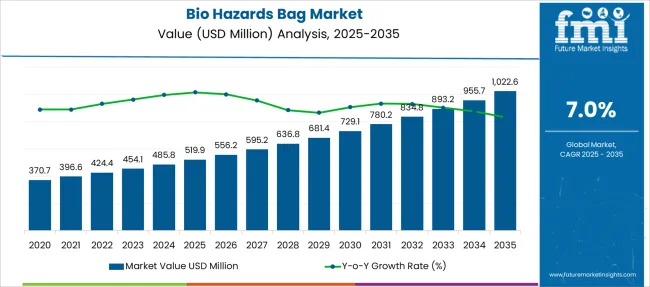

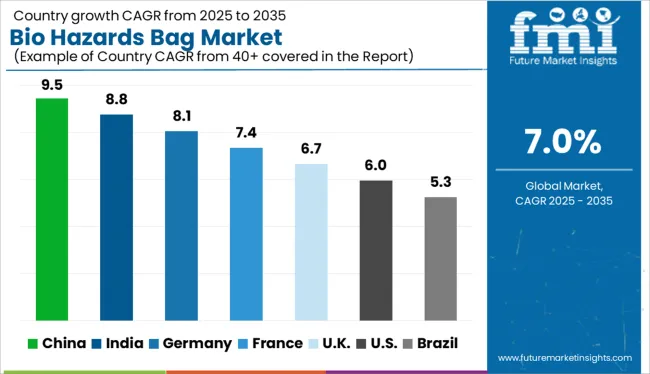

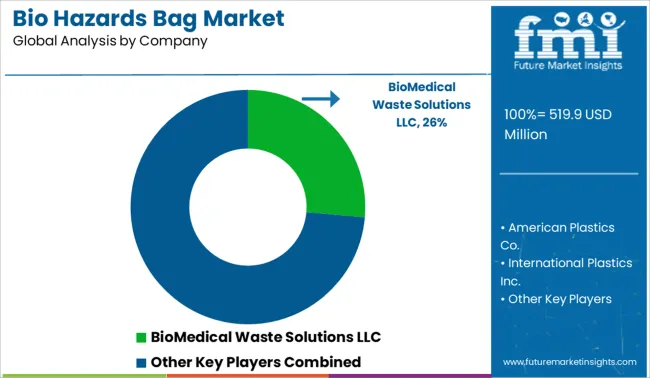

The Bio Hazards Bag Market is estimated to be valued at USD 519.9 million in 2025 and is projected to reach USD 1022.6 million by 2035, registering a compound annual growth rate (CAGR) of 7.0% over the forecast period.

| Metric | Value |

|---|---|

| Bio Hazards Bag Market Estimated Value in (2025 E) | USD 519.9 million |

| Bio Hazards Bag Market Forecast Value in (2035 F) | USD 1022.6 million |

| Forecast CAGR (2025 to 2035) | 7.0% |

The bio hazards bag market is expanding steadily due to the increasing focus on infection control, safe biomedical waste handling, and strict adherence to regulatory protocols in healthcare and research environments. Growing volumes of hazardous and infectious waste, especially from diagnostic labs, outpatient facilities, and hospitals, are reinforcing the demand for safe containment and disposal solutions.

Advances in manufacturing processes have improved material durability, puncture resistance, and leakage protection, meeting global standards for medical waste segregation. Additionally, heightened awareness of occupational safety, driven by pandemic preparedness and public health policy, is prompting institutions to adopt certified biohazard containment products.

The market outlook remains positive as healthcare providers and regulatory bodies continue prioritizing contamination prevention, staff safety, and environmental compliance through proper waste management systems.

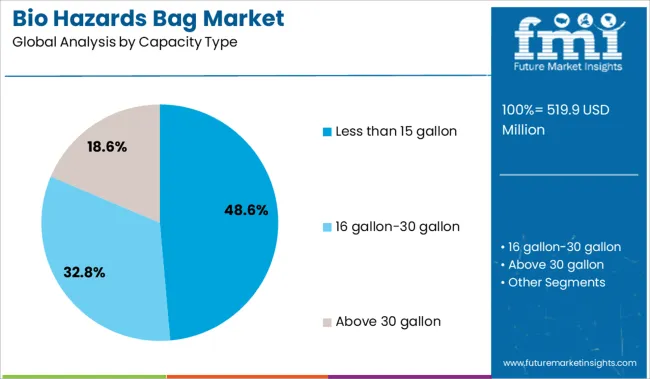

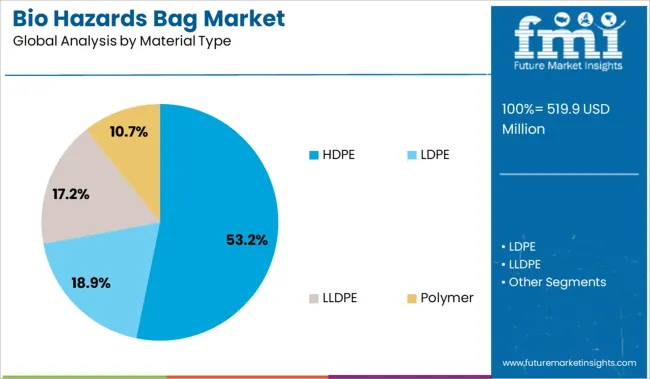

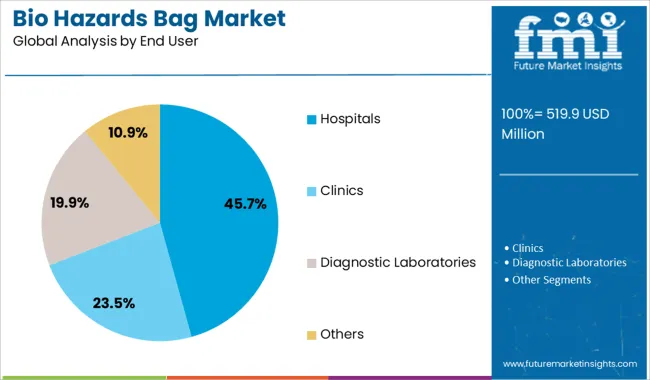

The market is segmented by Capacity Type, Material Type, and End User and region. By Capacity Type, the market is divided into Less than 15 gallon, 16 gallon-30 gallon, and Above 30 gallon. In terms of Material Type, the market is classified into HDPE, LDPE, LLDPE, and Polymer. Based on End User, the market is segmented into Hospitals, Clinics, Diagnostic Laboratories, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The less than 15 gallon capacity type segment is anticipated to contribute 48.60% of total market revenue by 2025, making it the dominant capacity type. This preference is due to its suitability for day to day waste disposal in compact settings such as clinics, testing labs, and outpatient departments.

Smaller volume bags enable quick disposal cycles, minimize contamination risks, and are easier to handle and transport. They are also cost effective for single use applications, especially in procedures generating low to moderate volumes of hazardous waste.

The compact size supports segregation at source, aiding in compliance with biomedical waste protocols. As a result, this segment continues to hold a leading share in capacity-based demand..

The HDPE material type segment is projected to hold 53.20% of market revenue by 2025, leading the material category. This is driven by the high tensile strength, durability, and resistance to chemicals and punctures offered by HDPE.

It provides reliable containment of infectious waste and supports regulatory labeling and heat sealing. The material’s compatibility with autoclaving and incineration processes also aligns with hospital disposal systems.

HDPE bags are increasingly used due to their ability to withstand pressure without leakage, enhancing safety during waste handling and transit. The consistent performance and regulatory approval of HDPE as a material of choice contribute to its leading market share.

The hospitals end user segment is expected to account for 45.70% of overall market revenue by 2025, emerging as the leading user segment. This is due to the high frequency of medical procedures and patient interactions that generate infectious waste on a large scale.

Hospitals require reliable biohazard containment solutions to comply with biomedical waste management rules and infection control protocols. The need for color coded, pre labeled, and leak resistant bags that meet safety standards is especially critical in surgical units, ICUs, and diagnostic departments.

Moreover, institutional procurement practices and budget allocations favor bulk purchasing of certified waste bags, further reinforcing hospital dominance in the end user landscape.

It is anticipated that some obstacles would persist and continue to hamper the market's long-term expansion. Public health is significantly impacted by the lack of knowledge among various medical and healthcare workers on proper handling, treatment, and disposal of medical waste by kind. Although this has a negative impact on public health, many medical and healthcare workers also lack the necessary expertise when it comes to disposing of medical waste, which further restrains market expansion.

Over the next five years, a growing patient population will drive growth in the worldwide biohazard bag industry.

The biohazardous bags market expansion is being driven by the rising patient population and the prevalence of chronic diseases like cancer and heart conditions. Additionally, the aging population around the world that is plagued by age-related disorders is fueling biohazardous bags market expansion during the projection period.

During the forecast period, the market has the potential to grow significantly with an increase in patient population as a result of rising health expenditures and better healthcare facilities.

For instance, lower back pain is one of the most prevalent causes of disability in adult Americans due to the high incidence of diseases in the country. The senior population's need for better medical facilities due to their illnesses is further boosting market expansion in the anticipated time frame.

The USA Department of Health and Human Services reports that over half of American people with arthritis experience continuous pain, and many of them receive many treatments in a hospital.

The occurrence of many respiratory disorders as well as cardiovascular illnesses is also boosting market demand. The USA is one of the most affected countries in the world by the COVID-19 scenario. Because of this, the market is currently driven to prosper despite the significant danger of developing coronavirus infections.

Thus, with an increase in the number of afflicted coronavirus-infected patients, it becomes vital to work toward appropriate hospital waste management.

In the future, hospitals are predicted to have robust expansion.

A growing patient population is expected to lead to healthy growth in hospitals in the future. Most of the biohazard waste is generated by hospitals, which increases the need for biohazard bags there. According to the World Health Organization (WHO), each hospital bed generates about 0.5 kilograms of hazardous waste per day in high-income nations and about 0.2 kg per day in low-income countries.

Additionally, according to the American Hospital Association, there is now much more biohazard waste generated per bed in hospitals around the country, which has boosted the demand for biohazard bags in this area.

North America is anticipated to have a sizable market share and is anticipated to continue doing so throughout the forecast period.

Due to its rapidly aging population, highly developed healthcare system, and rising incidence of infectious and chronic diseases, North America is anticipated to account for a sizeable portion of the global market for biohazard bags. The increased incidence of infectious diseases will increase the demand for sophisticated surgical and medical devices, which will also result in a large volume of waste products and residues. The market for biohazard bags in this area will be driven by the enormous amount of biohazard waste. The expansion of the regional market is also being greatly aided by rising healthcare spending as well as the presence of an established healthcare infrastructure.

The rising number of hospital beds in developing nations, the patient population, the volume of lab testing samples and diagnostics, and public awareness of the advantages of hospital waste management in preventing the spread of infection are all factors contributing to the rising demand for biohazard bags.

Over the past few years, there has been a substantial increase in public awareness of the advantages of waste management, particularly in hospitals and the healthcare sector of developing nations. Due to the pandemic, hospitals produced more biohazard waste every day since patient and healthcare worker safety is the top priority in increasing market expansion rapidly.

North America will drive the biohazard bag market owing to the stringent government regulation to use biohazard bags in pathological centers and hospitals. Furthermore, rising investment in the biohazard bag industry by key players boosts the market expansion in the North American region.

The Asian region is estimated to show substantial growth in the biohazard bag market due to a large number of hospital beds and a rising patient population. Furthermore, Europe and Latin America have seen lucrative growth owing to well-established healthcare infrastructure and spreading awareness about of advantages of good waste management.

Some of the key market players present in the biohazard bag industry are BioMedical Waste Solutions LLC, American Plastics Co., International Plastics Inc., Merck KGaA, Thermo Fisher Scientific Inc., Transcendia Inc., Abdos Labtech Pvt. Ltd., Champion Plastics, Medline Industries, Inc., Global Packaging Solutions and Dana Poly Inc.

| Report Attributes | Details |

|---|---|

| Growth Rate | CAGR of 6.5% from 2025 to 2035 |

| Base Year for Estimation | 2024 |

| Historical Data | 2012 to 2024 |

| Forecast Period | 2025 to 2035 |

| Qualitative Units | Revenue in USD Million, Volume in Units, and CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends, and Pricing Analysis |

| Segment Covered |

Capacity Type, Material Type, End User, Region |

| Region Covered |

North America; Latin America; Europe; East Asia; South Asia; Oceania; Middle East & Africa |

| Key Countries Profiled |

USA, Canada, Brazil, Mexico, Germany, United Kingdom, France, Spain, Italy, China, Japan, South Kore, Malaysia, Singapore, Australia, New Zealand, GCC Countries, South Africa, Israel |

| Key Players |

BioMedical Waste Solutions LLC; American Plastics Co.; International Plastics Inc.; Merck KGaA; Thermo Fisher Scientific Inc.; Transcendia Inc.; Abdos Labtech Pvt. Ltd.; Champion Plastics, Medline Industries, Inc.; Global Packaging Solutions; Dana Poly Inc |

| Customization | Available Upon Request |

The global bio hazards bag market is estimated to be valued at USD 519.9 million in 2025.

The market size for the bio hazards bag market is projected to reach USD 1,022.6 million by 2035.

The bio hazards bag market is expected to grow at a 7.0% CAGR between 2025 and 2035.

The key product types in bio hazards bag market are less than 15 gallon, 16 gallon-30 gallon and above 30 gallon.

In terms of material type, HDPE segment to command 53.2% share in the bio hazards bag market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Bio-based Cutlery Market Size and Share Forecast Outlook 2025 to 2035

Biodegradable Disposable Tableware Market Size and Share Forecast Outlook 2025 to 2035

Biodegradable Film Market Size and Share Forecast Outlook 2025 to 2035

Bio-wax Market Size and Share Forecast Outlook 2025 to 2035

Biomass Hot Air Generator Furnace Market Size and Share Forecast Outlook 2025 to 2035

Biological Indicator Vial Market Size and Share Forecast Outlook 2025 to 2035

Bioplastic and Biopolymer Market Forecast Outlook 2025 to 2035

Biodegradable Paper and Plastic Packaging Market Size and Share Forecast Outlook 2025 to 2035

Biocatalysis and Biocatalyst Market Size and Share Forecast Outlook 2025 to 2035

Biodegradable Polyester Fiber Market Forecast and Outlook 2025 to 2035

Biopsy Device Market Forecast and Outlook 2025 to 2035

Bioliquid Heat and Power Generation Market Size and Share Forecast Outlook 2025 to 2035

Biocontrol Solutions Market Size and Share Forecast Outlook 2025 to 2035

Biocement Market Size and Share Forecast Outlook 2025 to 2035

Biomedical Refrigerator and Freezer Market Size and Share Forecast Outlook 2025 to 2035

Biodegradable Packaging Market Size and Share Forecast Outlook 2025 to 2035

Bionic Glove's Market Size and Share Forecast Outlook 2025 to 2035

Biodegradable Insulated Panel Market Size and Share Forecast Outlook 2025 to 2035

Biopotential Sensor Market Size and Share Forecast Outlook 2025 to 2035

Biomaterial Tester Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA