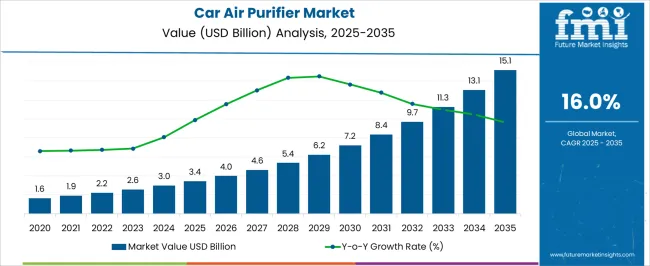

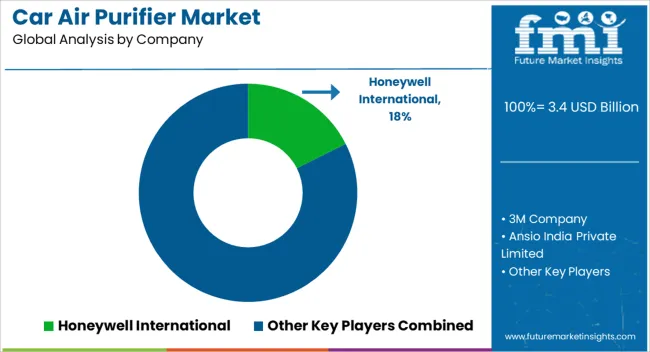

The car air purifier market is projected to be worth USD 3.4 billion in 2025 and is anticipated to expand significantly to reach USD 15.1 billion by 2035, registering a strong CAGR of 16.0% during the forecast period. This growth trajectory highlights an absolute dollar opportunity of USD 11.7 billion between 2025 and 2035, signaling robust demand dynamics in both developed and emerging economies. Increasing concerns about rising vehicular emissions, urban air pollution, and health risks such as asthma and respiratory issues are creating a favorable market environment.

Consumers are becoming more conscious of in-car air quality, driving adoption of purifiers with advanced HEPA filters, activated carbon systems, and ionizers. Automobile manufacturers are increasingly integrating air purification technologies into new vehicles as a differentiating feature, while the aftermarket is witnessing strong sales through e-commerce and retail channels. Premium passenger cars and electric vehicles are major adopters due to consumer preference for advanced safety and wellness features. Additionally, governments’ tightening emission norms and rising disposable incomes in Asia-Pacific markets like China and India are accelerating penetration. Beyond passenger cars, growth opportunities exist in commercial fleets, ride-sharing services, and luxury transport providers, making the market attractive for both established players and new entrants.

| Metric | Value |

|---|---|

| Car Air Purifier Market Estimated Value in (2025 E) | USD 3.4 billion |

| Car Air Purifier Market Forecast Value in (2035 F) | USD 15.1 billion |

| Forecast CAGR (2025 to 2035) | 16.0% |

The car air purifier market is significantly shaped by interlinked automotive and consumer wellness sectors, each influencing demand patterns and market expansion. The passenger vehicles segment holds the largest share at 45%, as car owners increasingly prioritize in-cabin air quality, seeking protection from pollutants, allergens, and airborne pathogens during daily commutes. The commercial vehicle segment contributes 20%, driven by fleet operators and ride-sharing services integrating air purifiers to enhance passenger comfort and comply with health-conscious standards. The luxury and premium car segment accounts for 15%, where advanced air purification systems are adopted as value-added features, enhancing brand perception and passenger experience. The automotive accessories and aftermarket sector represents 10%, supporting adoption among older vehicle owners through standalone or retrofit solutions, increasing awareness of in-car air quality. Finally, the public transportation and shared mobility segment holds a 10% share, as buses, taxis, and shuttles implement air purifiers to ensure passenger safety and improve user confidence in shared travel. Collectively, the passenger vehicle, commercial fleet, and luxury segments account for 80% of overall market demand, emphasizing that daily commuting, fleet operations, and premium experiences are the primary growth drivers, while aftermarket and shared mobility channels contribute to incremental adoption, shaping the global car air purifier market dynamics.

The car air purifier market is witnessing steady expansion, supported by rising consumer awareness regarding in-vehicle air quality and increasing concerns over urban pollution levels. Technological advancements in filtration systems, stricter environmental regulations, and the adoption of air purification as a standard or optional feature in various vehicle segments are reinforcing growth.

Manufacturers are focusing on integrating compact, energy-efficient designs that align with evolving automotive interior space requirements and sustainability goals. Demand is being driven both by OEM integration and the aftermarket, with competitive differentiation relying on filtration efficiency, durability, and cost-effectiveness.

In mature markets, product adoption is supported by health-conscious consumers and premium automotive trends, while emerging economies are experiencing demand acceleration due to worsening air quality and a growing mid-tier vehicle base Over the forecast period, sustained innovation, broader availability through diverse retail channels, and heightened focus on particulate matter and allergen removal are expected to position the market for consistent volume and value growth.

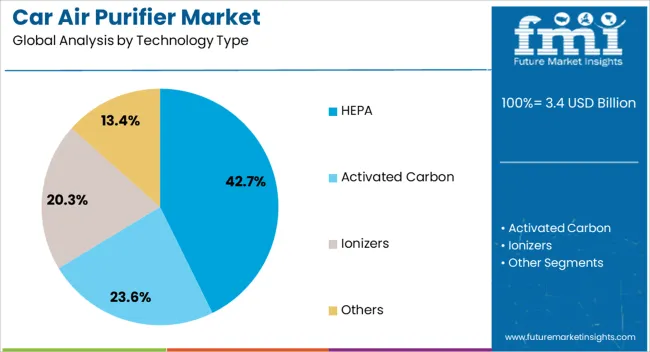

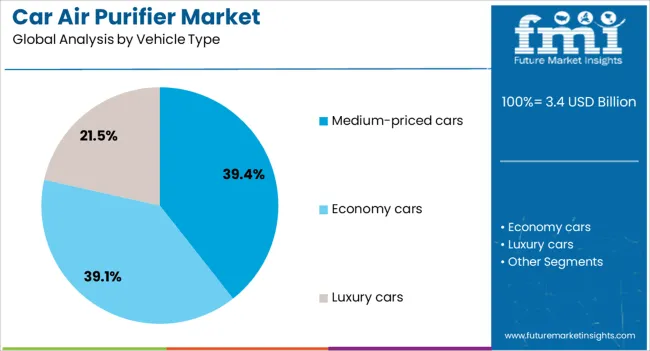

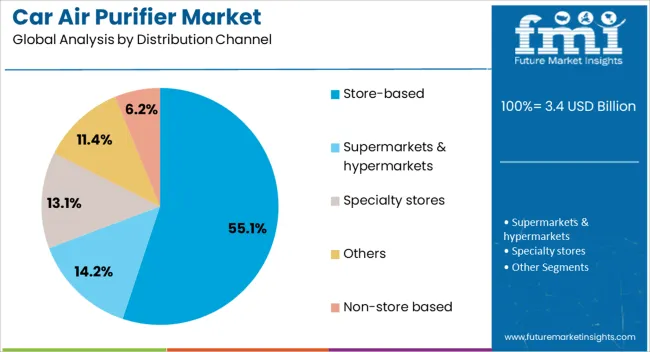

The car air purifier market is segmented by technology type, vehicle type, distribution channel, and geographic regions. By technology type, the car air purifier market is divided into HEPA, Activated Carbon, Ionizers, and Others. In terms of vehicle type, the car air purifier market is classified into Medium-priced cars, Economy cars, and Luxury cars. Based on distribution channel, the car air purifier market is segmented into Store-based, Supermarkets & hypermarkets, Specialty stores, Others, and non-store-based. Regionally, the car air purifier industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The HEPA segment, holding 42.7% of the technology type category, is leading the market due to its proven high-efficiency particulate filtration capability and strong consumer trust in medical-grade filtration standards. Adoption has been reinforced by increasing awareness of airborne health hazards and the demand for reliable removal of fine dust, allergens, and pollutants within vehicle cabins.

Manufacturers have been enhancing HEPA-based systems with multi-layer filtration and activated carbon integration to address both particulate and gaseous contaminants. Pricing competitiveness, combined with durability and minimal maintenance requirements, has strengthened its position in both OEM and aftermarket sales.

Regulatory emphasis on indoor air quality standards in vehicles has further driven OEM adoption, particularly in mid-to-premium automotive segments. The segment’s continued dominance is expected to be supported by advancements in miniaturization and airflow optimization, ensuring compatibility with diverse vehicle models while maintaining superior filtration performance.

The medium-priced cars segment, accounting for 39.4% of the vehicle type category, has emerged as the largest contributor due to its significant share in global automotive production and sales. Adoption of air purifiers in this segment has been driven by growing consumer expectations for enhanced comfort and safety features at accessible price points.

Competitive positioning has been reinforced by automakers integrating purification systems as standard or upgrade options in mid-tier models, bridging the gap between affordability and advanced cabin features. Demand has been particularly strong in urbanized regions with high air pollution indices, where mid-priced vehicles dominate market volumes.

Manufacturers targeting this segment have leveraged economies of scale to offer cost-effective yet efficient systems, contributing to broader penetration. Future growth is anticipated as environmental concerns and air quality awareness continue to rise among middle-income consumers, prompting OEMs to expand feature availability across a wider range of medium-priced offerings.

The store-based segment, representing 55.1% of the distribution channel category, has maintained its lead through the advantage of direct consumer engagement and product demonstration. Physical retail outlets, including automotive accessory stores, electronics retailers, and hypermarkets, have facilitated informed purchasing decisions by allowing consumers to assess build quality, brand reputation, and compatibility before purchase.

The trust associated with in-person transactions, coupled with after-sales service availability, has reinforced this channel’s preference among buyers, especially in markets where online retail penetration is still evolving. Competitive strategies have included in-store promotional campaigns, bundled offers with installation services, and strategic partnerships with automotive dealerships to boost visibility.

While e-commerce adoption is growing, the store-based channel’s dominance is expected to persist in the medium term, particularly in regions where consumers value physical product inspection and personalized guidance prior to investing in vehicle air purification solutions.

Health consciousness, premium vehicle integration, fleet adoption, and aftermarket solutions are the main drivers of car air purifier demand. Daily commuting, passenger safety, and comfort remain central to market growth.

The car air purifier market is heavily influenced by growing consumer awareness regarding air pollution and its health impacts. Drivers and passengers are increasingly concerned about allergens, dust, vehicle emissions, and harmful gases, leading to a surge in the adoption of in-cabin air purifiers. The rising prevalence of respiratory illnesses, seasonal allergies, and concerns over airborne pathogens are pushing vehicle owners to prioritize clean air solutions. Consumer preference for hygienic, odor-free driving environments is boosting sales, particularly in regions with high pollution levels. Vehicle manufacturers are responding by integrating air purification systems into new models, while aftermarket solutions are gaining traction among older car owners. This health-driven focus is expected to remain a critical factor influencing market growth over the forecast period.

Premium and luxury car segments are increasingly contributing to the car air purifier market by integrating high-efficiency filtration systems as standard or optional features. Vehicle owners in these segments perceive air purifiers as value-added benefits that enhance comfort, safety, and overall driving experience. Advanced filtration technologies, such as HEPA and activated carbon filters, are preferred for odor elimination and particulate removal. Automakers are positioning air purifiers as differentiating features in competitive markets, driving higher adoption among affluent consumers. The emphasis on cabin quality in premium models influences expectations in the mass-market segment, creating a trickle-down effect. As a result, the premium car segment remains a key growth driver for air purification solutions in vehicles worldwide.

Commercial and shared mobility sectors are emerging as important contributors to market expansion. Fleet operators, including ride-sharing, taxi, and shuttle services, are adopting in-cabin air purifiers to improve passenger comfort and safety. The implementation of air purifiers enhances user confidence in shared travel, particularly in urban areas with high pollution levels or during public health concerns. Corporate fleets are also integrating purifiers as part of service quality and health compliance measures. Demand is particularly strong in regions with dense traffic and public transportation reliance. The fleet adoption trend is expected to continue influencing product innovations, filtration efficiency standards, and after-sales services, expanding market opportunities beyond individual vehicle owners.

The aftermarket segment plays a critical role in enabling adoption among existing vehicle owners who lack factory-installed air purification systems. Standalone and retrofit solutions allow older vehicles to benefit from HEPA and carbon filter technologies without requiring vehicle replacement. Online and offline distribution channels, including e-commerce platforms, auto accessory stores, and service centers, facilitate easy accessibility and awareness. Consumer education and marketing campaigns highlighting health and hygiene benefits are driving incremental demand in the aftermarket sector. This segment is particularly important in developing regions, where vehicle replacement cycles are longer and factory-fitted air purifiers are less common. Expanding aftermarket penetration ensures broader market coverage and continuous growth potential globally.

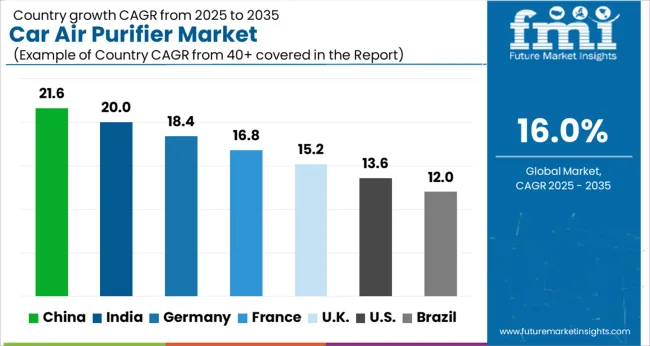

| Country | CAGR |

|---|---|

| China | 21.6% |

| India | 20.0% |

| Germany | 18.4% |

| France | 16.8% |

| UK | 15.2% |

| USA | 13.6% |

| Brazil | 12.0% |

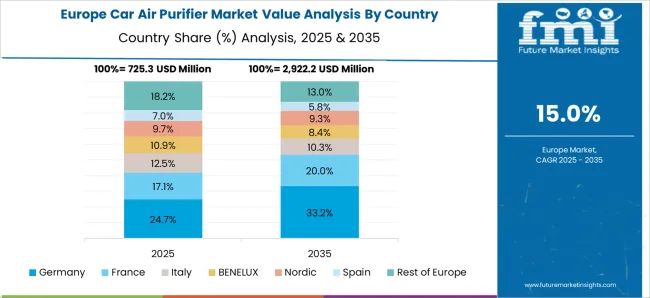

The global car air purifier market is projected to grow at a CAGR of 16.0% from 2025 to 2035. China leads at 21.6%, followed by India at 20.0%, Germany at 18.4%, the UK at 15.2%, and the USA at 13.6%. Market growth is driven by rising health awareness, increasing vehicle ownership, and the focus on in-cabin air quality. Asia, particularly China and India, demonstrates rapid expansion due to high urban pollution, commuter density, and disposable income growth. Europe and North America emphasize advanced filtration technologies, integration in premium vehicles, and regulatory compliance. Enhanced accessibility through online and offline retail channels, combined with retrofit and aftermarket solutions, continues to support global adoption. The analysis covers over 40 countries, with leading markets highlighted above.

The car air purifier market in China is projected to grow at a CAGR of 21.6% from 2025 to 2035, driven by rising vehicle ownership, worsening urban air pollution, and increasing consumer awareness of health and air quality. Consumers are seeking compact, energy-efficient, and easy-to-install purification solutions for cars to combat particulate matter, allergens, and odors. Advanced purification technologies, including HEPA filters, activated carbon, ionizers, and smart air quality sensors, are gaining widespread adoption for their ability to remove pollutants effectively. E-commerce platforms and automotive accessory retailers are expanding distribution, making innovative products more accessible in tier-1 and tier-2 cities. Domestic manufacturers are investing in R&D to enhance filter lifespan, durability, and design while collaborating with international brands to meet growing consumer expectations.

The car air purifier market in India is expected to expand at a CAGR of 20.0% from 2025 to 2035, fueled by rising urban air pollution, increasing health consciousness, and growing disposable incomes. Consumers are adopting portable, easy-to-install air purifiers for their vehicles to reduce exposure to dust, allergens, and vehicular emissions. Companies are offering products with multi-stage filters, UV sterilization, antibacterial coatings, and smart air quality monitoring to address diverse vehicle and environmental conditions. E-commerce and organized retail channels are enhancing market penetration, while awareness campaigns and collaborations with automobile brands highlight the importance of clean in-car air. Domestic manufacturers are innovating in lightweight, ergonomic designs and long-lasting filter systems to appeal to urban millennials and working professionals. Fleet operators and rideshare companies are also contributing to institutional demand.

The car air purifier market in Germany is projected to grow at a CAGR of 18.4% from 2025 to 2035, driven by high vehicle penetration, environmental consciousness, and stringent emission regulations. Consumers are increasingly adopting in-car air purifiers to reduce exposure to pollen, dust, and exhaust emissions in urban areas. Advanced technologies, including HEPA and activated carbon filters, ionizers, and real-time air quality sensors, are becoming standard among mid-range and premium vehicles. Automotive accessory stores and online marketplaces are expanding product availability with a focus on high durability, low noise, and energy efficiency. Collaborations between domestic manufacturers and global technology providers are fueling product innovation. OEM partnerships are also enabling integration of air purifiers as optional features in premium vehicles.

The car air purifier market in the UK is expected to grow at a CAGR of 15.2% from 2025 to 2035, supported by rising urban pollution awareness, growing vehicle ownership, and health-conscious consumer behavior. Urban commuters and long-distance drivers are increasingly adopting portable and efficient in-car purifiers to mitigate exposure to dust, allergens, and exhaust gases. Products featuring HEPA and activated carbon filters, UV sterilization, and real-time air quality monitoring are gaining popularity. Retail and e-commerce channels are expanding product reach across metropolitan and suburban areas. Domestic and international manufacturers are investing in compact, energy-efficient, and easy-to-install designs, while collaborations with OEMs allow integration of purifiers in premium vehicles.

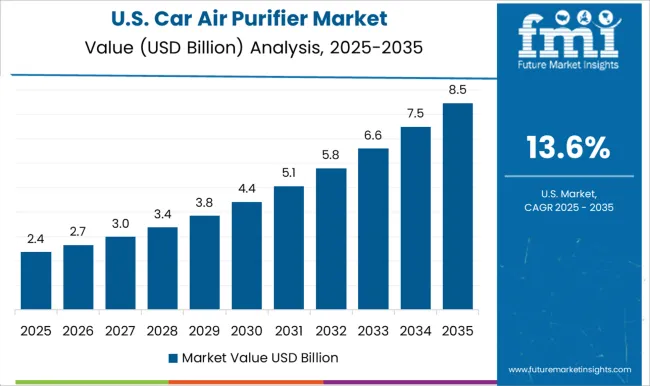

The car air purifier market in the USA is projected to grow at a CAGR of 13.6% from 2025 to 2035, driven by rising vehicle ownership, increasing health awareness, and demand for cleaner in-car environments. Consumers are seeking solutions to minimize exposure to dust, allergens, smoke, and vehicular emissions during commutes. Advanced purification technologies, including HEPA filters, activated carbon, UV sterilization, and IoT-enabled air quality monitors, are becoming standard features for health-conscious car owners. E-commerce platforms, automotive accessory retailers, and OEM collaborations are expanding product accessibility and adoption. Manufacturers focus on compact, energy-efficient, durable, and easy-to-install designs. Fleet operators, taxis, and rideshare companies are also contributing to market growth.

Filtration efficiency, portability, smart features, and durability define competition in the car air purifier market. Honeywell International leads with advanced HEPA and activated carbon filters, energy-efficient designs, and integration with smart sensors for real-time air quality monitoring.

3M Company competes with multi-stage filtration systems and compact, durable designs suitable for diverse vehicle sizes. Ansio India Private Limited and Eureka Forbes focus on affordability, lightweight construction, and easy installation for emerging markets. BlueAir differentiates through high-performance ionization and quiet operation, targeting premium car segments. Denso Corporation and Panasonic Corporation offer integrated solutions with OEM collaborations and advanced automotive-grade filtration technologies. Koninklijke Philips NV emphasizes smart IoT-enabled purifiers, app-controlled features, and real-time monitoring. Sharp Electronics Corporation targets both mid-range and premium vehicles with compact, energy-efficient purifiers featuring HEPA and activated carbon technologies.

Emerging and regional players compete through niche offerings such as UV sterilization, odor removal, and modular, replaceable cartridges. Strategies focus on portability, ease of maintenance, and compatibility with multiple vehicle types. Certifications, energy efficiency, low noise, and ergonomic design are marketed as differentiators. Product brochures highlight purification capacity, airflow, filter type, replacement intervals, and maintenance instructions. Smart sensor integration, app connectivity, quiet operation, and compact, aesthetic designs are emphasized, reflecting a market oriented toward health-conscious, tech-savvy consumers seeking reliable in-car air purification solutions.

| Item | Value |

|---|---|

| Quantitative Units | USD 3.4 Billion |

| Technology Type | HEPA, Activated Carbon, Ionizers, and Others |

| Vehicle Type | Medium-priced cars, Economy cars, and Luxury cars |

| Distribution Channel | Store-based, Supermarkets & hypermarkets, Specialty stores, Others, and Non-store based |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Honeywell International, 3M Company, Ansio India Private Limited, BlueAir, Denso Corporation, Eureka Forbes, Koninklijke Philips NV, Panasonic Corporation, and Sharp Electronics Corporation |

| Additional Attributes | Dollar sales, share by region and segment, consumer preferences, competitive landscape, pricing trends, key distribution channels, regulatory standards, and emerging technologies. |

The global car air purifier market is estimated to be valued at USD 3.4 billion in 2025.

The market size for the car air purifier market is projected to reach USD 15.1 billion by 2035.

The car air purifier market is expected to grow at a 16.0% CAGR between 2025 and 2035.

The key product types in car air purifier market are hepa, activated carbon, ionizers and others.

In terms of vehicle type, medium-priced cars segment to command 39.4% share in the car air purifier market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Caramel Malt Market Size and Share Forecast Outlook 2025 to 2035

Carbon Capture and Sequestration Market Forecast Outlook 2025 to 2035

Cardiac Rehabilitation Market Size and Share Forecast Outlook 2025 to 2035

Carbon Dioxide Incubators Market Size and Share Forecast Outlook 2025 to 2035

Carboxymethyl Tamarind Gum (CMT) Market Size and Share Forecast Outlook 2025 to 2035

Car Cover Market Size and Share Forecast Outlook 2025 to 2035

Cardiology Information System Market Size and Share Forecast Outlook 2025 to 2035

Cardiopulmonary Functional Testing Platform Market Size and Share Forecast Outlook 2025 to 2035

Carbon Enhanced Lead Acid Battery Market Size and Share Forecast Outlook 2025 to 2035

Car Bushing Market Size and Share Forecast Outlook 2025 to 2035

Carbon-negative Cement Market Size and Share Forecast Outlook 2025 to 2035

Card Printer Ribbon Market Size and Share Forecast Outlook 2025 to 2035

Carbon Tetrabromide Market Size and Share Forecast Outlook 2025 to 2035

Carbon Steel Market Size and Share Forecast Outlook 2025 to 2035

Carpet Spot Remover Market Size and Share Forecast Outlook 2025 to 2035

Cardiovascular CT Systems Market Size and Share Forecast Outlook 2025 to 2035

Carbon Brush Market Size and Share Forecast Outlook 2025 to 2035

Carpet and Rug Market Size and Share Forecast Outlook 2025 to 2035

Carbon Offset Platform Market Size and Share Forecast Outlook 2025 to 2035

Carob Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA