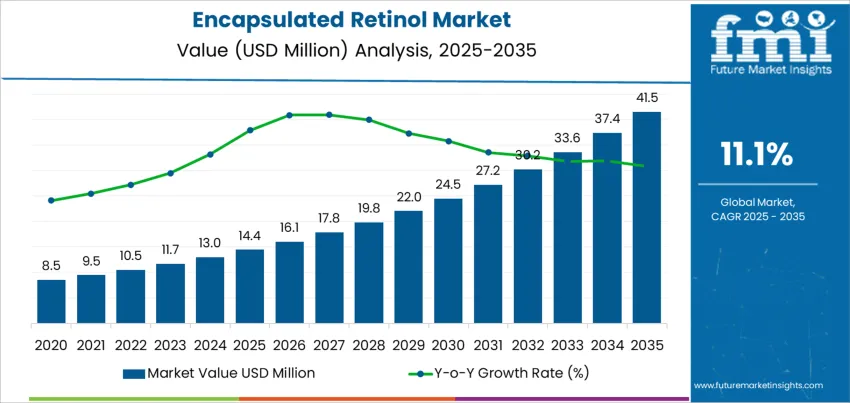

The global encapsulated retinol market is expected to grow from USD 14.4 million in 2025 to USD 41.5 million by 2035, at a compound annual growth rate (CAGR) of 11.1%. This growth represents an absolute increase of USD 27.1 million over the forecast period, with the market expanding by nearly 2.9 times. The increasing demand for encapsulated retinol in the cosmetics and skincare sectors is the primary driver of this market growth. Encapsulated retinol offers enhanced stability, controlled release, and improved efficacy, making it highly effective in anti-aging, skin rejuvenation, and other dermatological treatments.

Retinol, known for its anti-aging and skin renewal benefits, is sensitive to light and oxygen, which limits its effectiveness and shelf life in conventional formulations. By encapsulating retinol in protective carriers, the stability and penetration of the active ingredient are improved, leading to increased consumer demand. This has led to its widespread adoption in premium skincare products, especially in anti-aging creams, serums, and treatments aimed at reducing fine lines, wrinkles, and pigmentation issues. Advancements in encapsulation technologies are driving further growth by enhancing the performance of retinol-based products and enabling their use in a wider range of skincare formulations.

Between 2025 and 2030, the encapsulated retinol market is projected to grow from USD 14.4 million to USD 22.0 million, resulting in a value increase of USD 7.6 million, which represents 46.7% of the total forecast growth for the decade. This phase will be characterized by the growing adoption of encapsulated retinol in premium skincare products due to its enhanced stability, controlled release, and improved efficacy. The rise in consumer demand for anti-aging solutions and effective skin rejuvenation treatments will drive the growth of encapsulated retinol products, with product innovation in the cosmetics and dermatology sectors playing a key role. Companies will strengthen their market position by investing in advanced encapsulation technologies and developing more effective formulations, thus expanding their product offerings across anti-aging creams, serums, and targeted skin treatments.

From 2030 to 2035, the market is forecast to grow from USD 22.0 million to USD 41.5 million, adding another USD 19.5 million, which constitutes 53.3% of the overall ten-year expansion. This period will be characterized by continuous advancements in encapsulation technologies and the broadening application of encapsulated retinol in various skincare treatments. The demand for stabilized, long-lasting formulations will lead to further product innovations, with a particular focus on addressing specific skin concerns like pigmentation, wrinkles, and fine lines. The market expansion will also be fueled by increasing consumer awareness and the growing demand for more efficient and sustainable skincare products, as well as continued innovation and strategic partnerships in the cosmetics industry.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 14.4 million |

| Market Forecast Value (2035) | USD 41.5 million |

| Forecast CAGR (2025-2035) | 11.1% |

The encapsulated retinol market is expanding due to the increasing demand for advanced skincare products that deliver effective results without irritation. Encapsulated retinol, which is a stabilized form of vitamin A, is gaining popularity for its ability to improve skin texture, reduce wrinkles, and enhance overall skin appearance with minimized irritation. This is particularly valuable for consumers with sensitive skin, leading to increased adoption in skincare formulations aimed at anti-aging and skin rejuvenation.

The growth of the encapsulated retinol market is also driven by advancements in encapsulation technology, which ensures the controlled release of retinol over time, enhancing its effectiveness. This technology allows for better penetration into the skin, offering superior results compared to conventional retinol formulations. As consumer demand for safer and more efficient skincare solutions rises, encapsulated retinol provides an ideal solution for brands targeting premium and luxury skincare markets.

Despite the significant growth, challenges remain, including the high cost of production and the complexity of formulating effective encapsulated systems. Regulatory scrutiny over the safety and efficacy of encapsulated active ingredients in cosmetic products may pose barriers. Continuous innovations in formulation techniques, along with increasing consumer interest in skin health, are expected to overcome these hurdles, driving sustained growth in the encapsulated retinol market.

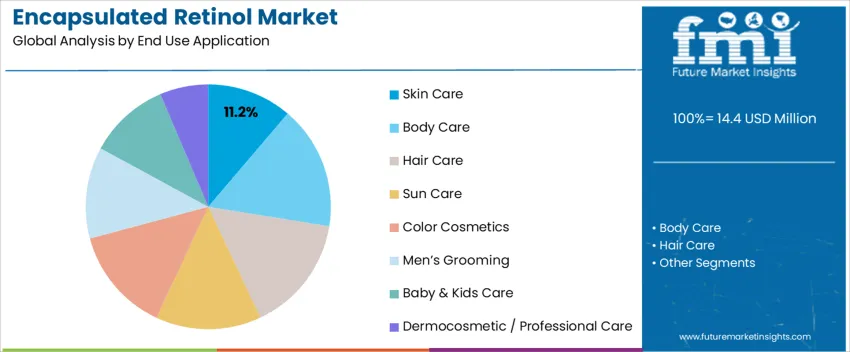

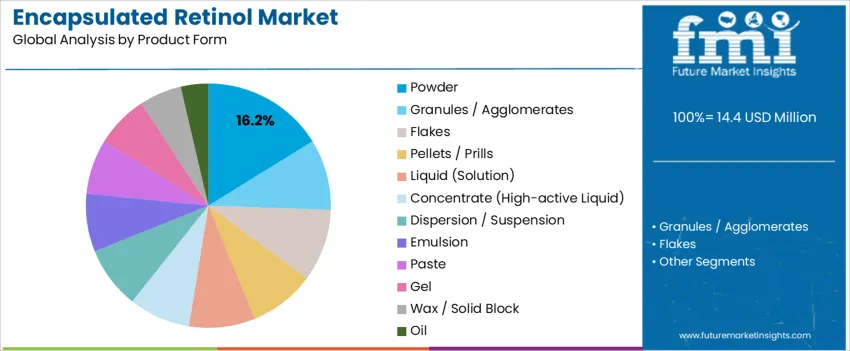

Global demand for encapsulated retinol is shaped by end use applications and product form, with significant concentration in East Asia, Western Europe, and North America. Skin care holds a 11.2% share, driven by the increasing focus on anti-aging, skin rejuvenation, and acne treatment. Other prominent segments include body care, hair care, sun care, color cosmetics, men’s grooming, baby and kids care, and dermocosmetic or professional care, spanning both mass and professional channels. On the product form side, powders capture a 16.2% share, alongside granules/agglomerates, flakes, pellets/prills, liquid solutions, high-active liquid concentrates, dispersions, emulsions, pastes, gels, wax/solid blocks, and oils.

Skin care accounts for 11.2% of global encapsulated retinol usage, reflecting the rising consumer demand for retinol-based solutions targeting anti-aging, acne, and overall skin texture improvement. Encapsulated retinol is commonly used in facial cleansers, serums, toners, and moisturizers, providing sustained release and minimizing irritation. Demand is especially high in regions like South Korea, Japan, the USA, and Western Europe, where dermatological innovations remain strong across both clinical and mass retail markets. Skin care products benefit from encapsulation as it enhances the effectiveness of retinol by allowing for gradual release, ensuring that sensitive skin is not irritated. Professional and dermocosmetic brands use encapsulated retinol to address specific concerns like fine lines, wrinkles, and skin regeneration. Ongoing product development in regions such as France, Germany, and the USA continues to focus on the incorporation of encapsulated actives to create high-performance skincare solutions within regulated environments.

Powder form holds a 16.2% share of global encapsulated retinol demand due to its superior stability, controlled moisture exposure, and consistent release properties. Powders enable precise dosing in various formulations, such as emulsions, gels, and masks, providing uniform performance in high-volume production in regions like Asia, Europe, and North America. Powder formats also offer logistical benefits, enhancing transport efficiency by minimizing leakage risk and reducing refrigeration needs during global shipping. Manufacturers favor powders due to their compatibility with automated blending systems, ensuring predictable product quality even in varying climate conditions. Regulatory documentation and microbial specifications for powders are well-established, further supporting powder’s leadership in the encapsulated retinol market. These logistical, processing, and compliance advantages continue to position powder as the dominant product form for encapsulated retinol.

The encapsulated retinol sector is shaped by rising consumer demand for effective anti-aging solutions with fewer side effects. Encapsulation protects retinol from degradation by light, heat, and oxygen, maintaining its stability, potency, and shelf life. This technology allows for a controlled release of retinol, minimizing irritation often associated with traditional formulations. Advanced encapsulation techniques, such as microspheres, liposomes, and polymer-based carriers, ensure that retinol is safely delivered to the skin. As consumers seek skin care products that offer both efficacy and gentleness, encapsulated retinol is becoming a preferred choice for sensitive skin and individuals new to retinol treatments.

Demand for encapsulated retinol is growing as consumers increasingly seek visible anti-aging results with minimal irritation. Encapsulated retinol offers a safer alternative to traditional retinol by providing controlled release, which reduces skin sensitivity, making it more suitable for a wider range of skin types. The rise in “clean” beauty trends, combined with heightened awareness of long-term skin health, is encouraging consumers to invest in products that promise effective, yet gentle solutions. Skincare brands also recognize the value of encapsulated retinol due to its stability during storage and delivery of consistent results. The demand for high-performance skincare products that support collagen production and rejuvenation continues to drive the expansion of this sector.

The adoption of encapsulated retinol faces challenges in formulation complexity and production costs. Ensuring that retinol remains stable throughout its shelf life while delivering consistent results requires sophisticated encapsulation methods and strict quality control. Encapsulation technologies can increase the cost of production, leading to higher retail prices, which may limit adoption in price-sensitive markets. Regulatory variations across different regions may impose restrictions on claims, further complicating global distribution. Some consumers may also be hesitant to switch from traditional retinol, as they may not immediately notice the results from slower-release formulations. These factors contribute to the slower uptake of encapsulated retinol compared to traditional skincare solutions.

Key trends in the encapsulated retinol sector include the development of products targeted at sensitive skin, with formulations designed to reduce irritation while enhancing anti-aging effects. Brands are increasingly combining encapsulated retinol with other active ingredients like peptides, antioxidants, and hydrating agents to create well-rounded, effective products that minimize skin dryness and irritation. Innovations in liposomal and polymer-microsphere encapsulation technologies are improving penetration and controlled release, optimizing the ingredient’s effectiveness. Marketing strategies also emphasize the stability and safety of encapsulated retinol, highlighting its ability to deliver visible results without the harshness of traditional retinol products. These trends are reshaping how retinol is perceived and used in skincare.

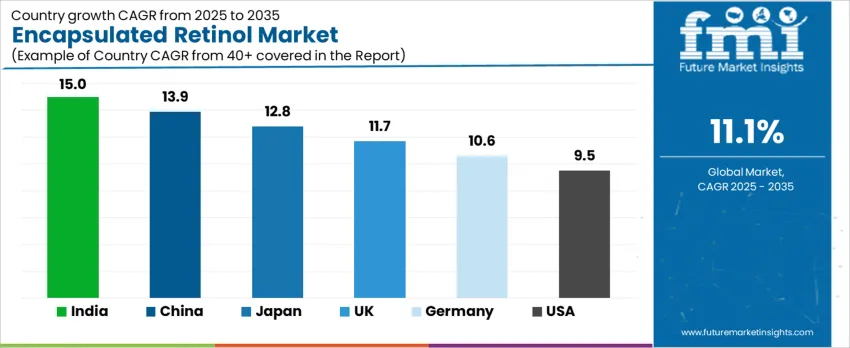

| Country | CAGR (%) |

|---|---|

| India | 15.0% |

| China | 13.9% |

| Japan | 12.8% |

| UK | 11.7% |

| Germany | 10.6% |

| USA | 9.5% |

The encapsulated retinol market is witnessing significant growth worldwide, with India leading at a 15.0% CAGR, driven by rising consumer awareness around skincare and the demand for advanced anti-aging solutions. China follows closely with a 13.9% growth rate, fueled by an expanding middle class and an increasing focus on high-performance skincare products. Japan, with a 12.8% CAGR, is benefiting from its aging population and a strong preference for scientifically validated skincare solutions. The UK and Germany are also experiencing steady growth, driven by strong retail infrastructures and the rising adoption of anti-aging products. In the USA, despite a mature market, the encapsulated retinol sector is still growing at a moderate pace of 9.5%, supported by consumer demand for targeted, effective skincare treatments.

India's encapsulated retinol market is experiencing rapid growth with a projected CAGR of 15.0% through 2035. This growth is fueled by the increasing demand for advanced skincare products, particularly those focused on anti-aging and skin rejuvenation. The rise in disposable income, along with growing consumer awareness about skin health, is driving the demand for encapsulated retinol, known for its enhanced stability and controlled release properties. The expanding presence of local and international skincare brands in urban and semi-urban regions is further accelerating market growth. India's thriving e-commerce sector and the growing interest in dermatological treatments are contributing to the wider accessibility of retinol-based skincare products. As more consumers seek effective and reliable skincare solutions, India's encapsulated retinol market is set to continue expanding.

China is witnessing significant growth in the encapsulated retinol market, with a 13.9% CAGR through 2035. This growth is primarily driven by the increasing demand for high-performance skincare solutions, particularly among the urban population. Encapsulated retinol, known for its ability to deliver controlled and stable skincare benefits, is becoming a preferred choice for anti-aging, acne treatment, and overall skin health. The expanding middle-class population and rising beauty consciousness are key factors contributing to the growing demand. China's robust retail infrastructure, combined with the surge in e-commerce platforms, ensures that these advanced skincare products reach a broader audience. The rise of dermatological clinics and beauty salons is further promoting the adoption of encapsulated retinol treatments, particularly among consumers seeking professional-grade skincare products.

Japan’s encapsulated retinol market is growing at a steady pace with a 12.8% CAGR through 2035, supported by the country’s strong focus on advanced skincare and anti-aging solutions. Encapsulated retinol is increasingly sought after for its ability to provide targeted skin benefits with reduced irritation, making it ideal for Japan’s skincare-conscious population. The demand is particularly driven by the aging population, which seeks products that promote skin rejuvenation and prevent signs of aging. Japan's strong culture of beauty and wellness, along with high consumer trust in scientifically-backed formulations, further supports the growth of encapsulated retinol. The availability of these products through both traditional retail channels and e-commerce platforms ensures broad consumer access, fostering continued market expansion.

The UK’s encapsulated retinol market is expanding with a CAGR of 11.7% through 2035, driven by rising demand for advanced anti-aging skincare solutions. With an increasing focus on personalized skincare, encapsulated retinol offers targeted delivery, reducing irritation and improving efficacy, which resonates with the health-conscious UK consumer. The growing popularity of clean beauty products and natural formulations is also contributing to the market’s growth, as encapsulated retinol is often paired with other beneficial ingredients to enhance skin health. Retail pharmacies, supermarkets, and online wellness platforms are key distribution channels for these products. The strong presence of established skincare brands and the UK’s widespread interest in beauty treatments are expected to sustain growth in the encapsulated retinol sector.

Germany is experiencing steady growth in the encapsulated retinol market, with a projected CAGR of 10.6% through 2035. The demand for advanced skincare products, particularly those with anti-aging properties, is a key driver of this growth. German consumers are increasingly seeking high-performance formulations, and encapsulated retinol is gaining popularity due to its ability to deliver stable, controlled results. The country’s strong pharmaceutical and dermatological sectors also contribute to the demand, as consumers look for professional-grade skincare treatments. The growing trend toward wellness and personal care is promoting the use of encapsulated retinol products across various retail channels. The highly regulated skincare market in Germany ensures that only high-quality products are available to consumers, which bolsters market growth.

The USA’s encapsulated retinol market is growing at a moderate 9.5% CAGR through 2035, driven by the demand for innovative skincare solutions focused on anti-aging, acne treatment, and overall skin health. Encapsulated retinol, with its enhanced stability and controlled release properties, is particularly popular among consumers seeking effective yet gentle skincare. The market is supported by a high degree of skincare awareness, with consumers increasingly turning to advanced formulations for long-term skin health. Retail pharmacies, beauty stores, and e-commerce platforms are major distribution channels, ensuring widespread availability. Despite the market's maturity, innovation in new encapsulated formulations and the growing trend of personalized skincare treatments are expected to sustain steady growth in the USA’s encapsulated retinol market.

The demand for encapsulated retinol is growing globally due to its ability to offer controlled release, enhanced stability, and reduced irritation compared to traditional retinol formulations. Encapsulated retinol is increasingly used in skincare products, particularly in anti-aging formulations, as it helps to improve skin texture, reduce wrinkles, and promote collagen production without the irritation commonly associated with retinol. As consumers become more focused on advanced skincare products with superior efficacy and gentle formulations, encapsulated retinol is gaining significant traction in the beauty and cosmetics industry. Furthermore, innovations in encapsulation technologies are enabling better targeting and more consistent delivery, fueling market growth.

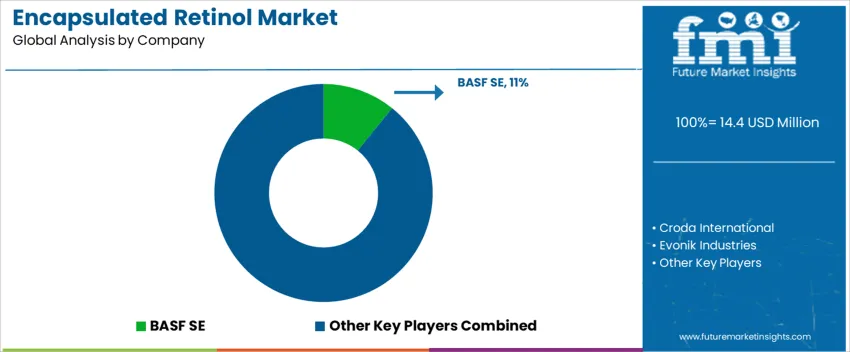

Key players shaping the encapsulated retinol industry include BASF SE, Croda International, Evonik Industries, Symrise (including IFF/Givaudan active ingredient businesses), Dow Inc., Ashland, Clariant, and Seppic. BASF SE holds a notable market share of 10.8%, leveraging its advanced encapsulation technologies and strong formulation expertise. These companies are at the forefront of providing high-quality, stable retinol products to meet the growing demand in the skincare sector. Smaller, specialized providers also contribute to the market by offering custom solutions tailored to specific consumer needs, adding diversity and competition to the landscape.

The expansion of the encapsulated retinol sector is driven by continuous advancements in encapsulation methods and growing awareness about the benefits of retinol. Encapsulation ensures that retinol remains stable and effective over a longer period, preventing degradation from light and air, which is a common challenge with traditional forms of retinol. As demand for anti-aging products and effective skincare solutions increases, particularly among aging populations, encapsulated retinol is becoming a key ingredient in high-performance formulations. The trend towards more advanced and personalized skincare solutions is further propelling its adoption.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD million |

| End Use Application | Skin Care, Body Care, Hair Care, Sun Care, Color Cosmetics, Men’s Grooming, Baby & Kids Care, Dermocosmetic / Professional Care |

| Product Form | Powder, Granules / Agglomerates, Flakes, Pellets / Prills, Liquid (Solution), Concentrate (High-active Liquid), Dispersion / Suspension, Emulsion, Paste, Gel, Wax / Solid Block, Oil |

| Regions Covered | North America, Europe, East Asia, South Asia, Latin America, Middle East & Africa, Eastern Europe |

| Countries Covered | USA, China, Japan, South Korea, India, Germany, UK, France, Italy, Brazil, Argentina, Mexico, Saudi Arabia, South Africa, Russia, others |

| Key Companies Profiled | BASF SE, Croda International, Evonik Industries, Symrise (including IFF/Givaudan actives), Dow / Dow Inc., Ashland, Clariant, Seppic |

| Additional Attributes | Dollar by sales by end use application and product form; regional CAGR and growth outlook; multi-strain formulation adoption; clinical validation and regulatory compliance tracking; distribution channels including retail, DTC, e-commerce, and institutional buyers; product form prevalence in powders, liquids, and emulsions; regional preference for strain libraries; supply chain logistics for cold chain and ambient stability; strain survivability, CFU consistency, and shelf-life performance; innovation trends including prebiotic/postbiotic combinations, non-dairy matrices, and personalized nutrition; competitive positioning of global vs regional suppliers. |

The global encapsulated retinol market is estimated to be valued at USD 14.4 million in 2025.

The market size for the encapsulated retinol market is projected to reach USD 41.5 million by 2035.

The encapsulated retinol market is expected to grow at a 11.1% CAGR between 2025 and 2035.

The key product types in encapsulated retinol market are skin care, body care, hair care, sun care, color cosmetics, men’s grooming, baby & kids care and dermocosmetic / professional care.

In terms of product form , powder segment to command 16.2% share in the encapsulated retinol market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Encapsulated Vitamin C Market Size and Share Forecast Outlook 2025 to 2035

Encapsulated Salicylic Acid Market Size and Share Forecast Outlook 2025 to 2035

Encapsulated Flavors Market Size and Share Forecast Outlook 2025 to 2035

Retinol Alternatives (Bakuchiol) Market Size and Share Forecast Outlook 2025 to 2035

Encapsulated Zinc Feed Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Encapsulated Lactic Acid Market Analysis by Application, Nature, Form, and Region from 2025 to 2035

Encapsulated Flavors and Fragrances Market Analysis by Product Type, Technology, Wall Material, End-use, Encapsulated Form, Process, and Region through 2035

Encapsulated Sodium Bicarbonate Market Trends - Growth & Industry Forecast 2025 to 2035

Encapsulated Citric Acid Market

Encapsulated Salt Market

Encapsulated Caffeine Market

BHA-Encapsulated Acne Treatment Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Microencapsulated Paraffin Phase Change Materials Market Size and Share Forecast Outlook 2025 to 2035

Microencapsulated Omega-3 Powders Market Size and Share Forecast Outlook 2025 to 2035

Microencapsulated Fish Oil Market

Micro-Encapsulated Vitamin C Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Bioactive Retinol Alternatives Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Demand for Encapsulated Flavors and Fragrances in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Encapsulated Flavors and Fragrances in USA Size and Share Forecast Outlook 2025 to 2035

Water-Soluble Retinol Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA