The fighter aircraft market is estimated to be valued at USD 52.9 billion in 2025 and is projected to reach USD 79.0 billion by 2035, registering a compound annual growth rate (CAGR) of 4.1% over the forecast period.

Between 2021 and 2025, the market expands from USD 43.3 billion in 2021 to USD 52.9 billion in 2025, representing an absolute dollar opportunity of USD 9.6 billion during this period. This growth is driven by increasing procurement of advanced fighter jets by defense forces worldwide, modernization of existing fleets, and rising emphasis on air superiority and tactical capabilities. From 2021 to 2025, incremental value additions are observed with the market reaching USD 45.0 billion in 2022, USD 46.9 billion in 2023, USD 48.8 billion in 2024, and USD 50.8 billion before attaining USD 52.9 billion in 2025.

This phase reflects early-stage opportunity capture as defense budgets expand and countries invest in next-generation aircraft with enhanced avionics, stealth features, and multirole capabilities. From 2025 to 2035, the market presents a substantial absolute dollar opportunity of USD 26.1 billion, increasing from USD 52.9 billion to USD 79.0 billion. Growth during this period is supported by rising exports of fighter aircraft, replacement of aging fleets, and development of indigenous programs in emerging economies. Incremental annual increases from USD 55.1 billion in 2026 to USD 67.3 billion in 2034 indicate consistent expansion.

| Metric | Value |

|---|---|

| Fighter Aircraft Market Estimated Value in (2025 E) | USD 52.9 billion |

| Fighter Aircraft Market Forecast Value in (2035 F) | USD 79.0 billion |

| Forecast CAGR (2025 to 2035) | 4.1% |

The fighter aircraft market is strongly influenced by several parent markets that shape its demand, development, and long-term adoption across the global defense and aerospace sectors. The defense and military aircraft market serves as the largest parent, with fighter aircraft representing nearly 30-35% of its share. Nations rely on fighter jets for air superiority, national defense, and strategic operations, making them central to defense procurement and modernization programs. The aerospace and aviation market contributes around 15-18%, as fighter aircraft are a vital part of aerospace manufacturing, supported by progress in propulsion systems, lightweight materials, and aerostructures that enhance performance and maneuverability.

The weapon systems and armaments market adds roughly 10-12%, since fighter aircraft integrate sophisticated missile systems, bombs, and electronic warfare solutions, creating strong interdependence between weapons development and fighter jet design. The defense electronics and avionics market plays an equally critical role, contributing 8-10%. Fighter aircraft depend on advanced avionics, radar, communication systems, and countermeasure technologies that ensure operational effectiveness in modern combat. The aerospace maintenance, repair, and overhaul (MRO) market accounts for about 6-8% of the share, as fighter aircraft require extensive lifecycle management, spare parts supply, and scheduled overhauls to maintain mission readiness.

The fighter aircraft market is experiencing consistent growth, driven by increasing defense budgets, technological advancements in combat systems, and evolving military strategies that emphasize air superiority. Modernization programs across multiple nations are accelerating the adoption of advanced fighter platforms equipped with next-generation avionics, stealth capabilities, and precision strike systems.

Demand is being reinforced by regional security challenges and the need for rapid deployment capabilities in diverse operational environments. The shift towards multi-role fighters that can perform a range of missions, from air-to-air combat to ground attack, is creating sustained procurement opportunities.

Additionally, integration of artificial intelligence, network-centric warfare capabilities, and advanced propulsion systems is enhancing operational efficiency and mission flexibility With strong focus on interoperability and fleet modernization, global air forces are prioritizing platforms that balance performance, maintenance efficiency, and lifecycle cost, ensuring continued growth potential for the fighter aircraft market in both developed and emerging defense sectors.

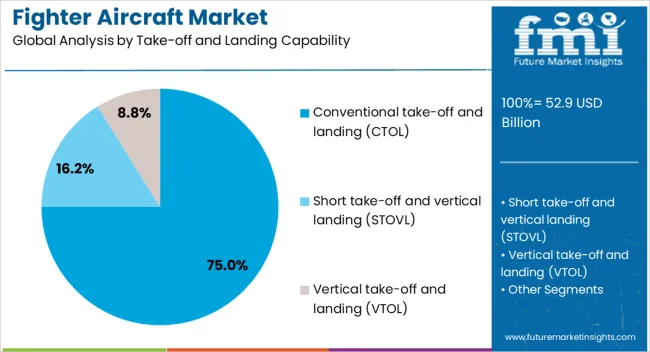

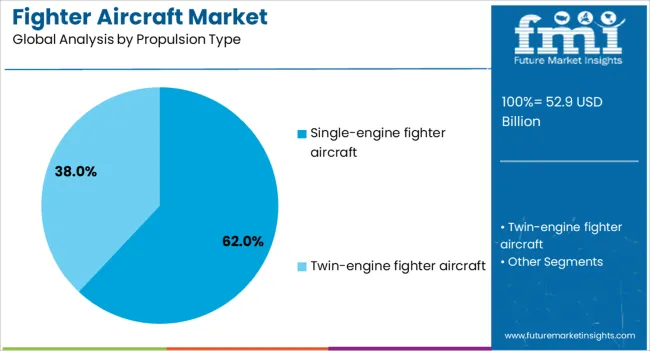

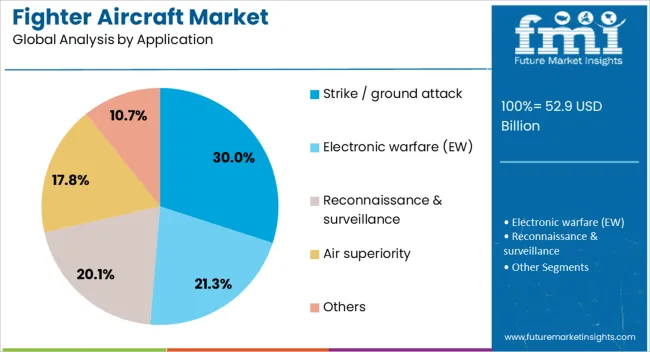

The fighter aircraft market is segmented by take-off and landing capability, propulsion type, application, and geographic regions. By take-off and landing capability, fighter aircraft market is divided into conventional take-off and landing (CTOL), short take-off and vertical landing (STOVL), and vertical take-off and landing (VTOL). In terms of propulsion type, fighter aircraft market is classified into single-engine fighter aircraft and twin-engine fighter aircraft. Based on application, fighter aircraft market is segmented into strike / ground attack, electronic warfare (EW), reconnaissance & surveillance, air superiority, and others. Regionally, the fighter aircraft industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The conventional take-off and landing capability segment is projected to hold 75% of the fighter aircraft market revenue share in 2025, making it the dominant operational configuration. Growth in this segment has been supported by its proven reliability, established infrastructure compatibility, and lower operational complexity compared to alternative configurations. Conventional take-off and landing fighter aircraft have been preferred for their ability to operate from standard runways, reducing the need for specialized facilities. This configuration supports a wider variety of mission types, enhancing fleet flexibility and deployment efficiency. The segment’s dominance is further reinforced by its cost-effectiveness in procurement and maintenance, as well as by the strong global presence of existing CTOL fleets that benefit from incremental upgrades rather than full platform replacements As nations continue to modernize their air forces while leveraging existing infrastructure, the conventional take-off and landing capability remains a practical and strategically advantageous choice.

The single-engine fighter aircraft propulsion type segment is expected to account for 62% of the market revenue share in 2025, positioning it as the leading propulsion configuration. This dominance has been influenced by its balance of performance, operational efficiency, and lower acquisition and maintenance costs compared to twin-engine counterparts. Single-engine fighters have been adopted extensively by air forces that require versatile, agile platforms capable of performing a wide range of missions without excessive budgetary strain. Advances in engine technology have improved thrust, fuel efficiency, and reliability, making modern single-engine fighters suitable for both air defense and offensive roles. Their reduced weight and streamlined design contribute to superior maneuverability, enhancing combat effectiveness The ability to integrate advanced avionics, weapon systems, and networked capabilities has strengthened the operational value of single-engine fighters, ensuring their continued preference in both large and mid-sized defense programs.

The strike or ground attack application segment is projected to hold 30% of the market revenue share in 2025, marking it as a significant mission category. Growth in this segment has been supported by the increasing need for precision engagement capabilities in modern warfare, where minimizing collateral damage and maximizing target effectiveness are critical. Fighter aircraft configured for strike missions have been optimized for carrying diverse payloads, including precision-guided munitions and long-range strike weapons, enhancing their versatility in combat scenarios. The segment’s relevance has been amplified by the rising frequency of asymmetric warfare and the requirement for rapid response to ground-based threats. Integration of advanced targeting systems, real-time data sharing, and electronic warfare capabilities has improved mission success rates As military doctrines evolve to prioritize multi-role capabilities, the strike or ground attack role remains central to ensuring tactical superiority and supporting broader operational objectives.

The fighter aircraft market is driven by defense modernization programs and the strategic need for air superiority. Rising demand for multi-role fighters and next-generation technologies is accelerating procurement across major economies. High development costs, complex maintenance requirements, and regulatory restrictions remain significant challenges for adoption. Opportunities lie in advancements such as stealth design, AI-enabled systems, and manned-unmanned teaming, which are redefining aerial combat strategies. The shift toward network-centric warfare and interoperability ensures fighter aircraft remain central to modern defense ecosystems, supporting both national security objectives and collaborative military operations.

The fighter aircraft market is expanding as nations prioritize air superiority and advanced combat readiness. Modernization of air fleets is a top defense objective, with many governments replacing aging aircraft with next-generation fighters that incorporate stealth, precision targeting, and advanced avionics. Rising geopolitical tensions and regional security concerns are pushing countries to strengthen aerial defense systems, making fighter aircraft a critical procurement category. The growing use of multi-role fighters capable of both offensive and defensive operations is further driving adoption. These aircraft are not only vital for conventional warfare but also for deterrence strategies, rapid deployment, and tactical superiority in evolving conflict scenarios. Defense budgets in both developed and emerging economies are increasingly directed toward acquiring or upgrading fighter fleets, ensuring long-term demand. This modernization wave highlights the strategic role of fighter aircraft in safeguarding national interests and securing dominance in contested airspaces.

Designing advanced fighters involves complex engineering, cutting-edge technologies, and years of R&D investment, making unit costs extremely high. Procurement programs often face delays due to budgetary restrictions, political considerations, and shifting defense priorities. Smaller economies find it difficult to allocate sufficient funds for modern fighters, leading them to rely on older fleets or limited acquisitions. Maintenance and lifecycle costs add further pressure, as these aircraft require specialized infrastructure, highly trained personnel, and expensive spare parts to remain operational. Export restrictions and stringent regulatory controls on defense technology transfer also complicate procurement for certain countries. These challenges create uneven adoption patterns, where wealthier nations progress rapidly toward modernization while others struggle with affordability, limiting global uniformity in fighter aircraft deployment and slowing the pace of widespread adoption.

Development of stealth materials, advanced radar systems, artificial intelligence integration, and next-generation propulsion is transforming fighter capabilities. These innovations allow aircraft to achieve greater maneuverability, improved situational awareness, and enhanced survivability in contested environments. The integration of digital twin simulations, predictive maintenance, and modular designs is reducing operational downtime and extending aircraft service lives. Unmanned systems and manned-unmanned teaming concepts are emerging as promising avenues, with fighter aircraft increasingly designed to work alongside drones in combat scenarios. Opportunities are also being created through international partnerships, joint development programs, and technology-sharing agreements that spread costs and accelerate deployment. As air forces prepare for future warfare, which emphasizes speed, adaptability, and electronic dominance, technological advancements are opening new pathways for aircraft manufacturers and defense contractors to secure long-term growth.

Modern fighters are expected to execute a variety of missions, ranging from air-to-air combat to ground attack, electronic warfare, and reconnaissance. Network integration with command centers, satellites, and allied systems enhances real-time situational awareness, allowing for coordinated and precise mission execution. Countries are prioritizing aircraft that can serve multiple roles with minimal modification, maximizing value from defense investments. This trend is also influenced by the rising importance of interoperability in coalition operations, where joint exercises and multilateral missions require seamless communication. Fighter aircraft are being increasingly designed as platforms within broader defense ecosystems, where connectivity and adaptability are as important as raw combat power. This transition is reshaping procurement strategies globally, with emphasis on versatility, long-term upgradability, and integration into digitally enabled defense networks.

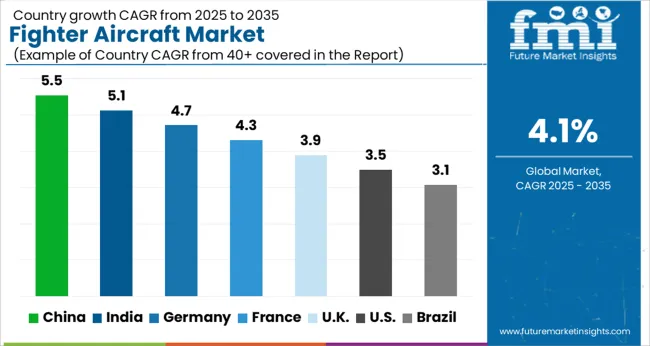

| Country | CAGR |

|---|---|

| China | 5.5% |

| India | 5.1% |

| Germany | 4.7% |

| France | 4.3% |

| UK | 3.9% |

| USA | 3.5% |

| Brazil | 3.1% |

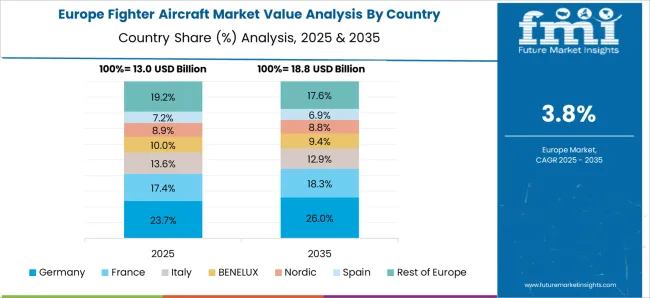

The global fighter aircraft market is projected to grow at a CAGR of 4.1% from 2025 to 2035. China leads with a growth rate of 5.5%, followed by India at 5.1% and Germany at 4.7%. The United Kingdom and the United States record moderate growth rates of 3.9% and 3.5%, respectively. Market growth is fueled by defense modernization programs, replacement of outdated fleets, and investment in next-generation aircraft. Participation in international collaborations such as FCAS and Tempest, along with strong domestic manufacturing capabilities, continues to shape the fighter aircraft market across these regions. The analysis includes over 40+ countries, with the leading markets detailed below.

China is projected to lead the fighter aircraft market with a CAGR of 5.5% from 2025 to 2035. The growth is supported by significant government investment in defense modernization programs, which prioritize advanced aircraft acquisition. China’s domestic defense industry continues to strengthen its capabilities in both design and production of fighter jets, contributing to a steady rise in procurement. Rising regional tensions and the need for advanced aerial superiority are further pushing demand. Strategic collaborations and export initiatives also ensure that China positions itself as both a key consumer and supplier in the global fighter aircraft market.

The light control switches market in India is projected to grow at an 11.3% CAGR through 2035. The increasing adoption of smart homes, particularly in urban centers, is a major contributor to this growth. The demand for energy-efficient lighting solutions in residential, commercial, and industrial buildings is rising as India focuses on improving energy access and efficiency. Government schemes promoting energy-efficient building construction and the expanding middle-class population contribute significantly to market expansion. Additionally, the growing preference for connected homes and office environments boosts the adoption of light control switches in India.

The fighter aircraft market in Germany is expected to grow at a CAGR of 4.7% between 2025 and 2035. Demand is mainly supported by Germany’s commitments to NATO defense goals and its ongoing efforts to modernize the Luftwaffe’s fleet. Procurement of advanced aircraft and participation in collaborative European programs, such as the Future Combat Air System (FCAS), highlight Germany’s long-term strategy. The focus on interoperability and joint development ensures greater access to cutting-edge technologies. Increased defense budgets and Germany’s emphasis on strengthening its aerospace industry provide momentum for fighter aircraft acquisitions.

The fighter aircraft market in the United Kingdom is projected to grow at a CAGR of 3.9% from 2025 to 2035. Growth is driven by defense modernization efforts and the country’s participation in advanced collaborative programs such as Tempest, aimed at developing sixth-generation aircraft. The UK continues to invest in strengthening its aerial combat capabilities through both domestic projects and partnerships with European allies. The replacement of older fleets and the push for advanced multirole fighters underline the demand for modern aircraft. The UK’s strategic defense policy ensures that fighter aircraft acquisition remains a priority.

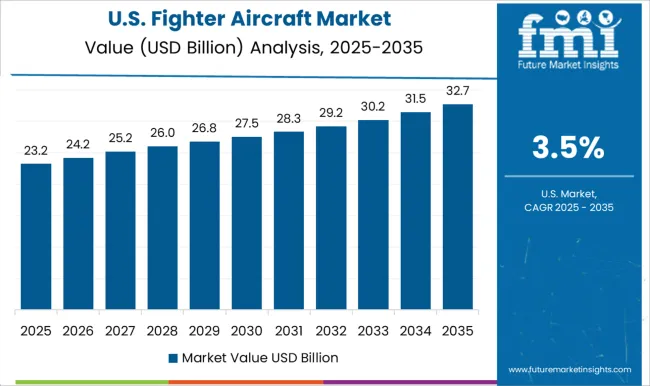

The United States is expected to grow at a CAGR of 3.5% from 2025 to 2035 in the fighter aircraft market. As the largest defense spender globally, the USA continues to prioritize procurement of advanced aircraft, including fifth- and sixth-generation fighter jets. Demand is supported by defense strategies that focus on maintaining air superiority in both domestic and international operations. Key programs such as the F-35 Lightning II and next-generation air dominance initiatives underline the USA focus on technological leadership. Strong aerospace manufacturing capabilities and significant defense budgets ensure a steady supply pipeline.

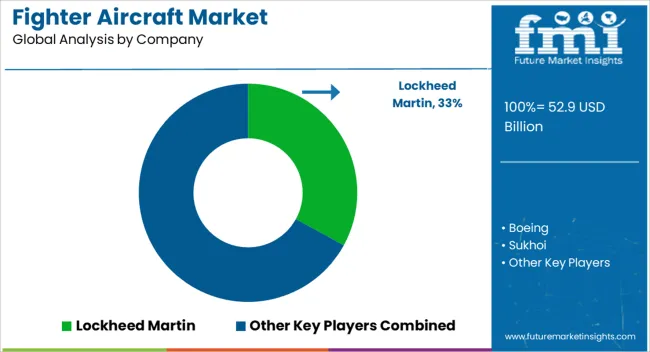

Competition in the fighter aircraft market is shaped by technology superiority, export reach, and multirole capabilities. Lockheed Martin dominates with the F-35 Lightning II, a stealth-enabled, multirole fighter offered in multiple variants, backed by a global supply chain and partnerships with allied air forces. Boeing competes through the F-15EX and F/A-18 Super Hornet, emphasizing proven performance, upgrade potential, and cost competitiveness for both domestic and foreign buyers. Sukhoi maintains a strong position with the Su-35 and Su-57 platforms, offering high maneuverability and advanced avionics aimed at markets in Asia, the Middle East, and regions seeking cost-effective alternatives. Dassault competes with the Rafale, a versatile twin-engine fighter positioned as a premium option, marketed on adaptability to both air-to-air and air-to-ground missions with strong export contracts.

Saab advances with the Gripen, highlighting affordability, advanced avionics, and interoperability, particularly for nations seeking capable fighters within constrained budgets. Chengdu Aircraft Industry Group competes primarily with the J-10 and J-20 fighters, leveraging China’s domestic procurement strength and expanding international sales efforts. Hindustan Aeronautics Limited (HAL) participates with the Tejas Light Combat Aircraft, targeting domestic fleet modernization and selective exports, supported by government initiatives. Korea Aerospace Industries (KAI) emphasizes the FA-50 and KF-21 programs, positioned for regional defense customers and cooperative development projects. Strategies across these players emphasize lifecycle upgrades, modular avionics, and interoperability with allied systems.

Lockheed Martin and Boeing leverage long-term sustainment contracts, Dassault and Saab pursue export-driven strategies, Sukhoi and Chengdu focus on state-backed procurement and regional alliances, while HAL and KAI aim at expanding indigenous manufacturing. Product brochures highlight specific capabilities: stealth, advanced sensors, electronic warfare, high payload capacities, and adaptability across mission profiles. These brochures underscore speed, agility, and multi-mission readiness as defining attributes in a market where air superiority is decisive.

| Item | Value |

|---|---|

| Quantitative Units | USD 52.9 billion |

| Take-off and Landing Capability | Conventional take-off and landing (CTOL), Short take-off and vertical landing (STOVL), and Vertical take-off and landing (VTOL) |

| Propulsion Type | Single-engine fighter aircraft and Twin-engine fighter aircraft |

| Application | Strike / ground attack, Electronic warfare (EW), Reconnaissance & surveillance, Air superiority, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Lockheed Martin, Boeing, Sukhoi, Dassault, Saab, Chengdu Aircraft (CAC), Hindustan Aeronautics Limited (HAL), Korea Aerospace Industries (KAI), and Others |

| Additional Attributes | Dollar sales by aircraft type (single-engine, twin-engine, multirole), propulsion type (turbofan, turboprop), and application (air superiority, multirole, training). Demand dynamics are influenced by defense modernization programs, geopolitical tensions, and increasing investment in aerospace technologies. Regional trends show strong adoption in North America, Europe, Asia-Pacific, and the Middle East, supported by government defense budgets, export agreements, and domestic aircraft development initiatives. |

The global fighter aircraft market is estimated to be valued at USD 52.9 billion in 2025.

The market size for the fighter aircraft market is projected to reach USD 79.0 billion by 2035.

The fighter aircraft market is expected to grow at a 4.1% CAGR between 2025 and 2035.

The key product types in fighter aircraft market are conventional take-off and landing (ctol), short take-off and vertical landing (stovl) and vertical take-off and landing (vtol).

In terms of propulsion type, single-engine fighter aircraft segment to command 62.0% share in the fighter aircraft market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Firefighter Tapes Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Cabin Environment Sensor Market Forecast and Outlook 2025 to 2035

Aircraft Flight Control System Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Electric Motor Market Forecast Outlook 2025 to 2035

Aircraft Cooling Turbines Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Smoke Detection and Fire Extinguishing System Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Hose Fittings Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Cabin Interior Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Galley Systems Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Interior Lighting Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Battery Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Floor Panels Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Fuel Systems Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Lubricant Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Seat Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Ground Support Equipment Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Maintenance, Repair and Overhaul Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Actuators Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Elevator Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Weapons Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA