The global encapsulated salicylic acid market is projected to reach USD 32.1 million by 2035, recording an absolute increase of USD 20.8 million over the forecast period. The market is valued at USD 11.3 million in 2025 and is set to rise at a CAGR of 11.0% during the assessment period. The overall market size is expected to grow by nearly 2.8 times during the same period, driven by increasing demand for advanced skincare solutions, particularly in acne treatment, exfoliation, and anti-aging formulations. Advancements in encapsulation technologies are enhancing the efficacy and stability of salicylic acid, leading to higher adoption in both over-the-counter and prescription products. Regulatory challenges and competition from alternative active ingredients may pose obstacles to market expansion.

The encapsulated salicylic acid market is driven by the need for improved delivery and stability in active ingredients. Encapsulation protects salicylic acid from oxidation and irritation, allowing for more effective, sustained-release formulations. The rise in demand for anti-aging and acne treatment products, combined with consumer awareness of skincare benefits, is driving market growth. The growing preference for gentler, more stable formulations is expected to support continued expansion. The major applications for encapsulated salicylic acid include facial cleansers, acne creams, anti-aging serums, and skin rejuvenation treatments. Market growth is also supported by increasing research and development investments into improved formulation technologies and delivery systems that enhance the performance of encapsulated salicylic acid in skincare.

Between 2025 and 2030, the encapsulated salicylic acid market is projected to grow from USD 11.3 million to USD 17.1 million, resulting in a value increase of USD 5.8 million, which represents 46.7% of the total forecast growth for the decade. This phase of development will be driven by rising demand for advanced skincare solutions, particularly in acne treatment, exfoliation, and anti-aging formulations. The encapsulation of salicylic acid enhances its stability, reduces skin irritation, and ensures sustained release, making it increasingly popular in both over-the-counter and prescription products. Companies will continue investing in research and development to improve encapsulation technologies and create more effective, consumer-friendly formulations.

From 2030 to 2035, the market is expected to grow from USD 17.1 million to USD 32.1 million, adding another USD 15.0 million, which constitutes 53.3% of the overall ten-year expansion. This period will be characterized by a significant rise in the adoption of encapsulated salicylic acid in high-performance skincare products aimed at targeting a wide range of skin concerns. Advanced delivery systems, improvements in product formulations, and an increasing focus on personalized skincare will drive the market’s expansion. With the growing consumer demand for gentle yet effective active ingredients, encapsulated salicylic acid is expected to become a key ingredient in next-generation dermatological treatments, propelling further market growth through 2035.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 11.3 million |

| Market Forecast Value (2035) | USD 32.1 million |

| Forecast CAGR (2025-2035) | 11.0% |

The encapsulated salicylic acid market is expanding as the demand for effective and controlled acne treatment solutions continues to rise. Encapsulated salicylic acid offers a more stable and controlled release of the active ingredient, providing enhanced penetration and minimizing irritation compared to conventional formulations. This has made it particularly appealing in skincare products targeting acne, blemishes, and oil control, where consumers seek effective solutions with reduced side effects. As awareness about skincare ingredients grows, encapsulated salicylic acid has gained popularity for its ability to deliver better results without compromising skin comfort.

Technological advancements in encapsulation techniques are driving the growth of this market. These innovations allow for the targeted release of salicylic acid, enabling more effective and sustained action over time. Encapsulation not only improves the stability of salicylic acid but also helps protect it from degradation, ensuring its potency throughout the shelf life of the product. The increasing demand for gentle yet effective acne treatments has further fueled the adoption of encapsulated salicylic acid in both over-the-counter and professional skincare products.

Despite its growth, challenges such as the cost of production and the complexity of developing stable formulations may limit the accessibility of encapsulated salicylic acid in some regions. Regulatory concerns surrounding the safety of encapsulated ingredients in cosmetics could pose barriers. Ongoing innovation and growing consumer interest in more effective, skin-friendly solutions are expected to drive continued growth in the encapsulated salicylic acid market.

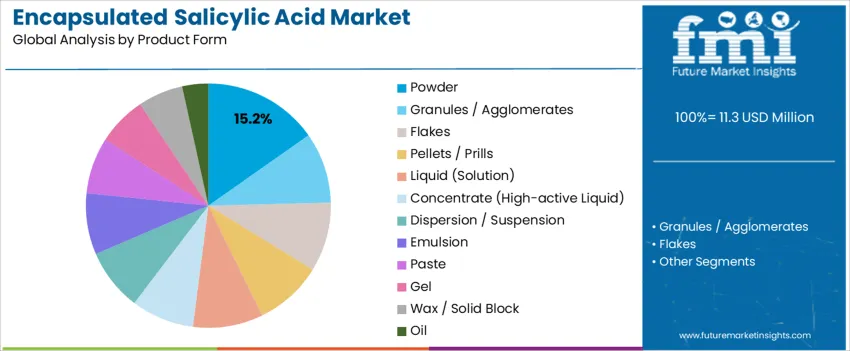

Global demand for encapsulated salicylic acid is shaped by end use applications and product form, with notable concentrations in East Asia, Western Europe, and North America. Skin care holds a 11.1% share, supported by the increasing demand for acne treatments, exfoliation, and skin resurfacing. Other significant segments include body care, hair care, sun care, color cosmetics, men’s grooming, baby and kids care, and dermocosmetic or professional care, spanning both mass and professional channels. On the product form side, powders dominate with a 15.2% share, alongside granules/agglomerates, flakes, pellets/prills, liquid solutions, high-active liquid concentrates, dispersions, emulsions, pastes, gels, wax/solid blocks, and oils. These trends reflect a focus on stability, controlled release, and effective formulation to meet consumer needs across diverse regional manufacturing hubs.

Skin care accounts for 11.1% of global encapsulated salicylic acid usage, driven by the increasing demand for acne treatment, skin exfoliation, and overall skin renewal. Encapsulated salicylic acid is commonly incorporated into cleansers, toners, serums, and spot treatments, where it provides gradual, targeted release, enhancing efficacy and minimizing irritation. Demand is particularly strong in regions like South Korea, Japan, the USA, and Western Europe, where innovations in dermocosmetics and professional skin care products are key drivers. Encapsulation allows salicylic acid to be delivered more effectively to deeper layers of the skin, supporting its use in acne care, anti-aging, and other therapeutic skin treatments. Professional and dermocosmetic brands leverage this technology to target sensitive skin conditions. Ongoing product development in countries such as France, Germany, and the USA continues to emphasize encapsulated actives within regulated cosmetic frameworks.

Powder form holds a 15.2% share of global encapsulated salicylic acid demand due to its superior stability, controlled moisture exposure, and consistent performance in formulations. Powders enable precise dosing, facilitating easy integration into emulsions, gels, and other formulations while ensuring uniform product quality across large-scale production in regions like Asia, Europe, and North America. Powder formats also offer logistical advantages, improving transport efficiency by minimizing leakage and reducing the need for refrigeration during global shipping. Manufacturers prefer powders for their compatibility with automated blending systems, providing predictable product quality even in varying climates. Regulatory documentation and microbial specifications for powders are more standardized, making them suitable for export markets. These factors contribute to powder’s dominance as the preferred product form for encapsulated salicylic acid.

The encapsulated salicylic acid sector is influenced by the growing demand for targeted skin care solutions, particularly in the treatment of acne, inflammation, and other skin imperfections. Salicylic acid is well-known for its ability to exfoliate the skin, unclog pores, and reduce acne-causing bacteria. Its potential for causing irritation limits its widespread use, especially for sensitive skin. Encapsulation technology addresses this issue by protecting the active ingredient and enabling controlled release, which reduces irritation while enhancing its efficacy. This technology makes salicylic acid more suitable for daily skin care formulations, including cleansers, serums, and moisturizers, thus expanding its appeal. The increasing focus on personalized skin care and multifunctional products further drives demand for encapsulated salicylic acid solutions.

Demand for encapsulated salicylic acid is growing as consumers seek more effective and gentle solutions for acne, oily skin, and exfoliation. The encapsulation process enhances stability, prevents degradation, and ensures a controlled release, making it more suitable for daily use compared to traditional formulations. Consumers with sensitive skin or those prone to irritation are attracted to encapsulated versions, as it allows the benefits of salicylic acid without the harshness. In addition, the rise of clean beauty trends and the growing awareness of skin health have pushed consumers toward advanced formulations that deliver targeted treatments. The need for gentle but potent acne treatments continues to drive the adoption of encapsulated salicylic acid in both mass-market and premium skincare lines.

Despite its benefits, the adoption of encapsulated salicylic acid faces challenges related to formulation complexity and cost. Developing stable encapsulated systems requires advanced technologies and precise control over manufacturing processes, which can increase production costs. This can make encapsulated formulations more expensive than traditional salicylic acid products, potentially limiting accessibility for some consumers. The process may affect the speed of visible results, as the controlled release can take longer compared to more immediate, unencapsulated products. Regulatory concerns, particularly in different regions regarding claims and ingredients, may also slow the market expansion. As the sector grows, overcoming these barriers will require continued innovation and consumer education on the benefits of encapsulated salicylic acid.

Several key trends are redefining the encapsulated salicylic acid sector, including the growing preference for multifunctional skin care products. Encapsulated salicylic acid is increasingly being combined with other actives such as niacinamide, peptides, or hyaluronic acid to address multiple skin concerns, including acne, pigmentation, and hydration. There is also a focus on developing products suitable for a wider range of skin types, especially sensitive skin, where encapsulation allows for gentler yet effective results. Advances in encapsulation technology, such as liposomes or nanocarriers, are improving the stability and penetration of salicylic acid, enhancing its ability to target deeper layers of the skin. The rise of personalized skincare and the demand for sustainable, eco-friendly packaging are also pushing the market towards more innovative and tailored solutions.

| Country | CAGR (%) |

|---|---|

| India | 14.8% |

| China | 13.7% |

| Japan | 12.6% |

| UK | 11.5% |

| Germany | 10.4% |

| USA | 9.3% |

The encapsulated salicylic acid market is witnessing substantial global growth, led by India with a 14.8% CAGR, driven by increasing consumer demand for targeted skincare solutions, particularly for acne and blemishes. China follows with a 13.7% CAGR, supported by the rising middle class and growing focus on skincare products that offer controlled release. Japan’s market is growing at 12.6%, bolstered by its emphasis on precision skincare and a focus on effective acne management. The UK and Germany show steady growth at 11.5% and 10.4%, respectively, driven by increased demand for acne treatments and anti-inflammatory skincare. In the USA, the market is growing at a moderate pace of 9.3%, reflecting continued interest in advanced skincare products, despite a mature market.

India’s encapsulated salicylic acid market is projected to grow at a 14.8% CAGR through 2035. This strong growth is driven by rising demand for targeted skincare solutions, especially for acne and blemish treatment. With a growing middle class and increasing disposable incomes, Indian consumers are becoming more aware of the importance of skincare. The shift toward advanced products that offer controlled release, effective results, and reduced irritation is a key trend. Urbanization is also accelerating demand for premium skincare products. E-commerce platforms are expanding access to encapsulated salicylic acid products, making them more widely available to consumers. Local manufacturing further supports affordability and availability, contributing to increased market penetration and broad adoption of encapsulated salicylic acid in the Indian skincare industry.

China’s encapsulated salicylic acid market is growing at a 13.7% CAGR through 2035. This growth is driven by an increasing focus on skincare, particularly acne and oily skin solutions. Encapsulated salicylic acid is highly favored due to its ability to offer controlled release with minimal irritation, which appeals to consumers with sensitive skin. China’s expanding middle class is increasingly seeking premium skincare products, further driving demand. Additionally, e-commerce platforms have made these advanced skincare treatments more accessible to a wider audience. Young consumers, in particular, are turning to encapsulated salicylic acid for acne management and overall skin health. As skincare awareness rises and more consumers opt for effective, gentle treatments, the encapsulated salicylic acid market in China is expected to continue its rapid expansion.

Japan’s encapsulated salicylic acid market is growing at a 12.6% CAGR through 2035, driven by the demand for acne treatments and precision skincare solutions. Encapsulated salicylic acid is favored for its controlled release, which minimizes irritation while targeting acne and other skin blemishes. Japan’s strong skincare culture and focus on scientific formulations further contribute to the demand. The country’s aging population, which often faces skin concerns like acne, also drives the market as consumers seek products that address their specific needs. Japan’s high consumer trust in dermatologically proven products ensures a strong market for encapsulated salicylic acid. As consumers prioritize skin health and seek reliable, effective solutions, the market for encapsulated salicylic acid in Japan continues to grow steadily.

The UK’s encapsulated salicylic acid market is experiencing steady growth with an 11.5% CAGR through 2035. This growth is driven by an increasing demand for acne treatments and overall skin health solutions. Encapsulated salicylic acid is especially popular for its ability to provide controlled release, reducing skin irritation while delivering effective results. As consumers become more educated on the benefits of salicylic acid for acne and blemish management, its demand is rising. The UK has a strong beauty culture, and clinical skincare treatments are becoming increasingly popular. With skincare products available through retail pharmacies, e-commerce platforms, and specialist stores, the accessibility and availability of encapsulated salicylic acid have improved, further driving growth in the market.

Germany’s encapsulated salicylic acid market is projected to grow at a 10.4% CAGR through 2035. The demand for encapsulated salicylic acid is driven by the need for effective acne treatments and anti-inflammatory skincare products. Consumers increasingly prefer encapsulated formulations as they target acne and blemishes with minimal irritation. Germany’s established skincare market places a premium on high-quality, scientifically proven products, which supports the growing interest in encapsulated salicylic acid. The country’s aging population, which often experiences acne and skin sensitivity issues, contributes to the sustained demand for these products. The market is further supported by wide distribution through retail pharmacies, dermatology clinics, and online platforms, which ensure better access and availability, boosting the growth of the encapsulated salicylic acid market.

The USA’s encapsulated salicylic acid market is growing at a 9.3% CAGR through 2035. Despite being a mature market, the USA continues to see steady growth in the encapsulated salicylic acid sector. The primary drivers include ongoing consumer demand for acne treatments and products that provide targeted, controlled release. Encapsulated salicylic acid is favored for its ability to deliver effective results while minimizing irritation, which appeals to those with sensitive skin. The growing interest in advanced skincare solutions, especially for acne and oily skin, is contributing to the market’s stability. With widespread availability through retail chains, dermatology clinics, and online platforms, encapsulated salicylic acid products are easily accessible. This continued demand for effective treatments ensures steady growth in the USA’s encapsulated salicylic acid market.

The demand for encapsulated salicylic acid is rising due to its ability to offer controlled release, enhanced stability, and reduced irritation compared to conventional formulations. Encapsulated salicylic acid is increasingly used in skincare products, especially those targeting acne, blackheads, and exfoliation. The controlled release of salicylic acid helps to improve skin clarity and texture without causing excessive dryness or irritation, making it ideal for sensitive skin. As consumer interest in effective and gentle skincare products grows, encapsulated salicylic acid is becoming a popular ingredient in formulations designed to treat acne, prevent breakouts, and promote skin health.

Key players shaping the encapsulated salicylic acid industry include BASF SE, Croda International, Evonik Industries, Symrise (including IFF/Givaudan active ingredient businesses), Dow Inc., Ashland, Clariant, and Seppic. BASF SE leads the market with a notable 14.6% share, leveraging its expertise in encapsulation technology and extensive product portfolio. These industry leaders focus on developing high-quality, stable encapsulated salicylic acid solutions to meet the growing demand for acne treatment and exfoliation products. Smaller, specialized providers also contribute by offering custom formulations for specific skincare needs, ensuring a diversified and competitive market.

The expansion of the encapsulated salicylic acid sector is driven by advancements in encapsulation techniques that improve the efficacy and stability of the active ingredient. By protecting salicylic acid from degradation, encapsulation ensures its long-lasting effect on the skin. As consumers increasingly seek products that offer both performance and gentleness, encapsulated salicylic acid is becoming an essential component of a wide range of skincare applications, particularly in acne treatment, exfoliation, and skin rejuvenation.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD million |

| End Use Application | Skin Care, Body Care, Hair Care, Sun Care, Color Cosmetics, Men’s Grooming, Baby & Kids Care, Dermocosmetic / Professional Care |

| Product Form | Powder, Granules / Agglomerates, Flakes, Pellets / Prills, Liquid (Solution), Concentrate (High-active Liquid), Dispersion / Suspension, Emulsion, Paste, Gel, Wax / Solid Block, Oil |

| Regions Covered | North America, Europe, East Asia, South Asia, Latin America, Middle East & Africa, Eastern Europe |

| Countries Covered | USA, China, Japan, South Korea, India, Germany, UK, France, Italy, Brazil, Argentina, Mexico, Saudi Arabia, South Africa, Russia, others |

| Key Companies Profiled | BASF SE, Croda International, Evonik Industries, Symrise (including IFF/Givaudan actives), Dow / Dow Inc., Ashland, Clariant, Seppic / Others (Lubrizol, Lonza, Inolex), Other regional and niche suppliers |

| Additional Attributes | Dollar by sales by end use application and product form; regional CAGR and growth outlook; multi-strain formulation adoption; clinical validation and regulatory compliance tracking; distribution channels including retail, DTC, e-commerce, and institutional buyers; product form prevalence in powders, liquids, and emulsions; regional preference for strain libraries; supply chain logistics for cold chain and ambient stability; strain survivability, CFU consistency, and shelf-life performance; innovation trends including prebiotic/postbiotic combinations, non-dairy matrices, and personalized nutrition; competitive positioning of global vs regional suppliers. |

The global encapsulated salicylic acid market is estimated to be valued at USD 11.3 million in 2025.

The market size for the encapsulated salicylic acid market is projected to reach USD 32.1 million by 2035.

The encapsulated salicylic acid market is expected to grow at a 11.0% CAGR between 2025 and 2035.

The key product types in encapsulated salicylic acid market are skin care, body care, hair care, sun care, color cosmetics, men’s grooming, baby & kids care and dermocosmetic / professional care.

In terms of product form , powder segment to command 15.2% share in the encapsulated salicylic acid market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Salicylic Acid Market Size, Growth, and Forecast for 2025 to 2035

Encapsulated Lactic Acid Market Analysis by Application, Nature, Form, and Region from 2025 to 2035

Encapsulated Citric Acid Market

Encapsulated Vitamin C Market Size and Share Forecast Outlook 2025 to 2035

Encapsulated Retinol Market Size and Share Forecast Outlook 2025 to 2035

Acid Resistant Pipe Market Forecast and Outlook 2025 to 2035

Encapsulated Flavors Market Size and Share Forecast Outlook 2025 to 2035

Acid Coil Cleaner Market Size and Share Forecast Outlook 2025 to 2035

Acid Filling and Leveling Machine Market Size and Share Forecast Outlook 2025 to 2035

Encapsulated Zinc Feed Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Acid Chlorides Market Size and Share Forecast Outlook 2025 to 2035

Acid-Sensitive APIs Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Acidified Whey Protein Market Analysis - Size, Share & Trends 2025 to 2035

Encapsulated Flavors and Fragrances Market Analysis by Product Type, Technology, Wall Material, End-use, Encapsulated Form, Process, and Region through 2035

Acid Dyes Market Growth - Trends & Forecast 2025 to 2035

Acidity Regulator Market Growth - Trends & Forecast 2025 to 2035

Acid Proof Lining Market Trends 2025 to 2035

Encapsulated Sodium Bicarbonate Market Trends - Growth & Industry Forecast 2025 to 2035

Acid Citrate Dextrose Tube Market Trends – Growth & Industry Outlook 2024-2034

Acid Orange Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA