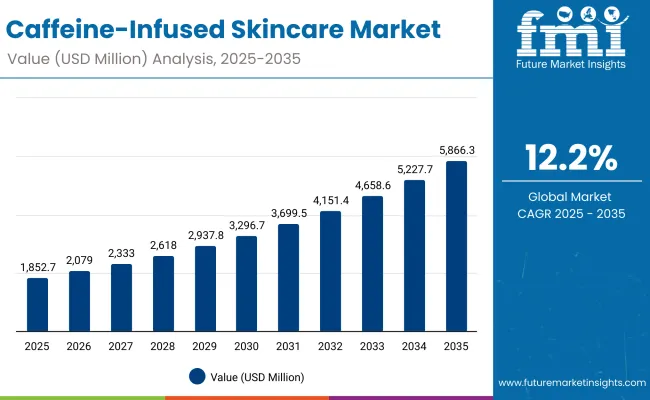

The global caffeine-infused skincare market is expected to record a valuation of USD 1,852.7 million in 2025 and USD 5,866.3 million in 2035, with an increase of USD 4,013.6 million, which equals a growth of over 216% across the decade. The overall expansion represents a CAGR of 12.2% and more than a 3X increase in market size.

Global Caffeine-Infused Skincare Market Key Takeaways

| Metric | Value |

|---|---|

| Global Caffeine-Infused Skincare Market Estimated Value in (2025E) | USD 1,852.7 million |

| Global Caffeine-Infused Skincare Market Forecast Value in (2035F) | USD 5,866.3 million |

| Forecast CAGR (2025 to 2035) | 12.2% |

During the first five-year period from 2025 to 2030, the market increases from USD 1,852.7 million to USD 3,296.7 million, adding USD 1,444.0 million, which accounts for nearly 36% of the total decade growth. This phase records steady adoption across mass and masstige categories, driven by consumer demand for anti-puffiness and anti-dark circle solutions. Eye serums dominate this period as they cater to over 56% of USA demand and nearly half of global function-led adoption, highlighting caffeine’s strong positioning in under-eye care.

The second half from 2030 to 2035 contributes USD 2,569.6 million, equal to 64% of total growth, as the market jumps from USD 3,296.7 million to USD 5,866.3 million. This acceleration is powered by premiumization in Japan and China, the expansion of masstige brands in India, and growing integration of caffeine into multi-functional skincare formats such as brightening serums, firming creams, and roll-ons.

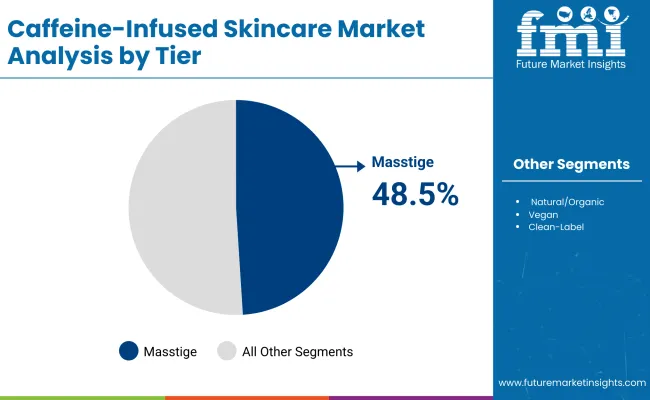

E-commerce-led distribution further amplifies growth, enabling global players to penetrate emerging Asian markets more effectively. By 2035, masstige and premium together hold more than 55% of category value, while mass remains resilient through pharmacy and retail channels.

From 2020 to 2024, the global caffeine-infused skincare market grew steadily from niche positioning in anti-puffiness solutions to broader consumer adoption across creams, roll-ons, and serums. During this period, the competitive landscape was dominated by masstige leaders such as The Ordinary and The Inkey List, alongside multinational beauty houses like L’Oréal and Estée Lauder.

Collectively, top brands controlled less than 10% global share, reflecting a highly fragmented market where innovation cycles centered around eye-care and brightening formulations. Competitive differentiation relied on price-accessible masstige positioning, dermatological claims, and digital-first marketing, while premium skincare labels leveraged brand loyalty and advanced R&D pipelines to sustain margins.

Demand for caffeine-infused skincare is forecast to expand to USD 1,852.7 million in 2025, and the revenue mix will shift meaningfully by 2035 as e-commerce and specialty beauty stores gain share at the expense of traditional mass retail. Masstige is expected to remain the largest tier through 2035, rising in double digits annually, supported by consumer inclination toward affordable luxury.

Traditional premium leaders face intensifying competition from digital-native brands offering targeted caffeine products, while multinational players are pivoting toward multi-functional launches that combine caffeine with hyaluronic acid, niacinamide, and vitamin C. The competitive advantage is moving away from standalone caffeine formulations toward ecosystem-driven skincare routines that deliver firming, brightening, and hydration simultaneously.

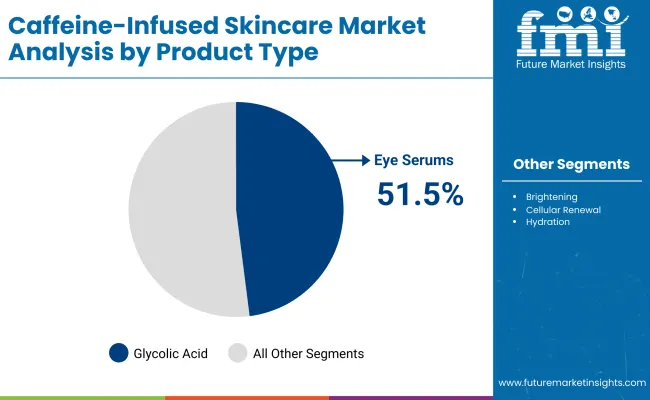

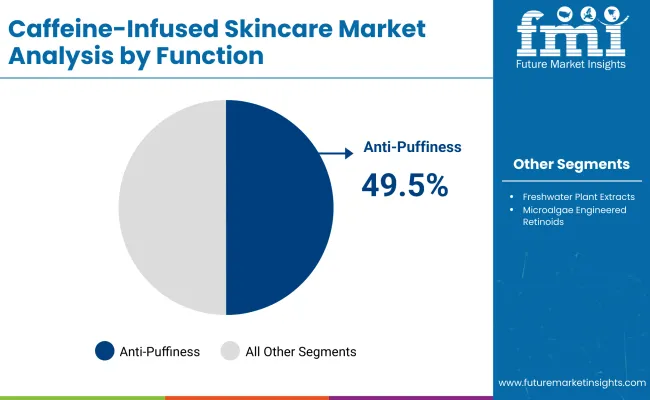

Advances in dermal science have improved the formulation of caffeine-infused skincare, enabling better absorption and targeted results. Eye serums, which address puffiness and dark circles, have emerged as the anchor category with proven efficacy claims and mass consumer resonance. Anti-puffiness products alone contribute nearly 50% of 2025 demand, underscoring caffeine’s role as a functional active in modern skincare routines.

Rising masstige consumption across Asia, coupled with growing e-commerce penetration, has accelerated the shift from traditional creams to serum-led regimens. The popularity of portable roll-ons and multi-functional formulations has broadened adoption beyond eye care into firming and brightening applications.

Innovations in formulation science, particularly the combination of caffeine with hydrating and antioxidant actives, are expected to open new premiumization pathways. Segment growth is expected to be led by eye serums in the product category, anti-puffiness in function, and masstige in tier due to their price-performance balance and accessibility across both developed and emerging markets.

The market is segmented by function, product type, channel, and tier, highlighting the core elements driving adoption. By function, categories include anti-puffiness, firming, brightening, and anti-dark circles. By product type, segments cover eye serums, face serums, creams/lotions, and roll-ons.

Channels include e-commerce, pharmacies, mass retail, and specialty beauty stores. Tiers are categorized into mass, masstige, and premium. Regionally, the scope spans North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa, with country-level analysis across the USA, Canada, Germany, France, UK, China, Japan, India, Brazil, and South Africa.

| Product Type | Value Share % 2025 |

|---|---|

| Eye serums | 51.5% |

| Others | 48.5% |

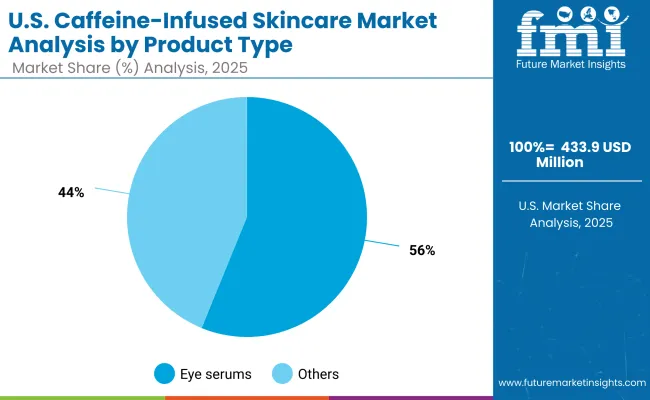

Eye serums are projected to contribute USD 953.5 million in 2025, maintaining their lead as the dominant product type. This is driven by consumer reliance on caffeine’s anti-puffiness and anti-dark circle properties, which align with global demand for quick-result eye care solutions.

The segment’s strength is reinforced by USA consumer behavior, where eye serums capture more than 56% of the national market. As product launches increasingly integrate caffeine with hydration and anti-aging actives, eye serums are expected to remain the anchor category across both mass and premium tiers.

| Function | Value Share % 2025 |

|---|---|

| Anti-puffiness | 49.5% |

| Others | 50.5% |

The anti-puffiness segment is forecasted to hold USD 916.2 million in 2025, led by its deep-rooted association with caffeine efficacy in reducing swelling and vasoconstriction under the skin. This functional attribute has made caffeine the most credible active ingredient in the eye care space. With work-from-home lifestyles and digital screen fatigue accelerating under-eye issues, demand for anti-puffiness solutions has broadened across younger demographics as well. The segment’s growth is bolstered by strong adoption in the USA, China, and Japan, where product innovation targets stressed and urban lifestyles.

| Tier | Value Share % 2025 |

|---|---|

| Masstige | 48.5% |

| Others | 51.5% |

The masstige segment is projected to contribute USD 896.7 million in 2025, maintaining its lead as the fastest-growing tier. Rising consumer inclination toward affordable luxury, fueled by digital retailing, has propelled masstige to the forefront of category expansion. Brands like The Ordinary and Garnier are driving penetration through accessible pricing and clinically-backed formulations.

Growth is particularly strong in China and India, where masstige accounts for over 51% of caffeine-infused skincare sales. With the blending of clinical positioning and luxury-like branding, masstige is expected to remain the growth engine through 2035.

Rising Demand for Functional Skincare with Proven Actives

Consumers are shifting from general moisturizers to targeted solutions that show visible outcomes. Caffeine, with clinically backed benefits for reducing puffiness and improving microcirculation, has strong credibility compared to “novel” botanicals. This makes it particularly attractive in eye serums, where efficacy is measurable, driving higher willingness to pay and repeat purchases.

Asia-Pacific Surge in Masstige Consumption

In markets like China, Japan, and India, masstige-positioned caffeine-infused skincare is growing fastest due to middle-class expansion and digital-first beauty adoption. Brands are scaling through e-commerce platforms (Tmall, Nykaa, Rakuten) with affordable-yet-scientific positioning. This demand concentration in Asia is creating disproportionate global growth momentum.

Formulation Stability and Delivery Challenges

Caffeine’s solubility and skin penetration vary depending on formulation base. Ensuring stability in creams/lotions without losing bioactivity is costly. Smaller brands often face reformulation cycles, delaying launches and inflating R&D spend, which constrains profitability in mid-tier players.

Intense Competition and Fragmented Differentiation

With 92% of global sales spread across “others,” brand loyalty is thin. Most caffeine-infused products overlap in claims (“reduce puffiness, brighten eyes”), leading to price compression. Without strong storytelling or clinical substantiation, many products risk commoditizationrestraining margin growth.

Shift from Eye Serums to Full-Face and Hybrid Formats

While eye serums dominate today, caffeine is being integrated into all-over brightening creams, sunscreens, and even hybrid skincare-makeup products (e.g., concealers with caffeine). This diversification is expanding TAM (Total Addressable Market) beyond under-eye concerns and creating opportunities for cross-category launches.

Scientific Transparency and Clinical Positioning as Differentiators

Consumers increasingly demand quantified claims (“clinically proven to reduce puffiness in 2 weeks”). Brands like The Ordinary and Clinique emphasize ingredient concentration and lab-backed results. This trend rewards brands with in-house R&D, partnerships with dermatologists, and published studiescreating a competitive moat against influencer-only brands.

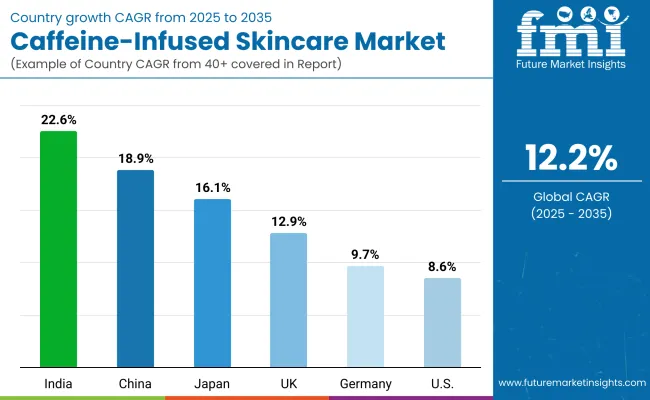

| Country | Estimated CAGR (2025-2035) |

|---|---|

| China | 18.9% |

| USA | 8.6% |

| India | 22.6% |

| UK | 12.9% |

| Germany | 9.7% |

| Japan | 16.1% |

The growth rates of the Caffeine-Infused Skincare Market highlight a clear geographic divergence. India (22.6%) and China (18.9%) are set to drive the fastest expansion, powered by a rising middle-class consumer base, strong e-commerce penetration, and increasing awareness of active-ingredient skincare. In India, premiumization is being fueled by younger demographics who prefer scientifically backed masstige brands over traditional beauty.

Meanwhile, China’s rapid growth reflects the dominance of online beauty retail ecosystems (like Tmall and Douyin), where caffeine-based products are marketed as affordable, effective solutions to urban lifestyle stressors such as puffiness and fatigue. Japan (16.1%) also shows robust growth, largely due to its high skincare sophistication, preference for multifunctional actives, and local innovation around hybrid formats (serum-lotion blends, roll-ons).

On the other hand, Western markets are expanding at slower but steady rates. The USA (8.6%) remains the largest single market by value but is maturing, with growth limited by brand saturation and competitive overlap around similar claims. Germany (9.7%) and the UK (12.9%) show modest to mid-tier growth, driven by masstige adoption and growing wellness positioning of caffeine as a “daily energizer” for skin.

However, these markets face consumer skepticism due to “active fatigue”where shoppers are overwhelmed by multiple competing ingredients like niacinamide and retinol. Overall, while the West ensures a stable base of revenues, the growth momentum is shifting decisively toward Asia, which is increasingly dictating global innovation, product formats, and brand playbooks.

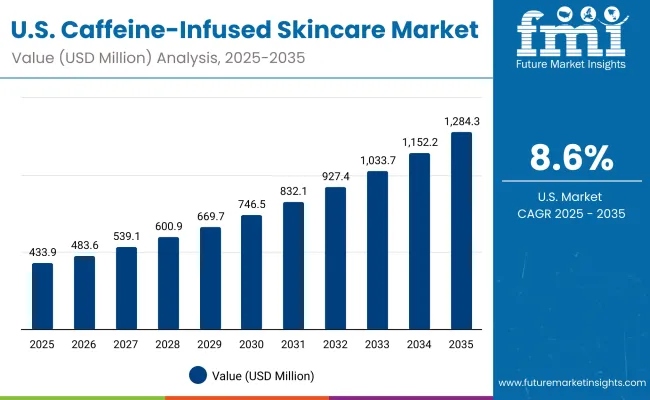

| Year | USA Market (USD Million) |

|---|---|

| 2025 | 434.0 |

| 2026 | 483.7 |

| 2027 | 539.1 |

| 2028 | 600.9 |

| 2029 | 669.8 |

| 2030 | 746.6 |

| 2031 | 832.1 |

| 2032 | 927.5 |

| 2033 | 1,033.8 |

| 2034 | 1,152.3 |

| 2035 | 1,284.3 |

The USA Caffeine-Infused Skincare Market is projected to grow at a CAGR of 8.6%, reaching USD 1.28 Bn by 2035. Growth is anchored by strong consumer adoption of eye serums, which accounted for 56.2% of category sales in 2025. Anti-puffiness and anti-dark circle claims resonate strongly with millennial and Gen Z consumers, particularly those with digital fatigue from long screen exposure.

Premium brands like Clinique and Estée Lauder are driving adoption through dermatology-backed marketing, while masstige players like Garnier are expanding retail penetration. Omni-channel distribution, especially through pharmacies and mass retail chains, underpins steady expansion, though market maturity limits share gains compared to Asia.

The UK Caffeine-Infused Skincare Market is forecast to grow at a CAGR of 12.9%, supported by rising demand for masstige-positioned products in e-commerce and specialty beauty stores. Eye-care routines have become more mainstream, with caffeine roll-ons gaining visibility in men’s grooming and unisex categories.

Heritage beauty retailers such as Boots and Superdrug are accelerating shelf presence of masstige brands like The Inkey List and The Ordinary. At the same time, premium players leverage influencer partnerships and clinical endorsements to differentiate. However, inflation-sensitive consumers are pushing volume towards mid-tier masstige offerings, balancing affordability with efficacy.

India is witnessing the fastest global growth in this category, with a projected CAGR of 22.6% through 2035. Expanding middle-class incomes, urban fatigue lifestyle concerns, and rising adoption of masstige-tier products are powering growth. Tier-2 and Tier-3 cities are emerging demand hubs, where e-commerce players like Nykaa and Amazon accelerate brand accessibility.

Domestic masstige launches are competing with international entrants by highlighting ayurvedic and herbal bases blended with caffeine. Premium adoption is niche but growing in urban metros through specialty stores. Overall, India’s young consumer demographic and preference for “scientifically natural” beauty make it a hotbed of caffeine-infused skincare innovation.

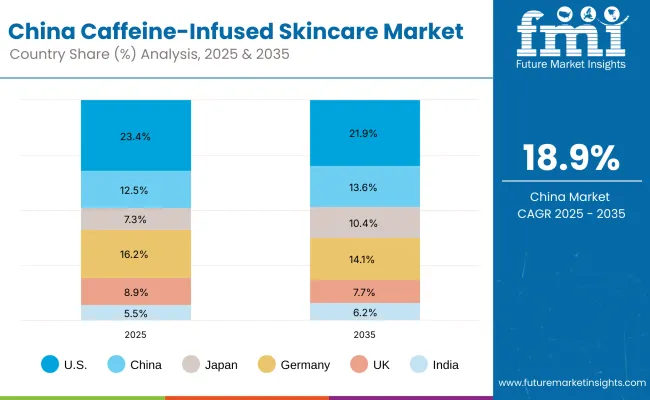

The China Caffeine-Infused Skincare Market is projected to grow at a CAGR of 18.9%, the second-fastest globally. Masstige leads the market with 51.8% share in 2025, supported by platforms like Tmall and Douyin that amplify influencer-driven discovery. Domestic brands are aggressively positioning caffeine as a daily energizing ingredient in face serums and roll-ons.

Local innovation focuses on hybrid products caffeine combined with hyaluronic acid or niacinamide to broaden appeal. Government support for cross-border beauty trade and competitive pricing from local manufacturers further accelerate adoption. China’s digitally native consumers, with high skincare sophistication, are driving both volume and premiumization.

| Country | 2025 Share (%) |

|---|---|

| USA | 23.4% |

| China | 12.5% |

| Japan | 7.3% |

| Germany | 16.2% |

| UK | 8.9% |

| India | 5.5% |

| Country | 2035 Share (%) |

|---|---|

| USA | 21.9% |

| China | 13.6% |

| Japan | 10.4% |

| Germany | 14.1% |

| UK | 7.7% |

| India | 6.2% |

| USA by Product Type | Value Share % 2025 |

|---|---|

| Eye serums | 56.2% |

| Others | 43.8% |

The USA market is valued at USD 433.9 million in 2025, with eye serums dominating at 56.2% due to strong consumer demand for anti-puffiness and anti-dark circle claims. The dominance of this segment is linked to the prevalence of “digital fatigue” lifestyles and long hours in front of screens, making under-eye concerns a primary skincare issue. Clinical credibility and dermatologist endorsements remain key purchase drivers, with premium players like Clinique and Estée Lauder commanding trust.

Roll-ons, though a smaller segment, are gaining traction in men’s grooming and unisex categories, while creams and lotions expand as hybrid face-care solutions with caffeine gain awareness. Growth is expected to remain steady but moderated compared to Asia due to market maturity and overlapping claims with other actives such as niacinamide and retinol.

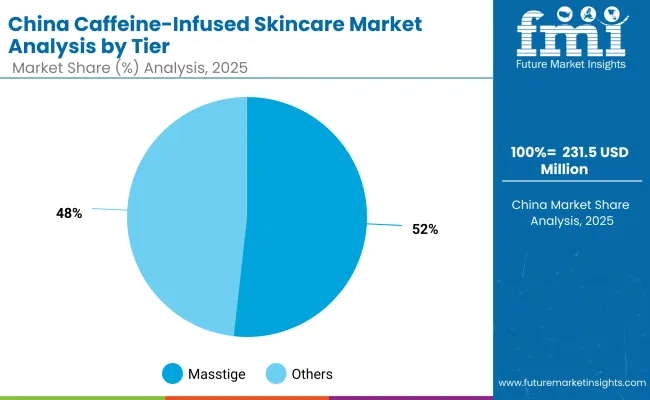

| China by Tier | Value Share % 2025 |

|---|---|

| Masstige | 51.8% |

| Others | 48.2% |

The China market is valued at USD ~231.5 million in 2025, with masstige leading at 51.8%, reflecting the country’s rapidly expanding middle class and its preference for affordable yet efficacious products. Platforms like Tmall, JD.com, and Douyin live-commerce are central to caffeine-infused skincare adoption, where influencer-driven campaigns highlight fast results for puffiness and dark circles.

Premium adoption is growing in Tier-1 cities, led by Shiseido and Estée Lauder, while mass-market rollouts remain strong in Tier-2 and Tier-3 cities due to competitive local pricing. Hybrid formulations combining caffeine with niacinamide or hyaluronic acid are becoming popular, reinforcing China’s role as a product innovation hub.

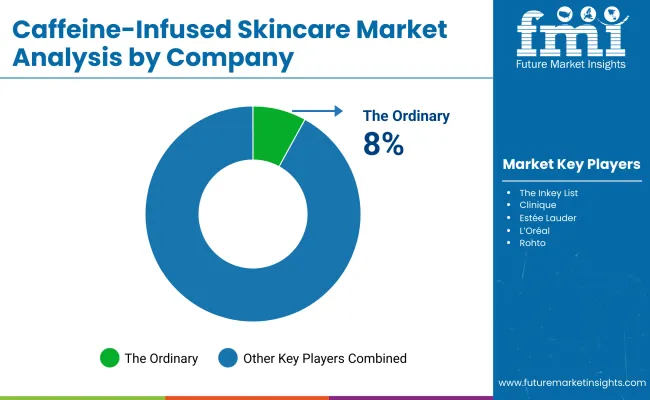

| Company | Global Value Share 2025 |

|---|---|

| The Ordinary | 8.0% |

| Others | 92.0% |

The market is highly fragmented, with no player holding more than 10% global share. The Ordinary leads due to its direct-to-consumer model, transparent pricing, and clinically positioned caffeine solutions (notably the Caffeine Solution 5% + EGCG eye serum). The Inkey List competes on affordability and simple ingredient-forward branding, while premium players like Clinique, Estée Lauder, and Shiseido capture loyalty with dermatologist-backed claims and global distribution.

Mass players such as L’Oréal (Garnier) and Unilever focus on volume through pharmacies and mass retail, leveraging their global networks. Regional specialists like Rohto (Japan) and Kiehl’s (premium natural-science positioning) capture niche followings.

Competitive differentiation is moving away from basic anti-puffiness claims toward integrated positioning: hybrid products (makeup + skincare), clinically quantified results, and sustainability storytelling (clean beauty, recyclable packaging). E-commerce ecosystems and influencer engagement are proving as decisive as formulation efficacy, especially in Asia.

Key Developments in Global Caffeine-Infused Skincare Market

| Item | Value |

|---|---|

| Quantitative Units | USD 1,852.7 million |

| Function | Anti-puffiness, Firming, Brightening, Anti -dark circles , Specialty beauty stores |

| Product Type | Eye serums ,Face serums, Creams/lotions, Roll-ons |

| Channel | E-commerce, Pharmacies, Mass retail |

| Tier | Mass, Masstige , Premium |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | The Ordinary, The Inkey List, Clinique, Estée Lauder, L’Oréal ( Garnier ), Shiseido, Origins, Unilever, Rohto, Kiehl’s |

| Additional Attributes | Dollar sales by product type, function, tier, and channel; eye-serum leadership and anti-puffiness dominance; China masstige outperformance (e-commerce, live-commerce); USA premium/pharmacy strength; fragmentation with the largest brand at ~8% (2025); evolution to hybrid formats (serum + concealer/sunscreen); emphasis on clinically quantified claims and repeat-purchase dynamics |

The global Caffeine-Infused Skincare Market is estimated to be valued at USD 1,852.7 million in 2025.

The market size for the Caffeine-Infused Skincare Market is projected to reach USD 5,866.3 million by 2035.

The Caffeine-Infused Skincare Market is expected to grow at a 12.2% CAGR between 2025 and 2035.

The key product types in the Caffeine-Infused Skincare Market are eye serums, face serums, creams/lotions, and roll-ons.

In terms of function, the anti-puffiness segment is set to command 49.5% share of the market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Skincare Supplement Market Size and Share Forecast Outlook 2025 to 2035

Skincare Oil Market Size and Share Forecast Outlook 2025 to 2035

Skincare Nutritional Serum Market Size and Share Forecast Outlook 2025 to 2035

Skincare Products Market Size and Share Forecast Outlook 2025 to 2035

Skincare Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Skincare Packaging Market Size, Share & Forecast 2025 to 2035

Skincare Industry in India – Trends & Growth Forecast 2024-2034

Global Skincare Treatment Market Analysis – Size, Share & Forecast 2024-2034

Global PDRN Skincare Market Size and Share Forecast Outlook 2025 to 2035

Men’s Skincare Products Market Size, Growth, and Forecast for 2025 to 2035

Global Smart Skincare Market Size and Share Forecast Outlook 2025 to 2035

Cooling Skincare Gels Market Size and Share Forecast Outlook 2025 to 2035

Natural Skincare Preservatives Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Ormedic Skincare Market Demand & Insights 2024-2034

Ceramide Skincare Market Size and Share Forecast Outlook 2025 to 2035

BPA-Free Skincare Market Trends – Demand & Forecast 2024-2034

Camellia Skincare & Cosmetics Market

Buffering Skincare Products Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Menopause Skincare Solutions Market Size and Share Forecast Outlook 2025 to 2035

Probiotic Skincare Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA