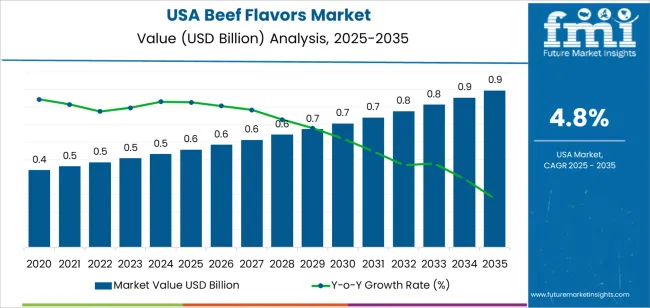

In 2025, demand for beef flavors in the USA is valued at USD 0.6 billion and is projected to reach USD 0.9 billion by 2035 at a CAGR of 4.8%. Early growth reflects stable consumption across processed foods, snacks, ready meals, and foodservice where beef flavor remains a core sensory profile. QSR menus, frozen entrees, seasoning blends, and instant soups account for a large share of volume. Growth is supported by sustained demand for convenience foods and steady expansion of private label prepared meals in retail. Reaction flavors and spray dried formats dominate commercial use due to compatibility with dry mixes and thermal processing requirements. Demand also benefits from the use of beef flavor in pet food coatings and wet formulations.

After 2030, market expansion is driven less by volume increase and more by product reformulation and value enrichment. Demand rises from about USD 0.7 billion in 2030 toward USD 0.9 billion by 2035 as manufacturers focus on cleaner label positioning, improved flavor authenticity, and longer shelf stability. Hybrid formulations that blend natural extracts with reaction flavors gain wider use to balance cost and sensory performance. Foodservice demand remains steady, supported by growth in quick service outlets and meal kit providers. Key suppliers focus on fat encapsulation, thermal stability, and sodium reduction compatibility. Distribution remains anchored in industrial food processing hubs across the Midwest, Texas, and California.

The overall demand for beef flavors in USA increases from USD 0.6 billion in 2025 to USD 0.7 billion by 2030, adding USD 0.1 billion in absolute value. This phase reflects steady consumption growth across processed foods, snacks, ready meals, and foodservice applications where beef profiles remain a core savory driver. Demand is supported by stable USAge in soups, sauces, instant meals, and extruded snacks rather than rapid category expansion. Product innovation during this period is concentrated on improving taste authenticity, heat stability, and flavor release rather than introducing entirely new USAge formats. Growth remains volume anchored, shaped by routine reformulation cycles and private label expansion within mass retail channels.

From 2030 to 2035, the market expands from USD 0.7 billion to USD 0.9 billion, adding a larger USD 0.2 billion in the second half of the decade. This back weighted acceleration reflects rising USAge of beef flavors in plant based and hybrid protein products, where flavor systems are required to replicate traditional meat profiles. Additional support comes from the expansion of premium frozen meals, high protein snacks, and convenience foods that rely heavily on savory depth. As flavor systems become more concentrated and tailored to specific matrices, value per formulation increases, shifting demand from simple volume growth to formulation driven value expansion.

| Metric | Value |

|---|---|

| Industry Value (2025) | USD 0.6 billion |

| Forecast Value (2035) | USD 0.9 billion |

| Forecast CAGR (2025 to 2035) | 4.8% |

The demand for beef flavors in the USA has been shaped by long standing consumption of savory processed foods, foodservice expansion, and the need for consistent taste delivery at scale. Historically, beef flavors were used primarily in soups, gravies, instant noodles, snacks, and frozen meals where real meat was either limited or cost restrictive. Growth in quick service restaurants and ready meals increased reliance on concentrated flavor systems to standardize taste across regions. Food manufacturers adopted beef flavors to control formulation cost, maintain shelf stability, and manage supply variability tied to fresh meat. Demand also expanded through seasoning blends for home cooking, where ease of use and predictable flavor profiles supported steady retail uptake.

Future demand for beef flavors in the USA will be shaped by shifts in product formulation, dietary preferences, and food manufacturing strategies. Plant based and hybrid protein products will rely heavily on beef flavor systems to mimic familiar taste profiles for consumers reducing direct meat intake. Demand will also grow in snack coatings, meal kits, sauces, and ethnic cuisines where beef taste is central to flavor identity. Clean label positioning will influence sourcing and processing methods but will not eliminate reliance on flavor systems. Barriers include regulatory scrutiny, rising cost of natural flavor precursors, and consumer sensitivity to artificial additives. Market evolution will depend on how effectively suppliers balance authenticity, cost control, and labeling expectations.

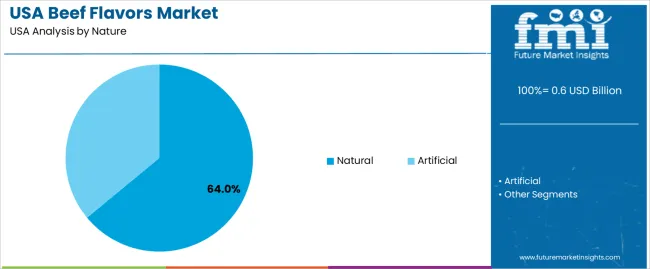

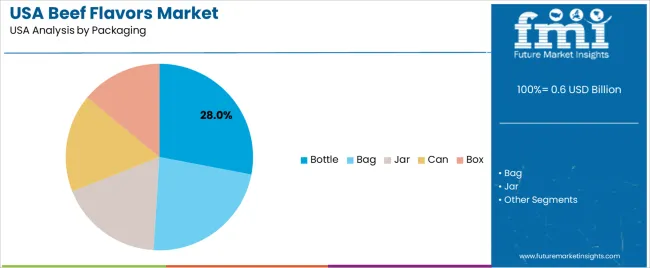

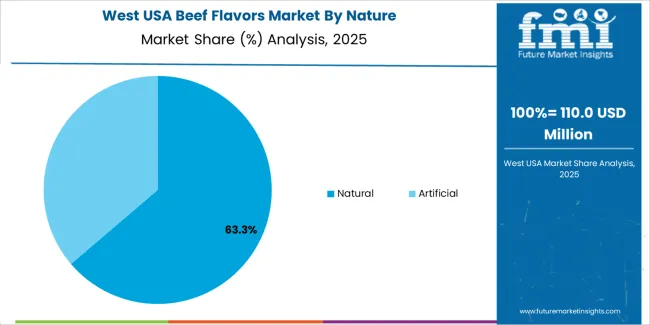

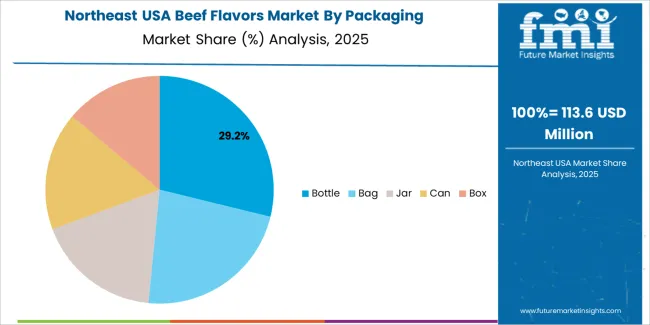

The demand for beef flavors in the USA is structured by nature and packaging format. Natural beef flavors account for 64% of total demand, while artificial variants serve cost sensitive and high volume applications. By packaging, bottles represent 28.0% of total consumption, followed by bags, jars, cans, and boxes used across food manufacturing and foodservice distribution. Demand patterns are shaped by clean label positioning, formulation compatibility, storage requirements, and handling efficiency. These segments reflect how ingredient sourcing preferences and logistical considerations influence purchasing behavior across processed food, ready meal, snack seasoning, and foodservice preparation channels in the USA.

Natural beef flavors account for 64% of total demand in the USA. This dominance reflects the sustained shift toward clean label formulations across processed foods, snacks, soups, sauces, and ready to eat meals. Food manufacturers increasingly prioritize naturally derived flavor systems to meet consumer expectations around ingredient transparency and minimal synthetic content. Natural beef flavors support labeling claims that align with premium positioning in both retail and foodservice products.

Natural variants also perform well in flavor authenticity, which is critical for meat analogs, culinary sauces, and savory snacks. Development of spray dried and encapsulated natural beef flavors has improved thermal stability and shelf performance in baked and extruded products. Regulatory acceptance and standardized sourcing practices further support scale up across manufacturing operations. These sensory performances and labeling advantages sustain natural beef flavors as the dominant nature segment across the USA market.

Bottle packaging accounts for 28.0% of total beef flavor demand in the USA. This leadership reflects widespread use of liquid and concentrated flavor formats in food processing and commercial kitchens. Bottles allow controlled pouring, resealing, and contamination prevention, which improves dosing accuracy during formulation and preparation. They are commonly used for stocks, marinades, gravies, and base flavor systems in foodservice operations.

Bottle packaging also supports inventory management in both industrial and commercial environments. Standardized bottle sizes enable efficient stacking, labeling, and batch traceability during production and storage. Plastic and glass bottle options provide compatibility with acidic and oil based flavor systems. Replacement demand from restaurants, catering, and institutional kitchens contributes to recurring bottle USAge. These operational handling and safety advantages position bottles as the leading packaging format for beef flavors across the USA.

Demand for beef flavors in the USA is anchored in the countrys long-standing consumption of beef-based foods across retail, foodservice, and institutional sectors. Beef remains a core taste reference for burgers, tacos, stews, gravies, and barbecue products. Large-scale production of frozen meals, shelf-stable sauces, and seasoning blends depends on consistent beef flavor delivery at controlled cost. Growth in ready-to-cook meal solutions and heat-and-serve foods keeps industrial flavor systems in steady demand. These mainstream eating patterns ensure that beef flavor remains a functional backbone in formulated foods.

Beef flavors play a critical role in U.S. industrial food processing where real meat use is often limited by cost, shelf-life, or handling constraints. Snack coatings, instant noodles, soup powders, bouillon bases, and economy meat products rely on concentrated beef flavors for taste impact. Large catering operations such as schools, healthcare facilities, and military food systems use flavor bases to standardize beef taste across high-volume production. Centralized kitchens and co-packers depend on flavor systems to stabilize taste across multiple production sites. These production realities anchor bulk beef flavor demand.

Beef flavor demand in the USA faces limits from rising scrutiny of ingredient labels and growing sensitivity to artificial flavor declarations. Consumers increasingly expect simplified ingredient statements, which raises the formulation cost of natural beef flavors. Volatility in raw material inputs tied to meat processing by-products also affects cost stability. Plant-forward menu expansion in schools, corporate cafeterias, and quick-service chains reduces exclusive reliance on beef. Inflation-driven food pricing pressure encourages manufacturers to reduce flavor load where possible. These forces collectively moderate aggressive expansion of traditional beef flavor USAge.

Beef flavors are now widely used to build sensory profiles in plant-based burgers, minced meat alternatives, and hybrid protein products, creating a new demand channel beyond conventional meat foods. Fermentation-derived and reaction-based natural beef flavors are gaining traction as brands move away from synthetic sources. Regional taste growth, including smoked Texas-style, spicy Southwestern, and slow-roasted diner-style profiles, drives specialization within beef flavor portfolios. These shifts show that beef flavor demand in the USA is no longer limited to meat processing but is expanding as a core building block of broader savory food design.

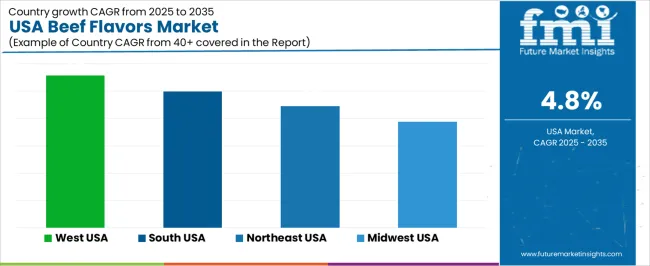

| Region | CAGR (%) |

|---|---|

| West | 5.6% |

| South | 5.0% |

| Northeast | 4.5% |

| Midwest | 3.9% |

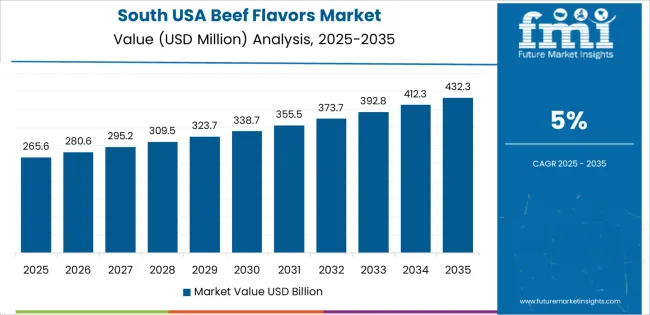

The demand for beef flavor ingredients in the USA shows growth across all regions, with the West leading at 5.6% CAGR. This reflects strong consumption of processed and convenience foods that use beef-flavor additives in that region, along with growing interest in grilled and ready-to-eat meals. The South region’s 5.0% growth is supported by food manufacturing and seasoning markets. The Northeast at 4.5% shows steady demand through restaurants, food services, and packaged food products. The Midwest’s 3.9% growth reflects more modest uptake, possibly due to established food preferences and lower growth in new product launches using beef flavors.

Growth in the West reflects a CAGR of 5.6% through 2035 for beef flavor demand, supported by strong consumption of processed foods, ready meals, and foodservice products across urban markets. High intake of plant based meat alternatives also increases the use of beef flavor systems for taste replication. Restaurant chains, snack manufacturers, and frozen food processors represent major volume users. Ethnic cuisine popularity supports diversified savory flavor blends. Demand remains formulation driven rather than seasonal, with steady purchasing from large scale food processors supplying retail, quick service restaurants, and institutional catering channels.

The South advances at a CAGR of 5.0% through 2035 for beef flavor demand, driven by high processed meat consumption, snack food manufacturing, and expansion of regional food processing plants. Barbecue style seasonings, savory snacks, and prepared meals dominate USAge. Poultry and beef processing clusters support steady industrial flavor blending activity. Foodservice distribution networks in southern states strengthen bulk flavor procurement. Demand remains volume oriented, with flavor houses supplying consistent formulations for large scale meat processors, snack brands, and foodservice operators serving high population growth corridors.

The Northeast records a CAGR of 4.5% through 2035 for beef flavor demand, shaped by strong demand for prepared foods, soups, sauces, and premium convenience meals. Dense urban populations rely heavily on packaged and foodservice meals, increasing flavor system USAge. Premium and clean label positioning strengthens demand for natural and yeast derived beef flavors. Institutional catering and private label retail add stable volume. Growth remains formulation focused rather than volume driven, with specialty food brands emphasizing consistent flavor profiles across repeat production batches.

The Midwest expands at a CAGR of 3.9% through 2035 for beef flavor demand, supported by meat processing, snack food manufacturing, and frozen entrée production. Large scale food plants rely on standardized flavor systems to maintain taste uniformity across national distribution. Beef flavors are widely used in gravies, seasonings, and ready to cook meals. Demand remains heavily manufacturing led rather than foodservice driven. Long term supply contracts stabilize purchase volumes. Growth stays steady due to mature processing infrastructure and consistent output across packaged food and ingredient manufacturing operations.

Demand for beef flavors in the USA is rising as processed foods, ready to eat meals, snacks, and meat alternatives expand rapidly. Consumers continue to favor savory and umami rich taste profiles, prompting manufacturers to add authentic beef notes to a wide range of products, from sauces and soups to snacks and plant based meat substitutes. The drive for convenience and consistent taste in packaged foods supports greater use of beef flavorings. The shift toward clean label and natural ingredient preferences pushes flavor makers to deliver beef derived or well formulated beef flavor systems that balance taste, stability, and labeling demands.

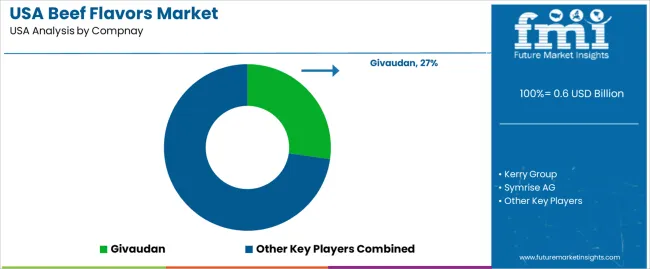

Leading flavor houses shaping this market include Givaudan, Kerry Group, Symrise AG, Firmenich, and International Flavors & Fragrances (IFF). These companies supply beef flavor formulations to major food processors, snack makers, seasoning producers, and alternative protein developers. Givaudan and Kerry Group are frequently chosen for large scale food production due to broad flavor portfolios and regulatory compliance capabilities. Symrise and Firmenich serve both conventional meat products and emerging plant based segments with tailored beef flavor systems. IFF complements the group with global supply networks and custom flavor solutions suitable for mass market and niche applications.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD billion |

| Nature | Natural, Artificial |

| Packaging | Bottle, Bag, Jar, Can, Box |

| Distribution Channel | B2B (Direct Sales), B2C (Indirect Sales) |

| Regions Covered | West USA, South USA, Northeast USA, Midwest USA |

| Countries Covered | USA |

| Key Companies Profiled | Givaudan, Kerry Group, Symrise AG, Firmenich, International Flavors & Fragrances (IFF) |

| Additional Attributes | Dollar-value distribution by nature and packaging; regional CAGR projections; natural beef flavors dominate due to clean label and flavor authenticity; artificial variants serve cost-sensitive high-volume applications; bottles lead packaging due to controlled dosing and re-sealability; demand driven by processed foods, ready meals, snacks, foodservice, and plant-based meat alternatives; post-2030 growth reflects hybrid and concentrated formulations, premium frozen meals, and convenience foods; supplier focus on thermal stability, encapsulation, sodium reduction, and matrix compatibility; regional hubs in Midwest, Texas, and California anchor distribution and formulation support. |

The demand for beef flavors in USA is estimated to be valued at USD 0.6 billion in 2025.

The market size for the beef flavors in USA is projected to reach USD 0.9 billion by 2035.

The demand for beef flavors in USA is expected to grow at a 4.8% CAGR between 2025 and 2035.

The key product types in beef flavors in USA are natural and artificial.

In terms of packaging, bottle segment is expected to command 28.0% share in the beef flavors in USA in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Beef Flavors Market Insights - Trends & Forecast 2025 to 2035

Analysis of the USA Processed Beef Market by Product Type, Processing Method, Distribution Channel, Packaging Type and Region through 2035

Demand for Beef Concentrate in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Encapsulated Flavors and Fragrances in USA Size and Share Forecast Outlook 2025 to 2035

Beef Grower Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

USA Medical Coding Market Size and Share Forecast Outlook 2025 to 2035

USA Labels Market Size and Share Forecast Outlook 2025 to 2035

USA Plant-based Creamers Market Size and Share Forecast Outlook 2025 to 2035

USA Barrier Coated Paper Market Size and Share Forecast Outlook 2025 to 2035

USA Electronic Health Records (EHR) Market Size and Share Forecast Outlook 2025 to 2035

USA Animal Model Market Size and Share Forecast Outlook 2025 to 2035

USA and Canada Packer Bottle Market Size and Share Forecast Outlook 2025 to 2035

USA Stretch Hood Films Market Size and Share Forecast Outlook 2025 to 2035

USA and Canada Fence Screen Market Size and Share Forecast Outlook 2025 to 2035

Beef Fat Market Size and Share Forecast Outlook 2025 to 2035

USA Lubricant Contaminated HDPE Container Waste Market Size and Share Forecast Outlook 2025 to 2035

Flavors for Pharmaceutical & Healthcare Applications Market Size and Share Forecast Outlook 2025 to 2035

USA Commercial Walk-In Refrigeration Market Size and Share Forecast Outlook 2025 to 2035

USA & Canada Pre-painted Steel Roofing and Cladding Market Size and Share Forecast Outlook 2025 to 2035

USA Residential Cotton Candy Maker Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA