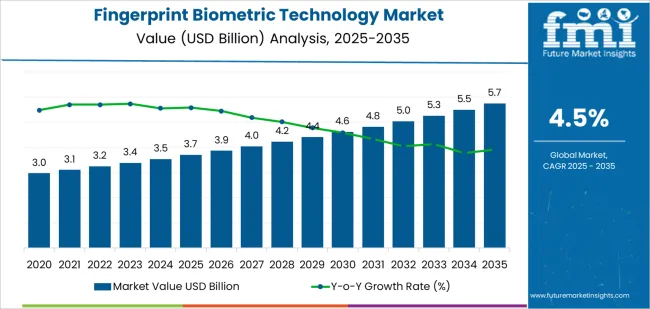

The global fingerprint biometric technology market is valued at USD 3.7 billion in 2025 and is projected to reach USD 5.8 billion by 2035, reflecting a CAGR of 4.5%. The acceleration phase of the market occurs in the early years, between 2025 and 2030, driven by the increasing adoption of fingerprint-based authentication across mobile devices, government identification systems, and financial services. As security concerns rise and the demand for seamless, secure access solutions grows, fingerprint biometric systems gain widespread usage. This period experiences an upward surge in growth as fingerprint sensors become a core component in smartphones, tablets, laptops, and other connected devices, propelled by consumer demand for more secure and convenient ways to authenticate identity.

After 2030, the market enters a deceleration phase as growth begins to moderate. The acceleration slows down as fingerprint biometrics become ubiquitous, and the technology reaches saturation in key consumer electronics and security applications. By this point, nearly all smartphones, tablets, and laptops have integrated fingerprint scanning, and the technology is well-established in government and financial sectors. However, the deceleration is softened by innovations such as multi-modal biometric systems and new applications in access control, healthcare, and IoT security, which provide continued, though more gradual, growth toward 2035.

Between 2025 and 2030, the Fingerprint Biometric Technology Market grows from USD 3.7 billion to USD 4.8 billion, generating USD 1.1 billion in additional value. The market shows consistent growth, with annual increases ranging from USD 0.2 billion to USD 0.3 billion each year. Over this period, market share gain is driven by higher adoption of fingerprint biometric systems in mobile devices, security applications, and government identification programs. The trend toward contactless solutions and integration of fingerprint sensors in emerging technologies (such as smart locks, wearables, and IoT devices) further supports this growth, with new applications boosting overall demand.

From 2030 to 2035, the market expands from USD 4.8 billion to USD 5.8 billion, adding USD 1.0 billion in value. During this phase, market share erosion is expected from alternative biometric technologies, especially facial recognition and iris scanning technologies, which increasingly compete with fingerprint biometrics in some sectors due to their non-contact capabilities. However, fingerprint biometrics will continue to capture strong growth in high-security applications and industries focused on affordability and convenience. Fingerprint biometric technology will maintain its market position by innovating with multi-modal biometric solutions and enhancing sensor accuracy, user convenience, and processing speed, ensuring continued market share gain in applications that require high security and precision, like banking, healthcare, and law enforcement.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 3.7 billion |

| Market Forecast Value (2035) | USD 5.8 billion |

| Forecast CAGR (2025–2035) | 4.5% |

The fingerprint biometric technology market is growing as organizations and device manufacturers expand deployment of fingerprint based systems for access control, identity authentication, and transaction approval. Demand increases because fingerprint recognition is relatively mature, cost effective, and widely accepted compared to newer modalities. It is embedded in smartphones, payment systems, border control kiosks, workforce attendance systems, and smart home devices, strengthening utility across applications. Hardware improvements such as capacitive, optical, and ultrasonic sensors enhance accuracy even under challenging conditions. Research also explores contactless and multi finger fingerprint solutions that boost reliability and hygiene. Growing regulatory demands for secure authentication, along with rising digital payments and remote identity use cases, further drive adoption across consumer electronics, enterprise IT, and public sector infrastructure.

Market expansion is also supported by regional growth in Asia Pacific and increasing government identity program roll outs in emerging countries, creating large volume potential. Vendors refine software layers, cloud based management, and integration with broader authentication frameworks (multi factor, multimodal) to add value. Although competition from alternative biometric modalities (facial, iris, vein) and privacy regulation concerns remain headwinds, the established ecosystem for fingerprint technology including standards, supply chains, and user familiarity supports continued growth. Overall, as digital transformation deepens and identity verification becomes more critical, fingerprint biometric technology remains a cornerstone solution with broad market potential.

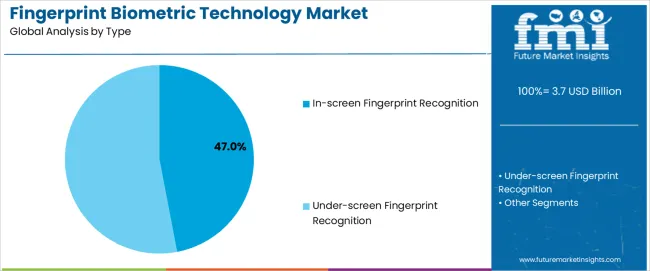

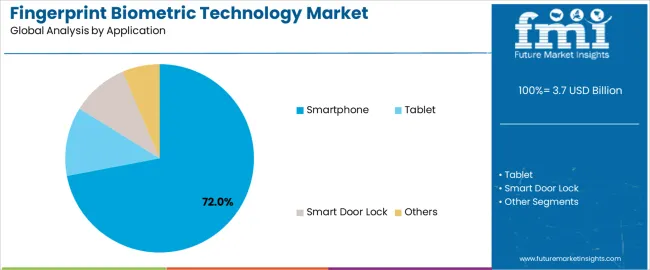

The fingerprint biometric technology market is segmented by type, application, and region. By type, the market includes in-screen fingerprint recognition and under-screen fingerprint recognition. Based on application, it is categorized into smartphone, tablet, smart door lock, and others. Regionally, the market is segmented into North America, Europe, East Asia, South Asia, Latin America, and the Middle East & Africa. These divisions reflect differing technological adoption rates, consumer preferences, and security needs across various sectors and regions.

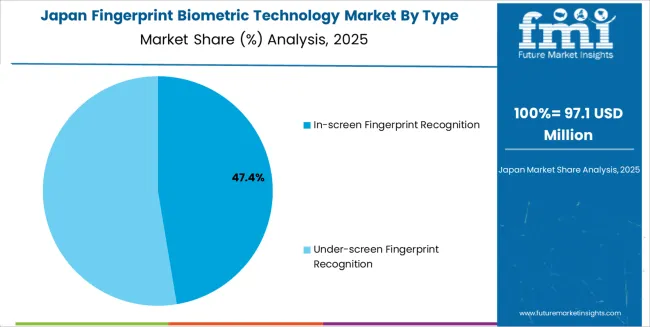

The in-screen fingerprint recognition segment accounts for approximately 47.0% of the global fingerprint biometric technology market in 2025, making it the leading type category. This position is driven by the increasing integration of fingerprint sensors within smartphone displays, allowing for a sleek, seamless user experience that aligns with the trend of maximizing screen space. In-screen sensors also provide enhanced security features by enabling users to unlock devices, authenticate payments, and access apps directly through the screen without needing physical buttons or external sensors.

In-screen fingerprint recognition is particularly popular in premium and mid-range smartphones, where manufacturers are prioritizing both aesthetics and functionality. The technology has gained strong adoption in North America, East Asia, and Europe, where smartphone penetration is high, and consumers demand advanced security features. The segment maintains its lead because it delivers an efficient, user-friendly experience and meets the growing demand for high-performance biometric systems in personal devices. As mobile devices continue to evolve, in-screen fingerprint recognition remains at the forefront due to its seamless integration and ability to provide high-level security within a compact design.

The smartphone segment represents about 72.0% of the total fingerprint biometric technology market in 2025, making it the dominant application category. This position is supported by the rapid adoption of biometric authentication as a standard feature in smartphones for security purposes, including device unlocking, mobile payment authentication, and app access control. The shift towards contactless technologies and the increasing importance of securing personal information in mobile devices have made fingerprint biometrics a highly sought-after feature.

Adoption is particularly strong in East Asia, North America, and Europe, where smartphone manufacturers have consistently integrated advanced fingerprint recognition systems into their devices to meet consumer demand for more secure and efficient unlocking methods. As smartphones become increasingly essential for daily activities, from communication to financial transactions, the demand for secure, reliable, and fast biometric solutions continues to grow. The smartphone segment retains its leading position because it represents the most prominent consumer use case for fingerprint recognition technology, driving both volume and innovation in the broader biometric technology market.

The fingerprint biometric technology market is expanding as demand for robust identity verification and authentication grows across consumer devices, enterprise access control and public security applications. Fingerprint biometrics remains one of the most mature and widely deployed modalities due to its high accuracy, user convenience and cost effectiveness. Growth is supported by increasing use in smartphones and wearable devices, strong government initiatives for digital identity programs and growing adoption in banking and payments. Adoption is moderated by concerns around data privacy, spoofing risks, and the shift toward multimodal and contactless biometric methods. Industry players are developing advanced sensors (ultrasonic, in display), cloud based analytics and liveness detection to maintain relevance in evolving environments.

Demand is being fuelled by the ubiquity of smartphones and mobile banking, where fingerprint sensors are often integrated for device unlock and secure transactions. Financial services and fintech companies increasingly require strong authentication methods to comply with regulatory standards and reduce fraud. Government digital ID schemes in many countries employ fingerprint recognition for enrolment and verification, making fingerprint biometric components and systems essential infrastructure. As digital services expand, fingerprint biometric technology provides a familiar and trusted authentication layer across consumer, enterprise and public sector contexts.

Several barriers inhibit broader uptake of fingerprint biometric technology. Privacy and data security concerns are significant: fingerprint data is highly sensitive and cannot be ‘reset’ like a password if compromised. Some users and regulatory jurisdictions raise concerns about collection, storage and use of biometric data. Technological limits such as sensor reliability on dirty or worn fingertips, spoofing vulnerability, and user perception of hygiene (especially in contact based systems) also reduce adoption in some settings. The emergence of alternatives such as face or iris recognition may displace or reduce the role of fingerprint biometrics in certain applications.

Key trends include advancement of in display and under glass fingerprint sensors in smartphones, ultrasonic and optical sensors that work through protective screen layers, and contactless fingerprint capture (for hygiene or wearable uses). There is growing integration of liveness detection and AI driven analytics to reduce spoofing risk and support multimodal authentication architectures (e.g., fingerprint + face). Enterprise and public sector users are increasingly adopting cloud based biometric as a service (BaaS) models for scalability and ease of deployment. Regionally, Asia Pacific is emerging as a high growth zone driven by smartphone penetration and national ID programs, while North America and Europe continue to focus on enterprise and border control applications.

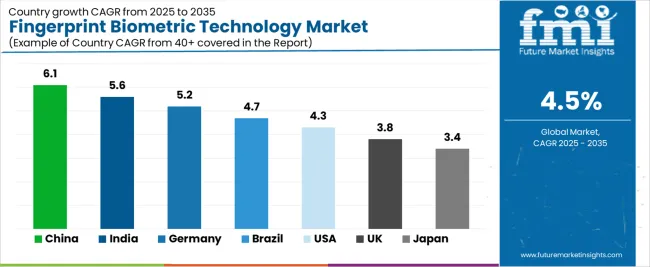

| Country | CAGR (%) |

|---|---|

| China | 6.1% |

| India | 5.6% |

| Germany | 5.2% |

| Brazil | 4.7% |

| USA | 4.3% |

| UK | 3.8% |

| Japan | 3.4% |

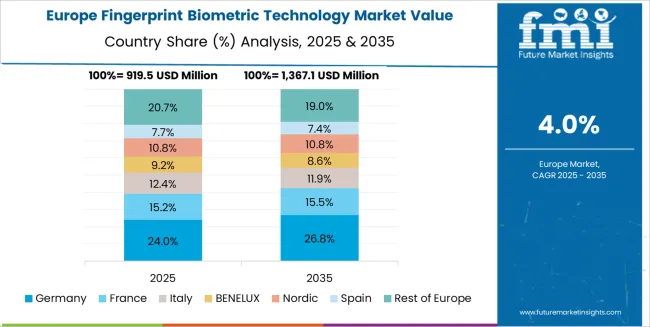

The Fingerprint Biometric Technology Market is expanding steadily across global security and identification sectors, with China leading at a 6.1% CAGR through 2035, driven by widespread adoption of fingerprint-based security systems in mobile devices, government services, and access control applications. India follows at 5.6%, supported by increasing use of biometric authentication in banking, e-commerce, and government initiatives. Germany records 5.2%, reflecting strong regulatory frameworks, high security standards, and growing demand for biometric solutions in enterprise security systems. Brazil grows at 4.7%, driven by the rise in digitalization, financial inclusion, and mobile payments, which rely on biometric verification. The USA, at 4.3%, remains a mature market emphasizing innovation in secure biometric systems for both consumer and enterprise applications, while the UK (3.8%) and Japan (3.4%) focus on advanced integration in mobile, healthcare, and law enforcement sectors.

China is projected to grow at a CAGR of 6.1% through 2035 in the fingerprint biometric technology market. Increasing concerns over data security and the rise of digital identification solutions boost the demand for fingerprint biometric technology. Financial institutions, government bodies, and tech companies adopt biometric systems to enhance security in mobile devices, banking transactions, and national ID programs. Manufacturers focus on improving the speed, accuracy, and cost-effectiveness of fingerprint sensors. The growing use of biometric authentication in consumer electronics and access control systems further drives market growth across various industries.

India is projected to grow at a CAGR of 5.6% through 2035 in the fingerprint biometric technology market. The rising adoption of digital identification systems in financial services, mobile applications, and government services drives the demand for fingerprint biometrics. Local manufacturers and service providers focus on providing low-cost, reliable fingerprint scanning solutions suitable for various industries. Government initiatives, such as digital India programs, support the integration of biometric systems for online services. The increasing demand for secure, user-friendly authentication systems in e-commerce and mobile banking further accelerates market expansion.

Germany is projected to grow at a CAGR of 5.2% through 2035 in the fingerprint biometric technology market. Strict regulations around data security and privacy laws, such as the GDPR, drive demand for biometric authentication technologies. The growing use of fingerprint recognition for access control, secure payment systems, and employee identification in corporate settings further contributes to market growth. Manufacturers are focused on developing advanced fingerprint sensors that offer high precision, faster recognition, and improved resistance to spoofing attacks. The adoption of biometric solutions across multiple sectors, including finance and healthcare, accelerates market demand.

Brazil is projected to grow at a CAGR of 4.7% through 2035 in the fingerprint biometric technology market. The growth of digital payments, e-commerce, and mobile banking in Brazil drives the adoption of biometric technologies for secure transactions. Biometric authentication is increasingly used in financial services, government programs, and mobile apps to enhance user security and prevent fraud. Manufacturers are focusing on developing affordable, reliable biometric solutions tailored to Brazil's unique market conditions. Government initiatives to digitise public services and enhance security further contribute to the rising demand for fingerprint-based systems.

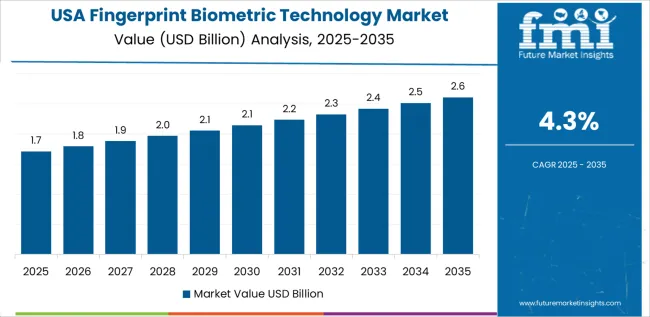

USA is projected to grow at a CAGR of 4.3% through 2035 in the fingerprint biometric technology market. Mobile security, online identity verification, and secure payments drive the need for fingerprint biometrics in the USA. Biometric solutions are increasingly integrated into smartphones, laptops, and access control systems to enhance security and streamline authentication processes. The financial and healthcare sectors contribute significantly to the market, implementing fingerprint-based verification systems to safeguard sensitive data. With the rise of digital fraud, companies continue to invest in more secure, convenient, and scalable biometric solutions for end-users.

UK is projected to grow at a CAGR of 3.8% through 2035 in the fingerprint biometric technology market. Growing concerns over digital privacy and the need for secure personal identification solutions drive the demand for biometric systems. UK businesses and government agencies increasingly adopt fingerprint biometric technology for secure access to digital services and facilities. Privacy protection regulations, such as GDPR, promote the use of secure, non-invasive authentication methods. The integration of biometric solutions in mobile banking, payment systems, and national identity programs also boosts market demand, especially in urban areas.

Japan is projected to grow at a CAGR of 3.4% through 2035 in the fingerprint biometric technology market. Rising concerns about digital security and the increasing use of mobile payments drive the demand for fingerprint authentication systems in Japan. Biometric technology is integrated into smartphones, laptops, and government-issued identification cards for secure access. The Japanese government’s push for digital transformation in public services accelerates the adoption of fingerprint-based systems for identification and authentication purposes. Technological advancements in sensor technology and the increasing integration of AI for biometric systems further enhance the growth of the market.

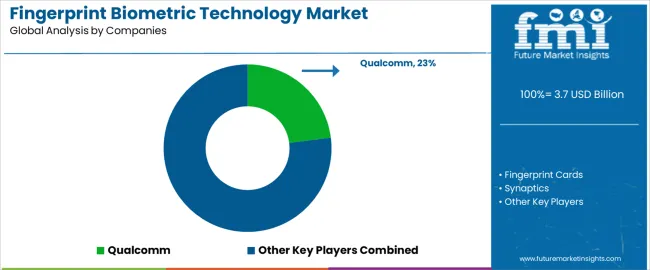

The global fingerprint biometric technology market is moderately competitive, shaped by companies providing advanced fingerprint sensors and biometric solutions for mobile devices, security systems, and access control applications. Qualcomm, Fingerprint Cards, and Synaptics hold leading positions by offering high-performance fingerprint sensors integrated into smartphones, tablets, and laptops, with innovations focused on accuracy, speed, and integration with next-gen mobile and smart devices. Japan Display and Goodix Technology strengthen the market by providing optical and capacitive fingerprint sensors designed for a wide range of consumer electronics, including wearables and laptops. Egis Technology and Beijing GigaDevice expand the market with specialized sensors used in mobile devices, IoT applications, and secure identification solutions.

Shanghai OXi Technology, Focaltech Electronics, and VKANSEE contribute to the market by delivering cost-effective fingerprint sensor solutions for emerging markets, offering both capacitive and optical fingerprint sensors suitable for mid-range devices. Competition across this market is influenced by sensor performance, ease of integration, and the ability to meet security standards, especially in mobile and financial transactions. Strategic differentiation depends on innovations in sensor miniaturization, multi-modal biometric integration, and enhanced security features such as liveness detection. As the demand for secure authentication methods continues to rise in consumer devices and public security applications, companies offering scalable, high-accuracy, and easily integrated biometric solutions are well-positioned to maintain a competitive edge.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD billion |

| Type | In-screen Fingerprint Recognition, Under-screen Fingerprint Recognition |

| Application | Smartphone, Tablet, Smart Door Lock, Others |

| Regions Covered | East Asia, Europe, North America, South Asia, Latin America, Middle East & Africa |

| Countries Covered | China, India, Germany, Brazil, USA, UK, Japan, and 40+ additional countries |

| Key Companies Profiled | Qualcomm, Fingerprint Cards, Synaptics, Japan Display, Goodix Technology, Egis Technology, Beijing GigaDevice, Shanghai OXi Technology, Focaltech Electronics, VKANSEE |

| Additional Attributes | Dollar sales by type and application, advancements in fingerprint sensor technology (capacitive, optical, ultrasonic), regulatory compliance (GDPR, privacy concerns), sensor reliability under challenging conditions, multi-modal biometric solutions, integration with mobile, IoT, healthcare, and security systems, contactless solutions, AI integration in biometric systems. |

The global fingerprint biometric technology market is estimated to be valued at USD 3.7 billion in 2025.

The market size for the fingerprint biometric technology market is projected to reach USD 5.7 billion by 2035.

The fingerprint biometric technology market is expected to grow at a 4.5% CAGR between 2025 and 2035.

The key product types in fingerprint biometric technology market are in-screen fingerprint recognition and under-screen fingerprint recognition.

In terms of application, smartphone segment to command 72.0% share in the fingerprint biometric technology market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Fingerprint Sensors Market Size and Share Forecast Outlook 2025 to 2035

Fingerprint Biometrics Market by Authentication Type, Mobility, Industry & Region Forecast till 2035

Brain Fingerprinting Technology Market

Optical Fingerprint Collector Market Size and Share Forecast Outlook 2025 to 2035

Automated Fingerprint Identification System (AFIS) Market Size and Share Forecast Outlook 2025 to 2035

Semiconductor Fingerprint Collector Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Biometric Vehicle Access Market Size and Share Forecast Outlook 2025 to 2035

Biometric Payment Cards Market Size and Share Forecast Outlook 2025 to 2035

Biometric PoS Terminals Market by Technology, End-Use, and Region - Growth, Trends, and Forecast through 2025 to 2035

Biometric Driver Identification System Market Growth - Trends & Forecast 2025 to 2035

Biometric Sensors Market Trends – Growth & Forecast 2025 to 2035

Biometric-as-a-Service Market Forecast 2025 to 2035

Biometric Lockers Market

Military Biometrics Market Size and Share Forecast Outlook 2025 to 2035

Behavioral Biometrics Market Size and Share Forecast Outlook 2025 to 2035

Healthcare Biometrics Market Trends - Growth, Demand & Forecast 2025 to 2035

AI-enabled Biometrics Market

Multi-Modal Biometric Cabin Sensors Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Contactless Biometric Technology Market by Technology, Component, Application & Region Forecast till 2035

Hand Geometry Biometrics Market Insights - Trends & Growth 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA