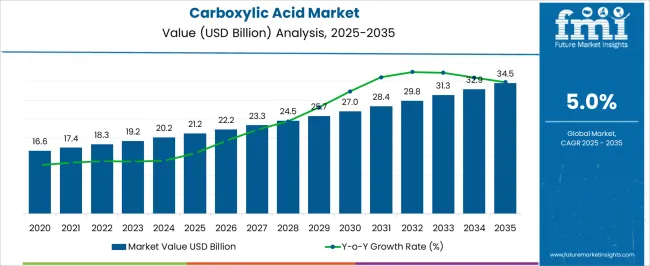

The carboxylic acid market is estimated to be valued at USD 21.2 billion in 2025 and is projected to reach USD 34.5 billion by 2035, registering a compound annual growth rate (CAGR) of 5.0% over the forecast period.

A 10-year growth comparison highlights the progression of market expansion over the forecast horizon, showing both absolute value gains and relative growth rates. In the initial phase, from 2025 to 2028, incremental growth is moderate as the market primarily benefits from steady demand in applications such as coatings, plastics, pharmaceuticals, and personal care products. Adoption in emerging regions, particularly Asia Pacific, drives a noticeable portion of the early expansion. Between 2028 and 2032, growth gains accelerate slightly as industrial demand increases, fueled by higher production of specialty chemicals, performance additives, and polymer intermediates. This mid-phase contributes a larger share of the total 10-year growth, reflecting broader penetration in manufacturing and chemical processing sectors.

In the final phase, from 2032 to 2035, growth stabilizes, with incremental gains resulting from product innovation, higher-value derivatives, and increasing regulatory compliance for environmentally compatible formulations. Comparing the first and second halves of the decade shows that while early-stage growth is steady, the mid-decade period accounts for stronger absolute expansion, and later years consolidate gains. This 10-year comparison underscores the role of regional adoption, industrial output, and innovation in shaping long-term value creation in the carboxylic acid market.

| Metric | Value |

|---|---|

| Carboxylic Acid Market Estimated Value in (2025 E) | USD 21.2 billion |

| Carboxylic Acid Market Forecast Value in (2035 F) | USD 34.5 billion |

| Forecast CAGR (2025 to 2035) | 5.0% |

The market is shaped by several upstream sectors. Chemical and specialty chemical manufacturers account for approximately 37%, producing acids for polymers, surfactants, and coatings. Pharmaceutical and healthcare companies contribute about 23%, using carboxylic acids as intermediates in drug synthesis. Food and beverage industry represents roughly 18%, employing acids as preservatives, acidulants, and flavor enhancers. Agrochemical producers hold close to 13%, applying acids in herbicides, pesticides, and fertilizers.

Cosmetics and personal care product manufacturers make up the remaining 9%, utilizing acids for formulation stabilization and pH regulation. The market is expanding with increasing demand for biobased and specialty acids. Biobased acids now account for over 21% of new product launches, supporting sustainable manufacturing. Polymer applications, particularly in polyesters and plasticizers, have grown by 12% year-on-year, driving higher acid consumption. Pharmaceutical intermediates have risen by 8%, reflecting increasing drug synthesis activity. Continuous flow production techniques are improving yields by 5–6% while reducing operational costs. Regional expansion in Asia and Europe is ensuring supply reliability, particularly for high-demand industrial sectors.

The carboxylic acid market is experiencing consistent expansion, driven by its extensive use across diverse industrial sectors and ongoing advancements in chemical synthesis technologies. Industry sources and chemical manufacturing updates have noted a steady rise in demand for carboxylic acids in food processing, polymers, pharmaceuticals, and agrochemicals.

Market growth has been supported by the scaling up of production capacities, particularly in Asia-Pacific, where end-user industries are rapidly expanding. Strategic integration of sustainable feedstocks and bio-based production routes is gaining traction, aligning with environmental regulations and consumer demand for greener chemicals.

The sector is also benefiting from innovations in downstream product applications, enhancing functionality, stability, and cost-efficiency. As global trade and industrial output recover, consumption of carboxylic acids is expected to increase steadily, with acetic acid leading in product demand due to its broad utility, and the food and beverages segment driving end-user growth due to its role in preservation, flavor enhancement, and pH regulation.

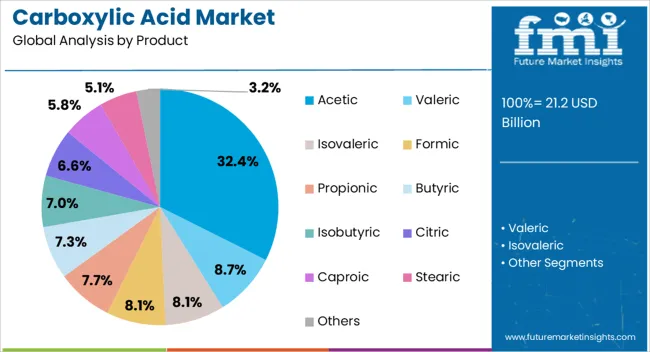

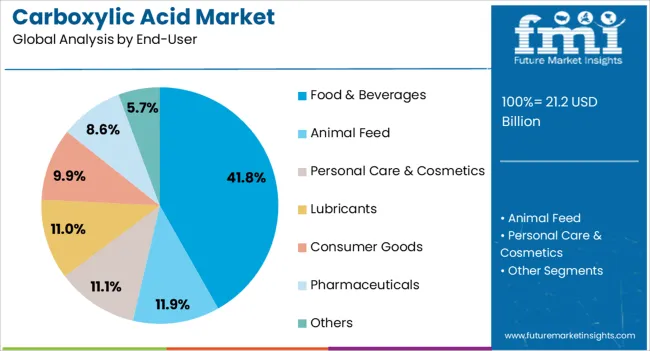

The carboxylic acid market is segmented by product, end-user, and geographic regions. By product, carboxylic acid market is divided into acetic, valeric, Isovaleric, formic, propionic, butyric, isobutyric, citric, caproic, stearic, and others. In terms of end-user, carboxylic acid market is classified into food & beverages, animal feed, personal care & cosmetics, lubricants, consumer goods, pharmaceuticals, and others. Regionally, the carboxylic acid industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The acetic segment is projected to hold 32.4% of the carboxylic acid market revenue in 2025, maintaining its position as the largest product segment. This dominance is supported by acetic acid’s versatility as a key intermediate in producing vinyl acetate monomer, acetic anhydride, and esters, as well as its widespread use in the food and beverage sector. Industry production reports highlight its consistent demand due to its effectiveness in applications ranging from food preservation to chemical synthesis. Acetic acid benefits from well-established manufacturing processes, abundant raw material availability, and strong integration into downstream industries. Additionally, its role in industrial solvents, adhesives, and coatings markets provides steady demand across multiple sectors. The combination of diversified applications and high consumption in both consumer and industrial products ensures that the acetic segment remains a cornerstone of the carboxylic acid market.

The food and beverages segment is projected to account for 41.8% of the carboxylic acid market revenue in 2025, sustaining its leadership among end-user industries. Growth in this segment is underpinned by the expanding global demand for processed foods, beverages, and convenience products, where carboxylic acids serve as preservatives, flavoring agents, and acidulants. Regulatory approvals for the safe use of specific carboxylic acids in food applications have reinforced their adoption. The segment’s strength is also linked to rising consumption in emerging markets, where urbanization and changing dietary habits are driving increased demand for packaged and shelf-stable foods. Moreover, food safety standards and quality control requirements have amplified the use of carboxylic acids to ensure product stability during storage and distribution. As the global food supply chain grows more complex and consumer preferences shift towards products with longer shelf life and consistent taste, the food and beverages segment is expected to continue as a dominant driver of market demand.

The carboxylic acid market is expanding due to industrial demand in polymers, coatings, adhesives, pharmaceuticals, and personal care products. Production of synthetic resins, specialty chemicals, and flavoring agents is supporting steady consumption of acids such as acetic, citric, and stearic acid. Asia Pacific leads consumption with robust chemical manufacturing and packaging activity, while Europe and North America focus on high-purity acids for specialty applications. Advancements in bio-based synthesis and green chemistry are improving environmental performance and operational efficiency. I believe that ongoing industrial development, regulatory compliance, and the need for reliable raw materials will maintain strong demand across multiple sectors globally.

Industrial expansion and rising consumer goods production drive carboxylic acid usage. Polymers and resins utilize acids as monomers and intermediates. Adhesives, lubricants, and coatings rely on acids for stability and performance. Personal care products employ acids for pH control, texture, and conditioning properties. Pharmaceuticals incorporate acids as active ingredients and excipients. Increasing construction activity, furniture manufacturing, and packaging solutions also reinforce demand. In my view, the combination of rising industrial activity and growing consumer markets ensures a durable foundation for carboxylic acid consumption worldwide.

Bio-based and specialty acids are expanding as manufacturers pursue environmentally compliant and high-performance solutions. Acids derived from renewable feedstocks reduce environmental impact while maintaining consistent purity levels. Specialty acids for adhesives, coatings, and lubricants provide enhanced chemical stability and compatibility. Companies investing in sustainable sourcing and product innovation are gaining access to long-term contracts in industrial and consumer sectors. I believe the combination of eco-friendly innovation and specialty-grade production will drive growth for both established and emerging players over the next decade.

Carboxylic acids are increasingly incorporated in pharmaceuticals, high-performance coatings, and adhesives. In coatings, acids act as intermediates for acrylic and alkyd resins that require chemical and thermal stability. Pharmaceutical applications include active ingredients and excipients with strict purity standards. Innovative formulations are being developed to enhance performance, reduce environmental impact, and meet industry standards. In my view, the combination of regulatory oversight, industrial innovation, and performance-driven requirements will reinforce adoption across specialty and high-value applications.

Raw material fluctuations, including acetic and citric acids, affect profitability for producers. Regulatory requirements for environmental compliance add costs, especially for small and mid-sized manufacturers. Transitioning to bio-based or high-performance formulations demands R&D and infrastructure investment. Companies that optimize supply chains, adopt sustainable technologies, and maintain quality standards are better positioned to manage costs and remain competitive in the evolving market landscape.

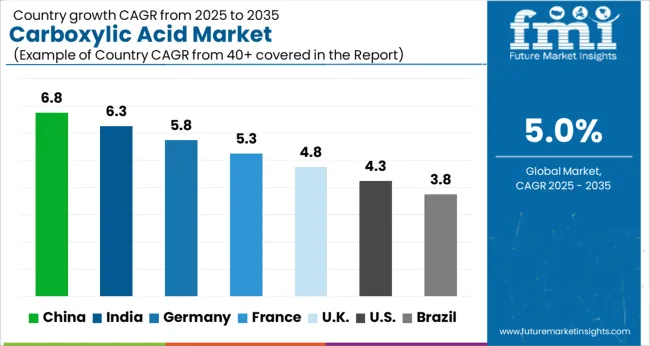

| Country | CAGR |

|---|---|

| China | 6.8% |

| India | 6.3% |

| Germany | 5.8% |

| France | 5.3% |

| UK | 4.8% |

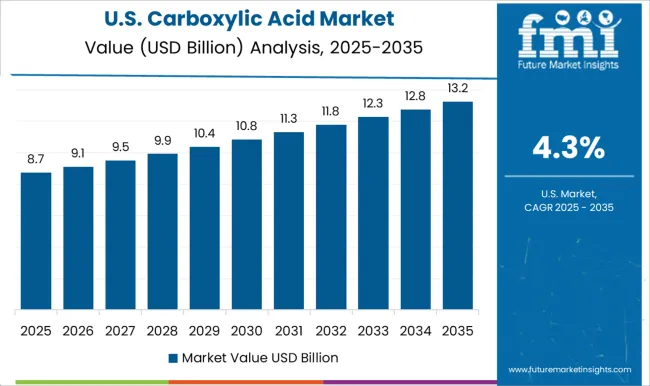

| USA | 4.3% |

| Brazil | 3.8% |

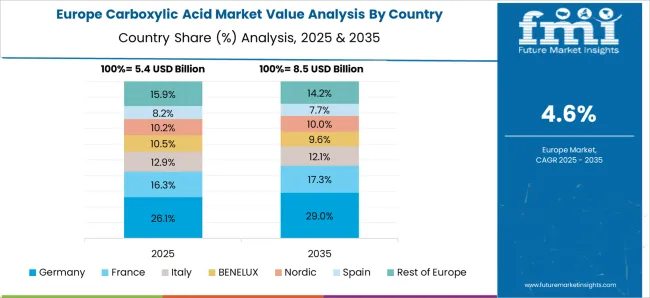

The carboxylic acid market is growing at a global CAGR of 5% from 2025 to 2035, driven by rising demand in chemical intermediates, polymers, and specialty applications. China leads with a CAGR of 6.8%, +36% above the global average, supported by BRICS-led expansion in chemical manufacturing, increasing exports, and adoption in industrial-scale production. India follows at 6.3%, +26% over the global benchmark, reflecting growing domestic chemical industries and demand for polymers and resins. Germany posts 5.8%, +16% above the global CAGR, shaped by OECD-supported innovation in bio-based carboxylic acids and applications in high-value chemicals. The United Kingdom records 4.8%, slightly below the global rate, influenced by steady but selective chemical production and adoption in specialized markets. The United States stands at 4.3%, −14% under the global average, with moderate growth driven by niche applications in coatings and pharmaceuticals. BRICS economies are leading volume growth, while OECD countries emphasize technological refinement and sustainable practices.

China is growing at a CAGR of 6.8% in the carboxylic acid market, driven by expanding chemical manufacturing and downstream industries. Rising production of polymers, coatings, and specialty chemicals is creating strong demand for acetic, citric, and adipic acids. Domestic producers are increasing capacities in Jiangsu and Shandong provinces to meet both local and export requirements. Industrial segments such as textiles, pharmaceuticals, and food processing are contributing to steady consumption. Technological advancements in production methods are improving yields and reducing energy costs. Export demand from Southeast Asia and Europe is also supporting growth, making China a significant player in the global carboxylic acid supply chain.

India is witnessing a CAGR of 6.3% in the carboxylic acid market, fueled by expansion in pharmaceutical, textile, and polymer industries. Demand for citric, acetic, and oxalic acids is rising as industrial and consumer chemical applications increase. Local manufacturers are enhancing production capacities in Gujarat and Maharashtra to serve both domestic industries and export markets. Pharmaceutical formulations, food preservatives, and chemical intermediates are key growth segments. Investments in chemical parks and industrial clusters are providing infrastructure to support manufacturing and logistics, helping India meet rising consumption needs while reducing dependency on imports.

Germany is recording a CAGR of 5.8% in the carboxylic acid market, driven by chemical and polymer industries. Demand for high-purity acids in coatings, adhesives, and specialty polymers is increasing. Producers are focusing on environmentally compliant manufacturing processes to meet EU standards, including low-emission production of acetic and adipic acids. Industrial applications in automotive, packaging, and electronics are also boosting consumption. Germany’s strong export orientation, particularly within the EU, reinforces production requirements. Research and development in biodegradable and bio-based acids is providing new growth opportunities, positioning Germany as a key supplier of specialty carboxylic acids in the European market.

The United Kingdom is expanding at a CAGR of 4.8% in the carboxylic acid market, supported by chemical, pharmaceutical, and food industries. Local production is complemented by imports from Europe and Asia to meet growing demand. Pharmaceutical applications, food additives, and coatings are primary drivers of consumption. Research and pilot projects in bio-based acids are increasing adoption of sustainable alternatives. Industrial clusters and chemical parks facilitate logistics and supply chain efficiency, helping maintain a steady supply of carboxylic acids across sectors. Partnerships between chemical producers and end-users are supporting development of tailored acid grades for specialized applications.

The United States is progressing at a CAGR of 4.3% in the carboxylic acid market, with strong consumption in polymers, coatings, and industrial chemicals. Demand for acetic, citric, and lactic acids is increasing across chemical and food processing industries. Domestic producers are expanding capacities and optimizing production to improve cost efficiency and meet quality standards. Industrial applications in packaging, adhesives, and automotive coatings are contributing to growth. Research initiatives on bio-based and low-emission acid production are gaining momentum. The USA market is also importing specialty acids to supplement domestic supply, ensuring availability for high-value industrial applications.

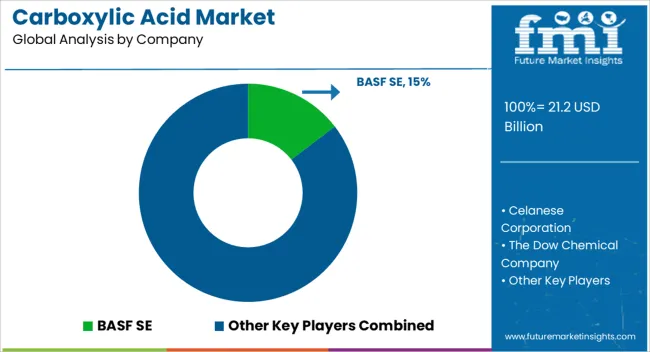

The carboxylic acid market is driven by global chemical producers and specialty manufacturers providing high-purity acids for applications in polymers, coatings, pharmaceuticals, and chemical intermediates. BASF SE is assumed to be the leading player, supported by its broad portfolio of mono-, di-, and polycarboxylic acids, along with global production and distribution networks. Celanese Corporation and The Dow Chemical Company maintain strong market positions through tailored solutions for polymer synthesis and industrial applications, emphasizing consistency, purity, and process efficiency. LyondellBasell Industries N.V. and Eastman Chemical Company enhance competitiveness by offering specialized acids designed for high-performance plastics and coatings. Alfa Aesar and Perstorp Holding AB provide region-specific solutions, combining cost-effectiveness with technical reliability for industrial and pharmaceutical applications.

Other players contribute to market depth with diverse approaches and focused product lines. Product brochures highlight technical specifications, solubility profiles, and compatibility with different chemical systems. Safety features, storage guidelines, and regulatory compliance are emphasized as key factors in selection. Collectively, these companies prioritize reliability, purity, and tailored solutions, ensuring consistent supply and performance for industrial users and chemical formulators worldwide.

| Item | Value |

|---|---|

| Quantitative Units | USD 21.2 billion |

| Product | Acetic, Valeric, Isovaleric, Formic, Propionic, Butyric, Isobutyric, Citric, Caproic, Stearic, and Others |

| End-User | Food & Beverages, Animal Feed, Personal Care & Cosmetics, Lubricants, Consumer Goods, Pharmaceuticals, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | BASF SE, Celanese Corporation, The Dow Chemical Company, LyondellBasell Industries N.V., Eastman Chemical Company, Alfa Aesar, Perstorp Holding AB, OXEA, Finetech Industry Limited, Ashok Alco-Chem Limited, and VVF LLC |

| Additional Attributes | Dollar sales by acid type and end-use industry, demand dynamics across pharmaceuticals, polymers, food additives, and agrochemicals, regional trends across North America, Europe, and Asia-Pacific, innovation in high-purity and bio-based acids, environmental impact of production waste and emissions, and emerging use in biodegradable plastics and specialty chemical applications. |

The global carboxylic acid market is estimated to be valued at USD 21.2 billion in 2025.

The market size for the carboxylic acid market is projected to reach USD 34.5 billion by 2035.

The carboxylic acid market is expected to grow at a 5.0% CAGR between 2025 and 2035.

The key product types in carboxylic acid market are acetic, valeric, isovaleric, formic, propionic, butyric, isobutyric, citric, caproic, stearic and others.

In terms of end-user, food & beverages segment to command 41.8% share in the carboxylic acid market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Furandicarboxylic Acid Market Size and Share Forecast Outlook 2025 to 2035

Acid Resistant Pipe Market Forecast and Outlook 2025 to 2035

Acid Coil Cleaner Market Size and Share Forecast Outlook 2025 to 2035

Acid Filling and Leveling Machine Market Size and Share Forecast Outlook 2025 to 2035

Acid Chlorides Market Size and Share Forecast Outlook 2025 to 2035

Acid-Sensitive APIs Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Acidified Whey Protein Market Analysis - Size, Share & Trends 2025 to 2035

Acid Dyes Market Growth - Trends & Forecast 2025 to 2035

Acidity Regulator Market Growth - Trends & Forecast 2025 to 2035

Acid Proof Lining Market Trends 2025 to 2035

Acid Citrate Dextrose Tube Market Trends – Growth & Industry Outlook 2024-2034

Acid Orange Market

Antacids Market Analysis – Size, Trends & Forecast 2025 to 2035

Lead Acid Battery Market Size and Share Forecast Outlook 2025 to 2035

Lead Acid Battery Recycling Market Size and Share Forecast Outlook 2025 to 2035

Feed Acidifier Market Analysis Size Share and Forecast Outlook 2025 to 2035

Food Acidulants Market Growth - Key Trends, Size & Forecast 2024 to 2034

Boric Acid Market Forecast and Outlook 2025 to 2035

Folic Acid Market Size and Share Forecast Outlook 2025 to 2035

Oleic Acid Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA