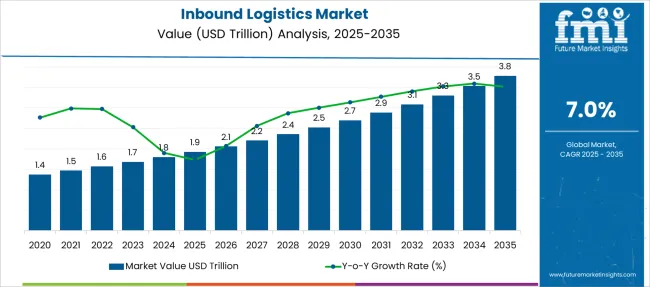

The Inbound Logistics Market is estimated to be valued at USD 1.9 trillion in 2025 and is projected to reach USD 3.8 trillion by 2035, registering a compound annual growth rate (CAGR) of 7.0% over the forecast period.

| Metric | Value |

|---|---|

| Inbound Logistics Market Estimated Value in (2025 E) | USD 1.9 trillion |

| Inbound Logistics Market Forecast Value in (2035 F) | USD 3.8 trillion |

| Forecast CAGR (2025 to 2035) | 7.0% |

Growth is being supported by the increasing adoption of digital logistics platforms, integrated transportation systems, and automation technologies that optimize inventory visibility and reduce lead times. As businesses face growing pressure to meet just-in-time manufacturing demands, inbound logistics has gained strategic significance across industries.

Rising globalization, expansion of industrial zones, and a surge in cross-border trade activities have further accelerated demand for efficient inbound logistics services. Organizations are placing greater emphasis on vendor-managed inventory, route optimization, and centralized procurement processes, which in turn is creating strong opportunities for inbound logistics providers.

Additionally, investments in data analytics, AI-based demand forecasting, and warehouse automation have enabled better resource planning and transportation coordination. The market is expected to witness continued momentum as businesses aim to build more resilient and responsive supply chain networks..

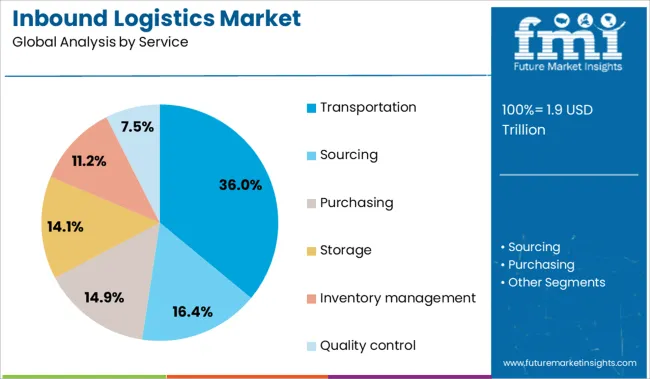

The inbound logistics market is segmented by service, transportation, organization size, and end-user and geographic regions. The inbound logistics market is divided into the following services: Transportation, Sourcing, Purchasing, Storage, Inventory management, and Quality control. In terms of transportation, the inbound logistics market is classified into Roadways, Railways, Airways, and Waterways. Based on organization size, the inbound logistics market is segmented into large enterprises and Small and medium enterprises (SMEs). The end-user of the inbound logistics market is segmented into Manufacturing, Retail & e-commerce, Automotive, Healthcare, Food and beverage, Consumer goods, Aerospace and defense, and Others. Regionally, the inbound logistics industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The transportation service segment is projected to contribute 36% of the inbound logistics market revenue share in 2025, securing its position as the leading service category. This dominance has been influenced by the central role that transportation plays in facilitating timely movement of raw materials, components, and equipment across supplier networks. With growing demand for precision and reliability in inbound supply chains, businesses have increasingly allocated resources toward dedicated transportation solutions.

The expansion of regional manufacturing hubs and global sourcing practices has intensified the need for secure and efficient transport services. Transportation providers offering real-time tracking, route optimization, and predictive maintenance capabilities have been preferred by enterprises seeking operational transparency and reduced risk.

The segment’s growth has also been supported by advancements in fleet management technologies and integration of AI-driven logistics platforms, enabling more agile and cost-effective delivery systems. As supply chain continuity becomes a competitive differentiator, transportation services are expected to remain a key focus within inbound logistics operations..

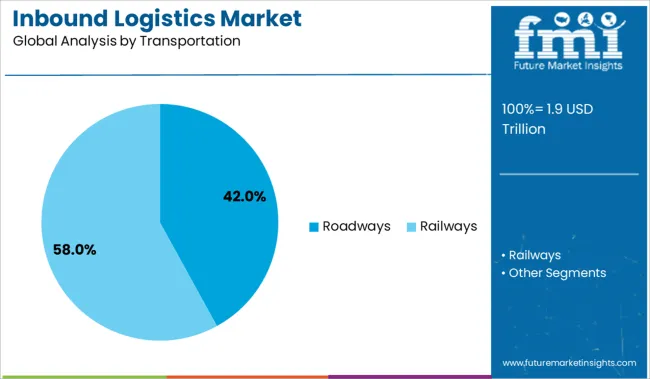

The roadways subsegment within the transportation segment is anticipated to command 42% of the inbound logistics market revenue share in 2025, making it the most prominent mode of transport. This leadership has been attributed to the flexibility, reach, and cost-efficiency offered by road-based logistics, particularly in short-haul and last-mile connectivity scenarios. As manufacturing and distribution facilities become more decentralized, roadways have continued to provide adaptable and scalable transport solutions for time-sensitive inbound flows.

Investments in highway infrastructure, smart trucking technologies, and vehicle telematics have improved speed, visibility, and reliability of road transport. The ability to serve a wider network of suppliers and production units across urban and rural geographies has reinforced the preference for roadways.

Moreover, environmental regulations and sustainability goals have prompted the adoption of greener fleet options, further modernizing the segment. Roadways are expected to maintain their dominant position due to their accessibility, responsiveness, and compatibility with multimodal logistics networks..

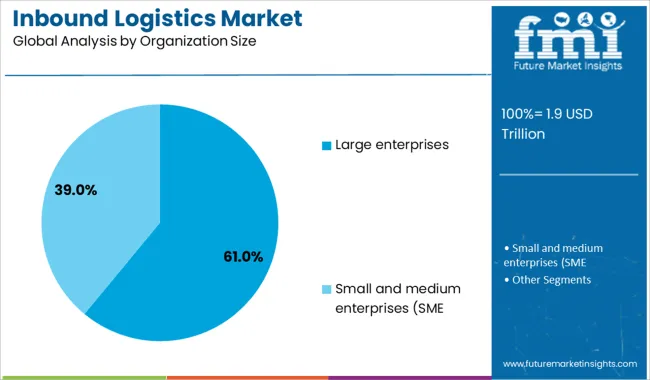

The large enterprises segment is forecasted to represent 61% of the inbound logistics market revenue share in 2025, establishing it as the leading organizational category. This dominance has been driven by the scale and complexity of supply chain operations within large corporations, which necessitate structured and high-volume inbound logistics management. These organizations often operate across multiple geographies, with intricate sourcing strategies and extensive supplier networks that require robust coordination and transport capabilities.

Large enterprises have been at the forefront of adopting digital logistics tools, advanced warehouse systems, and integrated procurement platforms to gain real-time visibility and control over inbound shipments. Their capacity to invest in dedicated logistics infrastructure and strategic partnerships has enabled them to implement scalable and cost-optimized inbound processes.

Stringent compliance standards and risk mitigation protocols have led large businesses to prioritize inbound logistics as a key area of operational efficiency. As global trade and industrial production continue to expand, large enterprises are expected to drive ongoing innovation and investment in this segment.

Demand for inbound logistics solutions is rising as manufacturers seek synchronized part flows and minimal inventory buffers. Sales of control tower platforms, dock scheduling tools, and AI-driven transport orchestration have increased in response to volatile supplier lead times and tighter assembly line windows.

Demand for AI-powered inbound logistics tools grew 28% in 2025 as supply chain planners aimed to reduce staging costs and prevent production line halts. Manufacturers using predictive ETAs and dynamic slotting engines achieved a 24% reduction in yard dwell time. Automotive and electronics factories integrated dock scheduling platforms with ERP systems, enabling 17% higher truck utilization during peak hours. In Mexico and Turkey, QR-based gate-in sequencing streamlined arrival batching, improving receiving throughput by 21%. Asia-Pacific firms deploying tiered lead-time buffers via software models reduced raw material overstocking by 19%. Inbound control towers with multi-tier supplier mapping also helped mitigate risk from geopolitical disruptions.

Sales of integrated inbound logistics systems surged 34% in 2025, fueled by labor constraints and the push for process automation. Manufacturers using scan-and-receive mobile apps cut manual check-in time by 31%. EU-based FMCG producers adopted ASN (Advanced Shipping Notice)-driven systems to pre-allocate warehouse labor, increasing dockside productivity by 18%. In Japan, auto part assemblers deploying digital Kanban triggers reduced emergency freight costs by 22%. Retail brands utilized RFID-based arrival confirmations to enable dynamic staging and unloading, shrinking unload cycle time by 3.4 hours on average. Software with cross-facility load balancing also helped flatten inbound spikes, reducing overtime payouts across distribution nodes.

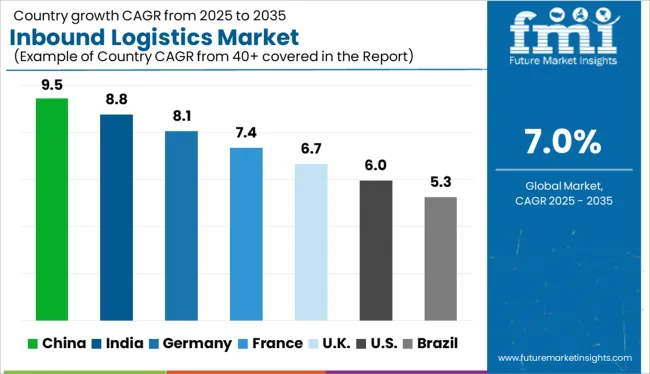

| Country | CAGR |

|---|---|

| China | 9.5% |

| India | 8.8% |

| Germany | 8.1% |

| France | 7.4% |

| UK | 6.7% |

| USA | 6.0% |

| Brazil | 5.3% |

The global market is projected to grow at a CAGR of 7.0% from 2025 to 2035. Leading the global expansion, China (BRICS) posts a strong CAGR of 9.5%, outperforming the global benchmark by 2.5 percentage points, supported by manufacturing scale, digitalized warehousing, and deep integration with supplier networks. India (BRICS) follows at 8.8% (+1.8 pp), driven by robust industrial output, port infrastructure upgrades, and government logistics reform programs. Within the OECD, Germany records 8.1% (+1.1 pp), backed by advanced automation and smart inventory systems across inbound supply chains. The UK posts 6.7% (–0.3 pp), slightly under the global average, while the United States trails at 6.0% (–1.0 pp), pointing to a more mature logistics environment with incremental optimization efforts. The report provides insights across 40+ countries. The five below are highlighted for their strategic influence and growth trajectory.

China’s inbound logistics market is on track to expand at a robust CAGR of 9.5% through 2035, supported by the scaling needs of its manufacturing and e-commerce sectors. From 2020 to 2024, growth was driven primarily by basic fleet expansion and warehouse additions. The future is now centered on smart inbound flows using IoT-based container tracking, warehouse robotics, and automated vendor coordination. China's 'Made in China 2025' initiative is fostering digital standardization across supplier chains to reduce inbound cycle time and enhance production agility.

A CAGR of 8.8% is expected for India’s inbound logistics market between 2025 and 2035, driven by factory modernization and improved multimodal connectivity. In the 2020–2024 period, the market depended heavily on road-based supply inflow and unorganized logistics operators. Moving forward, greater investment in vendor-managed inventory systems and digitally synchronized factory supply scheduling is evident. Dedicated freight corridors and government-supported logistics parks are streamlining raw material inflows, particularly across the automotive, textile, and pharma clusters.

Germany’s inbound logistics market is set to rise at a CAGR of 8.1% through 2035, supported by the country’s emphasis on just-in-sequence production and traceable supplier flows. From 2020–2024, improvements were largely focused on route optimization; now, the emphasis is on full visibility across inbound tiers. Manufacturers are investing in logistics software that enables collaboration across their European supplier base. Automation in material handling and digitized advance shipment notices (ASN) are becoming the new norm in inbound operations.

Expected to grow at a CAGR of 6.7%, the inbound logistics market in the UK is evolving rapidly as manufacturers look to reduce border-related friction and improve upstream visibility. Between 2020 and 2024, Brexit-induced uncertainty forced contingency planning in supplier logistics. Looking ahead, automation and customs-compliant software are enabling better coordination with European vendors. Electronics and food processing industries are particularly advancing the use of predictive inbound tracking and port-to-plant visibility tools to reduce delays.

The USA inbound logistics market is projected to register a CAGR of 6.0% from 2025 to 2035, driven by OEM investments in upstream supply chain transparency. From 2020–2024, many firms operated with fragmented inbound visibility. Today, focus has shifted to consolidating inbound data feeds using cloud-native logistics platforms and API-based ERP integration. The trend is especially prominent in sectors like aerospace, consumer electronics, and heavy equipment. Inbound risk management and real-time shipment intelligence are becoming embedded in operations.

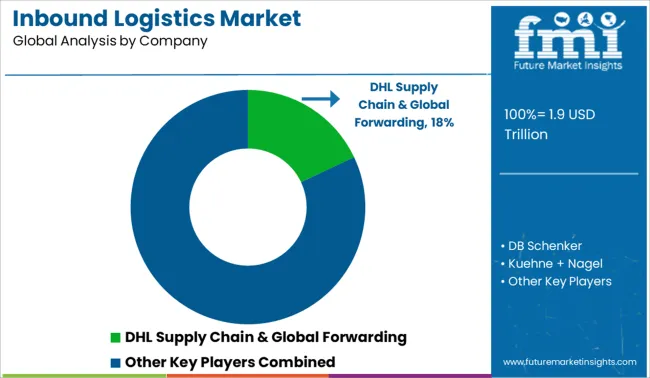

Demand for inbound logistics solutions is accelerating in 2025 due to rising pressure on manufacturers to optimize procurement cycles and inventory efficiency. DHL Supply Chain & Global Forwarding leads with a significant market share, driven by its integrated freight, warehousing, and vendor-managed inventory services across automotive and retail sectors. DB Schenker and Kuehne + Nagel are expanding capabilities in predictive ETA and shipment visibility to meet demand for resilient supply chains. C.H. Robinson and Nippon Express are capitalizing on nearshoring trends, offering agile multimodal solutions. Sales of inbound logistics services from FedEx Logistics and Maersk Logistics are also rising, particularly in North America and APAC, supported by their investment in AI-based demand forecasting and digitally orchestrated transport networks.

Recent Inbound Logistics Industry News In May 2024, DHL Supply Chain inaugurated a 34,000 m² carbon‑neutral logistics center at its Leipzig/Halle campus in Germany. The facility adds capacity for up to 55,000 pallets and supports multimodal inbound and distribution services across Europe.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.9 Trillion |

| Service | Transportation, Sourcing, Purchasing, Storage, Inventory management, and Quality control |

| Transportation | Roadways, Railways, Airways, and Waterways |

| Organization Size | Large enterprises and Small and medium enterprises (SME |

| End-User | Manufacturing, Retail & e-commerce, Automotive, Healthcare, Food and beverage, Consumer goods, Aerospace and defense, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | DHL Supply Chain & Global Forwarding, DB Schenker, Kuehne + Nagel, C.H. Robinson, Nippon Express, XPO Logistics, FedEx Logistics, and Maersk Logistics |

| Additional Attributes | Dollar sales by logistics service type and industry vertical, demand dynamics across raw material sourcing and component delivery, regional trends in supplier proximity and hub-based consolidation, innovation in digital freight matching and automated inventory reconciliation, environmental impact of inbound shipment emissions and packaging waste, and emerging use cases in just-in-sequence manufacturing and adaptive supply chain networks. |

The global inbound logistics market is estimated to be valued at USD 1.9 trillion in 2025.

The market size for the inbound logistics market is projected to reach USD 3.8 trillion by 2035.

The inbound logistics market is expected to grow at a 7.0% CAGR between 2025 and 2035.

The key product types in inbound logistics market are transportation, sourcing, purchasing, storage, inventory management and quality control.

In terms of transportation, roadways segment to command 42.0% share in the inbound logistics market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Inbound Medical Tourism Market is segmented by Treatment Type, Service Type, Customer Orientation, Age Group, and Booking Channel from 2025 to 2035

Logistics Packaging Market Size and Share Forecast Outlook 2025 to 2035

Logistics Robots Market Size and Share Forecast Outlook 2025 to 2035

Logistics Visibility Software Market Size and Share Forecast Outlook 2025 to 2035

Key Players & Market Share in the Logistics Packaging Industry

Logistics Outsourcing Market Analysis - Growth & Forecast 2025 to 2035

Logistics Visualization System Market

Logistics Automation Market

Cash Logistics Market Size and Share Forecast Outlook 2025 to 2035

Rail Logistics Market Size and Share Forecast Outlook 2025 to 2035

Intralogistics Automation Solutions Market Size and Share Forecast Outlook 2025 to 2035

Drone Logistics & Transportation Market Size and Share Forecast Outlook 2025 to 2035

Smart Logistics Services Market Size and Share Forecast Outlook 2025 to 2035

Green Logistics Market Size and Share Forecast Outlook 2025 to 2035

Event Logistics Market Size and Share Forecast Outlook 2025 to 2035

Cloud Logistics Market Insights – Demand & Growth Forecast 2025 to 2035

Timber Logistics Market Size and Share Forecast Outlook 2025 to 2035

Retail Logistics Market Size and Share Forecast Outlook 2025 to 2035

Secure Logistics Market Size and Share Forecast Outlook 2025 to 2035

Sea Air Logistics Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA