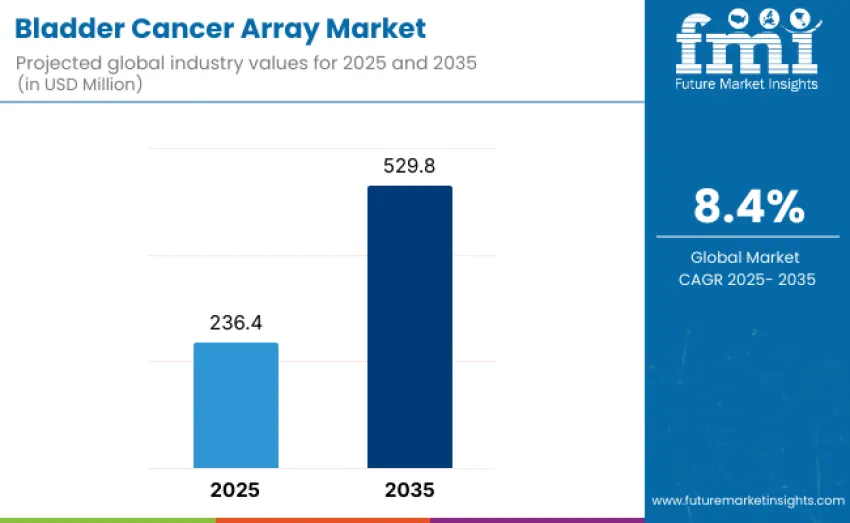

The bladder cancer array market is projected to reach USD 529.8 million by 2035, recording an absolute increase of USD 293.4 million over the forecast period. Value stands at USD 236.4 million in 2025 and is set to rise at a CAGR of 8.4% during the forecast period 2025-2035.

Growth reflects rising global incidence of bladder cancer, increasing adoption of molecular profiling for early detection and recurrence monitoring, and expanding use of multiplex array-based platforms that enable high-resolution genomic, transcriptomic, and proteomic interrogation of bladder cancer-associated biomarkers.

Bladder Cancer Array Market Key Takeaways

| Metric | Value |

|---|---|

| Market Value (2025) | USD 236.4 million |

| Market Forecast Value (2035) | USD 529.8 million |

| Forecast CAGR (2025 to 2035) | 8.4% |

Expansion is shaped by shifts toward precision oncology and data-rich molecular diagnostics. Bladder cancer arrays encompassing DNA mutation panels, RNA expression signatures, methylation markers, microRNA panels, and multiplex protein biomarker arrays allow comprehensive tumor characterization with significantly higher information density compared with conventional single-marker assays. These platforms typically deliver improvements in diagnostic sensitivity and workflow efficiency by simultaneously evaluating multiple analytes relevant to tumor biology, disease progression, recurrence likelihood, and therapeutic responsiveness.

Technological advancements are accelerating the maturation of bladder cancer array landscape. Improvements in nucleic acid extraction chemistry, probe design, microarray surface engineering, and liquid biopsy workflows enhance assay precision and reproducibility. Integration of advanced detection systems including high-sensitivity fluorescence scanners, electro chemiluminescence platforms, and digital quantification modules supports consistent performance across clinical laboratories.

Between 2025 and 2030, bladder cancer array market is projected to expand from USD 236.4 million to USD 353.9 million, resulting in a value increase of USD 117.5 million, representing 40.0% of total forecast growth for the decade. Expansion during this period is expected to be driven by rising adoption of genomic and transcriptomic profiling tools for bladder cancer detection, prognosis, and recurrence monitoring. Increasing emphasis on molecular characterization of urothelial carcinoma, coupled with broader integration of array-based assays into clinical research and stratified medicine programs, is anticipated to support sustained demand.

From 2030 to 2035, growth continues from USD 353.9 million to USD 529.8 million, adding another USD 175.9 million, constituting 60.0% of overall ten-year expansion. Growth in the latter half of the decade is expected to be shaped by development of more specialized bladder cancer array platforms designed for high-resolution mutation profiling, immune microenvironment analysis, and liquid biopsy-based tumor surveillance.

Bladder cancer array market grows by enabling clinical laboratories and oncology researchers to achieve higher diagnostic precision and workflow efficiency while maintaining consistent detection of genomic, transcriptomic, and protein-level abnormalities associated with bladder tumor progression. Diagnostic teams face increasing pressure to deliver accurate results within compressed turnaround times, with multiplex bladder cancer arrays typically improving analytical throughput and biomarker resolution by 30-50% compared with single-marker assays.

Expansion of precision oncology and rising global burden of bladder cancer continue to stimulate demand for multi-analyte arrays capable of detecting complex biomarker signatures, including DNA mutations, methylation patterns, cytokine profiles, and autoantibodies. These arrays are now widely adopted in academic cancer centers, clinical laboratories, and pharmaceutical R&D programs, where they directly influence early detection strategies, therapeutic stratification, and longitudinal monitoring of high-risk patients. Government-driven initiatives promoting cancer screening infrastructure, biomarker innovation, and oncology-focused translational research accelerate adoption.

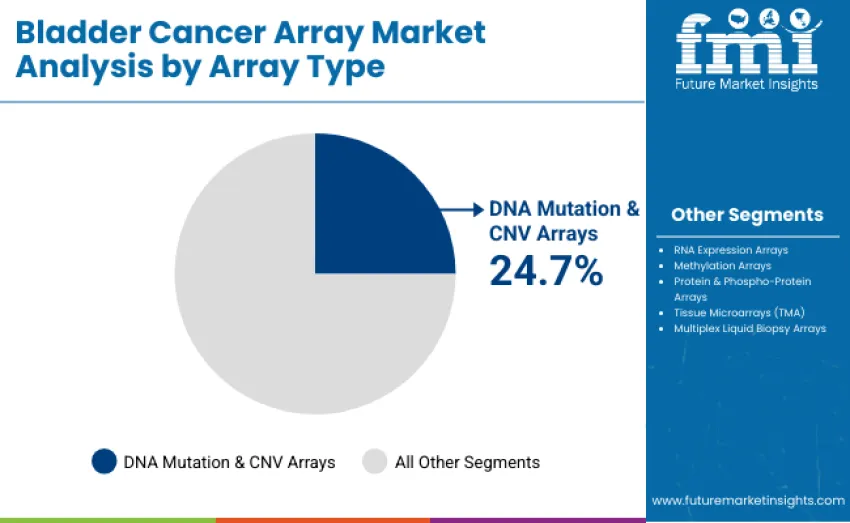

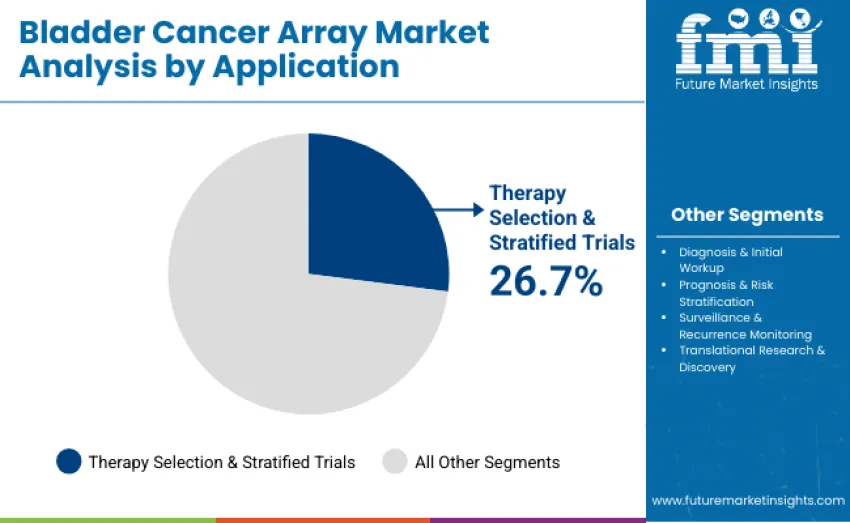

Bladder cancer array market is segmented by array type, application and region. By array type, it includes DNA mutation and copy-number variation arrays, RNA expression arrays, methylation arrays, protein and phospho-protein arrays, tissue microarrays (TMA), and multiplex liquid biopsy arrays. In terms of application, it is categorized into diagnosis and initial workup, prognosis and risk stratification, therapy selection and stratified clinical trials, surveillance and recurrence monitoring, and translational research and discovery. Regionally, it is divided into Asia Pacific, Europe, North America, Latin America, and Middle East & Africa.

DNA mutation and CNV arrays lead with 24.7% share in 2025, driven by detection of clinically relevant alterations such as FGFR3, TP53, ERCC2, and chromosomal instability essential for molecular characterization and early diagnosis. RNA expression arrays hold 21.6%, supported by tumor classification and immune profiling needs. Methylation arrays capture 15.3% as epigenetic markers gain value in non invasive monitoring. Protein and phospho protein arrays represent 13.9%, while TMAs hold 12.6% for validation studies. Multiplex liquid biopsy arrays account for 11.9%, enabling minimally invasive genomic assessment.

Key Advantages Driving the DNA Mutation & CNV Array Segment:

Therapy selection and stratified clinical trials dominate with 26.7% share, supported by growing use of FGFR, immune checkpoint, and targeted therapy biomarkers. Diagnosis and initial workup account for 22.8% as genomic confirmation improves early detection. Prognosis and risk stratification hold 20.9% through biomarker signatures predicting recurrence and progression. Surveillance and recurrence monitoring capture 18.6%, reducing reliance on repeated cystoscopy. Translational research holds 11%, driven by biomarker discovery and validation. The segment leads due to its strong role in precision therapy matching and biomarker driven clinical trial design.

Key Advantages Driving the Therapy Selection & Stratified Trials Segment:

The bladder cancer array market is driven by rising demand for non invasive diagnostic solutions, increasing emphasis on molecularly informed patient management, and the growing need for higher diagnostic sensitivity and specificity in hematuria evaluation and surveillance of non muscle invasive bladder cancer. Adoption of urine based and tissue derived multiplex arrays has expanded as clinicians seek alternatives that complement cytology and reduce reliance on cystoscopy. Growth is further supported by broader screening initiatives, increased recurrence monitoring, and integration of genomic and proteomic discovery programs that enable biomarker based therapy selection and clinical trial stratification.

What Are the Key Restraints Affecting Adoption in the Bladder Cancer Array Market?

Key restraints include significant biological and clinical heterogeneity of bladder tumors, which complicates biomarker selection and limits cross cohort reproducibility. Large validation cohorts and long regulatory approval timelines restrict rapid commercialization. Variability in urine sample quality, pre analytical handling, and lack of platform standardization across laboratories introduce diagnostic inconsistencies and raise overall testing costs. These operational and scientific challenges slow routine adoption in both clinical and decentralized diagnostic settings.

What Key Trends Are Shaping the Future of the Bladder Cancer Array Market?

Major trends include adoption of multi omic and high plex arrays integrating mutation, methylation, and protein signatures to enhance diagnostic accuracy. Growing use of urine based liquid biopsy assays, automation ready workflows, and decentralized testing models improves access and reduces procedural burden. Machine learning driven biomarker pattern recognition and decision support tools are increasingly incorporated to strengthen predictive performance. Regional growth is led by North America and Western Europe through established reimbursement and urology networks, while Asia Pacific adoption rises with expanding screening initiatives and research capacity.

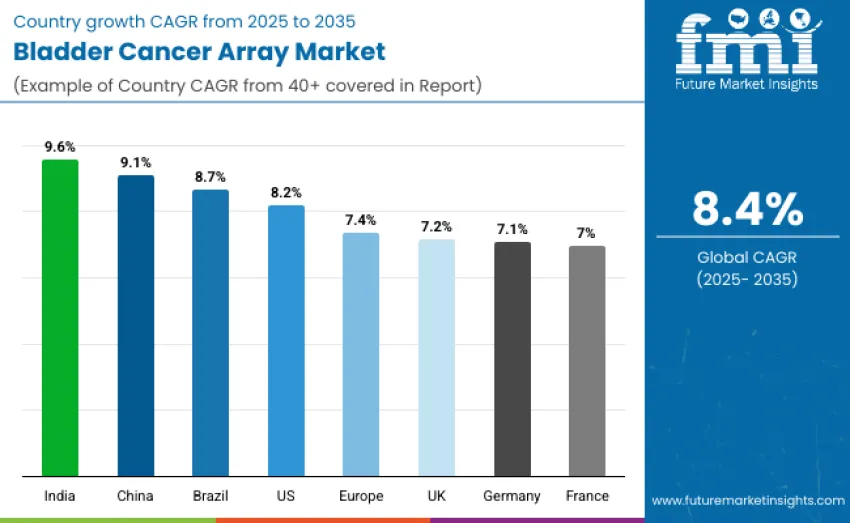

| Countries/Region | CAGR (2025 to 2035) |

|---|---|

| India | 9.6% |

| China | 9.1% |

| Brazil | 8.7% |

| United States | 8.2% |

| Europe | 7.4% |

| United Kingdom | 7.2% |

| Germany | 7.1% |

| France | 7.0% |

India leads the bladder cancer array landscape with a strong 9.6% CAGR, driven by rising urologic oncology incidence, expanding molecular diagnostics capacity, and national screening initiatives. China follows at 9.1%, supported by major precision oncology investments and rapid adoption of non invasive biomarker assays. Brazil grows at 8.7% as oncology networks expand early detection and recurrence monitoring. The United States advances at 8.2% with mature research and high demand for sensitive diagnostics. Europe grows at 7.4%, with the UK at 7.2%, Germany at 7.1%, and France at 7.0%, supported by advanced clinical adoption.

China’s bladder cancer array market is projected to grow at a 9.1% CAGR through 2035, supported by rapid expansion of molecular diagnostics and precision oncology services in major centers across Beijing, Shanghai, Guangzhou, and Shenzhen. Hospitals increasingly integrate genomic, methylation, and multiplex protein arrays into diagnostic workflows, aided by national biomarker discovery programs and provincial reimbursement pilots. Domestic manufacturing capacity is improving affordability and reducing dependence on imports. Large cohort validation studies are enabling China specific biomarker panels, while standardized array workflows enhance reproducibility and support automated, multiplexed diagnostic interpretation.

India’s bladder cancer array market is projected to grow at a 9.6% CAGR through 2035, driven by rapid expansion of oncology and urology networks and strengthened molecular pathology capacity in major centers such as Mumbai, Bengaluru, Hyderabad, and Delhi. Government programs promoting affordable diagnostics and standardized workflows are improving adoption across public hospitals and regional labs. Domestic manufacturing of reagents and mid range platforms enhances affordability, enabling wider deployment. Skill India initiatives improve personnel proficiency, while multi marker arrays gain adoption for recurrence surveillance. Collaboration among hospitals, research institutes, and manufacturers accelerates validation of India specific biomarker panels.

Germany’s bladder cancer array market is projected to grow at a 7.1% CAGR through 2035, driven by strict EU IVDR compliance, high technical standards, and deployment of validated multi omics platforms in leading oncology centers in Munich, Berlin, and Heidelberg. Hospitals increasingly use genomic, transcriptomic, and proteomic arrays for prognostic stratification, minimal residual disease monitoring, and therapy selection. Academic-industry partnerships are refining biomarker panels through multi center evaluations, while laboratories emphasize workflow standardization, automated high throughput integration, and long term quality assurance. Federal and state research funding further accelerates adoption of certified, high performance array systems.

Brazil’s bladder cancer array market is projected to grow at an 8.7% CAGR through 2035, driven by modernization of hospital networks and diagnostic laboratories in São Paulo, Rio de Janeiro, Brasília, and Porto Alegre. Public-private partnerships and Ministry of Health funding are expanding access to advanced multi marker arrays for early detection, prognosis, and therapy monitoring. Standardized workflows and clinician training programs improve reproducibility and clinical adoption. Better import pathways ensure reagent availability, while integration with automated analyzers and LIMS enhances throughput. Growing emphasis on cost-efficient, multi omics workflows is accelerating nationwide uptake.

The USA bladder cancer array market is projected to grow at an 8.2% CAGR through 2035, driven by strong adoption across academic medical centers, commercial labs, and hospital networks in California, Massachusetts, Texas, and New York. Multi omics arrays support early detection, therapy selection, risk stratification, and recurrence monitoring. NIH and NCI funding accelerate biomarker discovery and validation, while USA manufacturers advance automation and multiplexing to improve accuracy. Integration with EHR and LIMS systems strengthens clinical decision support. Reimbursement expansion, multi center clinical trials, and hospital-industry collaborations further reinforce demand and standardized implementation nationwide.

The UK bladder cancer array market is projected to grow at a 7.2% CAGR through 2035, driven by NHS adoption of multiplex array testing and structured molecular diagnostics pathways across London, Manchester, Bristol, and Edinburgh. National genomics programs, including Genomics England, support validation of biomarker panels for prognostic and therapeutic applications.

Centralized laboratory networks ensure MHRA and ISO 15189 compliant workflows, while academic-hospital partnerships strengthen training, technical support, and translational research. Integration with digital pathology platforms enables combined molecular and histopathology reporting. Workforce expansion and infrastructure funding increase capacity for complex multi marker testing, while standardized protocols across NHS trusts enhance result consistency and clinical utility.

Europe’s bladder cancer array market is projected to grow at a 7.4% CAGR through 2035, supported by expansion of molecular pathology laboratories and strong integration of multi-omics testing across Germany, France, the UK, Italy, and the Netherlands. EU IVDR regulations are accelerating adoption of analytically validated arrays with high reproducibility and clinical reliability. Horizon Europe and cross-border oncology research programs are funding biomarker discovery, panel harmonization, and multi-center validation studies. Centralized diagnostic networks, digital pathology integration, and standardized workflows enhance result consistency, while workforce upskilling initiatives strengthen interpretation accuracy and expand capacity for complex multi-marker testing.

France’s bladder cancer array market is projected to grow at a 7.0% CAGR through 2035, driven by widespread adoption of genomic, methylation, and protein-based arrays in oncology centers across Paris, Lyon, Marseille, and Toulouse. National cancer strategies and INCa-supported programs promote validation of multi-marker panels for diagnosis, prognosis, and therapy selection. Laboratories operating under HAS and ISO 15189 standards ensure high-quality, standardized diagnostic workflows. Academic-clinical partnerships advance biomarker discovery and clinical performance studies, while integration with digital pathology and national EHR platforms enables unified molecular and histopathology reporting. Growing investment in precision oncology is further strengthening nationwide deployment.

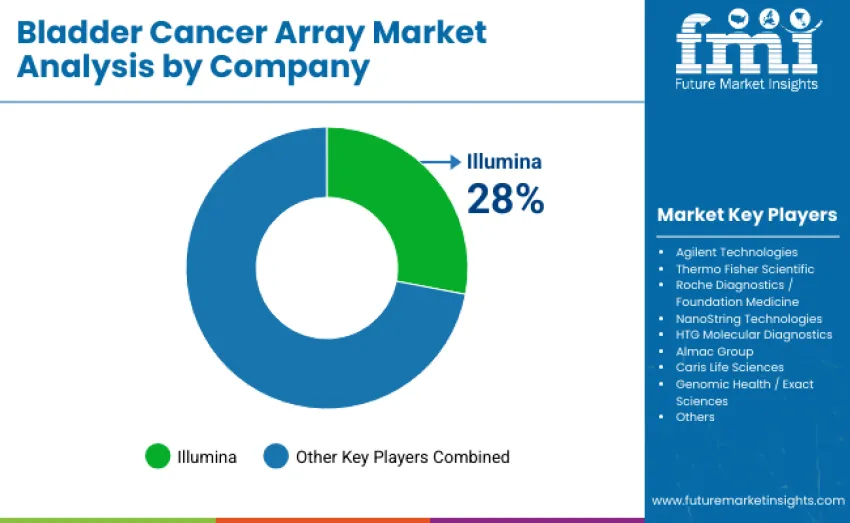

The bladder cancer array market features moderate concentration with 12 to 15 players, where the top three companies collectively command an estimated 55% to 60% of global revenue. Illumina leads with a dominant 28% share, supported by its extensive NGS array ecosystem, high-density microarray designs, and globally adopted oncology panels. Its competitive strength is reinforced by proprietary bioinformatics platforms, robust assay reproducibility, and seamless workflow integration spanning sample preparation to clinical-grade reporting.

Alongside Illumina, Agilent Technologies and Thermo Fisher Scientific maintain strong positions through validated array architectures, wide genomic coverage, and integrated analysis pipelines tailored for translational and clinical oncology applications. These leaders invest heavily in expanding biomarker content, improving assay precision, and supporting large cohort studies that drive precision medicine adoption.

Competition is shaped not by pricing but by panel breadth, data interpretation capabilities, regulatory compliance, and the ability to deliver consistent, high-sensitivity multi-omic profiling. Challenger companies such as Roche Diagnostics and NanoString Technologies compete with regulatory-compliant genomic profiling panels, liquid biopsy arrays, and spatial transcriptomics platforms that appeal to advanced oncology centers. Market dynamics continue to favor manufacturers that combine validated assay performance, bioinformatics support, and reliable service networks, enabling widespread use across discovery research, translational programs, and clinical decision-making in bladder cancer care.

| Item | Value |

|---|---|

| Quantitative Units | USD 236.4 million |

| Array Type | DNA Mutation & CNV Arrays, RNA Expression Arrays, Methylation Arrays, Protein & Phospho-Protein Arrays, Tissue Microarrays (TMA), Multiplex Liquid Biopsy Arrays |

| Application | Diagnosis & Initial Workup, Prognosis & Risk Stratification, Therapy Selection & Stratified Trials, Surveillance & Recurrence Monitoring, Translational Research & Discovery |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East & Africa |

| Country Covered | USA, Brazil, China, India, Europe, Germany, France, UK |

| Key Companies Profiled | llumina, Agilent Technologies, Thermo Fisher Scientific, Roche Diagnostics / Foundation Medicine, NanoString Technologies, HTG Molecular Diagnostics, Almac Group, Caris Life Sciences, Genomic Health / Exact Sciences, Others |

| Additional Attributes | Dollar sales vary by array type and application, shaped by adoption trends across Asia Pacific, Europe, and North America. Competition centers on manufacturers, distribution networks, technical performance, workflow and bioinformatics integration, improved probe design, higher multiplexing efficiency, reproducibility, and specialized arrays with greater biomarker coverage and diagnostic accuracy |

The global bladder cancer array market is estimated to be valued at USD 236.4 million in 2025.

The bladder cancer array market is projected to reach USD 529.8 million by 2035.

The bladder cancer array market is expected to grow at an 8.4% CAGR between 2025 and 2035.

The key array types in the bladder cancer array market are DNA mutation & CNV arrays, RNA expression arrays, methylation arrays, protein & phospho-protein arrays, tissue microarrays, and multiplex liquid biopsy arrays.

The therapy selection and stratified clinical trials segment is expected to lead with a 26.7% share in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cancer Registry Software Market Size and Share Forecast Outlook 2025 to 2035

Cancer Biological Therapy Market Size and Share Forecast Outlook 2025 to 2035

Cancer Diagnostics Market Analysis - Size, Share and Forecast 2025 to 2035

Cancer Biopsy Market - Growth & Technological Innovations 2025 to 2035

Cancer Vaccines Market Analysis by Technology, Treatment Method, Application and Region from 2025 to 2035

Bladder Liners Market Growth – Trends & Forecast 2025 to 2035

Cancer Gene Therapy Market Overview – Trends & Future Outlook 2024-2034

Cancer-focused Genetic Testing Service Market Analysis – Growth & Industry Insights 2024-2034

Cancer Tissue Diagnostic Market Trends – Growth & Industry Forecast 2024-2034

Cancer Supportive Care Products Market Trends – Growth & Forecast 2020-2030

Cancer Antigens Market

Pet Cancer Therapeutics Market Insights - Growth & Forecast 2024 to 2034

Skin Cancer Detection Devices Market Size and Share Forecast Outlook 2025 to 2035

Lung Cancer Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Lung Cancer Surgery Market - Size, Share, and Forecast 2025 to 2035

Lung Cancer Therapeutics Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Lung Cancer PCR Panel Market Trends, Growth, Demand & Forecast 2025 to 2035

Smart Bladder Scanner Market Size and Share Forecast Outlook 2025 to 2035

Brain Cancer Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Liver Cancer Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA