The automotive clean cold technology market is witnessing substantial growth due to the increasing demand for energy-efficient and environmentally friendly cooling solutions in vehicles. Rising concerns about carbon emissions, fuel consumption, and climate change are compelling the automotive sector to adopt clean cold technologies.

These systems help reduce the environmental footprint by using alternative refrigerants and innovative cooling methods. The adoption of clean cold solutions, such as liquid nitrogen-based and battery-powered refrigeration units, is gaining momentum, especially in commercial and transportation sectors.

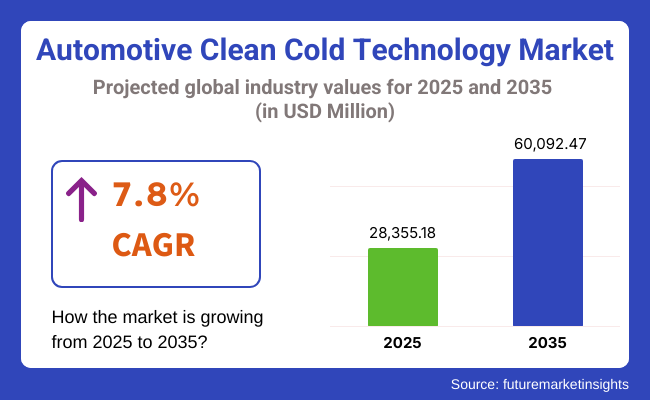

In 2025, the market size for automotive clean cold technology is estimated at approximately USD 28,355.18 million. By 2035, it is projected to reach around USD 60,092.47 million, growing at a compound annual growth rate (CAGR) of 7.8%.

The market's expansion is fueled by stringent government regulations promoting low-emission vehicles, advancements in alternative energy sources, and the booming e-commerce sector demanding sustainable refrigerated transportation. Innovations such as solar-powered cooling systems and AI-driven temperature monitoring are further driving the adoption of clean cold technologies across the automotive industry.

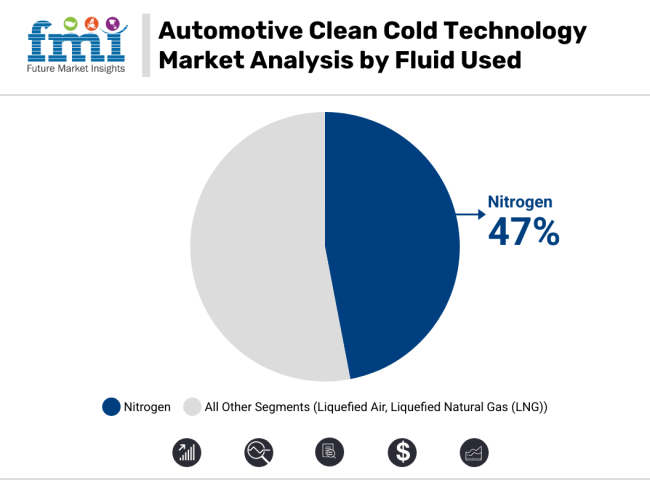

Due to its ability to provide zero-emission refrigeration with high cooling speed, nitrogen-powered clean cold technologies occupy a huge market. These systems are being increasingly adopted throughout urban delivery fleets, where tightening emissions regulations, heightened awareness of environmental impact, and sustainability goals are changing the face of cold chain logistics.

One of the main advantages of nitrogen powered solutions, is replacing diesel-powered refrigeration units, reducing carbon dioxide, nitrogen oxide, and particulate emissions in highly populated metropolitan areas. Due to their rapid-cooling performance, they help to protect temperature-sensitive items like perishables, medications and biological matter, which are essential constituents in contemporary supply chains. Furthermore, nitrogen is abundant and inexpensive, so, over time, the operational costs of these systems are competitive.

And the growth of e-commerce grocery deliveries, on-demand meal services and the burgeoning pharmaceutical distribution sector has only increased the need for portable, eco-friendly cooling solutions. Furthermore, government measures and commercial companies' ESG (Environmental, Social, and Governance) initiatives work affordably to recommend nitrogen-powered clean cold technologies to fleet owners as the go-to option.

ECB market leadership will further benefit from the emergence of technology-sensitive trends to: improve nitrogen’s-to-better and cooling unit efficiencies Broader adoption is being facilitated by partnerships involving logistics companies, urban policymakers, and technology providers, and nitrogen systems look set to become a key element of future low-carbon cold chain infrastructure.

| Fluid Used | Market Share (2025) |

|---|---|

| Liquefied Air | 33% |

As part of the transition to net zero systems, liquefied air systems are emerging as a highly sustainable technology for cold transport. These systems cool liquefied air down to a very low temperature before they deliver it, so they are an aggressive form of, especially dense, reliable and emission-free refrigeration with no diesel engines or chemical refrigerants.

Featured ultra-low emissions levels, greater energy efficiency capabilities, and lower audible operating noise emissions a trifecta of performance factors that also makes them highly practical for urban deliveries or last-mile distribution in cities with aggressive sustainability targets.

Liquefied air systems can also provide constant cooling temperatures, which are essential for the safe transport of perishables, pharmaceuticals, and high-value temperature-sensitive products. Adoption is particularly advanced in Europe and parts of North America, where net-zero roadmaps, carbon taxes, and corporate decarbonization commitments are driving fleets to wean themselves off of fossil-fuel-dependent technologies.

Moreover, the continual development of liquefied air production and storage technology is consistently enhancing the efficiency, cost-effectiveness, and operational reliability of this system, making it a more competitive solution for large-scale cold supply chains. These partnerships are accelerating market growth with pilot projects for liquefied air refrigeration that illustrates the technology's functional feasibility and cost-effectiveness for various transport sectors.

Challenge

High R&D Costs and Commercialization Barriers

The high cost of R&D and commercialization in the automotive clean cold technology market is hampering the overall Automotive clean cold technology market growth. Creating sustainable cold chain solutions, like zero-emission cooling systems, requires a significant investment in technology, materials, and adherence to changing environmental standards.

Additionally, reaching cost parity with traditional refrigeration methods is a barrier to mass adoption. When they work the same page, the path to bridging these financial and technical gaps becomes far clearer, viable, and increasingly a matter of corporate survival itself.

Limited Infrastructure and Market Awareness

Clean cold technology does not find infrastructure support and market awareness, particularly in emerging economies, but has the potential to expand. Limited availability of charging stations for battery-powered systems, lack of preparation on the part of the supply chain, and insufficient knowledge among fleet operators slow market penetration.

Adoption will need to be encouraged through systems of supportive infrastructure development and educational campaigning and proven to be the long-term most economically viable and environmentally sound means of achieving clean cold solutions.

Opportunity

Rising Demand for Sustainable Logistics Solutions

As sustainability becomes admittedly more imperative, the logistics and transportation industries are looking for more eco-friendly solutions to traditional cooling methods. Clean cold technologies are a critical solution as they reduce carbon emissions, fuel consumption, and operating costs.

With growing regulation of emissions and corporate sustainability commitments having created a colossal green logistics opportunity, the clean cold technologies, which can make or break a green supply chain, can be positioned as a critical enabler for green logistics.

Advancements in Energy Storage and Renewable Integration

Revolutionary battery storage technology as well as solar powered cooling systems and cryogenic energy solutions are changing the automotive clean cold industry. Incorporating smart systems to communicate with renewable energy sources improves efficiency, making power needs less reliant on fossil fuels. Investment in hybrid systems, AI-based temperature management, and smart energy storage technologies will position these companies to seize significant market share and to deliver the changing customer requirements.

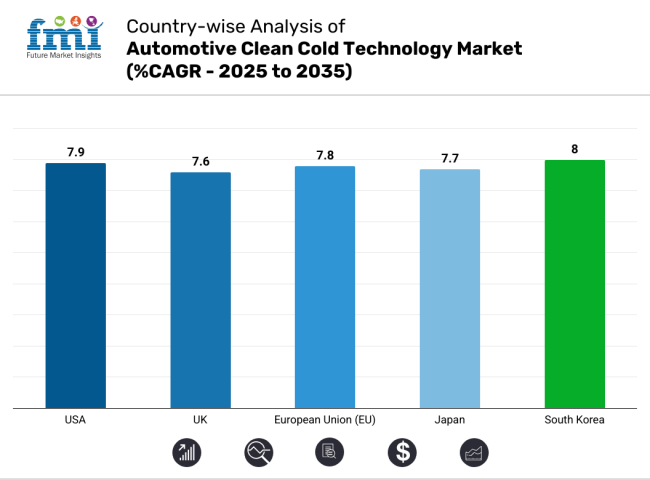

The United States market for automotive clean cold technology is growing rapidly due to a variety of factors, including stringent environmental regulations, the burgeoning e-commerce industry, and the need for sustainable logistics solutions. There is a growing investment into electric and alternative fuel-based cooling systems to help companies combat carbon footprints and associated operational costs.

The clean cold technologies are in great demand as cold chain logistics sector growing especially fresh foods and pharmaceuticals. Moreover, government incentives supporting greener transportation technologies are promoting adoption at a faster pace and are helping to establish the USA as a leader in the global clean cold innovation ecosystem. Key players are working with tech startups to fast track development.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 7.9% |

The UK is becoming one of the trailblazers in the automotive clean cold technology envelope, bolstered by national policies with a net-zero emissions target for 2050. Clean cold technology is becoming essential for sectors like logistics and food distribution and pharmaceutical transport as they work to reach new environmental standards. Battery-powered refrigeration units, liquid nitrogen-based cooling systems and solar-powered solutions are being quickly rolled out across the country.

Additionally, growing customer inclination toward goods transported ethically is driving the companies to incorporate sustainable cold chain solutions which, in turn, is positively influencing market scope for long-term advancement in urban as well as rural settings.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 7.6% |

The European Union continues to be a leader in the adoption of clean cold technologies, due to ambitious climate action plans, long-term carbon-neutrality objectives, and transportation fleets modernization efforts in member states. Germany, France and the Netherlands are pouring money into electric-powered refrigerated trucks, hydrogen-based cooling systems, low-emission logistics networks and more.

Expanding the market are government subsidies for green transportation technologies and more stringent emission standards for commercial vehicles. Moreover, the focus on improving food security, pharmaceutical supply chains, and export logistics are providing extensive opportunities for the automotive clean cold technology market in the European region.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 7.8% |

Drivers of the automotive clean cold technology market in Japan include the country’s strong technology foundation, carbon neutrality focus through 2050, and rising demand for sustainable transport solutions. Development of distribution infrastructures, especially for the cold chain for food, electronics and medical supply industries, is furthering the take on cleaner cold technologies; e.g., utilization of electric refrigeration units, advanced battery-powered systems, etc.

Additionally, the automotive titans are working closely with technology innovators to conceive of light-weight refrigeration vehicles that consume less energy to navigate cities. Consumer awareness of eco-friendly practices is also driving up demand across commercial fleets and logistics companies.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 7.7% |

The automotive clean cold technology market in South Korea is robustly growing as the government has been strongly supporting green mobility and rapid advancements in cold chain logistics. To meet new emissions regulations and address urban air quality concerns, companies are investing in electric refrigerated trucks, fuel cell-based cooling units and hybrid cooling technologies.

The booming e-commerce and food delivery markets are also the real impetus behind the demand for sustainable last-mile cold transportation solutions. Moreover, the proactive covering of South Korea in smart logistics infrastructure and innovation in energy storage technologies plays a great acceleration factor to the future development path of clean cold transportation systems.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 8.0% |

The automotive clean cold technology market is growing at an astounding rate owing to growing environmental concern and strict emission regulations, combined with a global focus on developing sustainable transport refrigeration solutions.

Adoption has hit an inflection point with commercial vehicle fleets of all kinds, especially for perishable, temperature sensitive goods such as pharmaceuticals, food and flowers. Technologies like cryogenic cooling, phase change materials, and battery-powered refrigeration are gathering steam.

Additionally, the push to cut down on diesel consumption in refrigeration trailers, along with government-sponsored incentives for low-carbon transportation solutions, has only spurred further growth in the market. The emergingtechnologies of the solar-assisted cooling systems, hybrid electric refrigeration models, etc., are reshaping the cold chain logistics and augmenting the general operational efficiency across the globe.

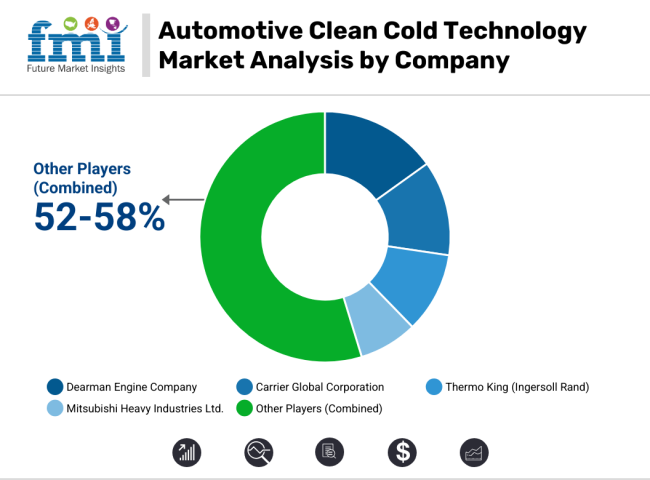

Dearman Engine Company (14-16%)

By leveraging its proprietary liquid air engine technology Dearman continues to lead the charge for automotive clean cold innovation. Their emission zero transport refrigeration units provide a zero-emission alternative to diesel-based systems, which supports cities with emerging low-emission zones (LEZs). It's deployed successfully in the UK, Germany, and the USA, speaking to its leadership.

Plus working in conjunction with government-funded programs to mitigate urban air quality issues will further reinforce Dearman's competitive advantages, which can only strengthen the financial attractiveness of its retrofitting options for legacy fleets and the upgrades that smaller to medium-sized logistics operators can viably consider.

Carrier Global Corporation (11-13%)

Carrier has a longstanding history of providing sustainable cooling solutions with its broad product portfolio serving both heavy- and light-duty commercial vehicles. Their focus on electric and battery-powered units mirrors electrification trends in modes of global transport. Carrier is positioning itself as an essential partner in a green cold chain solution actively pursued by its major grocery retailers and healthcare distributors.

Additionally, their investigation with combining cold tech with autonomous delivery folks suggests a push toward futureproofing for their business inside the face of evolving tech developments in logistics and transportation.

Thermo King (Ingersoll Rand) (9-11%)

Thermo King is becoming a pioneer in sustainable cold transport via its extensive portfolio of electrified refrigeration goods. The company's major reductions in GHG buckets by 2030 through innovation programs are in line with regulatory demands of Europe and North America.

Thermo King’s predictive analytics tools, which enhance refrigeration efficiency and vehicle uptime, are raising the bar for operational excellence. Thermo King is expanding its tech arsenal to dominate in the future market, with pilot programs for solar-assisted cool units and fuel-cell-powered refrigerator modules already being developed.

Mitsubishi Heavy Industries Ltd. (6-8%)

Mitsubishi Heavy Industries is actively working to develop lightweight, energy-efficient cold chain solutions that meets the needs of these markets, particularly for urban delivery density that exceeds anything we see in the developed market. By introducing hybrid cryogenic systems, they are building upon their broader experience in industrial engineering and moving the needle on efficient cooling and environmental effects.

Mitsubishi's investment in AI-driven monitoring tools to maintain temperature consistency and track energy consumption demonstrates its dedication to integrated cold chain management. The startup’s agile method of developing modular cooling units caters to a growing demand for flexibility in society’s fleet operations.

Other Key Players (52-58% Combined)

The competitive landscape is also being aggravated by a number of smaller players and entrepreneurs coming up with modular, or easy-to-deploy clean cold solutions for last mile logistics, small vans for deliveries and electric trucks. These range from cold storage pods that fit into urban compact spaces, to thermal battery systems, to zero-emission delivery carts.

They can react quickly to changing market demands, especially in urban logistics where light, emission-reducing and energy-saving means of transport are becoming increasingly relevant. With tightening sustainability regulations, these upstart players are expected to take an even larger share of niche cold logistics applications.

The overall market size for automotive clean cold technology market was USD 28,355.18 million in 2025.

The automotive clean cold technology market expected to reach USD 60,092.47 million in 2035.

Rising focus on reducing vehicle emissions, stricter environmental regulations, growing demand for sustainable cooling solutions, and innovations in clean cold technologies will drive the automotive clean cold technology market during the forecast period.

The top 5 countries which drives the development of cargo bike tire marketare USA, UK, Europe Union, Japan and South Korea.

Nitrogen-based systems segment driving market growth to command significant share over the assessment period.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automotive Smart Antenna Market Size and Share Forecast Outlook 2025 to 2035

Automotive Actuator Market Size and Share Forecast Outlook 2025 to 2035

Automotive Exhaust Manifold Market Size and Share Forecast Outlook 2025 to 2035

Automotive Vacuum Brake Booster Market Size and Share Forecast Outlook 2025 to 2035

Automotive Roof Rails Market Size and Share Forecast Outlook 2025 to 2035

Automotive Resonator Market Size and Share Forecast Outlook 2025 to 2035

Automotive Counter Shaft Market Size and Share Forecast Outlook 2025 to 2035

Automotive Wheel Coating Market Size and Share Forecast Outlook 2025 to 2035

Automotive Water Separation Systems Market Size and Share Forecast Outlook 2025 to 2035

Automotive Refinish Coating Market Size and Share Forecast Outlook 2025 to 2035

Automotive Emission Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Automotive Tire Market Size and Share Forecast Outlook 2025 to 2035

Automotive Glass Market Size and Share Forecast Outlook 2025 to 2035

Automotive Wire & Cable Material Market Size and Share Forecast Outlook 2025 to 2035

Automotive Camshaft Market Size and Share Forecast Outlook 2025 to 2035

Automotive DC-DC Converter Market Size and Share Forecast Outlook 2025 to 2035

Automotive Key Blank Market Size and Share Forecast Outlook 2025 to 2035

Automotive Tensioner Market Size and Share Forecast Outlook 2025 to 2035

Automotive Cabin Air Quality Sensors Market Size and Share Forecast Outlook 2025 to 2035

Automotive Fuel Accumulator Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA