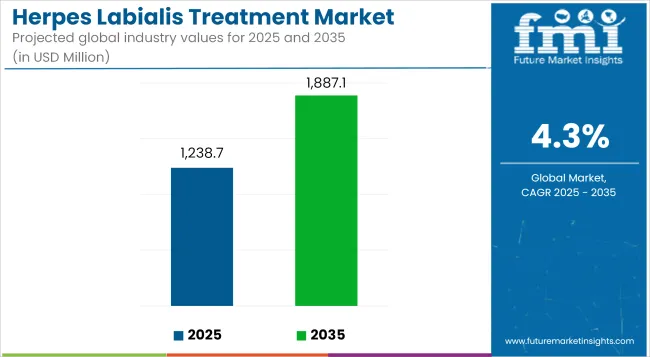

The global herpes labialis treatment market is estimated to be valued at USD 1,238.7 million in 2025 and is projected to reach USD 1,887.1 million by 2035, registering a CAGR of 4.3% over the forecast period.

| Metric | Value |

|---|---|

| Market Size (2025) | USD 1,238.7 Million |

| Market Value (2035) | USD 1,887.1 Million |

| CAGR (2025 to 2035) | 4.3% |

The herpes labialis treatment market has expanded steadily as recurrent cold sores remain a widespread health burden across geographies. Increasing patient awareness of early intervention benefits and the need for symptom suppression have driven consistent demand for both prescription antivirals and over-the-counter therapies.

Pharmaceutical manufacturers have prioritized reformulation of acyclovir, penciclovir, and valacyclovir into patient-friendly topical gels and patches to improve adherence and treatment efficacy. Regulatory approvals of novel delivery systems and bioequivalent generics have further broadened therapeutic options. Healthcare providers have emphasized timely initiation of therapy at prodromal stages, fueling prescription volumes and reinforcing the clinical value of suppressive regimens for frequent recurrences

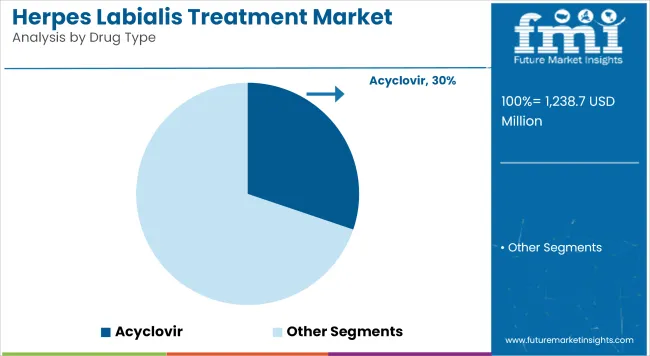

Acyclovir accounts for a revenue share of 30.2% has been attributed to acyclovir, underscoring its position as the first-line antiviral therapy for herpes labialis. This segment is driven by its well-documented safety profile, broad clinical experience, and consistent efficacy in reducing lesion duration and viral shedding.

Physicians have favored acyclovir due to its proven performance in both episodic and suppressive regimens, supporting high prescription volumes across primary care and dermatology practices. The widespread availability of affordable generics has further reinforced adoption among patients with recurrent outbreaks.

Regulatory endorsements and inclusion in treatment guidelines have solidified acyclovir’s position as the preferred antiviral agent. These factors have established acyclovir as the dominant drug type segment, with sustained growth expected as HSV-1 infection rates remain high globally.

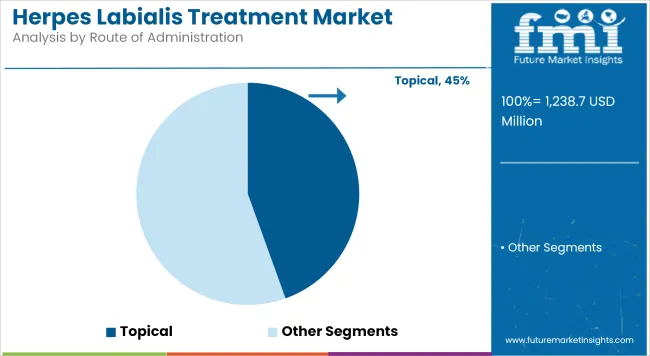

Topical Route contributes 44.5% revenue share in the overall market, reflecting their prominence in acute management of herpes labialis. This segment has been driven by the preference for localized therapy that directly targets lesions and minimizes systemic exposure.

Patients have favored topical antivirals for their ease of application, rapid symptom relief, and convenience during early outbreak stages. Manufacturers have invested in developing fast-absorbing gels, patches, and cream formulations that improve bioavailability and reduce dosing frequency. Healthcare providers have recommended topical therapies as first-line treatment for uncomplicated cases, reinforcing market share

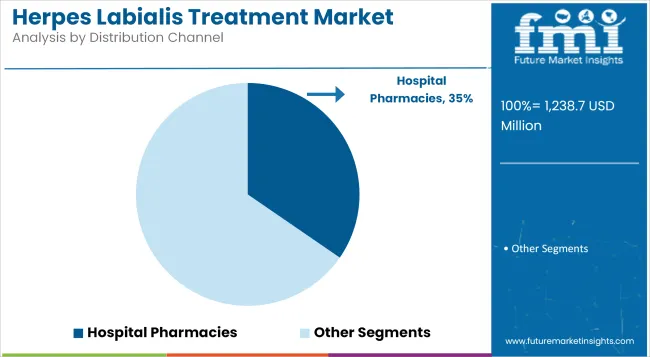

Hospital Pharmacies holds 34.6% revenue share due to their role in dispensing prescription antivirals and supporting comprehensive herpes labialis management. Utilization has been driven by hospitals’ ability to maintain consistent stock of branded and generic antiviral therapies, especially for patients with severe or immunocompromised conditions requiring specialist oversight.

Physicians have relied on hospital-based dispensing to ensure adherence to treatment regimens and monitor potential drug interactions. Hospital pharmacies have also facilitated patient education and timely initiation of suppressive therapy during acute flare-ups.

Recurring Nature of Infection and Resistance Issues

Herpes labialis, in common parlance, cold sores, would pose significant challenges due to the recurrent feature of this particular virus. Frequent reactivation of these viruses in patients requires repetitive treatment cycles, as well. Longer-term use of antiviral drugs can lead to resistance against the standard therapies of their choice, such as acyclovir and valacyclovir.

Limited Treatment Scope and Social Stigma

Treatments are addressing symptoms, they are not geared toward the eradication of the virus. This inability to get rid of HSV-1 from the system limits the long-term efficacy of the different therapeutics used. Furthermore, the presence of cold sores incurs a social stigma that distresses patients psychologically, therefore increasing demand for rapid and cosmetically acceptable therapies.

Growing Awareness and Early Diagnosis

The growing awareness of herpes labialis due to public health campaigns and improved health diagnostics, therefore, have allowed early intervention to take place. Such interventions, said to include treatment on offer, would not only shorten the duration of the outbreak but also ameliorate its severity, hence cultivating demand for affordable over-the-counter or prescription options.

Advances in Therapeutics and Delivery Mechanisms

Emerging therapies, such as topical antivirals that act rapidly, in conjunction with new delivery formats like patches and nano- carriers, offers new growth opportunities for the market. Research on vaccines for HSV and other gene-silencing approaches is providing the platform for other future options of long-term solutions.

The Herpes Labialis Treatment Market in the United States is on an impressive growth trajectory as more individuals end up developing HSV-1 infections. Due to the increasing aged population coupled with the rising number of individuals suffering from cold sores, demand for new treatment continues to improve.

The nation's strong healthcare infrastructure, reputable pharmaceutical market, and available health insurance coverage ensure the vast access to treatment.

| Country | CAGR (2025 to 2035) |

|---|---|

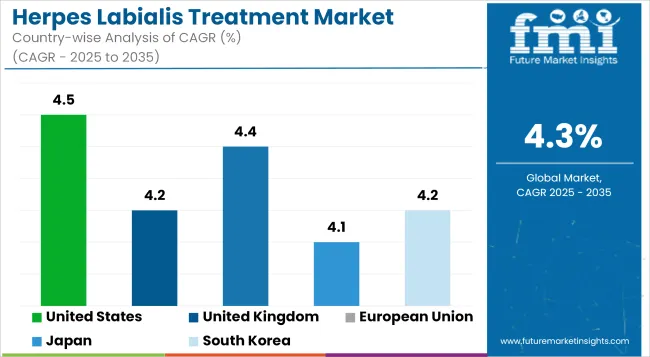

| United States | 4.5% |

In the United Kingdom, the Herpes Labialis Treatment Market is being fomented by public healthcare policies and initiatives by private health organizations. The National Health Service (NHS) is involved in making treatment options available; private health organizations make available more advanced tailor-made care.

The growing trend toward prophylactic treatment and early initiation is mainly responsible for the expanding market. Most consumers in the UK are opting for combination antiviral therapy, which allows faster relief and prevents a cold sore recurrence.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 4.2% |

The Herpes Labialis Treatment Market across the European Union (EU) supplements the Herpes Labialis Treatment Market in the United Kingdom by virtue of its wider, heterogeneous population and strong pharmaceutical industries. With the rising prescription demand for antiviral treatments and over-the-counter remedies for herpes labialis, there are increasing market chances.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union | 4.4% |

In Japan, the Herpes Labialis Treatment Market is being stimulated by individual interest in and emphasis upon health awareness and preventive medicine. Thus, the early intervention and treatment of viral infections such as HSV-1 have increasingly been adopted by the populace.

Further, Japan counts highly on this highly advanced healthcare system for speedy treatment and access to effective antiviral drugs. New treatment options, such as combination therapies and new topical formulations, are part of the evolution shaping the changing demography seen in the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.1% |

Herpes Labialis Treatment Market in South Korea is significantly stoked by the fast uptake of advanced dermatological treatments combined with the rise in incidence rates of herpes simplex virus infections. The strong healthcare system in the country in combination with high access to medications has been major drivers for this market. South Korea is really oriented towards the individual toward wellness in general-most encompassing therein would be skin health.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.2% |

The competitive landscape has been shaped by manufacturers investing in novel topical delivery systems, fast-dissolving patches, and combination regimens to differentiate products. Leading players have prioritized lifecycle management strategies, including pediatric formulations and single-dose options, to expand market reach.

Generic manufacturers have introduced cost-competitive alternatives that maintain adherence to regulatory standards. Digital marketing initiatives and patient education campaigns have increased awareness of early treatment benefits. These activities are expected to sustain strong competition and drive innovation in herpes labialis therapeutics over the coming years.

Key Development

In 2025, Theralase® Technologies announced that their drug, Ruvidar™, proved more effective in treating Herpes Simplex Virus, Type 1 (HSV-1). Preclinical animal model results showed superiority over FDA-approved standard treatments, Acyclovir (5%) and Abreva (10% Docosanol)..

In 2024, GSK announced the completion of primary data analysis from its phase II TH HSV REC-003 trial. This early-stage study assessed the potential efficacy of GSK3943104, a therapeutic herpes simplex virus (HSV) vaccine candidate, as a crucial step before further clinical development.

The overall market size for Herpes Labialis Treatment market was USD 1,238.7 Million in 2025.

The Herpes Labialis Treatment market is expected to reach USD 1,887.1 Million in 2035.

The demand for herpes labialis treatment will be driven by increasing prevalence of cold sores, advancements in antiviral drugs.

The top 5 countries which drives the development of Herpes Labialis Treatment market are USA, European Union, Japan, South Korea and UK.

Acyclovir demand supplier to command significant share over the assessment period.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Genital Herpes Treatment Market is segmented by transplant type, disease indication, and end user from 2025 to 2035

Herpes Simplex Keratitis Treatment Market – Trends & Forecast 2025 to 2035

Herpes Zoster Ophthalmicus Market Size and Share Forecast Outlook 2025 to 2035

Treatment-Resistant Hypertension Management Market Size and Share Forecast Outlook 2025 to 2035

Treatment-Resistant Depression Treatment Market Size and Share Forecast Outlook 2025 to 2035

Treatment Pumps Market Insights Growth & Demand Forecast 2025 to 2035

Pretreatment Coatings Market Size and Share Forecast Outlook 2025 to 2035

Air Treatment Ozone Generator Market Size and Share Forecast Outlook 2025 to 2035

CNS Treatment and Therapy Market Insights - Trends & Growth Forecast 2025 to 2035

Seed Treatment Materials Market Size and Share Forecast Outlook 2025 to 2035

Acne Treatment Solutions Market Size and Share Forecast Outlook 2025 to 2035

Scar Treatment Market Overview - Growth & Demand Forecast 2025 to 2035

Soil Treatment Chemicals Market

Water Treatment System Market Size and Share Forecast Outlook 2025 to 2035

Water Treatment Chemical Market Size and Share Forecast Outlook 2025 to 2035

Algae Treatment Chemical Market Forecast and Outlook 2025 to 2035

Water Treatment Market Size and Share Forecast Outlook 2025 to 2035

Water Treatment Ozone Generator Market Size and Share Forecast Outlook 2025 to 2035

Water Treatment Equipment Market Size and Share Forecast Outlook 2025 to 2035

Burns Treatment Market Overview – Growth, Demand & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA