The cook-up starch market is expected to remain under the influence of rising demand for label-friendly starches and growing preference for instant and cook-up applications.

Demand for cook-up starch is increasing against the backdrop of proliferating processed food industry that highly utilizes thickening agents, thereby driving the growth of the cook-up starch market.

Manufacturers in the cook-up starch market are engaged in aligning their product portfolio to ongoing label-friendly trend.

For instance, Cargill has introduced a new range of label-friendly functional cook-up starches in its SimPure™ portfolio, with the addition of three potato starches manufactured for meat, meat alternatives and culinary applications. Manufacturers in the cook-up starch market are also involved in introducing non-GMO cook-up starches.

Further, introduction of thermal-resistant cook-up starch is trending owing to evolving industrial manufacturing processes in the functional food industry.

As demand for ready-to-eat food is on the rise against the backdrop of growing population of working women and increasing preference for convenience among time-pressed consumers is expected to augur well for the cook-up starch market. A list of extensive end users including multiple food industry verticals and pet food is expected to bolster the growth of the cook-up starch market during the forecast period.

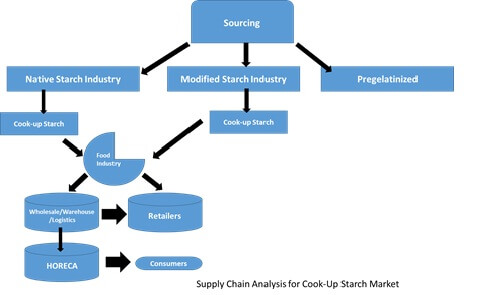

Starches have wide applications in the food industry and have been innovatively developed to improve the functionality of food products and now available in three major categories, namely instant, modified and pregelatinized.

The cook-up starch is part of the instant and modified starches segment. The cook-up starches possess a unique property to swell and form a gel after its suspension in cold water which is followed by heating.

The cook-up starch offers excellent texturizing and stabilizing properties in batters and flour mixes. The cook-up starch is a white to pale yellow colored powder and is ideal to use as a thickener in food processing industries. The growth of the cook-up starch market is governed by the demand for products which offer distinctive features and have advantages over the currently used starches.

With the markets for functional, clean label and shelf-stable starches are growing, the cook up-starch market is expected to witness a concurrent growth. Advanced research in overcoming the shortcomings of the current starch product portfolio is the basic factor that has fuelled the growth of the cook-up starch market.

In the overall starch market, the key players are focusing on launching innovative cook-up starch products that cater the specific demands of the food manufacturers. For instance, in May 2017, Tate & Lyle launched 17 new non-GMO starches, which also include the Rezista cook-up starch and Maxi-Gel cook-up starch, intended for applications in the dairy and soups industry.

In some countries, such as Japan, positive changes in the legislation concerning enlistment of food additives on product labels has also opened up market potential for international cook-up starch producers.

With major developments such as product launches and global expansions taking place, the cook-up starch market has made a separate and stronghold position for itself in the starch market and hence, other prospects of the cook-up starch market are also essential to scrutinize.

Examples of some of the key players operating in the cook-up starch market are Cargill Inc., SÜDSTÄRKE GMBH, Roquette, Tate & Lyle, Carst & Walker (C&W), Avebe, MGP, ASIA FRUCTOSE CO., LTD., Visco Starch, AGRANA Starch, Emsland Group, Ingredion, BENEO GmbH, Archer Daniels Midland Company, Grain Processing Corporation and Helios Kemostik, d.o.o., among others.

Major manufacturers in the cook-up starch market are focusing on launching new products. The prices of the cook-up starch are governed by the suppliers of the raw materials due to worldwide shortage of cereals.

In November 2017, Tate & Lyle, which produces food ingredients for industrial purpose, launched 17 new non-GMO starches including the Rezista cook-up starch and Maxi-Gel cook up-starch. These starches are mainly used in the yogurt and soups, sauces and gravy industries.

Ingredient manufacturers are also exploring more opportunities to diversify their starch sources. Also, manufacturers are robustly marketing their cook-up starch as plant-derived and clean-label products, catering the consumer demand for eco-friendly and clean-label products.

Educational marketing is a good opportunity for manufacturers for improving consumer penetration, as there is a lack of consumer awareness regarding the unique features of cook-up starch.

Also, there is immense scope for improving the product labels of the end-use products, as informative labels and additives in the product are key factors influencing the consumer buying decisions nowadays, especially in regions such as Europe and the U.S. Also, manufacturers targeting geographical expansions have an opportunity for establishing new and special plants dedicated to the cook-up starch facilities in regions such as Europe, due to easy procurement of raw materials for cook-up starch.

The cook-up starch market is still in the growth phase and awareness about the unique benefits of cook-up starch is highly masked by its competitor products such as pregelatinized starch and other native products.

Promotional efforts and development programs dedicated to cook-up starch are essential for marketing cook-up starch which will in turn, boost the growth of the cook-up starch market.

A modelling-based approach and triangulation methodology will be followed to estimate data covered in this report.

A detailed market understanding and assessment of the applications, types, forms and end uses of the product segments covered in the study is followed by carrying out a demand-side approach to estimate the sales of target product segments, which is then cross-referenced with a supply-side assessment of value generated over a pre-defined period.

The statistics and data is collected at a regional level, consolidated and synthesized at a global level to estimate the overall market sizes.

Some of the key data points covered in our report include:

The research report presents a comprehensive assessment of the market and contains thoughtful insights, facts, historical data, and statistically supported and industry-validated market data.

It also contains projections using a suitable set of assumptions and methodologies. The research report provides analysis and information according to market segments such as geographies, application, and industry.

The report is a compilation of first-hand information, qualitative and quantitative assessment by industry analysts, inputs from industry experts and industry participants across the value chain.

The report provides in-depth analysis of parent market trends, macro-economic indicators and governing factors along with market attractiveness as per segments. The report also maps the qualitative impact of various market factors on market segments and geographies.

On basis of type, the cook-up starch market is segmented as:

On the basis of source, the cook-up starch market is segmented as:

On the basis of end use, the cook-up starch market is segmented as:

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Starch-based Texturizing Agents Market Size and Share Forecast Outlook 2025 to 2035

Starch-based Packaging Market Size and Share Forecast Outlook 2025 to 2035

Starch-derived Fiber Market Size and Share Forecast Outlook 2025 to 2035

Starch-Based Bioplastics Packaging Market Insights - Growth & Forecast 2025 to 2035

Starch Derivatives Market by Product Type, Source, End Use and Region through 2035

Starches/Glucose Market

Starch Glucose Syrup Market

Starch Recovery Systems Market Outlook – Growth, Demand & Forecast 2023-2033

Distarch Phosphate Market Size and Share Forecast Outlook 2025 to 2035

UK Starch Derivatives Market Report – Size, Share & Innovations 2025-2035

Cornstarch Packaging Market Size and Share Forecast Outlook 2025 to 2035

Monostarch Phosphate Market Size and Share Forecast Outlook 2025 to 2035

Pea Starch Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

USA Starch Derivatives Market Analysis – Demand, Trends & Outlook 2025-2035

Pea Starch Concentrate Market Trends - Growth & Industry Forecast 2025 to 2035

Food Starch Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Wheat Starch Market Size and Share Forecast Outlook 2025 to 2035

ASEAN Starch Derivatives Market Trends – Growth, Demand & Forecast 2025-2035

Native Starch Market Analysis - Size, Growth, and Forecast 2025 to 2035

Europe Starch Derivatives Market Insights – Growth, Demand & Forecast 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA