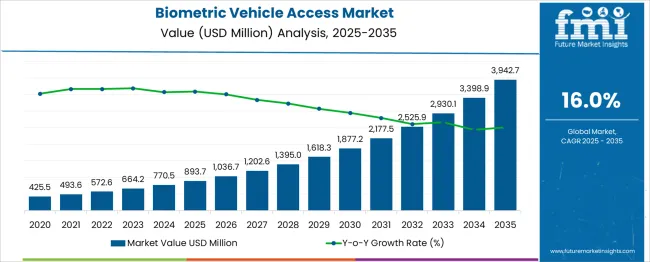

The Biometric Vehicle Access Market is estimated to be valued at USD 893.7 million in 2025 and is projected to reach USD 3942.7 million by 2035, registering a compound annual growth rate (CAGR) of 16.0% over the forecast period. The data reflects a distinctly accelerating growth curve that transitions from steady early adoption to rapid expansion in the latter half of the decade. From 2025 to 2028, the market advances from USD 893.7 million to USD 1,618.3 million, more than 80% growth in just three years.

This early phase is characterized by technology proving its value in high-end vehicles, with premium OEMs driving adoption as part of advanced security and personalization systems. Between 2029 and 2032, the curve steepens, moving from USD 1,877.2 million to USD 2,930.1 million, adding over USD 1 billion in value in only three years.

The acceleration is supported by cost reductions in biometric hardware, improved integration with infotainment and driver-assist platforms, and a shift toward inclusion in mid-tier vehicle segments. From 2033 to 2035, the market gains another USD 1 billion-plus annually, with the largest single-year jump of USD 543.8 million occurring in the final year.

This sharp incline suggests the curve is in a strong upward phase, with no visible signs of plateauing, indicating significant post-2035 growth potential for investors positioning early.

| Metric | Value |

|---|---|

| Biometric Vehicle Access Market Estimated Value in (2025 E) | USD 893.7 million |

| Biometric Vehicle Access Market Forecast Value in (2035 F) | USD 3942.7 million |

| Forecast CAGR (2025 to 2035) | 16.0% |

The biometric vehicle access market is viewed as a specialized yet steadily expanding category within its parent industries. It is estimated to account for about 2.4% of the global vehicle access control systems market given its growing importance in vehicle security. Within the automotive security and immobilizer technologies sector, a share of approximately 3.6% is assessed due to rising integration of fingerprint, facial, and iris recognition modules.

In the connected and smart car systems industry, around 2.9% is observed reflecting interest in seamless keyless entry technologies. Within the luxury vehicle infotainment and security segment, about 3.2% is evaluated as premium OEMs increasingly adopt biometric access. In the fleet and commercial vehicle telematics market, a contribution of roughly 2.5% is calculated given adoption in shared mobility and rental fleets.

Market momentum has been influenced by the need for authentication systems that enhance both vehicle security and convenience. Innovations have centered on multi modal biometric sensors, mobile app based fingerprint enrollment, and facial recognition modules integrated with vehicle electronics. Interest has been increasing in solutions that link driver profiles with personalized access settings as part of digital key ecosystems.

North America has been observed to lead early adoption, while Asia Pacific is showing rapid uptake in high growth automotive regions. Strategic initiatives have included collaborations between biometric technology developers and automotive OEMs to create modular, upgradeable access units equipped with over the air update capability, encrypted security protocols, and compatibility with connected vehicle networks.

The biometric vehicle access market is witnessing substantial momentum, underpinned by the increasing demand for personalized, secure, and keyless automotive access. Automakers are integrating biometric technologies as part of broader digitization and connected vehicle strategies.

Regulatory mandates to enhance vehicle safety, combined with rising consumer preference for seamless in-car experiences, are contributing to rapid adoption. Cost efficiencies in sensor hardware and improvements in software accuracy are enabling mass deployment across mid- and high-end vehicle segments.

Growing concerns over car theft and unauthorized access are accelerating demand for biometric-based systems. As automotive OEMs compete on in-cabin innovation and security differentiation, biometric access is anticipated to become a standard offering, particularly in urban mobility fleets and premium car models.

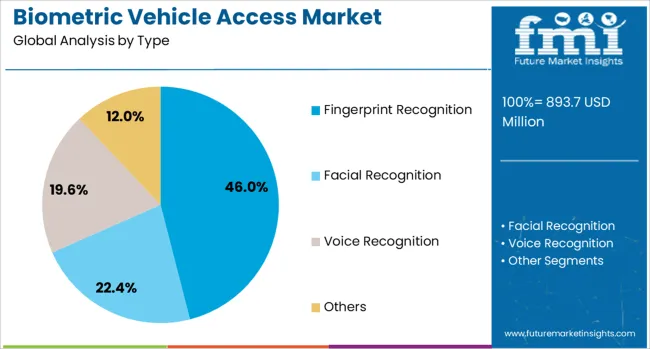

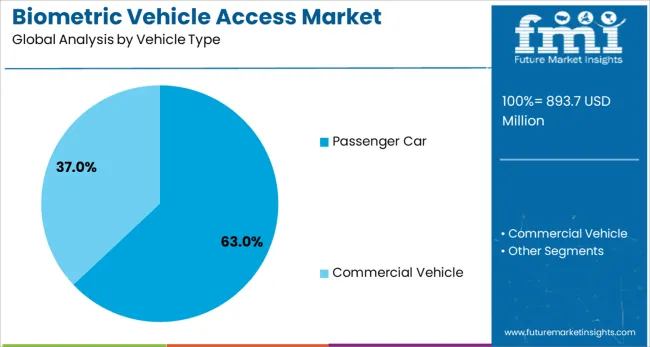

The biometric vehicle access market is segmented by type, vehicle type, application, and geographic regions. The biometric vehicle access market is divided by type into Fingerprint Recognition, Facial Recognition, Voice Recognition, and Others. In terms of vehicle type, the biometric vehicle access market is classified into Passenger Car and Commercial Vehicle.

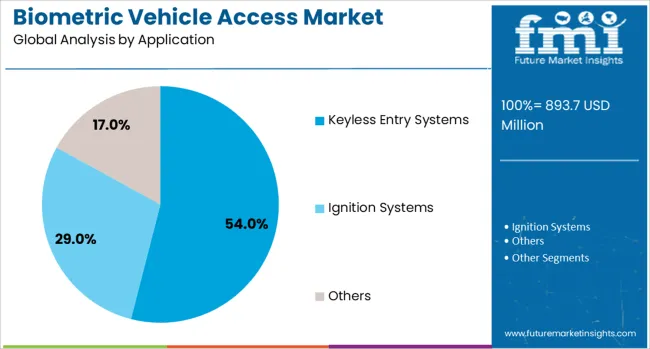

Based on the application, the biometric vehicle access market is segmented into Keyless Entry Systems, Ignition Systems, and Others. Regionally, the biometric vehicle access industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Fingerprint recognition is projected to account for 46.00% of the biometric vehicle access market by 2025, making it the leading type. This dominance is being driven by its high accuracy, ease of integration into door handles or dashboards, and low cost relative to more complex modalities like facial or iris recognition.

Consumer familiarity with fingerprint authentication from smartphones has accelerated trust and usability, making this the preferred biometric interface for vehicular applications.

Furthermore, its compatibility with encrypted vehicle start systems and multi-user access management has strengthened its utility in shared and fleet vehicle ecosystems.

Passenger cars are estimated to represent 63.00% of the total market share in 2025, making them the dominant vehicle type in biometric access adoption. This segment’s leadership is attributed to rising integration of premium and tech-centric features by OEMs, particularly in the compact and luxury segments.

Urbanization, vehicle personalization trends, and an increasing shift toward keyless entry among mid-range vehicle owners are supporting sustained growth.

Additionally, rising adoption of biometric-enabled infotainment and driver authentication systems in private vehicles is expected further to consolidate the dominance of passenger cars in this market.

Keyless entry systems are anticipated to hold a 54.00% revenue share in 2025, emerging as the leading application for biometric vehicle access technologies. This is being supported by consumer demand for faster, contactless, and more secure vehicle access experiences.

Keyless entry has become a critical component in vehicle safety and convenience, particularly in high-density urban environments. Automakers are leveraging biometric authentication to eliminate vulnerabilities associated with traditional key fobs and improve anti-theft capabilities.

As smart mobility expands and shared vehicle use increases, biometric keyless systems offer enhanced security without compromising convenience.

Biometric vehicle access systems have been increasingly integrated into modern vehicles to enhance security and convenience by using fingerprint, facial recognition, or iris scanning technologies. These systems have been designed to authenticate drivers and enable keyless entry, ignition, and personalized in-car settings.

Demand has been driven by advancements in automotive electronics, rising concerns over vehicle theft, and the growing popularity of premium features in connected cars. Automakers and technology providers have been focusing on improving accuracy, response speed, and reliability under varied environmental conditions.

Increasing incidents of vehicle theft and unauthorized access have prompted automakers to adopt biometric authentication systems. Unlike traditional keys or key fobs, biometric systems have offered a personalized security layer that is difficult to duplicate or bypass. Luxury vehicle manufacturers in Germany, Japan, and the United States have introduced fingerprint scanners and facial recognition as standard or optional features.

These systems have also been integrated with immobilizers and remote vehicle tracking to enhance protection. Fleet operators have implemented biometric access to restrict vehicle use to authorized drivers, improving accountability. As vehicle security becomes a greater consumer priority, biometric systems have been positioned as a premium yet practical solution that enhances both safety and driver confidence.

Advances in biometric sensor technology have significantly improved system reliability, even in challenging lighting or weather conditions. Multimodal biometric systems that combine fingerprint, facial, and voice recognition have been developed to enhance authentication accuracy. Integration with in-vehicle infotainment and connected car platforms has allowed biometric data to customize seating positions, climate control, and entertainment preferences for individual drivers.

Automakers in South Korea, China, and Europe have collaborated with technology firms to develop cost-efficient biometric modules suitable for mass-market vehicles. Improved encryption and secure data storage have addressed privacy concerns, while faster processing speeds have reduced authentication time. These innovations have expanded the practical applications of biometric systems beyond security, making them an integral part of personalized in-car experiences.

The initial adoption of biometric vehicle access systems has been concentrated in luxury and high-end vehicle segments, where consumers are more receptive to advanced convenience and safety technologies. Brands such as BMW, Mercedes-Benz, Genesis, and Tesla have positioned biometric features as differentiators in competitive premium markets.

Limited-edition and concept vehicles have showcased advanced biometric capabilities, generating interest among technology-focused buyers. Early adoption has also been seen in high-security government and law enforcement vehicles, where driver authentication is critical. While the premium segment has led market growth, the gradual reduction in sensor and processing costs is expected to enable broader integration into mid-range vehicles over the coming years.

Despite their benefits, biometric vehicle access systems have faced barriers to mass adoption due to high integration costs and consumer concerns about biometric data privacy. Developing robust sensors and secure storage systems has added to vehicle production expenses, making the technology more viable for premium models than entry-level cars.

Some consumers have expressed hesitation about storing biometric data in vehicles, particularly with the risk of hacking or unauthorized access. Maintenance and repair of biometric systems have also been more expensive compared to conventional keyless entry systems. Without cost optimization, standardized privacy protocols, and increased consumer education, adoption may remain limited to niche markets and high-end vehicle categories in the short term.

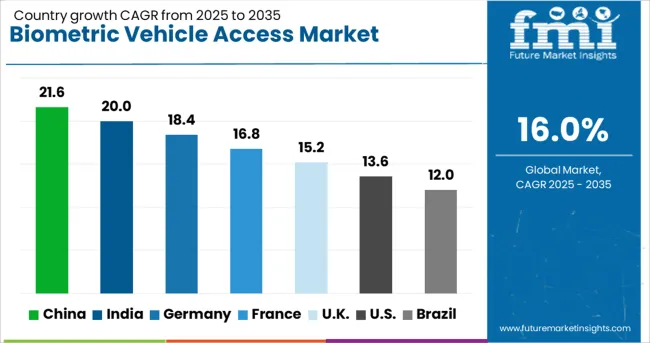

| Country | CAGR |

|---|---|

| China | 21.6% |

| India | 20.0% |

| Germany | 18.4% |

| France | 16.8% |

| UK | 15.2% |

| USA | 13.6% |

| Brazil | 12.0% |

The biometric vehicle access market is expected to grow at a global CAGR of 16.0% between 2025 and 2035, driven by rising demand for advanced vehicle security, personalized driving experiences, and adoption of keyless entry systems. China leads with a 21.6% CAGR, supported by rapid smart vehicle production and integration of facial recognition and fingerprint authentication. India follows at 20.0%, fueled by growing automotive electronics manufacturing and rising premium vehicle sales. Germany, at 18.4%, benefits from strong automotive R&D and luxury OEM innovations. The UK, projected at 15.2%, sees growth from connected car adoption and aftermarket security upgrades. The USA, at 13.6%, reflects steady uptake across electric and high-end vehicles. This report includes insights on 40+ countries; the top markets are shown here for reference.

China is projected to grow at a CAGR of 21.6% from 2025 to 2035 in the biometric vehicle access market, driven by rapid integration of advanced authentication systems in electric and premium vehicles. Automakers such as BYD, Geely, and NIO are equipping models with facial recognition and fingerprint start systems to enhance security and user convenience. Domestic technology providers including Hikvision and Dahua Technology are supplying AI-powered biometric modules tailored for automotive use. Rising demand for keyless entry and personalized in-car settings is further boosting adoption. Regulatory emphasis on vehicle security in urban areas is accelerating OEM investments.

India is forecasted to achieve a CAGR of 20.0% from 2025 to 2035, supported by growing interest in connected vehicle technologies and enhanced theft prevention. Automakers such as Tata Motors, Mahindra & Mahindra, and Hyundai India are piloting facial and iris recognition features in premium SUV models. Local tech firms are partnering with OEMs to offer cost-effective biometric solutions suited to the Indian market. Increased demand from corporate fleet operators and high-net-worth individuals is adding to growth momentum.

Germany is projected to post a CAGR of 18.4% from 2025 to 2035, supported by the presence of luxury automakers and a strong innovation ecosystem. BMW, Mercedes-Benz, and Audi are leading the integration of multi-modal biometric systems combining facial recognition, fingerprint authentication, and voice identification. Suppliers such as Bosch and Continental are developing high-accuracy sensors that perform reliably in varying lighting and weather conditions. Biometric access is increasingly being linked to personalized driving profiles for seat, climate, and infotainment settings.

The United Kingdom is expected to record a CAGR of 15.2% from 2025 to 2035, driven by luxury vehicle demand and heightened awareness of vehicle theft risks. Brands such as Jaguar Land Rover, Bentley, and Rolls-Royce are integrating fingerprint and facial recognition systems into flagship models. Aftermarket demand is also rising for retrofit biometric systems, especially in high-value vehicle segments. Integration with mobile apps for remote biometric authentication is becoming a common offering.

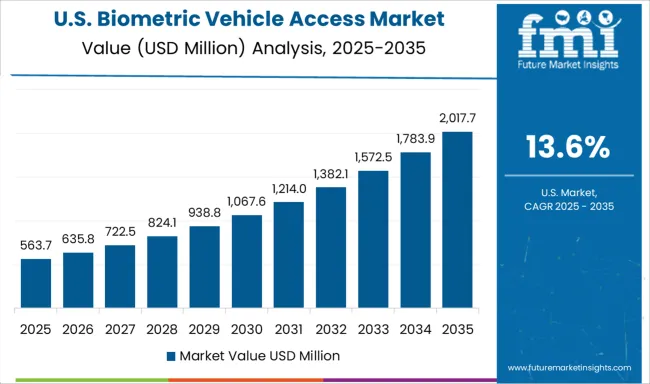

The United States is forecasted to grow at a CAGR of 13.6% from 2025 to 2035, supported by demand in the electric, luxury, and high-performance vehicle markets. Tesla, Ford, and General Motors are exploring facial recognition and fingerprint technologies for next-generation connected cars. Biometric access is being positioned as both a convenience and a cybersecurity feature, protecting vehicle data in addition to physical security. The aftermarket is expanding with specialist installers offering retrofits for both passenger cars and commercial fleets.

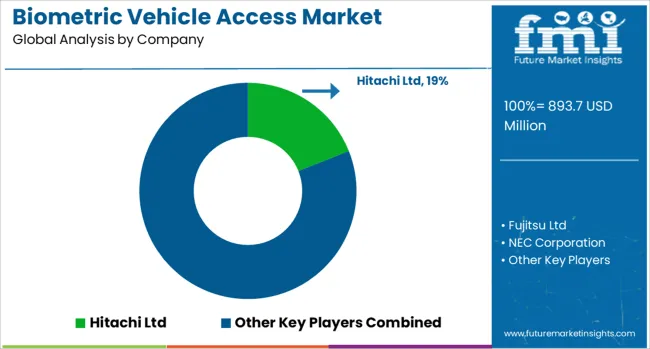

The biometric vehicle access market is led by global technology companies and automotive system suppliers specializing in fingerprint, facial recognition, and iris scanning solutions for secure vehicle entry and personalization. Hitachi Ltd, Fujitsu Ltd, and NEC Corporation are prominent players providing advanced biometric authentication modules integrated with in-vehicle systems, enabling seamless access and ignition control.

Thales Group leverages its expertise in security and identity management to supply robust biometric solutions tailored for connected and autonomous vehicles. Antolin focuses on integrating biometric sensors into vehicle interior components such as door panels and steering wheels, enhancing ergonomics and design integration.

Synaptics Incorporated and Fingerprints AB lead in capacitive and optical fingerprint sensor technologies adapted for automotive durability and environmental conditions. VOXX International Corporation provides aftermarket biometric vehicle access kits, targeting both individual consumers and fleet operators. BioKey International, Inc. and Biometric Vox serve niche markets with voice recognition and multi-modal biometric solutions, offering flexible integration for OEMs and retrofit applications.

Key strategies include collaborations with automakers for factory-installed systems, development of multi-factor authentication combining biometrics with digital keys, and enhancing sensor resilience for all-weather performance. Entry into this market is limited by stringent automotive safety and security standards, the need for proven accuracy and reliability, and established supplier relationships with major vehicle manufacturers.

| Item | Value |

|---|---|

| Quantitative Units | USD 893.7 Million |

| Type | Fingerprint Recognition, Facial Recognition, Voice Recognition, and Others |

| Vehicle Type | Passenger Car and Commercial Vehicle |

| Application | Keyless Entry Systems, Ignition Systems, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Hitachi Ltd, Fujitsu Ltd, NEC Corporation, Thales Group, Antolin, Synaptics Incorporated, VOXX International Corporation, Fingerprints AB, BioKey International, Inc, and Biometric Vox |

| Additional Attributes | Dollar sales by authentication type and vehicle application, demand dynamics across passenger cars and commercial fleets, regional trends in fingerprint vs face vs voice/iris recognition system adoption across North America, Europe, and Asia‑Pacific, innovation in AI‑driven multi‑modal biometrics, smartphone‑key integration, and vehicle personalization features, environmental impact of sensor/component disposal and energy consumption, and emerging use cases in connected fleets, autonomous vehicle platforms, and premium OEM safety packages. |

The global biometric vehicle access market is estimated to be valued at USD 893.7 million in 2025.

The market size for the biometric vehicle access market is projected to reach USD 3,942.7 million by 2035.

The biometric vehicle access market is expected to grow at a 16.0% CAGR between 2025 and 2035.

The key product types in biometric vehicle access market are fingerprint recognition, facial recognition, voice recognition and others.

In terms of vehicle type, passenger car segment to command 63.0% share in the biometric vehicle access market in 2025.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA