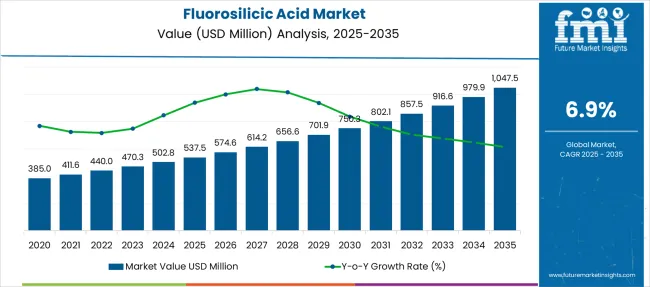

The Fluorosilicic Acid Market is estimated to be valued at USD 537.5 million in 2025 and is projected to reach USD 1047.5 million by 2035, registering a compound annual growth rate (CAGR) of 6.9% over the forecast period. In 2020, the market stood at USD 385 million, indicating steady yet accelerated adoption over time. The upward trend is strongly influenced by applications in water fluoridation, metal surface treatments, and industrial cleaning solutions. A pivotal demand surge is anticipated post-2027 as urban water infrastructure upgrades integrate fluoride dosing systems for large-scale public health programs. Cost optimization in chemical processing and higher-grade product formulations for pharmaceutical intermediates will add to value expansion. The sector’s competitive dynamic hinges on high-purity grades with improved stability under variable storage conditions.

Regional growth patterns underline Asia-Pacific as the most promising contributor, primarily due to its expansive industrial base and water treatment directives. Companies are expected to invest in sustainability-linked operational models and safety compliance certifications to penetrate government-backed tenders. Key strategies emphasize product standardization and digital tracking for efficient supply chain control, ensuring consistency in chemical concentration across distribution nodes.

The growth is supported by its indispensable role in water fluoridation, phosphate fertilizer processing, and industrial applications such as metal surface treatment and ceramics. Demand is less cyclical than most specialty chemicals because municipal water programs and large-scale chemical synthesis create baseline stability.

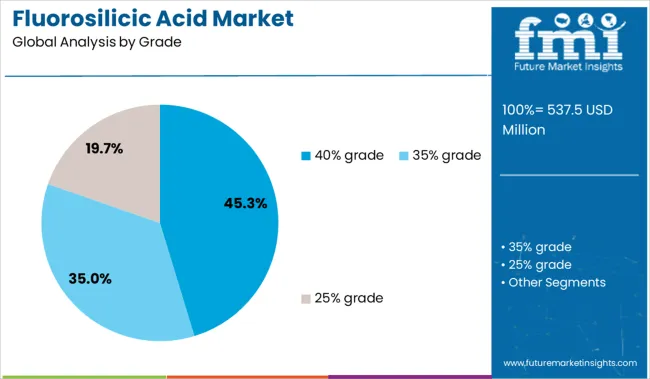

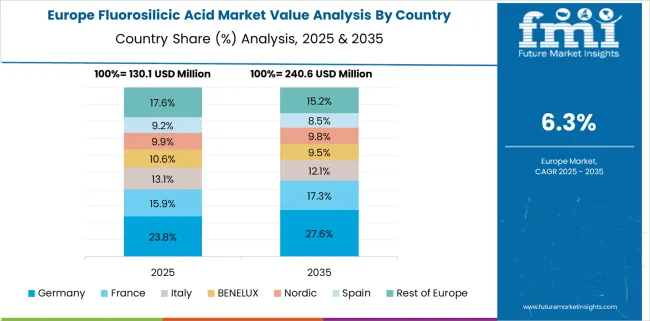

The 40% grade segment, accounting for 45.3% share, dominates due to its optimal balance of concentration for cost efficiency and handling safety. Asia-Pacific is emerging as a critical demand hub, fueled by fertilizer production expansion and growing urban water treatment projects. North America sustains strong uptake under established fluoridation programs. Europe’s role remains tied to stringent regulatory oversight and niche uses in specialty glass and enamel applications. Future dynamics will hinge on environmental compliance and safe transportation protocols, as the market faces scrutiny over storage hazards and potential toxicity concerns.

| Metric | Value |

|---|---|

| Fluorosilicic Acid Market Estimated Value in (2025 E) | USD 537.5 million |

| Fluorosilicic Acid Market Forecast Value in (2035 F) | USD 1047.5 million |

| Forecast CAGR (2025 to 2035) | 6.9% |

The fluorosilicic acid market is witnessing steady growth fueled by increased demand for its application in municipal water fluoridation, industrial processing, and surface treatment activities. The market’s progression is being guided by regulatory compliance in water quality enhancement, along with its cost-effective role in fluorine compound production.

Urbanization and infrastructure upgrades across developing regions have led to rising investments in potable water systems, where fluorosilicic acid remains a critical additive for dental health initiatives. In parallel, industrial applications such as metal surface cleaning, glass etching, and ceramics manufacturing continue to create stable demand.

Strategic collaborations between chemical producers and public utilities are strengthening the supply chain, while safety enhancements in storage and handling processes are encouraging broader acceptance. With evolving environmental frameworks and infrastructure expansion, particularly in Asia and the Middle East, new opportunities are expected to emerge in both public sector initiatives and specialty chemical markets.

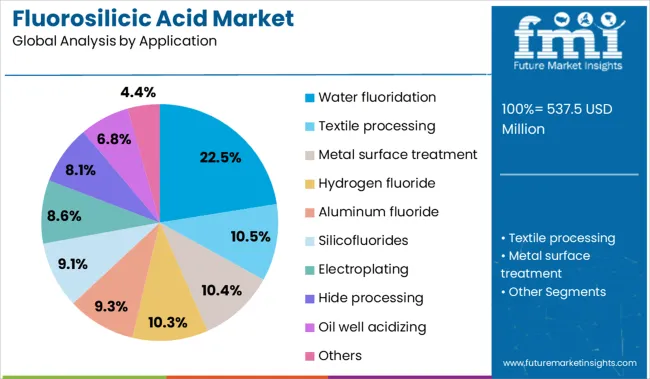

The fluorosilicic acid market is segmented by grade, application, and region. By grade, it includes 40% grade, 35% grade, and 25% grade, addressing different industrial concentration requirements. In terms of application, the segmentation covers water fluoridation, textile processing, metal surface treatment, hydrogen fluoride production, aluminum fluoride, silicofluorides, electroplating, hide processing, oil well acidizing, and other specialized uses. Regionally, the market spans North America, Latin America, Western and Eastern Europe, Balkan and Baltic countries, Russia and Belarus, Central Asia, East Asia, South Asia and Pacific, and the Middle East and Africa.

The 40% grade category is projected to contribute 45.3% of total revenue in the fluorosilicic acid market by 2025, positioning it as the most widely adopted concentration. This dominance is supported by its optimal balance between potency and manageability, making it suitable for bulk transport and dilution across multiple end-use industries.

Water treatment facilities, in particular, have standardized the 40% concentration due to its compatibility with dosing systems and its ability to provide consistent fluoride levels in municipal supplies. Additionally, the 40% grade is favored in glass manufacturing and chemical synthesis for its reactivity and ease of integration into automated processes.

Suppliers have increasingly focused on this grade for bulk packaging and long-term storage, reinforcing its logistical advantages and wide applicability. The consistency of this concentration across industrial protocols and public health mandates has sustained its lead over other grades in the global market.

Water fluoridation is anticipated to hold a 22.5% revenue share in the overall fluorosilicic acid market by 2025, establishing it as a leading application. This position has been reinforced by public health regulations advocating the controlled addition of fluoride in drinking water to reduce dental caries.

Government mandates and endorsements from health organizations have resulted in continued adoption of fluorosilicic acid in municipal water systems, especially in North America, Europe, and parts of Asia Pacific. The compound’s solubility, cost-efficiency, and effectiveness in small doses make it an ideal choice for large-scale distribution through urban water networks.

Infrastructure upgrades in water treatment and renewed policy focus on population-wide dental health have further catalyzed implementation. Additionally, increased awareness campaigns around oral hygiene in both developing and developed economies have ensured sustained demand, making water fluoridation a vital contributor to market expansion.

Demand for fluorosilicic acid has remained consistent due to its established role in municipal water fluoridation, metal surface conditioning, and chemical cleaning. Industrial operators have adopted the compound for its ease of dilution, compatibility with dosing systems, and effectiveness in scaling and etching processes.

Fluid-grade formats are being favored by end-users prioritizing storage stability and minimal residue generation. Grade-specific formulations are being tailored to suit sectoral purity and concentration preferences.

Fluorosilicic acid is widely used in water treatment facilities as a fluoride additive, valued for its compatibility with flow-metering systems and stable behavior in fluid dosing. Its role in reducing dental health risks has aligned with public health regulations, prompting widespread procurement by municipal authorities. In industrial applications, the compound is utilized for rust removal, aluminum fluoride synthesis, and etching in surface preparation routines.

Its use in cleaning laboratory glassware, ceramics, and high-purity surfaces is based on its predictable reactivity and minimal solid residue. Facilities operating with high-volume water circulation and chemical processing have incorporated fluorosilicic acid into regular maintenance cycles. Supply chain improvements and tank-level monitoring systems have allowed for bulk delivery models, while regulatory standards in key markets have ensured formulation consistency for both civic and industrial users.

Value creation has been observed in setups that convert off-gases from phosphate fertilizer production into commercial fluorosilicic acid. This approach lowers waste output and supplies acid to downstream industries without reliance on dedicated mineral sourcing.

Application growth has been noted in construction sectors using the compound for concrete hardening and anti-microbial surface treatments. Variants formulated for oil-well acidizing, textile conditioning, and pest control are being introduced with packaging designed for mobile and field-based deployment.

Distributors are offering modular delivery systems and refillable container models to service agrochemical blenders and regional chemical suppliers. Regulatory alignment for use in public spaces and consumer-contact surfaces has encouraged adoption across niche markets. As more industries seek reliable mineral-based additives, fluorosilicic acid is being integrated into workflows requiring efficient acidity control, metal ion interaction, and precise surface modification.

| Country | CAGR |

|---|---|

| China | 9.3% |

| India | 8.6% |

| Germany | 7.9% |

| France | 7.2% |

| UK | 6.6% |

| USA | 5.9% |

| Brazil | 5.2% |

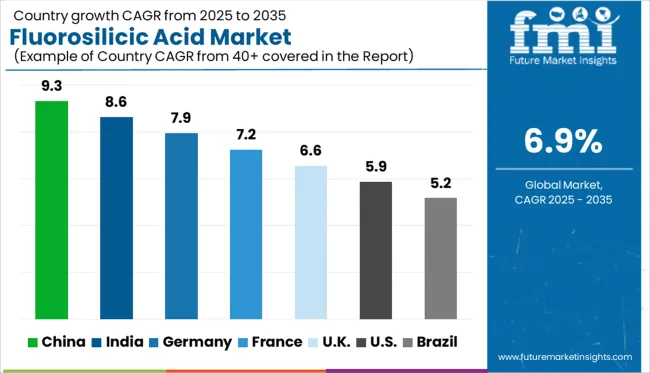

The global fluorosilicic acid market is projected to grow at a CAGR of 6.9% from 2025 to 2035, influenced by municipal water fluoridation, phosphate fertilizer processing, and surface treatment demand. China leads with a 9.3% CAGR, supported by large-scale water treatment projects, etching chemical production, and silica-based additive applications.

India follows at 8.6%, driven by fertilizer formulation, urban water compliance, and increased industrial-grade fluorosilicate sourcing. Germany grows at 7.9%, shaped by advancements in glass treatment, anti-corrosive chemical development, and recycling reagent production.

France posts 7.2%, backed by public sanitation initiatives and growing use in industrial cleaning blends. The United Kingdom grows at 6.6%, reflecting regulated dosing in water treatment and expanding demand from chemical formulation firms. These five countries anchor broader growth within a 40+ country analysis.

Demand for fluorosilicic acid in China is projected to grow at a 9.3% CAGR, significantly ahead of the global average. Industrial growth across phosphate processing, municipal fluoridation, and metallurgy has made China the central node for bulk production and regional redistribution. Domestic manufacturers supply water treatment chemicals with standardized fluorosilicate content for compliance across Tier I cities.

Additionally, fluorosilicic acid is used in aluminum surface finishing and glass etching. Integration into phosphate fertilizer production continues to anchor base-level demand across agriculture and agrochemical verticals. China's scale advantage and vertically integrated chemical clusters give it dominance over OECD markets in production agility.

Demand for fluorosilicic acid in Germany is projected to grow at a 7.9% CAGR, driven by EU-compliant water fluoridation, industrial acid applications, and surface treatment innovation. The country emphasizes controlled dosing for municipal water processing and uses fluorosilicic acid in refining high-grade glass and aluminum.

Chemical suppliers operate under stringent REACH compliance, favoring ultra-pure forms of the compound. Integration into cleaning agents for industrial hygiene, as well as chemical etching baths in electronics and photovoltaic segments, has expanded. As an OECD nation, Germany prioritizes precision use and regulated distribution channels, contrasting with BRICS nations focused on volume.

Fluorosilicic acid consumption in France is growing at a 7.2% CAGR, driven by its use in public water systems, chemical cleaning blends, and fluoride-based compound production. Regional health boards utilize controlled application of fluorosilicates in drinking water across urban centers, reinforcing demand stability. Industrial users integrate the acid into aluminum degreasing processes, boiler descaling, and ceramic etching.

France also exports fluorosilicic acid derivatives into regulated EU markets with strict limits on contaminant levels. Unlike BRICS markets that focus on broad agricultural uptake, France emphasizes certified-grade application in smaller but higher-value processing lines.

The United Kingdom fluorosilicic acid market is forecast to expand at a CAGR of 6.6%, slightly below the global rate, with demand anchored in regional water treatment programs and commercial-grade chemical cleaning products. Fluorosilicic acid is applied in controlled fluoridation schemes by local utilities, particularly in regions with naturally low fluoride levels.

Industrial demand comes from metal surface preparation, heat exchanger descaling, and cleaning agents for sanitary environments. Post-Brexit, sourcing protocols have been adjusted to ensure regulatory continuity and avoid import reliance. Unlike China or India, UK demand remains focused on safety, compliance, and moderate usage across sectors.

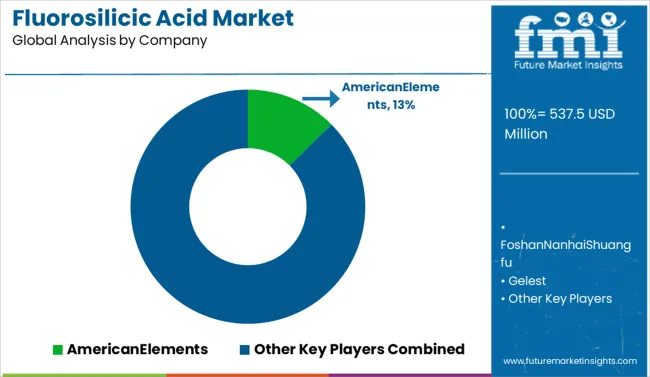

The fluorosilicic acid industry is led by American Elements, holding a prominent market share owing to its broad product catalog and high-purity formulations tailored for municipal water fluoridation, surface treatments, and chemical synthesis. Solvay and Honeywell International supply industrial-grade variants for metal cleaning, electroplating, and semiconductor processes.

Gelest and Hydrite Chemical focus on tailored grades used in pharmaceutical intermediates and specialty applications. Foshan Nanhai Shuangfu and Xinxiang Yellow River Fine Chemicals serve Asia-Pacific with cost-competitive bulk solutions. IXOM, Hawkins, and Napco Chemical Company support water treatment utilities across North America.

Competitive dynamics are increasingly driven by purity requirements, corrosion-control efficacy, and alignment with regional environmental and handling regulations for safe storage and transportation.

Key Developments in the Fluorosilicic Acid Market

Key players are investing in high-purity grades, especially the dominant 40%, to support precision applications like water fluoridation and advanced specialty uses. They’re deploying product standardization and digital tracking systems to ensure consistent quality and robust supply chain control. Geographic expansion into Asia-Pacific is prioritized to tap into fast-growing water treatment and industrial infrastructure demand. Companies also focus on sustainability-driven innovations, such as cleaner production technologies and safer handling processes. Strategic partnerships with public utilities and certification for regulatory compliance help secure access to government tenders and water-treatment programs.

| Item | Value |

|---|---|

| Quantitative Units | USD 537.5 Million |

| Grade | 40% grade, 35% grade, and 25% grade |

| Application | Water fluoridation, Textile processing, Metal surface treatment, Hydrogen fluoride, Aluminum fluoride, Silicofluorides, Electroplating, Hide processing, Oil well acidizing, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | AmericanElements, FoshanNanhaiShuangfu, Gelest, Hawkins, HoneywellInternational, HydriteChemical, IXOM, NapcoChemicalCompany, Solvay, and XinxiangYellowRiverFineChemicals |

| Additional Attributes | Dollar sales for fluorosilicic acid are segmented by gradeindustrial, potable water treatment, and food-grade, with industrial use holding the largest share. Rising demand is driven by municipal water fluoridation and phosphate recovery. CDMOs and chemical OEMs supply turnkey distribution systems. Adoption is strongest in North America and Asia‑Pacific, fueled by infrastructure upgrades and regulatory mandates. |

The global fluorosilicic acid market is estimated to be valued at USD 537.5 million in 2025.

The market size for the fluorosilicic acid market is projected to reach USD 1,047.5 million by 2035.

The fluorosilicic acid market is expected to grow at a 6.9% CAGR between 2025 and 2035.

The key product types in fluorosilicic acid market are 40% grade, 35% grade and 25% grade.

In terms of application, water fluoridation segment to command 22.5% share in the fluorosilicic acid market in 2025.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA