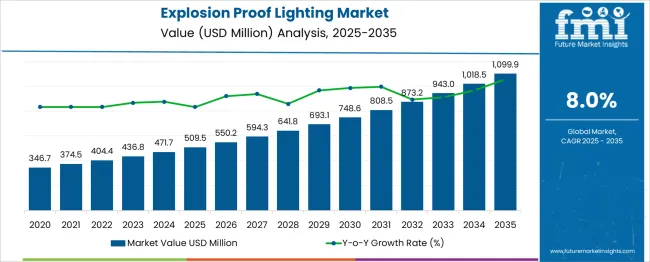

The Explosion-Proof Lighting Market is estimated to be valued at USD 509.5 million in 2025 and is projected to reach USD 1099.9 million by 2035, registering a compound annual growth rate (CAGR) of 8.0% over the forecast period. The data shows a consistent upward trajectory, with yearly value increments widening as the decade progresses. From 2025 to 2030, the market increases from USD 509.5 million to USD 748.6 million, adding USD 239.1 million.

Yearly additions in this period range from USD 40.7 million between 2025 and 2026 to USD 55.5 million between 2029 and 2030, indicating steady acceleration in demand. Between 2030 and 2035, the market expands from USD 748.6 million to USD 1,099.9 million, generating USD 351.3 million in additional value.

Annual increments grow notably in this phase, with gains of USD 65.3 million from 2030 to 2031 and reaching USD 81.4 million between 2034 and 2035. The distribution of the absolute dollar opportunity shows that approximately 40% of the total value creation occurs in the first half of the decade, while 60% is concentrated in the second half, reflecting a compounding growth pattern. This profile indicates that the most substantial revenue expansion is expected in the later years of the forecast period.

| Metric | Value |

|---|---|

| Explosion-Proof Lighting Market Estimated Value in (2025 E) | USD 509.5 million |

| Explosion-Proof Lighting Market Forecast Value in (2035 F) | USD 1099.9 million |

| Forecast CAGR (2025 to 2035) | 8.0% |

The explosion proof lighting market is witnessing steady expansion, driven by stricter safety regulations, increased hazardous area operations, and technological advancements in lighting systems. Industries such as oil & gas, mining, and chemical processing are increasing their reliance on certified lighting solutions to minimize ignition risks and ensure personnel safety in volatile environments.

Global enforcement of IECEx and ATEX directives, along with national safety norms, is prompting proactive replacement of outdated lighting with explosion proof alternatives. Demand is also being supported by the transition from conventional light sources to energy-efficient, long-life systems that can perform reliably under harsh industrial conditions.

Continued growth is expected as new infrastructure investments and brownfield upgrades prioritize safe illumination technologies that reduce maintenance cycles, improve visibility, and comply with global occupational safety mandates.

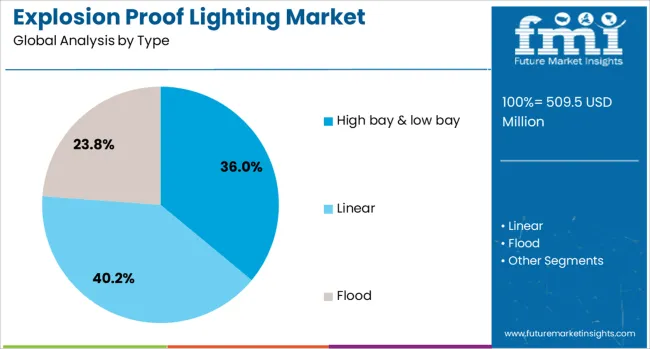

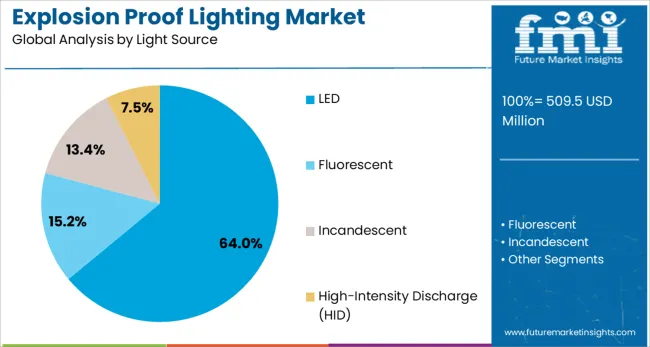

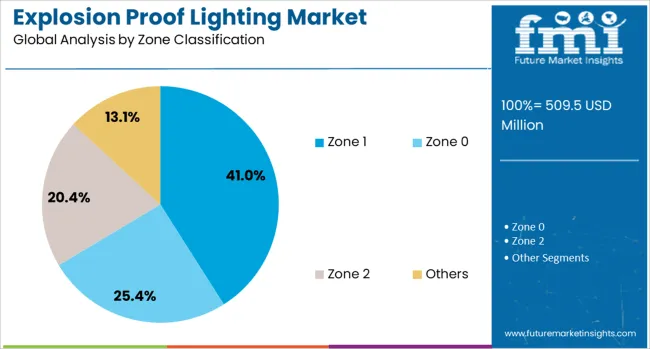

The explosion-proof lighting market is segmented by type, light source, zone classification, end-use industry, and geographic regions. The explosion-proof lighting market is divided by type into High bay & low bay, and Linear Flood. In terms of light source, the explosion-proof lighting market is classified into LED, Fluorescent, Incandescent, and High-Intensity Discharge (HID).

The explosion-proof lighting market is segmented based on zone classification into Zone 1, Zone 0, Zone 2, and others. By end-use industry, the explosion-proof lighting market is segmented into Oil & gas, Mining, Chemical & pharmaceutical, Marine, Food & beverage, Energy & power, and others. Regionally, the explosion-proof lighting industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

High bay and low bay lighting types are projected to lead the market in 2025, contributing 36.0% of total revenue share. This dominance is attributed to their suitability for illuminating large vertical spaces commonly found in processing plants, warehouses, and production facilities within hazardous zones.

These fixtures are designed to deliver uniform lighting across both high-ceiling and low-ceiling industrial environments, enhancing operational safety and visibility. Their structural integrity, thermal management capabilities, and adaptability to a range of mounting heights have positioned them as essential components in explosion proof lighting plans.

Increased construction of modular industrial spaces and growing retrofitting initiatives in oil, gas, and heavy manufacturing sectors have further supported their widespread adoption.

LED-based lighting solutions are expected to dominate the market with a 64.0% revenue share by 2025. Their leadership is being driven by superior energy efficiency, extended service life, and lower heat emission all critical in hazardous zones where thermal control is vital.

LEDs reduce power consumption while delivering high-lumen output, allowing for cost savings and fewer maintenance interventions over time. Their resistance to shock, vibration, and temperature fluctuations enhances operational reliability, especially in offshore, mining, and petrochemical environments.

As global industries shift toward sustainable and intelligent lighting infrastructures, LED technology is being increasingly embedded with smart controls, occupancy sensors, and dimming features that align with modern safety and environmental protocols.

Zone 1 classified lighting is projected to account for 41.0% of the market share in 2025, making it the leading zone classification. This prominence is influenced by the high-risk nature of Zone 1 environments, where explosive gas-air mixtures are likely to occur during normal operations.

Explosion proof lighting certified for Zone 1 applications must adhere to stringent performance and enclosure standards, which ensure operational continuity in sectors such as oil refineries, gas processing units, and chemical handling zones. Investments in upstream energy infrastructure, growing offshore exploration, and retrofitting of existing hazardous facilities have elevated demand for Zone 1 certified luminaires.

Manufacturers are also expanding their Zone 1 product lines to include advanced corrosion-resistant materials and integrated emergency backup features, addressing both safety and operational efficiency needs.

The explosion proof lighting market has been experiencing sustained growth as industries operating in hazardous locations prioritize safety and regulatory compliance. These lighting solutions are engineered to prevent ignition of flammable gases, vapors, or dust, making them vital in petrochemical plants, oil refineries, mining sites, offshore platforms, and grain processing facilities. The growing emphasis on worker protection and operational continuity in high-risk zones has strengthened adoption. Technological improvements in LED lighting, enclosure durability, and thermal management have enhanced performance and lifespan.

Advancements in lighting technology have significantly improved the operational reliability and efficiency of explosion proof systems. High-performance LED modules have replaced older incandescent and fluorescent lamps, delivering increased lumen output, extended service life, and reduced maintenance cycles. Enhanced thermal management designs have been incorporated to prevent overheating, while vibration-resistant mounting systems have been developed for heavy-duty environments. Corrosion-resistant aluminum and stainless-steel enclosures have improved longevity in marine and offshore applications. Integration of intelligent controls such as motion sensors, dimming features, and wireless monitoring has improved energy efficiency and operational flexibility. Modular construction has facilitated easier field servicing, reducing downtime. These developments have strengthened the role of explosion proof lighting as a core safety and operational asset in hazardous industries.

Explosion proof lighting has found widespread application in industries where combustible atmospheres are present. Oil and gas facilities have relied on it for drilling rigs, storage tanks, and refining operations, ensuring illumination without ignition risk. Chemical processing plants have adopted certified fixtures for both production and storage areas. Underground mining operations have installed rugged, shock-resistant units to endure constant vibration and dust exposure. Food and grain processing plants have utilized them to prevent dust ignition during milling and storage. Even commercial facilities such as fuel stations and maintenance workshops have integrated these systems for safety compliance. The ability to customize lighting designs for specific hazard classifications and operational conditions has expanded market reach and sustained demand across multiple industrial and commercial environments.

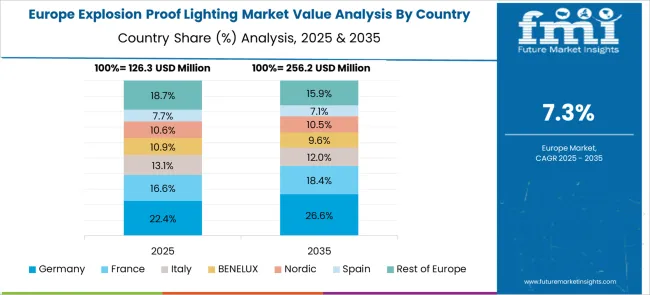

Regional adoption of explosion proof lighting has been shaped by variations in industrial infrastructure, energy sector investments, and safety regulations. North America has maintained a mature market, supported by strict OSHA and NEC standards and extensive oil, gas, and mining operations. Europe has emphasized ATEX-certified products to comply with EU hazardous location directives, especially in petrochemical hubs. Asia-Pacific has seen rapid adoption, driven by industrial expansion in China, India, and Southeast Asia, where new infrastructure is being built with safety compliance as a priority. The Middle East has invested heavily in explosion proof systems for oilfield and offshore projects, while Latin America has focused on mining and industrial processing applications. Manufacturers have expanded through joint ventures, regional assembly plants, and tailored product certifications to meet local standards and accelerate market penetration.

While growth prospects remain strong, certain challenges have hindered broader adoption of explosion proof lighting systems. High initial capital costs for certified equipment have discouraged uptake among small and medium enterprises. Complex certification requirements and varying safety standards across countries have increased design, testing, and compliance expenses. Harsh operational conditions, such as high humidity, corrosive chemicals, and extreme temperatures, can accelerate wear and necessitate frequent maintenance. Supply chain disruptions for specialized components have delayed project completions. Additionally, installation must often be performed by certified technicians, increasing labor costs and project timelines. To overcome these barriers, manufacturers have focused on cost optimization, universal certification strategies, extended warranties, and more resilient supply chain models to maintain competitiveness in this regulated market.

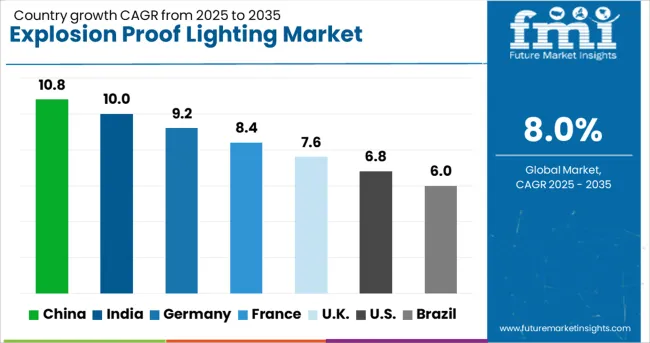

| Country | CAGR |

|---|---|

| China | 10.8% |

| India | 10.0% |

| Germany | 9.2% |

| France | 8.4% |

| UK | 7.6% |

| USA | 6.8% |

| Brazil | 6.0% |

The explosion proof lighting market is expected to grow at a global CAGR of 8.0% between 2025 and 2035, driven by increasing safety regulations, rising demand in hazardous industrial environments, and advancements in LED technology. China leads with a 10.8% CAGR, supported by large-scale industrial expansion and stringent workplace safety standards. India follows at 10.0%, fueled by growth in oil and gas, mining, and manufacturing sectors. Germany, at 9.2%, benefits from advanced engineering capabilities and adoption in chemical and energy industries. France, projected at 8.4%, sees growth from infrastructure upgrades in hazardous zones. The UK, at 7.6%, and the USA, at 6.8%, reflect steady demand from petrochemical, offshore, and manufacturing facilities. This report includes insights on 40+ countries; the top markets are shown here for reference.

China is forecasted to grow at a CAGR of 10.8% from 2025 to 2035, driven by widespread modernization of hazardous-area facilities in petrochemical, mining, and shipbuilding sectors. Government-enforced safety mandates are accelerating the replacement of outdated lighting with LED-based explosion-proof systems. Key domestic players like Opple Lighting, Zhejiang Tormin Electrical, and Ocean’s King Lighting are enhancing designs for higher lumen efficiency, thermal resistance, and long operational lifespans. The country’s coastal regions are seeing a surge in installations due to increased marine trade and port expansions. Additionally, Chinese manufacturers are securing overseas contracts under infrastructure initiatives, expanding the export share of certified hazardous-area lighting.

India is projected to grow at a CAGR of 10.0% from 2025 to 2035, fueled by the expansion of oil refineries, chemical processing plants, and offshore drilling projects. Companies such as Havells India, Bajaj Electricals, and Surya Roshni are producing durable, hazardous-location-certified lighting for onshore and offshore industrial environments. Growing industrial corridors in Gujarat, Maharashtra, and Andhra Pradesh are generating significant demand. In addition, large-scale oil and gas projects in the Bay of Bengal and Arabian Sea are adopting marine-grade explosion-proof lighting to withstand corrosive, high-humidity conditions. Compliance with workplace safety regulations is further pushing industrial operators toward certified lighting solutions.

Germany is expected to grow at a CAGR of 9.2% from 2025 to 2035, backed by advanced engineering capabilities and strong compliance frameworks. Market leaders like R. STAHL and Adolf Schuch GmbH are launching smart explosion-proof lighting with IoT connectivity for remote monitoring and predictive maintenance. Adoption is notable in pharmaceuticals, aerospace manufacturing, and high-risk chemical processing facilities. Germany’s established export infrastructure enables significant shipments of hazardous-area lighting to EU and Middle Eastern industrial hubs. The integration of smart features is expected to further differentiate German products in the competitive global market.

The United Kingdom is projected to expand at a CAGR of 7.6% between 2025 and 2035, with demand driven by offshore oil platform retrofits, defense infrastructure projects, and hazardous material storage facilities. Companies such as Wolf Safety Lamp and Petrel Ltd are introducing ATEX-certified LED units with improved lumen performance and corrosion resistance. Regions like Teesside and Grangemouth are major consumers due to ongoing upgrades in chemical and petrochemical plants. The refurbishment of aging offshore rigs is also generating retrofit demand for explosion-proof systems.

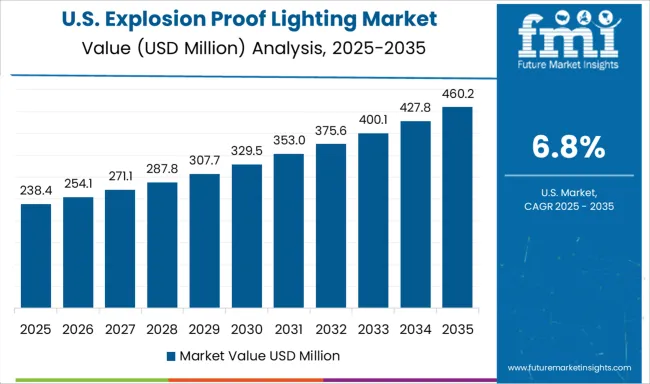

The United States is set to grow at a CAGR of 6.8% from 2025 to 2035, led by large-scale shale gas operations, mining activities, and aerospace manufacturing. Companies such as Eaton, Emerson Electric, and Hubbell are investing in IoT-enabled explosion-proof lighting for predictive maintenance and operational efficiency. Strict OSHA and NFPA regulations are compelling industrial operators to upgrade to certified lighting systems. Adoption is also increasing in hazardous storage warehouses and chemical processing zones across Texas, Louisiana, and California.

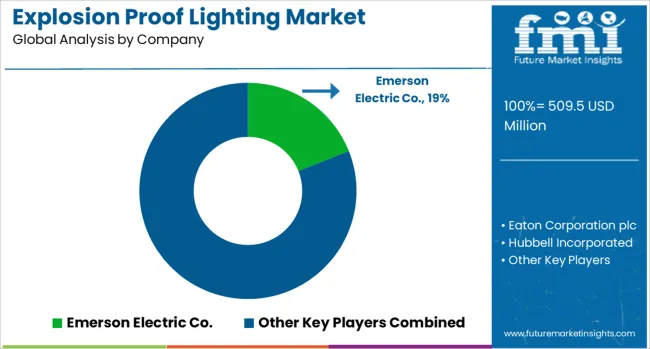

Explosion proof lighting plays a crucial role in protecting operations across oil and gas, mining, marine, and chemical industries where hazardous atmospheres are present. The competitive space features established global electrical brands alongside specialized marine and industrial lighting manufacturers. Emerson Electric Co., through its Appleton range, and Eaton Corporation plc, via its Crouse Hinds line, have a strong foothold in large scale hazardous area installations.

Hubbell Incorporated addresses both land based industrial facilities and offshore platforms with robust, certified fixtures capable of withstanding extreme conditions. ABB Ltd combines hazardous location lighting with a broad electrical solutions portfolio, supplying both LED and legacy HID systems for varied project requirements.

Glamox AS focuses on marine and offshore clients, designing corrosion resistant products built for harsh saltwater environments. Signify delivers high lumen LED options engineered for long service life in remote or maintenance challenged sites, while GE Current offers rugged, energy efficient luminaires with compliance to multiple international safety standards.

Competition is shaped by demands for extended product longevity, adherence to global certification protocols, and a shift toward advanced LED technologies replacing traditional HID fixtures. Manufacturers able to merge efficiency, durability, and safety compliance remain best positioned to serve this highly regulated sector.

| Item | Value |

|---|---|

| Quantitative Units | USD 509.5 Million |

| Type | High bay & low bay, Linear, and Flood |

| Light Source | LED, Fluorescent, Incandescent, and High-Intensity Discharge (HID) |

| Zone Classification | Zone 1, Zone 0, Zone 2, and Others |

| End Use Industry | Oil & gas, Mining, Chemical & pharmaceutical, Marine, Food & beverage, Energy & power, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Emerson Electric Co., Eaton Corporation plc, Hubbell Incorporated, ABB Ltd, Glamox AS, Signify, and GE Current |

| Additional Attributes | Dollar sales by product type and application sector, demand dynamics across oil and gas, mining, chemical processing, and marine industries, regional trends in adoption across North America, Europe, and Asia-Pacific, innovation in LED efficiency, wireless control systems, and corrosion-resistant housing materials, environmental impact of energy consumption, hazardous material handling, and end-of-life disposal, and emerging use cases in offshore wind farms, electric vehicle battery facilities, and remote industrial maintenance operations. |

The global explosion-proof lighting market is estimated to be valued at USD 509.5 million in 2025.

The market size for the explosion-proof lighting market is projected to reach USD 1,099.9 million by 2035.

The explosion-proof lighting market is expected to grow at a 8.0% CAGR between 2025 and 2035.

The key product types in explosion-proof lighting market are high bay & low bay, linear and flood.

In terms of light source, led segment to command 64.0% share in the explosion-proof lighting market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Lighting As A Service Market Size and Share Forecast Outlook 2025 to 2035

Lighting as a Service (LaaS) Market Size and Share Forecast Outlook 2025 to 2035

Lighting Product Market Size and Share Forecast Outlook 2025 to 2035

Lighting Contactor Market Growth – Trends & Forecast 2024-2034

Lighting Fixture Market

EV Lighting Market Growth - Trends & Forecast 2025 to 2035

LED Lighting Controllers Market

Strobe Lighting Market Size and Share Forecast Outlook 2025 to 2035

Runway Lighting Market Trends, Outlook & Forecast 2025 to 2035

Marine Lighting Market

Runway Lighting System Market

Plasma Lighting Market

Stadium Lighting Market Size and Share Forecast Outlook 2025 to 2035

Outdoor Lighting Market Growth – Trends & Forecast 2025 to 2035

Airport Lighting Market

Aircraft Lighting Market Size and Share Forecast Outlook 2025 to 2035

High End Lighting Market Size and Share Forecast Outlook 2025 to 2035

Hospital Lighting Market Size and Share Forecast Outlook 2025 to 2035

Military Lighting Market Size and Share Forecast Outlook 2025 to 2035

Wireless Lighting Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA