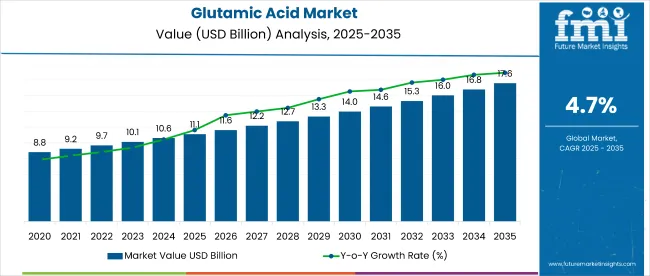

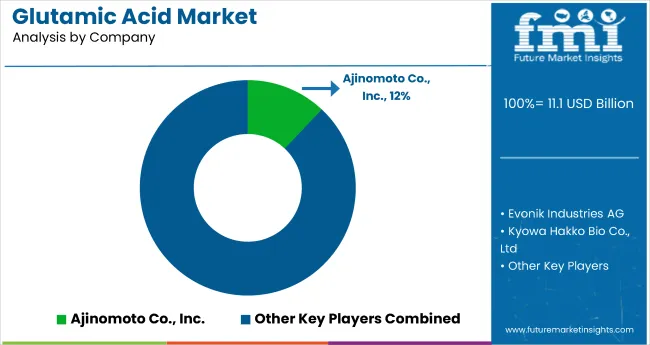

The global glutamic acid market is valued at USD 11.1 billion in 2025 and is expected to reach USD 17.6 billion by 2035, registering a CAGR of 4.7%. Market expansion is driven by increased demand across food and pharmaceutical applications, supported by rising consumer awareness toward nutritional and functional ingredients.

| Metric | Value |

|---|---|

| Market Size(2025) | USD 11.1 billion |

| Market Size(2035) | USD 17.6 billion |

| CAGR (2025 to 2035) | 4.7% |

Additionally, the proliferation of processed and convenience food products is boosting the need for flavor-enhancing compounds such as glutamic acid in food formulations.

The market holds 12% of the global amino acids market, driven by its role as a key proteinogenic amino acid. Within the functional food ingredients market, it contributes around 8%, owing to its use as a flavor enhancer. In the food additives market, glutamic acid represents nearly 10% of the total value. It holds a smaller 6% share in the pharmaceutical ingredients market and around 7% in animal feed additives, reflecting its broad yet specialized utility across these sectors.

Government regulations impacting the market focus onagencies like the USA FDA, EFSA in Europe, and FSSAI in India enforce strict guidelines to ensure the safe use of glutamic acid as an additive and active ingredient. These rules focus on product safety, labeling transparency, and usage limits.

Increasing concerns over synthetic additives and demand for clean-label products have led to tighter compliance norms. Consequently, manufacturers are shifting toward natural, fermentation-based production methods to align with regulatory requirements and evolving consumer preferences.

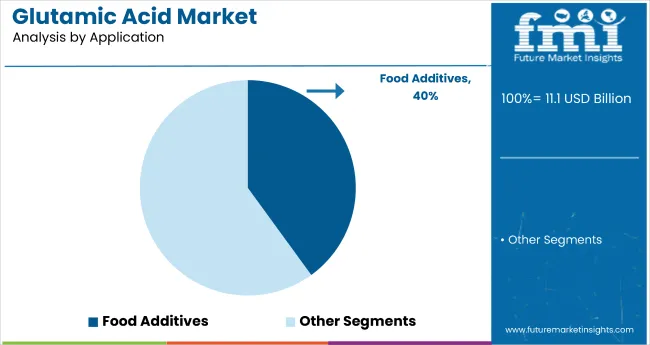

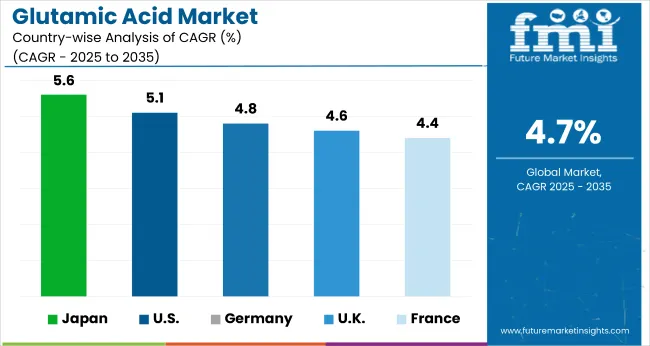

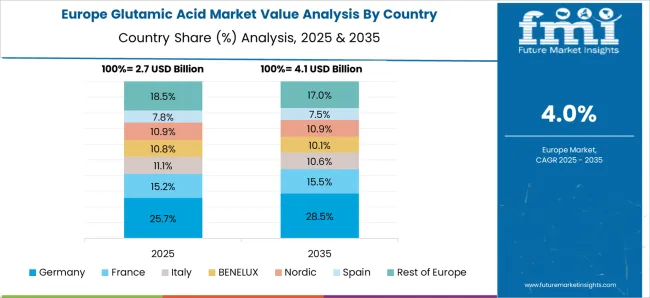

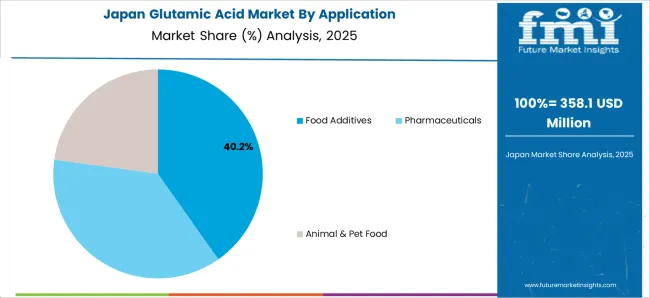

The Japan is projected to be the fastest-growing marketat a CAGR of 5.6% from 2025 to 2035, driven by strong demand for processed foods and pharmaceutical-grade amino acids. Food additives will continue to dominate the application segment, accounting for 40% of total demand. Germany is projected to grow at a CAGR of 4.8% from 2025 to 2035.

The glutamic acid market is segmented into application and region. By application, the market is segmented into food additives, pharmaceuticals, and animal & pet food. Regionally, the market is classified into North America, Latin America, Europe, Asia Pacific, and the Middle East & Africa (MEA).

Food additives are projected to lead the application segment with 40% of the market share in 2025. This dominance is driven by the widespread use of glutamic acid as a flavor enhancer in processed foods, rising demand for convenience foods, and increasing consumer preference for umami-rich products across global markets.

The market is growing steadily, driven by rising demand for natural flavor enhancers, increasing application in processed and functional foods, and expanding use in pharmaceutical formulations for neurological and metabolic health.

Additionally, growing consumer awareness about clean-label products and the shift towards sustainable production methods are further fueling market growth. Technological advancements in fermentation processes are also enabling manufacturers to improve product quality and reduce costs, boosting adoption across various industries.

Recent Trends in the Glutamic Acid Market

Key Challenges in the Glutamic Acid Market

Japan leads the market, driven by advancements in biotechnology and rising demand for functional foods. The USA follows with a CAGR of 5.1%, supported by its developed pharmaceutical and food sectors. Germany is expected to grow at 4.8%, while the UK and France will see moderate growth at 4.6% and 4.4% respectively. The growth rates reflect varying levels of regulatory influence, innovation capacity, and consumer demand for clean-label and fortified food products.

The report covers an in-depth analysis of 40+ countries; with the five top-performing OECD nations highlighted below.

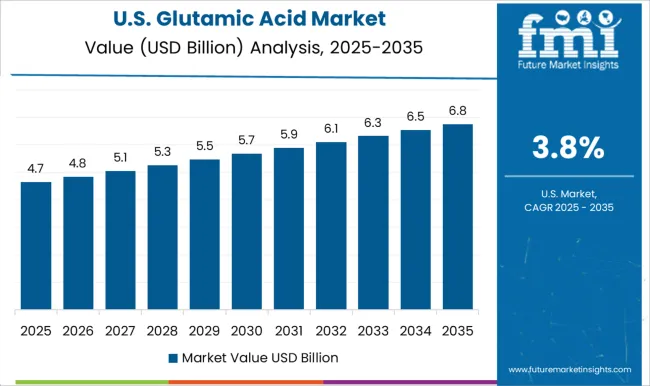

The USA glutamic acid products revenue is projected to grow at a CAGR of 5.1% from 2025 to 2035. Growth is being driven by the country’s highly developed food processing and pharmaceutical industries. Demand for natural amino acids continues to rise amid clean-label trends and the growing popularity of functional and fortified food products.

The sales of glutamic acid products in the UK are anticipated to expand at a CAGR of 4.6% from 2025 to 2035. Growth is driven by strict regulations around food additives and growing preference for clean-label products. Glutamic acid is increasingly used in dairy products, savory snacks, and nutraceutical formulations across the country.

The glutamic acid product demand in Germany is projected to grow at a CAGR of 4.8% from 2025 to 2035. The country’s robust pharmaceutical sector and food manufacturing base are fueling demand for glutamic acid. Strict safety and quality standards support the adoption of naturally derived additives.

The French glutamic acid revenue is expected to grow at a CAGR of 4.4% over the forecast period. The country’s culinary heritage and high consumption of dairy and savory products contribute to steady glutamic acid demand. Pharmaceutical usage is also on the rise due to increasing neurological health awareness.

The glutamic acid market in Japan is projected to grow at a CAGR of 5.6% from 2025 to 2035. Growth is driven by strong domestic demand for glutamic acid across both traditional cuisine and modern packaged foods. The country also leads in biotechnological innovation and pharmaceutical usage.

The glutamic acid market is moderately competitive, with several global and regional players actively competing based on price, innovation, production scale, and strategic collaborations. Leading suppliers such as Ajinomoto Co., Inc., Evonik Industries AG, and Kyowa Hakko Bio Co., Ltd dominate the high-purity and pharmaceutical-grade segments, while other players cater to regional demand with cost-effective, food-grade alternatives.

Top companies are focusing on expanding fermentation-based production, improving product purity, and securing strategic partnerships to penetrate emerging markets. Innovation in clean-label and bio-based production processes has become a major focus, especially in Europe and North America, where regulatory compliance is strict.

Ajinomoto continues to lead in research on amino acid functionality, while Evonik leverages its biotechnology division to scale amino acid production for animal and human nutrition. Companies like Iris Biotech and Bachem AG are expanding their portfolios in pharmaceutical amino acids, catering to rising therapeutic demands.

Meanwhile, consolidation is underway as large players seek to strengthen their positions by acquiring or partnering with niche biotech firms. China-based companies such as Ningxia EPPEN Bioengineering are investing in large-scale production and export capabilities, while European players focus on compliance, traceability, and premium-quality ingredients. The drive for sustainability and traceability in ingredient sourcing is influencing new investments and operational decisions globally.

Recent Glutamic Acid Industry News

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 11.1 billion |

| Projected Market Size (2035) | USD 17.6 billion |

| CAGR (2025 to 2035) | 4.7% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Report Parameters | Revenue in USD billions/Volume in Metric Tons |

| By Application | Food Additives, Pharmaceuticals, and Animal & Pet Food |

| Regions Covered | North America, Latin America, Europe, Asia Pacific, and MEA (Middle East & Africa) |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, Brazil, Australia, and 40+ countries |

| Key Players | Bio-chem Technology Group Company, Bachem AG, Ningxia EPPEN Bioengineering Stock Co., Ltd, Kyowa Hakko Bio Co., Ltd, Sichuan Tongsheng Amino Acid Co., Ltd, Iris Biotech GmbH, Suzhou Yuanfang Chemical Co., Ltd., Ajinomoto Co., Inc., Akzo Nobel N.V., Evonik Industries AG. |

| Additional Attributes | Dollar sales by product type, share by functionality, regional demand growth, regulatory influence, clean-label trends, competitive benchmarking |

The global glutamic acid market is estimated to be valued at USD 11.1 billion in 2025.

The market size for the glutamic acid market is projected to reach USD 17.2 billion by 2035.

The glutamic acid market is expected to grow at a 4.5% CAGR between 2025 and 2035.

The key product types in glutamic acid market are food additives, pharmaceuticals and animal & pet food.

In terms of , segment to command 0.0% share in the glutamic acid market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Acid Resistant Pipe Market Forecast and Outlook 2025 to 2035

Acid Coil Cleaner Market Size and Share Forecast Outlook 2025 to 2035

Acid Filling and Leveling Machine Market Size and Share Forecast Outlook 2025 to 2035

Acid Chlorides Market Size and Share Forecast Outlook 2025 to 2035

Acid-Sensitive APIs Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Acidified Whey Protein Market Analysis - Size, Share & Trends 2025 to 2035

Acid Dyes Market Growth - Trends & Forecast 2025 to 2035

Acidity Regulator Market Growth - Trends & Forecast 2025 to 2035

Acid Proof Lining Market Trends 2025 to 2035

Acid Citrate Dextrose Tube Market Trends – Growth & Industry Outlook 2024-2034

Acid Orange Market

Antacids Market Analysis – Size, Trends & Forecast 2025 to 2035

Lead Acid Battery Market Size and Share Forecast Outlook 2025 to 2035

Lead Acid Battery Recycling Market Size and Share Forecast Outlook 2025 to 2035

Feed Acidifier Market Analysis Size Share and Forecast Outlook 2025 to 2035

Food Acidulants Market Growth - Key Trends, Size & Forecast 2024 to 2034

Nylon Acid Dye Fixing Agent Market Size and Share Forecast Outlook 2025 to 2035

Boric Acid Market Forecast and Outlook 2025 to 2035

Folic Acid Market Size and Share Forecast Outlook 2025 to 2035

Oleic Acid Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA