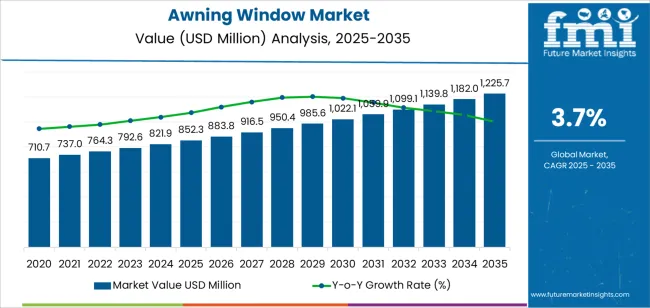

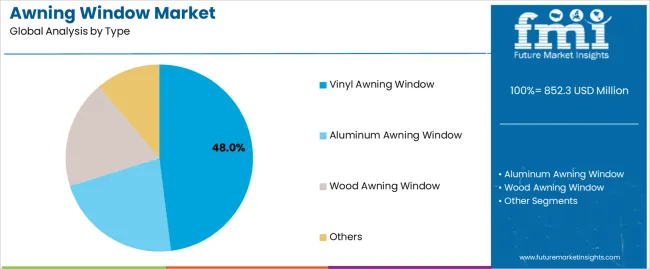

The awning window market is forecast to expand from USD 852.3 million in 2025 to USD 1,225.7 million by 2035, at a CAGR of 3.7%, with the segment structure shaping most of the long-term growth. The vinyl awning window segment leads with 48% share, supported by strong adoption in residential and light-commercial projects where durability, cost efficiency and insulation performance matter most. Vinyl frames resist moisture, corrosion and UV exposure, making them suitable for humid, coastal and high-rainfall areas. Their thermal efficiency aligns with rising interest in energy-conserving building materials, while simplified fabrication and lower maintenance costs reinforce their leadership in high-volume construction.

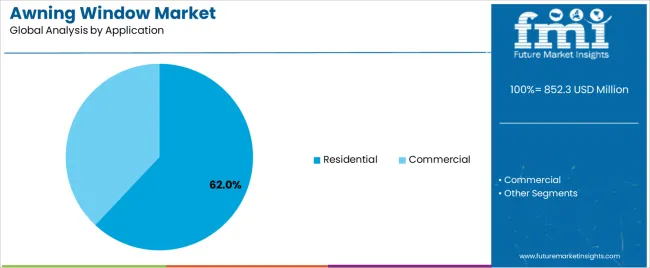

Aluminum awning windows form the second-largest segment as commercial buildings, offices and institutional projects prioritize strength, slim profiles and long service life. Aluminum systems remain appealing where architectural minimalism and structural rigidity are required. Wood awning windows maintain niche relevance in premium residential applications, driven by aesthetic appeal and custom design flexibility, though their higher maintenance requirements limit broader adoption. Hybrid and composite variants are gaining steady traction as manufacturers blend strength, insulation and weather resistance in modern façade design. Application segmentation is led by residential installations at 62%, supported by renovation demand, rising adoption of compact ventilation solutions, and the suitability of awning windows for kitchens, bathrooms and narrow openings. Commercial applications grow steadily as energy-efficient envelope upgrades and moisture-managed ventilation frameworks become common in offices, retail buildings and hospitality projects.

The growing construction and renovation activities, particularly in emerging economies, are driving market expansion. Increasing awareness of building initiatives and the adoption of energy-efficient materials are further boosting the demand for awning windows. The ongoing trend toward smart homes and buildings, where energy efficiency and automation are prioritized, is also expected to drive market growth. Awning windows, being compatible with modern building technologies, are increasingly integrated into energy-efficient building designs.

Between 2025 and 2030, the awning window market is projected to grow from USD 852.3 million to approximately USD 1,060.1 million, adding USD 207.8 million, which accounts for about 55.6% of the total forecasted growth for the decade. This period will be marked by increased adoption of energy-efficient and durable window solutions in both new constructions and renovation projects, as well as innovations in window technology and design.

From 2030 to 2035, the market is expected to expand from approximately USD 1,060.1 million to USD 1,225.7 million, adding USD 165.6 million, which constitutes about 44.4% of the overall growth. This phase will be characterized by continued demand for energy-efficient solutions in residential and commercial buildings, driven by ongoing building initiatives, smart home trends, and the growing focus on reducing energy consumption.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 852.3 million |

| Market Forecast Value (2035) | USD 1,225.7 million |

| Forecast CAGR (2025 to 2035) | 3.7% |

The awning window market is growing due to the increasing demand for energy-efficient and aesthetically versatile windows in both residential and commercial buildings. Awning windows, which open outward from the bottom, allow for improved airflow and ventilation while maintaining privacy and protection from the elements. These windows are particularly popular in areas with frequent rainfall, as they provide effective ventilation while preventing water from entering the interior.

The growing emphasis on energy efficiency and natural lighting in building design is a key driver of market growth. Awning windows offer benefits such as enhanced insulation and improved air circulation, which help reduce reliance on artificial cooling and heating systems. This makes them a desirable option for energy-conscious homeowners and building managers seeking to improve the energy performance of their buildings.

The rise in home renovations and construction projects is boosting demand for awning windows, particularly in the residential market. The flexibility of awning windows in terms of size and design, along with their ability to complement modern architectural styles, further contributes to their popularity. As urbanization increases and the demand for energy-efficient, cost-effective window solutions rises, the market for awning windows is expected to continue its steady growth.

The market is segmented by type, application, and region. By type, the market is divided into vinyl awning window, aluminum awning window, wood awning window, and others, with vinyl awning window leading the market. Based on application, the market is categorized into residential and commercial, with residential representing the largest segment in terms of market share. Regionally, the market is divided into North America, Europe, Asia Pacific, and other key regions.

The vinyl awning window segment leads the market, accounting for 48% of the total market share. Vinyl’s popularity is driven by its affordability, durability, and low maintenance compared to other materials like wood and aluminum. Vinyl windows are highly resistant to weather conditions such as moisture and UV rays, making them a reliable choice for homes and businesses in diverse climates. Vinyl awning windows offer excellent insulation properties, which contribute to better energy efficiency by helping maintain consistent interior temperatures.

With a growing demand for cost-effective, long-lasting window solutions, vinyl has become the preferred material due to its combination of aesthetic appeal, functional benefits, and ease of installation. Its versatility makes it suitable for both residential and commercial applications, and as homeowners and businesses increasingly prioritize energy efficiency and durability, the vinyl awning window segment is poised to remain the dominant choice in the market.

The residential application dominates the awning window market, holding 62% of the total market share. This growth is largely driven by the increasing demand for energy-efficient and visually appealing window solutions for homes. Awning windows, which open outward, are particularly popular in residential buildings because they allow for ventilation even during rainy conditions, ensuring protection from the weather. This feature makes them ideal for areas with frequent rain or fluctuating weather conditions.

Homeowners are also focusing on energy-efficient solutions that improve both comfort and curb appeal. Vinyl and aluminum awning windows are known for their durability, low maintenance, and excellent thermal insulation, making them an attractive option for new builds and renovations. As the residential housing market grows, the demand for awning windows will continue to rise, with the residential sector remaining a key driver of market growth due to the increasing focus on both energy efficiency and aesthetic value.

Awning windows offer features like outward‑top‑hinged sashes for better airflow, improved sealing against rain, and compatibility with energy‑efficient glazing. Key drivers include growth in renovation projects, stricter building‑energy codes, and increased interest in modern façade designs. Restraints stem from higher upfront costs compared to standard windows, limited awareness of awning benefits in some markets, and installation complexity in retrofits.

Why are Awning Windows Gaining Popularity in Construction and Renovation Projects?

Awning windows are gaining popularity because they strike a balance between functionality and design providing ventilation even during rain, offering compact sill profiles, and enabling unique architectural façades. As builders and homeowners pursue improved indoor‑air quality, passive ventilation strategies, and energy efficiency, awning windows align well with these objectives. Their ease of use in smaller openings and suitability for both modern and traditional style homes strengthen their appeal. In renovation environments where space and installation flexibility are constrained, awning windows provide a practical solution that enhances comfort and performance without major structural changes.

How are Technological Innovations Driving Growth in This Segment?

Technological innovations are accelerating growth in the awning window segment through advances in frame materials, sealing systems, and automation. Lightweight but strong frames made from fiberglass or hybrid materials allow for larger glazed areas and slimmer profiles. Improved gasket and hinge designs enhance weather‑tightness and durability in challenging climates. Motorised or sensor‑controlled awning windows are providing smart‑ventilation features that integrate with building‑automation systems. Advanced glazing options (low‑E coatings, vacuum‑insulated units) further enable better thermal performance while maintaining the outward‑opening configuration. These innovations increase appeal in both new builds and retrofits by delivering higher performance, design flexibility, and user convenience.

What are the Key Challenges Limiting Adoption of Awning Windows?

The higher initial cost of premium materials or motorised mechanisms can deter use, particularly in cost‑sensitive markets or basic renovation projects. Installation complexity is another barrier these windows may require more careful coordination of sill slopes, exterior clearance and hinge setup compared with standard casement or sliding windows. In certain markets, limited awareness of awning benefits (like ventilation during rain) means they are often overlooked. Compatibility issues in retrofit scenarios—especially where existing masonry or frame openings don’t immediately suit top‑hinged operation may necessitate extra renovation work, reducing attractiveness.

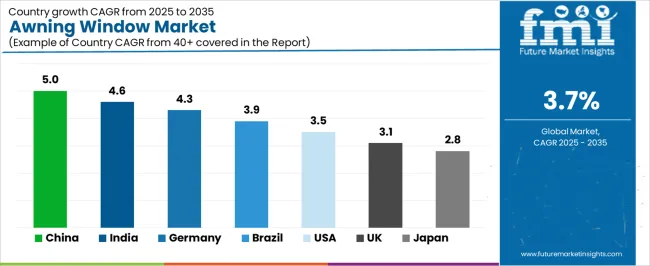

| Country | CAGR (%) |

|---|---|

| China | 5.0% |

| India | 4.6% |

| Germany | 4.3% |

| Brazil | 3.9% |

| USA | 3.5% |

| UK | 3.1% |

| Japan | 2.8% |

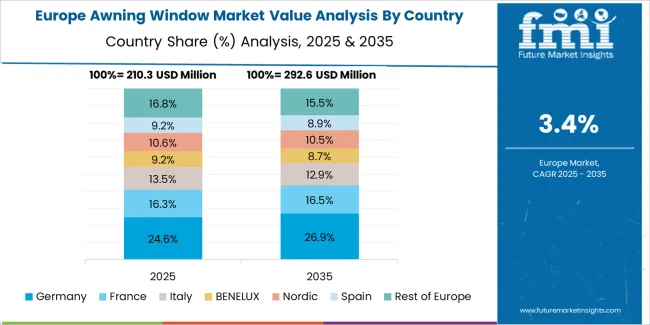

The awning window market is expanding across key countries, with China leading at a 5.0% CAGR. This growth is driven by urbanization, increasing construction activities, and a rising preference for energy-efficient windows. India follows at 4.6%, with rapid urban development and growing demand for modern window designs. Germany is growing at 4.3%, supported by the demand for energy-efficient building solutions and architectural trends. Brazil shows a 3.9% CAGR, driven by construction sector growth and demand for durable window solutions. The USA, UK, and Japan are experiencing moderate growth, at 3.5%, 3.1%, and 2.8%, respectively, driven by home renovations and the need for better ventilation and weather-resistant windows.

China is the leader in the awning window market, growing at a 5.0% CAGR. The demand for awning windows in China is primarily driven by the booming construction and real estate sectors. As urbanization continues, there is a growing need for energy-efficient windows that provide better ventilation and protection against the elements. Awning windows are particularly popular in residential and commercial buildings, as they offer optimal airflow while protecting against rain. These windows are also favored for their aesthetic appeal and ability to enhance the building’s energy efficiency.

China's ongoing infrastructure development, along with increasing environmental awareness, has further boosted the demand for energy-saving building materials. The government’s push for green building practices and environmentally friendly construction materials has spurred the growth of energy-efficient window designs like awning windows. As the country continues to invest in residential and commercial construction, the demand for awning windows is expected to rise, contributing to sustained growth in the market.

India is experiencing steady growth in the awning window market with a 4.6% CAGR. The rapid urbanization and construction boom in the country are the key drivers of this market. As more people move to urban areas, there is an increased demand for modern, functional, and aesthetically pleasing window designs, including awning windows. These windows provide excellent ventilation and weather protection, making them particularly attractive in India’s climate, which experiences heavy monsoons.

The growing focus on energy efficiency in building designs is further driving the demand for awning windows in India. As the country’s residential and commercial sectors expand, more architects and builders are incorporating energy-efficient features in their designs to reduce energy consumption and improve indoor air quality. This trend is expected to continue, contributing to the growth of the awning window market in India as more consumers and developers opt for durable and weather-resistant window solutions.

Germany is experiencing steady growth in the awning window market, with a 4.3% CAGR. The country’s growing demand for energy-efficient building solutions is one of the main factors driving the market. Awning windows are a popular choice in Germany due to their ability to provide better airflow and natural ventilation while offering protection from the rain. As energy efficiency becomes a priority in the construction and renovation sectors, the popularity of awning windows, known for their ability to contribute to a building’s overall energy efficiency, continues to rise.

Germany’s strong commitment to sustainable building practices, as well as government incentives promoting green construction, has further fueled the demand for energy-efficient window designs. With a focus on improving building insulation and reducing heating and cooling costs, awning windows are increasingly being incorporated into both residential and commercial buildings. The rise in demand for these windows, driven by the need for better energy performance and indoor comfort, ensures continued growth in the German awning window market.

Brazil is witnessing moderate growth in the awning window market, with a 3.9% CAGR. The growth in the construction sector, particularly residential and commercial buildings, is driving the demand for awning windows. These windows are sought after for their ability to provide excellent ventilation, natural light, and weather protection, especially in regions with varying weather conditions. As Brazil continues to develop its urban centers and expands its residential housing, there is an increasing preference for modern and energy-efficient window solutions like awning windows.

Brazil’s focus on energy-efficient construction materials and building solutions is contributing to the growth of the awning window market. Builders and homeowners are becoming more conscious of the need for windows that enhance a building’s insulation and reduce energy consumption. With increasing interest in energy-efficient homes and buildings, the demand for awning windows is expected to continue growing, positioning Brazil as a key player in the global market for this window type.

The USA is experiencing moderate growth in the awning window market, with a 3.5% CAGR. This growth is mainly driven by the rising trend of home renovations and the increasing demand for energy-efficient windows. As more homeowners look for ways to enhance the comfort and energy performance of their homes, awning windows are gaining popularity for their ability to provide both natural ventilation and weather protection. These windows are especially valued in areas with fluctuating weather conditions, as they can be left open during rain without letting water enter.

The growing focus on sustainable building practices in the USA is also contributing to the rise of awning windows. With the increased adoption of energy-efficient technologies and building materials, the demand for windows that can improve insulation and reduce energy costs is growing. As more consumers and builders look for durable and environmentally friendly window solutions, the market for awning windows is expected to continue expanding in the USA.

The UK is seeing steady growth in the awning window market with a 3.1% CAGR. The key drivers of this market include the increasing demand for energy-efficient building solutions and the growing popularity of home renovations. As more homeowners and builders look for ways to improve indoor air quality and reduce energy consumption, awning windows, known for their ability to provide ventilation without compromising on weather protection, have become a popular choice. These windows are especially suited for homes in areas with unpredictable weather, as they allow fresh air to enter while keeping out rain.

The rise of green building practices and government incentives for energy-efficient home improvements have boosted the adoption of awning windows in the UK. With increasing awareness of the environmental impact of construction, consumers and developers are seeking window solutions that contribute to energy savings and improved indoor comfort. As the demand for energy-efficient and weather-resistant windows grows, the UK’s market for awning windows is set to continue expanding.

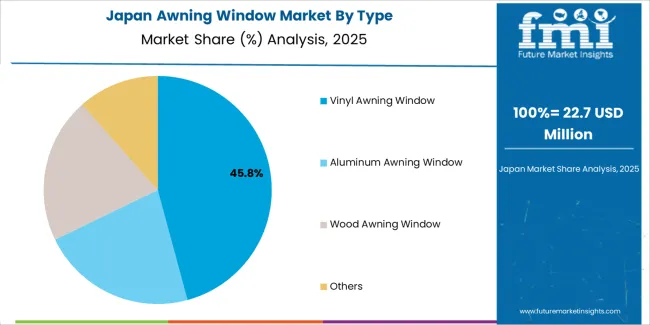

Japan’s awning window market is growing at a steady rate of 2.8% CAGR. The market is driven by increasing urbanization and a growing demand for energy-efficient and weather-resistant windows. In Japan, where the climate can vary significantly, awning windows are especially popular due to their ability to provide ventilation while protecting against rain. With many consumers and businesses looking for practical and durable solutions to improve building comfort and energy efficiency, awning windows are becoming an increasingly preferred choice.

The trend towards energy-efficient construction materials, as well as Japan’s commitment to reducing carbon footprints and improving building insulation, is contributing to the steady growth of the awning window market. As Japan continues to modernize its infrastructure and buildings, the demand for functional window solutions like awning windows is expected to rise. The growing need for products that balance energy efficiency with aesthetic appeal positions Japan as an important market for the global awning window industry.

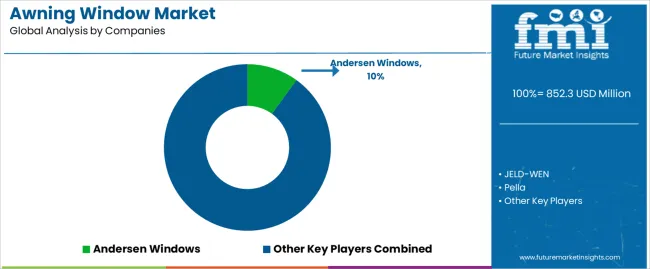

The awning window market is growing as consumers and builders seek versatile, energy-efficient window solutions for both residential and commercial applications. Andersen Windows leads the market with a 10% share, known for its high-quality windows and innovation in energy-efficient designs. Andersen’s strong reputation, broad product range, and commitment to sustainability make it a dominant player in the awning window market.

Other significant players in the market include JELD-WEN, Pella, and Milgard, which offer a variety of awning window designs tailored to different architectural styles and functional needs. JELD-WEN is well-regarded for its wide range of windows and doors, offering customizable options with an emphasis on durability and performance. Pella is a key competitor, known for its energy-efficient window solutions, and Milgard offers a wide selection of windows with a focus on high-quality construction and energy savings.

Companies like Harvey Windows & Doors, PGT, and MI Windows contribute to the market by providing reliable awning window solutions that meet both aesthetic and practical requirements. Ply Gem, Sierra Pacific, and VEKA further strengthen the competitive landscape by offering diverse product lines, with a focus on strength, energy efficiency, and ease of installation.

Other regional and specialized players, such as TAFCO, Rosati Windows, Prime Window Systems, Oridow Industrial, and Champion Windows, offer cost-effective and customizable awning window solutions to meet the growing demand for both residential and commercial applications. The competition in this market is driven by factors such as energy efficiency, customization options, durability, and the ability to meet the specific needs of modern architecture.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD million |

| Type | Vinyl Awning Window, Aluminum Awning Window, Wood Awning Window, Others |

| Application | Residential, Commercial |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East & Africa |

| Countries Covered | China, Japan, South Korea, India, Australia & New Zealand, ASEAN, Rest of Asia Pacific, Germany, United Kingdom, France, Italy, Spain, Nordic, BENELUX, Rest of Europe, United States, Canada, Mexico, Brazil, Chile, Rest of Latin America, Kingdom of Saudi Arabia, Other GCC Countries, Turkey, South Africa, Other African Union, Rest of Middle East & Africa |

| Key Companies Profiled | Andersen Windows, JELD-WEN, Pella, Milgard, Harvey Windows & Doors, PGT, MI Windows, Ply Gem, Sierra Pacific, VEKA, TAFCO, Rosati Windows, Prime Window Systems, Oridow Industrial, Champion Windows |

| Additional Attributes | Dollar sales by type and application categories, market growth trends, market adoption by classification and application segments, regional adoption trends, competitive landscape, advancements in awning window materials and designs, integration with residential and commercial building projects. |

The global awning window market is estimated to be valued at USD 852.3 million in 2025.

The market size for the awning window market is projected to reach USD 1,225.7 million by 2035.

The awning window market is expected to grow at a 3.7% CAGR between 2025 and 2035.

The key product types in awning window market are vinyl awning window, aluminum awning window, wood awning window and others.

In terms of application, residential segment to command 62.0% share in the awning window market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Wood Awning Window Market Size and Share Forecast Outlook 2025 to 2035

Vinyl Awning Window Market Size and Share Forecast Outlook 2025 to 2035

Clad Wood Awning Window Market Size and Share Forecast Outlook 2025 to 2035

Window Air Conditioner Market Size and Share Forecast Outlook 2025 to 2035

Window Packaging Market Size and Share Forecast Outlook 2025 to 2035

Window Coverings Market – Trends, Growth & Forecast 2025 to 2035

Assessing Window Packaging Market Share & Industry Trends

Window Rain Guards Market

Cat Window Perches & Wall Shelves Market Growth - Trends & Forecast 2025 to 2035

Vinyl Windows and Doors Market Size and Share Forecast Outlook 2025 to 2035

Power Window Lift Motor Market Size and Share Forecast Outlook 2025 to 2035

Railway Window Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Window Frame Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Windows and Windshields Market Size and Share Forecast Outlook 2025 to 2035

Automated Window Blinds Market Size and Share Forecast Outlook 2025 to 2035

Automotive Window Regulator Motor Market Size and Share Forecast Outlook 2025 to 2035

Automotive Window Regulator Market Growth – Trends & Forecast 2025 to 2035

X-Arm Type Window Regulator Market

Double Hung Windows Market Size and Share Forecast Outlook 2025 to 2035

Vinyl Sliding Window Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA