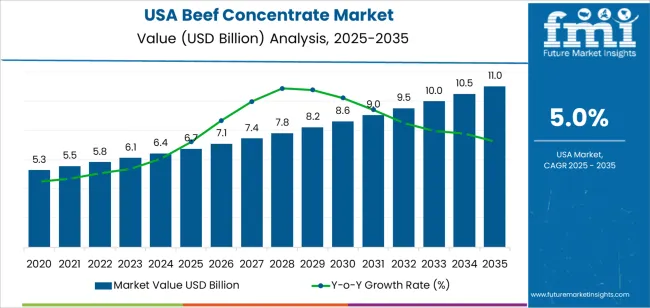

Beef concentrate demand in the USA stands at USD 6.7 billion in 2025 and is projected to reach USD 11.0 billion by 2035 at a CAGR of 5.0%. Early growth is shaped by rising use of concentrated meat bases across industrial food manufacturing rather than direct retail consumption. Prepared meals, sauces, soups, frozen entrées, and snack seasonings account for the largest share of volume as processors prioritize flavor intensity, shelf stability, and production efficiency. Foodservice demand also supports baseline growth through quick-service restaurants, institutional kitchens, and meal kit operators that rely on standardized flavor systems for menu consistency. The market remains closely tied to domestic beef processing volumes and byproduct utilization rates within rendering and extraction operations.

After 2030, market expansion is guided more by formulation value and application diversity than by throughput alone. Demand rises from about USD 8.6 billion in 2030 toward USD 11.0 billion by 2035 as hybrid formulations combining beef concentrate with yeast extracts, amino acids, and reaction flavors gain wider use. Growth also reflects rising deployment in pet food, jerky marinades, savory snacks, and low-sodium food systems where concentrated flavor delivery is required at reduced dosage levels. Export-oriented processed food manufacturers add incremental demand as global distribution expands. Pricing dynamics increasingly reflect protein input costs, energy intensity of concentration processes, and contract-based supply arrangements with large food processors rather than spot market food ingredient pricing.

Beef concentrate demand in USA is closely linked to industrial food processing throughput rather than direct retail meat consumption, which gives the category a structurally different growth profile from fresh or frozen beef. Demand increases from USD 6.7 billion in 2025 to USD 7.1 billion by 2030, adding USD 0.4 billion in absolute value. This phase reflects stable expansion across soups, sauces, gravies, ready meals, snack seasonings, and foodservice bases where concentrates are used for flavor standardization and yield control. Growth is driven by consistent production of convenience foods and contract food manufacturing rather than shifts in household cooking behavior. Value growth remains controlled as formulation inclusion rates stay relatively stable.

From 2030 to 2035, the market expands from USD 7.1 billion to USD 11.0 billion, adding USD 3.9 billion in the second half of the decade. This back weighted acceleration reflects deeper penetration of beef concentrates into high-protein snacks, premium ready meals, and plant-based hybrid formulations where meat flavor intensity is required at lower inclusion levels. Increased automation in food manufacturing, export growth of processed protein products, and higher demand for clean-label concentrated bases raise value per ton. As manufacturers focus on flavor consistency across large batch production, beef concentrate shifts from a background ingredient to a strategic formulation component, strengthening long-term demand growth.

| Metric | Value |

|---|---|

| Industry Value (2025) | USD 6.7 billion |

| Forecast Value (2035) | USD 11.0 billion |

| Forecast CAGR (2025 to 2035) | 5.0% |

Beef concentrate in the USA finds demand because manufacturers and foodservice providers value its ability to deliver stable, intense beef flavor and savory depth without relying on fresh meat or long cooking processes. Processed-food producers, ready-to-eat meal makers, and sauce or soup manufacturers use beef concentrate to ensure consistent taste and aroma across batches, even when raw beef prices fluctuate or supply is unpredictable. The convenience of a shelf-stable concentrate reduces production complexity for companies that wish to replicate traditional beef profiles in items such as soups, gravies, sauces, snacks, and prepared meals. This functional benefit helped beef concentrate gain traction in food processing and large-scale meal manufacturing where cost control and flavor uniformity matter.

Looking ahead, use of beef concentrate in the USA will likely expand as consumer demand grows for convenience foods, meat-based snacks, and value-oriented prepared meals. As dietary trends such as high-protein snacks, meat snacks, and ready meals continue to grow, beef concentrate offers a way to satisfy savory flavor demand with lower raw-material and storage costs than fresh meat. At the same time, rising production of plant-based and hybrid meat alternatives may create demand for beef-flavored concentrates to deliver familiar taste profiles even in partially meat-free applications. Challenges remain: changing dietary patterns, growing health consciousness, and pressure to reduce saturated fats could limit growth. Regulatory scrutiny and raw material cost fluctuations may also influence long-term adoption.

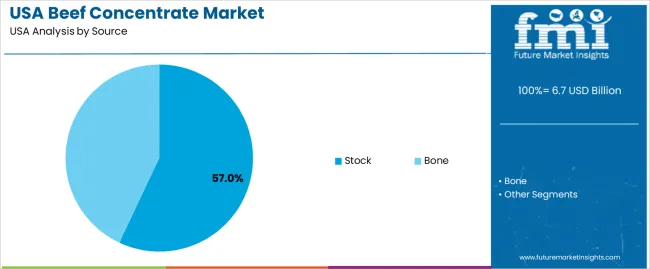

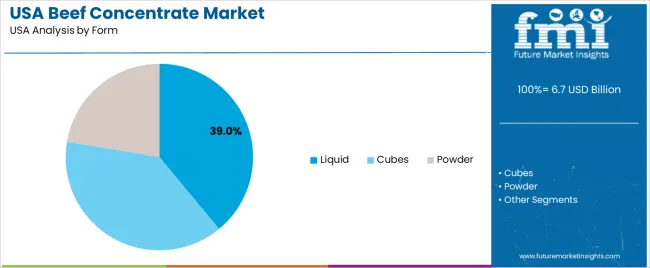

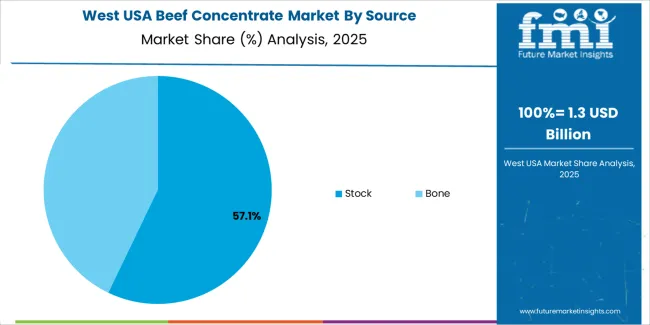

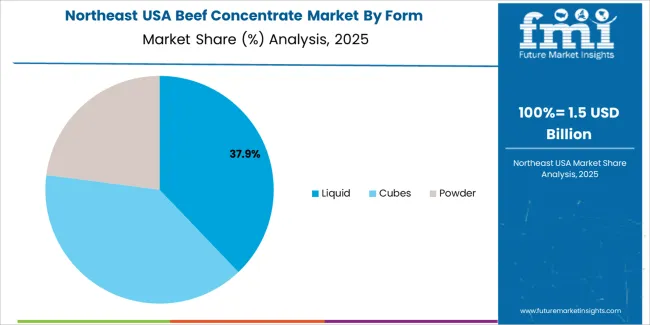

The demand for beef concentrate in the USA is structured by source and form. Stock based beef concentrate accounts for 57% of total demand, followed by bone based concentrates used in specialty culinary and nutrition applications. By form, liquid beef concentrate represents 39.0% of total consumption, followed by cube and powder formats used across foodservice, industrial food processing, and retail cooking segments. Demand behavior is shaped by flavor intensity requirements, ease of handling, storage stability, and preparation convenience. These segments reflect how flavor sourcing preferences and application specific USAbility requirements shape purchasing decisions across commercial kitchens, packaged food manufacturing, and household cooking in the USA.

Stock based beef concentrate accounts for 57% of total demand in the USA due to its balanced flavor profile and broad applicability across foodservice and home cooking. Stock concentrates are derived from simmered meat, vegetables, and seasonings, which delivers a rounded savory base suitable for soups, sauces, gravies, stews, and prepared meals. Chefs and food manufacturers prefer stock due to its consistent taste, predictable salt levels, and compatibility with a wide range of recipes. It performs well as a primary flavor base without overpowering other ingredients, which supports standardized menu preparation.

Stock based concentrates also integrate smoothly into large scale food manufacturing where consistency across batches is essential. Shelf stable stock concentrates support long storage cycles and centralized distribution across restaurant chains and packaged food producers. Retail consumers favor stock based formats for everyday cooking due to familiarity and ease of use. These flavor versatility, processing compatibility, and consumer familiarity factors sustain stock as the leading source segment in the USA beef concentrate demand structure.

Liquid beef concentrate accounts for 39.0% of total demand in the USA due to its ease of dilution, rapid flavor dispersion, and compatibility with automated dispensing systems. Liquid formats dissolve instantly in hot or cold water, which simplifies preparation in fast paced foodservice environments. Restaurants, catering units, and institutional kitchens rely on liquid concentrates for soups, broths, sauces, and marinades where precise flavor control and fast turnaround are required. Liquid formats also support pump based dosing, which improves hygiene and reduces handling variation.

Liquid beef concentrate also supports industrial food processing where continuous mixing systems require uniform dispersion without clumping. Packaging in bottles, jerry cans, and bulk containers allows efficient storage and transport. Retail users favor liquid forms for convenience and accurate portioning during daily cooking. These preparation speed, dosing accuracy, and processing compatibility advantages position liquid beef concentrate as the dominant form across the USA flavor ingredient demand structure.

Beef concentrate demand in the USA is driven by the need for flavor density, processing consistency, and cost control in large-scale food production. Manufacturers use concentrates to deliver uniform beef taste across soups, gravies, sauces, frozen meals, snack seasonings, and institutional foods. Concentrates reduce dependence on fresh meat inputs that fluctuate in price and supply. Centralized food processing favors ingredients with predictable strength, long shelf life, and easy dosing. These industrial throughput requirements make beef concentrate a foundational formulation input rather than a specialty flavor adjunct.

U.S. foodservice chains rely on beef concentrate to standardize taste across thousands of locations without relying on variable raw beef handling. Schools, hospitals, and military kitchens depend on it for broth systems, stews, and protein-enhanced meals under strict budget control. Private-label packaged foods use beef concentrate to match branded flavor profiles at lower production cost. Co-packers favor concentrates for batch-to-batch uniformity. These institutional and contract-driven production channels generate steady bulk demand that is structurally insulated from short-term retail flavor trends.

Beef concentrate demand in the USA is constrained by clean-label pressure, raw material volatility, and formulation transparency rules. Consumers increasingly scrutinize “concentrate” and “extract” declarations, pushing brands toward yeast-based or reaction flavors that partially substitute traditional beef concentrate. Fluctuations in beef by-product supply affect concentrate input economics. Regulatory interpretation of natural flavor labeling also limits aggressive expansion in certain product categories. Margin-sensitive packaged food segments cap concentrate loading levels to protect cost structures. These forces restrain unchecked growth despite strong industrial reliance.

Beef concentrate in the USA is increasingly used to build realistic meat profiles in plant-based and hybrid protein products. Flavor engineers refine concentrate systems to deliver specific roast, seared, or slow-cooked flavor notes rather than generic beef taste. Culinary-focused ready-meal brands use layered concentrate blending to achieve regional cuisine authenticity. Low-sodium concentrates respond to nutrition reformulation targets. These shifts show beef concentrate evolving from a bulk taste booster into a precision flavor-structuring ingredient within both traditional and alternative protein food systems.

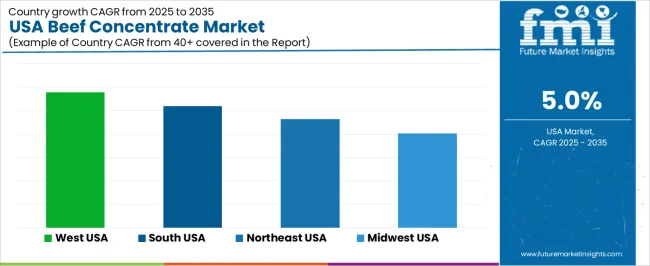

| Region | CAGR (%) |

|---|---|

| West | 5.8% |

| South | 5.2% |

| Northeast | 4.6% |

| Midwest | 4.0% |

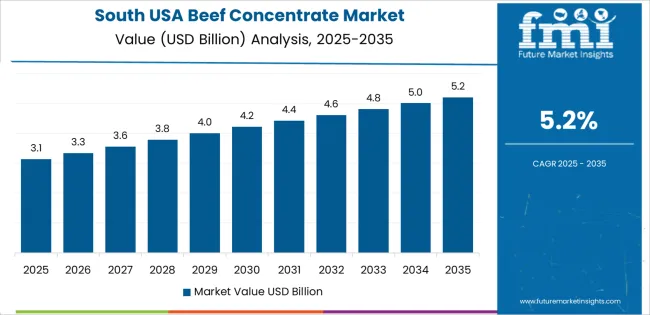

The demand for beef concentrate in the USA shows steady regional growth, led by the West at a 5.8% CAGR. Growth in this region is supported by strong consumption of processed foods, ready meals, and foodservice products that use beef concentrate as a flavor and protein base. The South follows at 5.2%, driven by expanding food manufacturing, rising demand for convenience foods, and steady growth in quick service restaurants. The Northeast records 4.6% growth, supported by urban foodservice demand, packaged soup and sauce production, and institutional catering. The Midwest shows comparatively moderate growth at 4.0%, reflecting stable demand from meat processing, food manufacturing, and more traditional consumption patterns with slower adoption of concentrated meat ingredients.

Expansion in the West reflects a CAGR of 5.8% through 2035 for beef concentrate demand, supported by strong production of ready meals, soups, sauces, and premium pet food across coastal processing hubs. Food manufacturers rely on beef concentrate for flavor consistency in shelf stable and frozen products. Plant growth in California and Pacific Northwest strengthens institutional procurement. Export oriented production for Asia also contributes to volume movement. Demand remains formulation driven rather than retail driven, with processors prioritizing stable flavor intensity, solubility, and batch performance across industrial cooking operations.

The South advances at a CAGR of 5.2% through 2035 for beef concentrate demand, driven by large scale meat processing, snack food manufacturing, and foodservice ingredient supply. Seasoned meat products, gravies, and savory snacks account for major concentrate USAge. Poultry and beef co processing facilities increase blended flavor system demand. Foodservice distributors source concentrates for regional commissaries and institutional kitchens. Demand remains volume oriented, aligned with continuous production schedules and steady consumption across quick service restaurants, catering services, and packaged food plants serving high population growth corridors.

The Northeast records a CAGR of 4.6% through 2035 for beef concentrate demand, shaped by dense urban food manufacturing, soup and sauce production, and institutional catering operations. Food processors supply hospitals, universities, and corporate cafeterias with bulk prepared meals requiring consistent beef flavor profiles. Premium soup brands emphasize slow cooked taste replication using concentrated bases. Import dependence for certain flavor inputs also supports steady procurement cycles. Demand remains stability driven rather than expansion driven, with repeat volume anchored to fixed institutional foodservice contracts and private label retail supply.

The Midwest expands at a CAGR of 4.0% through 2035 for beef concentrate demand, supported by meatpacking, frozen food production, and large scale food ingredient manufacturing. Gravy mixes, seasoning blends, and ready to cook meal kits represent major end uses. Centralized production facilities supply national retail brands with standardized formulations. Demand remains manufacturing led rather than foodservice led. Long term supply agreements dominate procurement behavior. Growth stays steady and predictable, aligned with consistent output from protein processing plants and value added food manufacturing across regional industrial corridors.

Demand for beef concentrate in the USA is rising as food manufacturers, quick service restaurants, and convenience meal producers seek efficient, flavour intense, and protein rich ingredients. Ready-to-eat meals, sauces, soups, and processed foods increasingly rely on beef concentrate to provide authentic meat flavor without the cost or perishability of fresh beef. Consumers’ growing emphasis on high protein diets and rich umami taste supports this shift. Foodservice operators value the ease of storage, extended shelf life, and consistency of beef concentrates. Demand also comes from culinary and industrial kitchens that require scalable, shelf stable meat bases for sauces, gravies, and processed meat blends.

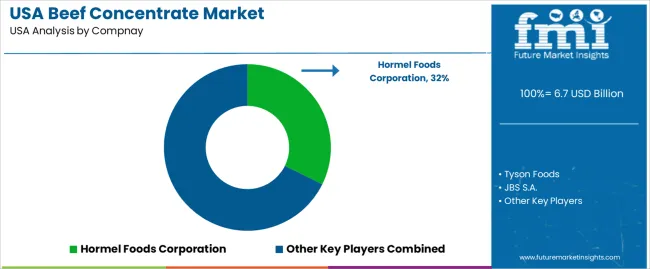

Key players influencing supply and innovation in the USA beef concentrate market include major meat processors and diversified food ingredient firms: Hormel Foods Corporation, Tyson Foods, JBS S.A., Cargill Inc., and Kerry Group. These companies supply fresh beef and processed beef derivatives, enabling large scale production of beef concentrate for food industry use. Cargill and Tyson provide bulk supply chains and processing capacity that support high volume concentrate production. JBS and Hormel contribute through integrated meat processing and value added product lines. Kerry Group offers flavor system expertise and formulation support for manufacturers using beef concentrate as a flavor or protein base. Together, these players shape the market through supply chain integration, processing capacity, and alignment with demand for flavour, convenience, and protein rich foods in the USA and beyond.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD billion |

| Source | Stock, Bone |

| Form | Liquid, Cubes, Powder |

| Nature | Conventional, Organic |

| Region | Northeast USA, West USA, Midwest USA, South USA |

| Countries Covered | USA |

| Key Companies Profiled | Hormel Foods Corporation, Tyson Foods, JBS S.A., Cargill Inc., Kerry Group |

| Additional Attributes | Dollar by sales by source, Dollar by sales by form, Dollar by sales by nature, Dollar by sales by region, Regional CAGR, Industrial food processing penetration, Foodservice and prepared meal USAge, Export-oriented production influence, Contract supply arrangements, Flavor consistency and protein concentration impact |

The demand for beef concentrate in USA is estimated to be valued at USD 6.7 billion in 2025.

The market size for the beef concentrate in USA is projected to reach USD 11.0 billion by 2035.

The demand for beef concentrate in USA is expected to grow at a 5.0% CAGR between 2025 and 2035.

The key product types in beef concentrate in USA are stock and bone.

In terms of form, liquid segment is expected to command 39.0% share in the beef concentrate in USA in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Beef Concentrate Market Size, Growth, and Forecast for 2025 to 2035

USA Omega-3 Concentrates Market Report – Trends, Demand & Outlook 2025-2035

Analysis of the USA Processed Beef Market by Product Type, Processing Method, Distribution Channel, Packaging Type and Region through 2035

Demand for Beef Flavors in USA Size and Share Forecast Outlook 2025 to 2035

Beef Grower Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Concentrate Containers Market Size and Share Forecast Outlook 2025 to 2035

USA Medical Coding Market Size and Share Forecast Outlook 2025 to 2035

USA Labels Market Size and Share Forecast Outlook 2025 to 2035

USA Plant-based Creamers Market Size and Share Forecast Outlook 2025 to 2035

USA Barrier Coated Paper Market Size and Share Forecast Outlook 2025 to 2035

USA Electronic Health Records (EHR) Market Size and Share Forecast Outlook 2025 to 2035

USA Animal Model Market Size and Share Forecast Outlook 2025 to 2035

Concentrated Solar Power Market Size and Share Forecast Outlook 2025 to 2035

USA and Canada Packer Bottle Market Size and Share Forecast Outlook 2025 to 2035

USA Stretch Hood Films Market Size and Share Forecast Outlook 2025 to 2035

USA and Canada Fence Screen Market Size and Share Forecast Outlook 2025 to 2035

Beef Fat Market Size and Share Forecast Outlook 2025 to 2035

USA Lubricant Contaminated HDPE Container Waste Market Size and Share Forecast Outlook 2025 to 2035

Concentrate Pods Market Analysis Size and Share Forecast Outlook 2025 to 2035

USA Commercial Walk-In Refrigeration Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA