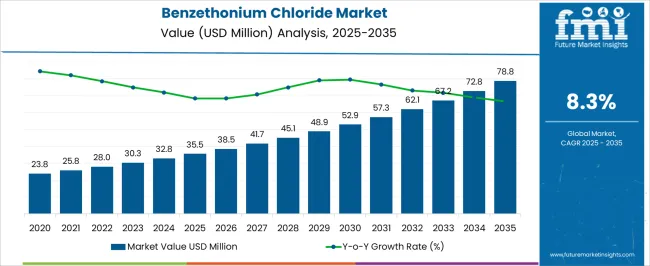

The benzethonium chloride market is projected to grow at a CAGR of 8.3% from 2025 to 2035, with the market estimated at USD 35.5 million in 2025 and anticipated to reach USD 78.8 million by 2035. In the early growth phase, adoption is primarily driven by increasing demand from personal care and hygiene industries, where benzethonium chloride serves as a key antimicrobial agent in hand sanitizers, soaps, wet wipes, and topical antiseptics.

Cosmetic formulations, particularly in skincare and cleansing products, are increasingly incorporating this quaternary ammonium compound due to its efficacy in controlling microbial contamination and ensuring product safety. Small- and medium-scale manufacturers focus on integrating benzethonium chloride into cost-effective formulations while adhering to regulatory limits on concentration and usage. In the later growth phase, expansion is fueled by industrial and institutional applications, including disinfectants for hospitals, food processing facilities, and water treatment systems. Rising awareness about hygiene, stringent sanitation standards, and increased production of antimicrobial household and industrial products further support long-term adoption.

Market maturation also sees technological optimization in production processes, enhanced purity grades, and formulation innovations that improve stability and compatibility across diverse applications. Global trade and regional manufacturing hubs contribute to supply chain robustness, ensuring wider availability and market penetration. Strategic partnerships, mergers, and collaborations among chemical producers, personal care brands, and healthcare product manufacturers facilitate innovation, regulatory compliance, and rapid commercialization, reflecting a dynamic market evolving from early niche usage to widespread industrial and consumer adoption.

| Metric | Value |

|---|---|

| Benzethonium Chloride Market Estimated Value in (2025 E) | USD 35.5 million |

| Benzethonium Chloride Market Forecast Value in (2035 F) | USD 78.8 million |

| Forecast CAGR (2025 to 2035) | 8.3% |

The benzethonium chloride market is strongly influenced by five interrelated parent markets, each contributing uniquely to overall demand and growth. The personal care and hygiene products market holds the largest share at 40%, as hand sanitizers, soaps, wet wipes, and antiseptic creams increasingly incorporate benzethonium chloride for its antimicrobial properties, ensuring product safety and efficacy. The healthcare and hospital disinfection market contributes 25%, with hospitals, clinics, and laboratories utilizing benzethonium chloride-based disinfectants and surface sanitizers to maintain hygiene standards, prevent infections, and comply with regulatory protocols. The industrial cleaning and sanitation market accounts for 15%, driven by food processing, water treatment, and pharmaceutical facilities requiring effective biocides for equipment and surface cleaning.

The household disinfectant and surface cleaner segment holds a 12% share, as growing awareness about home hygiene and pathogen control increases adoption of antibacterial sprays, wipes, and solutions containing benzethonium chloride. Finally, the cosmetic and personal care formulation market represents 8%, leveraging benzethonium chloride in skincare, cleansing, and wet wipe products for its preservative and antimicrobial effects. Collectively, personal care, healthcare, and industrial segments account for 80% of overall demand, highlighting that hygiene, infection control, and regulatory compliance are the primary growth drivers, while household and cosmetic applications provide supplementary opportunities for global market expansion.

In 2025, demand is being supported by heightened awareness of hygiene standards, stringent safety regulations, and the growing use of antimicrobial agents in consumer products.

The compound’s multifunctional benefits, including preservation, disinfection, and conditioning properties, have strengthened its role in various formulations. Rising investment in advanced formulation technologies and the incorporation of high-purity ingredients in personal care and pharmaceutical products are expected to pave the way for further growth.

The ability of Benzethonium Chloride to meet regulatory requirements while offering broad-spectrum antimicrobial efficacy positions it as a critical ingredient for both established and emerging applications. As industries continue to focus on product safety, efficacy, and shelf life enhancement, the market is expected to maintain strong growth momentum over the forecast period.

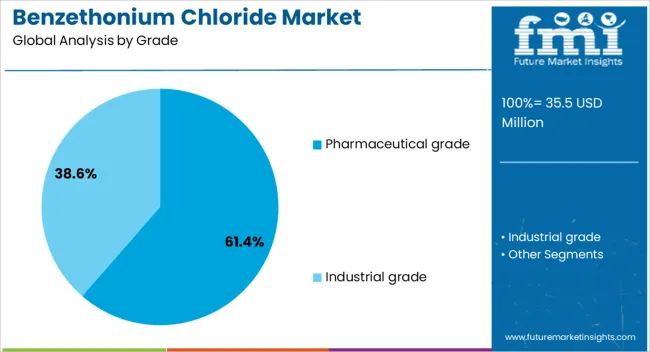

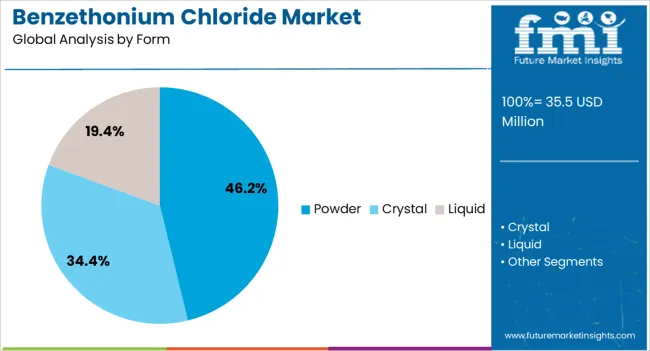

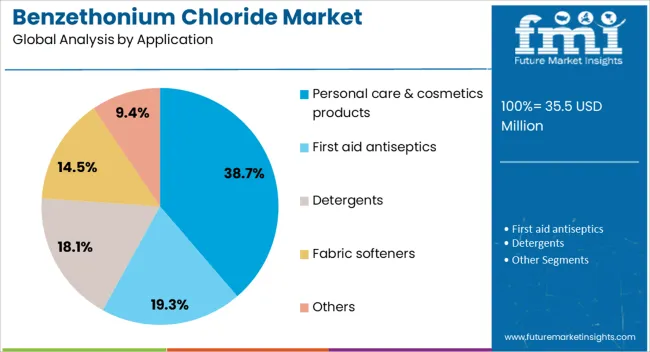

The benzethonium chloride market is segmented by grade, form, application, distribution channel, and geographic regions. By grade, benzethonium chloride market is divided into Pharmaceutical grade and Industrial grade. In terms of form, benzethonium chloride market is classified into Powder, Crystal, and Liquid.

Based on application, benzethonium chloride market is segmented into Personal care & cosmetics products, First aid antiseptics, Detergents, Fabric softeners, and Others. By distribution channel, benzethonium chloride market is segmented into Distributors and wholesalers, Direct sales, and Online sales. Regionally, the benzethonium chloride industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The pharmaceutical grade segment is projected to hold 61.4% of the Benzethonium Chloride market revenue in 2025, making it the leading grade category. This dominance is being driven by its compliance with stringent quality and purity standards required for pharmaceutical and medical applications.

Its role as an active ingredient in topical antiseptics, hand sanitizers, and prescription formulations has supported its widespread adoption in healthcare and clinical settings. The segment’s growth is also being reinforced by increased demand for hospital-grade disinfectants and sterile preparation products.

Its consistent performance, safety profile, and regulatory approval in multiple regions have positioned pharmaceutical-grade Benzethonium Chloride as a preferred choice for manufacturers seeking high-quality antimicrobial agents. As global healthcare infrastructure expands and infection control measures intensify, the demand for pharmaceutical-grade formulations is anticipated to remain strong.

The powder form segment is expected to account for 46.2% of the Benzethonium Chloride market revenue in 2025, representing the largest share among forms. This leading position is being attributed to the stability, ease of storage, and cost-effectiveness of powdered formulations.

The segment benefits from its adaptability in various end-use industries, allowing precise dosage control during manufacturing processes. Its compatibility with a wide range of product formulations, from disinfectant wipes to cosmetic creams, has supported its consistent market presence.

Additionally, the extended shelf life and minimal risk of degradation associated with powder form make it highly suitable for bulk procurement and distribution. Growing adoption in both pharmaceutical manufacturing and personal care product lines is expected to sustain its leading position over the coming years.

The personal care and cosmetics products segment is projected to hold 38.7% of the Benzethonium Chloride market revenue in 2025, making it the top application category. Growth in this segment is being driven by rising consumer preference for hygiene-focused and multifunctional personal care products.

Benzethonium Chloride is valued for its dual role as an antimicrobial preservative and conditioning agent, which enhances both safety and sensory attributes of formulations. Its use in skincare, haircare, and hygiene products has expanded due to increasing awareness of product safety and longevity.

The segment’s momentum is further supported by the premiumization trend in cosmetics, where high-performance and compliant ingredients are in demand. As personal care brands continue to innovate with formulations that balance efficacy, safety, and consumer appeal, the role of Benzethonium Chloride in this segment is expected to strengthen.

Benzethonium chloride demand is primarily driven by personal care, healthcare, and industrial sanitation sectors. Household and cosmetic applications offer additional opportunities for market expansion globally.

The benzethonium chloride market is witnessing strong growth in personal care and hygiene products due to increased consumer focus on antimicrobial protection and skin safety. Hand sanitizers, antibacterial soaps, wet wipes, and creams incorporating benzethonium chloride are gaining popularity as effective solutions against germs and bacteria. Manufacturers emphasize high-purity grades, formulation flexibility, and regulatory compliance to meet global standards.

Growth is further supported by rising awareness of hygiene in schools, workplaces, and public spaces, alongside expanding retail and e-commerce channels that enhance accessibility. Market players are also focusing on differentiated packaging, multi-functional product formulations, and competitive pricing strategies to capture consumer attention and encourage repeat purchases in diverse geographic regions.

Benzethonium chloride is increasingly adopted in hospitals, clinics, and laboratories for surface sanitization, antiseptic solutions, and surgical hand scrubs. The healthcare sector’s stringent hygiene and infection control standards drive demand, particularly in regions with high patient turnover and advanced medical infrastructure. Hospitals and medical facilities prefer stable, high-efficacy formulations that maintain microbial control without damaging surfaces or causing skin irritation. OEM partnerships and collaborations with healthcare product manufacturers ensure customized solutions, scalable production, and consistent supply. Regulatory approvals, certifications, and adherence to antimicrobial efficacy testing further support market penetration. Training and educational programs for hospital staff regarding proper disinfectant usage also boost adoption, highlighting safety, reliability, and compliance as key growth drivers.

The industrial cleaning and sanitation sector contributes significantly to benzethonium chloride demand, especially in food processing, pharmaceuticals, and water treatment facilities. Effective microbial control in production environments is critical for operational safety and regulatory compliance. Manufacturers supply concentrated solutions, wipes, and sprays tailored for equipment cleaning, surface sanitization, and water treatment applications. Growing industrial output, strict hygiene standards, and global expansion of manufacturing facilities drive the market. Companies are focusing on cost-effective bulk supply, easy-to-use formulations, and robust technical support to improve client adoption. Strategic partnerships with facility service providers and cleaning solution integrators enhance distribution networks and ensure reliable availability across regional and global markets.

Benzethonium chloride is gaining traction in household disinfectants, surface cleaners, and cosmetic formulations due to rising consumer hygiene awareness. Antimicrobial sprays, wipes, and skincare products utilize benzethonium chloride for safe and effective germ control. Market growth is fueled by increasing home cleaning frequency, health-conscious lifestyles, and rising preference for multi-functional products combining cleansing, moisturizing, and preservative properties. Manufacturers emphasize product stability, skin compatibility, and aesthetic appeal in packaging.

E-commerce platforms, retail promotions, and influencer marketing campaigns enhance product visibility and adoption. Companies are also innovating with compact, travel-friendly formats to meet diverse consumer needs while focusing on brand loyalty and repeat usage, making household and cosmetic segments key growth contributors.

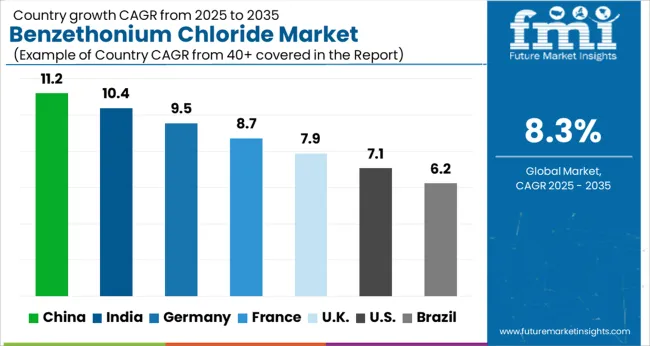

| Country | CAGR |

|---|---|

| China | 11.2% |

| India | 10.4% |

| Germany | 9.5% |

| France | 8.7% |

| UK | 7.9% |

| USA | 7.1% |

| Brazil | 6.2% |

The global benzethonium chloride market is projected to grow at a CAGR of 8.3% from 2025 to 2035, led by China at 11.2% and India at 10.4%, driven by rising demand in personal care, healthcare, and industrial sanitation applications. France, the UK, and the USA, as leading OECD markets, are witnessing increased adoption due to stringent hygiene regulations, healthcare infrastructure expansion, and growing awareness of antimicrobial solutions in households and commercial spaces. Growth is further fueled by the rising use of benzethonium chloride in disinfectants, hand sanitizers, antiseptics, and cosmetic products, along with technological improvements in formulations and packaging. Manufacturers are expanding production capacities, partnering with healthcare and industrial distributors, and focusing on cost-effective solutions to meet global demand. E-commerce and retail penetration, combined with regulatory compliance and certifications, also enhance market reach, while emerging economies show accelerated adoption due to expanding industrial, healthcare, and hygiene-conscious consumer segments. The analysis spans over 40+ countries, with the leading markets highlighted below.

The benzethonium chloride market in China is projected to grow at a CAGR of 11.2% from 2025 to 2035, driven by surging demand across healthcare, personal care, and industrial sanitation sectors. Hospitals, clinics, and pharmaceutical facilities increasingly rely on benzethonium chloride for antiseptics, disinfectants, and surface sanitizers, ensuring compliance with hygiene and infection control protocols. Rapid urbanization, expanding middle-class populations, and heightened awareness of antimicrobial hygiene in households are further fueling adoption. Domestic manufacturers are scaling up production, optimizing formulations, and investing in high-purity, cost-efficient derivatives. Collaborations with global suppliers enable technology transfer, improved quality standards, and wider distribution networks. Retail penetration and e-commerce platforms enhance accessibility for end consumers, while large-scale commercial and industrial buyers adopt bulk solutions for operational hygiene. Regulatory frameworks, safety certifications, and compliance with international standards support sustained market growth.

The benzethonium chloride market in India is expected to grow at a CAGR of 10.4% from 2025 to 2035, fueled by increased use in antiseptics, hand sanitizers, disinfectants, and personal care products. Hospitals, clinics, and pharmaceutical industries demand high-quality benzethonium chloride to maintain strict hygiene standards, while the food and beverage sector incorporates it in sanitation processes. Rising consumer awareness about antimicrobial protection, coupled with regulatory guidelines from health authorities, is driving widespread adoption. Domestic manufacturers are expanding production capacities, improving purity levels, and investing in modern formulation technologies. Partnerships with international chemical suppliers ensure access to advanced derivatives and compliance with global standards. Growth in urban centers and industrial hubs accelerates industrial procurement, while retail and online distribution channels broaden access for smaller enterprises and individual consumers. Market dynamics are also influenced by pricing strategies, import-export regulations, and bulk procurement agreements.

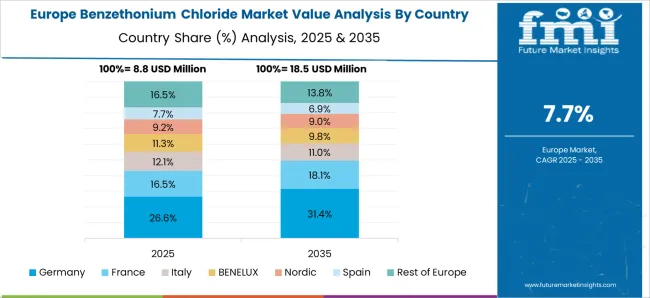

The benzethonium chloride market in France is projected to grow at a CAGR of 8.7% from 2025 to 2035, driven by stringent hygiene regulations, rising public and private healthcare infrastructure, and increased consumer awareness of antimicrobial solutions. Hospitals, nursing homes, laboratories, and pharmaceutical manufacturers are key consumers, relying on benzethonium chloride for disinfectants, antiseptics, and preservative formulations. Cosmetic and personal care companies also incorporate it in sanitizing creams and antibacterial formulations. French manufacturers focus on high-purity derivatives, regulatory compliance, and environmentally responsible production processes. The adoption of standardized hygiene protocols and safety certifications across industries enhances consistent demand. Strategic partnerships with European suppliers support technology transfer and access to innovative formulations. Retail pharmacies, e-commerce channels, and industrial distributors facilitate widespread market reach, while pricing strategies and bulk procurement agreements influence adoption patterns in commercial and institutional segments.

The benzethonium chloride market in the UK is expected to expand at a CAGR of 7.9% from 2025 to 2035, supported by growing applications in healthcare, hygiene, and personal care products. Hospitals, clinics, pharmaceutical manufacturers, and commercial cleaning services utilize benzethonium chloride in disinfectants, antiseptics, and sanitizing formulations to maintain hygiene compliance and reduce microbial contamination. Cosmetic brands increasingly incorporate it in antibacterial creams, hand sanitizers, and personal care items. UK-based producers emphasize high-quality derivatives, process optimization, and adherence to EU chemical regulations. Partnerships with multinational suppliers ensure access to advanced derivatives and bulk procurement options. Retail pharmacies, online marketplaces, and industrial distributors expand market penetration, while pricing strategies and certification standards influence adoption rates across healthcare, institutional, and consumer segments. Urban and industrial centers are primary contributors to demand, with commercial cleaning contracts further supporting volume growth.

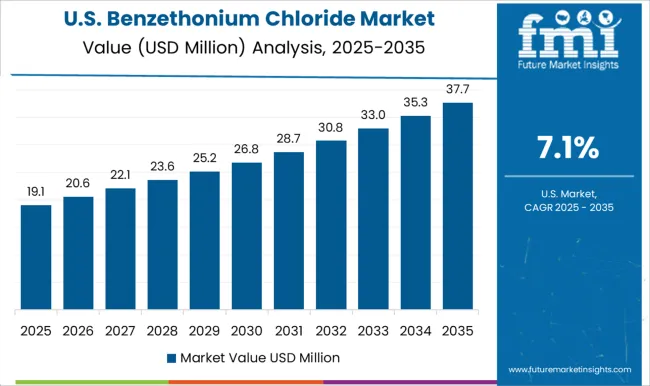

The benzethonium chloride market in the USA is projected to grow at a CAGR of 7.1% from 2025 to 2035, fueled by widespread use in healthcare, industrial sanitation, and personal care applications. Hospitals, clinics, laboratories, and pharmaceutical manufacturers rely on benzethonium chloride for disinfectants, antiseptics, and preservative formulations. Consumer awareness of antimicrobial hygiene is driving adoption in hand sanitizers, soaps, and cosmetic products. USA manufacturers are focusing on high-purity derivatives, scalable production capacities, and compliance with FDA and EPA guidelines. Strategic partnerships with chemical suppliers and distributors ensure consistent supply and access to innovative formulations. Retail pharmacies, online platforms, and industrial distributors enhance product availability, while bulk procurement by healthcare and sanitation service providers sustains large-volume demand. Pricing competitiveness, regulatory compliance, and supply chain reliability remain key factors influencing market growth.

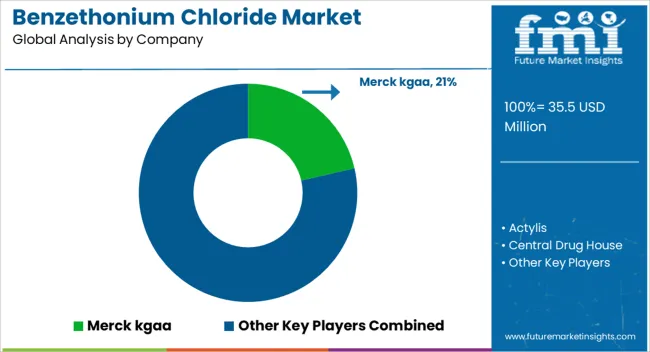

Competition in the benzethonium chloride market is defined by product purity, formulation versatility, and regulatory compliance. Merck KGaA leads with high-purity derivatives, focusing on applications in pharmaceuticals, antiseptics, and personal care products, emphasizing consistent quality and large-scale production capabilities. Actylis competes through specialized formulations optimized for sanitizers, surface disinfectants, and cosmetic applications, highlighting efficacy and stability. Central Drug House and Glentham Life Sciences differentiate by offering customizable chemical solutions, research-grade reagents, and bulk supply for industrial and laboratory use, catering to pharmaceutical manufacturers and hygiene product companies.

ITW Reagents focuses on high-quality, scalable production, integrating process optimization to ensure regulatory compliance and consistent yields. Regional and mid-tier players such as Otto Chemie, RXSOL, Sisco Research Laboratories, Spectrum Chemical, and Zhengzhou Meiya Chemical Products provide niche solutions including laboratory-grade benzethonium chloride, small-batch production, and cost-efficient industrial supply. Strategies emphasize adherence to FDA, EPA, and EU chemical regulations, process standardization, and quality assurance protocols. Partnerships with distributors, pharmaceutical manufacturers, and research institutions enable market penetration and adoption in both industrial and commercial segments.

| Item | Value |

|---|---|

| Quantitative Units | USD 35.5 Million |

| Grade | Pharmaceutical grade and Industrial grade |

| Form | Powder, Crystal, and Liquid |

| Application | Personal care & cosmetics products, First aid antiseptics, Detergents, Fabric softeners, and Others |

| Distribution Channel | Distributors and wholesalers, Direct sales, and Online sales |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Merck kgaa, Actylis, Central Drug House, Glentham Life Sciences, ITW Reagents, Otto Chemie, RXSOL, Sisco Research Laboratories, Spectrum Chemical, and Zhengzhou Meiya Chemical Products |

| Additional Attributes | Dollar sales, market share, CAGR, application-wise demand (pharmaceuticals, personal care, disinfectants), regulatory compliance trends, key competitors, pricing dynamics, supply chain constraints, and growth drivers, share, adoption patterns, market entry opportunities, product formulation trends, and bulk vs. lab-grade consumption. |

The global benzethonium chloride market is estimated to be valued at USD 35.5 million in 2025.

The market size for the benzethonium chloride market is projected to reach USD 78.8 million by 2035.

The benzethonium chloride market is expected to grow at a 8.3% CAGR between 2025 and 2035.

The key product types in benzethonium chloride market are pharmaceutical grade and industrial grade.

In terms of form, powder segment to command 46.2% share in the benzethonium chloride market in 2025.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA