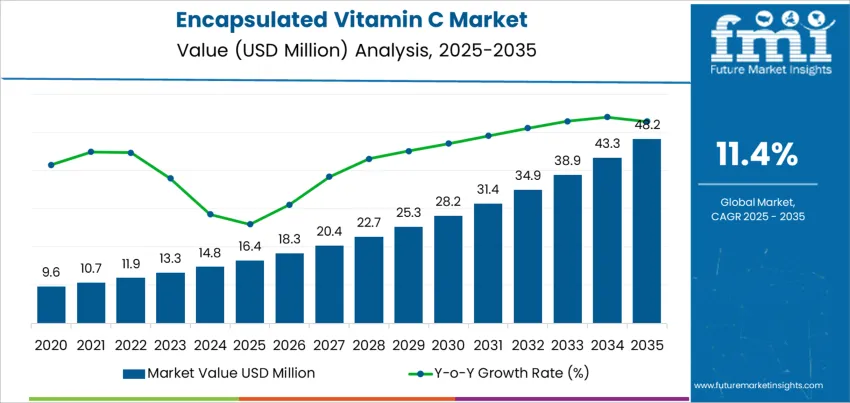

The global encapsulated vitamin C market is expected to grow from USD 16.4 million in 2025 to USD 48.2 million by 2035, at a compound annual growth rate (CAGR) of 11.4%. This growth represents an absolute increase of USD 31.8 million over the forecast period, representing a nearly 2.9-fold increase. Encapsulated vitamin C is gaining popularity in the cosmetics and skincare industries due to its superior stability, controlled release, and enhanced bioavailability compared to traditional forms of vitamin C. Vitamin C is widely known for its anti-aging, skin-brightening, and antioxidant properties, making it a key ingredient in many skincare products aimed at reducing wrinkles, pigmentation, and improving overall skin tone.

Encapsulation protects vitamin C from oxidation, preserving its potency and extending the shelf life of products. This has led to the growing use of encapsulated vitamin C in serums, creams, and other skin care formulations, contributing to its increasing demand. The food and beverage industry is also adopting encapsulated vitamin C for use in functional foods and beverages, where the encapsulation ensures the vitamin remains effective and stable over time. As advancements in encapsulation technologies continue and regulatory frameworks become more favorable, the demand for encapsulated vitamin C is expected to rise, further fueling market expansion.

Between 2025 and 2030, the encapsulated vitamin C market is projected to grow from USD 16.4 million to USD 25.3 million, creating an absolute expansion of USD 8.9 million. This growth is driven by the increasing demand for stable, bioavailable vitamin C in skincare products, particularly for anti-aging, skin brightening, and antioxidant effects. The rise in the adoption of encapsulated vitamin C in functional foods and beverages will also contribute significantly to market growth, with advancements in encapsulation technologies further improving product effectiveness and shelf life. Manufacturers are focused on enhancing formulation innovation to meet consumer demand for effective skincare and wellness solutions.

From 2030 to 2035, the market value increases from USD 25.3 million to USD 48.2 million, representing an additional USD 22.9 million, which constitutes 53.3% of the overall forecasted growth for the decade. This period will see continued strong demand for encapsulated vitamin C, driven by consumer preference for products that offer superior stability and targeted efficacy. The expanding use of encapsulated vitamin C in high-performance skincare products and functional foods will drive growth, as ongoing product innovations and increased consumer awareness fuel demand. With the evolution of encapsulation technologies and the expansion of applications across industries, the market is expected to grow significantly through 2035.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 16.4 million |

| Market Forecast Value (2035) | USD 48.2 million |

| Forecast CAGR (2025-2035) | 11.4% |

The encapsulated vitamin C market is growing due to the increasing consumer demand for advanced skincare products that provide effective and stable vitamin C delivery. Encapsulated vitamin C, known for its potent antioxidant properties, is highly sought after for its ability to brighten skin, reduce signs of aging, and protect against environmental damage. The encapsulation process stabilizes vitamin C, which is prone to oxidation, ensuring its effectiveness and longer shelf life in cosmetic formulations. As consumers prioritize anti-aging and skin health benefits, encapsulated vitamin C has become a preferred ingredient in high-performance skincare products.

Advancements in encapsulation technology have significantly contributed to the market's growth. New methods of encapsulation have improved the delivery system, allowing for a slow, controlled release of vitamin C into the skin. This provides enhanced benefits, such as deeper penetration and sustained efficacy over time. The growing awareness of the importance of skin care ingredients in combating environmental stressors, such as pollution and UV radiation, further boosts the adoption of encapsulated vitamin C in cosmetics.

Challenges like the high cost of production and formulation complexity may limit accessibility for some brands, especially smaller companies. Regulatory concerns over the safety and stability of encapsulated ingredients in skincare products could create hurdles. Despite these challenges, technological advancements and growing demand for effective skincare solutions are expected to propel continued growth in the encapsulated vitamin C market.

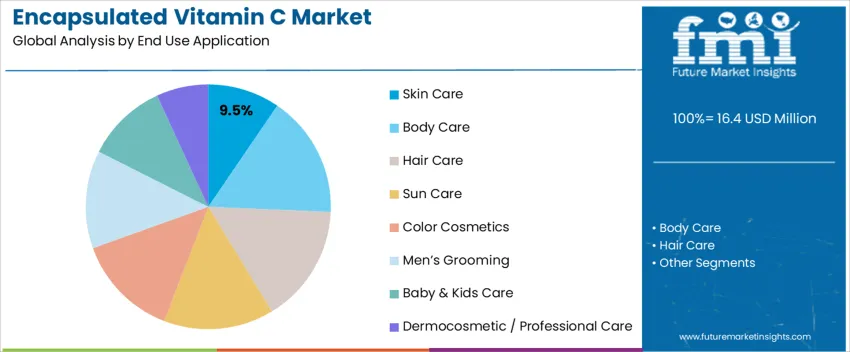

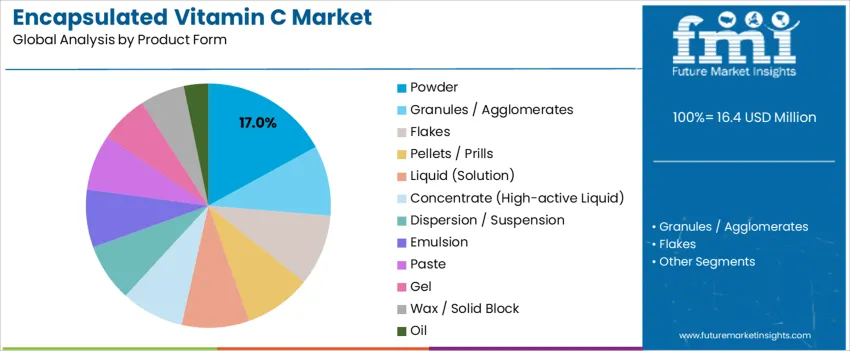

Global demand for encapsulated vitamin C is structured by end use application and product form, with strong concentrations in East Asia, Western Europe, and North America. Skin care holds a 9.5% share, driven by the growing adoption of vitamin C for its brightening, anti-aging, and antioxidant properties. Other segments include body care, hair care, sun care, color cosmetics, men’s grooming, baby and kids care, and dermocosmetic or professional care, distributed across both mass and professional channels. On the product form side, powders capture a 17.0% share, along with granules/agglomerates, flakes, pellets/prills, liquid solutions, high-active liquid concentrates, dispersions, emulsions, pastes, gels, wax/solid blocks, and oils.

Skin care accounts for 9.5% of global encapsulated vitamin C usage, driven by its popularity in formulations targeting skin brightening, anti-aging, and overall skin health. Encapsulated vitamin C is widely used in serums, toners, creams, and moisturizers, providing a stable and gradual release of the active ingredient, ensuring maximum skin absorption with minimal irritation. Demand is particularly high in South Korea, Japan, the USA, and Western Europe, where continuous innovations in dermocosmetics and professional skin care products remain strong. Encapsulation allows for enhanced stability of vitamin C, protecting it from degradation and ensuring consistent efficacy. Professional and dermocosmetic brands leverage encapsulated vitamin C for specific skincare concerns such as hyperpigmentation, collagen synthesis, and skin rejuvenation. Ongoing development in countries like France, Germany, and the USA continues to focus on delivering high-quality encapsulated vitamin C within regulated cosmetic frameworks.

Powder form holds a 17.0% share of global encapsulated vitamin C demand, largely due to its excellent shelf stability, moisture control, and consistent performance in formulations. Powders offer precise dosing, allowing for flexibility in various product forms such as emulsions, gels, and masks, ensuring uniform quality and performance across high-volume production in Asia, Europe, and North America. Powder formats also provide logistical advantages, reducing leakage risks and lowering the need for refrigeration during global shipping. Manufacturers prefer powders for their compatibility with automated blending systems, ensuring predictable product quality even under varying climate conditions. Regulatory documentation and microbial specification controls are more standardized for powdered inputs, reinforcing powder as the dominant product form for encapsulated vitamin C. These benefits continue to position powders as the leading choice in the global encapsulated vitamin C sector.

The encapsulated vitamin C sector is driven by growing demand for stable and effective skin care solutions. Vitamin C is widely known for its antioxidant properties, promoting skin brightening, collagen synthesis, and reducing the effects of aging. However, its instability when exposed to light, air, and heat has limited its widespread use. Encapsulation protects vitamin C, maintaining its potency and extending its shelf life, making it more suitable for various cosmetic products. This technology enables controlled release, allowing the active ingredient to penetrate deeper into the skin, enhancing effectiveness and minimizing irritation. As consumers increasingly seek high-performance, clean-label products, encapsulated vitamin C is becoming a preferred choice in formulations targeting anti-aging and skin rejuvenation.

Global demand for encapsulated vitamin C is rising due to increasing consumer interest in antioxidant-rich, anti-aging skincare. Encapsulation protects vitamin C from degradation, ensuring it remains stable and effective over time. This technology allows for a controlled release of vitamin C, which enhances its absorption and minimizes skin irritation, making it suitable for all skin types, including sensitive skin. As consumers prioritize clean beauty and high-quality ingredients, encapsulated vitamin C is gaining popularity in a wide range of cosmetics, from serums to moisturizers. The growing awareness of the benefits of vitamin C in boosting skin radiance, reducing dark spots, and improving collagen production fuels the demand for encapsulated formulations.

The adoption of encapsulated vitamin C faces challenges in formulation complexity and higher production costs. The encapsulation process requires specialized techniques and precise quality control to maintain the stability and effectiveness of the active ingredient. This increases manufacturing costs, which can make encapsulated vitamin C products more expensive than traditional formulations. Some consumers may be hesitant to switch from conventional vitamin C products due to unfamiliarity with encapsulated technologies or concerns about efficacy. Regulatory hurdles in different regions around labeling and claims for active ingredients further complicate the market’s expansion. Despite these challenges, continued technological advancements and consumer education are helping to overcome these barriers.

Key trends reshaping the encapsulated vitamin C sector include the development of formulations designed for sensitive skin, offering powerful antioxidant effects without irritation. There is a growing emphasis on combining encapsulated vitamin C with other ingredients such as peptides, hyaluronic acid, and antioxidants to enhance skin hydration and overall skin health. Technological innovations in encapsulation methods, such as liposomal and polymer-based carriers, are improving delivery systems, enabling better penetration and more controlled release. The rising consumer preference for clean, sustainable beauty products is also influencing the market, as brands increasingly focus on transparent labeling, eco-friendly packaging, and using high-quality, stable vitamin C forms in their formulations.

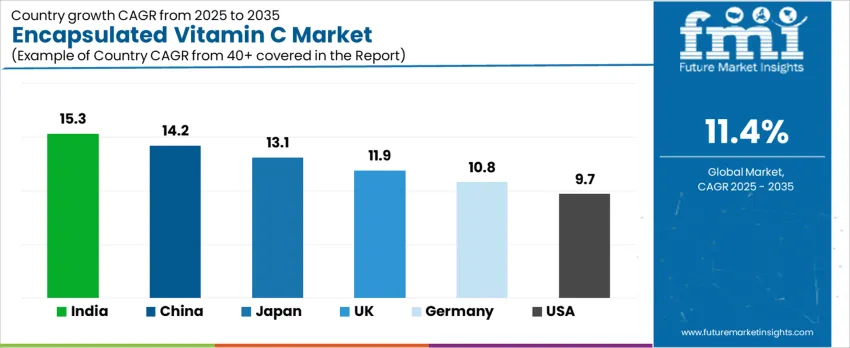

| Country | CAGR (%) |

|---|---|

| India | 15.3% |

| China | 14.2% |

| Japan | 13.1% |

| UK | 11.9% |

| Germany | 10.8% |

| USA | 9.7% |

The encapsulated vitamin C market is experiencing robust global growth, with India leading at a 15.3% CAGR, driven by the increasing demand for advanced skincare products and the growing awareness of vitamin C’s benefits for skin health. China follows with a 14.2% CAGR, fueled by a rising middle class and increased interest in high-quality cosmetic and health supplements. Japan’s growth at 13.1% is driven by its aging population and a strong culture of skincare. The UK and Germany are witnessing steady growth at 11.9% and 10.8%, respectively, supported by the expanding demand for anti-aging and wellness products. In the USA, the encapsulated vitamin C market shows a moderate 9.7% growth rate, driven by continued interest in skincare and the availability of innovative vitamin C formulations.

India’s encapsulated vitamin C market is growing rapidly, with a projected CAGR of 15.3% through 2035. This growth is driven by the increasing demand for advanced skincare solutions that offer anti-aging, brightening, and skin protection benefits. The rising awareness of vitamin C’s skincare advantages, particularly in urban and semi-urban areas, is encouraging consumers to incorporate it into their daily routines. The growing middle class and rising disposable income are boosting the demand for high-quality skincare products. India’s robust e-commerce sector ensures wider product access, while local manufacturing initiatives help improve availability and affordability. As consumers become more health-conscious and beauty-focused, the demand for encapsulated vitamin C in India is expected to continue rising.

China’s encapsulated vitamin C market is expanding at a 14.2% CAGR through 2035, supported by the growing demand for high-quality skincare products. Consumers are increasingly seeking effective skincare treatments that address multiple concerns such as pigmentation, fine lines, and skin protection, making encapsulated vitamin C a popular choice. China’s rising middle class, along with the growing interest in wellness and personal care, drives the market. The country's beauty-conscious population, combined with the increasing availability of these products through both traditional retail and online platforms, ensures widespread accessibility. The advancement of local skincare brands focusing on innovative formulations is contributing to the demand for encapsulated vitamin C. With rising skincare awareness, the market is set to continue its upward trajectory.

Japan’s encapsulated vitamin C market is projected to grow at a 13.1% CAGR through 2035, fueled by the increasing popularity of advanced skincare products among its health-conscious population. Encapsulated vitamin C is favored for its stability and effective delivery, which appeals to consumers seeking anti-aging, brightening, and skin rejuvenation benefits. Japan’s aging population is a significant factor driving the demand for skincare products focused on maintaining youthful skin. The country’s strong emphasis on beauty and wellness, combined with its scientific approach to skincare, positions encapsulated vitamin C as a trusted solution. Japan's highly regulated skincare industry ensures that only premium, effective products reach consumers, further strengthening market growth.

The UK’s encapsulated vitamin C market is experiencing steady growth, with a 11.9% CAGR through 2035. This growth is driven by increasing consumer awareness about the benefits of vitamin C for skin health, particularly in preventing signs of aging and promoting a brighter complexion. Encapsulated vitamin C products are gaining popularity for their ability to provide stable and controlled release, enhancing their effectiveness. The UK market benefits from a strong culture of preventive skincare, with consumers prioritizing long-term skin health. The rise of clean beauty trends and natural skincare products further boosts demand for encapsulated vitamin C. Retail pharmacies, supermarkets, and online platforms are key distribution channels, making these products easily accessible to consumers.

Germany’s encapsulated vitamin C market is growing at a steady pace with a 10.8% CAGR through 2035. The demand for encapsulated vitamin C is driven by its popularity in addressing skin concerns such as pigmentation, aging, and dullness. The German market is characterized by a strong preference for scientifically backed and high-quality skincare formulations. The demand for encapsulated vitamin C is especially driven by the country’s aging population, which is increasingly seeking effective solutions for skin rejuvenation and protection. Furthermore, Germany's stringent regulatory standards ensure that only the most effective and reliable skincare products are available, bolstering consumer confidence. The country’s growing focus on wellness and health-conscious beauty trends continues to support the steady expansion of the encapsulated vitamin C market.

The USA’s encapsulated vitamin C market is experiencing moderate growth, with a 9.7% CAGR through 2035. The growth is primarily fueled by increasing consumer interest in anti-aging, skin protection, and overall skin health. Encapsulated vitamin C products are particularly popular due to their stable formulation, which ensures effective delivery and minimizes irritation. The USA’s mature skincare market continues to see steady growth driven by consumer demand for innovative and high-performance skincare products. E-commerce platforms and retail pharmacies are key distribution channels, ensuring widespread availability. While the market growth is moderate due to high market penetration, the ongoing demand for effective and targeted skincare solutions supports a steady expansion of the encapsulated vitamin C market in the USA.

The demand for encapsulated vitamin C is increasing due to its ability to offer enhanced stability, controlled release, and prolonged effectiveness compared to traditional forms of vitamin C. Encapsulated vitamin C is widely used in skincare products due to its antioxidant properties, which help reduce the appearance of wrinkles, brighten the skin, and protect against environmental stressors. As consumers prioritize products that deliver potent and sustained benefits without degradation, encapsulated vitamin C is becoming a key ingredient in premium skincare formulations. Innovations in encapsulation technology are ensuring the stability and effectiveness of vitamin C, even in products exposed to light and air.

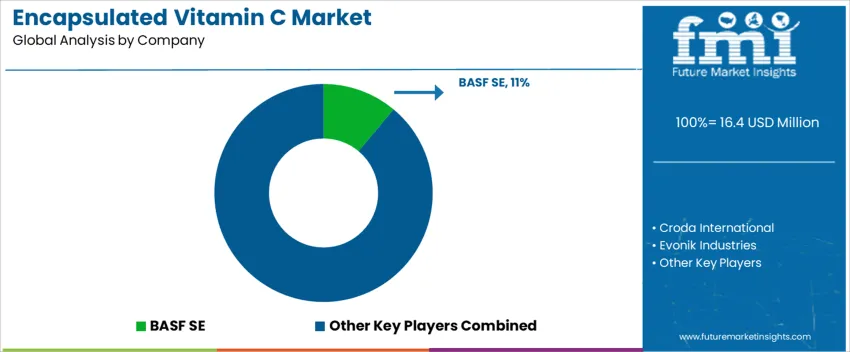

Key players shaping the encapsulated vitamin C industry include BASF SE, Croda International, Evonik Industries, Symrise (including IFF/Givaudan active ingredient businesses), Dow Inc., Ashland, Clariant, and Seppic. BASF SE leads the market with a significant share of 11.1%, capitalizing on its extensive expertise in vitamin C formulation and encapsulation. These companies provide high-quality, stable encapsulated vitamin C solutions that cater to the growing consumer demand for anti-aging and brightening skincare products. Smaller, specialized players also contribute by offering customized formulations for niche applications, ensuring a competitive and diverse landscape.

The growth of the encapsulated vitamin C sector is driven by continuous advancements in encapsulation techniques and increased consumer awareness of the benefits of vitamin C in skincare. The encapsulation process protects the active ingredient from degradation, ensuring that it remains effective over time. As demand for products that provide long-lasting skin benefits grows, encapsulated vitamin C is becoming an essential ingredient in a wide range of cosmetic and skincare applications, further fueling market expansion.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD million |

| End Use Application | Skin Care, Body Care, Hair Care, Sun Care, Color Cosmetics, Men’s Grooming, Baby & Kids Care, Dermocosmetic / Professional Care |

| Product Form | Powder, Granules / Agglomerates, Flakes, Pellets / Prills, Liquid (Solution), Concentrate (High-active Liquid), Dispersion / Suspension, Emulsion, Paste, Gel, Wax / Solid Block, Oil |

| Regions Covered | North America, Europe, East Asia, South Asia, Latin America, Middle East & Africa, Eastern Europe |

| Countries Covered | USA, China, Japan, South Korea, India, Germany, UK, France, Italy, Brazil, Argentina, Mexico, Saudi Arabia, South Africa, Russia, others |

| Key Companies Profiled | BASF SE, Croda International, Evonik Industries, Symrise (including IFF/Givaudan actives), Dow / Dow Inc., Ashland, Clariant, Seppic / Others (Lubrizol, Lonza, Inolex), Other regional and niche suppliers |

| Additional Attributes | Dollar by sales by end use application and product form; regional CAGR and growth outlook; multi-strain formulation adoption; clinical validation and regulatory compliance tracking; distribution channels including retail, DTC, e-commerce, and institutional buyers; product form prevalence in powders, liquids, and emulsions; regional preference for strain libraries; supply chain logistics for cold chain and ambient stability; strain survivability, CFU consistency, and shelf-life performance; innovation trends including prebiotic/postbiotic combinations, non-dairy matrices, and personalized nutrition; competitive positioning of global vs regional suppliers. |

The global encapsulated vitamin C market is estimated to be valued at USD 16.4 million in 2025.

The market size for the encapsulated vitamin C market is projected to reach USD 48.2 million by 2035.

The encapsulated vitamin C market is expected to grow at a 11.4% CAGR between 2025 and 2035.

The key product types in encapsulated vitamin C market are skin care, body care, hair care, sun care, color cosmetics, men’s grooming, baby & kids care and dermocosmetic / professional care.

In terms of product form , powder segment to command 17.0% share in the encapsulated vitamin C market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Micro-Encapsulated Vitamin C Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Encapsulated Salicylic Acid Market Size and Share Forecast Outlook 2025 to 2035

Encapsulated Retinol Market Size and Share Forecast Outlook 2025 to 2035

Encapsulated Flavors Market Size and Share Forecast Outlook 2025 to 2035

Encapsulated Zinc Feed Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Encapsulated Lactic Acid Market Analysis by Application, Nature, Form, and Region from 2025 to 2035

Encapsulated Flavors and Fragrances Market Analysis by Product Type, Technology, Wall Material, End-use, Encapsulated Form, Process, and Region through 2035

Encapsulated Sodium Bicarbonate Market Trends - Growth & Industry Forecast 2025 to 2035

Encapsulated Citric Acid Market

Encapsulated Salt Market

Encapsulated Caffeine Market

Microencapsulated Paraffin Phase Change Materials Market Size and Share Forecast Outlook 2025 to 2035

Microencapsulated Omega-3 Powders Market Size and Share Forecast Outlook 2025 to 2035

Microencapsulated Fish Oil Market

Vitamin C Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Vitamin C Serums (Ascorbic Acid) Market Analysis - Size and Share Forecast Outlook 2025 to 2035

BHA-Encapsulated Acne Treatment Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Vitamin Patches Market - Size, Share, and Forecast Outlook 2025 to 2035

Vitamin Tonics Market Size and Share Forecast Outlook 2025 to 2035

Vitamin D Deficiency Treatment Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA