, 2022 to 2033

Figure 40: North America Value (US$ Million) Analysis by Type, 2023 & 2033

Figure 41: North America Volume (Units) Analysis by Type, 2023 & 2033

Figure 42: North America Value Share (%) and BPS Analysis by Type, 2022 & 2033

Figure 43: North America Y-o-Y Growth (%) Projections by Type, 2022 to 2033

Figure 44: North America Value (US$ Million) Analysis by Vehicles, 2023 & 2033

Figure 45: North America Volume (Units) Analysis by Vehicles, 2023 & 2033

Figure 46: North America Value Share (%) and BPS Analysis by Vehicles, 2022 & 2033

Figure 47: North America Y-o-Y Growth (%) Projections by Vehicles, 2022 to 2033

Figure 48: North America Value (US$ Million) Analysis by Distribution Channel, 2023 & 2033

Figure 49: North America Volume (Units) Analysis by Distribution Channel, 2023 & 2033

Figure 50: North America Value Share (%) and BPS Analysis by Distribution Channel, 2022 & 2033

Figure 51: North America Y-o-Y Growth (%) Projections by Distribution Channel, 2022 to 2033

Figure 52: North America Value (US$ Million) Analysis by Material, 2023 & 2033

Figure 53: North America Volume (Units) Analysis by Material, 2023 & 2033

Figure 54: North America Value Share (%) and BPS Analysis by Material, 2022 & 2033

Figure 55: North America Y-o-Y Growth (%) Projections by Material, 2022 to 2033

Figure 56: North America Attractiveness by Type, 2022 to 2033

Figure 57: North America Attractiveness by Vehicles, 2022 to 2033

Figure 58: North America Attractiveness by Distribution Channel, 2022 to 2033

Figure 59: North America Attractiveness by Material, 2022 to 2033

Figure 60: North America Attractiveness by Country, 2022 to 2033

Figure 61: Latin America Value (US$ Million) by Type, 2022 & 2033

Figure 62: Latin America Value (US$ Million) by Vehicles, 2022 & 2033

Figure 63: Latin America Value (US$ Million) by Distribution Channel, 2022 & 2033

Figure 64: Latin America Value (US$ Million) by Material, 2022 & 2033

Figure 65: Latin America Value (US$ Million) by Country, 2022 & 2033

Figure 66: Latin America Value (US$ Million) Analysis by Country, 2023 & 2033

Figure 67: Latin America Volume (Units) Analysis by Country, 2023 & 2033

Figure 68: Latin America Value Share (%) and BPS Analysis by Country, 2022 & 2033

Figure 69: Latin America Y-o-Y Growth (%) Projections by Country, 2022 to 2033

Figure 70: Latin America Value (US$ Million) Analysis by Type, 2023 & 2033

Figure 71: Latin America Volume (Units) Analysis by Type, 2023 & 2033

Figure 72: Latin America Value Share (%) and BPS Analysis by Type, 2022 & 2033

Figure 73: Latin America Y-o-Y Growth (%) Projections by Type, 2022 to 2033

Figure 74: Latin America Value (US$ Million) Analysis by Vehicles, 2023 & 2033

Figure 75: Latin America Volume (Units) Analysis by Vehicles, 2023 & 2033

Figure 76: Latin America Value Share (%) and BPS Analysis by Vehicles, 2022 & 2033

Figure 77: Latin America Y-o-Y Growth (%) Projections by Vehicles, 2022 to 2033

Figure 78: Latin America Value (US$ Million) Analysis by Distribution Channel, 2023 & 2033

Figure 79: Latin America Volume (Units) Analysis by Distribution Channel, 2023 & 2033

Figure 80: Latin America Value Share (%) and BPS Analysis by Distribution Channel, 2022 & 2033

Figure 81: Latin America Y-o-Y Growth (%) Projections by Distribution Channel, 2022 to 2033

Figure 82: Latin America Value (US$ Million) Analysis by Material, 2023 & 2033

Figure 83: Latin America Volume (Units) Analysis by Material, 2023 & 2033

Figure 84: Latin America Value Share (%) and BPS Analysis by Material, 2022 & 2033

Figure 85: Latin America Y-o-Y Growth (%) Projections by Material, 2022 to 2033

Figure 86: Latin America Attractiveness by Type, 2022 to 2033

Figure 87: Latin America Attractiveness by Vehicles, 2022 to 2033

Figure 88: Latin America Attractiveness by Distribution Channel, 2022 to 2033

Figure 89: Latin America Attractiveness by Material, 2022 to 2033

Figure 90: Latin America Attractiveness by Country, 2022 to 2033

Figure 91: Western Europe Value (US$ Million) by Type, 2022 & 2033

Figure 92: Western Europe Value (US$ Million) by Vehicles, 2022 & 2033

Figure 93: Western Europe Value (US$ Million) by Distribution Channel, 2022 & 2033

Figure 94: Western Europe Value (US$ Million) by Material, 2022 & 2033

Figure 95: Western Europe Value (US$ Million) by Country, 2022 & 2033

Figure 96: Western Europe Value (US$ Million) Analysis by Country, 2023 & 2033

Figure 97: Western Europe Volume (Units) Analysis by Country, 2023 & 2033

Figure 98: Western Europe Value Share (%) and BPS Analysis by Country, 2022 & 2033

Figure 99: Western Europe Y-o-Y Growth (%) Projections by Country, 2022 to 2033

Figure 100: Western Europe Value (US$ Million) Analysis by Type, 2023 & 2033

Figure 101: Western Europe Volume (Units) Analysis by Type, 2023 & 2033

Figure 102: Western Europe Value Share (%) and BPS Analysis by Type, 2022 & 2033

Figure 103: Western Europe Y-o-Y Growth (%) Projections by Type, 2022 to 2033

Figure 104: Western Europe Value (US$ Million) Analysis by Vehicles, 2023 & 2033

Figure 105: Western Europe Volume (Units) Analysis by Vehicles, 2023 & 2033

Figure 106: Western Europe Value Share (%) and BPS Analysis by Vehicles, 2022 & 2033

Figure 107: Western Europe Y-o-Y Growth (%) Projections by Vehicles, 2022 to 2033

Figure 108: Western Europe Value (US$ Million) Analysis by Distribution Channel, 2023 & 2033

Figure 109: Western Europe Volume (Units) Analysis by Distribution Channel, 2023 & 2033

Figure 110: Western Europe Value Share (%) and BPS Analysis by Distribution Channel, 2022 & 2033

Figure 111: Western Europe Y-o-Y Growth (%) Projections by Distribution Channel, 2022 to 2033

Figure 112: Western Europe Value (US$ Million) Analysis by Material, 2023 & 2033

Figure 113: Western Europe Volume (Units) Analysis by Material, 2023 & 2033

Figure 114: Western Europe Value Share (%) and BPS Analysis by Material, 2022 & 2033

Figure 115: Western Europe Y-o-Y Growth (%) Projections by Material, 2022 to 2033

Figure 116: Western Europe Attractiveness by Type, 2022 to 2033

Figure 117: Western Europe Attractiveness by Vehicles, 2022 to 2033

Figure 118: Western Europe Attractiveness by Distribution Channel, 2022 to 2033

Figure 119: Western Europe Attractiveness by Material, 2022 to 2033

Figure 120: Western Europe Attractiveness by Country, 2022 to 2033

Figure 121: Eastern Europe Value (US$ Million) by Type, 2022 & 2033

Figure 122: Eastern Europe Value (US$ Million) by Vehicles, 2022 & 2033

Figure 123: Eastern Europe Value (US$ Million) by Distribution Channel, 2022 & 2033

Figure 124: Eastern Europe Value (US$ Million) by Material, 2022 & 2033

Figure 125: Eastern Europe Value (US$ Million) by Country, 2022 & 2033

Figure 126: Eastern Europe Value (US$ Million) Analysis by Country, 2023 & 2033

Figure 127: Eastern Europe Volume (Units) Analysis by Country, 2023 & 2033

Figure 128: Eastern Europe Value Share (%) and BPS Analysis by Country, 2022 & 2033

Figure 129: Eastern Europe Y-o-Y Growth (%) Projections by Country, 2022 to 2033

Figure 130: Eastern Europe Value (US$ Million) Analysis by Type, 2023 & 2033

Figure 131: Eastern Europe Volume (Units) Analysis by Type, 2023 & 2033

Figure 132: Eastern Europe Value Share (%) and BPS Analysis by Type, 2022 & 2033

Figure 133: Eastern Europe Y-o-Y Growth (%) Projections by Type, 2022 to 2033

Figure 134: Eastern Europe Value (US$ Million) Analysis by Vehicles, 2023 & 2033

Figure 135: Eastern Europe Volume (Units) Analysis by Vehicles, 2023 & 2033

Figure 136: Eastern Europe Value Share (%) and BPS Analysis by Vehicles, 2022 & 2033

Figure 137: Eastern Europe Y-o-Y Growth (%) Projections by Vehicles, 2022 to 2033

Figure 138: Eastern Europe Value (US$ Million) Analysis by Distribution Channel, 2023 & 2033

Figure 139: Eastern Europe Volume (Units) Analysis by Distribution Channel, 2023 & 2033

Figure 140: Eastern Europe Value Share (%) and BPS Analysis by Distribution Channel, 2022 & 2033

Figure 141: Eastern Europe Y-o-Y Growth (%) Projections by Distribution Channel, 2022 to 2033

Figure 142: Eastern Europe Value (US$ Million) Analysis by Material, 2023 & 2033

Figure 143: Eastern Europe Volume (Units) Analysis by Material, 2023 & 2033

Figure 144: Eastern Europe Value Share (%) and BPS Analysis by Material, 2022 & 2033

Figure 145: Eastern Europe Y-o-Y Growth (%) Projections by Material, 2022 to 2033

Figure 146: Eastern Europe Attractiveness by Type, 2022 to 2033

Figure 147: Eastern Europe Attractiveness by Vehicles, 2022 to 2033

Figure 148: Eastern Europe Attractiveness by Distribution Channel, 2022 to 2033

Figure 149: Eastern Europe Attractiveness by Material, 2022 to 2033

Figure 150: Eastern Europe Attractiveness by Country, 2022 to 2033

Figure 151: East Asia Value (US$ Million) by Type, 2022 & 2033

Figure 152: East Asia Value (US$ Million) by Vehicles, 2022 & 2033

Figure 153: East Asia Value (US$ Million) by Distribution Channel, 2022 & 2033

Figure 154: East Asia Value (US$ Million) by Material, 2022 & 2033

Figure 155: East Asia Value (US$ Million) by Country, 2022 & 2033

Figure 156: East Asia Value (US$ Million) Analysis by Country, 2023 & 2033

Figure 157: East Asia Volume (Units) Analysis by Country, 2023 & 2033

Figure 158: East Asia Value Share (%) and BPS Analysis by Country, 2022 & 2033

Figure 159: East Asia Y-o-Y Growth (%) Projections by Country, 2022 to 2033

Figure 160: East Asia Value (US$ Million) Analysis by Type, 2023 & 2033

Figure 161: East Asia Volume (Units) Analysis by Type, 2023 & 2033

Figure 162: East Asia Value Share (%) and BPS Analysis by Type, 2022 & 2033

Figure 163: East Asia Y-o-Y Growth (%) Projections by Type, 2022 to 2033

Figure 164: East Asia Value (US$ Million) Analysis by Vehicles, 2023 & 2033

Figure 165: East Asia Volume (Units) Analysis by Vehicles, 2023 & 2033

Figure 166: East Asia Value Share (%) and BPS Analysis by Vehicles, 2022 & 2033

Figure 167: East Asia Y-o-Y Growth (%) Projections by Vehicles, 2022 to 2033

Figure 168: East Asia Value (US$ Million) Analysis by Distribution Channel, 2023 & 2033

Figure 169: East Asia Volume (Units) Analysis by Distribution Channel, 2023 & 2033

Figure 170: East Asia Value Share (%) and BPS Analysis by Distribution Channel, 2022 & 2033

Figure 171: East Asia Y-o-Y Growth (%) Projections by Distribution Channel, 2022 to 2033

Figure 172: East Asia Value (US$ Million) Analysis by Material, 2023 & 2033

Figure 173: East Asia Volume (Units) Analysis by Material, 2023 & 2033

Figure 174: East Asia Value Share (%) and BPS Analysis by Material, 2022 & 2033

Figure 175: East Asia Y-o-Y Growth (%) Projections by Material, 2022 to 2033

Figure 176: East Asia Attractiveness by Type, 2022 to 2033

Figure 177: East Asia Attractiveness by Vehicles, 2022 to 2033

Figure 178: East Asia Attractiveness by Distribution Channel, 2022 to 2033

Figure 179: East Asia Attractiveness by Material, 2022 to 2033

Figure 180: East Asia Attractiveness by Country, 2022 to 2033

Figure 181: South Asia Value (US$ Million) by Type, 2022 & 2033

Figure 182: South Asia Value (US$ Million) by Vehicles, 2022 & 2033

Figure 183: South Asia Value (US$ Million) by Distribution Channel, 2022 & 2033

Figure 184: South Asia Value (US$ Million) by Material, 2022 & 2033

Figure 185: South Asia Value (US$ Million) by Country, 2022 & 2033

Figure 186: South Asia Value (US$ Million) Analysis by Country, 2023 & 2033

Figure 187: South Asia Volume (Units) Analysis by Country, 2023 & 2033

Figure 188: South Asia Value Share (%) and BPS Analysis by Country, 2022 & 2033

Figure 189: South Asia Y-o-Y Growth (%) Projections by Country, 2022 to 2033

Figure 190: South Asia Value (US$ Million) Analysis by Type, 2023 & 2033

Figure 191: South Asia Volume (Units) Analysis by Type, 2023 & 2033

Figure 192: South Asia Value Share (%) and BPS Analysis by Type, 2022 & 2033

Figure 193: South Asia Y-o-Y Growth (%) Projections by Type, 2022 to 2033

Figure 194: South Asia Value (US$ Million) Analysis by Vehicles, 2023 & 2033

Figure 195: South Asia Volume (Units) Analysis by Vehicles, 2023 & 2033

Figure 196: South Asia Value Share (%) and BPS Analysis by Vehicles, 2022 & 2033

Figure 197: South Asia Y-o-Y Growth (%) Projections by Vehicles, 2022 to 2033

Figure 198: South Asia Value (US$ Million) Analysis by Distribution Channel, 2023 & 2033

Figure 199: South Asia Volume (Units) Analysis by Distribution Channel, 2023 & 2033

Figure 200: South Asia Value Share (%) and BPS Analysis by Distribution Channel, 2022 & 2033

Figure 201: South Asia Y-o-Y Growth (%) Projections by Distribution Channel, 2022 to 2033

Figure 202: South Asia Value (US$ Million) Analysis by Material, 2023 & 2033

Figure 203: South Asia Volume (Units) Analysis by Material, 2023 & 2033

Figure 204: South Asia Value Share (%) and BPS Analysis by Material, 2022 & 2033

Figure 205: South Asia Y-o-Y Growth (%) Projections by Material, 2022 to 2033

Figure 206: South Asia Attractiveness by Type, 2022 to 2033

Figure 207: South Asia Attractiveness by Vehicles, 2022 to 2033

Figure 208: South Asia Attractiveness by Distribution Channel, 2022 to 2033

Figure 209: South Asia Attractiveness by Material, 2022 to 2033

Figure 210: South Asia Attractiveness by Country, 2022 to 2033

Figure 211: MEA Value (US$ Million) by Type, 2022 & 2033

Figure 212: MEA Value (US$ Million) by Vehicles, 2022 & 2033

Figure 213: MEA Value (US$ Million) by Distribution Channel, 2022 & 2033

Figure 214: MEA Value (US$ Million) by Material, 2022 & 2033

Figure 215: MEA Value (US$ Million) by Country, 2022 & 2033

Figure 216: MEA Value (US$ Million) Analysis by Country, 2023 & 2033

Figure 217: MEA Volume (Units) Analysis by Country, 2023 & 2033

Figure 218: MEA Value Share (%) and BPS Analysis by Country, 2022 & 2033

Figure 219: MEA Y-o-Y Growth (%) Projections by Country, 2022 to 2033

Figure 220: MEA Value (US$ Million) Analysis by Type, 2023 & 2033

Figure 221: MEA Volume (Units) Analysis by Type, 2023 & 2033

Figure 222: MEA Value Share (%) and BPS Analysis by Type, 2022 & 2033

Figure 223: MEA Y-o-Y Growth (%) Projections by Type, 2022 to 2033

Figure 224: MEA Value (US$ Million) Analysis by Vehicles, 2023 & 2033

Figure 225: MEA Volume (Units) Analysis by Vehicles, 2023 & 2033

Figure 226: MEA Value Share (%) and BPS Analysis by Vehicles, 2022 & 2033

Figure 227: MEA Y-o-Y Growth (%) Projections by Vehicles, 2022 to 2033

Figure 228: MEA Value (US$ Million) Analysis by Distribution Channel, 2023 & 2033

Figure 229: MEA Volume (Units) Analysis by Distribution Channel, 2023 & 2033

Figure 230: MEA Value Share (%) and BPS Analysis by Distribution Channel, 2022 & 2033

Figure 231: MEA Y-o-Y Growth (%) Projections by Distribution Channel, 2022 to 2033

Figure 232: MEA Value (US$ Million) Analysis by Material, 2023 & 2033

Figure 233: MEA Volume (Units) Analysis by Material, 2023 & 2033

Figure 234: MEA Value Share (%) and BPS Analysis by Material, 2022 & 2033

Figure 235: MEA Y-o-Y Growth (%) Projections by Material, 2022 to 2033

Figure 236: MEA Attractiveness by Type, 2022 to 2033

Figure 237: MEA Attractiveness by Vehicles, 2022 to 2033

Figure 238: MEA Attractiveness by Distribution Channel, 2022 to 2033

Figure 239: MEA Attractiveness by Material, 2022 to 2033

Figure 240: MEA Attractiveness by Country, 2022 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automotive Manufacturing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Automotive Pressure Sensor Market Size and Share Forecast Outlook 2025 to 2035

Automotive Vacuum Brake Booster Market Size and Share Forecast Outlook 2025 to 2035

Automotive Smart Antenna Market Size and Share Forecast Outlook 2025 to 2035

Automotive Actuator Market Size and Share Forecast Outlook 2025 to 2035

Automotive Exhaust Manifold Market Size and Share Forecast Outlook 2025 to 2035

Automotive Roof Rails Market Size and Share Forecast Outlook 2025 to 2035

Automotive Resonator Market Size and Share Forecast Outlook 2025 to 2035

Automotive Counter Shaft Market Size and Share Forecast Outlook 2025 to 2035

Automotive Wheel Coating Market Size and Share Forecast Outlook 2025 to 2035

Automotive Water Separation Systems Market Size and Share Forecast Outlook 2025 to 2035

Automotive Refinish Coating Market Size and Share Forecast Outlook 2025 to 2035

Automotive Emission Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Automotive Tire Market Size and Share Forecast Outlook 2025 to 2035

Automotive Glass Market Size and Share Forecast Outlook 2025 to 2035

Automotive Camshaft Market Size and Share Forecast Outlook 2025 to 2035

Automotive DC-DC Converter Market Size and Share Forecast Outlook 2025 to 2035

Automotive Key Blank Market Size and Share Forecast Outlook 2025 to 2035

Automotive Tensioner Market Size and Share Forecast Outlook 2025 to 2035

Automotive Cabin Air Quality Sensors Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA