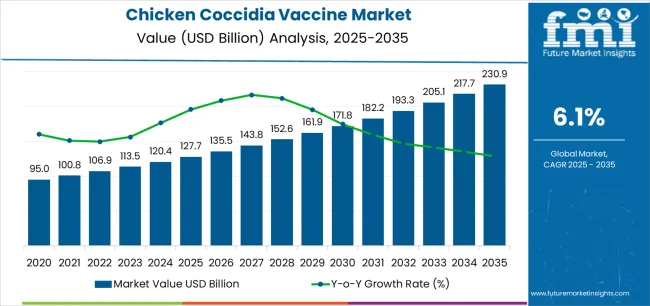

The chicken coccidia vaccine market is valued at USD 127.7 billion in 2025 and is forecasted to reach USD 230.9 billion by 2035, advancing at a CAGR of 6.1%. Market growth is driven by increasing global poultry production, rising awareness of disease prevention, and the growing shift toward vaccination-based coccidiosis control as an alternative to anticoccidial drugs. The expanding commercial broiler and layer segments, along with regulatory efforts to reduce antibiotic dependence in animal husbandry, are further supporting vaccine adoption.

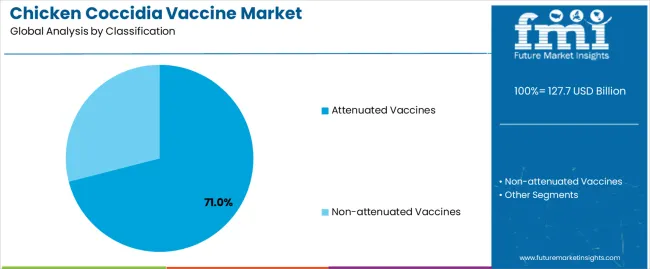

Attenuated vaccines hold the leading market share due to their proven efficacy in inducing long-lasting immunity and reducing infection recurrence rates. These vaccines use live oocysts with reduced pathogenicity, enabling effective immune response without compromising flock performance. Non-attenuated and recombinant vaccine developments are gaining attention as producers seek broader protection and simplified administration processes.

Asia Pacific leads the global market, supported by rapid poultry industry expansion in China, India, and Southeast Asia. Europe and North America maintain steady demand through established biosecurity regulations and integrated disease management programs. Major industry participants include MSD Animal Health, Boehringer Ingelheim, HIPRA, Ceva Santé Animale, and Bioproperties, focusing on vaccine innovation, strain diversification, and production scalability to meet global poultry health standards.

The market’s saturation point analysis indicates progressive growth followed by gradual stabilization as vaccine adoption becomes standard across commercial poultry operations. Between 2025 and 2029, expansion will be rapid due to rising poultry production, improved biosecurity practices, and government-led disease control initiatives in major producing regions. Increased awareness among farmers regarding resistance management and reduced antibiotic use will accelerate early growth.

From 2030 onward, the market will approach its initial saturation point as vaccination programs reach near-universal coverage in industrial poultry farms across North America, Europe, and parts of Asia-Pacific. Further growth will be driven by replacement demand, updated vaccine formulations, and adoption among small and medium poultry producers in developing economies. The approaching saturation phase reflects a mature yet resilient market, supported by continuous research on multivalent and recombinant vaccines. This stage will emphasize optimization of delivery methods and cold-chain logistics rather than volume expansion, indicating steady performance after achieving broad immunization penetration within the global poultry industry.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 127.7 billion |

| Market Forecast Value (2035) | USD 230.9 billion |

| Forecast CAGR (2025-2035) | 6.1% |

The chicken coccidia vaccine market is expanding as poultry producers seek effective preventive solutions against Coccidiosis, a parasitic disease caused by multiple species of the genus Eimeria that reduces flock productivity and drives economic losses. The global rise in poultry meat and egg consumption fuels the scale of commercial flocks, increasing the exposure of birds to coccidial infections and prompting vaccine uptake. Heightened regulatory scrutiny of prophylactic anticoccidial drugs and growing demand for antibiotic-free and ecofriendly farming practices support a shift toward biological control via vaccination.

Technological advances in live-attenuated, inactivated and recombinant vaccine formats strengthen immune protection, broaden strain coverage and improve operational practicality in large-scale poultry operations. The market faces constraints: high development and manufacturing costs for multivalent vaccines, variable uptake in small-scale or low-income farm settings, and the complexity of matching vaccine strains to region-specific Eimeria species threaten optimal adoption.

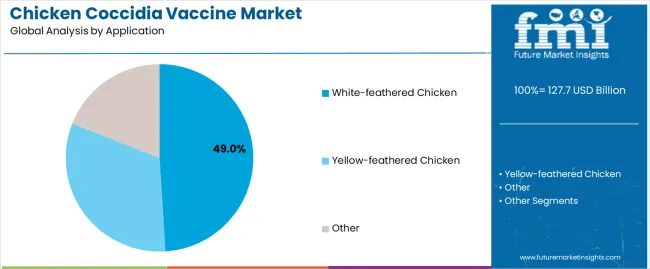

The chicken coccidia vaccine market is segmented by classification and application. By classification, the market is divided into attenuated vaccines and non-attenuated vaccines. Based on application, it is categorized into white-feathered chicken, yellow-feathered chicken, and other poultry breeds. Regionally, the market is divided into Asia Pacific, Europe, North America, and other key regions.

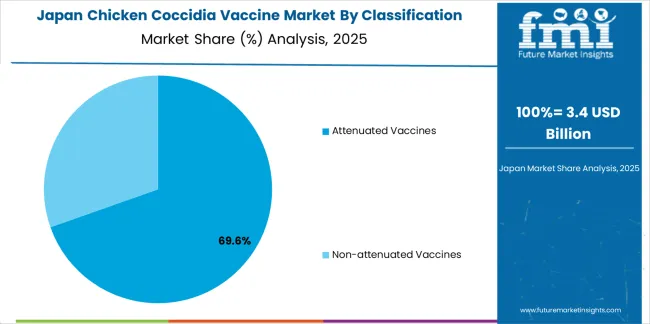

The attenuated vaccine segment holds the leading position in the chicken coccidia vaccine market, representing approximately 71.0% of total market share in 2025. These vaccines are developed using live but weakened strains of Eimeria species to stimulate protective immunity without causing disease. Their dominance is attributed to consistent efficacy, broad immunogenic coverage, and long-lasting protection across multiple coccidial species that affect poultry production.

Attenuated vaccines are preferred in large-scale commercial broiler and layer operations, particularly within integrated poultry systems where early immunization is critical for flock health and productivity. Improved safety profiles and reduced post-vaccination reactions have further increased their use in high-performance production environments. Non-attenuated vaccines, while utilized in specific regional markets, are gradually being replaced due to higher risks of residual virulence and less predictable immune response.

Key factors supporting the attenuated vaccine segment include:

The white-feathered chicken segment accounts for approximately 49.0% of the chicken coccidia vaccine market in 2025. This dominance reflects the high prevalence of vaccination programs in commercial broiler operations, where disease prevention directly affects feed efficiency, growth rate, and overall production economics. White-feathered breeds are primarily raised for meat production under confined rearing systems, making them more susceptible to coccidial infections and dependent on consistent immunization programs.

The yellow-feathered chicken segment follows, supported by increasing adoption of vaccination practices in regional and small-scale poultry farms. The other category includes indigenous or specialty poultry breeds where vaccine application remains limited due to lower production density or alternative disease management practices.

Primary dynamics driving demand from the white-feathered chicken segment include:

Rising global poultry production, increased disease burden from coccidiosis, and pressure to reduce antibiotic use in broiler and layer flocks.

The chicken coccidia vaccine market benefits from steady growth in the poultry sector, especially in emerging economies where meat and egg consumption is rising. The high cost of coccidiosis outbreaks, including reduced weight gain, higher mortality and feed conversion loss, encourages producers to adopt immunization solutions. In parallel, the move away from prophylactic antibiotics in poultry husbandry has elevated interest in vaccine-based prevention of parasitic diseases, thus boosting demand for vaccines targeting Eimeria species in chickens.

Complex vaccine development, cold-chain logistics in remote farming regions, and cost sensitivity among small-scale producers.

Development of effective coccidiosis vaccines is constrained by the complex life cycle of Eimeria parasites, genetic variation across strains and the need for robust field efficacy, which increases time-to-market and research expense. Many poultry farms operate in regions with limited cold-chain infrastructure, making storage and distribution of live or attenuated vaccines difficult. Finally, small and mid-scale producers may find upfront vaccination costs high relative to perceived risk, slowing uptake in less organised segments of the poultry industry.

Development of next-generation recombinant or live vector vaccines, geographic expansion in Asia-Pacific and Latin America, and integration of vaccination protocols with precision farm health-management platforms. Vaccine manufacturers are increasingly investing in novel technologies, such as recombinant subunit vaccines, multi-strain live vaccines and orally delivered formulations, to improve protection and reduce administration labour. Rapid poultry-industry expansion in Asia-Pacific (notably in India, China and Vietnam) and Latin America is driving regional market growth as producers adopt improved biosecurity and vaccination strategies. Concurrently, digital and data-driven farm-management systems are being used to coordinate vaccination timing, monitor flock health and optimise immunization outcomes in large-scale operations.

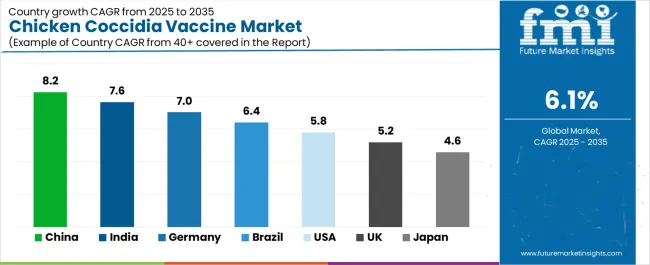

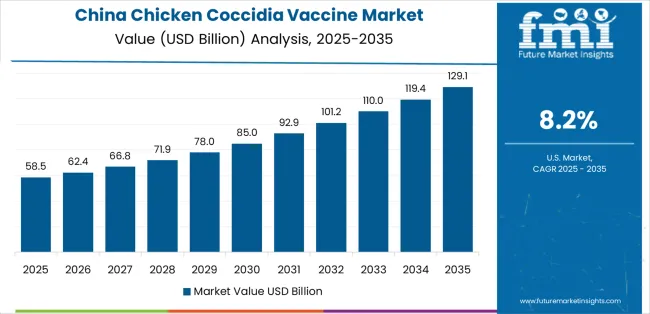

The global chicken coccidia vaccine market is expanding steadily through 2035, driven by increasing poultry production, biosecurity measures, and advancements in live and attenuated vaccine formulations. China leads with an 8.2% CAGR, followed by India at 7.6%, supported by rising poultry farming intensity and veterinary immunization programs. Germany grows at 7.0%, reflecting progress in animal health biotechnology. Brazil’s 6.4% growth stems from export-focused poultry operations and disease control initiatives. The United States records 5.8%, emphasizing preventive vaccination in commercial farms. The United Kingdom (5.2%) and Japan (4.6%) maintain steady growth through technology-driven animal health innovation and strict regulatory compliance.

| Country | CAGR (%) |

|---|---|

| China | 8.2 |

| India | 7.6 |

| Germany | 7.0 |

| Brazil | 6.4 |

| USA | 5.8 |

| UK | 5.2 |

| Japan | 4.6 |

China’s chicken coccidia vaccine market grows at 8.2% CAGR, driven by large-scale poultry production and government efforts to enhance livestock disease prevention. Expanding demand for antibiotic-free poultry feed has increased vaccine adoption across commercial and contract farms. Domestic veterinary firms are producing advanced live attenuated vaccines targeting multiple Eimeria species. National programs under the Ministry of Agriculture and Rural Affairs are promoting immunization standards and biosafety compliance. The establishment of regional vaccine manufacturing facilities and R&D centers enhances supply capacity. Growth is supported by the country’s focus on ecofriendly poultry farming and export-grade livestock health management.

Key Market Factors:

India’s market grows at 7.6% CAGR, supported by rising poultry output, veterinary awareness, and demand for preventive disease management. The government’s National Livestock Mission encourages vaccine use to reduce reliance on anticoccidial drugs. Domestic manufacturers are expanding production of live and recombinant vaccines for both broilers and layers. Increasing adoption of modern poultry housing systems supports structured immunization programs. Collaborations between state veterinary universities and private firms are improving vaccine strain development and field validation. Market growth is further supported by integration of vaccination in large-scale poultry farming and improved cold chain distribution networks.

Market Development Factors:

Germany’s market grows at 7.0% CAGR, driven by strong focus on animal welfare, ecofriendly farming, and antibiotic reduction policies. Research institutions and veterinary pharmaceutical companies are developing recombinant and vector-based vaccines for enhanced protection. EU directives supporting antibiotic-free production encourage adoption across poultry operations. High investment in veterinary biotechnology supports precision vaccine delivery systems and diagnostic monitoring. The country’s poultry sector prioritizes compliance with animal health certification and welfare standards, boosting vaccine demand. Germany’s focus on R&D-led production under strict quality control frameworks ensures a robust market environment for biologics and coccidia vaccines.

Key Market Characteristics:

Brazil’s chicken coccidia vaccine market grows at 6.4% CAGR, supported by its leading global position in poultry exports and livestock biosecurity programs. The country’s agribusiness sector is integrating vaccination protocols to control Eimeria infections and maintain production efficiency. Veterinary companies are expanding regional distribution of live and attenuated vaccines across major poultry-producing states. Government support for sanitary certification and export compliance promotes preventive immunization in commercial flocks. Partnerships with multinational animal health firms enable technology transfer and large-scale vaccine manufacturing. The focus on maintaining antibiotic-free export standards further strengthens vaccine market penetration.

Market Development Factors:

The United States grows at 5.8% CAGR, supported by established animal health infrastructure and technological advancement in vaccine delivery. The shift toward antibiotic-free poultry production has increased reliance on vaccination for disease control. Major animal health companies are developing precision immunization systems for large commercial flocks. Integration of molecular diagnostics enhances monitoring of Eimeria outbreaks and vaccine efficacy. Federal agencies and poultry associations promote vaccination as a key tool for ecofriendly livestock production. Market expansion is further supported by automation in hatchery vaccination and increased R&D investment in recombinant vaccine technologies.

Key Market Factors:

The United Kingdom’s market grows at 5.2% CAGR, supported by ecofriendly -driven livestock management and strong veterinary infrastructure. The poultry sector’s commitment to antibiotic reduction and welfare compliance has accelerated vaccine adoption. Research collaborations under Innovate UK and leading universities are supporting next-generation vaccine formulation development. Integration of digital tracking and biosecurity protocols enhances immunization efficiency. The country’s regulatory framework aligns with European standards, promoting early adoption of new vaccine technologies. Growth is driven by expanding poultry operations and increased public awareness of food safety and antibiotic stewardship.

Market Development Factors:

Japan’s market grows at 4.6% CAGR, reflecting a mature poultry sector emphasizing disease prevention and regulatory compliance. Domestic vaccine manufacturers are focusing on improved live vaccines targeting prevalent Eimeria strains. Integration of precision dosing technologies and temperature-stable formulations supports adoption across hatcheries and farms. The Ministry of Agriculture, Forestry, and Fisheries promotes consistent vaccination within national poultry health programs. Research institutions are exploring recombinant vaccine technologies to enhance immunity duration and reduce handling complexity. Japan’s high standards for animal health, combined with technological expertise, maintain a stable and innovation-oriented market environment.

Key Market Characteristics:

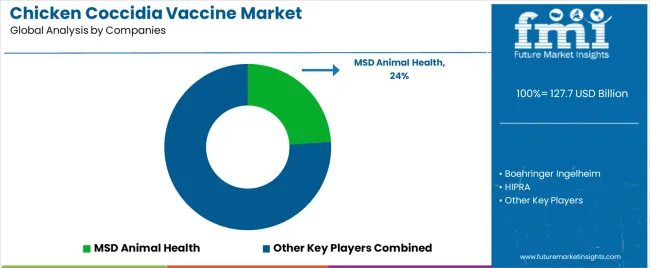

The chicken coccidia vaccine market is moderately consolidated, with approximately ten to fifteen companies active in developing and commercializing live and attenuated vaccines targeting avian coccidiosis. MSD Animal Health leads the market with an estimated 24.0% global share, supported by its broad poultry vaccine portfolio, extensive distribution network, and proven efficacy in multi-species Eimeria protection. Its leadership is further strengthened by robust research capabilities and long-standing relationships with integrated poultry producers worldwide.

Boehringer Ingelheim, HIPRA, and Ceva Santé Animale follow as key global competitors, leveraging comprehensive vaccine pipelines, high biosecurity production facilities, and technical support programs for large-scale poultry operations. These companies maintain competitive strength through formulation innovation, thermostability improvements, and post-vaccination performance monitoring.

Mid-tier firms such as Bioproperties, Huvepharma, and Nisseiken specialize in regional vaccine supply, focusing on regulatory compliance and strain adaptation suited to local poultry populations. Biopharm and Vaxxinova contribute through research into next-generation recombinant and subunit vaccines designed for enhanced immunity and reduced production downtime.

Emerging participants, including Foshan Standard Biotech, Qilu Qingda Bio-Pharmaceutical, and Guangdong Winsun Bio-Pharmaceutical, drive competitive pressure in Asia, leveraging cost efficiency and expanding domestic demand for sustainable poultry health solutions. Competition in this market is defined by immunogenicity, safety consistency, and production scalability, with ongoing R&D emphasizing improved strain coverage and reduced vaccine handling complexity in commercial poultry operations.

| Items | Values |

|---|---|

| Quantitative Units | USD billion |

| Classification | Attenuated Vaccines, Non-attenuated Vaccines |

| Application | White-feathered Chicken, Yellow-feathered Chicken, Other |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East & Africa |

| Countries Covered | India, China, USA, Germany, South Korea, Japan, Italy, and 40+ countries |

| Key Companies Profiled | MSD Animal Health, Boehringer Ingelheim, HIPRA, Bioproperties, Huvepharma, Nisseiken, Biopharm, Ceva Santé Animale, Vaxxinova, Foshan Standard Biotech, Qilu Qingda Bio-Pharmaceutical, Skystar Bio-pharm, Hlinte, Guangdong Winsun Bio-pharmaceutical |

| Additional Attributes | Dollar sales by classification and application categories; regional adoption trends across Asia Pacific, Europe, and North America; competitive landscape of poultry vaccine manufacturers; advancements in coccidiosis prevention technologies; integration with large-scale poultry farming and disease control programs. |

The global chicken coccidia vaccine market is estimated to be valued at USD 127.7 billion in 2025.

The market size for the chicken coccidia vaccine market is projected to reach USD 230.9 billion by 2035.

The chicken coccidia vaccine market is expected to grow at a 6.1% CAGR between 2025 and 2035.

The key product types in chicken coccidia vaccine market are attenuated vaccines and non-attenuated vaccines.

In terms of application, white-feathered chicken segment to command 49.0% share in the chicken coccidia vaccine market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Chicken Feeder and Drinkers Market Size and Share Forecast Outlook 2025 to 2035

Chicken Plucking Machine Market Size, Growth, and Forecast 2025 to 2035

Chicken Coops Market Analysis – Trends & Growth Forecast 2025 to 2035

Chicken Offal Market Analysis by Organ and End Use Through 2035

Chicken Buckets Market

Chicken Flavors Market

Electric Chicken Scalder Market Size and Share Forecast Outlook 2025 to 2035

Automatic Chicken Deboning Machine Market Size and Share Forecast Outlook 2025 to 2035

Air-dried Chicken Dog Food Market Size and Share Forecast Outlook 2025 to 2035

Commercial Chicken Plucker Market Size and Share Forecast Outlook 2025 to 2035

Plant-Based Chicken Market Analysis - Size, Share, and Forecast 2025 to 2035

Fresh Organic Chicken Market

Organic Starter-Grower Chicken Feed Market

Vaccine Preservatives Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Vaccine Stabilizers Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Vaccine Vial Rubber Stopper Market Size and Share Forecast Outlook 2025 to 2035

Vaccine Transport Carrier Market Size and Share Forecast Outlook 2025 to 2035

Vaccine Shippers Market Size and Share Forecast Outlook 2025 to 2035

Vaccines Market Insights - Trends, Growth & Forecast 2025 to 2035

Vaccine Packaging Market Growth - Demand & Forecast 2024 to 2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA