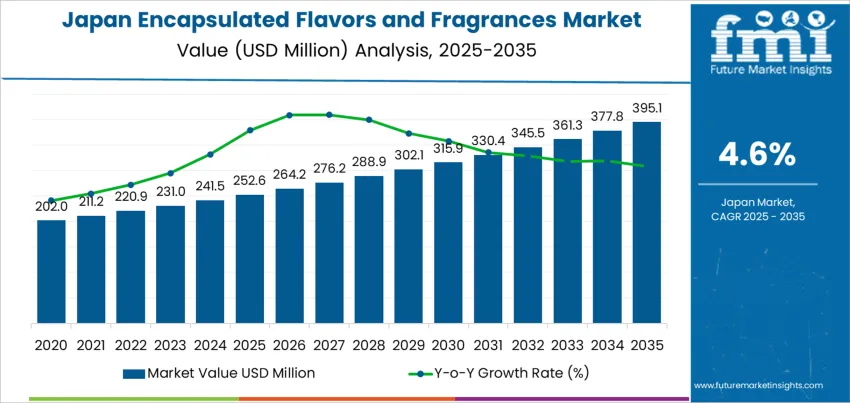

The demand for encapsulated flavors and fragrances in Japan is expected to grow from USD 252.6 million in 2025 to USD 395.1 million by 2035, reflecting a compound annual growth rate (CAGR) of 4.6%. Encapsulated flavors and fragrances are widely used in the food and beverage industry, cosmetics, and personal care products, offering controlled release and enhanced stability of volatile ingredients. The demand for these encapsulated products is driven by growing consumer preference for long-lasting, high-quality scents and flavors, as well as advances in encapsulation technology. With continuous growth in the food, beverage, and personal care industries, the market for encapsulated flavors and fragrances is expected to rise steadily throughout the forecast period.

The market will experience consistent growth, starting at USD 252.6 million in 2025 and gradually increasing to USD 264.2 million in 2026. By 2027, the demand for encapsulated flavors and fragrances will reach USD 276.2 million, with continued steady growth expected in the following years. By 2035, the market is projected to reach USD 395.1 million, reflecting sustained demand driven by innovation in flavor and fragrance technologies and expanding applications in multiple industries.

The encapsulated flavors and fragrances market in Japan is expected to experience steady growth through 2035. Starting at USD 252.6 million in 2025, the market will increase to USD 264.2 million in 2026 and USD 276.2 million in 2027. By 2029, demand will rise to USD 302.1 million, continuing to expand to USD 315.9 million by 2030. By 2035, the market is forecasted to reach USD 395.1 million, driven by increased demand for high-quality, long-lasting flavors and fragrances in food, beverage, and personal care applications.

The acceleration and deceleration pattern of this market shows an initial gradual increase in demand, with steady growth observed in the early years (2025–2029). The rate of growth slightly accelerates starting from 2029, as the market enters a phase of higher demand in the latter years, particularly driven by advancements in encapsulation technology and increased consumer interest in premium products. However, after 2029, growth rate stabilization is anticipated, with demand continuing to rise steadily but at a more moderate pace as the market matures. This suggests a smooth progression with an early period of steady growth followed by a slight acceleration in the later years, leading to a stable and predictable long-term increase.

| Metric | Value |

|---|---|

| Industry Sales Value (2025) | USD 252.6 million |

| Industry Forecast Value (2035) | USD 395.1 million |

| Industry Forecast CAGR (2025-2035) | 4.6% |

Demand for encapsulated flavors and fragrances in Japan is increasing as food, beverage and consumer product manufacturers respond to evolving consumer preferences for convenience, consistent quality, and enhanced sensory experience. Encapsulation helps protect sensitive flavor and aroma compounds from heat, oxygen, moisture and light. This preserves taste and scent integrity during processing, storage and distribution. As more Japanese consumers purchase packaged foods, ready to eat meals, bottled drinks and processed snacks, producers increasingly use encapsulated flavors to maintain stable, appealing taste and aroma over shelf life. Similarly fragrance based products such as personal care, household cleaners and scented items benefit from encapsulation because it ensures longer lasting scent release and more reliable performance under Japanese supply chain and retail conditions.

At the same time rising interest in functional foods, natural ingredients, and health oriented products supports the uptake of encapsulated formats. Encapsulation enables inclusion of delicate natural extracts, essential oils or botanical compounds which might otherwise degrade or lose potency. This flexibility appeals to manufacturers of supplements, functional beverages, wellness oriented foods and “clean label” products that Japanese consumers increasingly favour. Advances in micro encapsulation technology and improved manufacturing processes make encapsulation more cost effective and scalable for both domestic and multinational firms operating in Japan. As regulatory scrutiny, quality standards and consumer expectations increase, encapsulated flavors and fragrances provide a means to balance product stability, safety and sensory performance. These combined factors suggest steady growth in demand for encapsulated flavors and fragrances in Japan over the coming years.

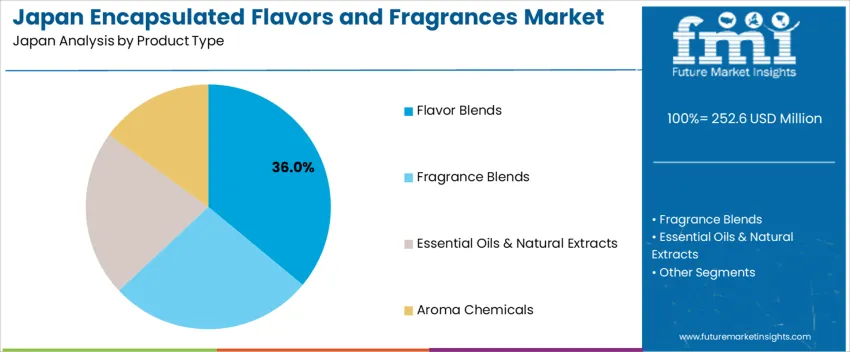

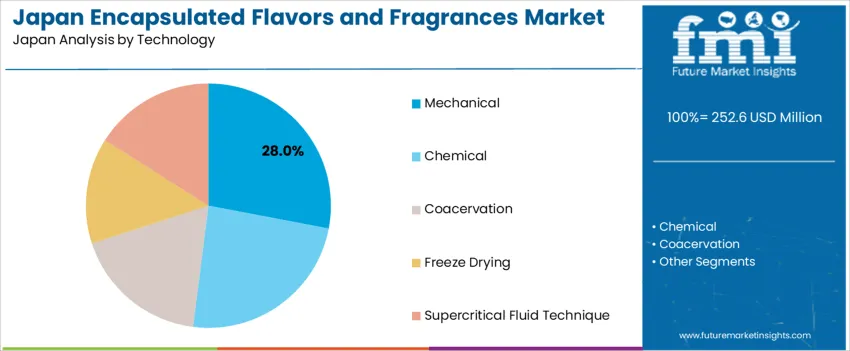

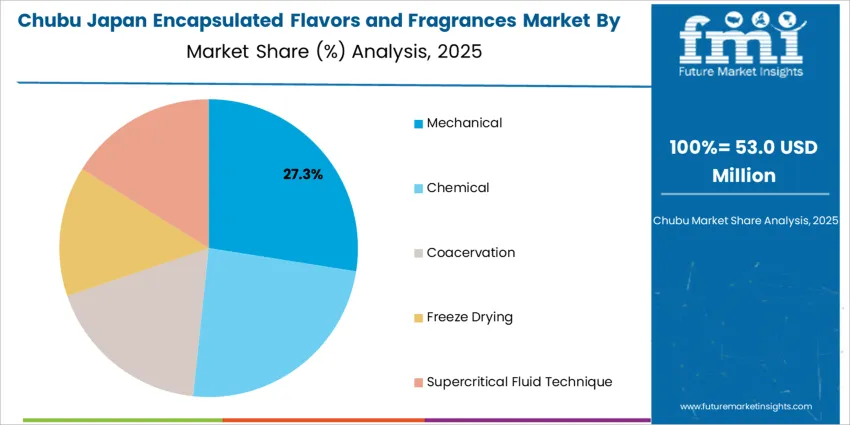

The demand for encapsulated flavors and fragrances in Japan is driven by product type and technology. The leading product type is flavor blends, accounting for 36% of the market share, while mechanical technology is the dominant method, capturing 28% of the demand. Encapsulated flavors and fragrances are increasingly used in food, beverages, cosmetics, and other consumer products to improve stability, extend shelf life, and release flavors and fragrances at the right time. The growing focus on product customization and consumer preferences for fresh, potent scents and tastes continues to drive the demand for encapsulated solutions in Japan.

Flavor blends lead the demand for encapsulated flavors and fragrances in Japan, holding 36% of the market share. Flavor blends are created by combining multiple flavor compounds to achieve a desired taste profile, and encapsulation allows these blends to be protected from environmental factors like heat, moisture, and air, which can degrade flavor quality. Encapsulation helps in releasing the flavors at a controlled rate, enhancing the sensory experience for consumers in food and beverage applications.

The demand for flavor blends is driven by their versatility and ability to meet the diverse and evolving taste preferences of consumers in Japan. As the food and beverage industry continues to focus on providing fresh, customized, and high-quality products, flavor blends offer an effective solution for manufacturers seeking to enhance the taste experience while ensuring consistency and long shelf life. The increasing popularity of convenience foods, beverages, and ready-to-eat products is expected to further fuel the demand for encapsulated flavor blends in Japan.

Mechanical technology leads the demand for encapsulated flavors and fragrances in Japan, accounting for 28% of the market share. Mechanical encapsulation involves physically enclosing flavors and fragrances within a protective coating using methods like spray-drying, extrusion, or fluidized bed techniques. This technology is widely used because it is simple, cost-effective, and well-suited for large-scale production.

The demand for mechanical technology in encapsulation is driven by its ability to provide reliable, scalable solutions for encapsulating a wide variety of flavor and fragrance compounds. Mechanical encapsulation methods are particularly beneficial for the food and beverage industries, where they help protect sensitive ingredients, improve the stability of volatile compounds, and control the release of flavors and scents during consumption. As the demand for convenience foods and beverages with enhanced sensory properties continues to grow in Japan, mechanical encapsulation technology is expected to remain a dominant method for delivering encapsulated flavors and fragrances in a wide range of consumer products.

Demand for encapsulated flavors and fragrances in Japan is rising as food, beverage, personal care, and household product manufacturers increasingly value controlled-release scent and taste solutions. Encapsulation helps preserve aroma and flavor stability through processing, storage, and shelf life. The broader flavors and fragrances sector in Japan is growing, which supports rising demand for encapsulated variants. As consumer preferences shift toward convenience foods, ready-to-drink beverages, premium cosmetics, and home-care items, encapsulated products provide advantages in consistency, performance, and product quality. Demand is expected to grow steadily in the coming years.

What are the Drivers of Demand for Encapsulated Flavors and Fragrances in Japan?

One key driver is growth in the food and beverage industry, including ready-to-eat and packaged foods, processed snacks, and bottled or canned drinks. Encapsulated flavors allow manufacturers to deliver stable taste and aroma even after thermal processing or long shelf life. Another driver is rising demand in personal care, cosmetics, and household products for long-lasting scent, slow fragrance release, or controlled aroma delivery. Encapsulated fragrances enable more controlled and durable scent performance in lotions, detergents, air fresheners, and similar products. A further driver is increasing consumer interest in products with natural or nature-derived flavor and fragrance profiles, where encapsulation helps preserve delicate botanical aromas and flavors. Finally, advances in micro-encapsulation and delivery technologies improve stability, release control, and overall performance of encapsulated flavors and fragrances, making them more attractive to manufacturers seeking high-quality sensory ingredients.

What are the Restraints on Demand for Encapsulated Flavors and Fragrances in Japan?

One significant restraint is the higher cost of encapsulation compared with simple flavor or fragrance additives. The extra processing, encapsulation materials, and stability testing raise costs, which may deter cost-sensitive producers or limit use in low-margin products. Another restraint relates to the complexity of formulation and integration. Encapsulated flavors or fragrances may require different handling, mixing, or processing conditions, adding technical and quality-control burdens for food or cosmetic manufacturers. In some applications, settling, uneven release, or incompatibility with certain formulations may reduce effectiveness, discouraging widespread use. Supply chain or raw material volatility for encapsulation materials or core flavor/fragrance compounds may also add uncertainty. Finally, for small or niche manufacturers, scale advantages may be limited, reducing incentive to adopt encapsulated solutions unless volumes or value-addition justify the extra expense.

What are the Key Trends Influencing Demand for Encapsulated Flavors and Fragrances in Japan?

A prominent trend is increasing use of encapsulation technology in products positioned as premium or value-added, such as ready beverages, gourmet foods, cosmetics, and home-care items seeking stable flavor or fragrance over shelf life. Encapsulated solutions help deliver a consistent sensory experience and support product differentiation. Another trend is growth in micro-encapsulation across sectors beyond food, particularly in nutraceuticals, dietary supplements, and functional-food products, expanding the use base for encapsulated flavors and fragrances. There is also a rising focus on natural and clean-label ingredients. Encapsulation helps preserve flavor and aroma derived from botanical or natural sources, aligning with consumer demand for perceived naturalness. Advances in encapsulation methods, such as more efficient micro-encapsulation and improved delivery systems, support better performance, lower cost per unit, and broader applicability. Finally, increasing interest in convenience products and processed foods or beverages requiring shelf stability supports demand for encapsulated flavors and fragrances over traditional flavor delivery.

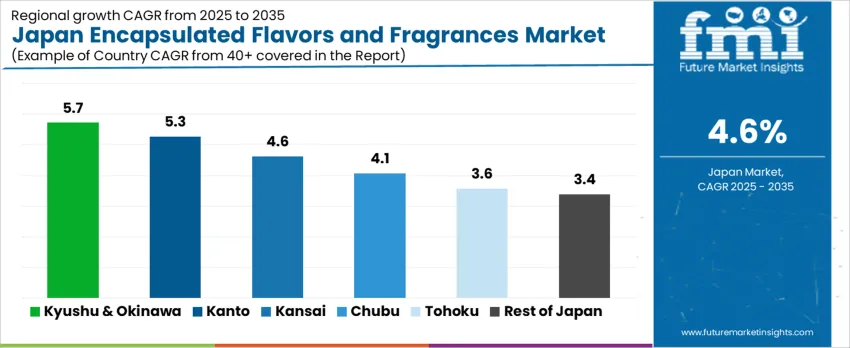

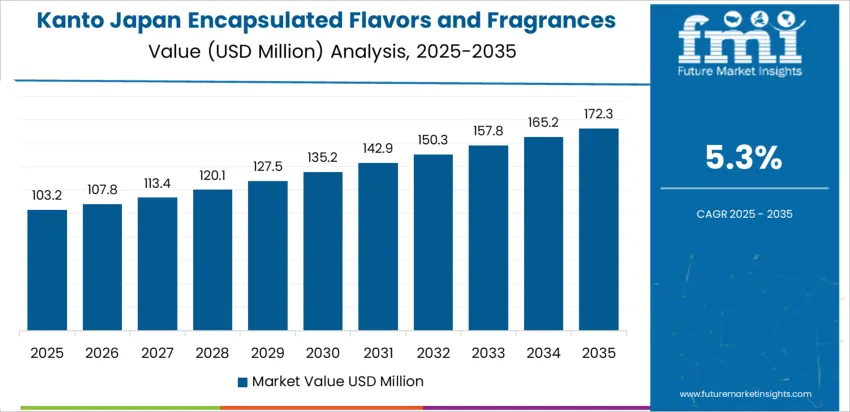

The demand for encapsulated flavors and fragrances in Japan shows steady growth, with Kyushu & Okinawa leading at a CAGR of 5.7%. Kanto follows with a CAGR of 5.3%, driven by its strong food and beverage industry. The Kinki region shows moderate growth at 4.6%, while Chubu, Tohoku, and the Rest of Japan exhibit slower growth, with respective CAGRs of 4.1%, 3.6%, and 3.4%. These differences reflect regional variations in consumer preferences, industrial applications, and the adoption of advanced encapsulation technologies in flavor and fragrance products.

| Region | CAGR (%) |

|---|---|

| Kyushu & Okinawa | 5.7 |

| Kanto | 5.3 |

| Kinki | 4.6 |

| Chubu | 4.1 |

| Tohoku | 3.6 |

| Rest of Japan | 3.4 |

The demand for encapsulated flavors and fragrances in Kyushu & Okinawa is projected to grow at a CAGR of 5.7%, driven by the region’s increasing focus on food innovation and natural ingredients. Kyushu & Okinawa have a growing food and beverage industry that increasingly utilizes encapsulated flavors and fragrances to enhance product appeal, improve shelf life, and reduce ingredient loss during production. The region’s emphasis on sustainable, plant-based products, along with the rising consumer interest in wellness and health, supports the demand for flavors and fragrances that can deliver longer-lasting, controlled release. As the food and beverage market in Kyushu & Okinawa continues to modernize and adapt to changing consumer preferences, the demand for advanced flavor and fragrance technologies, such as encapsulation, is expected to rise.

In Kanto, the demand for encapsulated flavors and fragrances is expected to grow at a CAGR of 5.3%, supported by the region’s large and diverse food and beverage sector. Kanto, home to Tokyo and other major cities, is a hub for consumer goods, including food and beverages, personal care, and household products. As the demand for high-quality, long-lasting, and natural flavors and fragrances rises, manufacturers in Kanto are increasingly turning to encapsulation technologies to deliver controlled release and enhanced product stability. Encapsulated flavors and fragrances allow for better taste and scent retention in food and drink products, contributing to Kanto’s growing market for these ingredients. The region’s focus on innovation and consumer satisfaction in the food and beverage sector ensures strong demand for encapsulated flavors and fragrances.

The demand for encapsulated flavors and fragrances in Kinki is projected to grow at a CAGR of 4.6%, reflecting moderate growth driven by the region’s robust manufacturing and food production sectors. Kinki, which includes major cities like Osaka and Kyoto, is home to numerous food and beverage companies that increasingly rely on encapsulated flavors and fragrances to enhance product quality and extend shelf life. The growing consumer preference for natural, sustainable ingredients in both food and personal care products is also contributing to this demand. As the region continues to innovate in flavor and fragrance applications, particularly in functional food products and wellness items, demand for encapsulation technologies will continue to rise, ensuring steady growth in the Kinki region.

The demand for encapsulated flavors and fragrances in Chubu is expected to grow at a CAGR of 4.1%, supported by the region’s diverse industrial and consumer product base. Chubu, home to Nagoya and several industrial centers, has a strong presence in food production, automotive, and consumer goods. Encapsulated flavors and fragrances are increasingly used in the food and beverage industry to improve the sensory appeal and stability of products. Additionally, Chubu’s growing interest in functional foods, natural beauty products, and wellness trends contributes to the demand for encapsulation technologies. As the region adapts to new product innovations and consumer demands for high-quality, sustainable ingredients, the use of encapsulated flavors and fragrances is expected to rise steadily.

In Tohoku, the demand for encapsulated flavors and fragrances is projected to grow at a CAGR of 3.6%, reflecting more gradual adoption compared to other regions. Tohoku’s smaller industrial base and rural demographics result in a slower pace of demand growth for encapsulated products. However, the region’s increasing interest in natural ingredients for food and wellness products is contributing to the gradual rise in demand for encapsulated flavors and fragrances. As consumer awareness of health and sustainability grows, Tohoku is seeing a shift toward cleaner, more natural food products, which drives the need for advanced flavor and fragrance technologies like encapsulation. Although the growth rate is moderate, Tohoku’s adoption of these products will continue to grow in line with overall consumer trends toward healthier, more sustainable food choices.

In the Rest of Japan, the demand for encapsulated flavors and fragrances is expected to grow at a CAGR of 3.4%, reflecting steady but slower growth. This region, which includes smaller cities and rural areas, has a lower concentration of large-scale food and beverage manufacturers, but the growing interest in functional and health-conscious food products is contributing to demand. As consumers in rural areas become more aware of the benefits of natural ingredients and clean labels, the adoption of encapsulated flavors and fragrances is increasing. While the growth rate is slower compared to more industrialized regions, the ongoing trend toward natural, sustainable food and wellness products will drive consistent demand for encapsulation technologies in the Rest of Japan.

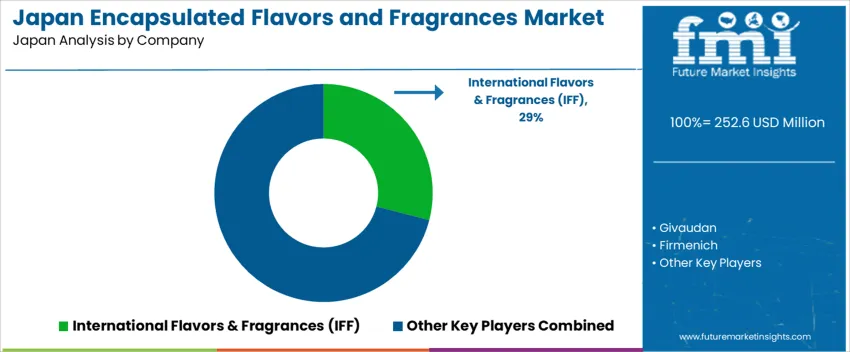

Demand for encapsulated flavors and fragrances in Japan is rising as food and beverage manufacturers, personal care brands, and household product producers seek solutions offering controlled release, longer shelf life, and stability under varying processing and storage conditions. Key suppliers include International Flavors & Fragrances (IFF) with about 29 % market share, along with Givaudan, Firmenich, Symrise, and Sensient Technologies. These firms supply micro and nano encapsulated flavor and fragrance systems that can be used in products such as baked goods, beverages, oral care items, perfumes, detergents, and air fresheners.

Competition in this market is shaped by encapsulation technology, release control, and formulation flexibility. Leading companies invest in encapsulation methods-such as spray drying, coacervation, nano encapsulation-that preserve volatile compounds and ensure controlled release at desired stages (e.g. heating, chewing, rubbing). Another competitive factor is compatibility with varied end use processing: encapsulates must withstand pH changes, heat, mechanical mixing, or moisture without premature release. Suppliers that provide tailored solutions for different applications-food, cosmetics, or homecare-gain preference. Quality consistency, traceability of raw materials, and compliance with Japanese regulatory standards for food additives or cosmetic ingredients also matter. By delivering stable, versatile, and controlled release flavor and fragrance encapsulates, these companies aim to serve evolving demand and strengthen their positions in Japan’s encapsulated flavors and fragrances market.

| Items | Details |

|---|---|

| Quantitative Units | USD Million |

| Regions Covered | Japan |

| Product Type | Flavor Blends, Fragrance Blends, Essential Oils & Natural Extracts, Aroma Chemicals |

| Technology | Mechanical, Chemical, Coacervation, Freeze Drying, Supercritical Fluid Technique |

| Wall Material | Gum Arabic, Modified Starch, Maltodextrin (DE<20), Corn Syrup Solid (DE>20), Gelatin, Modified Cellulose |

| Encapsulated Form | Powder, Granules, Paste |

| End-Use Industry | Food and Beverage, Consumer Goods |

| Key Companies Profiled | International Flavors & Fragrances (IFF), Givaudan, Firmenich, Symrise, Sensient Technologies |

| Additional Attributes | The market analysis includes dollar sales by product type, technology, wall material, encapsulated form, and end-use industry categories. It also covers regional demand trends in Japan, driven by the increasing use of encapsulated flavors and fragrances in the food and beverage, as well as consumer goods sectors. The competitive landscape highlights key manufacturers focusing on innovations in encapsulation technologies to improve flavor and fragrance retention and release. Trends in the growing demand for natural extracts and the use of sustainable encapsulation materials are explored, along with advancements in the application of these products in functional food, cosmetics, and home care items. |

The demand for encapsulated flavors and fragrances in Japan is estimated to be valued at USD 252.6 million in 2025.

The market size for the encapsulated flavors and fragrances in Japan is projected to reach USD 395.1 million by 2035.

The demand for encapsulated flavors and fragrances in Japan is expected to grow at a 4.6% CAGR between 2025 and 2035.

The key product types in encapsulated flavors and fragrances in Japan are flavor blends, fragrance blends, essential oils & natural extracts and aroma chemicals.

In terms of technology, mechanical segment is expected to command 28.0% share in the encapsulated flavors and fragrances in Japan in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Encapsulated Flavors and Fragrances Market Analysis by Product Type, Technology, Wall Material, End-use, Encapsulated Form, Process, and Region through 2035

Demand for Encapsulated Flavors and Fragrances in USA Size and Share Forecast Outlook 2025 to 2035

Flavors and Fragrances Market Analysis by Type, Nature, Application, and Region through 2035

Encapsulated Flavors Market Size and Share Forecast Outlook 2025 to 2035

Japan Faith-based Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Sports Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Respiratory Inhaler Devices Market Size and Share Forecast Outlook 2025 to 2035

Japan Halal Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Automated People Mover Industry Size and Share Forecast Outlook 2025 to 2035

Japan Automotive Load Floor Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Japan Food Cling Film Market Size and Share Forecast Outlook 2025 to 2035

Japan Polypropylene Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Encapsulated Zinc Feed Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Flavors for Pharmaceutical & Healthcare Applications Market Size and Share Forecast Outlook 2025 to 2035

Japan Probiotic Yogurt Market is segmented by product type, source type, nature type, flavor type, fat content, sales channel and key city/province through 2025 to 2035.

japan Tortilla Market - Growth, Trends and Forecast from 2025 to 2035

Japan Cosmetics ODM Market Analysis - Size, Share & Trends 2025 to 2035

Japan Automotive Turbocharger Market Insights – Demand, Size & Industry Trends 2025–2035

Japan Yeast Market Insights – Demand, Size & Industry Trends 2025–2035

Japan Green and Bio-based Polyol Market Insights – Demand, Size & Industry Trends 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA