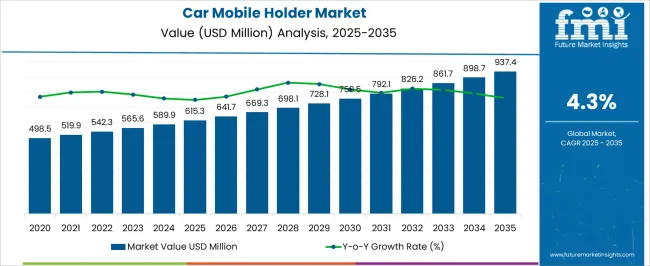

The car mobile holder market is estimated to be valued at USD 615.3 million in 2025 and is projected to reach USD 937.4 million by 2035, registering a compound annual growth rate (CAGR) of 4.3% over the forecast period.

The market exhibits characteristics of a mature phase within the adoption lifecycle, as initial rapid adoption driven by smartphone proliferation and in-vehicle connectivity has largely stabilized. Consumer demand continues to expand steadily, but the pace indicates that the market is transitioning from early majority adoption into late majority stages. This gradual growth suggests that product differentiation, design innovation, and enhanced functionality are now critical to sustaining consumer interest. The annual incremental growth from USD 615.3 million in 2025 to USD 937.4 million in 2035 highlights a relatively consistent uptake, with no dramatic spikes, reinforcing the view of a mature market where adoption is widespread but incremental.

Saturation levels in key regions, particularly Asia-Pacific and North America, suggest that the focus is shifting toward replacement cycles, premium features, and integration with vehicle dashboards rather than purely first-time adoption. Innovation in material quality, adjustable mechanisms, and wireless charging capabilities is likely to influence future adoption rates. The market is characterized by steady, predictable growth, with the adoption lifecycle firmly in the mature stage, indicating that incremental enhancements and value-added features will drive continued consumer engagement and market expansion over the coming decade.

The car mobile holder market represents a specialized segment within the automotive accessories and consumer electronics industry, emphasizing convenience, safety, and device accessibility. Within the broader automotive accessories market, it accounts for about 4.8%, driven by widespread smartphone adoption and in-vehicle usage. In the mobile and personal electronics accessories segment, it holds nearly 5.2%, reflecting demand for hands-free and ergonomic solutions. Across the vehicle interior and dashboard accessories market, the segment captures 3.9%, supporting customization and driver convenience.

Within the e-commerce and online retail distribution channel category, it represents 3.4%, highlighting the role of digital sales channels. In the car aftermarket products sector, it secures 4.1%, emphasizing adoption in both new and existing vehicles for enhanced driver safety and comfort. Recent developments in this market have focused on multifunctional designs, material innovation, and mounting versatility. Innovations include magnetic, wireless charging integrated, and adjustable holders compatible with diverse smartphone sizes. Key players are collaborating with smartphone manufacturers and automotive OEMs to optimize compatibility and improve ergonomic design.

Use of high-strength plastics, silicone, and aluminum alloys has enhanced durability and grip performance. The integration of suction, vent clip, and adhesive mounting options has broadened installation flexibility. Digital retail expansion and social media marketing campaigns have accelerated consumer adoption. These advancements demonstrate how convenience, safety, and technological integration are driving growth in the car mobile holder market.

| Metric | Value |

|---|---|

| Car Mobile Holder Market Estimated Value in (2025 E) | USD 615.3 million |

| Car Mobile Holder Market Forecast Value in (2035 F) | USD 937.4 million |

| Forecast CAGR (2025 to 2035) | 4.3% |

The car mobile holder market is witnessing robust expansion, driven by increasing smartphone penetration, heightened road safety awareness, and the growing demand for hands-free navigation solutions. Market performance has been supported by advancements in design ergonomics, material durability, and adjustable mechanisms, which enhance user convenience and compatibility with diverse vehicle types. Regulatory emphasis on reducing distracted driving incidents has further reinforced adoption rates, particularly in developed regions.

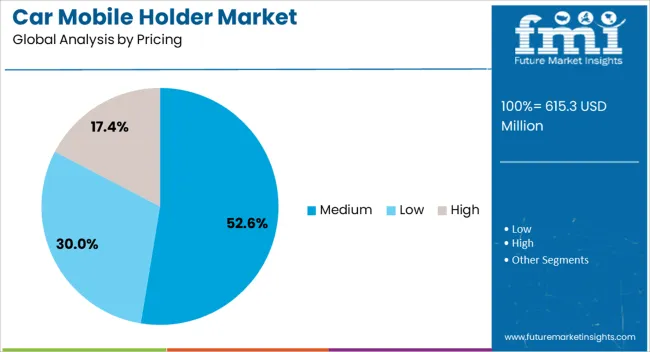

Pricing segmentation has allowed manufacturers to cater to both cost-conscious and premium buyers, creating a balanced demand landscape. Competitive intensity has prompted continuous product innovation, including multi-angle adjustability and integrated charging capabilities, to secure brand differentiation.

Distribution channels, spanning online marketplaces and offline automotive accessory outlets, have been instrumental in improving product accessibility across urban and semi-urban markets Over the forecast period, sustained consumer preference for enhanced driving comfort, combined with incremental technological integration, is expected to drive consistent revenue growth and broaden the market footprint globally.

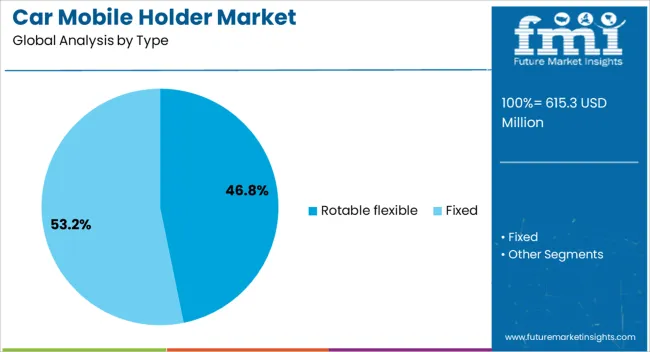

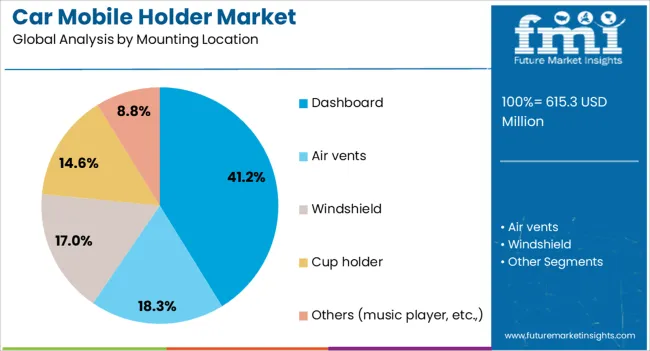

The car mobile holder market is segmented by type, mounting location, pricing, material, distribution channel, and geographic regions. By type, car mobile holder market is divided into rotable flexible and fixed. In terms of mounting location, car mobile holder market is classified into dashboard, air vents, windshield, cup holder, and others (music player, etc.,). Based on pricing, car mobile holder market is segmented into medium, low, and high. By material, car mobile holder market is segmented into plastic, rubber, glass, and others (Aluminum, metal, polycarbonate). By distribution channel, car mobile holder market is segmented into online and offline. Regionally, the car mobile holder industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The rotable flexible segment, commanding 46.80% of the type category, has emerged as the leading design preference due to its superior adaptability and enhanced user experience. Its dominance has been reinforced by the ability to rotate and adjust viewing angles, which improves usability across varying driver heights and seating positions.

The segment benefits from widespread compatibility with multiple smartphone sizes and mounting systems, making it a versatile choice for both personal and commercial vehicle owners. Production scalability, supported by standardized manufacturing techniques, has ensured steady supply to meet rising demand.

Additionally, this design’s ability to accommodate diverse use cases, such as navigation, calling, and media streaming, without obstructing the driver’s view, has contributed to its strong market position Continuous refinement in joint stability, material resilience, and ease of installation is anticipated to sustain the segment’s leadership in the coming years.

The dashboard segment, holding 41.20% of the mounting location category, remains the preferred installation choice due to its ergonomic accessibility and minimal interference with driving controls. Its popularity is supported by enhanced visibility for navigation and ease of interaction without requiring the driver to avert attention significantly.

The segment has benefited from innovations in adhesive and suction technologies, which ensure secure placement even under varying temperature and vibration conditions. Compatibility with a wide range of vehicle interiors and the absence of permanent modifications have further fueled adoption across diverse consumer demographics.

Manufacturers have been focusing on offering aesthetically integrated designs that blend with modern dashboard layouts, enhancing the visual appeal while maintaining functionality Over the forecast period, steady consumer inclination toward convenience and safety, alongside rising availability of universal dashboard mounts, is expected to reinforce the segment’s competitive standing.

The medium pricing tier, accounting for 52.60% of the pricing category, has established its dominance by striking a balance between affordability and quality. Products in this range offer durability, functional versatility, and modern aesthetics without the premium price tag, making them attractive to a wide consumer base.

This segment has gained traction among both first-time buyers and repeat customers seeking value-for-money solutions. Manufacturers operating in this range have leveraged economies of scale to maintain competitive pricing while integrating advanced features such as adjustable arms, 360-degree rotation, and robust locking mechanisms.

The segment’s strong presence in both online and offline retail channels has enhanced accessibility, contributing to consistent sales performance With demand driven by the preference for dependable yet cost-effective products, the medium pricing category is expected to maintain its leadership, supported by strategic marketing and incremental product enhancements.

The market has experienced robust growth due to the increasing reliance on smartphones for navigation, communication, and infotainment while driving. Car mobile holders provide secure mounting solutions, ensuring driver convenience, hands-free operation, and improved road safety. Rising smartphone penetration, growth of connected car technologies, and demand for ergonomic in-vehicle accessories have fueled adoption across passenger cars, commercial vehicles, and ride-sharing fleets. Technological advancements in adjustable grips, magnetic mounts, wireless charging compatibility, and multi-angle positioning have enhanced product functionality. Expansion of e-commerce platforms and organized automotive accessory retail channels has increased accessibility.

Growing awareness of road safety and strict regulations against mobile phone usage while driving have significantly contributed to the adoption of car mobile holders. Drivers are increasingly required to use hands-free devices to reduce accidents and comply with traffic laws. Car mobile holders allow secure placement of smartphones for GPS navigation, music control, and voice-assisted commands without diverting attention from the road. Fleet operators, taxi services, and logistics companies are increasingly equipping vehicles with mobile holders to ensure compliance with safety standards. Rising consumer consciousness about safe driving practices, combined with regulatory enforcement, has strengthened demand, positioning car mobile holders as essential automotive accessories in both personal and commercial vehicles.

Advances in product design, materials, and connectivity have improved the functionality, durability, and versatility of car mobile holders. Features such as 360-degree rotation, telescopic arms, magnetic mounts, suction cups, and dashboard or air vent attachments enhance ease of use and compatibility with various smartphone sizes. Integration with wireless charging capabilities, GPS tracking, and app-based locking mechanisms has further improved utility. Manufacturers are also focusing on premium materials, ergonomic designs, and customizable aesthetics to appeal to consumer preferences. These technological improvements have elevated the user experience, increased product adoption, and created opportunities for differentiation in a competitive market.

The expansion of organized retail outlets, automotive accessory stores, and e-commerce platforms has significantly increased the availability and visibility of car mobile holders. Online marketplaces allow consumers to compare features, read reviews, and access a wide variety of models, fostering informed purchase decisions. Retail partnerships with automotive dealerships and ride-sharing companies have also enhanced market penetration. Promotions, seasonal discounts, and bundled accessory offerings have further stimulated demand. The combination of offline and online distribution channels ensures accessibility across urban and semi-urban regions, contributing to consistent market growth.

Emerging markets in Asia-Pacific, Latin America, and Africa present significant growth potential for car mobile holders due to rising smartphone penetration, expanding automotive sales, and increasing adoption of ride-hailing services. Consumers in these regions are seeking affordable, durable, and multifunctional holders compatible with local vehicle types and smartphone models. Customization in terms of color, material, and integrated features such as wireless charging or additional storage solutions is driving differentiation. Growing awareness of road safety, convenience, and connected car technology further supports market expansion. These factors collectively provide ample opportunities for manufacturers to innovate, localize production, and capture increasing demand in emerging economies globally.

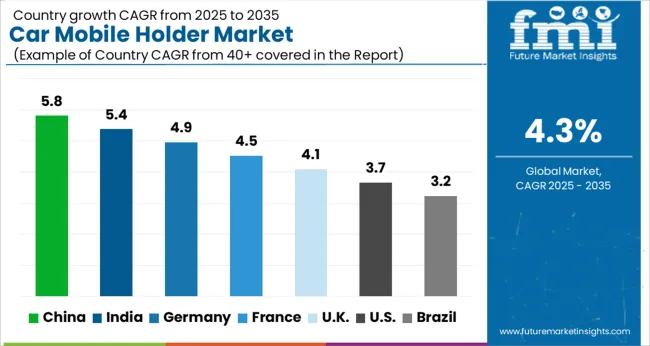

| Country | CAGR |

|---|---|

| China | 5.8% |

| India | 5.4% |

| Germany | 4.9% |

| France | 4.5% |

| UK | 4.1% |

| USA | 3.7% |

| Brazil | 3.2% |

The market is projected to witness steady expansion driven by increasing smartphone usage and in-vehicle convenience solutions. China leads with a 5.8% growth rate, propelled by widespread adoption in passenger vehicles and rising e-commerce availability. India follows at 5.4%, scaling through growing urban vehicle penetration and mobile accessory demand. Germany grows at 4.9%, supported by integration of ergonomic and safety-oriented designs in automotive interiors. The United Kingdom records 4.1%, innovating through smart mounting solutions and advanced material utilization. The United States achieves 3.7%, where demand from personal and commercial vehicles sustains steady market activity. These countries represent a varied landscape of production, deployment, and technological adoption in car mobile holders. This report includes insights on 40+ countries; the top markets are shown here for reference.

China is expected to expand at a CAGR of 5.8%, driven by rising smartphone penetration and increasing vehicle sales. Consumers are seeking convenient and safe solutions for mounting smartphones while driving, contributing to steady adoption. E-commerce platforms, automotive accessory stores, and specialized outlets are increasing product availability. Manufacturers are focusing on innovative designs, such as adjustable grips, magnetic mounts, and wireless charging-enabled holders, to cater to diverse customer preferences. Growing awareness of road safety regulations and hands-free device usage is also boosting market growth. Collaborations with car accessory brands and automotive companies enhance product visibility and adoption. Product diversification, including portable, dashboard, and vent-mounted holders, is further stimulating market demand.

India is anticipated to grow at a CAGR of 5.4%, supported by increasing smartphone usage and a rise in personal vehicle ownership. Consumers are adopting mobile holders to ensure safe driving and hands-free usage. Local and international manufacturers are offering products with adjustable mounts, magnetic grips, and flexible designs to meet diverse vehicle types and user needs. E-commerce and automotive retail channels are expanding product accessibility across urban and semi-urban regions. Regulatory emphasis on road safety and driver attention is fostering the adoption of hands-free accessories. Promotional campaigns, product demonstrations, and collaborations with car accessory brands are increasing consumer awareness and adoption in the Indian market.

Germany’s market is projected to grow at a CAGR of 4.9%, fueled by technological integration in vehicles and increasing focus on road safety. Consumers prefer holders that allow secure positioning of smartphones while driving, enhancing hands-free communication and navigation. Manufacturers emphasize high-quality materials, ergonomic designs, and compatibility with various car models. Online and retail automotive stores are major distribution channels. Consumer awareness campaigns and government initiatives highlighting safe driving practices further contribute to market adoption. Advanced features, such as wireless charging and magnetic locking mechanisms, are creating differentiation and boosting growth in Germany.

The UK market for car mobile holders is expected to expand at a CAGR of 4.1%, driven by increasing smartphone penetration and adherence to road safety regulations. Consumers are opting for mobile holders that ensure hands-free operation, improve navigation, and enhance driving safety. Product differentiation, such as vent-mounted, dashboard, and magnetic holders, addresses various vehicle models and user preferences. Retailers and online platforms are enhancing product accessibility, while collaborations between automotive accessory manufacturers and tech brands help raise awareness. Continuous innovations in design and usability, along with consumer education on safe driving, are strengthening the market outlook in the United Kingdom.

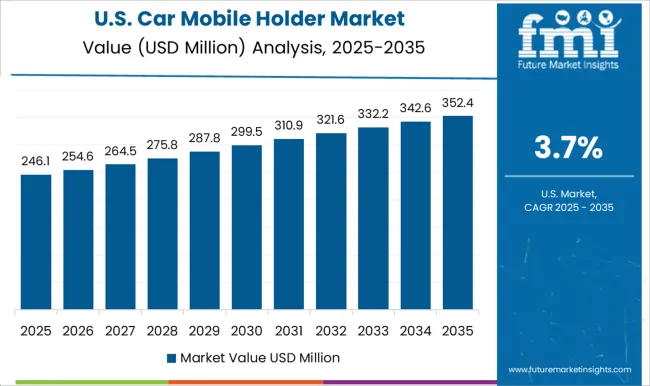

The United States market is projected to grow at a CAGR of 3.7%, supported by increasing reliance on smartphones for navigation, communication, and entertainment while driving. Consumers prefer holders that provide secure, adjustable mounting options compatible with different vehicles. Manufacturers are offering portable, vent-mounted, and magnetic holders to meet the evolving demands of drivers. Online marketplaces, automotive accessory stores, and specialty outlets enhance product availability nationwide. Awareness campaigns promoting safe driving practices and hands-free usage are also contributing to adoption. Continuous innovation in holder design, usability, and integration with car interiors is expected to sustain market growth in the US.

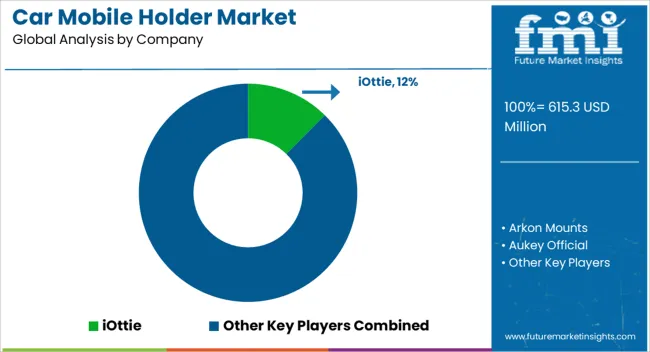

The market has experienced significant growth due to increasing smartphone adoption, rising vehicle connectivity, and growing awareness of road safety and hands-free device usage. iOttie is recognized as a leading provider, offering adjustable and ergonomic mobile holders compatible with various vehicle dashboards and windshields, combining safety and convenience.

Arkon Mounts specializes in versatile mounting solutions that accommodate smartphones and tablets, catering to both consumer and professional needs. Aukey Official and Belkin focus on innovative designs integrating magnetic mounts and wireless charging functionalities, enhancing in-car usability. Bonafide Creation and Brodit AB provide precision-engineered holders tailored to specific vehicle models, ensuring stability, safety, and a seamless fit. Kenu and Mpow deliver compact, cost-effective solutions without compromising quality, targeting a broad consumer base. Nite Ize and Portronics emphasize durability and multifunctionality, suitable for long-term use and varying vehicle conditions.

Scosche Industries and Spigen merge aesthetics with functionality, producing holders that complement modern vehicle interiors. TechMatte, Vanmass, and WixGear complete the market ecosystem by offering universal, customizable holders designed for adaptability, innovation, and enhanced user experience, driving widespread adoption across regions. The combined focus on safety, convenience, design, and technological integration positions these players to lead market growth and influence future trends.

| Item | Value |

|---|---|

| Quantitative Units | USD 615.3 million |

| Type | Rotable flexible and Fixed |

| Mounting Location | Dashboard, Air vents, Windshield, Cup holder, and Others (music player, etc.,) |

| Pricing | Medium, Low, and High |

| Material | Plastic, Rubber, Glass, and Others (Aluminum, metal, polycarbonate) |

| Distribution Channel | Online and Offline |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | iOttie, Arkon Mounts, Aukey Official, Belkin, Bonafide Creation, Brodit AB, Kenu, Mpow, Nite Ize, Portronics, Scosche Industries, Spigen, TechMatte, Vanmass, and WixGear |

| Additional Attributes | Dollar sales by holder type and vehicle category, demand dynamics across passenger and commercial vehicles, regional trends in mobile accessory adoption, innovation in adjustability, mounting mechanisms, and material durability, environmental impact of production and disposal, and emerging use cases in hands-free navigation, entertainment, and safety solutions. |

The global car mobile holder market is estimated to be valued at USD 615.3 million in 2025.

The market size for the car mobile holder market is projected to reach USD 937.4 million by 2035.

The car mobile holder market is expected to grow at a 4.3% CAGR between 2025 and 2035.

The key product types in car mobile holder market are rotable flexible and fixed.

In terms of mounting location, dashboard segment to command 41.2% share in the car mobile holder market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Mobile Cardiac Telemetry System Market Size and Share Forecast Outlook 2025 to 2035

Mobile Car Wash & Detailing Market Growth - Trends & Forecast 2025 to 2035

Car Phone Holder Market Analysis by Type, Vehicle, Material Type, Distribution Channel, and Region, Forecast through 2035

Mobile Healthcare Devices Market Size and Share Forecast Outlook 2025 to 2035

Healthcare Mobile Computers Market Size and Share Forecast Outlook 2025 to 2035

Business Card Holder Market from 2024 to 2034

Mobile Camping Toilet Market Size and Share Forecast Outlook 2025 to 2035

Cartridge Heating Element Market Size and Share Forecast Outlook 2025 to 2035

Mobile Phone Screen Underlayer Cushioning Material Market Size and Share Forecast Outlook 2025 to 2035

Carboxymethyl Tamarind Kernel Powder Market Size and Share Forecast Outlook 2025 to 2035

Car Tail Light Mould Market Size and Share Forecast Outlook 2025 to 2035

Mobile Application Store Market Size and Share Forecast Outlook 2025 to 2035

Car OS Market Size and Share Forecast Outlook 2025 to 2035

Caramel Malt Market Size and Share Forecast Outlook 2025 to 2035

Carbon Capture and Sequestration Market Forecast Outlook 2025 to 2035

Cardiac Rehabilitation Market Size and Share Forecast Outlook 2025 to 2035

Carbon Dioxide Incubators Market Size and Share Forecast Outlook 2025 to 2035

Carboxymethyl Tamarind Gum (CMT) Market Size and Share Forecast Outlook 2025 to 2035

Car Cover Market Size and Share Forecast Outlook 2025 to 2035

Mobile Money Market Forecast and Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA