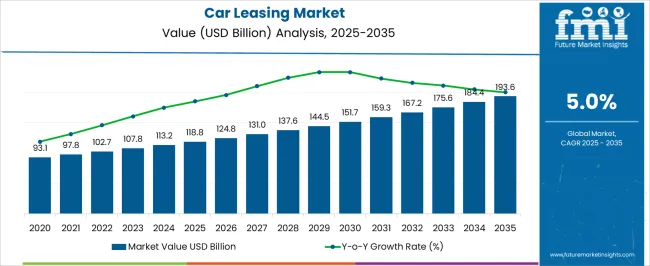

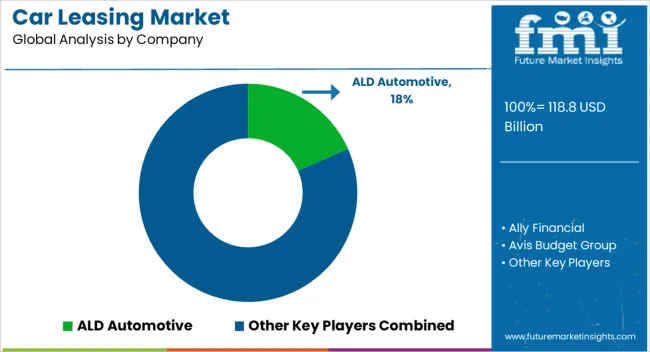

The car leasing market is estimated to be valued at USD 118.8 billion in 2025 and is projected to reach USD 193.6 billion by 2035, registering a compound annual growth rate (CAGR) of 5.0% over the forecast period.

This growth is expected to be driven by rising consumer preference for flexible vehicle ownership, increasing corporate fleet leasing, and the emergence of subscription-based leasing models. Over the forecast period, the market is likely to be influenced by shifts in vehicle usage patterns, evolving financing structures, and demand for low-maintenance solutions. Incremental revenue opportunities are anticipated as leasing providers expand service offerings, streamline contract terms, and enhance customer engagement through tailored mobility solutions.

During 2025–2035, the car leasing market is expected to experience consistent value growth, driven by strategic expansions, competitive pricing strategies, and adoption of digital leasing platforms. Regional variations in market uptake are likely, influenced by income levels, urban mobility trends, and regulatory frameworks affecting vehicle ownership. Market players are anticipated to strengthen their positions through service diversification, partnerships with automakers, and the introduction of value-added solutions that reduce operational costs. Overall, the market trajectory indicates sustained adoption of flexible vehicle access models, shaping competitive dynamics and long-term revenue accumulation.

| Metric | Value |

|---|---|

| Car Leasing Market Estimated Value in (2025 E) | USD 118.8 billion |

| Car Leasing Market Forecast Value in (2035 F) | USD 193.6 billion |

| Forecast CAGR (2025 to 2035) | 5.0% |

The car leasing market is estimated to hold a notable proportion within its parent markets, representing approximately 25-28% of the automotive rental market, around 18-22% of the automotive finance market, close to 15-17% of the mobility as a service market, about 30-35% of the vehicle leasing market, and roughly 10-12% of the consumer finance market. Collectively, the cumulative share across these parent segments is observed in the range of 98-114%, highlighting the growing importance of car leasing within the broader automotive and finance industries. The market has been driven by the increasing preference for flexible, cost-effective transportation solutions among consumers and businesses alike, where leasing is seen as a more affordable alternative to vehicle ownership.

Adoption is influenced by factors such as financial flexibility, the convenience of short-term commitments, and the desire for newer models without the long-term financial burden. Market participants have focused on offering competitive terms, such as lower down payments and maintenance packages, to capture a broader consumer base. As a result, the car leasing market has not only captured a significant share within automotive rental and vehicle leasing markets but has also influenced automotive finance, MaaS, and consumer finance sectors, underlining its role in changing consumer behavior and reshaping the way vehicles are financed and used.

The car leasing market is experiencing significant growth, driven by the increasing preference for flexible vehicle ownership models and the growing cost of vehicle purchase and maintenance. Rising urbanization, expanding corporate fleets, and enhanced financing solutions are encouraging both individual and business customers to adopt leasing options. Market expansion is further supported by advancements in telematics, fleet management systems, and digital leasing platforms that simplify the leasing process and improve customer experience.

Regulatory incentives promoting eco-friendly vehicles and the rising focus on corporate sustainability are shaping leasing decisions, particularly in large organizations and commercial fleets. The convenience of predictable monthly payments, minimal upfront investment, and the ability to upgrade vehicles regularly are fueling consumer adoption.

Additionally, urban mobility trends and growing awareness of total cost of ownership are prompting individuals to favor leasing over traditional ownership As the automotive industry continues to evolve and digital solutions become integral to vehicle management, the car leasing market is expected to witness sustained growth and increasing penetration across both private and corporate sectors.

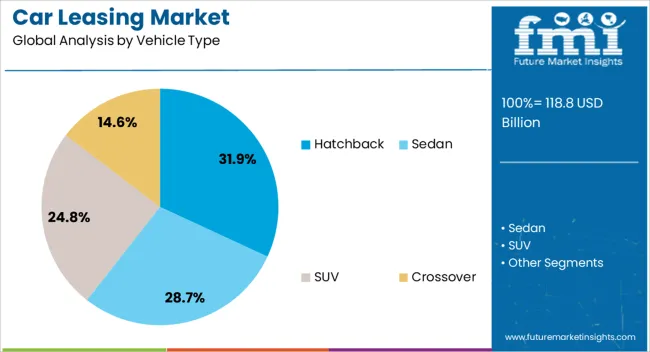

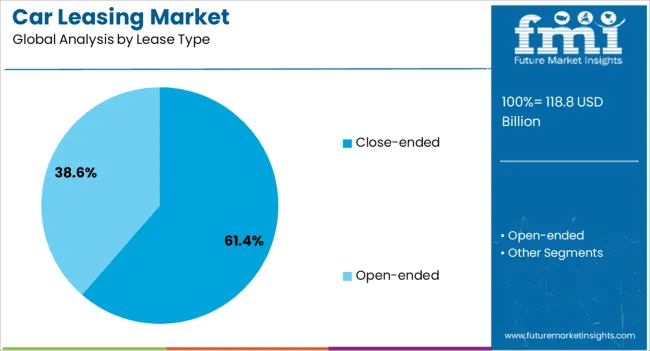

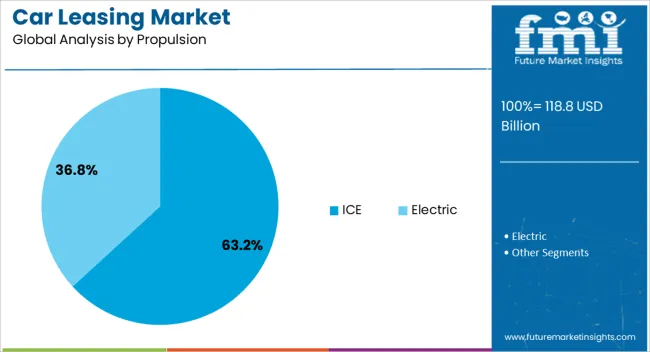

The car leasing market is segmented by vehicle type, lease type, propulsion, end use, and geographic regions. By vehicle type, car leasing market is divided into hatchback, sedan, SUV, and crossover. In terms of lease type, car leasing market is classified into close-ended and open-ended. Based on propulsion, car leasing market is segmented into ICE and electric. By end use, car leasing market is segmented into commercial and individual. Regionally, the car leasing industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The hatchback vehicle type segment is projected to hold 31.9% of the car leasing market revenue share in 2025, making it the leading vehicle type. Its popularity is being driven by affordability, fuel efficiency, and ease of maneuverability in congested urban environments, which aligns with the needs of both individual and corporate lessees. Hatchbacks offer lower maintenance costs and competitive resale value, which improves total cost of ownership for leasing customers.

Their compact size facilitates convenient parking and navigation in cities, enhancing user experience and adoption. Fleet operators prefer hatchbacks for cost-effective solutions in ride-sharing, corporate mobility programs, and urban delivery services.

The segment is further supported by automakers expanding hatchback offerings with modern features, safety enhancements, and connectivity options, making them more attractive to a broad customer base Overall, the combination of economic, operational, and convenience factors is reinforcing hatchbacks as the preferred vehicle type in the leasing market.

The close-ended lease type segment is expected to capture 61.4% of the car leasing market revenue share in 2025, establishing it as the leading lease type. Its dominance is being driven by the predictability and risk mitigation it provides to both lessees and lessors. Fixed-term contracts with clearly defined residual values minimize financial uncertainty, making budgeting easier for businesses and individual customers.

Lessees benefit from the flexibility to return the vehicle at the end of the contract without concerns about depreciation or resale value. The segment is increasingly preferred by corporate clients managing large fleets, as it simplifies accounting and reduces administrative burdens.

Growing awareness of total cost of ownership and the availability of bundled services such as maintenance, insurance, and roadside assistance further enhance the attractiveness of close-ended leases This leasing structure is also being supported by digital platforms that streamline contract management, payments, and vehicle tracking, solidifying its position as the dominant lease type in the market.

The internal combustion engine propulsion segment is projected to account for 63.2% of the car leasing market revenue share in 2025, making it the leading propulsion type. This leadership is being supported by the wide availability of ICE vehicles across multiple vehicle categories, extensive fueling infrastructure, and comparatively lower acquisition and leasing costs.

Lessees benefit from familiar technology, consistent performance, and predictable maintenance requirements, which simplify adoption for both individual and corporate customers. Fleet operators often prefer ICE vehicles for longer range applications and higher payload capacity, particularly in urban and suburban logistics operations.

Despite the rise of electric vehicles, ICE propulsion continues to dominate due to its well-established supply chain, repair ecosystem, and variety of models catering to different budget segments The segment’s ongoing leadership is further reinforced by incremental efficiency improvements, emission control technologies, and favorable financing options that make ICE vehicles a practical and cost-effective choice for the majority of leasing customers globally.

The car leasing market is experiencing robust growth due to increasing consumer demand for flexible vehicle solutions, with advancements in technology offering more personalized leasing options. Opportunities are emerging through the integration of electric vehicles and subscription-based models, while trends indicate a strong shift towards shared mobility and digitalization. Challenges arising from supply chain disruptions and rising vehicle costs pose potential hurdles, but leasing companies are finding innovative solutions to address these concerns. The market is expected to continue expanding as consumer preferences evolve and leasing providers adapt to these shifts.

The car leasing market is being driven by growing consumer demand for flexible and cost-effective vehicle ownership solutions. With increasing preference for short-term commitments, leasing has emerged as an attractive alternative to traditional vehicle purchases. Consumers are drawn to the ability to drive newer models without the long-term financial commitment, especially with the rising cost of vehicle ownership. The ease of maintenance, inclusive insurance packages, and low upfront costs make leasing highly popular, especially among young professionals and urban dwellers. This demand is further fueled by increased awareness of the benefits of leasing, such as lower monthly payments and the option to upgrade vehicles regularly. Leasing also offers consumers access to luxury cars and more expensive models that they might not have otherwise considered purchasing outright, contributing to the market's expansion.

Opportunities within the car leasing market are emerging from changing consumer preferences and advancements in service offerings. As customers become more accustomed to technology-driven solutions, the demand for online leasing platforms and digital documentation has soared. Car leasing companies are expanding their offerings to include flexible terms, customization options, and the integration of electric and hybrid vehicles in their fleets. The increasing trend of consumers seeking a hassle-free experience is compelling leasing firms to adopt seamless, customer-friendly processes such as doorstep delivery, real-time tracking, and mobile apps. Partnerships with ride-sharing services and the introduction of subscription-based leasing models present new avenues for market growth, especially in urban environments where mobility needs are changing rapidly.

The car leasing market is seeing key trends influenced by the growing popularity of shared mobility and fleet management services. Consumers are increasingly opting for car subscriptions that provide more flexibility than traditional leases, allowing for more frequent model swaps and access to various vehicle types. The trend toward shared ownership and flexible leasing options is especially evident in younger generations who value convenience and reduced long-term commitments. Additionally, there is a noticeable shift towards electric vehicles (EVs), with leasing companies incorporating EVs into their fleets as consumers opt for eco-friendly transportation. The trend is also seen in corporate fleets, where companies are moving toward EV leasing as part of their sustainability initiatives. These evolving trends reflect how the car leasing market is aligning itself with changing global preferences, creating a competitive environment for leasing providers.

Despite the growing demand, the car leasing market is facing challenges related to fluctuating market conditions, supply chain disruptions, and rising vehicle prices. The global chip shortage, for example, has affected the production of vehicles, leading to inventory shortages and delays in fleet expansion for leasing companies. Additionally, inflationary pressures and increasing vehicle costs are affecting the affordability of leasing plans, which could potentially limit market growth in certain segments. The uncertainty around fuel prices and government regulations surrounding emissions also presents challenges for leasing companies, particularly those offering traditional combustion engine vehicles. Leasing firms must navigate these challenges by adjusting their pricing models, diversifying their fleets, and strategically managing their inventory to maintain competitiveness and profitability in an increasingly unpredictable market.

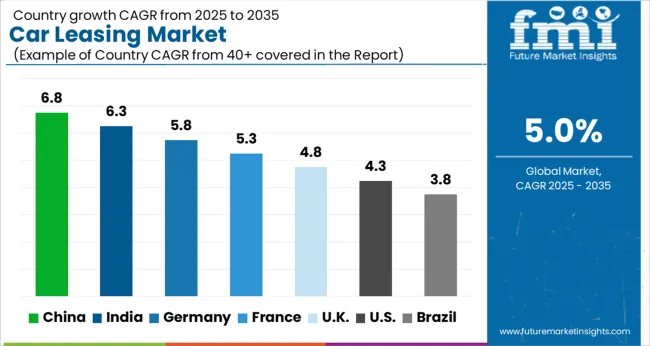

| Country | CAGR |

|---|---|

| China | 6.8% |

| India | 6.3% |

| Germany | 5.8% |

| France | 5.3% |

| UK | 4.8% |

| USA | 4.3% |

| Brazil | 3.8% |

The global car leasing market is projected to grow at a CAGR of 5% from 2025 to 2035. China leads with a growth rate of 6.8%, followed by India at 6.3%, and France at 5.3%. The United Kingdom records a growth rate of 4.8%, while the United States shows a comparatively slower growth of 4.3%. Growth is driven by increased urbanization, rising disposable income, and the shift towards shared mobility solutions. Emerging economies like China and India benefit from a growing middle class and preference for flexible vehicle ownership, while developed markets such as the USA and UK focus on sustainable transportation and innovative leasing models. This report includes insights on 40+ countries; the top markets are shown here for reference.

The car leasing market in China is expanding rapidly with a growth rate of 6.8%, supported by the rise in disposable income and urbanization. As urban populations grow, there is a shift in consumer behavior toward flexible transportation options like car leasing. Additionally, the government’s support for green initiatives is fueling demand for electric vehicle (EV) leasing, contributing to the market’s growth. Chinese car leasing companies are increasingly offering a wide range of services, including long-term leases, short-term rentals, and even corporate leasing solutions for businesses. As more companies adopt leasing models, the market in China is poised for further growth.

The car leasing market in India is growing at a strong pace with a 6.3% CAGR, driven by an expanding middle class and a shift toward urbanization. Car leasing in India is becoming more attractive due to rising awareness about its cost-effectiveness compared to traditional car ownership. Increasing demand for corporate leasing solutions, along with the growing adoption of fleet management by businesses, is contributing to the market’s growth. The expansion of car-sharing platforms and the rise of electric vehicle (EV) leasing are further pushing the market forward, as consumers seek affordable, environmentally friendly options.

The car leasing market in France is expected to grow at a 5.3% CAGR, fueled by a strong preference for flexible mobility solutions and the adoption of eco-friendly vehicles. Consumers in France are increasingly seeking alternatives to traditional car ownership, especially in urban areas where parking and maintenance costs are higher. The market has seen a rise in demand for electric vehicle (EV) leasing as the French government offers incentives for sustainable transportation. Additionally, businesses and corporate fleets are increasingly opting for leasing solutions to reduce fleet management costs. The French market is also experiencing a shift toward short-term leases, catering to the growing need for flexible mobility solutions.

The car leasing market in the United Kingdom is growing at a moderate pace of 4.8%, with a noticeable shift in consumer preferences toward mobility solutions that offer flexibility and lower upfront costs. The UK’s car leasing market is increasingly characterized by a rising demand for electric vehicles (EVs), driven by both environmental awareness and government policies promoting greener transportation. Additionally, the adoption of car-sharing models and subscription-based car leasing services is growing, especially among urban dwellers and younger generations. Leasing companies in the UK are adapting to these trends by offering more diversified leasing options, from short-term rentals to long-term contracts.

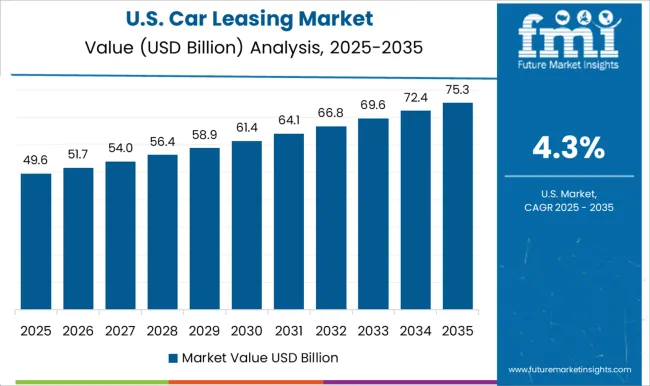

The car leasing market in the United States is growing at a slower pace of 4.3%, driven by evolving consumer preferences and a shift toward shared mobility solutions. Leasing is particularly popular in metropolitan areas, where high car ownership costs, such as insurance and maintenance, are discouraging traditional vehicle purchases. Additionally, corporate fleets and businesses are increasingly opting for vehicle leasing to reduce capital expenditure and enhance operational flexibility. The market is also experiencing a growing demand for electric vehicle (EV) leasing, as American consumers become more environmentally conscious and governments provide incentives for EV adoption.

The car leasing market is experiencing robust growth as both consumers and businesses increasingly prefer leasing vehicles over purchasing them, driven by the flexibility, cost-effectiveness, and convenience that leasing offers. Leading players in the market such as ALD Automotive, Ally Financial, and Avis Budget Group are capitalizing on this demand by providing a wide range of leasing options for individuals, fleets, and corporate clients. The growth of ride-sharing services, the increasing adoption of electric vehicles, and the shift towards a subscription-based car ownership model are further fueling the expansion of the car leasing market. Additionally, BNP Paribas SA and Deutsche Leasing AG are enhancing their service portfolios to cater to diverse consumer preferences, offering long-term and short-term lease agreements with flexible payment options and tailored services.

The flexibility and lower upfront costs of leasing continue to make it an attractive option for a variety of customers across the globe. As the market evolves, the competitive landscape is becoming more dynamic, with traditional financial institutions such as Chase Auto Finance and Ford Motor Credit entering the car leasing space, offering competitive interest rates and a wide variety of vehicle models. Technological advancements, such as mobile apps and online platforms for easy lease management and payment, are enhancing customer experience and driving market growth.

Additionally, the increasing preference for electric vehicles and hybrid models is leading to a shift in leasing portfolios, with major players like Ford Motor Credit adapting their offerings to accommodate the demand for eco-friendly options. These trends, combined with rising fuel prices and changing consumer preferences towards more flexible and sustainable mobility options, position the car leasing market for continued expansion in the coming years. The ability to provide tailored leasing solutions that meet evolving customer needs will be crucial for companies aiming to maintain a competitive edge in this growing market.

| Item | Value |

|---|---|

| Quantitative Units | USD 118.8 billion |

| Vehicle Type | Hatchback, Sedan, SUV, and Crossover |

| Lease Type | Close-ended and Open-ended |

| Propulsion | ICE and Electric |

| End Use | Commercial and Individual |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | ALD Automotive, Ally Financial, Avis Budget Group, BNP Paribas SA, Chase Auto Finance, Deutsche Leasing AG, and Ford Motor Credit |

| Additional Attributes | Dollar sales by lease type (operational leasing, financial leasing) and vehicle type (compact, luxury, electric, commercial) are key metrics. Trends include rising demand for flexible leasing options, growth in electric vehicle adoption, and increasing preference for long-term rental solutions in urban areas. Regional adoption, consumer preferences, and regulatory incentives are driving market growth. |

The global car leasing market is estimated to be valued at USD 118.8 billion in 2025.

The market size for the car leasing market is projected to reach USD 193.6 billion by 2035.

The car leasing market is expected to grow at a 5.0% CAGR between 2025 and 2035.

The key product types in car leasing market are hatchback, sedan, and others.

In terms of lease type, close-ended segment to command 61.4% share in the car leasing market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Carboxymethyl Tamarind Kernel Powder Market Size and Share Forecast Outlook 2025 to 2035

Car Tail Light Mould Market Size and Share Forecast Outlook 2025 to 2035

Car OS Market Size and Share Forecast Outlook 2025 to 2035

Caramel Malt Market Size and Share Forecast Outlook 2025 to 2035

Carbon Capture and Sequestration Market Forecast Outlook 2025 to 2035

Cardiac Rehabilitation Market Size and Share Forecast Outlook 2025 to 2035

Carbon Dioxide Incubators Market Size and Share Forecast Outlook 2025 to 2035

Carboxymethyl Tamarind Gum (CMT) Market Size and Share Forecast Outlook 2025 to 2035

Car Cover Market Size and Share Forecast Outlook 2025 to 2035

Cardiology Information System Market Size and Share Forecast Outlook 2025 to 2035

Cardiopulmonary Functional Testing Platform Market Size and Share Forecast Outlook 2025 to 2035

Carbon Enhanced Lead Acid Battery Market Size and Share Forecast Outlook 2025 to 2035

Car Bushing Market Size and Share Forecast Outlook 2025 to 2035

Carbon-negative Cement Market Size and Share Forecast Outlook 2025 to 2035

Card Printer Ribbon Market Size and Share Forecast Outlook 2025 to 2035

Carbon Tetrabromide Market Size and Share Forecast Outlook 2025 to 2035

Carbon Steel Market Size and Share Forecast Outlook 2025 to 2035

Carpet Spot Remover Market Size and Share Forecast Outlook 2025 to 2035

Cardiovascular CT Systems Market Size and Share Forecast Outlook 2025 to 2035

Carbon Brush Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA