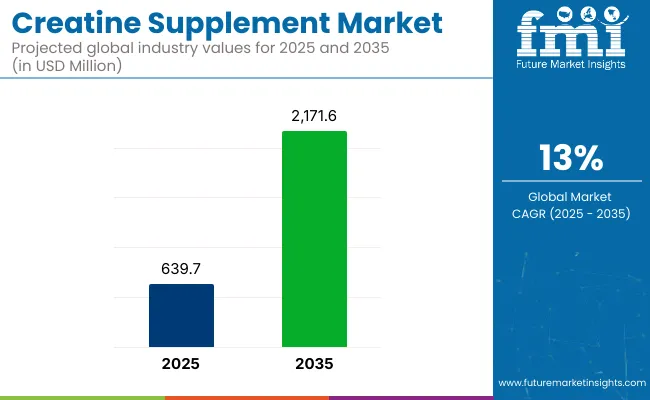

Surging demand is expected to elevate the global creatine supplement market from USD 639.7 million in 2025 to approximately USD 2,171.6 million by 2035, translating to a CAGR of 13.0% over the decade. As consumer emphasis on muscle strength, recovery, and physical endurance intensifies, creatine-based formulations are gaining mainstream traction in both professional and recreational fitness regimes.

| Attributes | Description |

|---|---|

| Estimated Market Size (2025E) | USD 639.7 million |

| Projected Market Value (2035F) | USD 2,171.6 million |

| Value-based CAGR (2025 to 2035) | 13.0% |

The supplement's widespread research-backed efficacy in enhancing ATP production, improving high-intensity performance, and delaying fatigue is driving broader adoption. Additionally, the rising prevalence of personalized nutrition and sports-centric supplementation is paving new pathways for growth.

The market is witnessing strong momentum across fitness enthusiasts, athletes, and aging populations seeking to preserve muscle mass and functional mobility. While powdered creatine remains dominant due to ease of consumption and bioavailability, innovations in delivery formats such as capsules, chewables, and RTDs are steadily expanding the consumer base.

However, concerns regarding purity, digestive discomfort in some users, and lack of awareness in emerging markets continue to restrain full-scale market penetration. Nevertheless, industry players are responding with micronized creatine, vegan-certified variants, and stackable blends. A notable trend is the entry of creatine into non-traditional channels such as e-sports recovery, healthy aging, and cognition-enhancing supplements, further diversifying its application profile.

Between 2025 and 2035, the creatine supplement landscape is expected to experience intensified competition and product differentiation. Market expansion will likely be steered by direct-to-consumer online retail, targeted influencer-led marketing, and science-backed formulation upgrades.

North America and Europe are anticipated to retain strong footholds, while Asia-Pacific is poised to emerge as a high-growth region due to rising disposable incomes and fitness awareness. By 2035, strategic brand consolidation, personalized creatine regimens, and clean-label innovations are expected to redefine the value proposition of creatine supplements.

In 2025, creatine supplements catering to cognition and healthy aging represent a modest 6.4% market share, but this niche is expanding rapidly with double-digit annual growth. Clinical studies highlighting creatine’s role in neuromuscular function, cognitive resilience, and mitochondrial efficiency are drawing interest from older adults, biohackers, and longevity-focused consumers.

The European Food Safety Authority (EFSA) has recognized creatine’s contribution to normal energy metabolism and muscle function, creating regulatory support for such health claims. Companies such as Thorne HealthTech and Momentous have already launched creatine monohydrate products tailored for neurological performance and age-related sarcopenia prevention.

Unlike traditional sports supplements, these formulations are marketed with a broader wellness narrative, often combined with adaptogens or nootropics like lion’s mane or magnesium l-threonate. Despite lower overall consumption volumes, unit value is higher due to premium positioning, clean-label demands, and specialty packaging.

Product development is skewing toward capsules and RTD formats to appeal to non-sporting populations. With the healthy aging population projected to grow by 60% in key markets such as Japan, Germany, and the US by 2035, this segment offers a high-margin diversification route for formulators.

By 2025, e-sports-focused creatine products contribute less than 2.8% of global market revenue but are gaining prominence as performance supplements align with cognitive endurance and reaction time. Emerging research suggests that creatine supports brain energy metabolism and neural resilience, both of which are critical for competitive gaming. Brands like CTRL and MADMONQ are already exploring synergistic blends combining creatine with caffeine, theanine, and B-vitamins to optimize focus without crashes.

The North American e-sports supplement space, supported by partnerships with streamers and leagues, has accelerated product visibility, especially via platforms like Twitch and Discord. Regulatory categorization remains loosely governed, typically falling under the broader food supplement directives (FDA or EFSA), enabling flexible marketing language. With e-sports viewership expected to surpass traditional sports in key demographics by 2030, strategic alliances and targeted formulations are critical levers.

The opportunity lies in formulating micro-dose creatine stacks with rapid uptake and minimal bloating-factors crucial for sedentary but high-performance users. This sub-segment will see innovation in packaging (single-serve sticks, gaming-themed containers), format (chews, hydration mixers), and marketing, setting it apart from athletic positioning.

There is high demand due to factors such as heightened fitness trends, enhanced sporting activity, and heightened awareness of the role of creatine in muscle recovery and strength gain. Bodybuilders and athletes opt for high-quality, research-formulated creatine monohydrate due to its established performance-enhancing virtues. Fitness enthusiasts, such as those who visit the gym occasionally, consider affordable, flavored, and mixable alternatives. The pharmaceutical segment has creatine as an area of interest for neurological and muscular disorders, with ensuing demand for drug-grade supplements.

Online and retail sales are booming, with e-commerce sites fueling expansion through bulk bargains, subscriptions, and reviews. Third-party testing, ingredient transparency, and brand reputation are top purchasing considerations. Vegan-friendly and micronized creatine formulations are also fast becoming consumer favorites that appeal to digestive and solubility enhancements.

As more interest is being generated for natural and sustainable supplement formulations, companies are innovating with plant-based, additive-free, and scientifically developed creatine products to cater to changing consumer tastes.

There is good growth due to the rapidly growing consumer interest in sports nutrition and muscle recovery. However, the regulatory issue surrounding supplement safety, labeling, and health claims appears to be a huge challenge. Companies must follow the global dietary supplement rules, conduct clinical experiments, and provide product transparency to protect themselves from legal risks and build up consumer trust.

Supply chain interruptions involving increases in raw material availability and manufacturability issues have adverse effects on industry fluctuations. Specificity on sourcing the original ingredient for creatine production may cause price changes and product shortages. Building a network of different suppliers aside, companies need to invest in environment-friendly sourcing and product update avenues.

The pressure on pricing and the competition mainly come from alternative products such as protein shakes and amino acid-feature supplements. Since the competition is very high, companies should invest in distinct ingredients and flavors along with the use of product formats personalized to different consumers' needs, such as ready-to-mix powders and gummies.

Economic ups and downs, as well as changing trends in fitness, can affect sales. To maintain growth over the years, the businesses should focus on cost-best research-backed advantages and venturing into new distribution channels such as online shops and special nutrition stores, in addition to adapting to customers' demands in the sports and wellness sector.

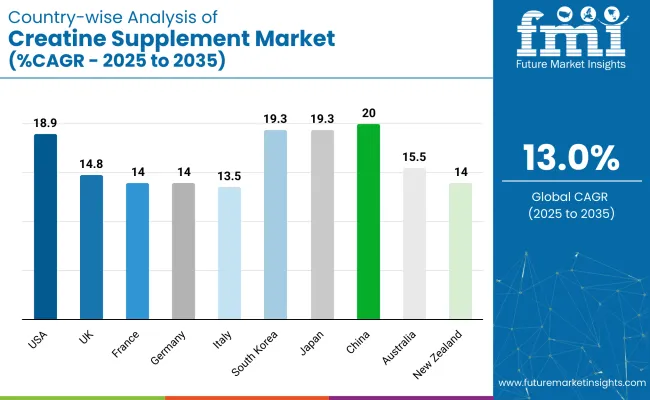

| Countries | CAGR (2025 to 2035) |

|---|---|

| USA | 18.9% |

| UK | 14.8% |

| France | 14% |

| Germany | 14% |

| Italy | 13.5% |

| South Korea | 19.3% |

| Japan | 19.3% |

| China | 20% |

| Australia | 15.5% |

| New Zealand | 14% |

The USA is projected to expand at a CAGR of 18.9% during the period 2025 to 2035. This growth is fueled by a robust fitness culture and growing health awareness among consumers. Key American players such as Optimum Nutrition and MuscleTech have gained prominence by providing high-quality creatine supplements. The popularity of e-commerce platforms has also given a significant fillip to sales, and supplements are now more easily available across the country.

Furthermore, recommendations by professional athletes and fitness influencers have increased consumer demand for creatine. The American industry is also supported by a strong regulatory system that protects product safety and efficacy, thus generating trust among consumers. Innovations in the form of flavored creatine powders and easy delivery options such as capsules have made the product more popular among a greater population of consumers, both amateur and professional sportspeople.

While the United Kingdom creatine supplement market is expected to expand at a CAGR of 14.8% between 2025 and 2035, increased demand for fitness activities and greater awareness of nutritional supplements drive the growing trend. Domestic brands such as Myprotein have become popular because they provide low-cost, high-quality creatine products. Growth in online distribution channels has also contributed significantly to growth.

Furthermore, government initiatives promoting physical activity and health have positively influenced consumer behavior. The UK 's stringent regulatory standards ensure product quality, enhancing consumer confidence. Collaborations between supplement manufacturers and fitness centers have also facilitated targeted marketing efforts, effectively reaching potential customers.

France's creatine supplement market is expected to grow at a CAGR of 14.0% over the forecast period. The focus on sporting culture and wellness in the country has resulted in higher supplement usage. French companies such as Eiyolab have taken advantage of this trend by providing high-end creatine products that appeal to the French consumer who is particular about products. The availability of specialty health stores and pharmacies has made the product widely available.

Additionally, partnerships between sports organizations and supplement firms have improved product visibility. Natural and organic products are also favored, leading brands to emphasize clean-label products. Educational campaigns on the advantages of creatine have also increased consumer demand and acceptability.

The creatine supplement industry in Germany is projected to see a CAGR of 14.0% during 2025 to 2035. A strong focus on body fitness and established sports infrastructure help drive the same. Established domestic brands such as ESN (Elite Sports Nutrients) enjoy a high quality and performance brand image, thus appealing to recreational as well as professional players. Mainstream integration of supplements in retail channels has increased accessibility to the masses.

Finally, Germany's strict standards of quality control also guarantee that products are up to high safety and efficacy standards, generating consumer confidence. Fitness events and expo popularity offer opportunities for brands to present their products, boosting consumer interaction. The move toward individualized nutrition has also resulted in the creation of individualized creatine products to suit different fitness objectives.

Italy is likely to expand at a CAGR of 13.5% during the current decade. Sports and football have always been a favorite pastime in Italy, and in its pursuit, there has been growing interest in such performance-enhancing supplements. To capitalize on the trend, domestic brands such as Yamamoto Nutrition have established a portfolio of creatine products, each addressing the different needs of athletes. The rise of gyms and fitness centers in Italy has also fuelled supplement intake.

In addition, Italy's gastronomic heritage is focused on natural ingredients, prompting consumers to look for quality, clean-label supplements. The partnership between sports clubs and supplement companies has helped boost brand presence and reputation. Health and wellness tourism in Italy has also provided new opportunities for growth, targeting health-oriented consumers.

South Korea's creatine supplement market will expand at a CAGR of 19.3% during 2025 to 2035. The nation's vibrant fitness culture and the impact of K-pop and entertainment sectors have increased interest in physical form and performance. Domestic players such as NutriPlanet have profited from the trend by introducing innovative creatine products targeting the youth population. The prevalence of social media platforms has also promoted successful marketing techniques.

Furthermore, the high level of technological development in South Korea has facilitated the emergence of innovative e-commerce systems that make it easier for people to access supplements. The country's encouragement of the health and wellness sector further increased demand. Partnering between supplement organizations and fitness ambassadors has also effectively spread their scope.

Japan's creatine supplement market is expected to expand at a CAGR of 19.3% over the forecast period. The aging population in the country has resulted in a growing interest in preserving muscle mass and overall well-being, fueling supplement consumption. Domestic brands such as Dymatize have launched products that target both the elderly and young fitness enthusiasts. The incorporation of supplements into conventional health practices has also helped drive growth.

Further, Japan's emphasis on technological innovation has resulted in the creation of sophisticated supplement formulations to increase efficacy and consumer popularity. Easy retail outlets, including vending machines and specialty stores, have made supplements easily available. Partnerships between supplement producers and healthcare professionals have also contributed to consumer awareness of the advantages of creatine.

China is expected to rise at a rate of 20.0% CAGR throughout 2025 to 2035. Increasingly rapid urbanization and the rapidly expanding middle-class population with a growing disposable income have boosted health and fitness products, including the demand for creatine.

The rising adoption of home workout routines and gym memberships has led to more Chinese consumers desiring performance-improving supplements. Local brands such as By-Health have picked up a lot of momentum by providing localized products that respond to consumer demand for clean-label and certified products. Penetration by e-commerce leaders like Alibaba and JD.com has made product availability nationwide, including in smaller cities, easier.

Active promotion by the Chinese government of health and wellness, coupled with pervasive social media influence, has further driven demand. Fitness bloggers and livestream shopping activities have become significant sales platforms, enabling brands to reach target audiences directly.

Additionally, the youth population's fascination with bodybuilding and athletic performance is increasing, making creatine a top pick among amateur and professional athletes. Further, local brands began investing in research and development to differentiate their products through new forms of delivery, such as effervescent tablets and ready-to-drink, creating more consumer involvement in a crowded industry.

Australia is expected to grow at a CAGR of 15.5% during the period 2025 to 2035. The nation boasts a rich sporting and fitness culture, with a large majority of the population regularly engaging in gym activities, outdoor sports, and wellness programs. This has led to a strong demand for creatine products.

Local brands such as Bulk Nutrients have made a name for themselves with a purity and transparency approach, providing unflavored, additive-free creatine monohydrate to appeal to the health-conscious. Increased plant-based and allergen-free product options have also created new consumer groups.

Apart from gym users, Australia has witnessed increased interest from endurance athletes and fitness professionals interested in muscle recovery and strength development. Retail chains and websites have a broad availability of supplements, and the nation's strict regulatory climate provides product safety and confidence.

Sustainability and ethical sourcing are also high on the agendas of Australian consumers, leading brands to integrate environmentally-friendly packaging and sustainable ingredient sourcing, boosting their presence and customer loyalty. Ongoing investments in product education and awareness through agreements with gyms are likely to continue driving growth.

New Zealand is projected to expand at a CAGR of 14.0% during 2025 to 2035. The nation's compact but deeply passionate fitness base appreciates performance supplements that reflect the clean and natural wellness motif. Local players such as Nuzest, which has become synonymous with quality and sustainability, have entered the creatine industry with products that are specifically designed for athletes and health enthusiasts. The focus on openness and third-party testing has increased consumer confidence in domestically manufactured supplements.

With its robust sporting tradition, encompassing rugby and long-distance sports, creatine has gained popularity with amateur and elite athletes alike. New Zealanders also prefer additives-free supplements as part of the general trend toward natural and low-processed items. The increased availability of specialty health stores and online retailers has brought creatine closer to people, even in rural settings. Further, partnerships between health professionals and supplement companies are assisting in making consumers aware of the specific use of creatine as a muscle recovery agent and strength booster, propelling sustained demand.

The industry is strongly supported and enhanced by the increasing demands for sports nutrition products, muscle recovery products, and products with cognitive health benefits. Perceived fitness, advanced e-commerce channels, and scientific explorations of creatine’s efficacy in athletic performance and neurological health are contributing to growth.

Industry giants like Optimum Nutrition, MuscleTech, Thorne HealthTech, Bulk Supplements, and Kaged Muscle have established their supremacy with diverse formulations, strong branding, and a wide distribution network. Emerging players and niche firms are offering vegan creatine, micronized versions, and formulations supported by clinical results to cater to shifting consumer preferences.

Key product offerings include creatine monohydrate, creatine hydrochloride (HCL), creatine ethyl ester, and creatine nitrate in powder, capsule, and ready-to-mix drink forms. Companies are focusing on flavor and stackable supplement mixture options and enhanced solubility formulations to make their products better competitively.

Strategic influences of high relevancy shaping competition will include clinical research support through NSF and Informed-Sport certifications and perceived brand trust as more consumers move into the DTC sales format. Firms are also investing in very transparent labeling, third-party testing, and digital marketing campaigns targeted by audiences such as athletes, bodybuilders, and normal well-being consumers.

The trend is transforming in favor of more demanding people, with North America, Europe, and Asia-Pacific continuing to grow. Thus, the key players would strengthen penetration through subscription models, influencer partnerships, and enhancement of retail presence.

The industry is expected to generate USD 639.7 million, driven by rising demand for sports nutrition, fitness awareness, and increasing adoption of creatine in dietary supplements.

The market is projected to surpass USD 2,171.6 million by 2035, growing at a CAGR of 13%, fueled by expanding consumer interest in performance-enhancing supplements, increasing sports participation, and research-backed health benefits.

Key players in the market include Alzchem Group, Muscle Feast, BioTrust, Optimum Nutrition (ON), Raw Barrel, N&R Industries, Merck KGaA, Tradichem, Central Drug House (CDH), Shanghai Biosundrug, Spectrum Chemical MFG CORP, Bactolac Pharmaceutical, and Other industry players.

North America leads the market due to high consumer awareness, a strong fitness culture, and a well-developed supplement industry. Europe follows closely, driven by increasing demand for sports nutrition. Asia-Pacific is emerging as a high-growth region, fueled by rising health-conscious consumers and expanding gym and fitness trends.

Creatine monohydrate remains the most popular form due to its extensive research, effectiveness, and affordability.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Creatine Kinase Reagent Market Size and Share Forecast Outlook 2025 to 2035

Supplements And Nutrition Packaging Market

Supplementary Protectors Market

ACF Supplements Market Size and Share Forecast Outlook 2025 to 2035

Food Supplement Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Viscosupplementation Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

PDRN Supplements Market Size and Share Forecast Outlook 2025 to 2035

Viscosupplementation Industry Analysis in Europe - Size, Share & Forecast 2025 to 2035

Feed Supplements Market Analysis - Size, Share & Forecast 2025 to 2035

Sleep Supplement Market Size and Share Forecast Outlook 2025 to 2035

Gummy Supplements Market Size and Share Forecast Outlook 2025 to 2035

Fiber Supplements Market Size and Share Forecast Outlook 2025 to 2035

Vegan Supplements Market Analysis by Ingredient Type, Form, Customer Orientation , Sales Channel and Health Concer Through 2035

Analysis and Growth Projections for Green Supplement Business

Andro Supplements Market

Custom Supplement Formulation Service Market Size and Share Forecast Outlook 2025 to 2035

Beauty Supplements Packaging Market Size and Share Forecast Outlook 2025 to 2035

Herbal Supplement Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Beauty Supplement Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Biotin Supplement Market Analysis – Size, Share & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA