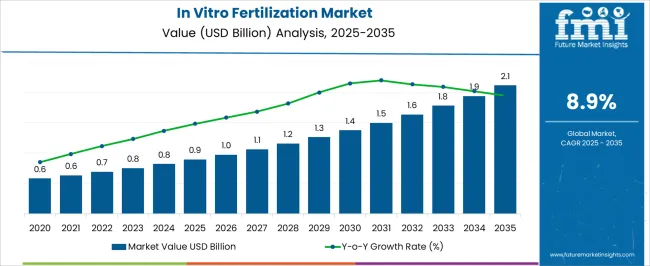

The In Vitro Fertilization Market is estimated to be valued at USD 0.9 billion in 2025 and is projected to reach USD 2.1 billion by 2035, registering a compound annual growth rate (CAGR) of 8.9% over the forecast period.

| Metric | Value |

|---|---|

| In Vitro Fertilization Market Estimated Value in (2025 E) | USD 0.9 billion |

| In Vitro Fertilization Market Forecast Value in (2035 F) | USD 2.1 billion |

| Forecast CAGR (2025 to 2035) | 8.9% |

The in vitro fertilization (IVF) market is experiencing steady expansion, driven by the rising prevalence of infertility, delayed family planning, and advancements in reproductive technologies. Industry updates and clinical publications have emphasized the growing adoption of IVF procedures due to improved success rates, supported by innovations in culture media, incubators, and genetic screening tools.

Governments and healthcare organizations have also increased funding and awareness campaigns to support assisted reproductive technologies, reducing social stigma and enhancing treatment accessibility. Investor briefings from fertility service providers have highlighted expansions in IVF infrastructure, particularly in emerging economies where medical tourism for fertility treatments is rising.

Furthermore, the integration of digital monitoring platforms and automated systems in laboratories has enhanced procedural efficiency and patient outcomes. Looking ahead, the market’s trajectory is expected to be shaped by continued technological improvements, broader insurance coverage, and increasing patient demand, with growth concentrated in equipment, fresh non-donor cycles, and fertility clinics as primary revenue drivers.

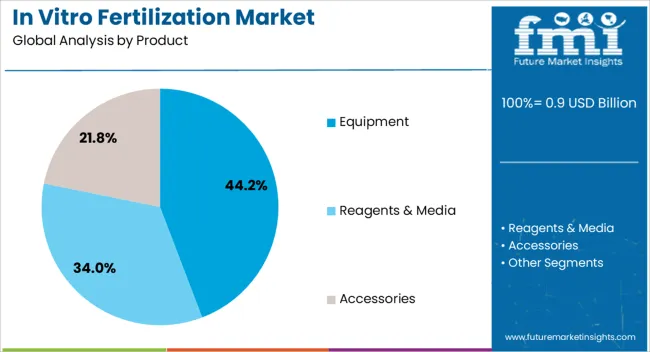

The Equipment segment is projected to contribute 44.2% of the IVF market revenue in 2025, establishing itself as the leading product category. This dominance has been driven by the growing reliance on advanced incubators, imaging systems, and cryopreservation devices that ensure higher procedural accuracy and success rates.

Fertility centers have increasingly adopted technologically advanced equipment to improve embryo culture conditions and reduce the risks of contamination. Additionally, automation and digital integration in IVF laboratories have enhanced consistency and reduced operator-related variability.

Industry announcements from equipment manufacturers have highlighted ongoing innovation in time-lapse monitoring and microfluidic systems, further strengthening the segment’s growth. As demand for high-quality IVF procedures continues to rise globally, investment in specialized equipment remains central to ensuring clinical success and patient confidence, solidifying the Equipment segment’s leadership position.

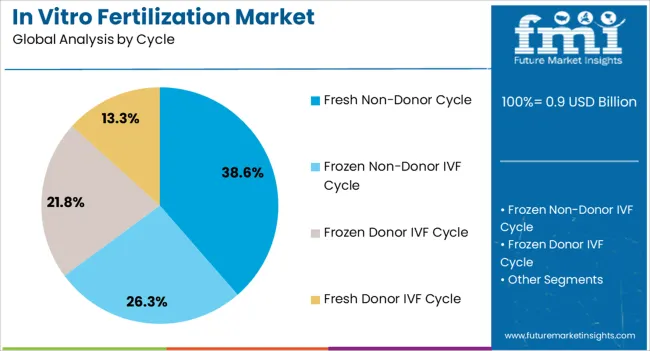

The Fresh Non-Donor Cycle segment is projected to account for 38.6% of the IVF market revenue in 2025, maintaining its leadership among treatment cycles. This prominence has been attributed to its higher success rates compared to frozen or donor cycles, as well as its widespread adoption in clinical practice.

Clinical journals have reported that fresh non-donor cycles typically yield favorable fertilization and implantation outcomes, which has sustained physician preference. Additionally, patients often opt for this cycle type due to the reduced waiting time associated with embryo transfer and the perception of natural continuity in the reproductive process.

Regulatory frameworks in several regions have also encouraged the use of non-donor cycles by promoting patient-specific fertility treatments. As awareness and acceptance of IVF expand, the Fresh Non-Donor Cycle segment is expected to retain its share, supported by clinical effectiveness and continued innovation in laboratory practices that enhance embryo viability.

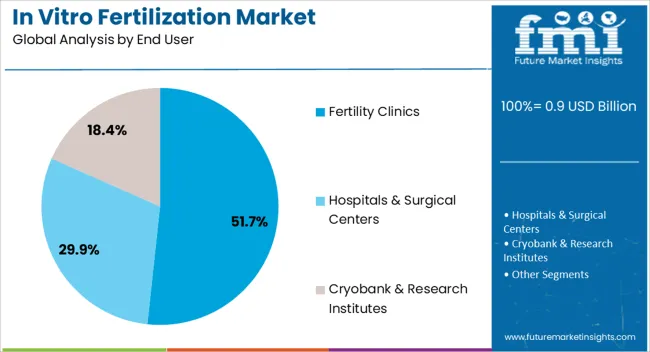

The Fertility Clinics segment is projected to capture 51.7% of the IVF market revenue in 2025, establishing itself as the dominant end-user category. This leadership has been underpinned by the growing number of specialized fertility centers that offer comprehensive IVF services under one roof.

Fertility clinics have become the preferred destination for patients due to their specialized expertise, advanced laboratory infrastructure, and personalized treatment protocols. Press releases from healthcare providers have noted significant expansions in fertility clinic networks, particularly in urban centers, to meet rising patient demand.

Moreover, fertility clinics have benefited from medical tourism, as patients travel internationally to access affordable and high-quality IVF services. Enhanced patient support systems, including counseling and digital follow-ups, have further reinforced their leading role. With continued investments in infrastructure and patient-focused care models, fertility clinics are expected to remain the primary hubs for IVF treatment delivery worldwide.

| Attributes | Details |

|---|---|

| Valuation for 2020 | USD 465.6 million |

| Valuation for 2025 | USD 1746 million |

| HCAGR from 2020 to 2025 | 9.9% |

From 2020 to 2025, demand for IVF solutions increased at a CAGR of 9.9%. Rising stress levels among couples with the outbreak of the COVID-19 pandemic back in 2020, led to high risks of infertility. It encouraged them to opt for IVF solutions to conceive.

A study published in 2025 by the National Library of Medicine found that the ovary was vulnerable to coronavirus infection. However, neither the COVID-19 infection nor the vaccine had a negative effect on IVF results. Hence, the industry grew at a fast pace in the historical period.

In the forecast period 2025 to 2035, the industry is projected to witness 9% CAGR, a little lesser than the historical CAGR. Growth is anticipated to be pushed by the development of novel technologies, including embryoscope, cryopreservation, laser assisted hatching, and preimplantation genetic screening. High disposable income of millennials has encouraged them to invest in premium healthcare services like the ones mentioned above.

The segmented in vitro fertilization market analysis is encompassed in the ensuing subsection. Based on a comprehensive review, the equipment segment is ruling the product type category. Correspondingly, the fresh non-donor cycle segment is spearheading the cycle category.

| Segment | Equipment |

|---|---|

| Share (2025) | 44.2% |

The equipment sector acquires a significant share through 2035 and aids the ascendency during the forecast period, according to the global in vitro fertilization market. Their amplifying adoption characterizes this during and after IVF therapies.

The innovations in semen analysis techniques and the swift expansion of the embryo incubator market intensify the share of the equipment segment from the forecast period. As clinics seek pre-eminence in patient care and results, the credence of refined equipment is predominant, boosting sales.

The fresh non-donor cycle segment emerges as the segment in the global in vitro fertilization market, accounting for a considerable revenue share through 2035. This segment takes precedence over the others because of its high success rate, better birth rates compared with frozen embryos, and simpler implantation.

The soaring adoption of fresh non-donor cycles, in accordance with the global prevalence of infertility, is an impetus to this segment. The popularity of the fresh non-donor cycle retains its supremacy between 2025 and 2035.

| Segment | Fresh Non-donor Cycle |

|---|---|

| Share (2025) | 38.6% |

The frozen non-donor segment witnessed accelerated growth in the forecast period. This growth is because of higher pregnancy rates from frozen transfers at lower prices. The frozen non-donor cycle segment also imparts better efficiency for patients as well as endocrinologists. The frozen cycle segment stresses less physical and mental health, propelling the growth of this segment in the future.

The in vitro fertilization (IVF) industry can be observed in the subsequent tables, which focus on the leading regions in North America, Europe, and Asia Pacific. A comprehensive evaluation demonstrates that Asia Pacific has significant potential for the in vitro fertilization market.

Trend Analysis of In Vitro Fertilization in North America

Technological developments and the appearance of an entrenched healthcare configuration aid the sturdy growth of the in vitro fertilization market

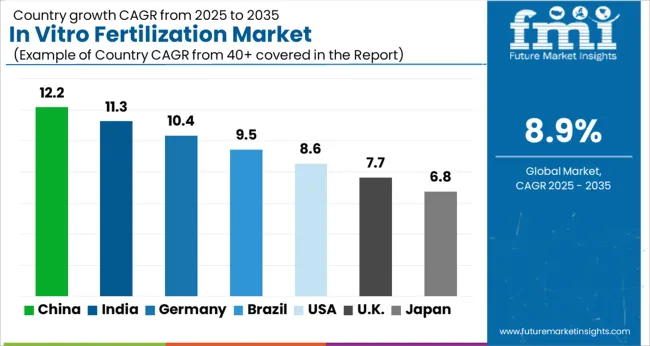

| Countries | CAGR (2025 to 2035) |

|---|---|

| Canada | 11% |

| United States | 8% |

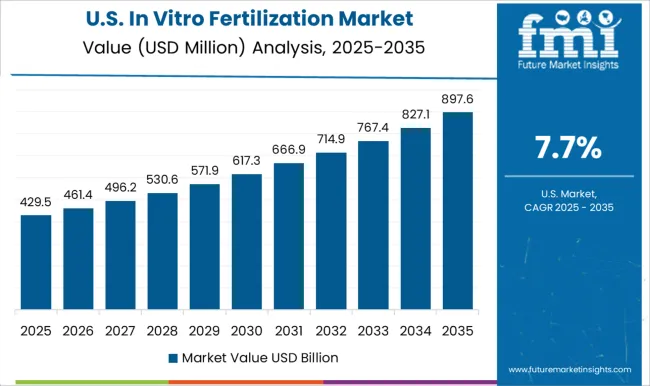

The administrative reform and insurance coverage enhancements are ushering accessibility and encouraging the expansion of IVF adoption in the United States. The changes in societal trends, like late childbirth and spurring infertility rates, propel the demand for in vitro fertilization services in the United States.

The in vitro fertilization market in Canada is indicated by an increased focus on comprehensiveness and accessibility, with endeavors to cater to the imbalance in avenues to fertility therapies. The geographical differences in medical administration and easy usage are obstacles to the distribution chain of in vitro fertilization in Canada.

The promoting realization of fertility preservation alternatives and the escalating consumption of elective egg freezing transforms the demand for the in vitro fertilization (IVF)sector in Canada.

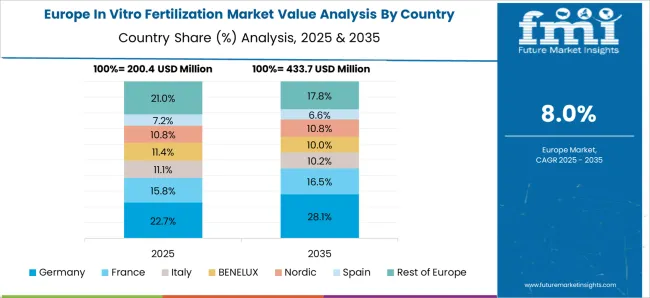

With a progressive medical structure and superior expertise, Spain lures numerous foreign patients to find demand for in vitro fertilization (IVF) treatment.

| Countries | CAGR (2025 to 2035) |

|---|---|

| Spain | 13.5% |

| Italy | 12 % |

| France | 10.8% |

| United Kingdom | 9.8% |

| Germany | 9% |

The cultural move towards late parenthood boosts a spur in the adoption of IVF services in Spain, demonstrating shifting societal standards. The medical centers in Spain concentrate on tailored care and breakthrough procedures, assisting the reputation as a dominant destination for fertility tourism.

Cultural determinants, like resilient family values and religious impacts, affect the awareness of IVF in Italy, transforming patient choices and treatment methods. Technological innovations and emphasizing on research facilitate demand for in vitro fertilization (IVF)clinics in Italy to remain at the core of innovation, thrusting ongoing advancements in success rates.

The advent of specialized fertility clinics gratifies the shifting requirements of Italian couples, dispensing customized services and complete support.

Government incentives and insurance scope make IVF procurable in France, supporting higher adoption rates and stimulating a compassionate environment for people on fertility therapies. The IVF clinics of France put forward thorough care, assimilating psychological assistance and integral treatments to address the emotional element of infertility. These factors promote the in vitro fertilization market growth in France.

Government strategies facilitating reproductive health and soothing the one-child policy advance the adoption of in vitro fertilization techniques in China.

| Countries | CAGR (2025 to 2035) |

|---|---|

| China | 16.8% |

| Japan | 12.5% |

| Australia & New Zealand | 12% |

| India | 9.7% |

The escalating disposable income and shifting way of life encourage the demand for IVF in China. The presence of a wide population base and encouraging medical administration are catalysts promoting the growth of the in vitro fertilization market in China.

Cultural determinants like pressure from society to conceive and the humiliation around infertility thrust couples towards looking at IVF therapies in Japan. The technical innovations and a high standard of medical care infrastructure encourage Japan's position as a spearheading in vitro fertilization market in the Asia Pacific.

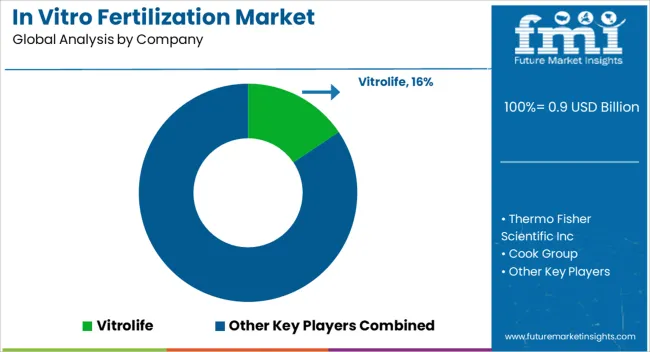

Major in vitro fertilization vendors invest in research and development to broaden their product portfolio, which assists the industry growth. The IVF providers are taking an assortment of strategic plans to expand their global presence, with key sector advancements like novel product introduction, partnership agreements, mergers and acquisitions, surged investments, and alliances with other firms.

The in vitro fertilization providers provide economical items to widen and endure in a progressively competitive and escalating market scenario. A primary business approach used by vendors to aid clients and magnify the sector is to produce regionally to curb production prices. The in vitro fertilization market has equipped medicine with some noteworthy advantages during the forecast period.

Key Developments in the In Vitro Fertilization Market

| Date and Approach | Industry Development |

|---|---|

| June 2025, New Product Launch | The launch of United States-based MilliporeSigma's novel CellToxTM Assay Platform was declared. The platform comprises a collection of IVF tests to check the security of products and medicines. |

| May 2025, New Product Launch | WuXi AppTec was introduced in China and its in vitro toxicant abilities were proliferated. Analysis was included as a segment of the expansion and a novel service for making customized in vitro assays is to be declared. |

| April 2025, Acquisition | Thermo Fisher Scientific Inc., based in the United States, acquired CooperSurgical, a dominant IVF provider. This purchase considerably strengthened Thermo Fisher's share in the IVF industry, improving its competition. |

| March 2025, Product Approval | Sweden-based Vitrolife published that it received FDA approval on its Cryotop vitrification equipment. It is an innovative procedure for vitrifying embryos. |

The market is classified based on equipment, reagents & media, and accessories.

The segment is categorized based on fresh non-donor cycle, frozen non-donor IVF cycle, frozen donor IVF cycle, and fresh donor IVF cycle.

The report consists of key end-users based on fertility clinics, hospitals & surgical centers, and cryobank & research institutes.

The market is classified into conventional IVF, IVF with ICSI, and IVF with donor eggs.

Analysis of the in vitro fertilization market has been carried out in key countries of North America, Latin America, Middle East and Africa, Asia Pacific, and Europe.

The global in vitro fertilization market is estimated to be valued at USD 0.9 billion in 2025.

The market size for the in vitro fertilization market is projected to reach USD 2.1 billion by 2035.

The in vitro fertilization market is expected to grow at a 8.9% CAGR between 2025 and 2035.

The key product types in in vitro fertilization market are equipment, reagents & media and accessories.

In terms of cycle, fresh non-donor cycle segment to command 38.6% share in the in vitro fertilization market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

In Vitro Fertilization Banking Services Market - Trends, Demand & Forecast 2025 to 2035

In vitro Fertilization Monitoring System Market

Donor Egg IVF Market Growth – Trends, Demand & Forecast 2024-2034

Cryopreservation for In-vitro Fertilization (IVF) Market - Trends & Forecast 2025 to 2035

Incline Impact Tester Market Size and Share Forecast Outlook 2025 to 2035

In-line Emulsifier Market Size and Share Forecast Outlook 2025 to 2035

Industrial Precision Oven Market Size and Share Forecast Outlook 2025 to 2035

Industrial Water Chiller for PCB Market Size and Share Forecast Outlook 2025 to 2035

Internal Anthelmintics for Cats Market Size and Share Forecast Outlook 2025 to 2035

Inorganic Cobalt Blue Pigments Market Size and Share Forecast Outlook 2025 to 2035

Injection Epoxy Chemical Anchors Market Size and Share Forecast Outlook 2025 to 2035

Industrial & Commercial HVLS Fans Market Size and Share Forecast Outlook 2025 to 2035

Industrial Robot Controller Market Size and Share Forecast Outlook 2025 to 2035

India Sustainable Tourism Market Size and Share Forecast Outlook 2025 to 2035

Invar Market Size and Share Forecast Outlook 2025 to 2035

Intelligent Road Test Instruments Market Size and Share Forecast Outlook 2025 to 2035

Intelligent Driving Technology Solution Market Size and Share Forecast Outlook 2025 to 2035

Industrial Wired Routers Market Size and Share Forecast Outlook 2025 to 2035

Infertility Treatment Market Size and Share Forecast Outlook 2025 to 2035

Industry Analysis of Outbound Tourism in Germany Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA