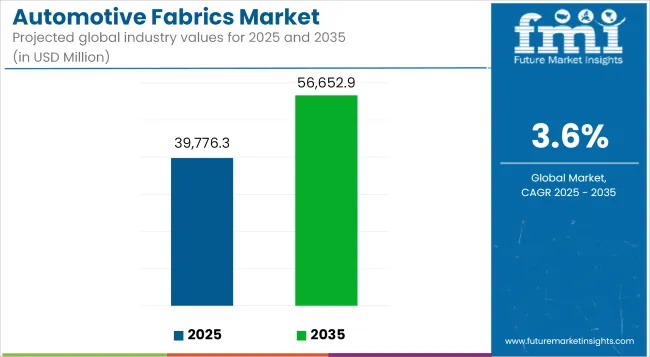

The global automotive fabrics market is expected to reach USD 39,776.3 million in 2025 and expand to approximately USD 56,652.9 million by 2035, reflecting a CAGR of 3.6% percent during the forecast period. Growth is being supported by the evolution of vehicle interiors, increased demand for enhanced passenger comfort, and continued innovation in high-performance textiles.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 39,776.3 million |

| Industry Value (2035F) | USD 56,652.9 million |

| CAGR (2025 to 2035) | 3.6% |

Automotive fabrics are being incorporated into various components, including seating, roof liners, carpets, door trims, and safety systems, to enhance functionality and visual appeal. As passenger expectations evolve, emphasis is being placed on materials that offer breathability, resistance to ultraviolet exposure, and long-term durability. These characteristics are especially important for applications in warmer climates and long-haul usage.

The rising penetration of electric and autonomous vehicles is accelerating the need for advanced fabrics that support acoustic dampening and thermal regulation. Materials with low weight and high flexibility are being selected to meet these functional requirements without compromising on design or quality.

Regulatory pressures and industry standards are encouraging the use of flame-retardant and compliant textiles in vehicle interiors. As a result, automakers and suppliers are investing in next-generation materials, including nanofiber-enhanced fabrics and smart coatings that support hygiene, ease of maintenance, and occupant protection.

The shift toward synthetic alternatives such as PU-based leather and technical polyester blends is gaining momentum. These materials are preferred for their cost-effectiveness, ease of cleaning, and adaptability to various interior styling themes. Such alternatives are also less resource-intensive to manufacture compared to traditional options, providing additional benefits in production and logistics.

Technical advancements in fabric reinforcement are also addressing safety-related applications. Tear-resistant textiles are being incorporated into airbag construction and seatbelt assemblies to meet global crash safety standards, without compromising flexibility or passenger comfort.

The automotive fabrics market is projected to maintain consistent growth through 2035, driven by advancements in manufacturing technology, evolving vehicle cabin design trends, and a growing preference for feature-rich and low-maintenance interiors.

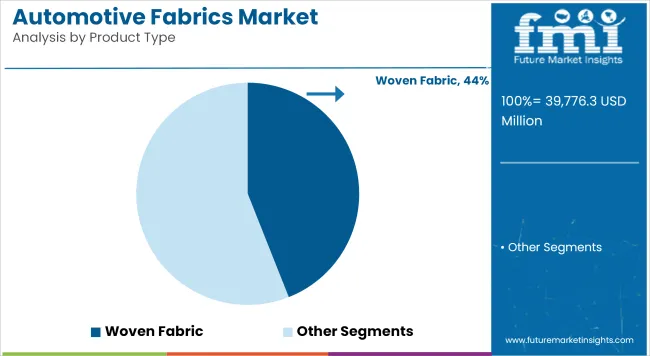

Woven fabrics are estimated to account for approximately 44% of the global automotive fabrics market share in 2025 and are projected to grow at a CAGR of 3.7% through 2035. These fabrics are widely used in applications that require dimensional stability and abrasion resistance, such as seat upholstery, airbags, safety belts, and door trims.

Their tightly structured interlacing ensures longevity and strength under mechanical stress, making them ideal for occupant protection systems and heavy-wear interior areas. Manufacturers are focusing on incorporating recycled polyester, high-tenacity nylon, and blended fibers to improve sustainability and performance, particularly in premium automotive interiors and electric vehicle designs.

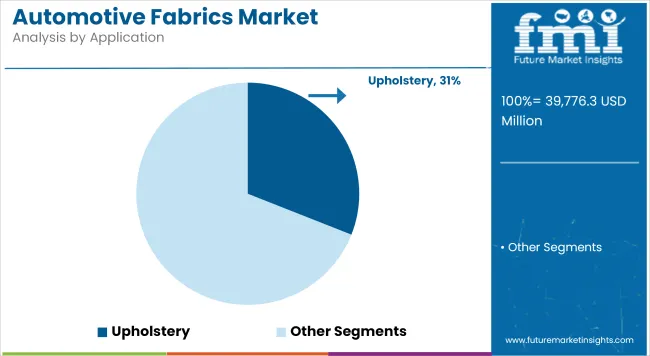

Upholstery is projected to hold approximately 31% of the global automotive fabrics market share in 2025 and is expected to grow at a CAGR of 3.8% through 2035. Automotive OEMs are increasingly utilizing high-quality fabrics for seat covers, armrests, and interior paneling to enhance the cabin ambiance and differentiate their brands.

With the growing adoption of modular and pre-assembled interior components, fabric-backed panels offer a balance of weight savings, acoustic damping, and visual appeal. The shift toward sustainable mobility is also driving the integration of low-emission, recyclable textiles into vehicle interiors. As automakers expand their EV portfolios and compete on interior comfort and design innovation, upholstery remains the largest and most value-driven segment in the automotive fabrics market.

Raw Material Price Fluctuations

The automotive fabrics sector is significantly dependent on primary raw materials, such as polyester, nylon, and leather, whose costs are influenced by fluctuations in crude oil prices, trade policies, and the supply chain. The petrochemical derivative-dependent synthetic fiber business is most vulnerable to fluctuations in the oil market, which directly impacts the entire production cost.

Moreover, interferences in the international supply chain, resulting from geopolitical tensions, natural disasters, or manpower shortages, can lead to material shortages and extended lead times. This unstable situation affects both fabric manufacturers and automakers, resulting in cost variations that can ultimately impact vehicle prices and profits for suppliers and manufacturers.

Stringent Environmental Regulations

Governments in all parts of the world are implementing measures that involve stringent environmental regulations aimed at reducing carbon footprints and promoting sustainability, in order to attract more business.

Regulations such as the European Union's REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) and California's Proposition 65 have prompted leading manufacturers to ban toxic substances, including VOCs, which are often harmful to the environment, and to use eco-friendly alternatives.

also, the industry is being pressured to come up with biodegradable, recyclable, or bio-based textiles. While eco-friendly materials are on the rise, converting to greener ones entails hefty funding through research, testing, and production upgrades, which makes it difficult both financially and technologically for the manufacturers in this highly competitive automotive textiles market.

Growth in Electric and Autonomous Vehicles

The electric vehicle (EV) boom and self-driving technology, in the long run, are changing the way of automakers. With weight reduction being a priority for battery-efficient electric vehicles, the focus will now shift to smart surfaces and autonomous spaces that are more functional than the traditional ones.

Molded sensor fabrics, active thermal barrier, and sound absorption textiles are the trendsetters in comfort and safety enhancement in the vehicle's cabin textiles. Likewise, breathable, resource-saving, and visually appealing textile materials are gaining market acceptance. When the car manufacturers are greenlighting the interior innovation to distinguish their electric and self-driving vehicles, the fabric producers have the chance to offer state-of-the-art, multifunctional materials specifically formulated for the next generation of mobility solutions.

Advancements in Sustainable and Smart Fabrics

The automotive fabric industry is racing towards achieving sustainability and implementing smart textile innovations amid growing environmental concerns. The development of self-cleaning, antibacterial, and biodegradable fabrics has been a major hit, besides being considered health-promoting and longer-lasting.

Similarly, the makers are on a search for replacing the synthetic fibers with natural materials like bio-polyesters, and organic cotton blends to lessen carbon emissions. The combination of yarns with nanotechnology is also providing the textiles with new functionalities such as temperature monitoring and energy harvesting. Thus, the future of the automotive interior is planned to be the place of sustainable and intelligent textiles that obey both consumer and regulatory demands.

Customization and Luxury Interior Trends

As buyers' desires for high-quality car interiors increase every day, car manufacturers have been passing on the message of prioritizing products with customizable and designer fabrics. Customers are now seeking alternatives such as velvet upholstery, jacquard twill, and other high-end fabrics, leading to increased purchases of materials like synthetic leather, Alcantara, and other technical woven products.

In addition to that, the new generation of coatings with exceptional performances, such as durability enhancement, stain resistance, and quick visual appeal, is put forward. Besides, luxury labels are using artisanal fabrics, elaborate stitching, and excellent natural fibers in their quest to make the interiors unique. The shift of interest toward individualization and enhanced luxury indeed creates wealth opportunities for fabric makers, enabling them to meet the varying customer tastes and at the same time, solidify the brand uniqueness in the highly competitive automotive market.

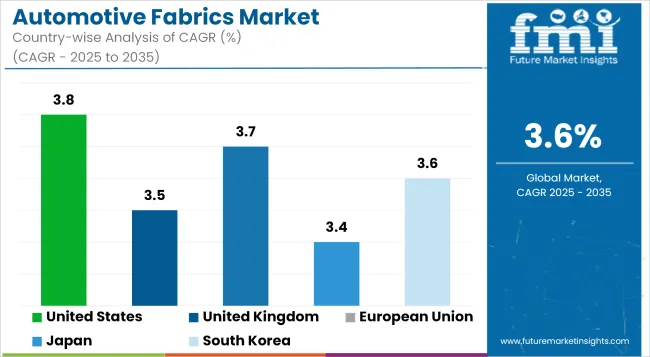

The USA auto fabrics market is growing strongly as it is a byproduct of the growing application of innovative textiles in car production. Consumer's shift towards high-performance, sustainable, and aesthetically pleasing interiors is driving demand for these kinds of products. Increased EV production and the development of lighter materials are also fueling the sector's growth. Further, strict safety regulations which necessitate the use of flame-retardant and impact-resistant fabrics are shaping the trends in the sector. Coating the textile with the smart heating/cooling functions is one more vector for the market growth. It is thus the automotive fabrics area in the United States that continues to develop and conquer new heights.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 3.8% |

Automotive soft goods in the United Kingdom are on the road to success due to the growing investment in the interiors of sustainable and luxury vehicles. The increasing presence of electric and autonomous vehicles in the market is what drives the industry to new and better materials. Furthermore, the support of the government for the environment by promoting a reduction in carbon footprint is also a very good factor for the vehicle companies to use reused textiles and bio-based textiles in their products. The growing focus on premium automotive upholstery is another factor that will push the market forward regarding the incorporation of technical features like smart and antimicrobial fabrics providing passengers more comfort and hygiene.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 3.5% |

The European Union (EU) automotive fabrics market is progressing frequently with the increasing need for eco-friendly and high-performance textiles. Strict regulations promoting the use of eco-friendly materials such as recycled polyester or plant-based fibers are supporting this process. Moreover, innovations in fabric coatings, fire-retardant materials, and smart textiles are making automotive fabrics multifunctional. The growth of electric and hybrid vehicles in the area is creating additional demands for innovative textiles that insulate better and are more comfortable for passengers.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 3.7% |

Japan's automotive fabrics industry is stimulated by the nation's emphasis on innovation, environmental sustainability, and high-performance fibers. The increasing adoption of electric and hybrid cars is driving demand for lightweight and environmentally friendly textile materials. Also, Japan's nanotechnology and intelligent textile research is stimulating the production of self-cleaning, antibacterial, and power-saving interior fabrics in cars. The country's leadership in the production of luxury cars is also driving demand for premium and customized textiles.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 3.4% |

South Korea’s automotive fabrics market is expanding rapidly due to the country’s leadership in smart and sustainable textile manufacturing. The increasing production of electric and autonomous vehicles is fueling demand for lightweight, energy-efficient, and high-performance fabrics. Additionally, South Korea’s strong research and development (R&D) sector is driving innovations in fabric coatings, antimicrobial treatments, and integrated electronics for automotive interiors. The increasing focus on luxury car interiors and personalization is also adding to market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 3.6% |

The automotive fabric industry is strategically focusing on several key areas to meet evolving market demands. Companies are prioritizing the development of lightweight materials that not only contribute to fuel efficiency but also enhance passenger comfort, aligning with industry goals for sustainability and regulatory compliance. As consumer demand for eco-friendly products rises, manufacturers are increasingly investing in sustainable alternatives, such as recycled and bio-based fabrics, to reduce environmental impact.

Regional players are concentrating on providing cost-effective solutions tailored to specific vehicle segments, including both economy and luxury markets. Technological innovations, such as advanced weaving techniques and enhanced coatings, are also becoming a competitive differentiator, improving fabric durability, wear resistance, and aesthetics.

The Automotive Fabrics Market can be segmented based on:

The global automotive fabrics market is projected to reach USD 39,776.3 million by the end of 2025.

The market is anticipated to grow at a CAGR of 3.6% over the assessment period.

By 2035, the automotive fabrics market is expected to reach USD 56,652.9 million.

The Woven Fabric segment is expected to lead due to its widespread use in airbags, safety belts, and upholstery.

Major companies operating in the automotive fabrics market include Henkel AG & Co. KGaA, Namics Corporation, ASE Group.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automotive Nonwoven Fabrics Market Size and Share Forecast Outlook 2025 to 2035

Automotive Manufacturing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Automotive Pressure Sensor Market Size and Share Forecast Outlook 2025 to 2035

Automotive Vacuum Brake Booster Market Size and Share Forecast Outlook 2025 to 2035

Automotive Smart Antenna Market Size and Share Forecast Outlook 2025 to 2035

Automotive Actuator Market Size and Share Forecast Outlook 2025 to 2035

Automotive Exhaust Manifold Market Size and Share Forecast Outlook 2025 to 2035

Automotive Roof Rails Market Size and Share Forecast Outlook 2025 to 2035

Automotive Resonator Market Size and Share Forecast Outlook 2025 to 2035

Automotive Counter Shaft Market Size and Share Forecast Outlook 2025 to 2035

Automotive Wheel Coating Market Size and Share Forecast Outlook 2025 to 2035

Automotive Water Separation Systems Market Size and Share Forecast Outlook 2025 to 2035

Automotive Refinish Coating Market Size and Share Forecast Outlook 2025 to 2035

Automotive Emission Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Automotive Tire Market Size and Share Forecast Outlook 2025 to 2035

Automotive Glass Market Size and Share Forecast Outlook 2025 to 2035

Automotive Wire & Cable Material Market Size and Share Forecast Outlook 2025 to 2035

Automotive Camshaft Market Size and Share Forecast Outlook 2025 to 2035

Automotive DC-DC Converter Market Size and Share Forecast Outlook 2025 to 2035

Automotive Key Blank Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA