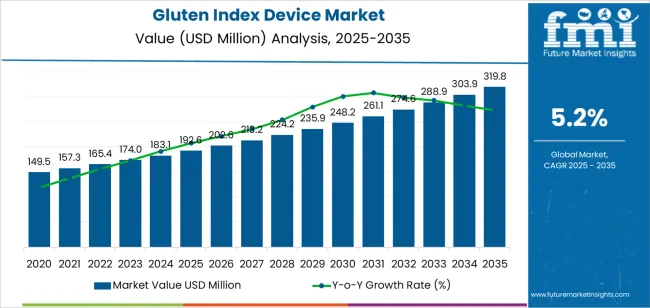

The global gluten index device market is projected to grow from USD 192.6 million in 2025 to approximately USD 319.8 million by 2035, recording an absolute increase of USD 127.2 million over the forecast period. This translates into a total growth of 66%, with the market forecast to expand at a compound annual growth rate (CAGR) of 5.2% between 2025 and 2035. The overall market size is expected to grow by nearly 1.7X during the same period, supported by increasing quality control requirements across flour milling operations, growing adoption of standardized gluten measurement protocols in food processing facilities, and rising research demands driving analytical instrument procurement across agricultural testing laboratories and cereal science applications.

The market exhibits distinct regional dynamics with Asia Pacific emerging as the fastest-growing region, led by China's expanding food processing infrastructure and India's agricultural research modernization. Europe maintains substantial market presence through established quality control frameworks and advanced cereal testing capabilities. North America demonstrates growing adoption driven by food safety regulations and wheat breeding research programs.

The gluten index device segment demonstrates particular strength in applications requiring precise gluten quality assessment, including wheat variety evaluation, flour specification verification, and baking performance prediction where standardized measurement protocols ensure consistent product characteristics. Technology evolution continues toward automated measurement systems incorporating image analysis and digital data management capabilities enhancing operational efficiency compared to conventional centrifugation methods. Market participants increasingly focus on developing user-friendly interfaces, establishing regional service networks, and expanding calibration support to address growing demand across flour mills, bakery ingredient suppliers, and agricultural research institutions.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 192.6 million |

| Market Forecast Value (2035) | USD 319.8 million |

| Forecast CAGR (2025-2035) | 5.2% |

| QUALITY CONTROL EXPANSION | RESEARCH & DEVELOPMENT DRIVERS | REGULATORY & STANDARDIZATION FACTORS |

|---|---|---|

| Food Processing Quality Standards Manufacturing facilities implementing comprehensive quality control protocols requiring standardized gluten measurement for flour specification verification and product consistency assurance. Supply Chain Traceability Requirements Flour mills and ingredient suppliers establishing analytical capabilities for supplier qualification, incoming material verification, and customer specification compliance. Baking Performance Prediction Industrial bakeries adopting gluten index testing to predict dough handling characteristics, final product quality, and process parameter optimization. | Wheat Breeding Program Advancement Agricultural research institutions evaluating gluten quality characteristics in variety development programs targeting improved baking performance and disease resistance. Functional Property Investigation Cereal science laboratories studying gluten protein structure-function relationships supporting ingredient innovation and formulation optimization. Climate Impact Assessment Research programs evaluating environmental stress effects on wheat quality characteristics requiring comprehensive gluten protein analysis capabilities. | International Trade Standards Global wheat commerce requiring standardized quality measurement protocols enabling specification communication and contract compliance verification. Food Safety Certification Requirements Quality management systems including ISO, FSSC, and BRC requiring documented analytical capabilities and measurement traceability. Gluten Content Labeling Regulations Regulatory requirements for gluten-free product certification driving demand for accurate gluten characterization supporting compliance documentation. Industry Specification Harmonization Trade associations and standards organizations establishing uniform testing protocols requiring specific analytical equipment and methodology compliance. |

| Category | Segments Covered |

|---|---|

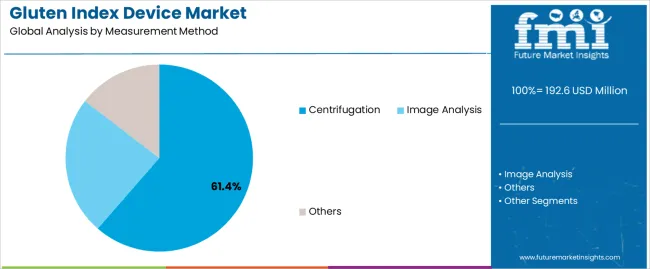

| By Measurement Method | Centrifugation, Image Analysis, Others |

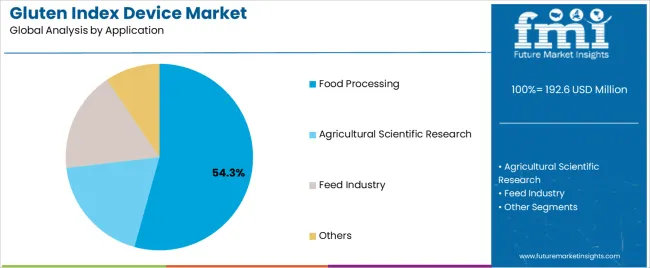

| By Application | Food Processing, Agricultural Scientific Research, Feed Industry, Others |

| By Region | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Segment | 2025 to 2035 Outlook |

|---|---|

| Centrifugation |

|

| Image Analysis |

|

| Others |

|

| Segment | 2025 to 2035 Outlook |

|---|---|

| Food Processing |

|

| Agricultural Scientific Research |

|

| Feed Industry |

|

| Others |

|

| Region | Status & Outlook 2025-2035 |

|---|---|

| Asia Pacific |

|

| Europe |

|

| North America |

|

| Latin America |

|

| Middle East & Africa |

|

| DRIVERS | RESTRAINTS | KEY TRENDS |

|---|---|---|

| Food Safety Regulation Expansion Government quality standards and food safety frameworks requiring documented analytical capabilities and measurement traceability across wheat processing operations. Quality-Based Wheat Pricing Commercial wheat trading incorporating quality premiums and penalties creating economic incentives for accurate gluten characterization supporting contract compliance. Processed Food Market Growth Expanding bakery product consumption and convenience food demand requiring consistent flour quality specifications supporting analytical capability investment. | Capital Investment Requirements Equipment costs and laboratory infrastructure requirements creating barriers to adoption in small-scale operations and resource-constrained facilities. Technical Skill Dependencies Manual centrifugation methodology requiring trained laboratory personnel and standardized testing procedures affecting measurement consistency and operational costs. Equipment Maintenance Complexity Specialized calibration requirements, consumable costs, and technical service needs affecting total cost of ownership and operational continuity. | Automation Technology Advancement Development of automated sample handling, measurement execution, and data management systems reducing operator dependency and enhancing throughput capacity. Digital Integration Capabilities Connectivity features enabling laboratory information management system integration, cloud-based data storage, and remote monitoring supporting quality management compliance. Portable Device Development Compact instrumentation enabling on-site testing in mills, grain elevators, and field research locations reducing sample handling requirements and accelerating decision-making. Multi-Parameter Analysis Systems Integrated platforms combining gluten index measurement with protein content, moisture determination, and falling number analysis consolidating quality testing requirements. |

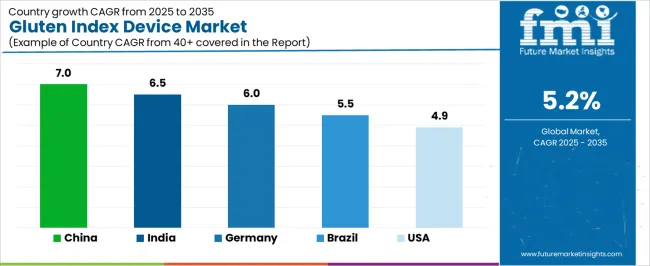

| Country | CAGR (2025-2035) |

|---|---|

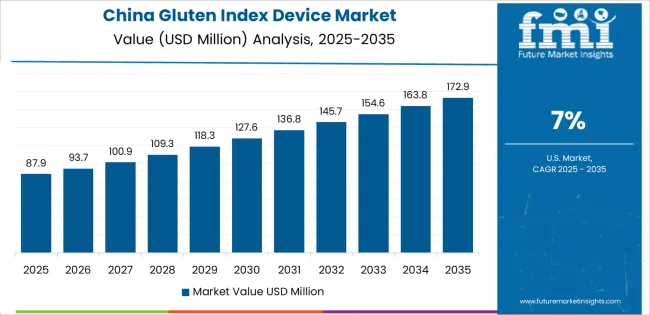

| China | 7% |

| India | 6.5% |

| Germany | 6% |

| Brazil | 5.5% |

| United States | 4.9% |

Revenue from gluten index devices in China is projected to exhibit exceptional growth with market value reaching significant levels by 2035, driven by massive wheat production volumes and comprehensive food safety infrastructure development programs creating substantial opportunities for analytical equipment suppliers across flour milling operations, food processing quality control laboratories, and agricultural research institutions. The country's expanding food safety regulatory framework and growing quality consciousness are creating significant demand for standardized gluten measurement capabilities. Major flour milling corporations and food processing companies are establishing comprehensive quality control laboratories supporting demand for analytical instrumentation.

Food safety regulation implementation and quality standard enforcement are supporting widespread adoption of gluten index testing across wheat processing operations, driving demand for reliable measurement devices and technical support services. Flour milling capacity expansion and processed food manufacturing growth are creating substantial opportunities for analytical equipment suppliers offering comprehensive training programs and maintenance support. Wheat quality improvement initiatives and agricultural modernization programs are facilitating adoption of standardized testing methodologies throughout major wheat-producing provinces and processing centers.

Revenue from gluten index devices in India is expanding substantially by 2035, supported by agricultural research institution modernization and comprehensive wheat breeding program development creating sustained demand for analytical equipment across government research facilities, university laboratories, and emerging private sector quality control operations. The country's wheat self-sufficiency programs and expanding food processing sector are driving demand for gluten measurement capabilities supporting variety evaluation and quality verification requirements. International equipment suppliers and domestic distributors are investing in technical service networks to support equipment installation and operator training needs.

Wheat breeding research programs and variety evaluation initiatives are creating opportunities for gluten index devices across agricultural research centers requiring comprehensive quality assessment capabilities. Food processing sector development and flour milling modernization are driving investments in quality control infrastructure supporting product consistency and specification compliance throughout wheat value chains. Quality standard implementation and food safety awareness programs are enhancing demand for analytical capabilities throughout primary wheat-producing states and processing centers.

Demand for gluten index devices in Germany is projected to reach substantial levels by 2035, supported by the country's leadership in cereal science research and advanced food processing technologies requiring sophisticated analytical capabilities for wheat quality evaluation, flour specification verification, and baking performance prediction. German research institutions and milling companies are implementing advanced gluten measurement systems that support comprehensive quality protocols, data management integration, and regulatory compliance requirements. The market is characterized by focus on analytical precision, methodology advancement, and compliance with stringent food quality and research standards.

Premium baking ingredient production and specialized flour manufacturing are prioritizing advanced analytical technologies that demonstrate superior measurement precision and reliability while meeting German food quality and research excellence standards. Wheat breeding programs and cereal science research initiatives are driving adoption of standardized testing protocols supporting variety evaluation and functional property investigation. Technology development programs for automated measurement systems are facilitating innovation in gluten characterization methodologies throughout major research centers and industrial quality control laboratories.

Revenue from gluten index devices in United States is growing to reach substantial levels by 2035, driven by comprehensive wheat breeding programs and advanced cereal science research creating sustained opportunities for analytical equipment suppliers serving both agricultural research institutions and commercial milling operations. The country's extensive wheat production diversity and established food processing infrastructure are creating demand for gluten index devices that support variety evaluation, quality verification, and regulatory compliance requirements. Equipment manufacturers and distributors are developing comprehensive technical support capabilities to address research specifications and industrial quality control demands.

Wheat variety development programs and agricultural research initiatives are facilitating adoption of gluten index measurement capabilities supporting breeding selection decisions and quality trait evaluation. Specialty flour production and artisanal baking ingredient supply are enhancing demand for analytical capabilities that support product differentiation and quality positioning strategies. Food safety compliance requirements and quality management system implementation are creating opportunities for standardized analytical methodologies across American milling operations and food processing facilities.

Demand for gluten index devices in Brazil is projected to reach meaningful levels by 2035, driven by domestic wheat production expansion and flour milling modernization programs supporting gradual quality control capability adoption in processing facilities and agricultural research operations. The country's growing wheat self-sufficiency initiatives and expanding bakery product consumption are creating demand for gluten measurement capabilities supporting quality improvement and specification compliance. International equipment suppliers and regional distributors are maintaining technical service capabilities to support equipment installation and operator training requirements.

Wheat breeding programs and agricultural research development are supporting demand for gluten index devices that enable variety evaluation and quality assessment capabilities. Flour milling modernization and food processing quality improvement initiatives are creating opportunities for analytical equipment that provides measurement reliability and compliance support. Wheat quality awareness programs and industry standardization efforts are facilitating adoption of testing methodologies throughout wheat-producing regions and processing centers.

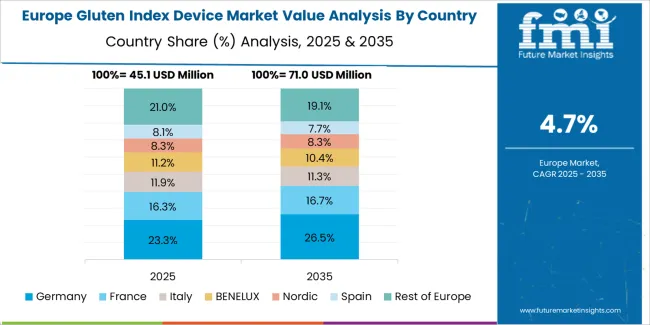

The gluten index device market in Europe is projected to grow from USD 66.6 million in 2025 to USD 145.3 million by 2035, registering a CAGR of 8.1% over the forecast period. Germany is expected to maintain its leadership position with a 36.4% market share in 2025, declining slightly to 35.1% by 2035, supported by its advanced cereal science research infrastructure and comprehensive flour milling quality control capabilities serving premium baking ingredient production.

France follows with a 24.7% share in 2025, projected to reach 25.3% by 2035, driven by wheat breeding research programs and artisanal baking tradition supporting quality verification requirements. The United Kingdom holds a 15.2% share in 2025, expected to maintain 14.9% by 2035 with established milling operations and food science research institutions. Italy commands a 12.1% share, while Spain accounts for 8.3% in 2025. The Rest of Europe region is anticipated to gain momentum, expanding its collective share from 3.3% to 4.5% by 2035, attributed to increasing wheat production in Eastern European countries and quality control adoption in emerging milling operations implementing modern analytical capabilities.

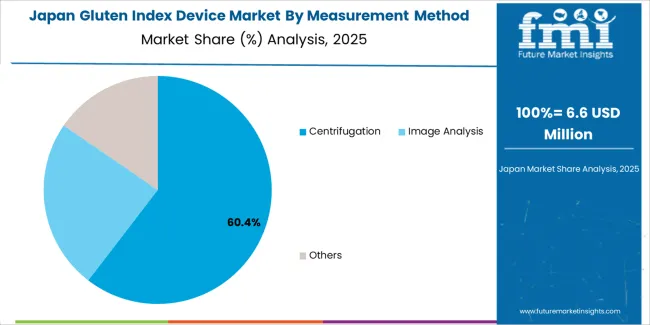

Japanese gluten index device operations reflect the country's precision standards and sophisticated food science research capabilities. Major research institutions including National Agriculture and Food Research Organization and university cereal science programs maintain comprehensive analytical capabilities emphasizing measurement precision, methodology validation, and international standard compliance. This creates structured market conditions favoring established equipment manufacturers with proven reliability and extensive technical documentation.

The Japanese market demonstrates advanced application focus, with significant research activity on wheat quality factors affecting noodle production characteristics, texture properties, and processing functionality. Research programs require detailed analytical protocols and comprehensive data management capabilities that align with Japanese scientific rigor standards, driving demand for sophisticated instrumentation and technical support services.

Quality standards emphasize measurement traceability and calibration verification, with research laboratories maintaining strict documentation protocols and equipment maintenance schedules. The analytical framework creates advantages for equipment suppliers with established calibration services, comprehensive technical support capabilities, and proven measurement precision.

Supplier relationships focus on long-term technical partnerships supporting research collaboration and methodology development. Japanese research institutions typically maintain extended relationships with equipment manufacturers, emphasizing technical consultation, application support, and continuous measurement improvement rather than competitive procurement processes. This stability supports specialized equipment development and application optimization investments tailored to Japanese wheat quality research requirements and noodle processing applications.

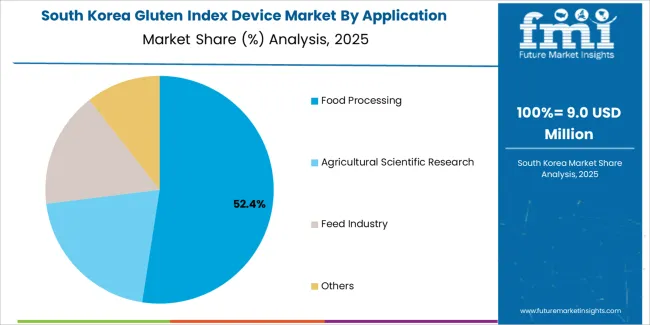

South Korean gluten index device operations reflect the country's advanced food science research capabilities and developing wheat processing sector. Major research institutions including Rural Development Administration and university food science programs drive analytical equipment procurement supporting wheat breeding initiatives, quality evaluation research, and processing technology development targeting improved noodle and baking product characteristics.

The Korean market demonstrates particular interest in wheat quality factors affecting traditional food applications, with research programs investigating gluten characteristics suitable for Korean noodle products and Asian bakery applications. This application focus creates demand for comprehensive analytical capabilities supporting product development and quality specification establishment.

Research funding frameworks emphasize agricultural productivity improvement and food security objectives, with government support for wheat breeding programs and quality research initiatives. Equipment procurement decisions require comprehensive performance validation and technical justification, creating structured evaluation processes that favor established manufacturers with proven analytical capabilities.

Technical collaboration between Korean research institutions and equipment suppliers focuses on methodology adaptation for Asian wheat varieties and traditional product applications. Research programs invest in comprehensive analytical capabilities supporting wheat quality improvement initiatives and processing technology advancement, positioning the market for development as wheat production expands and quality consciousness increases in food processing operations.

Profit pools consolidate around manufacturers demonstrating measurement reliability and comprehensive technical support capabilities addressing customer application requirements. Value migrates from basic centrifugation equipment toward advanced automated systems where throughput enhancement, operator independence, and data management integration command premiums. Several operational models define competitive positioning: established analytical equipment manufacturers offering comprehensive laboratory instrumentation portfolios and global service networks; specialized cereal testing equipment producers focusing on wheat quality measurement and application expertise; regional distributors providing localized technical support and calibration services; and emerging technology developers introducing image analysis and automated measurement alternatives.

Switching costs remain moderate for standard centrifugation methodology where dimensional specifications enable equipment substitution with minimal disruption. However, established measurement protocols, operator familiarity, and historical data correlation create practical barriers to equipment changes requiring retraining and method validation. Competitive advantages accrue to manufacturers maintaining comprehensive technical documentation supporting regulatory compliance while offering responsive service networks addressing calibration, maintenance, and troubleshooting requirements.

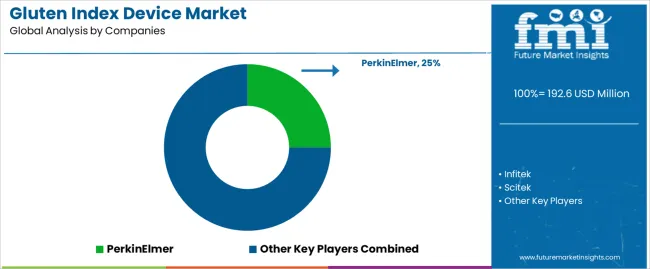

Market structure demonstrates concentration among established manufacturers controlling significant share through brand recognition, proven reliability, and regulatory acceptance while regional suppliers compete through price positioning and localized service. Distribution approaches vary with direct sales predominating for research institutions while distributor networks serve commercial quality control laboratories. Technology differentiation focuses on automation advancement, measurement throughput enhancement, and data management integration supporting modern laboratory information systems. Strategic positioning emphasizes application support capabilities with manufacturers providing training programs, methodology consultation, and technical resources supporting customer success and measurement confidence.

| Items | Values |

|---|---|

| Quantitative Units | USD 192.6 million |

| Measurement Method | Centrifugation, Image Analysis, Others |

| Application | Food Processing, Agricultural Scientific Research, Feed Industry, Others |

| Regions Covered | North America, Latin America, Europe, Asia Pacific, Middle East & Africa |

| Key Countries Covered | United States, Germany, China, India, Brazil, Japan, South Korea, and other countries |

| Key Companies Profiled | Infitek, PerkinElmer, Scitek, Bioevopeak, Saytek, Erkaya Instruments, Bastak Instruments, Ardazmanlian Engineering, Perten Glutomatic, Nanbei Instrument, Calibre Control International, Sartorom |

| Additional Attributes | Revenue analysis by measurement method and application segment, regional market dynamics, competitive landscape assessment, testing methodology evolution, automation technology trends, and analytical capability innovations driving quality assurance enhancement, research advancement, and operational efficiency |

The global gluten index device market is estimated to be valued at USD 192.6 million in 2025.

The market size for the gluten index device market is projected to reach USD 319.8 million by 2035.

The gluten index device market is expected to grow at a 5.2% CAGR between 2025 and 2035.

The key product types in gluten index device market are centrifugation, image analysis and others.

In terms of application, food processing segment to command 54.3% share in the gluten index device market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Gluten-free Food Market Size and Share Forecast Outlook 2025 to 2035

Gluten Free Flours Market Size and Share Forecast Outlook 2025 to 2035

Gluten-free Bakery Premix Market Size and Share Forecast Outlook 2025 to 2035

Gluten Feed Market Size and Share Forecast Outlook 2025 to 2035

Gluten-Free Pizza Crust Market Size, Growth, and Forecast for 2025 to 2035

Analysis and Growth Projections for Gluten-free Product Business

Gluten-Free Soup Market Insights - Specialty Diets & Consumer Demand 2025 to 2035

Gluten-Free Pasta Market Trends - Health-Conscious Eating & Market Growth 2025 to 2035

Gluten-Free Oats Market Insights – Clean Eating & Industry Growth 2025 to 2035

Analysis and Growth Projections for Gluten Free Prepared Food Market

Gluten-Free Tortilla Market Trends – Free-From Foods & Market Growth 2024-2034

Gluten-Free Facial Product Market Trends – Growth & Forecast 2024-2034

Gluten Intolerance Treatment Market

Wheat Gluten Market Size and Share Forecast Outlook 2025 to 2035

Indexable Milling Cutters Market Size and Share Forecast Outlook 2025 to 2035

Indexable Tool Inserts Market

Rotary Indexer Market Analysis - Share, Size, and Forecast 2025 to 2035

Viscosity Index Improver Market Size and Share Forecast Outlook 2025 to 2035

Device-Embedded Biometric Authentication Market Size and Share Forecast Outlook 2025 to 2035

IoT Device Management Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA