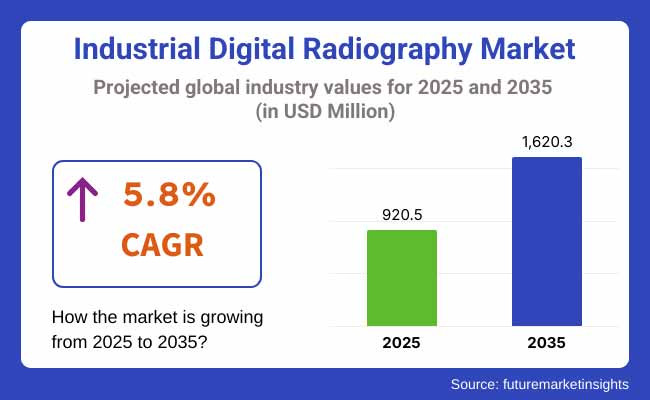

The industrial digital radiography market is expected to witness steady growth between 2025 and 2035, driven by the increasing adoption of non-destructive testing (NDT) techniques across various industries. The market was valued at USD 920.5 million in 2025 and is projected to reach USD 1,620.3 million by 2035, reflecting a compound annual growth rate (CAGR) of 5.8% over the forecast period.

Several factors contribute to the expansion of the industrial digital radiography market. The growing need for efficient and accurate inspection methods in aerospace, automotive, and manufacturing industries is a significant driver. Advancements in imaging technologies, including high-resolution X-ray detectors, AI-powered image processing, and real-time monitoring, have further enhanced the adoption of digital radiography solutions. Additionally, stringent regulatory standards for quality control and safety in industrial processes are fuelling market growth.

Despite the promising outlook, challenges such as the high cost of digital radiography systems, data security concerns, and technical limitations in handling complex materials may hinder market expansion. However, ongoing technological innovations, increasing automation in industrial inspection, and the development of portable radiography solutions are expected to create new growth opportunities.

The market is expanding, owing to factors such as the need for enhanced quality control, improved safety standards, and the integration of advanced analytics in imaging techniques. The growing automated and AI-based inspection approach is expected to be a major factor driving growth in the market in the coming decade.

The North American industrial digital radiography market is led by stringent industrial safety regulations, innovations in non-destructive testing (NDT) technologies, and growing uptake of digital imaging solutions. The strong industrial infrastructure in the United States and Canada, aerospace and defence investments in these countries and growing requirements from manufacturers for precision testing will continue to position the United States and Canada as leaders within the region.

Rising need of quality inspection in industries such as automotive, oil & gas, and power generation is driving the growth of inspection robotics market. Market expansion is also driven by the presence of key industry players and technological innovations in high-resolution digital detectors and AI-driven image analysis.

The European market is one of the major markets for industrial digital radiography owing to strong regulatory frameworks, established manufacturing sector and increasing adoption of automated NDT solutions. Germany, the UK, France, and Italy are among the following, they benefit from technological developments and high demand from growth industries such as aerospace, automotive and energy.

With a growing emphasis on quality assurance, material integrity and safety standards, there has been a shift toward the use of digital radiography from traditional methods in the region. In fact, government initiatives to boost industrial innovation and digital transformation accelerate the growth of the market. Nonetheless, uncertainties revolving around the economy and significant initial capital investments for digital radiography devices will restrict the market expansion.

The industrial digital radiography market in the Asia-Pacific region is anticipated to witness the highest growth rate, driven by rapid industrialization, booming manufacturing sectors, and rising demand for advanced NDT solutions. High demand for industrial equipment and machineries in countries including China, India, Japan, South Korea etc. Investing considerably on automotive, aerospace and solid infrastructure is boosting the demand of high-precision inspection technology in respective industries.

With its efficiency, effectiveness, and cracks in complex structures, the adoption of digital radiography is on the rise. Government initiatives promoting industrial safety and quality assurance also contribute to market expansion. High costs of equipment, unaffordability, and regulatory issues are likely to hinder market penetration.

Challenges

High Initial Investment and Operational Costs

Industrial digital radiography (DR) systems need a lot of initial investments e.g. hardware, software, training. The necessity of specialized advanced X-ray detectors, high-resolution imaging systems, and AI-driven analysis tools means that adoption is cost prohibitive for small and mid-sized enterprises (SMEs). Moreover, operations and compliance with radiological safety standards add to long-term operation costs. Manufacturers need to find cost-effective, scalable solutions and consider leasing or subscription-based models to improve accessibility.

Opportunities

Advancements in AI-Powered Image Processing and Automation

AI, machine learning, and automation are playing a significant role in this industrial DR as AI-powered defect detection solutions, real-time imaging analytics in NDT, real-time analysis and predictive maintenance in aerospace inspections, and machine learning applications in manufacturing can enhance efficiency. In a world hungry for speed efficient, accurate and automated imaging solutions, businesses that continue to develop cloud-based AI diagnostics, automated flaw detection, or digital workflow integration will have a competitive advantage.

Industrial DR continued to be widely adopted across precision-driven sectors from automotive, aerospace, and energy between 2020 and 2024, as the need for speed and regulatory compliance necessitated the emergence of DR tools. The movie radiography imaging mission replaced the old movie physics with digital imaging both improved the inspection process and presentational accuracy. But high costs of equipment and skilled labour shortages limited widespread adoption.

Although this report focuses on 2025 to 2035, there will be significant progress and adoption in AI-driven automation, real-time cloud-based image analysis, and 3D computed tomography (CT) integration for industrial DR during this intermediate time. Portable digital X-ray systems, robotics-assisted inspections with real-time-image monitoring on smartphones and quantum imaging technology can transform non-destructive testing (NDT) and industrial quality assurance.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Stricter safety and quality compliance in NDT |

| Technological Advancements | Growth in digital X-ray and real-time imaging |

| Industry Adoption | Transition from film to digital radiography |

| Supply Chain and Sourcing | Dependence on high-cost digital detectors |

| Market Competition | Dominance of key industrial X-ray solution providers |

| Market Growth Drivers | Demand for precision NDT in aerospace and automotive |

| Sustainability and Energy Efficiency | Increased adoption of eco-friendly radiography solutions |

| Consumer Preferences | Demand for high-speed, real-time defect analysis |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | AI-driven automated compliance monitoring |

| Technological Advancements | Integration of AI-powered defect detection and 3D imaging |

| Industry Adoption | Full adoption of AI-assisted and cloud-based radiography |

| Supply Chain and Sourcing | Development of cost-effective, portable DR solutions |

| Market Competition | Expansion of AI-driven start-ups in automated imaging |

| Market Growth Drivers | Rise of smart factories and AI-powered industrial inspections |

| Sustainability and Energy Efficiency | Ultra-low radiation imaging and sustainable digital workflows |

| Consumer Preferences | Preference for automated, AI-powered, and cloud-connected DR solutions |

Strong industrial sector, high adoption of non-destructive testing (NDT) methods, and constant growth of imaging technology drives USA market. Digital radiography is also widely adopted for quality control, flaw detection and material testing in the aerospace and defence industries, given their stringent safety and compliance requirements.

Moreover, automotive and oil & gas industries are also increasingly adopting digital radiography for fast and accurate inspection as the downtime is minimum while concierge reviews are part of the process which enhances operational efficiency. Government mandates for non-destructive testing methods drive market growth, while investment in AI-based imaging products is improving the performance of digital radiography in industrial applications.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 5.6% |

In the UK, there has been a gradual increase in the adoption of industrial digital radiography, which has been further fuelled by the demand for accurate testing in the manufacturing, aerospace and defence industries. Automation process control is used in many industrial processes, and quality control in this automated environment has led to the increased implementation of advanced inspection techniques to meet product quality and regulatory compliance needs.

Furthermore, market growth has been boosted by the involvement of prominent companies investing in AI-driven imaging products and cloud-based examinations in radiography. Rising government leads to Digital transformation across industries also contributing to market growth

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 5.1% |

The European Union industrial digital radiography market is expected to grow considerably, led by Germany, France, and Italy. There is a strong manufacturing base in the region and strict safety regulations that make regular non-destructive testing mandatory. Automotive and energy sectors are the front runners in the adoption of digital radiography for weld inspection, structural analysis, and defect detection.

Moreover, technologies like high-resolution imaging and real-time radiography enable the non-destructive testing process, thereby improving overall testing performance, promoting better industrial performance. The market is being driven by the convergence of smart imaging systems with IoT and cloud platform due to the emergence of Industry 4.0.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union | 5.4% |

Geographically, the Japan industrial digital radiography market is segmented into the Americas, Europe, Asia-Pacific, and Middle East and Africa. The high-quality production in conjunction of defect-free components in the country has led to introducing advanced NDT methods such as digital radiography.

Moreover, with the advent of AI and machine learning, automated image analysis is becoming more refined and accurate, which not only improves the efficiency of the process but also decreases the dependency on manual inspection. Thus, climbing adoption of digital radiography in robotics, semiconductor manufacturing, and automotive sectors is further boosting the market traction.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.2% |

As manufacturing in electronics, automotive, and semiconductors picks up, South Korea is becoming a major player in the industrial digital radiography market. On top of these regulations, the nation's push for innovation and smart factory initiatives has facilitated adoption of digital radiography for quality control and defect analysis.

The growing demand for automation in industrial processes and technology advancement for manufacturing processes are expected to boost the growth of the market. Relationships between research institutions and industry players are also paving the way for AI-based imaging solutions, improving the precision and efficiency of inspections.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.7% |

The industrial digital radiography market is evolving rapidly, propelled by the advancement of technology and exploration of non-destructive inspection (NDI) in various industries. Digital radiography (DR) has started to play a vital role in quality control, safety inspections, and failure analysis, providing better image quality, immediate data processing, and improved defect detection as compared to the conventional radiography approaches. The key drivers of the market are the increasing adoption of automated and AI-powered radiographic systems that help to optimize industries' inspection processes while reducing operational costs and downtimes.

The demand for advanced imaging technologies is being driven by regulatory standards and safety compliance in aerospace, automotive, oil & gas, and other industries. Some companies are implementing more efficient and accurate portable and high-resolution radiographic systems to capture smaller defects. Moreover, the market is witnessing a shift from film-based radiography to digital solutions owing to environmental concerns and cost-efficiency, thereby, contributing to its growth trajectory.

Among the various technologies used in imaging, the direct radiography (DR) segment dominates the market, as it provides high-resolution images quickly and is highly efficient. In contrast to compute radiography (CR) (which requires an intermediate processing step), DR allows real-time imaging, enabling industries to identify defects immediately and undertake corrective actions without delay. DR is considered the standard for advanced imaging applications such as aerospace, automotive and manufacturing due to its effective methods of imaging, data storage and integration into automated inspection systems.

Given the pressing need for precision and quality in industries like aerospace and medical device manufacturing, CT is finding increasing use in industrial applications. CT provides 3D visualization of intricate components allowing for complex structural analysis and failure investigation. CT is also being increasingly adopted in additive manufacturing and electronics, as it enables manufacturers to inspect complex geometries and internal structures with unprecedented accuracy.

Conversely, computed radiography (CR) is still in use in industry migrating from traditional x-ray film to digital methods. Although CR is less expensive than DR, it is less popular in high-speed production environments due to slower image processing and the use of phosphor (or photostimulable phosphor) imaging plates. Nevertheless, CR is still applicable, as it might suit the cases when using moderate imaging speed and low pricing takes precedence over real-time results.

The most important end-use market components are: aerospace & defence as one of the major market growth drivers due to the strict safety regulations and the nature of the aircraft component inspection. Electronic systems for digital radiography are crucial for inspecting aerospace materials, where compliance with international safety standards is critical for structural integrity, crack, and porosity detection. Increased production of both commercial and military aircraft, coupled with rising investments in space exploration, is also bolstering demand for advanced radiographic inspection technologies.

Another important factor fuelling the industrial digital radiography market is the automotive industry. With the automotive industry moving toward lighter materials and electric vehicles, manufacturers are looking for accurate NDT techniques to inspect welds, battery parts and composite frameworks. Digital Radiography was essential to maintaining quality control on production lines as it improved workflow and cut inspection time.

Industrial digital radiography is widely used in the oil & gas sector including for pipeline inspections, weld integrity checks, and corrosion tracking. Since oil & gas operations are dangerous, it is important to maintain structural integrity through accurate radiographic testing. Portable and high-energy digital radiography systems enable on-site inspections to ensure operational safety and efficiency in off-the-beaten-path and offshore locations.

At the same time, the manufacturing sector has seen a growing tendency for industrial digital radiography, especially for use in metal casting, electronics and 3D-printed elements. To meet the increasing demands for defect detection accuracy and quality assurance, investments in advanced radiographic solutions are on the rise. With the rise of Industry 4.0 and the increased need for automated inspection solutions, manufacturers can reduce their workload while maintaining high production standards.

With industries switching to prioritize safety, efficiency, and regulatory compliance, the industrial digital radiography market is expected to see upward movement. Advancements, such as AI-driven imaging, portable radiographic devices, and 3D radiography solutions, are anticipated to further improve the capabilities of the market, rendering digital radiography an essential adjunct to industrial quality assurance and non-destructive testing applications.

Industrial digital radiography provides an in-depth overview of the historical, current, and projected earnings of this industry and also accounts for an immensely multi-billion-dollar industry, offering a glimpse into what are some of the competitive facets driving value across the business landscape and influencing benefits and the future of the competitive landscape. The companies are applying AI-enabled image diagnosis, portable radiography systems, and face specificity automation in inspection processes.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| General Electric (GE) | 20-24% |

| Fujifilm Holdings | 15-19% |

| Carestream Health | 12-16% |

| Canon Inc. | 10-14% |

| Other Companies (Combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| General Electric (GE) | Develops high-resolution industrial radiography systems for aerospace, oil & gas, and automotive applications. |

| Fujifilm Holdings | Specializes in portable X-ray imaging, digital detector arrays (DDAs), and advanced image processing software. |

| Carestream Health | Offers computed radiography (CR) and digital radiography (DR) solutions for high-speed industrial inspections. |

| Canon Inc. | Focuses on flat-panel detectors and high-precision digital imaging for non-destructive testing (NDT). |

Key Company Insights

General Electric (GE) (20-24%)}

The industrial digital radiography market has its leader in GE with its high-end X-ray inspection systems applied in the aerospace, power generation, and manufacturing sectors. With its advanced AI defect-detection and automated inspection processes, the company solidifies its leadership in the market.

Fujifilm Holdings (15-19%)

Fujifilm provides portable, high-performance industrial imaging solutions for pipeline inspection, automotive manufacturing, material testing, and more. The company’s vision for image enhancement and AI-assisted diagnostics are a real differentiator.

Carestream Health (12-16%)

Carestream is a leading provider of compute and digital radiography solutions, including high-performance, versatile, high-speed imaging for non-destructive testing (NDT) applications. Market position is supported by innovations in wireless imaging and digital detector technologies.

Canon Inc. (10-14%)

Canon specializes in high-resolution imaging solutions and offers precision inspection in aerospace, electronics and heavy industries with flat-panel detectors and digital radiography (DR) systems. And its know-how in sensor technology and image processing contributes to its growth in market share.

Other Players (30-40% Combined)

The industrial digital radiography market is dominated by a few players heavily investing in developing advanced imaging solutions, introducing automation processes, and enabling AI-based analysis. Key players include:

The overall market size for the industrial digital radiography market was USD 920.5 million in 2025.

The industrial digital radiography market is expected to reach USD 1,620.3 million in 2035.

The demand for industrial digital radiography is expected to rise due to the increasing adoption of non-destructive testing (NDT) techniques, advancements in imaging technology, stringent quality control regulations, and the need for efficient inspection methods across industries such as aerospace, automotive, and manufacturing.

The top five countries driving the development of the industrial digital radiography market are the USA, Germany, China, Japan, and the UK.

Computed radiography (CR) and direct digital radiography (DDR) are expected to dominate the market due to their enhanced imaging capabilities, improved efficiency, and growing adoption in industrial inspection applications.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Value (US$ Million) Forecast by Imaging Technology, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 4: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 5: North America Market Value (US$ Million) Forecast by Imaging Technology, 2018 to 2033

Table 6: North America Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 7: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 8: Latin America Market Value (US$ Million) Forecast by Imaging Technology, 2018 to 2033

Table 9: Latin America Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 10: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 11: Western Europe Market Value (US$ Million) Forecast by Imaging Technology, 2018 to 2033

Table 12: Western Europe Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 13: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Eastern Europe Market Value (US$ Million) Forecast by Imaging Technology, 2018 to 2033

Table 15: Eastern Europe Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 16: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 17: South Asia and Pacific Market Value (US$ Million) Forecast by Imaging Technology, 2018 to 2033

Table 18: South Asia and Pacific Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 19: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 20: East Asia Market Value (US$ Million) Forecast by Imaging Technology, 2018 to 2033

Table 21: East Asia Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 22: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 23: Middle East and Africa Market Value (US$ Million) Forecast by Imaging Technology, 2018 to 2033

Table 24: Middle East and Africa Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Imaging Technology, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by End Use, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 5: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 6: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 7: Global Market Value (US$ Million) Analysis by Imaging Technology, 2018 to 2033

Figure 8: Global Market Value Share (%) and BPS Analysis by Imaging Technology, 2023 to 2033

Figure 9: Global Market Y-o-Y Growth (%) Projections by Imaging Technology, 2023 to 2033

Figure 10: Global Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 13: Global Market Attractiveness by Imaging Technology, 2023 to 2033

Figure 14: Global Market Attractiveness by End Use, 2023 to 2033

Figure 15: Global Market Attractiveness by Region, 2023 to 2033

Figure 16: North America Market Value (US$ Million) by Imaging Technology, 2023 to 2033

Figure 17: North America Market Value (US$ Million) by End Use, 2023 to 2033

Figure 18: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 19: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 20: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 21: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 22: North America Market Value (US$ Million) Analysis by Imaging Technology, 2018 to 2033

Figure 23: North America Market Value Share (%) and BPS Analysis by Imaging Technology, 2023 to 2033

Figure 24: North America Market Y-o-Y Growth (%) Projections by Imaging Technology, 2023 to 2033

Figure 25: North America Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 26: North America Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 27: North America Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 28: North America Market Attractiveness by Imaging Technology, 2023 to 2033

Figure 29: North America Market Attractiveness by End Use, 2023 to 2033

Figure 30: North America Market Attractiveness by Country, 2023 to 2033

Figure 31: Latin America Market Value (US$ Million) by Imaging Technology, 2023 to 2033

Figure 32: Latin America Market Value (US$ Million) by End Use, 2023 to 2033

Figure 33: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 34: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 35: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 36: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 37: Latin America Market Value (US$ Million) Analysis by Imaging Technology, 2018 to 2033

Figure 38: Latin America Market Value Share (%) and BPS Analysis by Imaging Technology, 2023 to 2033

Figure 39: Latin America Market Y-o-Y Growth (%) Projections by Imaging Technology, 2023 to 2033

Figure 40: Latin America Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 41: Latin America Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 42: Latin America Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 43: Latin America Market Attractiveness by Imaging Technology, 2023 to 2033

Figure 44: Latin America Market Attractiveness by End Use, 2023 to 2033

Figure 45: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 46: Western Europe Market Value (US$ Million) by Imaging Technology, 2023 to 2033

Figure 47: Western Europe Market Value (US$ Million) by End Use, 2023 to 2033

Figure 48: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 49: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 50: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 51: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 52: Western Europe Market Value (US$ Million) Analysis by Imaging Technology, 2018 to 2033

Figure 53: Western Europe Market Value Share (%) and BPS Analysis by Imaging Technology, 2023 to 2033

Figure 54: Western Europe Market Y-o-Y Growth (%) Projections by Imaging Technology, 2023 to 2033

Figure 55: Western Europe Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 56: Western Europe Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 57: Western Europe Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 58: Western Europe Market Attractiveness by Imaging Technology, 2023 to 2033

Figure 59: Western Europe Market Attractiveness by End Use, 2023 to 2033

Figure 60: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 61: Eastern Europe Market Value (US$ Million) by Imaging Technology, 2023 to 2033

Figure 62: Eastern Europe Market Value (US$ Million) by End Use, 2023 to 2033

Figure 63: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 64: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 65: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 66: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 67: Eastern Europe Market Value (US$ Million) Analysis by Imaging Technology, 2018 to 2033

Figure 68: Eastern Europe Market Value Share (%) and BPS Analysis by Imaging Technology, 2023 to 2033

Figure 69: Eastern Europe Market Y-o-Y Growth (%) Projections by Imaging Technology, 2023 to 2033

Figure 70: Eastern Europe Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 71: Eastern Europe Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 72: Eastern Europe Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 73: Eastern Europe Market Attractiveness by Imaging Technology, 2023 to 2033

Figure 74: Eastern Europe Market Attractiveness by End Use, 2023 to 2033

Figure 75: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 76: South Asia and Pacific Market Value (US$ Million) by Imaging Technology, 2023 to 2033

Figure 77: South Asia and Pacific Market Value (US$ Million) by End Use, 2023 to 2033

Figure 78: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 79: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 80: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 81: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 82: South Asia and Pacific Market Value (US$ Million) Analysis by Imaging Technology, 2018 to 2033

Figure 83: South Asia and Pacific Market Value Share (%) and BPS Analysis by Imaging Technology, 2023 to 2033

Figure 84: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Imaging Technology, 2023 to 2033

Figure 85: South Asia and Pacific Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 86: South Asia and Pacific Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 87: South Asia and Pacific Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 88: South Asia and Pacific Market Attractiveness by Imaging Technology, 2023 to 2033

Figure 89: South Asia and Pacific Market Attractiveness by End Use, 2023 to 2033

Figure 90: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 91: East Asia Market Value (US$ Million) by Imaging Technology, 2023 to 2033

Figure 92: East Asia Market Value (US$ Million) by End Use, 2023 to 2033

Figure 93: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 94: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 95: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 96: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 97: East Asia Market Value (US$ Million) Analysis by Imaging Technology, 2018 to 2033

Figure 98: East Asia Market Value Share (%) and BPS Analysis by Imaging Technology, 2023 to 2033

Figure 99: East Asia Market Y-o-Y Growth (%) Projections by Imaging Technology, 2023 to 2033

Figure 100: East Asia Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 101: East Asia Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 102: East Asia Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 103: East Asia Market Attractiveness by Imaging Technology, 2023 to 2033

Figure 104: East Asia Market Attractiveness by End Use, 2023 to 2033

Figure 105: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 106: Middle East and Africa Market Value (US$ Million) by Imaging Technology, 2023 to 2033

Figure 107: Middle East and Africa Market Value (US$ Million) by End Use, 2023 to 2033

Figure 108: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 109: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 110: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 111: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 112: Middle East and Africa Market Value (US$ Million) Analysis by Imaging Technology, 2018 to 2033

Figure 113: Middle East and Africa Market Value Share (%) and BPS Analysis by Imaging Technology, 2023 to 2033

Figure 114: Middle East and Africa Market Y-o-Y Growth (%) Projections by Imaging Technology, 2023 to 2033

Figure 115: Middle East and Africa Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 116: Middle East and Africa Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 117: Middle East and Africa Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 118: Middle East and Africa Market Attractiveness by Imaging Technology, 2023 to 2033

Figure 119: Middle East and Africa Market Attractiveness by End Use, 2023 to 2033

Figure 120: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Industrial Dust Treatment System Market Size and Share Forecast Outlook 2025 to 2035

Industrial Vertical Washing Tower Market Size and Share Forecast Outlook 2025 to 2035

Industrial Electronics Packaging Market Forecast and Outlook 2025 to 2035

Industrial Absorbent Market Forecast and Outlook 2025 to 2035

Industrial Furnace Industry Analysis in Europe Forecast and Outlook 2025 to 2035

Industrial Denox System Market Size and Share Forecast Outlook 2025 to 2035

Industrial Electronic Pressure Switch Market Size and Share Forecast Outlook 2025 to 2035

Industrial WiFi Module Market Size and Share Forecast Outlook 2025 to 2035

Industrial Security System Market Forecast Outlook 2025 to 2035

Industrial Film Market Forecast Outlook 2025 to 2035

Industrial Floor Mat Market Forecast Outlook 2025 to 2035

Industrial Insulation Market Forecast and Outlook 2025 to 2035

Industrial Process Water Coolers Market Forecast and Outlook 2025 to 2035

Industrial Grade Ammonium Hydrogen Fluoride Market Forecast and Outlook 2025 to 2035

Industrial Grade Sodium Bifluoride Market Forecast and Outlook 2025 to 2035

Industrial Evaporative Condenser Market Size and Share Forecast Outlook 2025 to 2035

Industrial Power Supply Market Size and Share Forecast Outlook 2025 to 2035

Industrial Crystallizer Market Size and Share Forecast Outlook 2025 to 2035

Industrial Counterweight Market Size and Share Forecast Outlook 2025 to 2035

Industrial Gas Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA