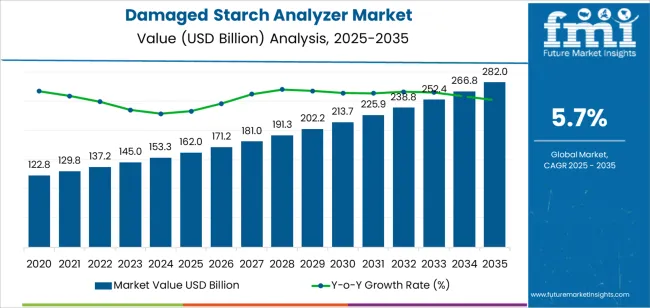

The damaged starch analyzers market is set to rise from USD 162 billion in 2025 to USD 282.0 billion by 2035 at a 5.7% CAGR. Growth is being anchored by flour milling and industrial baking, where tighter specification windows require consistent starch damage measurement to stabilize dough absorption, fermentation behavior, and crumb structure. Pharmaceutical excipient control is being treated as a second engine, since tablet hardness, disintegration, and release profiles depend on well-characterized starch fractions. In practical terms, procurement has shifted toward automated systems that cut operator variability, integrate LIMS, and deliver audit-ready traceability.

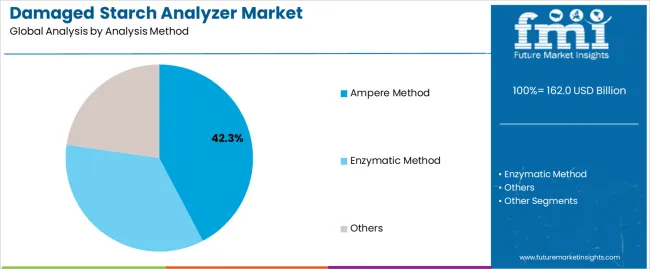

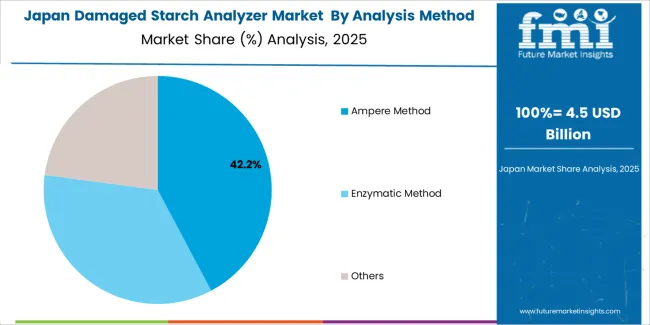

The Ampere method retains the installed-base edge in mills for speed and cost, while enzymatic assays gain traction in pharma and R&D for higher specificity. Asia Pacific is expected to post the fastest adoption due to millennial modernization and regulatory tightening in China and India. Europe sustains share through process discipline and standardization, and North America focuses on throughput, digital connectivity, and compliance documentation. Barriers do exist. Calibration governance, method comparability, and total cost of ownership still slow smaller plants. Even so, the competitive advantage sits with vendors that ship validated, multi-method platforms, deliver field calibration programs, and back it with dense service networks.

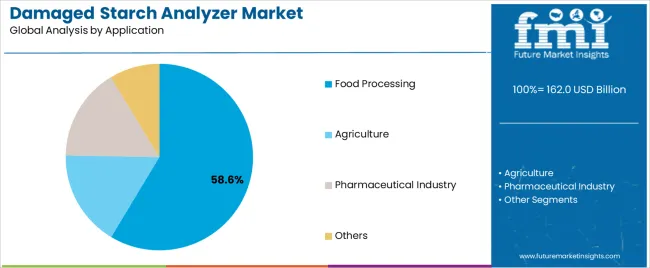

Pharmaceutical companies require precise damaged starch measurements to optimize excipient performance in tablet formulations and controlled-release applications. Agricultural research institutions are investing in advanced testing equipment to support crop breeding programs focused on starch quality improvement and variety selection.

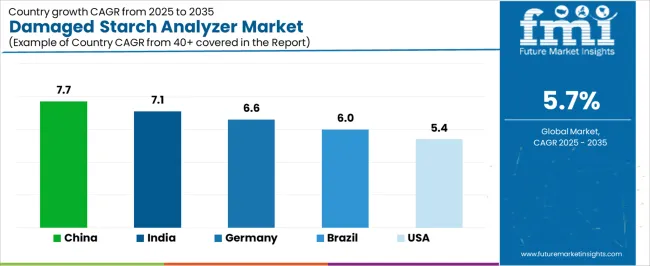

Regional dynamics demonstrate concentrated growth in established manufacturing economies with mature food processing infrastructure and expanding pharmaceutical sectors. Asian markets, led by China and India, are experiencing accelerated adoption driven by food safety regulation enhancement and pharmaceutical manufacturing expansion. European markets maintain steady growth supported by stringent quality standards and continuous process improvement initiatives in food manufacturing. North American operations focus on automation integration and efficiency optimization across laboratory testing workflows.

Technology adoption patterns reflect the transition from manual testing procedures to automated measurement systems capable of rapid sample processing and comprehensive data analysis. Laboratory equipment manufacturers are developing integrated platforms that combine multiple testing methodologies with digital data management capabilities, addressing manufacturer requirements for operational efficiency and regulatory compliance. The market faces ongoing challenges related to equipment calibration requirements, measurement standardization across testing methodologies, and cost justification for smaller manufacturing operations with limited testing volumes.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 162 billion |

| Market Forecast Value (2035) | USD 282.0 billion |

| Forecast CAGR (2025-2035) | 5.7% |

| QUALITY CONTROL REQUIREMENTS | REGULATORY COMPLIANCE | TECHNOLOGICAL ADVANCEMENT |

|---|---|---|

| Food Processing Standards Increasing quality specifications in flour milling and bakery ingredient manufacturing requiring precise starch damage measurement for product consistency and performance optimization. Pharmaceutical Excipient Testing Growing pharmaceutical manufacturing complexity demanding accurate starch characterization for excipient functionality and formulation stability in tablet production. Agricultural Breeding Programs Crop development initiatives requiring comprehensive starch quality assessment for variety selection and improvement programs across wheat and grain production. | Food Safety Regulations Regulatory frameworks establishing mandatory quality testing protocols favoring automated measurement systems with comprehensive documentation capabilities. Pharmaceutical Manufacturing Standards GMP requirements necessitating validated testing methodologies and equipment qualification procedures for excipient characterization and quality verification. International Quality Standards ISO certification requirements and export market specifications driving investment in standardized testing equipment with traceability capabilities. | Automated Testing Systems Development of integrated measurement platforms combining multiple testing methodologies with digital data management and reduced manual intervention requirements. Enhanced Measurement Accuracy Advanced sensor technologies and calibration procedures enabling precise starch damage quantification across diverse sample matrices and application requirements. Digital Integration Capabilities Laboratory information management systems integration and remote monitoring features supporting operational efficiency and regulatory compliance documentation. |

| Category | Segments Covered |

|---|---|

| By Analysis Method | Ampere Method, Enzymatic Method, Others |

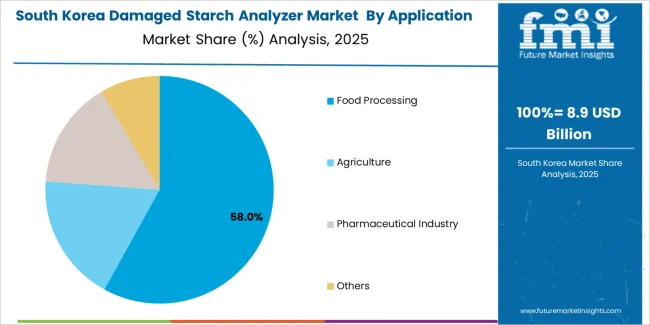

| By Application | Food Processing, Agriculture, Pharmaceutical Industry, Others |

| By Region | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Segment | 2025 to 2035 Outlook |

|---|---|

| Ampere Method |

|

| Enzymatic Method |

|

| Others |

|

| Segment | 2025 to 2035 Outlook |

|---|---|

| Food Processing |

|

| Agriculture |

|

| Pharmaceutical Industry |

|

| Others |

|

| DRIVERS | RESTRAINTS | KEY TRENDS |

|---|---|---|

| Quality Control Enhancement Expanding food processing quality requirements and pharmaceutical manufacturing standards driving investment in precise measurement systems for starch characterization and performance optimization. Laboratory Automation Growing emphasis on testing efficiency and throughput capacity creating demand for automated analysis systems with digital data management and reduced manual intervention. Regulatory Compliance Food safety regulations and pharmaceutical manufacturing standards requiring validated testing methodologies with comprehensive documentation and traceability capabilities. | Equipment Cost Barriers High initial investment requirements and calibration maintenance expenses limiting adoption among smaller manufacturing operations and research institutions with constrained budgets. Standardization Challenges Variations in measurement methodologies across different testing protocols affecting result comparability and complicating equipment selection for diverse applications. Technical Expertise Requirements Specialized knowledge needed for equipment operation and result interpretation creating adoption barriers in facilities with limited technical staff and training resources. | Digital Integration Laboratory information management system connectivity and automated data analysis capabilities enabling enhanced operational efficiency and regulatory compliance documentation. Multiparameter Platforms Development of integrated testing equipment combining starch damage measurement with additional quality parameters in unified systems supporting comprehensive ingredient characterization. Remote Monitoring Cloud connectivity and predictive maintenance capabilities providing operational insights and reducing equipment downtime through proactive service interventions. |

| Country | CAGR (2025-2035) |

|---|---|

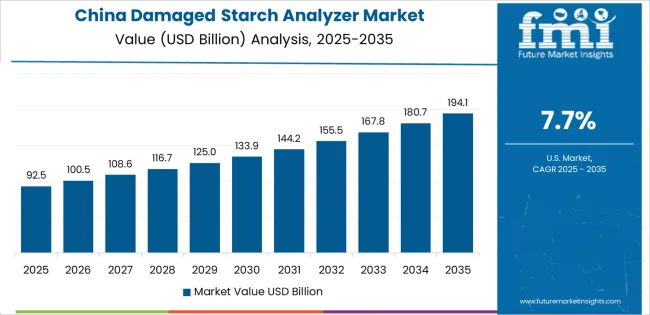

| China | 7.7% |

| India | 7.1% |

| Germany | 6.6% |

| Brazil | 6.0% |

| United States | 5.4% |

Revenue from Damaged Starch Analyzers in China is projected to exhibit strong growth with a market value of USD 76.9 million by 2035, driven by expanding flour milling infrastructure and comprehensive food safety regulation implementation creating substantial opportunities for laboratory equipment suppliers across food processing operations, pharmaceutical manufacturing facilities, and agricultural research institutions. The country's massive wheat processing capacity and expanding quality testing requirements are creating significant demand for automated measurement systems supporting operational efficiency and regulatory compliance. Major flour mills and food manufacturers are establishing comprehensive laboratory testing facilities to support large-scale production operations and meet growing domestic quality standards.

Food processing modernization programs are supporting widespread adoption of automated testing equipment across manufacturing operations, driving demand for measurement systems with proven performance capabilities. Quality standard enhancement initiatives and safety regulation implementation are creating substantial opportunities for equipment suppliers requiring reliable measurement accuracy and cost-effective operational performance. Manufacturing excellence programs and laboratory capability development are facilitating equipment adoption throughout major industrial regions.

Revenue from Damaged Starch Analyzers in India is expanding to reach USD 61.4 million by 2035, supported by extensive flour milling capacity expansion and comprehensive food processing industry development creating sustained demand for quality testing equipment across diverse manufacturing operations and agricultural research segments. The country's growing food safety awareness and expanding pharmaceutical manufacturing capabilities are driving demand for measurement systems that provide consistent analytical performance while supporting cost-effective laboratory operations. Equipment suppliers and manufacturers are investing in local service infrastructure to support growing testing requirements and equipment adoption.

Agricultural research program expansion and quality improvement initiatives are creating opportunities for testing equipment across diverse segments requiring reliable performance and competitive operational costs. Food manufacturing modernization and laboratory capability enhancement programs are driving investments in measurement systems supporting quality requirements throughout major production regions. Pharmaceutical sector growth and excipient testing development programs are enhancing demand for validated measurement equipment throughout manufacturing facilities.

Demand for Damaged Starch Analyzers in Germany is projected to reach USD 18.7 million by 2035, supported by the country's leadership in food processing technology and advanced pharmaceutical manufacturing requiring sophisticated testing systems for quality control and research applications. German manufacturers implement high-precision measurement systems that support advanced testing protocols, operational reliability, and comprehensive quality documentation. The market is characterized by focus on equipment accuracy, measurement standardization, and compliance with stringent quality and validation requirements.

Food processing industry investments are prioritizing advanced testing technologies that demonstrate superior measurement precision and reliability while meeting German quality standards and food safety regulations. Manufacturing excellence programs and operational optimization initiatives are driving adoption of automated measurement systems that support efficient laboratory workflows and quality assurance protocols. Research and development programs for ingredient optimization are facilitating adoption of specialized testing capabilities throughout major industrial centers.

Revenue from Damaged Starch Analyzers in Brazil is growing to reach USD 15.0 million by 2035, driven by agricultural research expansion and wheat processing capacity development creating sustained opportunities for equipment suppliers serving both commercial flour mills and university research facilities. The country's extensive agricultural research infrastructure and expanding food processing capabilities are creating demand for testing equipment that supports diverse quality assessment requirements while maintaining operational performance standards. Manufacturers and research institutions are developing procurement strategies to support laboratory capability enhancement and quality program implementation.

Agricultural breeding programs and crop quality improvement initiatives are facilitating equipment adoption capable of supporting diverse research requirements and competitive performance specifications. Food processing development and quality testing expansion programs are enhancing demand for measurement systems that support operational efficiency and analytical reliability. Wheat industry modernization and laboratory infrastructure development are creating opportunities for automated testing capabilities across Brazilian research and manufacturing facilities.

Demand for Damaged Starch Analyzers in United States is projected to reach USD 19.8 million by 2035, expanding at a CAGR of 5.4%, driven by food processing innovation and pharmaceutical manufacturing excellence supporting advanced quality control programs and comprehensive testing capabilities. The country's established laboratory infrastructure and growing automation emphasis are creating demand for integrated measurement systems that support operational efficiency and regulatory compliance standards. Equipment manufacturers and suppliers are maintaining comprehensive technical support capabilities to serve diverse testing requirements.

Food manufacturing advancement and quality program enhancement initiatives are supporting demand for automated testing equipment that meets contemporary performance and reliability standards. Pharmaceutical sector development and excipient characterization programs are creating opportunities for validated measurement systems that provide comprehensive analytical capabilities. Laboratory modernization and digital integration programs are facilitating adoption of advanced testing platforms throughout major manufacturing regions.

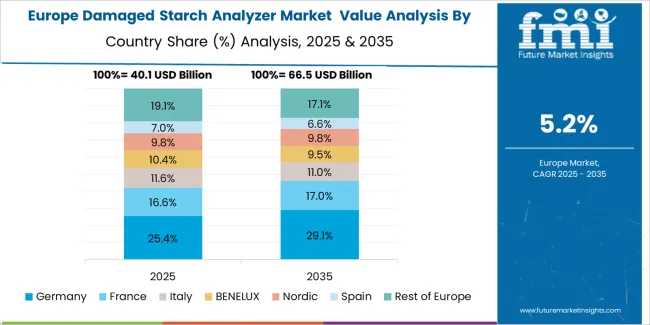

The damaged starch analyzer market in Europe is projected to grow from USD 38.7 million in 2025 to USD 67.4 million by 2035, registering a CAGR of 5.7% over the forecast period. Germany is expected to maintain its leadership position with a 28.4% market share in 2025, declining slightly to 27.8% by 2035, supported by its advanced food processing infrastructure and major flour milling operations concentrated in Bavaria and North Rhine-Westphalia.

France follows with a 21.6% share in 2025, projected to reach 22.1% by 2035, driven by comprehensive bakery ingredient manufacturing and pharmaceutical excipient production facilities. The United Kingdom holds a 18.9% share in 2025, expected to decrease to 18.3% by 2035 due to consolidation in flour milling operations. Italy commands a 15.7% share, while Spain accounts for 9.8% in 2025. The Rest of Europe region is anticipated to gain momentum, expanding its collective share from 5.6% to 6.3% by 2035, attributed to increasing quality testing adoption in Nordic countries and emerging Eastern European food processing operations implementing laboratory modernization programs.

Japanese damaged starch analyzer operations reflect the country's precise quality control standards in food manufacturing and pharmaceutical production. Major flour mills including Nisshin Seifun Group and Nitto Fuji require comprehensive starch quality testing protocols that exceed international standards, driving demand for automated measurement systems with validated performance specifications. Companies maintain rigorous equipment qualification procedures and calibration protocols supporting consistent quality assurance across production operations.

The pharmaceutical sector demonstrates particular strength in excipient characterization programs, with companies requiring detailed starch damage measurements for tablet formulation development and manufacturing quality control. Regulatory oversight through the Ministry of Health, Labour and Welfare emphasizes comprehensive testing documentation and equipment validation procedures that favor established manufacturers with proven measurement technologies.

South Korean damaged starch analyzer operations reflect the country's advanced food manufacturing capabilities and pharmaceutical sector growth. Major flour processors including CJ CheilJedang and Daesang implement sophisticated quality testing programs supporting both domestic production and export operations targeting Asian markets. Companies are investing in automated testing systems to enhance operational efficiency while meeting international quality specifications.

The pharmaceutical ingredient manufacturing sector drives demand for validated measurement systems capable of supporting GMP compliance requirements and regulatory submissions. Korean food and pharmaceutical manufacturers prioritize equipment suppliers with comprehensive technical support capabilities and established service networks supporting rapid maintenance response and calibration services.

Market dynamics favor established equipment manufacturers with proven measurement technologies and comprehensive service networks supporting food processing and pharmaceutical applications. Value concentration occurs around automated testing platforms capable of delivering precise measurement accuracy with minimal operator intervention, creating barriers for new entrants lacking validation documentation and installed base credibility. Several competitive archetypes dominate market positioning: global analytical equipment manufacturers leveraging broad laboratory equipment portfolios and established customer relationships across food and pharmaceutical sectors; specialized starch testing companies offering focused measurement solutions with deep application expertise in flour milling and grain quality assessment; regional equipment suppliers providing localized service capabilities and cost-competitive solutions for emerging market operations; and emerging automation providers developing integrated testing platforms combining multiple measurement methodologies with digital data management capabilities.

Switching costs remain elevated due to equipment validation requirements, operator training investments, and established testing protocols that favor incumbent suppliers in regulated pharmaceutical applications and quality-critical food processing operations. Technology transitions toward automated measurement systems and digital integration create opportunities for suppliers offering enhanced operational efficiency and comprehensive data management, though standardization challenges and method validation requirements slow adoption in conservative manufacturing environments. Consolidation pressure increases as larger analytical equipment companies acquire specialized testing manufacturers to expand application coverage and strengthen regional market positions.

Strategic positioning requires comprehensive validation support capabilities and proven measurement accuracy across diverse application requirements, particularly for pharmaceutical GMP operations and food safety compliance programs. Service network density and technical support responsiveness become critical differentiation factors as manufacturers prioritize equipment reliability and minimal downtime in high-volume testing operations. Market share stability depends on maintaining measurement standardization leadership and regulatory acceptance while adapting testing platforms to emerging automation requirements and digital laboratory management systems without disrupting established customer workflows or requiring extensive revalidation investments.

| Items | Values |

|---|---|

| Quantitative Units | USD 162 million |

| Analysis Method | Ampere Method, Enzymatic Method, Others |

| Application | Food Processing, Agriculture, Pharmaceutical Industry, Others |

| Regions Covered | North America, Latin America, Europe, Asia Pacific, Middle East & Africa |

| Country Covered | United States, Germany, China, India, Brazil, and other 40+ countries |

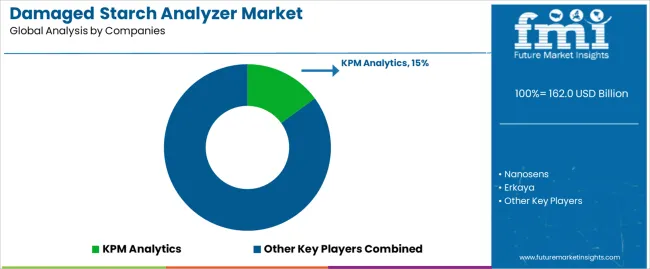

| Key Companies Profiled | KPM Analytics, Nanosens, Erkaya, Metron Group, SAYTEK, Yucebas Machinery Analytical Equipment Industry |

| Additional Attributes | Dollar sales by analysis method and application, regional demand across NA, EU, APAC, competitive landscape, technology adoption patterns, laboratory automation integration, and testing standardization initiatives driving measurement accuracy, operational efficiency, and quality compliance |

Analysis Method

The global damaged starch analyzer market is estimated to be valued at USD 162.0 billion in 2025.

The market size for the damaged starch analyzer market is projected to reach USD 282.0 billion by 2035.

The damaged starch analyzer market is expected to grow at a 5.7% CAGR between 2025 and 2035.

The key product types in damaged starch analyzer market are ampere method, enzymatic method and others.

In terms of application, food processing segment to command 58.6% share in the damaged starch analyzer market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Starch-based Texturizing Agents Market Size and Share Forecast Outlook 2025 to 2035

Starch-based Packaging Market Size and Share Forecast Outlook 2025 to 2035

Starch-derived Fiber Market Size and Share Forecast Outlook 2025 to 2035

Starch-Based Bioplastics Packaging Market Insights - Growth & Forecast 2025 to 2035

Starch Derivatives Market by Product Type, Source, End Use and Region through 2035

Starches/Glucose Market

Starch Glucose Syrup Market

Starch Recovery Systems Market Outlook – Growth, Demand & Forecast 2023-2033

Distarch Phosphate Market Size and Share Forecast Outlook 2025 to 2035

UK Starch Derivatives Market Report – Size, Share & Innovations 2025-2035

Cornstarch Packaging Market Size and Share Forecast Outlook 2025 to 2035

Monostarch Phosphate Market Size and Share Forecast Outlook 2025 to 2035

Pea Starch Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

USA Starch Derivatives Market Analysis – Demand, Trends & Outlook 2025-2035

Pea Starch Concentrate Market Trends - Growth & Industry Forecast 2025 to 2035

Food Starch Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Wheat Starch Market Size and Share Forecast Outlook 2025 to 2035

ASEAN Starch Derivatives Market Trends – Growth, Demand & Forecast 2025-2035

Native Starch Market Analysis - Size, Growth, and Forecast 2025 to 2035

Europe Starch Derivatives Market Insights – Growth, Demand & Forecast 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA