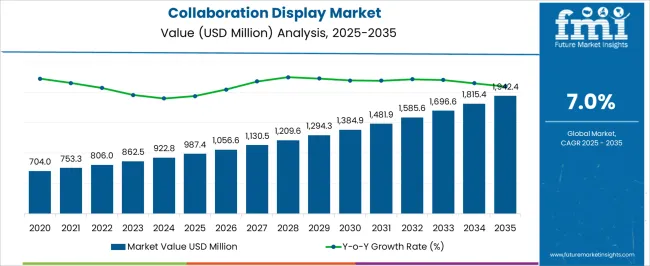

The collaboration display market is projected to grow from USD 987.4 million in 2025 to USD 1,942.4 million by 2035, with a growth rate of 7.0%. A year-on-year (YoY) growth analysis shows consistent growth over the forecast period. Starting at USD 704.0 million in 2024, the market sees incremental growth, reaching USD 753.3 million in 2025. This early growth reflects the rising demand for advanced collaboration tools that are increasingly essential in both business and educational settings.

From 2025 to 2027, the market experiences steady growth, reaching USD 806.0 million in 2026 and USD 862.5 million in 2027. The increase is driven by the adoption of collaboration displays in remote work environments, interactive communication, and conference settings. The demand for efficient communication systems has accelerated due to the need for more flexible and effective ways to connect people across different locations.

Between 2028 and 2032, the market experiences a more significant acceleration, reaching USD 922.8 million in 2028, USD 1,056.6 million in 2029, and USD 1,209.6 million in 2030. This growth is fueled by industries embracing digital transformation and integrated display solutions, particularly in sectors like healthcare, education, and corporate settings, which increasingly rely on advanced collaborative technologies.

Corporate meeting environments represent the largest market segment where collaboration displays facilitate presentation sharing, real-time annotation, and participant engagement during face-to-face and hybrid meetings. IT procurement teams evaluate systems based on compatibility with existing video conferencing platforms, enterprise security requirements, and integration capabilities with corporate networks and authentication systems.

Facility management considerations include installation flexibility, maintenance accessibility, and energy efficiency characteristics that affect total cost of ownership calculations. Return-to-office initiatives create demand for technology that enhances in-person collaboration while maintaining connectivity with remote participants.

Educational institution deployments encompass classrooms, lecture halls, and collaborative learning spaces where interactive displays support teaching methodologies that emphasize student participation, multimedia content delivery, and group project collaboration.

Academic technology departments balance pedagogical effectiveness against budget constraints while ensuring accessibility compliance and integration with learning management systems. Professional development programs require training resources that help educators effectively utilize collaboration technology to improve learning outcomes and student engagement levels.

Government and public sector installations require enhanced security features including data encryption, access controls, and compliance with national cybersecurity standards that protect sensitive information during collaborative sessions. Procurement processes emphasize domestic manufacturing preferences, security clearance requirements, and interoperability with existing government IT systems. Emergency response applications utilize collaboration displays for situation awareness, resource coordination, and multi-agency communication during crisis management operations.

| Metric | Value |

|---|---|

| Collaboration Display Market Estimated Value in (2025 E) | USD 987.4 million |

| Collaboration Display Market Forecast Value in (2035 F) | USD 1942.4 million |

| Forecast CAGR (2025 to 2035) | 7.0% |

The collaboration display market is witnessing sustained expansion, driven by the growing demand for interactive and connected work environments across corporate, educational, and public sectors. Increasing adoption of hybrid work models and remote collaboration has elevated the need for large-format, high-resolution displays that can seamlessly integrate with communication platforms. Technological advancements in touch sensitivity, wireless connectivity, and cloud-based content sharing are enhancing user experience and operational efficiency.

Rising investments in smart meeting spaces and digital classrooms are further accelerating market penetration. Enterprises are prioritizing solutions that improve engagement, productivity, and decision-making, with collaboration displays emerging as a central element of workplace digital transformation. The integration of AI-driven features, multi-device compatibility, and low-latency interaction capabilities is reshaping expectations for display performance.

As organizations continue to adapt to flexible work practices and prioritize real-time information sharing, demand for advanced collaboration display solutions is expected to remain strong The market outlook remains positive, supported by continuous innovation, competitive pricing strategies, and increasing adoption across both developed and emerging economies.

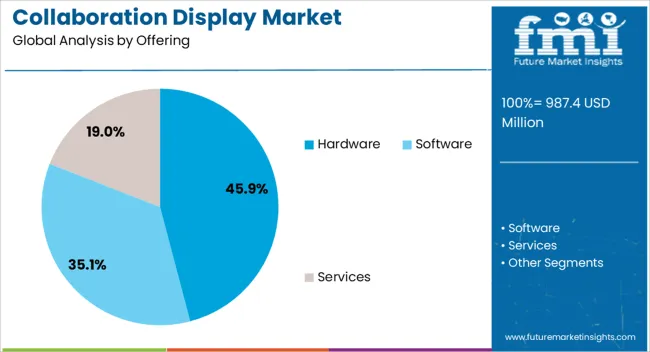

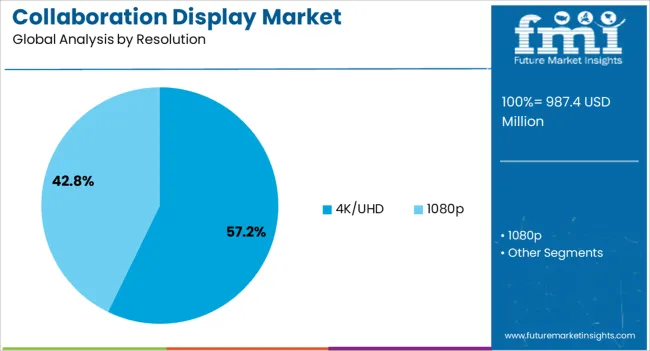

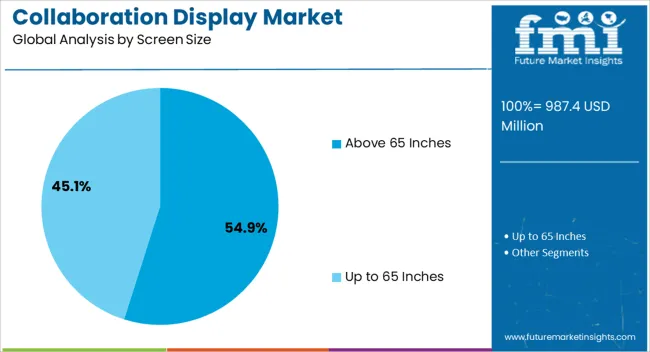

The collaboration display market is segmented by offering, resolution, screen size, application, end users, and geographic regions. By offering, collaboration display market is divided into Hardware, Software, and Services. In terms of resolution, collaboration display market is classified into 4K/UHD and 1080p. Based on screen size, collaboration display market is segmented into Above 65 Inches and Up to 65 Inches. By application, collaboration display market is segmented into Large Meeting Rooms, Huddle Rooms, Classrooms, Open Layouts, Offices, and Others. By end users, collaboration display market is segmented into Corporate Offices, Educational Institutions, Government Organizations, and Others. Regionally, the collaboration display industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The hardware segment is projected to account for 45.9% of the collaboration display market revenue share in 2025, making it the dominant offering category. Its leadership is being supported by the critical role hardware plays in delivering core display functionality, visual clarity, and durability in professional collaboration environments. The increasing preference for high-performance panels, integrated cameras, microphones, and speakers within a single display unit is enhancing the convenience and appeal of hardware-centric solutions.

Hardware investments are being driven by organizations seeking reliable, high-quality displays capable of supporting diverse conferencing platforms and interactive applications. Continuous advancements in display panel technology, energy efficiency, and durability are further improving performance and lifespan, making hardware a cost-effective long-term investment.

The segment is also benefiting from growing adoption in sectors such as corporate boardrooms, educational institutions, and government facilities, where physical display quality and stability remain priorities As demand for interactive and visually rich collaboration tools increases, the hardware segment is expected to retain its dominant market position.

The 4K/UHD resolution segment is anticipated to hold 57.2% of the collaboration display market revenue share in 2025, establishing itself as the leading resolution category. Its dominance is driven by the superior image clarity, sharpness, and detail that 4K/UHD technology provides, significantly enhancing the visual experience during presentations, video conferences, and collaborative sessions. The ability to display intricate details with minimal pixelation improves readability and engagement, especially in large meeting spaces and educational settings.

Advancements in 4K panel manufacturing, coupled with declining costs, are making this resolution more accessible to a broader range of customers. The demand is further reinforced by the growing use of high-definition content, data visualizations, and complex graphics that require enhanced resolution for effective communication.

The integration of 4K/UHD technology with interactive touch capabilities and seamless connectivity is improving functionality and versatility As visual quality continues to play a critical role in collaborative work environments, 4K/UHD displays are expected to maintain their leadership in the resolution segment.

The above 65 inches screen size segment is expected to capture 54.9% of the collaboration display market revenue share in 2025, positioning it as the largest screen size category. This dominance is being reinforced by the growing preference for larger displays that provide better visibility, improved engagement, and enhanced interaction in both corporate and educational environments. Large-format displays facilitate group collaboration by ensuring content is visible to all participants, even in spacious meeting rooms or lecture halls.

The segment is benefiting from advancements in display manufacturing that allow for thinner bezels, lighter frames, and higher resolution without significantly increasing installation complexity. Increasing deployment in conference rooms, training centers, and auditoriums is further driving demand for this size category.

The combination of large screen real estate with features such as touch interactivity, multi-user input, and seamless integration with conferencing platforms is enhancing overall productivity and collaboration outcomes As organizations continue to invest in premium meeting and learning spaces, the above 65 inches segment is expected to sustain its leadership.

The collaboration display market is experiencing significant growth, driven by the increasing adoption of remote and hybrid work models, which have heightened the demand for interactive and efficient collaboration tools. Advancements in display technologies, such as 4K/UHD resolutions and interactive touchscreens, are enhancing user experiences and facilitating seamless communication across various sectors, including education, healthcare, and corporate environments. The integration of artificial intelligence (AI) and machine learning (ML) technologies is further elevating the functionality of collaboration displays, enabling features like real-time translation and content recognition. As businesses and educational institutions seek improved ways to collaborate and share information, the market is expected to continue expanding with the increasing reliance on these advanced display solutions.

The increasing need for more efficient communication and collaboration in modern work environments, especially as remote and hybrid work models become more prevalent. Organizations require interactive displays that allow seamless, real-time collaboration across locations. Advances in display technology, including higher resolutions and better touch functionalities, are enhancing the overall experience. The integration of cloud computing has made sharing and collaborating in real-time easier, fueling market growth. Furthermore, industries like healthcare and education are increasingly adopting collaboration displays to enhance remote communication and streamline the teaching process. As more sectors recognize the value of these tools, the demand for advanced collaboration displays is expected to continue growing, leading to wider adoption across various industries.

One major hurdle is the high initial cost of advanced collaboration display systems, which can be prohibitive, especially for small and medium-sized enterprises. Integrating these systems into existing IT infrastructures, particularly those with legacy technologies, can be complex and time-consuming. Another challenge is ensuring seamless interoperability between different display systems, software applications, and platforms, which requires continuous innovation to adapt to evolving technological standards. The integration of advanced features like AI and cloud services necessitates frequent updates and maintenance, increasing resource demands and operational costs. These factors, combined with the need for continuous technical support, can limit the widespread adoption of collaboration displays, particularly in resource-constrained sectors.

The collaboration display market offers numerous opportunities for innovation and market expansion. One significant opportunity lies in developing affordable yet high-performing solutions tailored to small and medium-sized enterprises (SMEs). As remote and hybrid work models continue to rise, there is an increasing demand for cost-effective, efficient, and reliable collaboration tools. The integration of AI and machine learning technologies presents an exciting avenue for enhancing collaboration displays by enabling features such as automatic content recognition, real-time translation, and intelligent content management. The growing adoption of cloud-based solutions for remote collaboration offers the potential to create more scalable and flexible display systems. As sectors like healthcare, education, and retail look for new solutions to improve remote interaction, the collaboration display market has significant growth opportunities, driven by technological advancements and changing work dynamics.

The increasing adoption of cloud-based solutions is allowing seamless integration and real-time collaboration across multiple devices and platforms, enhancing the overall functionality of collaboration displays. Advances in display technology, such as 4K and ultra-high-definition (UHD) displays, are improving visual quality and user experiences, making collaboration more immersive. The integration of artificial intelligence (AI) and machine learning (ML) is enabling smarter collaboration features, including automatic content arrangement, voice recognition, and personalized experiences. Furthermore, the growing demand for compact, portable collaboration displays is driven by the need for mobile and flexible working solutions. These trends are signaling a dynamic and rapidly evolving market, with continued technological innovations enhancing the adoption and capabilities of collaboration displays across a wide range of industries.

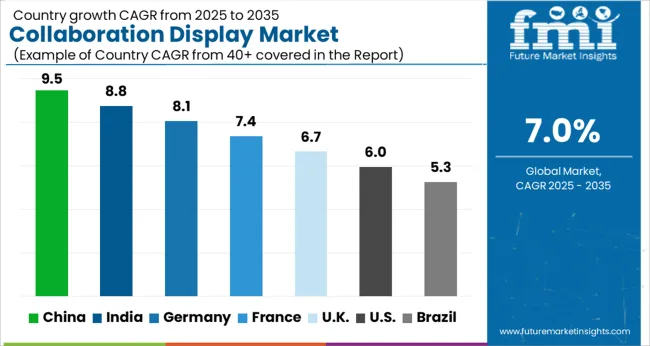

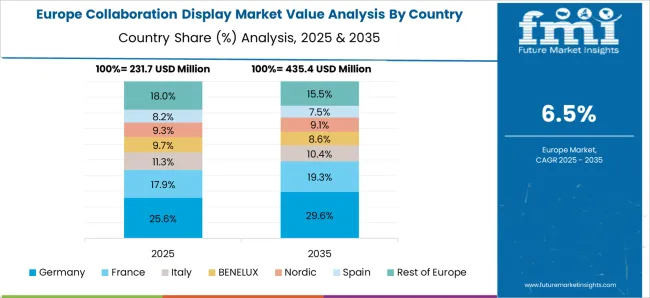

The global collaboration display market is projected to grow at a CAGR of 7.0% from 2025 to 2035. Among the key markets, China leads with a growth rate of 9.5%, followed by India at 8.8%, and France at 6.0%. The United Kingdom and the United States show more moderate growth rates of 6.7% and 6.0%, respectively. This growth is driven by the increasing demand for digital solutions in business, education, and government sectors. Emerging markets like China and India are expanding rapidly, while developed markets continue to focus on integrating digital collaboration technologies and enhancing communication solutions. The analysis includes over 40+ countries, with the leading markets detailed below.

The global collaboration display market is projected to grow at a CAGR of 7.0% from 2025 to 2035. Among the key markets, China leads with a growth rate of 9.5%, followed by India at 8.8%, and France at 6.0%. The United Kingdom and the United States show more moderate growth rates of 6.7% and 6.0%, respectively. This growth is driven by the increasing demand for digital solutions in business, education, and government sectors. Emerging markets like China and India are expanding rapidly, while developed markets continue to focus on integrating digital collaboration technologies and enhancing communication solutions. The analysis includes over 40+ countries, with the leading markets detailed below.

China is expected to lead the global collaboration display market, growing at a projected CAGR of 9.5% from 2025 to 2035. The country’s increasing demand for advanced display technology in sectors like education, business, and government institutions is driving market growth. China’s rapid adoption of digital technologies and smart solutions in education and corporate environments is further fueling the demand for collaboration displays. The rise in remote working and virtual meetings, combined with China’s emphasis on integrating technology in business operations, is expected to boost market expansion. As China continues to invest in innovation and digital infrastructure, the demand for collaboration displays will continue to rise.

The collaboration display market in India is projected to grow at a CAGR of 8.8% from 2025 to 2035. The increasing adoption of digital education and remote working solutions is driving demand for collaboration displays in India. The country’s growing focus on smart classrooms, virtual learning platforms, and business digitization is expected to contribute to the market’s growth. As India continues to enhance its infrastructure and invest in digital tools for education and business operations, collaboration displays are becoming integral to enhancing communication and collaboration. The rise in startups and tech adoption in various sectors will also continue to fuel demand for these displays.

Demand for collaboration display in France is expected to grow at a steady pace, with a projected CAGR of 6.0% from 2025 to 2035. The country’s strong presence in the automotive, aerospace, and industrial sectors continues to drive demand for collaboration displays. France’s increasing focus on integrating digital technologies in its business and educational environments further contributes to the market’s growth. The rising demand for remote collaboration solutions in industries like automotive, aerospace, and education is also fueling the need for collaboration displays. As France continues to innovate in business processes and expand its digital infrastructure, the demand for advanced display solutions is set to grow.

The collaboration display market in the United Kingdom is projected to grow at a CAGR of 6.7% from 2025 to 2035. The UK’s demand for collaboration displays is driven by the increasing need for fast, reliable, and cost-effective delivery methods, particularly in urban environments. The rise of e-commerce, along with government support for drone-based services in healthcare, retail, and infrastructure sectors, is expected to contribute to the market’s growth. As the UK continues to innovate in autonomous transportation systems and smart city technologies, the market for collaboration displays is set to expand, offering new opportunities for companies in the sector.

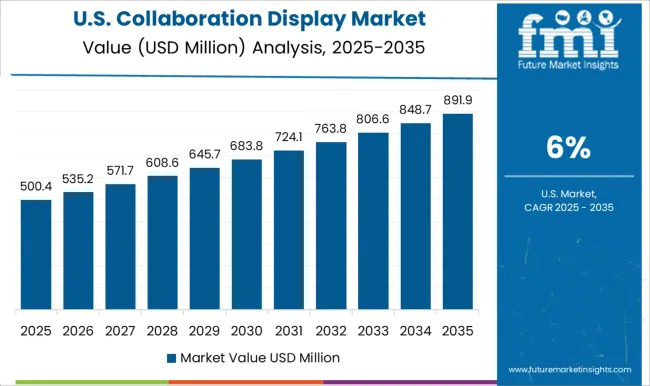

The collaboration display market in the United States is projected to grow at a CAGR of 6.0% from 2025 to 2035. The country’s strong demand for collaboration displays in business, education, and government sectors is driven by the increasing need for effective communication and teamwork. The rise in remote working, online learning, and virtual meetings is also fueling the market. As industries continue to adopt advanced technology and digital platforms for collaboration, the USA market for collaboration displays will continue to expand. With continued investments in digital infrastructure and remote communication technologies, market growth is expected to remain steady.

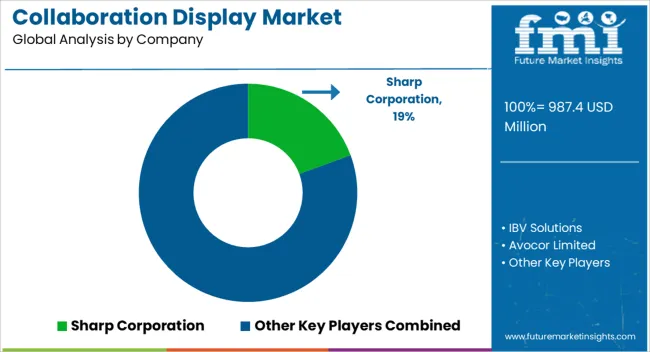

The collaboration display market is expanding rapidly as organizations prioritize interactive, connected solutions to support hybrid and remote work models. Sharp Corporation, Microsoft Corporation, and Cisco Systems Inc. lead the market through advanced hardware and integrated software ecosystems that enable seamless communication and real-time collaboration. Sharp offers high-resolution interactive displays with intuitive interfaces suitable for classrooms, boardrooms, and enterprise settings. Microsoft drives innovation with its Surface Hub series, integrating Microsoft 365 and Teams for enhanced productivity and connectivity. Cisco Systems combines collaboration displays with its Webex platform, delivering unified communication and conferencing solutions tailored for global enterprises.

Avocor Limited focuses on open-platform interactive displays that integrate smoothly with leading conferencing applications, offering flexibility for corporate and educational users. IBV Solutions provides customized collaboration display systems that align with existing IT infrastructure, helping organizations optimize hybrid work environments. InFocus Corporation targets education and small-to-medium enterprises with reliable, cost-effective displays that emphasize usability and performance. ViewSonic Corporation delivers collaboration displays featuring advanced touch technology and real-time annotation tools, serving both business and education markets.

| Item | Value |

|---|---|

| Quantitative Units | USD 987.4 Million |

| Offering | Hardware, Software, and Services |

| Resolution | 4K/UHD and 1080p |

| Screen Size | Above 65 Inches and Up to 65 Inches |

| Application | Large Meeting Rooms, Huddle Rooms, Classrooms, Open Layouts, Offices, and Others |

| End Users | Corporate Offices, Educational Institutions, Government Organizations, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Sharp Corporation, IBV Solutions, Avocor Limited, Cisco Systems Inc., InFocus Corporation, Microsoft Corporation, and ViewSonic Corporation. |

| Additional Attributes | Dollar sales by product type (interactive flat panels, all-in-one collaboration displays, digital signage solutions) and end-use segments (corporate offices, educational institutions, healthcare facilities, government organizations). Demand dynamics are driven by the increasing adoption of hybrid work models, the need for efficient communication tools, and advancements in display technologies. Regional trends indicate strong growth in North America, Europe, and Asia-Pacific, fueled by technological advancements and investments in digital infrastructure. |

The global collaboration display market is estimated to be valued at USD 987.4 million in 2025.

The market size for the collaboration display market is projected to reach USD 1,942.4 million by 2035.

The collaboration display market is expected to grow at a 7.0% CAGR between 2025 and 2035.

The key product types in collaboration display market are hardware, software and services.

In terms of resolution, 4k/uhd segment to command 57.2% share in the collaboration display market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Display Material Market Size and Share Forecast Outlook 2025 to 2035

Collaboration Tools Market Size and Share Forecast Outlook 2025 to 2035

Display Packaging Market Size and Share Forecast Outlook 2025 to 2035

Display Panel Market Size and Share Forecast Outlook 2025 to 2035

Display Pallets Market Size and Share Forecast Outlook 2025 to 2035

Display Controllers Market by Type, Application, and Region-Forecast through 2035

Display Drivers Market Growth – Size, Demand & Forecast 2025 to 2035

Displays Market Insights – Growth, Demand & Forecast 2025 to 2035

Market Share Distribution Among Display Pallet Manufacturers

Display Paper Box Market

Display Cabinets Market

3D Display Market Size and Share Forecast Outlook 2025 to 2035

4K Display Resolution Market Size and Share Forecast Outlook 2025 to 2035

3D Display Module Market

LED Displays, Lighting and Fixtures Market Size and Share Forecast Outlook 2025 to 2035

OLED Display Market Size and Share Forecast Outlook 2025 to 2035

Microdisplay Market Size and Share Forecast Outlook 2025 to 2035

IGZO Display Market Size and Share Forecast Outlook 2025 to 2035

Food Display Counter Market Size and Share Forecast Outlook 2025 to 2035

4K VR Displays Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA