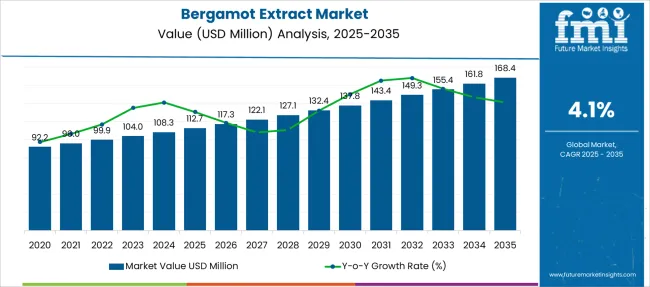

The bergamot extract market is projected to grow from USD 112.7 million in 2025 to USD 168.5 million by 2035, registering a CAGR of 4.1% during the forecast period. The market operates through a highly specialized supply chain centered in Southern Italy, where over 90% of global production originates from smallholder orchards in Reggio Calabria.

| Attributes | Description |

|---|---|

| Estimated Industry Size (2025E) | USD 112.7 million |

| Projected Industry Value (2035F) | USD 168.5 million |

| Value-based CAGR (2025 to 2035) | 4.1% |

Nearly 1,200 hectares of groves support around 300 farming families, with seasonal output reaching 200,000 kilograms of essential oil. Cultivation involves grafting onto bitter orange rootstock and relies on manual harvesting to preserve oil quality.

The peel is processed through cold pressing or centrifugal separation, followed by vacuum distillation to retain volatile aromatic compounds. Regional cooperatives and certified mills handle extraction under stringent purity and geographic indication standards. Downstream, major fragrance and nutraceutical firms maintain integrated sourcing agreements that emphasize traceability and sustainability.

Demand is being driven by clean-label beverage formulations, cardiovascular health supplements, and prestige perfumery. Regulatory alignment with EU PDO frameworks and a growing push toward regenerative farming have further solidified bergamot extract as a premium, origin-protected input across several high-value applications.

The bergamot extract market is being recognized as a valuable niche within its broader parent industries. Approximately 6-8% of the global essential oils market is represented by bergamot extract, driven by its unique citrus‑floral aroma and widespread use in perfumery and aromatherapy. In the nutraceutical ingredients space, a share of nearly 3-4% is maintained as bergamot extract continues to be used for supporting cardiovascular health and cholesterol management.

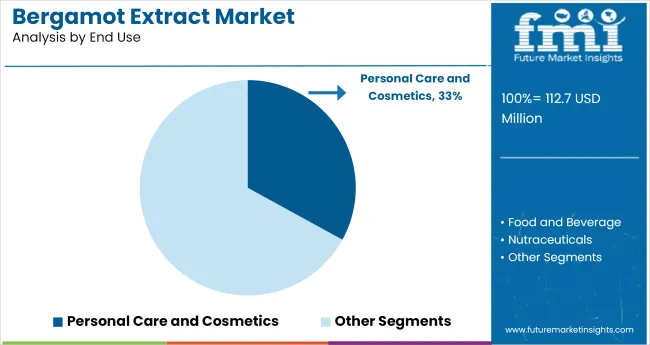

Around 5-6% of the cosmetics and personal care ingredients market is occupied by this extract due to its inclusion in skincare, hair care, and fragrance products. In the functional food and beverages sector, bergamot extract holds about 2-3% share, largely in teas, flavored waters, and wellness drinks. Its contribution to the aromatherapy products market reaches approximately 8-10%, reflecting its premium positioning among therapeutic essential oils.

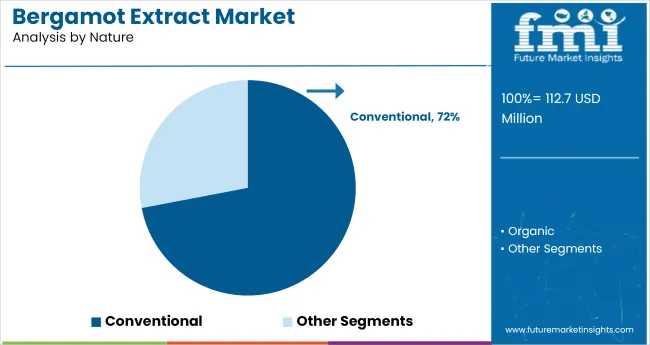

Bergamot extract demand is rising, particularly in personal care and cosmetics. The market favors conventional sourcing, supported by large-scale availability and diverse applications ranging from skincare to spa-grade aromatherapy products.

Conventional bergamot extract is projected to dominate the nature segment with a 72% market share by 2025. Its stronghold stems from cost-effectiveness, scalable production, and widespread industrial use. Manufacturers in cosmetics and food sectors prefer conventional grades for stable aroma concentration, large-volume sourcing, and compatibility with existing formulations. Countries like Italy, known for high-quality bergamot cultivation, continue to supply the bulk of extract demand globally.

Personal care and cosmetics are expected to account for 33% of the bergamot extract market share by 2025. Natural formulations, eco-conscious packaging, and clean beauty trends are fueling demand for botanical ingredients like bergamot oil. Its citrusy aroma and antibacterial benefits make it a key additive in shampoos, deodorants, creams, and facial serums. Multinational cosmetics companies are incorporating bergamot in both skincare lines and fragrance collections.

The industry is expanding due to its growing use in functional beverages, nutraceuticals, and aromatherapy. In 2024, global demand exceeded 780 metric tons, with Italy accounting for over 78% of total production. High-flavonoid content and antioxidant properties are driving its use in cardiovascular supplements and metabolic health products.

Rising Demand from Nutraceuticals and Functional Food Sectors

Bergamot extract is widely used in lipid-lowering and blood sugar management formulations. In North America, over 34% of new botanical supplement launches in 2023 featured citrus-based actives, with bergamot gaining preference for its natural statin-like properties. Encapsulated and powdered forms are being adopted in functional teas, gummies, and capsules.

Expansion in Aromatherapy, Perfumery, and Natural Cosmetics

In 2024, over 62% of cosmetic-grade bergamot oil was consumed by the personal care industry for its calming aroma and antibacterial efficacy. It is now formulated in skin balms, natural deodorants, and aromatherapy oils. Cold-pressed variants are favored in clean-label fragrance lines across the EU and Japan.

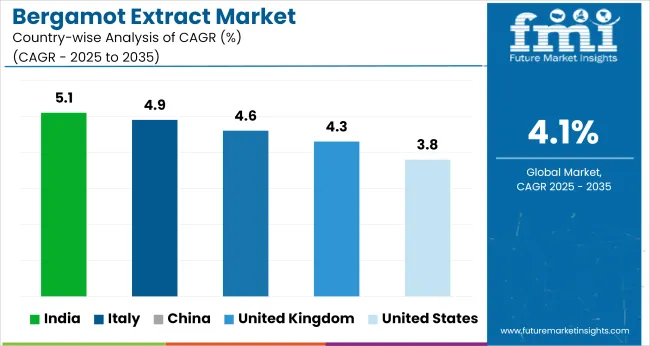

| Country | CAGR (2025 to 2035) |

|---|---|

| India | 5.1% |

| Italy | 4.9% |

| China | 4.6% |

| United Kingdom | 4.3% |

| United States | 3.8% |

The global market is projected to expand at a 4.1% CAGR from 2025 to 2035, but country-level performance varies across BRICS and OECD economies. India leads with a 5.1% CAGR, outperforming the global average due to rising use of citrus-based bioactives in ayurvedic formulations and functional nutrition. Small-scale cultivators in Tamil Nadu and Kerala are integrating vertically with essential oil processors targeting ASEAN wellness and aromatherapy sectors.

Italy, at 4.9%, remains a dominant producer with over 85% of global bergamot fruit sourced from Calabria. While supply is stable, growth is constrained by demand saturation in premium perfumery and cosmetic exports to OECD countries. China follows at 4.6%, supported by rising inclusion of bergamot in tea blends and therapeutic supplements, though domestic supply chains remain underdeveloped.

The UK (4.3%) and USA (3.8%) fall below the global CAGR, with slower adoption in clinical and high-margin food applications despite strong consumer awareness of citrus-based extracts.

The report provides insights across 40+ countries. The five below are highlighted for their strategic influence and growth trajectory.

Registering a CAGR of 5.1% from 2025 to 2035, India is emerging as one of the fastest-growing markets. Increasing consumer preference for plant-based wellness solutions is fueling demand across the nutraceutical and cosmetic industries.

The extract is especially favored in cholesterol-lowering herbal supplements and stress-relief oils. Ayurvedic and natural health brands are innovating with bergamot-infused products for mood and cardiovascular balance. Growth is further supported by domestic production of citrus derivatives and expanding e-commerce health platforms.

Italy’s market is poised to register a CAGR of 4.9% from 2025 to 2035, supported by its historic leadership in bergamot cultivation and oil production. Calabria remains the primary source of authentic bergamot extract used in fragrances and wellness products globally. Local firms are investing in value-added formats such as capsules and cosmetic-grade distillates. Italian consumers are also showing renewed interest in organic personal care and natural supplements, boosting domestic consumption.

China’s market is forecast to grow at a robust CAGR of 4.6% between 2025 and 2035, driven by increasing demand for citrus-based health and beauty ingredients. Consumers are gravitating toward functional teas and supplements that use bergamot extract for its antioxidant and cholesterol-lowering properties. The extract is also gaining popularity in aromatherapy and high-end personal care products across metro regions. Domestic producers are aligning formulations with Traditional Chinese Medicine while incorporating Western health trends.

The bergamot extract industry in the United Kingdom is projected to expand at a CAGR of 4.3% from 2025 to 2035. Demand remains steady across tea, aromatherapy, and personal wellness categories. Bergamot is a staple in Earl Grey tea and is now seeing expanded applications in calming essential oils and natural remedies. Growing consumer inclination toward holistic health is pushing UK-based nutraceutical firms to explore citrus polyphenol-based supplements. Regulatory support for clean-label formulations is also benefiting the sector.

Posting a CAGR of 3.8% over the forecast period, the USA remains a stable but expanding market for bergamot extract. The extract is widely used in cholesterol-lowering supplements and natural mood-enhancement formulations. Interest is growing across spa therapies, clean beauty products, and wellness-focused beverages.

Consumer preference for natural citrus compounds is contributing to new product launches by organic and plant-based wellness brands. Strong retail presence in the dietary supplement segment is also boosting demand.

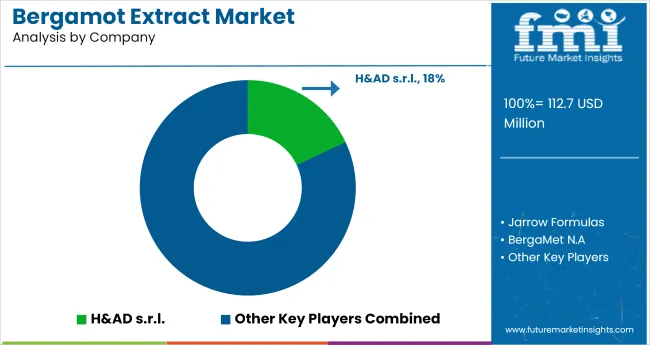

The market is moderately fragmented, with Italy-based firms like H&AD s.r.l., Norex Group, and Bergamot Biotech holding a dominant share due to proximity to Calabria-the primary cultivation region. H&AD specializes in patented bergamot polyphenolic fraction (BPF) used in cardiometabolic health products. BergaMet N.A. focuses on clinical-grade supplements in North America, backed by proprietary sourcing.

HP Ingredients partners directly with Italian producers to maintain traceability for nutraceutical applications. Bontoux S.A.S. and Citroglobe export essential oil derivatives globally, catering to the aromatherapy and cosmetics industries. In the USA, Sigma-Aldrich and Berjé Inc. serve pharmaceutical and food clients, while Indukern (Spain) and Aromhuset (Sweden) supply flavors and functional blends to the broader European market.

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 112.7 million |

| Projected Market Size (2035) | USD 168.5 million |

| CAGR (2025 to 2035) | 4.1% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD million for market value |

| Nature Analyzed (Segment 1) | Organic, Conventional |

| End Uses Analyzed (Segment 2) | Food & Beverage, Personal Care & Cosmetics, Nutraceuticals, Dietary Supplements, Other End Uses (Pharmaceutical, etc.) |

| Regions Covered | North America, Latin America, Europe, Middle East & Africa, East Asia, South Asia, Oceania |

| Countries Covered | United States, Canada, Germany, United Kingdom, France, Japan, China, India, South Korea, Brazil |

| Key Players | H&AD s.r.l., Jarrow Formulas, BergaMet N.A, HP Ingredients, Citroglobe, Nutraceuticals International Group, Bontoux S.A.S., Citromax S.A.C.I., Norex Group, Bergamot Biotech, Ransom Naturals Ltd., Sigma-Aldrich, Vigon International, Inc., Aromhuset, Berjé Inc., Indukern |

| Additional Attributes | Dollar sales by nature and end use, growing consumer focus on citrus-based antioxidants, increasing demand in herbal nutraceuticals, and expanding adoption in clean-label personal care formulations. |

By nature, industry has been categorised into Organic and Conventional.

By end use industry has been categorised into Food and Beverage, Personal care & cosmetics, Nutraceuticals, Dietary Supplements and Other End Uses (e.g. Pharmaceutical, etc.)

Industry analysis has been carried out in key countries of North America, Latin America, Europe, Middle East and Africa, East Asia, South Asia, and Oceania

The global bergamot extract market is estimated to be valued at USD 112.7 million in 2025.

The market size for the bergamot extract market is projected to reach USD 168.4 million by 2035.

The bergamot extract market is expected to grow at a 4.1% CAGR between 2025 and 2035.

The key product types in bergamot extract market are conventional and organic.

In terms of end use, food and beverage segment to command 32.9% share in the bergamot extract market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Retail Sales of Bergamot from Calabria in Italy Analysis - Size, Share & Forecast 2025 to 2035

Extraction Kits Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Extracts and Distillates Market

Sage Extract Market Size and Share Forecast Outlook 2025 to 2035

Fume Extractor Market Size and Share Forecast Outlook 2025 to 2035

Meat Extracts Market Size and Share Forecast Outlook 2025 to 2035

Kale Extract Skincare Market Size and Share Forecast Outlook 2025 to 2035

Wine Extract Market Size and Share Forecast Outlook 2025 to 2035

Amla Extract Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Dust Extractor Market Growth – Trends & Forecast 2025 to 2035

Data Extraction Software Market

Lipid Extraction Kit Market Size and Share Forecast Outlook 2025 to 2035

Peony Extract Brightening Creams Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Peony Extracts for Brightening Market Size and Share Forecast Outlook 2025 to 2035

Algae Extracts Market Size and Share Forecast Outlook 2025 to 2035

Juice Extraction Equipment Market Size and Share Forecast Outlook 2025 to 2035

Yucca Extract Market Size and Share Forecast Outlook 2025 to 2035

Maple Extracts Market Size and Share Forecast Outlook 2025 to 2035

Yeast Extract Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Yeast Extract Industry Analysis in USA Size, Growth, and Forecast for 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA