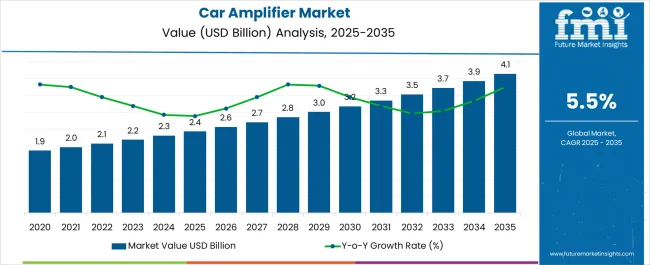

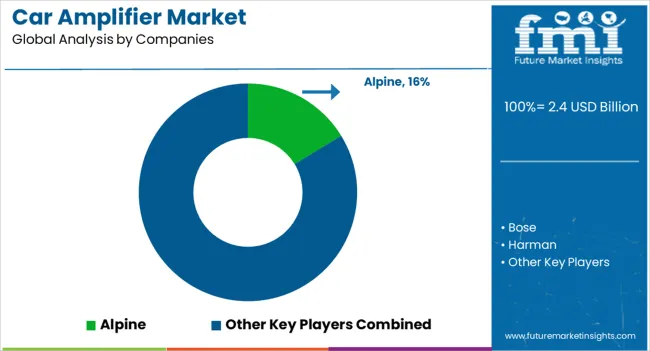

The Car Amplifier Market is estimated to be valued at USD 2.4 billion in 2025 and is projected to reach USD 4.1 billion by 2035, registering a compound annual growth rate (CAGR) of 5.5% over the forecast period. The market’s growth is heavily influenced by technological contributions, with different amplifier types shaping overall adoption and revenue generation. Traditional Class AB amplifiers maintain a significant presence due to their balanced performance, reliability, and cost efficiency, supporting baseline market growth.

The Class D amplifiers are increasingly contributing a larger share owing to their superior energy efficiency, reduced heat generation, and compatibility with modern automotive audio systems, particularly in hybrid and electric vehicles. The shift toward digital signal processing integration further enhances the functionality of Class D and Class H amplifiers, offering improved sound quality and adaptive audio performance, which is becoming a key differentiator in premium vehicle segments. Technological innovation also influences pricing dynamics, with high-performance digital amplifiers commanding higher average selling prices, thereby elevating revenue contributions. Manufacturers investing in R&D for compact, multi-channel, and high-efficiency amplifiers are capturing greater market share by addressing consumer demand for immersive in-car audio experiences. By 2035, the technology-driven market composition is expected to increasingly favor digital and high-efficiency amplifier solutions, while traditional analog technologies will continue to sustain the lower-cost segment. Contribution analysis indicates that Class D and digital amplifiers will dominate revenue generation, supported by integration with advanced automotive infotainment systems and increasing consumer preference for superior audio performance in both luxury and mid-tier vehicles.

| Metric | Value |

|---|---|

| Car Amplifier Market Estimated Value in (2025 E) | USD 2.4 billion |

| Car Amplifier Market Forecast Value in (2035 F) | USD 4.1 billion |

| Forecast CAGR (2025 to 2035) | 5.5% |

The car amplifier market is expanding steadily, driven by rising consumer demand for high fidelity in-vehicle audio experiences and the growing integration of advanced infotainment systems. As automotive manufacturers prioritize premium sound systems to differentiate vehicle trims, demand for both factory-fitted and aftermarket audio components has intensified.

Increasing sales of luxury and electric vehicles have also contributed to the proliferation of amplifiers, especially those compatible with noise-cancelling and smart audio technologies. Advancements in compact, energy-efficient amplifier designs are enabling better space utilization and improved thermal management.

As consumers continue to prioritize personalization and sound quality in their driving experience, the market is positioned for consistent growth across both OEM and aftermarket channels.

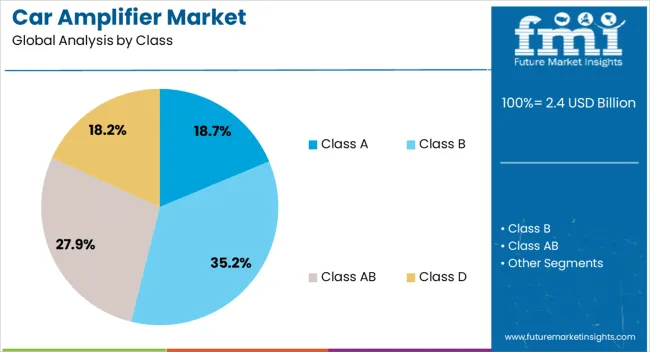

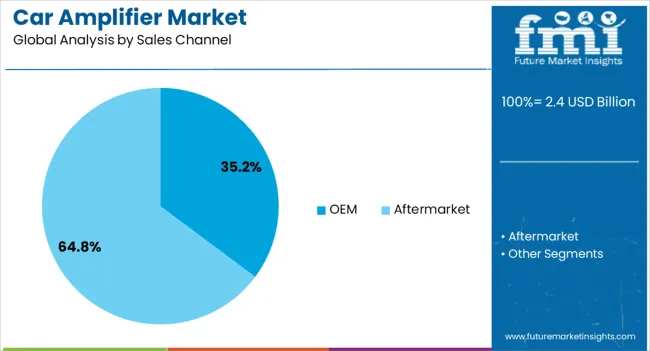

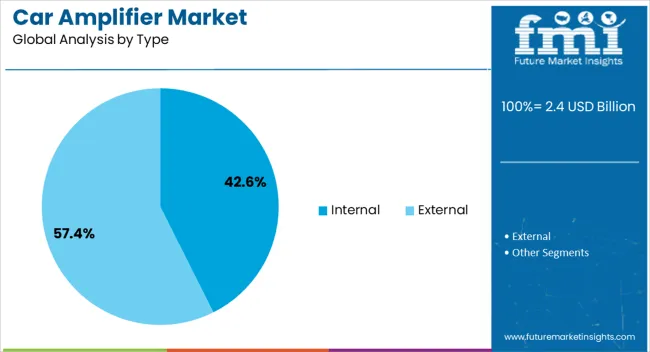

The car amplifier market is segmented by class, sales channel, type, amplifier, and geographic regions. The car amplifier market is categorized by class into Class A, Class B, Class AB, and Class D. In terms of sales channels, the market is divided into OEM and Aftermarket. Based on type, the car amplifier market is segmented into Internal and External.

By amplifier type, the car amplifier market is segmented into Mono, 2-channel, and Multi-channel. Regionally, the car amplifier industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Class A segment is expected to account for 18.70% of total market revenue by 2025 within the class category. Its continued relevance is attributed to the superior audio clarity and low distortion levels offered by this amplifier class, making it a preferred choice for audiophiles and luxury vehicle sound systems.

Despite its lower energy efficiency and higher heat generation compared to newer classes, Class A technology is still favored for high-performance audio setups where sound quality takes precedence.

This segment’s demand is also reinforced by select premium automotive brands that integrate these systems into upper-tier models, maintaining its niche dominance in quality-driven use cases.

The OEM sales channel is projected to capture 35.20% of total revenue in 2025, driven by the growing integration of premium sound systems directly from vehicle manufacturers. As customer expectations around in-car entertainment rise, OEMs are increasingly collaborating with high-end audio brands to deliver superior factory-installed systems.

This integration not only enhances vehicle value but also ensures better system compatibility and aesthetic alignment.

Furthermore, the shift toward embedded infotainment ecosystems and advanced driver assistance systems has increased the need for amplifiers optimized for factory specifications, reinforcing OEMs’ leadership in this category.

The internal amplifier type segment is anticipated to contribute 42.60% of total market revenue by 2025, making it the leading type. Internal amplifiers are preferred for their seamless integration within vehicle dashboards or head units, conserving space and maintaining factory aesthetics.

Their rising adoption is supported by improvements in compact circuitry and thermal efficiency, which allow powerful performance without additional bulk. Internal types are also more cost-effective for OEM installation and are increasingly favored in mass-market and mid-range vehicles.

With consumer preferences shifting toward cleaner installations and less aftermarket modification, internal amplifiers are expected to maintain their dominance in the car amplifier market.

The car amplifier market has been expanding due to growing demand for enhanced in-vehicle audio systems, infotainment integration, and premium sound experiences. These amplifiers have been widely used in passenger vehicles, luxury cars, and commercial fleets to deliver improved audio quality and output power. Manufacturers have focused on compact designs, energy efficiency, and advanced signal processing technologies to meet consumer expectations. Increasing adoption of connected car solutions, personalized audio systems, and aftermarket upgrades has collectively reinforced the market, while rising interest in immersive sound and noise management has strengthened overall growth.

The increasing consumer preference for high-quality sound experiences inside vehicles has driven the market. Amplifiers have been widely incorporated in car audio systems to enhance sound clarity, volume, and bass performance, delivering immersive entertainment. OEMs have collaborated with premium audio brands to offer factory-installed amplifiers with high-fidelity output.

Aftermarket adoption has been significant, particularly among enthusiasts seeking customized sound systems with multi-channel amplifiers and subwoofer integration. Noise reduction technologies have also been applied to optimize audio clarity in high-speed driving environments. Consumers have increasingly preferred vehicles equipped with advanced audio systems, supporting both factory-installed and aftermarket amplifier adoption. This trend has been reinforced by growing awareness of audio quality as a differentiating feature in automotive selection, making car amplifiers an essential component in enhancing in-car entertainment experiences globally.

Technological innovation has significantly shaped the market, improving efficiency, signal processing, and device integration. Class-D amplifiers, known for compact size and low heat generation, have been increasingly deployed to support high-output audio while reducing energy consumption. Signal processing enhancements, including digital sound processing (DSP) and equalization controls, have enabled customizable audio profiles and noise compensation. Wireless connectivity solutions have allowed seamless integration with infotainment systems and smartphones.

Heat-resistant materials, modular designs, and protective circuitry have extended amplifier lifespan and reliability. Manufacturers have focused on reducing distortion while increasing output power, ensuring compatibility with various speaker configurations. Continuous development in amplifier miniaturization, energy management, and multi-channel integration has strengthened adoption across both premium and mid-range vehicles, enhancing user experience while maintaining performance consistency in diverse automotive environments.

The growing integration of connected and smart vehicle technologies has influenced the market. Amplifiers have been increasingly embedded into infotainment systems that allow seamless interaction with navigation, voice control, and mobile devices. Connected car solutions have enabled real-time adjustments to audio settings based on cabin noise, passenger preference, and driving conditions.

Integration with advanced driver assistance systems (ADAS) has facilitated auditory alerts and notifications, making amplifiers multifunctional components beyond entertainment purposes. Smart vehicle platforms have encouraged automakers to offer customizable sound profiles that can be remotely controlled or personalized per driver. Cloud-based audio content and streaming services have further driven demand for amplifiers capable of maintaining consistent output quality. The synergy between connectivity, intelligent vehicle systems, and audio enhancements has reinforced the role of amplifiers in modern vehicles, enhancing both functionality and user satisfaction.

The aftermarket segment has been a key driver of the market, fueled by consumer interest in customization and performance upgrades. Vehicle owners have increasingly opted for amplifier installations to support enhanced speaker systems, subwoofers, and multi-zone audio setups. Specialty retailers and automotive audio installers have offered a wide range of products tailored to different vehicle types, sizes, and power requirements. The rise of DIY installations and online sales channels has facilitated accessibility to high-performance amplifiers.

Vehicle modification culture, including participation in car audio competitions and community events, has further promoted adoption. Flexibility in amplifier design has allowed integration with both standard and premium audio configurations, meeting diverse user needs. The combination of personalization, performance optimization, and consumer-driven upgrades has ensured continued growth in the market across multiple regions and vehicle segments.

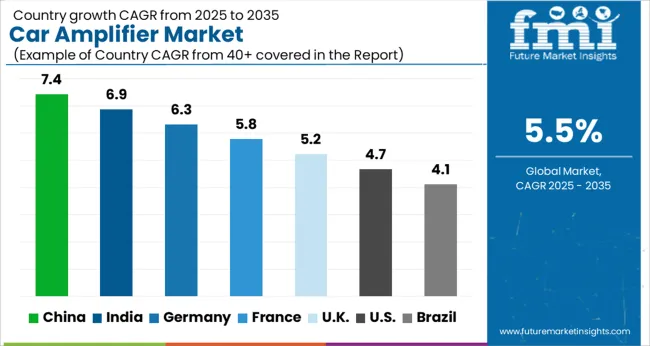

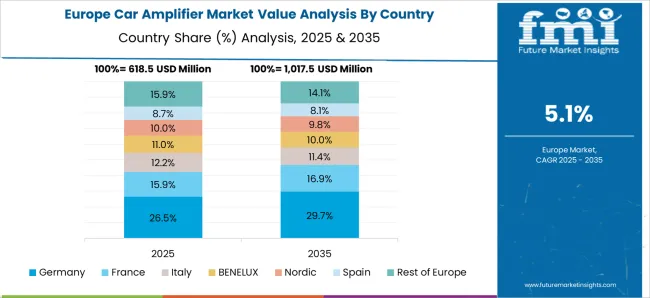

The market is projected to grow at a CAGR of 5.5% between 2025 and 2035, driven by increasing in-vehicle entertainment adoption, demand for high-quality audio systems, and rising consumer preference for connected cars. China leads with a 7.4% CAGR, expanding through large-scale automotive electronics production and growing consumer electronics integration. India follows at 6.9%, supported by rising automotive sales and aftermarket audio system adoption. Germany, at 6.3%, benefits from advanced automotive engineering and premium car market growth. The UK, growing at 5.2%, innovates through integration of smart infotainment systems. The USA, at 4.7%, witnesses steady demand fueled by automotive aftermarket upgrades and infotainment expansion. This report covers 40+ countries, with the top markets highlighted here for reference.

The market in China is anticipated to expand at a CAGR of 7.4% from 2025 to 2035, driven by increasing demand for enhanced in-vehicle entertainment systems and upgraded audio technology in passenger vehicles. Rising consumer preference for premium audio experiences and smart infotainment integration is boosting sales. Leading electronics manufacturers are investing in R&D to improve sound quality, energy efficiency, and compact designs. Collaborations between domestic automotive OEMs and audio technology providers are enhancing market penetration. The aftermarket sector is also witnessing growth, fueled by rising vehicle customization trends. Strategic initiatives focus on expanding distribution networks and providing technologically advanced products to cater to urban and semi-urban vehicle owners.

India is projected to grow at a CAGR of 6.9% over the next decade, supported by the increasing adoption of connected vehicles and consumer interest in superior sound systems. Urban vehicle owners are seeking enhanced audio experiences, while aftermarket customization is gaining traction. Key players are investing in lightweight, energy-efficient, and high-fidelity amplifiers suitable for small and mid-size vehicles. Strategic alliances between local and international audio equipment manufacturers are accelerating market penetration. Rising awareness about smart infotainment systems is further boosting sales across private vehicles and commercial fleets.

Germany’s market is expected to grow at a CAGR of 6.3%, supported by strong automotive manufacturing and consumer demand for premium audio technology. Electric and hybrid vehicles are increasingly integrated with advanced infotainment systems requiring high-quality amplifiers. Market leaders are focusing on R&D to deliver compact, high-efficiency audio modules compatible with modern vehicle architectures. Sales are driven by both OEM installations and aftermarket upgrades. Collaborative initiatives between automotive and audio technology firms are enhancing technological capabilities and distribution reach. Sustainability trends and energy-efficient audio solutions are shaping product development strategies.

The market in the United Kingdom is projected to expand at a CAGR of 5.2% from 2025 to 2035, driven by increasing demand for premium audio systems in passenger and commercial vehicles. Adoption of connected vehicle technology and infotainment integration is boosting market growth. Key manufacturers are focusing on energy-efficient, compact amplifier designs suitable for urban vehicles. Strategic collaborations between automotive companies and audio equipment providers are facilitating wider market reach. Aftermarket sales are growing as vehicle owners increasingly seek customized sound systems. Urban and suburban demand is particularly high, supported by rising awareness of audio quality and technological integration.

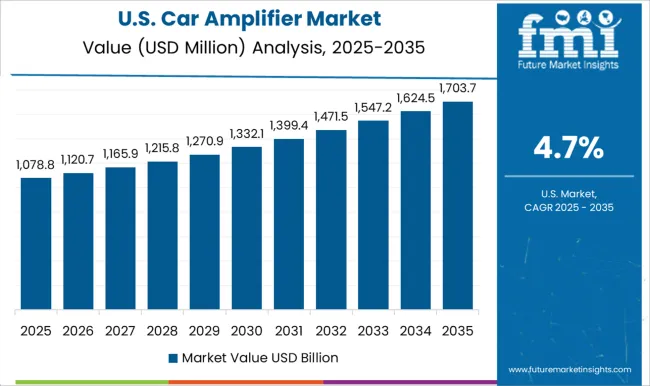

The United States market is forecasted to grow at a CAGR of 4.7%, fueled by consumer preference for advanced in-car entertainment systems and integration of smart infotainment solutions. Sales are supported by aftermarket customization trends and the expansion of electric and hybrid vehicle fleets. Major manufacturers are investing in compact, energy-efficient, and high-fidelity amplifiers suitable for modern vehicle architectures. Strategic alliances with domestic and international partners are strengthening distribution networks and product innovation. Demand in suburban and urban regions is high due to increasing awareness about audio performance and vehicle personalization.

Alpine, Bose, and Harman lead the industry with innovative amplifier designs, advanced signal processing technologies, and extensive integration capabilities with vehicle infotainment systems. JL Audio, Kenwood, and Kicker focus on delivering powerful sound output and compact designs suitable for a wide range of passenger vehicles, emphasizing premium audio performance.

Pioneer and Sony contribute through consumer-focused solutions, combining affordability with reliable audio quality, while Meridian is recognized for high-end, audiophile-grade amplification systems. Rockford maintains a strong presence with durable, performance-oriented amplifiers targeted at aftermarket upgrades and enthusiast markets. Market players are increasingly leveraging R&D to develop next-generation amplifiers featuring digital signal processing, high efficiency, and connectivity options such as Bluetooth and smartphone integration. Strategic partnerships with automotive OEMs, aftermarket distributors, and audio technology providers are driving competitive advantage. Companies are also exploring lightweight materials, compact form factors, and multi-channel designs to meet evolving vehicle requirements. Overall, the Car Amplifier market is shaped by innovation, technological sophistication, and the growing demand for premium in-car audio experiences, making performance, reliability, and integration capabilities key differentiators among leading providers.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.4 Billion |

| Class | Class A, Class B, Class AB, and Class D |

| Sales Channel | OEM and Aftermarket |

| Type | Internal and External |

| Amplifier | Mono, 2-channel, and Multi-channel |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled |

Alpine, Bose, Harman, JL Audio, Kenwood, Kicker, Meridian, Pioneer, Rockford, Sony |

| Additional Attributes | Dollar sales by amplifier type and vehicle segment, demand dynamics across aftermarket and OEM installations, regional trends in audio system upgrades, innovation in sound quality and connectivity features, environmental impact of electronic waste, and emerging use cases in smart and luxury vehicles. |

The global car amplifier market is estimated to be valued at USD 2.4 billion in 2025.

The market size for the car amplifier market is projected to reach USD 4.1 billion by 2035.

The car amplifier market is expected to grow at a 5.5% CAGR between 2025 and 2035.

The key product types in car amplifier market are class A, class B, class AB and class D.

In terms of sales channel, oem segment to command 35.2% share in the car amplifier market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Carboxymethyl Tamarind Kernel Powder Market Size and Share Forecast Outlook 2025 to 2035

Car Tail Light Mould Market Size and Share Forecast Outlook 2025 to 2035

Car OS Market Size and Share Forecast Outlook 2025 to 2035

Caramel Malt Market Size and Share Forecast Outlook 2025 to 2035

Carbon Capture and Sequestration Market Forecast Outlook 2025 to 2035

Cardiac Rehabilitation Market Size and Share Forecast Outlook 2025 to 2035

Carbon Dioxide Incubators Market Size and Share Forecast Outlook 2025 to 2035

Carboxymethyl Tamarind Gum (CMT) Market Size and Share Forecast Outlook 2025 to 2035

Car Cover Market Size and Share Forecast Outlook 2025 to 2035

Cardiology Information System Market Size and Share Forecast Outlook 2025 to 2035

Cardiopulmonary Functional Testing Platform Market Size and Share Forecast Outlook 2025 to 2035

Carbon Enhanced Lead Acid Battery Market Size and Share Forecast Outlook 2025 to 2035

Car Bushing Market Size and Share Forecast Outlook 2025 to 2035

Carbon-negative Cement Market Size and Share Forecast Outlook 2025 to 2035

Card Printer Ribbon Market Size and Share Forecast Outlook 2025 to 2035

Carbon Tetrabromide Market Size and Share Forecast Outlook 2025 to 2035

Carbon Steel Market Size and Share Forecast Outlook 2025 to 2035

Carpet Spot Remover Market Size and Share Forecast Outlook 2025 to 2035

Cardiovascular CT Systems Market Size and Share Forecast Outlook 2025 to 2035

Carbon Brush Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA