Between 2025 and 2035 the balsam bottle market will see significant expansion since customers desire natural herbal pharmaceuticals and prefer sustainable packaging solutions and technological improvements in plastic and glass bottle production. The pharmaceutical industry depends heavily on Balsam bottles which constitute an essential part of storing personal care products and oils and herbal extracts while maintaining product purity. Market expansion continues to grow because people choose organic plant-based medical remedies and the wellness industry keeps expanding. The adoption of environmentally responsible packaging solutions linked to sustainable market expansion has risen substantially.

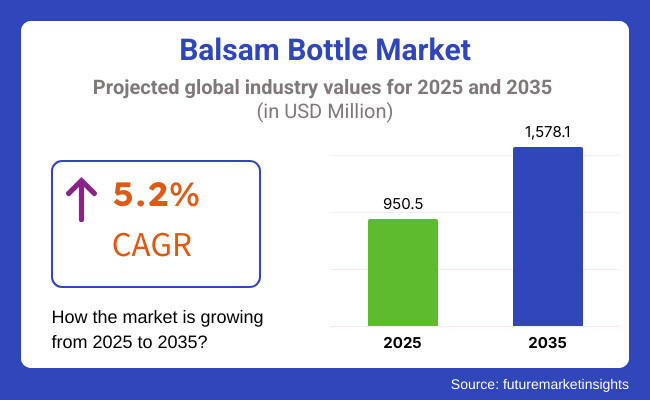

Balsam bottles will experience a market growth of 5.2% through 2035 until they reach USD 1,578.1 Million in value from their initial USD 950.5 Million in 2025. The market grows due to elevated demands for superior packaging solutions and innovative durable lightweight bottle production alongside rising governmental regulations applicable to pharmaceutical packaging. The market will be reshaped through smart packaging advances that integrate tamper-evident features along with counterfeit deterrent technologies. Secure and aesthetically pleasing balsam bottles have gained more demand due to rising online sales of herbal and therapeutic products.

North America is another strong market for balsam bottles, as more consumers are drawn to herbal medicine, essential oils, and sustainable packaging initiatives. Rising consumer consciousness regarding eco-friendly packaging solutions and their affinity toward glass-based packaging solutions in the US and Canada is creating further momentum for the demand for recyclable balsam bottles. Presence of major industry participants and innovations in bottle design, including UV-resistant coatings and dropper attachments are also contributing to the market expansion. With advances like regulatory compliance for pharmaceutical and food-grade packaging, the material is becoming increasingly quality- and safety-oriented across the industry.

Europe balsam bottle market is growing at a steady pace due to higher consumer inclination towards organic and natural healthcare products, coupled with regulatory environment supporting eco-friendly packaging. Germany, France, and the UK are leading the market in implementing recyclable and biodegradable materials in balsam bottle manufacturing. In addition, rising trend of alternative medicine and aromatherapy is increasing demand for specialized balsam bottles with advanced sealing and dispensing mechanism. Europe’s strict laws on packaging waste are another factor fostering innovations in how materials are sourced and recycling initiatives, she said.

With rapid industrialization, increasing demand for traditional herbal medicines, and rising disposable incomes, the balsam bottle market is set to grow the most in the Asia-Pacific region. With the presence of various giant companies, these countries are developing advanced pharmaceutical and cosmetic packaging leading to boost the consumption of balsam bottles. Furthermore, the growth of e-commerce platforms and direct-to-consumer sales channels is increasing the demand for attractive and sturdy packaging solutions. The growing government initiatives and policies promoting sustainable materials and circular economy practices are also driving the adoption of eco-friendly balsam bottles across the region.

Challenge

High Costs and Regulatory Complexities

High production costs, stringent regulatory requirements, and limited access to sustainable packaging materials pose challenges to the Balsam Bottle Market. To manufacture balsam bottles, it should contain certain types of glass or eco-friendly plastic materials, which ultimately makes the production expensive. Furthermore, regulation bodies have strict specifications regarding to packaging integrity, recyclability, and labelling such as FDA (United States Food and Drug Administration) and EFSA (European Food Safety Authority). Balancing compliance with market affordability requires companies to invest in cost-effective production techniques, advanced packaging technologies, and eco-friendly alternatives.

Restrictions on the Supply Chain and Lockdown of Fake Goods

The industry faces supply chain disruptions driven by shortages of raw materials and rising prices, as well as logistical challenges in the sourcing of premium-grade balsam extracts and packaging components. Brands face the challenge of maintaining credibility through the availability of counterfeit balsam bottles and imitation products. Traceability systems and tamper-proof packaging provide manufacturers the ability to protect their products while ensuring authenticity and supply chain transparency in order to ensure consumer confidence and distinguish their products in a competitive marketplace.

Opportunity

Rising Demand for Natural and Organic Packaging

Rising inclination of consumers towards natural and organic products is augmenting the demand for aesthetic and sustainable balsam bottles. A lot of brands are now working with eco-friendly glass, biodegradable plastics, or reusable packaging solutions to contribute towards sustainability goals. The premiumization of balsam-based wellness and cosmetic products also provides opportunities for innovative and luxury packaging designs. Brands that are making investments in high-quality, recyclable materials and unique bottle designs will naturally appeal to consumers with environmental concerns, and this includes wine drinkers.

Advancements in Smart Packaging and E-commerce Growth

The Balsam Bottle Market has been revolutionized by technological advancements in smart packaging, for instance, QR codes, NFC-enabled bottles, and tamper-evident seals. These advancements help boost consumer interaction, verify product authenticity and strengthen brand security. In addition, the rise of e-commerce and direct-to-consumer sales channels is generating new growth opportunities. Businesses that adopt digital marketing tactics, subscription packaging systems, and balsa bottles with personalized designs will be ahead of the competition in the changing marketplace.

The Balsam Bottle Market experienced consistent growth from 2020 to 2024, showing higher demand for herbal remedies, natural beauty products, and sustainable packaging solutions. Bottling companies developed BPA-free, recyclable, and reusable bottles for eco-conscious consumers. Nonetheless, supply chain disruptions, high material costs, and regulatory challenges in the ATON technology market were hindering factors to the market expansion. Manufacturers have reacted by sampling production to improve efficiencies, looking for alternative packaging materials, and implementing stricter traceability measures to ensure product authenticity.

In the long term (2025 to 2035), the packaging market will be transformed with smart packaging, consumer engagement using AI, and innovative recycling technology. The demand for sustainable practices will lead to innovations in refillable (and biodegradable) balsam bottle solutions. Another essential aspect of supply chain efficiency will stem from the rise of AI-driven inventory management and block chain-supported transparency solutions. Sustainable, innovative and digitally integrated companies will drive the next wave of market growth.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Adherence to food, cosmetic, and pharmaceutical packaging standards |

| Technological Advancements | Innovation and expansion in BPA-free and recyclable packaging options |

| Industry Adoption | Increased use in herbal medicine, cosmetics, and essential oils |

| Supply Chain and Sourcing | Dependence on traditional glass and plastic packaging suppliers |

| Market Competition | Presence of established packaging manufacturers and emerging sustainable brands |

| Market Growth Drivers | Demand for organic and natural product packaging solutions |

| Sustainability and Energy Efficiency | Initial focus on recyclable materials and reducing packaging waste |

| Integration of Smart Monitoring | Limited use of QR codes and authentication seals |

| Advancements in Bottle Design | Traditional glass and plastic bottles with standard labelling |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | Sustainability regulations, mandates for biodegradable packaging, and circular economy policies globally. |

| Technological Advancements | Smart packaging, NFC bottles, and block chain-based authentication systems. |

| Industry Adoption | Expansion into luxury wellness, subscription-based packaging, and AI-powered consumer engagement. |

| Supply Chain and Sourcing | Shift toward localized, eco-friendly packaging materials, sustainable sourcing, and AI-driven inventory management. |

| Market Competition | Growth of premium balsam bottle designers, smart packaging providers, and innovative sustainable packaging start-ups. |

| Market Growth Drivers | Increased investment in digital-first branding, sustainable e-commerce packaging, and smart inventory tracking. |

| Sustainability and Energy Efficiency | Large-scale adoption of compostable packaging, refillable balsam bottles, and carbon-neutral manufacturing practices. |

| Integration of Smart Monitoring | Expansion of AI-powered packaging analytics, interactive product tracking, and personalized consumer engagement. |

| Advancements in Bottle Design | Evolution of artistic, eco-friendly bottle designs, sustainable ink printing, and innovative bio-based packaging solutions. |

Increasing demand for high quality packaging vessels in the cosmetics and drug industry is contributing to the steady growth of USA balsam bottle market. Increasing awareness of organic and herbal products is also expected to drive the demand for high quality balsam bottles.

With sustainability goals in focus, manufacturers are placing high importance on eco-friendly and recyclable packaging materials. Moreover, the growth of the cosmetics and essential oils market is driving innovation in bottle design and functionality.

| country | CAGR (2025 to 2035) |

|---|---|

| USA | 5.5% |

The UK balsam bottle market is expanding with increasing use of sustainable and visually-appealing packaging in the beauty and wellness sector. Market trends are shifting as consumers increasingly prefer glass and biodegradable plastic bottles.

Moreover, increasing adoption of refillable and reusable packaging solutions is fuelling demand. Increased shift towards premium product presentation along with the emergence of artisanal and luxury personal care brands that utilizes balsam bottles fuel the market growth.

| country | CAGR (2025 to 2035) |

|---|---|

| UK | 5.0% |

The balsam bottle market is stable in the European Union, with Germany, France, and Italy accounting for the highest demand for premium packaging solutions. Stringent environmental regulations supporting uses for sustainable packaging pretend the integrative use of recycled and eco-friendly balsam bottles.

Rapid growth of the fragrance, essential oils, and pharmaceutical industries is bolstering the demand for quality packaging. Market growth is also facilitated by rising investments in new-age packaging formats like glass and bioplastic packaging.

| country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 5.2% |

The Japan balsam bottle market is growing with increasing demand for luxury skincare and personal care packaging. The country’s canon of minimalist yet premium packaging design is inspiring experimentation with materials and aesthetics at balsam bottles.

Moreover, the rising use of UV resistant and air tight bottles for pharmaceutical and cosmetic applications is also supporting market growth. There is also increasing consumer awareness of sustainable and refillable packaging impacting purchasing decisions.

| country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.9% |

The balsam bottles market in South Korea has grown rapidly, spurred on the beauty and skincare industry. Demand for high-quality balsam bottles is rising due to the emergence of K-beauty brands concentrating on high-end and eco-friendly packages.

Market trends are increasingly being driven by refillable and recyclable packaging solutions. Bottle manufacturing technology has also spurred innovation and consumer interest, with the development of lightweight glass and biodegradable plastics.

| country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.4% |

Manufacturers in the borosilicate glass and personal care sectors account for a considerable share of the balsam bottle market due to the growing need for durable, locally detergent-resistant, and visually-pleasing packaging solutions for perfumes, essential oil, and pharmaceutical applications across industries. For cosmetic brands, pharmaceutical laboratories, aromatherapy businesses, and specialty liquid packaging providers, these balsam bottles are a necessary component of product integrity, shelf life, and appeal.

With trends in premium packaging and sustainability driving ongoing change, manufacturers are increasingly working on glass compositions with high strength, enhanced UV protection and ergonomic bottles that take up less storage space, reduce product degradation and facilitate customer satisfaction over the longer term.

Over the past decade, borosilicate glass has emerged as one of the most preferred types of bottle materials due to its high performance and heat-resistant properties.

Borosilicate glass stands as a widely accepted material in balsam bottle applications since it provides superior thermal stability along with high resistance to chemical reactions and excellent durability when storing essential oils and pharmaceutical compounds and laboratory solutions. Borosilicate glass exceeds regular lime glass through its capacity to resist high temperature changes and stop contamination while protecting sensitive liquids to maintain storage reliability for extended periods.

Adoption has been driven by the demand for high-strength borosilicate glass with improved UV shielding, scratch resistant coatings, and impact resistant formulations. More than 60% of premium personal care and pharmaceutical brands prefer borosilicate glass for better protection of product, which is expected to generate strong demand for this segment.

The proliferation of sustainable packaging initiatives, such as eco-friendly production methods, recyclable glass solutions, biodegradable bottle caps, continues to bolster the market demand, leading to eventual consumer preference for environmentally conscious balsam bottles.

By adding next-gen borosilicate glass technologies with AI-augmented precision melding, anti-corrosion treatment layers and lighter-weight structural elements, adoption has skyrocketed, allowing seamless adaptation to changing storage and cosmetic goals.

The customizable borosilicate bottle design, with embossed branding, sealed for airtight closure and dispenser with spill-containing technology, is crucial for market development due to increased usability and customer engagement.

Challenges faced by the borosilicate glass segment include higher production costs, complex manufacturing processes, and delicate handling requirements, though it has advantages such as securing product integrity, minimizing environmental disruptions, and providing better visual appearance. While cost-effective and durable alternatives present strong competition, new advancements in artificial intelligence for glass product material engineering, self-healing surface texture technology, and impact-resistant borosilicate formulations are becoming increasingly cost-efficient, affecting better production scale-up, further fuelling positive boons in borosilicate balsam bottle market expansion across global grounds.

This has also resulted in steady adoption of borosilicate glass for luxury personal care, laboratory suppliers, and perfume manufacturers, since such industries place greater emphasis on product longevity and value of brand. Unlike that of standard glass compositions, borosilicate glass possesses higher optical clarity, extraction resistance, and shelf-life protection that ensures the preservation of high-quality products and the trust of consumers.

Demand for next-generation borosilicate glass bottles, such as those with high-transparency finishes, low-reactivity coatings, and ultraviolet blocking properties, has driven adoption. Producers of high-end essential oils and fragrances are increasingly incorporating borosilicate glass for higher aesthetic appeal and lower interaction of oil volatiles, indicates studies, making this segment a high-demand one.

The increase in the adoption of custom-designed borosilicate packaging solutions, including decorated etching, anti-fingerprint coatings, and airtight dispensing mechanisms, has supported market adoption as they ensure better consumer engagement and improved appeal for premium branding.

The inclusion of smart borosilicate glass technologies, including self-cleaning ability, liquid preservation analytics in real-time, and digital labelling for pedigree verification, has enhanced adoption even further, ensuring improved user experience and product longevity assurance.

As a result, the borosilicate glass segment has to vacate its potential benefits such as lower contamination risks, better longevity, and an elevated luxury product appeal at a high price point, even though the denied services such as higher energy demand in its production, lower consumer availabilities in mass-market packaging, and possess regulatory submissions in the pharmaceutical segment pose some challenges on the product segment. Nonetheless, novel advances in AI-assisted bottle weight minimization, nanotechnology-derived scratch rejection, and block-chain-supported stability monitoring are enhancing manufacturer performance, consumer health, and eco-friendliness and are preventing global growth for borosilicate balsam bottles.

The demand for balsam bottles in the personal care manufacturer segment has seen a positive trend, as leading beauty and wellness brands aim to preserve the purity of essential oils, serums, lotions and luxury skincare formulations in aesthetic, eco-friendly containers. Glass packaging for balsams not only protects against chemical leaching (as with plastic packaging), but also protects the constituents of the fragrance intact while providing a great look and feel for consumers, leading to improved customer satisfaction and lifetime brand loyalty.

Growing adoption of eco-friendly balsam bottle solutions that includes lead-free glass formulations, AI-assisted precision melding and anti-oxidation coating technologies is driving demand. According to studies, more than 65% of premium beauty and wellness brands prefer to use balsam bottles, providing safe and sustainable packaging for their products, which indicates strong demand for this segment.

The growing proliferation of refillable and reusable packaging, including recyclable glass bottles incentives, green product refill stations, and biodegradable packaging accessories are expected to boost growth in the market owing to higher adoption of glass balsam bottles across industries.

The adoption was further accelerated by integrating AI-powered smart packaging solutions already featuring QR code-based authenticity tracking, digital ingredient transparency displays, and connected packaging experiences that strengthen customer engagement and product authenticity.

Market growth of luxury balsam bottle designs, accompanied by gold-plated accents, UV-resistant coatings, and custom ergonomic grips, has led to differentiation advantage for high-end personal care brands.

While it is a solution for bettering brand identity, sustainability, and safety for products, the manufacturer segment of the personal care industry suffers from higher packaging costs, fragile handling challenges, and a lesser scalability when compared to products intended for mass markets. Adapting packaging with enhancements in lightweight glass packaging, AI-assisted durable testing, and digitalized sustainability verification platforms improve packaging effectiveness, production scalability, and eco-friendly consumer inclination, driving market growth for balsam bottles in the personal care sector.

Adoption of glass-based packaging solutions for personal care manufacturers has reached considerably among high-end beauty brands, wellness companies, and sustainable cosmetic product manufacturers turned to glass-based packaging solutions as industries are moving to adopt glass-based packaging solution to reduce plastic waste, enhance brand identity, and elevate consumer experience among others. So, their all-star product balsam glass bottles is much better in the long run helping preserve, prevent chemical degradation and providing beautiful packaging format compared to plastic or metal alternatives greater premium product positioning and customer retention.

Adoption has also been driven by the demand for premium balsam bottle solutions, with bio-based ink labelling, AI-led aesthetic customization and ultra-thin lightweight glass making. More than 70 percent of the leading personal care brands are targeting balsam bottles for their premium product lines, indicating that sustainable, recyclable glass packaging will be in demand.

The personal care manufacturer segment has advantages that include improved sustainability and the appeal of premium packaging, but it also faces challenges like increased raw material costs, longer lead times for production and constraints on the supply chain. Nevertheless, the advent of innovations such as block chain-tracking sustainable sourcing, biodegradable eco-coatings and self-sterilizing balsam bottle technologies are enhancing the safety, regulatory compliance and manufacturing efficiency of packaging, thereby providing the perquisites for a sustained growth of the usage of balsam bottle in the personal care sector around the globe.

Industry Overview

The market for balsam bottles continues to grow steadily because businesses in pharmaceuticals and cosmetics together with specialty foods require sophisticated premium packaging solutions. The glass balsam bottles are commonly selected for essential oil storage as well as herbal extract preservation and syrup preservation and balsamic product storage. The market growth is supported by three main factors including customer demand for sustainable packaging solutions alongside the growing organic and herbal product market and gains in glass and plastic bottle manufacturing technologies. Major manufacturers dedicate efforts to creating sustainable materials and intelligent labelling systems and customizable product designs to match emerging industry requirements.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Hergesheimer AG | 18-22% |

| Bormio Pharma | 15-19% |

| Stella Glass Group | 12-16% |

| Berlin Packaging | 9-13% |

| Beatson Clark | 7-11% |

| Other Companies & Regional Players (Combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Hergesheimer AG | Specializes in high-quality glass balsam bottles for pharmaceuticals, cosmetics, and premium food packaging. |

| Bormio Pharma | Provides sustainable and innovative balsam bottles with enhanced barrier protection for liquid formulations. |

| Stella Glass Group | Develops customized balsam bottle solutions with premium design options for luxury and organic products. |

| Berlin Packaging | Offers a range of glass and plastic balsam bottles with smart labelling and branding capabilities. |

| Beatson Clark | Focuses on lightweight and recyclable balsam bottles, catering to the growing demand for eco-friendly packaging. |

Hergesheimer AG (18-22%)

With this years of experience in producing high-quality pharmaceutical-grade glass packaging, Hergesheimer is at the forefront for both medicinal as well as cosmetic application providing precise and engineered inputs for the production of balsam bottles.

Bormio Pharma (15-19%)

Bormio Pharma is a key player in sustainable packaging, offering advanced balsam bottles with enhanced durability, chemical resistance, and innovative closure solutions.

Stella Glass Group (12-16%)

Stella specializes in premium and customized balsam bottles, focusing on high-end cosmetic, perfumery, and organic product packaging solutions.

Berlin Packaging (9-13%)

Berlin Packaging integrates smart labelling and design flexibility into its balsam bottle offerings, catering to both pharmaceutical and specialty food markets.

Beatson Clark (7-11%)

Beatson Clark is known for its lightweight and recyclable balsam bottles, aligning with the industry’s push toward sustainability and environmentally responsible packaging.

Other Key Players (30-40% Combined)

Several other manufacturers contribute to the balsam bottle market by providing innovative packaging solutions tailored to diverse industry needs. Notable players include:

The overall market size for Balsam Bottle Market was USD 950.5 Billion in 2025.

The Balsam Bottle Market expected to reach USD 1,578.1 Billion in 2035.

The demand for the balsam bottle market will grow due to increasing consumer preference for premium packaging in the cosmetic and pharmaceutical industries, rising demand for herbal and essential oil products, advancements in sustainable packaging, and the expanding global personal care market.

The top 5 countries which drives the development of Balsam Bottle Market are USA, UK, Europe Union, Japan and South Korea.

Borosilicate Glass and Personal Care Manufacturers lead market growth to command significant share over the assessment period.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Bottle Sealing Wax Market Size and Share Forecast Outlook 2025 to 2035

Bottle Filling Machines Market Size and Share Forecast Outlook 2025 to 2035

Bottle Shippers Market Size and Share Forecast Outlook 2025 to 2035

Bottled Water Packaging Market Size and Share Forecast Outlook 2025 to 2035

Bottle Sticker Labelling Machine Market Size and Share Forecast Outlook 2025 to 2035

Bottle Dividers Market Size and Share Forecast Outlook 2025 to 2035

Bottle Jack Market Size and Share Forecast Outlook 2025 to 2035

Bottles Market Analysis - Growth & Forecast 2025 to 2035

Bottle Capping Machine Market Analysis by Automation, Operating Speed, Machine Type, End-use Industry, and Region Forecast Through 2035

Market Share Distribution Among Bottle Dividers Suppliers

Bottle Carrier Market Trends – Growth & Forecast 2024-2034

Bottle Cap Market Analysis & Industry Forecast 2024-2034

Bottled Water Processing Equipment Market Trends – Growth & Industry Forecast 2025-2035

Bottle Pourers Market

RTD Bottled Cocktail Market - Size, Share, and Forecast Outlook 2025 to 2035

PET Bottles Market Demand and Insights 2025 to 2035

PCR Bottles Market Growth - Demand, Innovations & Outlook 2024 to 2034

Asia & MEA PET Bottle Market Trends & Industry Forecast 2024-2034

Foam Bottle Technology Market Size and Share Forecast Outlook 2025 to 2035

Beer Bottles Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA