The furandicarboxylic acid (FDCA) market is expected to grow from USD 911.7 million in 2025 to USD 1,932.0 million by 2035, representing a CAGR of 7.8%, reflecting strong industrial demand and increasing adoption in bioplastics and specialty polymers. Regulatory frameworks significantly influence the trajectory of this market, particularly environmental policies, chemical safety standards, and sustainability mandates.

Stricter chemical handling and emission regulations in developed regions, such as North America and Europe, necessitate adherence to stringent production guidelines, driving manufacturers to invest in compliant processes, waste treatment, and emission control technologies. Regulatory incentives for bio-based materials and green chemistry adoption further shape market growth.

Policies promoting renewable feedstocks and reduced carbon footprints encourage the use of FDCA in producing polyethylene furanoate (PEF) and other bio-polymers, supporting demand expansion. However, compliance costs and certification requirements impose financial and operational burdens on smaller producers, potentially affecting market entry and competitive dynamics. The regional differences in regulatory rigor create imbalances, with Asia-Pacific markets often benefiting from more flexible policies, facilitating faster adoption, whereas Europe and North America face higher compliance costs but stronger market validation for bio-based products. Overall, regulatory frameworks act as both a growth enabler and cost driver, influencing production strategies, technology adoption, and global supply chain configuration, ultimately shaping market scalability and competitive positioning.

| Metric | Value |

|---|---|

| Furandicarboxylic Acid Market Estimated Value in (2025 E) | USD 911.7 million |

| Furandicarboxylic Acid Market Forecast Value in (2035 F) | USD 1932.0 million |

| Forecast CAGR (2025 to 2035) | 7.8% |

The furandicarboxylic acid market is experiencing strong growth momentum driven by rising global focus on bio-based alternatives to petroleum-derived chemicals. Increasing environmental regulations and consumer preference for sustainable materials are encouraging the shift toward renewable monomers such as furandicarboxylic acid.

The material's compatibility with producing high-performance polymers like polyethylene furanoate and its potential to replace conventional terephthalic acid have positioned it as a critical component in the green chemistry movement. Advancements in catalytic oxidation processes and biomass feedstock availability are enabling more efficient production pathways.

Moreover, the packaging industry’s growing investment in sustainable and recyclable solutions is supporting the commercial viability of furandicarboxylic acid. As industries continue to realign supply chains toward circular and low-carbon models, the demand for this bio-based platform chemical is projected to increase steadily over the coming years.

The furandicarboxylic acid market is segmented by type, application, end-use, and geographic regions. By type, the furandicarboxylic acid market is divided into 2,5-Furandicarboxylic Acid and 3,4-Furandicarboxylic Acid. In terms of application, the furandicarboxylic acid market is classified into PET, Polyamides, Polycarbonates, Plasticizers, Polyester Polyols, and Others. Based on end-use, the furandicarboxylic acid market is segmented into Packaging, Automotive, Textile, Electronics, and Others. Regionally, the furandicarboxylic acid industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The 2 5 furandicarboxylic acid segment is expected to contribute 54.20% of total market revenue by 2025 within the type category, making it the dominant segment. This growth is attributed to its essential role as a building block for bio-based polymers and its superior thermal and mechanical properties compared to fossil-based counterparts.

Its application in the synthesis of polyethylene furanoate, which offers better barrier performance than traditional polyethylene terephthalate, has boosted adoption across environmentally conscious industries.

The increasing shift from petrochemical-based monomers to renewable alternatives is reinforcing the position of 2 5 furandicarboxylic acid as a core component in the sustainable materials market.

The PET segment is projected to hold 48.90% of market share by 2025 under the application category, positioning it as the leading area of use. This is driven by the increasing adoption of polyethylene furanoate as a high performance and sustainable alternative to traditional PET.

The application of furandicarboxylic acid in PET manufacturing enhances recyclability, reduces carbon footprint, and aligns with industry goals for lightweight, durable, and biodegradable plastics. Strong demand from the food and beverage packaging sector and increasing use in textile and consumer goods have also contributed to this segment’s growth.

As brands and manufacturers pivot toward greener supply chains, PET applications based on bio-based monomers are expected to maintain market leadership.

The packaging segment is expected to contribute 46.10% of total revenue by 2025 under the end use category, establishing itself as the dominant consumer of furandicarboxylic acid. This is due to escalating demand for sustainable and recyclable packaging formats across food, beverage, and personal care industries.

Packaging producers are adopting furandicarboxylic acid based polymers to improve barrier properties, shelf life, and environmental performance. The shift toward single material recyclable packaging and reduction in plastic waste have further accelerated the use of bio-based alternatives in packaging.

With increasing pressure from both regulators and environmentally conscious consumers, the packaging sector is leading the way in integrating furandicarboxylic acid into scalable and eco-friendly product lines.

The FDCA market has been growing due to its increasing application in bio-based polymers, particularly polyethylene furanoate (PEF), which is considered a sustainable alternative to conventional plastics. Demand has been driven by rising awareness of environmental sustainability, adoption in packaging, and expansion in specialty chemical industries. FDCA has been valued for its renewable origins, thermal stability, and potential to replace petroleum-based monomers. The market has been shaped by research advancements, investments in green chemistry, and regulatory encouragement for eco-friendly polymer solutions globally.

The market has been influenced significantly by its adoption in bio-based polymers, particularly PEF, which is used in packaging films, bottles, and fibers. FDCA has been preferred due to its ability to provide superior barrier properties compared to traditional polyethylene terephthalate (PET). Beverage and food packaging industries have increasingly relied on PEF for extending product shelf life while reducing carbon footprints. In addition, fibers and specialty films incorporating FDCA have been explored for textile, automotive, and industrial applications. Investments in pilot plants and commercial-scale production facilities have further reinforced market growth. The trend toward sustainable packaging and biodegradable polymer alternatives has positioned FDCA as a critical raw material in the transition from petroleum-based plastics.

Advances in FDCA synthesis and processing technologies have strengthened the market by improving yield, efficiency, and cost-effectiveness. Catalytic oxidation of 5-hydroxymethylfurfural (HMF) and other bio-based precursors has been optimized through process innovations, reducing production costs and enabling scalability. Green chemistry principles have been incorporated to minimize waste and energy consumption during FDCA manufacture. Research in enzymatic and electrochemical production methods has opened pathways for sustainable, high-purity FDCA suitable for polymer applications. These technological improvements have encouraged adoption among chemical manufacturers and downstream polymer producers, facilitating broader penetration in bio-based packaging, films, and specialty applications while ensuring environmental compliance and consistent quality.

The market has been stimulated by regulatory measures promoting sustainable chemical production and reduced environmental impact. Governments and environmental agencies have encouraged bio-based polymer adoption through incentives, subsidies, and eco-labeling programs. Consumer preference for environmentally friendly packaging has further accelerated demand, particularly in developed regions where regulatory pressure is high. Sustainability trends have encouraged companies to incorporate FDCA in polymer blends, replacing traditional petrochemical-based monomers. Collaboration between chemical manufacturers, research institutions, and packaging companies has facilitated knowledge sharing and technology transfer, enabling a steady increase in FDCA applications across food, beverage, and specialty industrial segments.

Despite positive growth drivers, the FDCA market has faced challenges related to raw material availability, high production costs, and technological complexity. Limited commercial-scale production of HMF and other bio-based precursors has restricted consistent supply of FDCA. The need for specialized catalysts and advanced production equipment has increased capital expenditure for manufacturers. Market adoption has also been impacted by price sensitivity when compared to conventional PET and other petroleum-based polymers. The scaling up from pilot projects to industrial-scale plants has required careful planning and investment. These factors have constrained widespread deployment, although ongoing research and strategic partnerships are expected to improve efficiency, reduce costs, and expand availability in the near future.

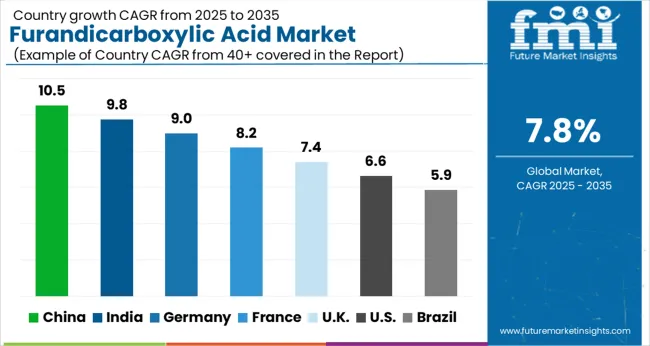

| Country | CAGR |

|---|---|

| China | 10.5% |

| India | 9.8% |

| Germany | 9.0% |

| France | 8.2% |

| UK | 7.4% |

| USA | 6.6% |

| Brazil | 5.9% |

The market is projected to grow at a CAGR of 7.8% from 2025 to 2035, driven by rising demand in bio-based polymers, packaging materials, and specialty chemicals. China leads with a 10.5% CAGR, supported by large-scale chemical production and increasing adoption in sustainable packaging applications. India follows at 9.8%, fueled by growing chemical manufacturing capabilities and investment in bio-based materials. Germany, at 9.0%, benefits from advanced polymer research and development infrastructure. The UK, growing at 7.4%, focuses on specialty chemical innovation, while the USA, at 6.6%, experiences steady demand from packaging and industrial applications. This report includes insights on 40+ countries; the top markets are shown here for reference.

China is expected to grow at a CAGR of 10.5% during the forecast period, driven by high demand from packaging, automotive, and textile industries. Increasing production of bio-based polymers and eco-friendly plastics is contributing to steady sales growth. Manufacturers are focusing on innovation in polymer applications, enhancing mechanical and thermal properties. Rapid industrialization and adoption of advanced manufacturing technologies are further supporting market expansion. Strategic partnerships between chemical producers and downstream users are facilitating market penetration, while government policies promoting green chemicals reinforce demand.

India is forecasted to expand at a CAGR of 9.8%, supported by increasing use in biodegradable plastics and sustainable packaging solutions. Rapid industrial growth, combined with a surge in chemical and textile manufacturing, is encouraging market adoption. Companies are introducing high-purity FDCA with improved performance for diverse industrial applications. Online B2B distribution channels and partnerships with end-users are expanding availability across regions. Emphasis on environmentally friendly chemicals is influencing corporate procurement strategies and fostering adoption.

Germany is projected to grow at a CAGR of 9.0%, driven by the chemicals and automotive sectors. High-quality FDCA for specialty polymers is in rising demand. Manufacturers are focused on eco-friendly chemical production and innovations in polymer blends. Increasing investments in green chemical technologies and supportive government regulations are enhancing adoption. Collaborative initiatives between research institutions and industrial players are fostering product innovation. The market benefits from strong industrial infrastructure and high technical expertise in polymer applications.

The United Kingdom is expected to expand at a CAGR of 7.4%, influenced by demand in packaging, textiles, and green polymers. Increasing awareness about eco-friendly alternatives and sustainable chemical solutions drives adoption. Manufacturers focus on high-purity FDCA with enhanced thermal stability and polymer compatibility. Strategic investments in research and development for bio-based polymers support product innovation. The market is further aided by collaborative initiatives with end-users and growing consumer preference for sustainable products.

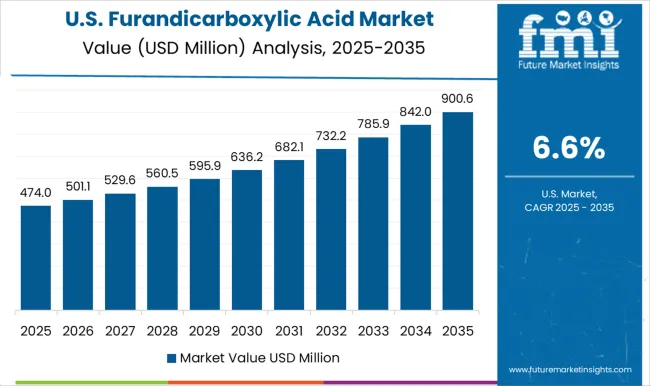

The United States is projected to grow at a CAGR of 6.6%, supported by use in packaging, automotive, and specialty chemicals. Adoption of bio-based polymers and biodegradable materials is rising. Manufacturers are focusing on process optimization and enhanced FDCA purity to meet industrial requirements. Increasing corporate sustainability initiatives and regulatory encouragement for eco-friendly chemicals strengthen market prospects. Collaborative projects between chemical producers and downstream users further enhance penetration and technological advancement.

The market is expanding rapidly due to growing demand for sustainable, bio-based alternatives to conventional petrochemical-derived polymers. Leading providers such as Avantium and Synvina have established themselves as innovators, focusing on high-purity FDCA production that enables the manufacture of polyethylene furanoate (PEF) and other next-generation bio-polyesters. Their emphasis on research and development has resulted in more efficient and scalable production methods, positioning them as key enablers for industrial-scale adoption of bio-based materials. Companies like AVA Biochem and Clearsynth are contributing through cost-effective and scalable production technologies, ensuring consistent quality and purity of FDCA for industrial applications.

TCL America and V.V. Pharma Industries are further broadening market reach by supplying FDCA for specialty applications including resins, coatings, and biodegradable packaging solutions. These companies are actively integrating sustainable feedstocks, energy-efficient processes, and environmentally friendly manufacturing practices to meet global regulatory requirements and rising consumer preference for greener products. The combined efforts of these providers are accelerating adoption across packaging, textile, automotive, and specialty chemical industries. By prioritizing innovation, sustainability, and high-quality standards, they are shaping the competitive dynamics of the FDCA market and supporting the transition toward a circular, bio-based economy. Strategic partnerships, technological advancements, and expanded production capacities are expected to drive continued market growth in the coming decade.

| Item | Value |

|---|---|

| Quantitative Units | USD 911.7 Million |

| Type | 2,5-Furandicarboxylic Acid and 3,4-Furandicarboxylic Acid |

| Application | PET, Polyamides, Polycarbonates, Plasticizers, Polyester Polyols, and Others |

| End-use | Packaging, Automotive, Textile, Electronics, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Avantium, AVA Biochem, Clearsynth, Synvina, TCL America, and V.V. Pharma Industries |

| Additional Attributes | Dollar sales by acid type and application, demand dynamics across polymers, coatings, and packaging sectors, regional trends in bio-based chemical adoption, innovation in sustainable production processes and material performance, environmental impact of manufacturing and disposal, and emerging use cases in biodegradable plastics and high-performance polymers. |

The global furandicarboxylic acid market is estimated to be valued at USD 911.7 million in 2025.

The market size for the furandicarboxylic acid market is projected to reach USD 1,932.0 million by 2035.

The furandicarboxylic acid market is expected to grow at a 7.8% CAGR between 2025 and 2035.

The key product types in furandicarboxylic acid market are 2,5-furandicarboxylic acid and 3,4-furandicarboxylic acid.

In terms of application, pet segment to command 48.9% share in the furandicarboxylic acid market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Acid Resistant Pipe Market Forecast and Outlook 2025 to 2035

Acid Coil Cleaner Market Size and Share Forecast Outlook 2025 to 2035

Acid Filling and Leveling Machine Market Size and Share Forecast Outlook 2025 to 2035

Acid Chlorides Market Size and Share Forecast Outlook 2025 to 2035

Acid-Sensitive APIs Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Acidified Whey Protein Market Analysis - Size, Share & Trends 2025 to 2035

Acid Dyes Market Growth - Trends & Forecast 2025 to 2035

Acidity Regulator Market Growth - Trends & Forecast 2025 to 2035

Acid Proof Lining Market Trends 2025 to 2035

Acid Citrate Dextrose Tube Market Trends – Growth & Industry Outlook 2024-2034

Acid Orange Market

Antacids Market Analysis – Size, Trends & Forecast 2025 to 2035

Lead Acid Battery Market Size and Share Forecast Outlook 2025 to 2035

Lead Acid Battery Recycling Market Size and Share Forecast Outlook 2025 to 2035

Feed Acidifier Market Analysis Size Share and Forecast Outlook 2025 to 2035

Food Acidulants Market Growth - Key Trends, Size & Forecast 2024 to 2034

Nylon Acid Dye Fixing Agent Market Size and Share Forecast Outlook 2025 to 2035

Boric Acid Market Forecast and Outlook 2025 to 2035

Folic Acid Market Size and Share Forecast Outlook 2025 to 2035

Oleic Acid Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA