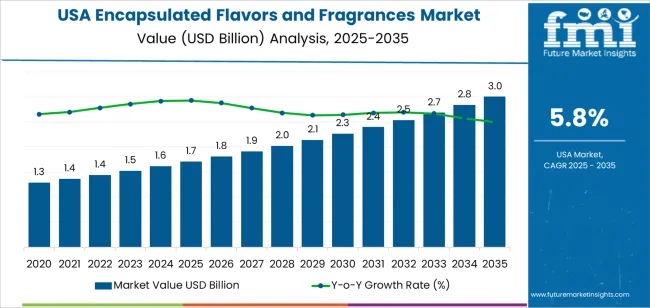

The demand for encapsulated flavors and fragrances in the USA is expected to grow steadily from USD 1.7 billion in 2025 to USD 3.0 billion by 2035, demonstrating a compound annual growth rate (CAGR) of 5.8%. Encapsulated flavors and fragrances are increasingly being utilized across various industries, including food and beverages, cosmetics, and household products, for their ability to deliver controlled release and enhanced stability of volatile ingredients. This trend is expected to continue, driven by the need for improved consumer experiences and product efficiency.

The increasing emphasis on clean-label products and the growing demand for eco-friendly, eco-friendly packaging solutions will be major drivers for the adoption of encapsulated flavors and fragrances. As manufacturers and brands seek to address both environmental concerns and consumer expectations for better product performance, encapsulation technology will play a key role in delivering superior products. Furthermore, the trend toward personalization in consumer goods, such as fragrances tailored to individual preferences, will also drive the growth of encapsulated products, particularly in cosmetics and personal care.

Between 2025 and 2030, the demand for encapsulated flavors and fragrances will gradually increase from USD 1.7 billion to USD 2.3 billion. In the early years, the YoY growth will be moderate, with small but consistent gains as more industries, particularly food and beverage manufacturers, adopt encapsulation technologies for better flavor delivery, shelf-life enhancement, and improved product stability. As consumer preferences shift toward more natural and long-lasting products, encapsulated ingredients are increasingly viewed as essential in addressing these demands. The introduction of more advanced encapsulation methods, such as those utilizing biopolymers or plant-based materials, will further support growth in the food and beverage industry.

From 2030 to 2035, demand for encapsulated flavors and fragrances will grow more rapidly, rising from USD 2.3 billion to USD 3.0 billion. This period will see accelerated adoption, driven by innovations in flavor and fragrance technology and by increasing consumer demand for premium, longer-lasting, and naturally derived products. Industries such as personal care, cosmetics, and cleaning products will contribute significantly to growth, as encapsulated ingredients enhance sensory experiences and reduce the impact of volatile chemicals. The growth of e-commerce and the expansion of functional foods and wellness products will also amplify demand for encapsulated solutions across sectors.

| Metric | Value |

|---|---|

| Demand for Encapsulated Flavors and Fragrances in USA Value (2025) | USD 1.7 billion |

| Demand for Encapsulated Flavors and Fragrances in USA Forecast Value (2035) | USD 3.0 billion |

| Demand for Encapsulated Flavors and Fragrances in USA Forecast CAGR (2025-2035) | 5.8% |

The demand for encapsulated flavors and fragrances in the USA is growing due to the increasing need for long-lasting, controlled-release ingredients in the food, beverage, personal care, and home care industries. Encapsulation technology allows flavors and fragrances to be preserved in a protective coating, which enables a gradual release during consumption or use. This provides a superior sensory experience and helps maintain the potency of flavors and fragrances over time, driving demand across various sectors.

A key driver of this growth is the rising demand for innovative food and beverage products, where consumers are seeking enhanced flavors and more natural, long-lasting experiences. Encapsulated flavors offer the ability to deliver consistent taste and aroma, improving the shelf life of products without compromising on flavor quality. The growing trend toward functional foods and beverages, which include ingredients aimed at improving health or offering specific benefits, is further fueling the adoption of encapsulated flavors.

The cosmetics and personal care industries are also contributing to the rise in encapsulated fragrances. Consumers are increasingly looking for products with sustained fragrance release, such as in perfumes, deodorants, and skin care formulations. Encapsulation technology helps enhance the longevity of fragrances, offering a premium user experience. As demand for both food and non-food products with enhanced sensory experiences continues to rise, the industry for encapsulated flavors and fragrances in the USA is expected to grow steadily through 2035.

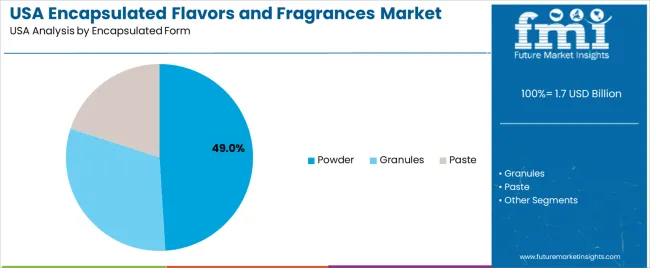

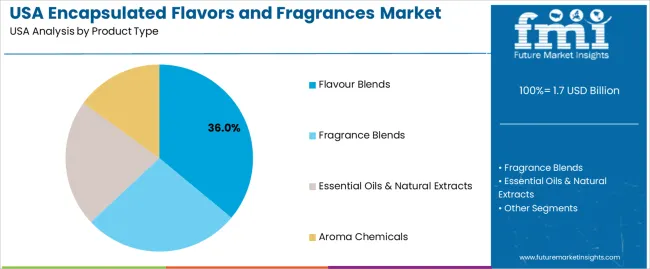

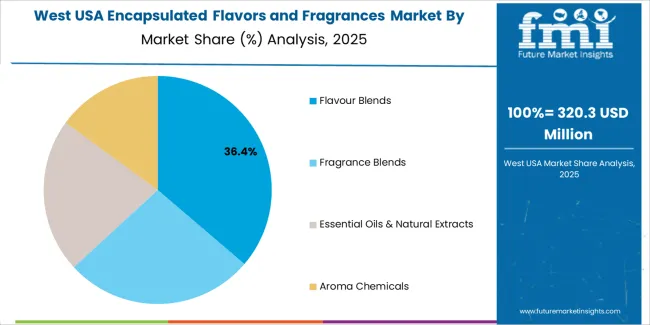

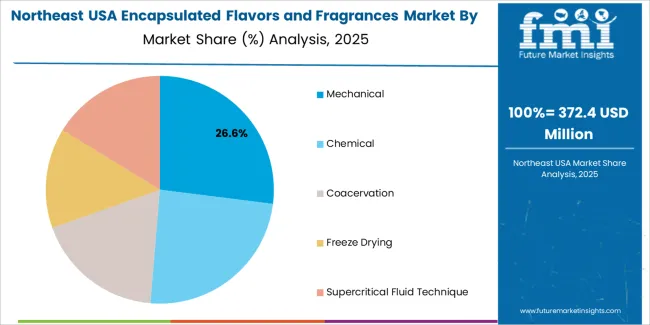

Demand for encapsulated flavors and fragrances in the USA is segmented by encapsulated form, product type, end-use industry, technology, and wall material. By encapsulated form, demand is divided into powder, granules, and paste. The demand is also segmented by product type, including flavor blends, fragrance blends, essential oils & natural extracts, and aroma chemicals. In terms of end-use, the food and beverage industry leads, accounting for 61% of demand. Technologies used in encapsulation include mechanical, chemical, coacervation, freeze drying, and supercritical fluid technique. Wall materials like gum arabic, modified starch, maltodextrin, corn syrup solid, gelatin, and modified cellulose are commonly used in the encapsulation process. Regionally, demand is divided into West USA, South USA, Northeast USA, and Midwest USA.

Powdered encapsulated flavors and fragrances account for 49% of the demand in the USA. Powder is highly favored for its ease of handling, storage, and seamless integration into various applications, particularly in the food and beverage industry. It offers outstanding stability, a longer shelf life, and controlled release of flavors or fragrances, ensuring a consistent and enjoyable sensory experience for consumers. This form is ideal for incorporation into dry mixes, seasonings, snacks, and dietary supplements. Its versatility also extends to other industries, such as consumer goods, pharmaceuticals, and cosmetics, where it ensures the integrity of volatile and heat-sensitive compounds. Powdered encapsulates are cost-effective and allow for efficient scaling of production, making them a popular choice across sectors. As demand for products that prioritize flavor retention and longer shelf life continues to rise, powdered encapsulation will remain a key segment in the flavors and fragrances industry.

Flavor blends account for the largest share in the product type demand for encapsulated flavors and fragrances. These blends are crucial for providing complex, tailored flavors in a variety of products, especially in the food and beverage industry. Encapsulating these flavor blends ensures that volatile compounds are protected from environmental factors, preserving their integrity and extending the product's shelf life. This method is essential for maintaining consistent flavor profiles in beverages, snacks, ready-to-eat meals, and convenience foods. As consumers continue to demand high-quality, reliable, and consistent taste experiences, the need for flavor blends in encapsulated form will remain strong. Encapsulation protects the flavors during processing and storage, ensuring that they reach the consumer in optimal condition. With the growth of the food and beverage industry, particularly in the health-conscious and convenience product segments, encapsulated flavor blends will continue to be in high demand.

Demand for encapsulated flavors and fragrances in the USA is growing as manufacturers increasingly prefer flavor and fragrance ingredients that retain potency, stability, and controlled release over time, especially in processed foods, beverages, personal care products, and home-care items. Encapsulation helps protect volatile flavor and aroma compounds against degradation from heat, light, moisture, or processing, enabling stable taste and scent even after long storage or processing steps. Restraints include higher cost and complexity compared with conventional flavor and fragrance ingredients, and sometimes tighter margins for processors and retailers who adopt encapsulated solutions.

In USA, demand is rising because consumer preferences continue shifting toward convenience foods, ready-to-eat meals, functional beverages, and processed snacks categories where maintaining consistent flavor over shelf life is critical. Encapsulated flavors let manufacturers deliver consistent taste and aroma despite processing, storage, or transport, increasing consumer satisfaction and reducing waste. In personal-care, cosmetics, and household-product segments, encapsulated fragrances allow for long-lasting scent release enhancing product value and user experience. As consumers demand products with premium sensory appeal, brands use encapsulation technology to differentiate their offerings and meet higher quality expectations.

Advances in encapsulation technologies such as spray-drying, coacervation, fluidized-bed coating, and polymer shell microencapsulation are making flavor and fragrance encapsulation more efficient, scalable, and cost-effective. These methods protect sensitive aromatic compounds and enable controlled or triggered release, improving shelf life and product stability across food, beverage, and personal-care applications. Growing demand for natural, clean-label ingredients and reduced use of synthetic additives encourages flavor and fragrance houses to develop encapsulated natural-extract blends which align with consumer preferences while retaining performance under processing conditions.

Despite the benefits, wider adoption faces some constraints. The encapsulation process often involves higher manufacturing costs and specialized equipment compared with conventional flavor and fragrance addition, which can be a barrier for small or price-sensitive producers. Achieving consistent quality and controlled release performance especially across different applications (food, beverage, personal care) requires careful formulation, which can add complexity. For low-margin or budget-focused products, the extra cost and effort may not deliver proportional benefit, limiting uptake. Competition from simpler or cheaper flavor and fragrance solutions (e.g., standard liquid concentrates or synthetic additives) remains in many segments.

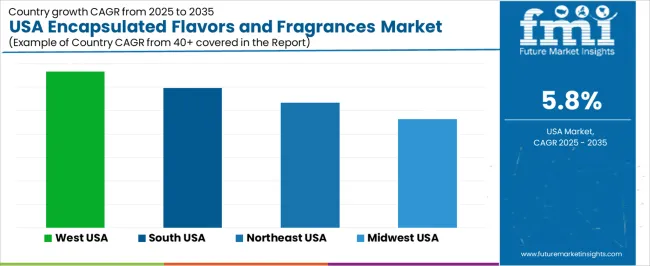

| Region | CAGR (%) |

|---|---|

| West USA | 6.7% |

| South USA | 6.0% |

| Northeast USA | 5.3% |

| Midwest USA | 4.6% |

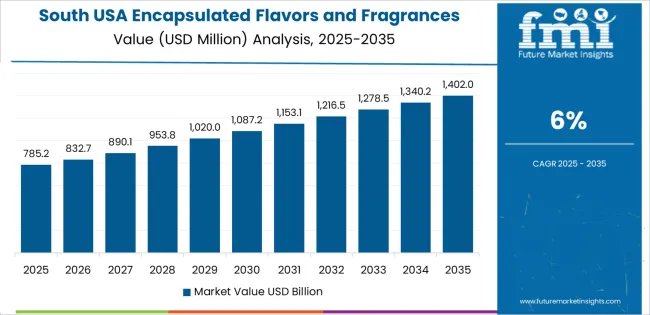

Demand for encapsulated flavors and fragrances in the USA is rising steadily, with West USA leading at a 6.7% CAGR, driven by strong demand in food & beverage, personal care, and home‑care sectors. South USA follows at 6.0% CAGR, supported by growing interest in clean‑label foods, ready‑to‑eat meals, and scented personal care products. Northeast USA shows a 5.3% CAGR, fueled by demand for high‑quality flavors and long‑lasting fragrances in processed foods, beverages, and toiletries. Midwest USA records a 4.6% CAGR, with modest but consistent growth across food manufacturing, household goods, and consumer products. As consumers increasingly seek natural ingredients, improved shelf life, and controlled release of aromas and tastes, encapsulated flavors and fragrances are becoming essential across diverse industries in the USA.

In West USA demand for encapsulated flavors and fragrances is rising at a 6.7% CAGR, driven by fast growth in food and beverage innovation, clean‑label trends, and lifestyle brands. Producers of snacks, ready‑to‑eat meals, and functional beverages are increasingly using encapsulation to extend flavor stability and mask strong tastes. The booming personal care and home‑care industrys in states like California and Washington fuel demand for long‑lasting fragrances in products such as candles, air fresheners, shampoos, and body care. The concentration of small-batch artisan food makers and specialty cosmetic brands with emphasis on natural or premium ingredients supports adoption of encapsulated solutions that deliver controlled release and improved shelf life. As consumers focus more on sensory quality, convenience, and sustainability, West USA remains the leading region for encapsulated flavors and fragrances USAge.

South USA registers a 6.0% CAGR for encapsulated flavors and fragrances demand thanks to a mix of growing population, expanding food manufacturing sector, and rising demand for convenience foods and ethnic flavor profiles. Large-scale snack, beverage, and spice processors around states like Texas and Florida rely on encapsulation to preserve volatile flavor compounds during high‑heat processing and long distributions. The region’s warm climate favors fragranced personal care and household products, boosting needs for stable encapsulated fragrance oils in products like deodorants, detergents, and air fresheners. Demographic growth and rising disposable income drive demand for premium and differentiated foods and lifestyle items, encouraging manufacturers to invest in encapsulated additives to enhance taste, aroma, and product stability. The combination of strong food processing infrastructure and consumer demand for quality keeps growth steady in South USA.

In Northeast USA demand grows at 5.3% CAGR, propelled by established food processing, beverage, and personal care industries seeking advanced flavor and fragrance technologies. Urban centers such as New York, Boston, and Philadelphia house many food‑service businesses, bakeries, confectioners, and craft beverage makers that value encapsulation for consistent flavor delivery and improved shelf stability. The region’s high consumer sensitivity to quality and premium products encourages manufacturers to use encapsulated flavors to support taste, freshness, and clean ingredient labels. In personal care and home‑care industrys, companies leverage encapsulated fragrance oils to offer longer fragrance retention in products like lotions, soaps, and home fragrances. The growing interest in functional and gourmet foods boosts the use of encapsulated flavor systems for innovative flavor profiles. With focus on quality, safety, and product differentiation, Northeast USA sustains steady growth for encapsulated flavors and fragrances.

Midwest USA shows a 4.6% CAGR, driven by the region’s strong food manufacturing base, household goods production, and growing interest in value-added processed foods. Large food processors and ingredient suppliers in states like Illinois, Ohio, and Minnesota are integrating encapsulated flavors to maintain flavor integrity through long supply chains, thermal processing, and extended shelf life. The fragrance demand in personal care and home‑care also contributes as manufacturers leverage encapsulation to stabilize scents in products such as detergents, candles, and air fresheners for broad distribution across the region. As smaller brands and private-label producers expand into natural and clean-label segments, encapsulated solutions help meet consumer expectations without compromising stability or cost. Even though growth is more modest compared to coastal regions, Midwest USA offers steady demand due to its manufacturing infrastructure and cost-sensitive industrys adopting efficient flavor and fragrance technologies.

The demand for encapsulated flavors and fragrances in the USA is growing as industries such as food and beverages, cosmetics, and personal care seek innovative ways to deliver long-lasting, controlled-release aromas and tastes. Encapsulation technology protects delicate flavors and fragrances from degradation due to environmental factors, enhancing product shelf life and user experience. As consumer preferences shift towards eco-friendlier, natural, and enhanced sensory experiences, encapsulated solutions are gaining traction in both mass-industry and premium products.

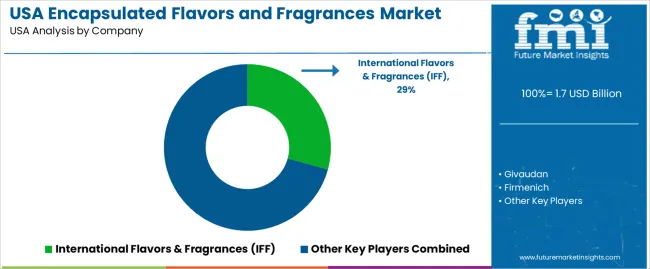

Key players in the encapsulated flavors and fragrances industry in the USA include International Flavors & Fragrances (IFF), Givaudan, Firmenich, Symrise, and Sensient Technologies. IFF holds a leading industry share of 29.3%, offering innovative encapsulated flavors and fragrances used in food, beverages, and personal care products. Givaudan is another major player, providing encapsulation solutions that cater to a wide range of industries, with a focus on enhancing flavor delivery and fragrance longevity. Firmenich specializes in premium encapsulated fragrances for both personal care and household products. Symrise and Sensient Technologies also offer advanced encapsulation solutions, targeting food and beverage applications as well as the cosmetic industry, ensuring optimal flavor release and fragrance retention.

Competition in the encapsulated flavors and fragrances industry is driven by the increasing demand for high-quality, long-lasting sensory experiences and eco-friendly production processes. Companies compete by offering encapsulation technologies that enhance the stability, release control, and delivery of flavors and fragrances in a variety of applications. As the focus on clean-label products intensifies, providers are innovating to meet consumer demands for natural, eco-friendly, and functional ingredients.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD billion |

| Product Type | Flavour Blends, Fragrance Blends, Essential Oils & Natural Extracts, Aroma Chemicals |

| Technology | Mechanical, Chemical, Coacervation, Freeze Drying, Supercritical Fluid Technique |

| Wall Material | Gum Arabic, Modified Starch, Maltodextrin (DE<20), Corn Syrup Solid (DE>20), Gelatin, Modified Cellulose |

| End-use | Food and Beverage, Consumer Goods |

| Encapsulated Form | Powder, Granules, Paste |

| Region | West USA, South USA, Northeast USA, Midwest USA |

| Countries Covered | USA |

| Key Companies Profiled | International Flavors & Fragrances (IFF), Givaudan, Firmenich, Symrise, Sensient Technologies |

| Additional Attributes | Dollar sales by product type, technology, wall material, and encapsulated form; regional CAGR and adoption trends; demand trends in encapsulated flavors and fragrances; growth in food, beverage, and consumer goods sectors; technology adoption for encapsulation; vendor offerings including flavor and fragrance blends, essential oils, and aroma chemicals; regulatory influences and industry standards |

The demand for encapsulated flavors and fragrances in USA is estimated to be valued at USD 1.7 billion in 2025.

The market size for the encapsulated flavors and fragrances in USA is projected to reach USD 3.0 billion by 2035.

The demand for encapsulated flavors and fragrances in USA is expected to grow at a 5.8% CAGR between 2025 and 2035.

The key product types in encapsulated flavors and fragrances in USA are flavour blends, fragrance blends, essential oils & natural extracts and aroma chemicals.

In terms of technology, mechanical segment is expected to command 28.0% share in the encapsulated flavors and fragrances in USA in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Encapsulated Flavors and Fragrances Market Analysis by Product Type, Technology, Wall Material, End-use, Encapsulated Form, Process, and Region through 2035

Flavors and Fragrances Market Analysis by Type, Nature, Application, and Region through 2035

Encapsulated Flavors Market Size and Share Forecast Outlook 2025 to 2035

USA Medical Coding Market Size and Share Forecast Outlook 2025 to 2035

USA Labels Market Size and Share Forecast Outlook 2025 to 2035

USA Plant-based Creamers Market Size and Share Forecast Outlook 2025 to 2035

USA Barrier Coated Paper Market Size and Share Forecast Outlook 2025 to 2035

USA Electronic Health Records (EHR) Market Size and Share Forecast Outlook 2025 to 2035

USA Animal Model Market Size and Share Forecast Outlook 2025 to 2035

Encapsulated Zinc Feed Market Analysis - Size and Share Forecast Outlook 2025 to 2035

USA and Canada Packer Bottle Market Size and Share Forecast Outlook 2025 to 2035

USA Stretch Hood Films Market Size and Share Forecast Outlook 2025 to 2035

USA and Canada Fence Screen Market Size and Share Forecast Outlook 2025 to 2035

USA Lubricant Contaminated HDPE Container Waste Market Size and Share Forecast Outlook 2025 to 2035

Flavors for Pharmaceutical & Healthcare Applications Market Size and Share Forecast Outlook 2025 to 2035

USA Commercial Walk-In Refrigeration Market Size and Share Forecast Outlook 2025 to 2035

USA & Canada Pre-painted Steel Roofing and Cladding Market Size and Share Forecast Outlook 2025 to 2035

USA Residential Cotton Candy Maker Market Size and Share Forecast Outlook 2025 to 2035

USA Faith Based Tourism Market Size and Share Forecast Outlook 2025 to 2035

United States NFC Lemon Juice Market Analysis - Size, Growth and Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA