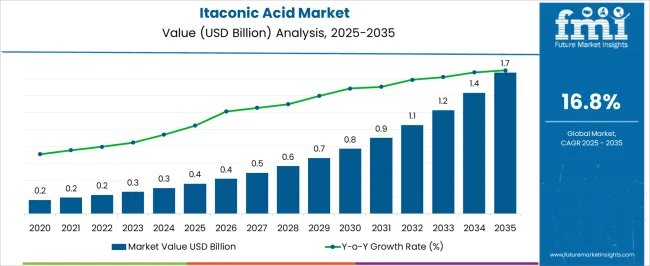

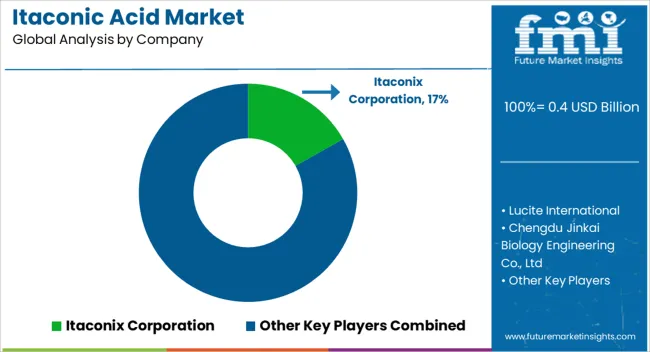

The itaconic acid market is estimated to be valued at USD 0.4 billion in 2025 and is projected to reach USD 1.7 billion by 2035, registering a compound annual growth rate (CAGR) of 16.8% over the forecast period.

This growth is being driven by increasing utilization of itaconic acid in specialty chemicals, resins, coatings, and bio-based polymers. Market momentum is being influenced as manufacturers focus on improving production efficiency, product purity, and application versatility. Over the forecast period, supply chains are being optimized to ensure consistent availability, while research in alternative feedstocks and cost-effective production methods is being emphasized to meet rising global demand. During the 2025–2035 period, the itaconic acid market is being shaped by the growing preference for functional monomers, chemical intermediates, and polymer additives across multiple industrial segments.

Demand is being reinforced by the role of itaconic acid in enhancing performance properties such as adhesion, durability, and chemical resistance. In opinion, the market is positioned as a critical contributor to chemical manufacturing and formulation processes, with growth supported by strategic production expansions, enhanced quality control practices, and increased integration in diverse applications. The market is being further strengthened by the adoption of specialized processing techniques and targeted product development to address evolving industrial requirements.

| Metric | Value |

|---|---|

| Itaconic Acid Market Estimated Value in (2025 E) | USD 0.4 billion |

| Itaconic Acid Market Forecast Value in (2035 F) | USD 1.7 billion |

| Forecast CAGR (2025 to 2035) | 16.8% |

The itaconic acid market has secured a meaningful presence across its parent industries, owing to its versatile applications in polymers, resins, coatings, and specialty chemical formulations. Within the biochemicals market, itaconic acid accounts for approximately 12–15% share, as it serves as a bio-based platform chemical for multiple industrial processes. In the specialty chemicals market, the segment contributes nearly 18–20%, reflecting its incorporation in high-performance coatings, adhesives, and chemical intermediates. Within the polymer and resin market, itaconic acid represents around 20–22% share, as it is used to enhance crosslinking, thermal stability, and mechanical properties of synthetic resins and polymer blends. In the coatings and adhesives market, the share is approximately 10–12%, as itaconic acid is valued for improving adhesion, durability, and chemical resistance in protective and decorative coatings. Within the food and beverage additives market, it contributes roughly 6–8%, given its role as an acidulant, flavor enhancer, and preservative in select formulations.

While challenges such as production cost and competitive substitutes exist, the adoption of itaconic acid continues to be reinforced by its functional versatility and industrial relevance. In my opinion, the market has moved beyond a niche biochemical segment to become an essential component across multiple industrial value chains, demonstrating its influence in polymer modification, chemical synthesis, and product formulation, and ensuring its strategic importance in modern chemical and materials applications.

The itaconic acid market is experiencing steady expansion, supported by rising demand for sustainable and bio-based chemical alternatives in diverse industrial applications. Industry updates and corporate announcements have highlighted increasing production capacities as manufacturers shift toward renewable feedstocks to meet tightening environmental regulations.

The material’s versatility as a building block for resins, plastics, and specialty polymers has driven adoption in coatings, adhesives, and textile treatments. Additionally, its biodegradability and compatibility with green chemistry principles have positioned itaconic acid as a preferred option for eco-conscious product development.

Strategic collaborations between producers and end-use industries have accelerated research into new application areas, broadening market potential. Looking ahead, further integration into biopolymer production, coupled with advances in fermentation technology, is expected to strengthen supply reliability and reduce production costs, making itaconic acid more competitive in the global chemicals market.

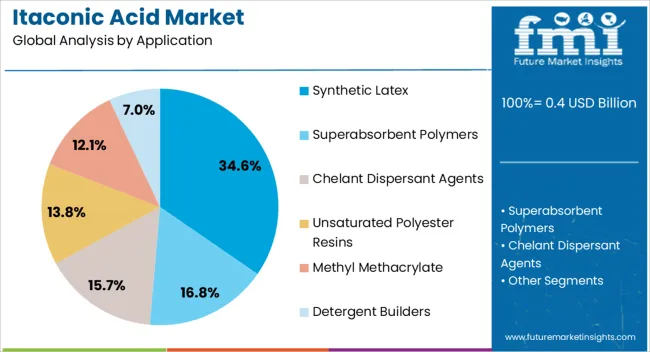

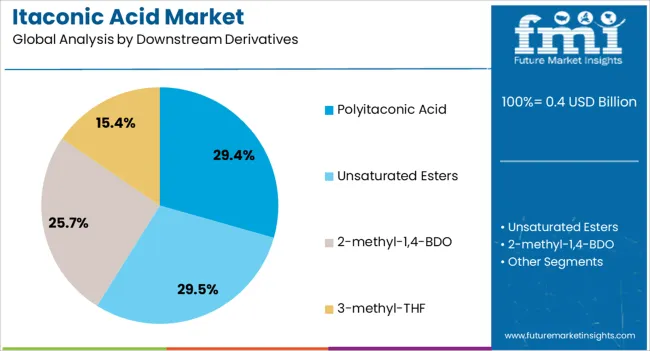

The itaconic acid market is segmented by application, downstream derivatives, and geographic regions. By application, itaconic acid market is divided into synthetic latex, superabsorbent polymers, chelant dispersant agents, unsaturated polyester resins, methyl methacrylate, and detergent builders. In terms of downstream derivatives, itaconic acid market is classified into polyitaconic acid, unsaturated esters, 2-methyl-1,4-BDO, and 3-methyl-THF. Regionally, the itaconic acid industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The synthetic latex segment is projected to contribute 34.6% of the itaconic acid market revenue in 2025, maintaining its position as the leading application area. This growth has been driven by itaconic acid’s effectiveness as a comonomer in latex formulations, where it improves adhesion, flexibility, and chemical resistance. Demand has been further supported by the material’s role in enhancing latex performance in paints, coatings, and paper finishing applications. Manufacturers have increasingly adopted bio-based latex solutions to align with environmental sustainability goals, bolstering demand for itaconic acid in this segment. Industry adoption has also been aided by its ability to enhance product durability without significantly increasing production costs, making it suitable for large-scale industrial use. As regulatory frameworks continue to encourage the transition toward low-VOC and renewable materials, the Synthetic Latex segment is expected to remain a primary consumer of itaconic acid.

The polyitaconic acid segment is anticipated to account for 29.4% of the itaconic acid market revenue in 2025, establishing itself as a key downstream derivative. This segment’s growth is attributed to the polymer’s excellent chelating ability, water solubility, and biodegradability, which make it suitable for use in water treatment agents, dispersants, and superabsorbent materials. Industry research has emphasized polyitaconic acid’s potential in replacing petroleum-based polyacrylic acids, particularly in eco-friendly detergent and cleaning product formulations. Increased investment in the development of high-performance biopolymers has also expanded its applications in specialty chemicals and personal care products. As market demand shifts toward sustainable polymers with functional versatility, polyitaconic acid is expected to play a growing role in supporting industrial and consumer product innovations, further strengthening its share in the itaconic acid value chain.

The itaconic acid market is expanding due to rising demand in biodegradable polymers, coatings, and specialty chemicals. Opportunities exist in bio-based and performance-enhancing polymer applications, while trends emphasize fermentation-based sustainable production. Challenges stem from high production costs, raw material volatility, and competition from alternative acids. Overall, the market outlook is positive as manufacturers focus on cost-effective, high-performance, and environmentally compliant itaconic acid solutions to serve industrial segments seeking sustainable and functional chemical alternatives.

The itaconic acid market is witnessing increasing demand due to its role as a key monomer in biodegradable polymers, coatings, and resins. Industries producing adhesives, paints, and bio-based plastics are adopting itaconic acid to enhance product performance while reducing reliance on petroleum-based chemicals. Rising consumer preference for environmentally friendly materials and regulations favoring biodegradable alternatives are further boosting adoption. Additionally, its application in water treatment, detergents, and chemical intermediates expands market reach. The combination of versatility, functional properties, and regulatory support positions itaconic acid as a preferred bio-based chemical in multiple industrial applications.

Opportunities in the market are expanding as bio-based chemical production and specialty polymer sectors grow. Itaconic acid is increasingly incorporated into superabsorbent polymers, thermosetting resins, and coating formulations, offering performance benefits such as enhanced adhesion, water resistance, and biodegradability. Emerging economies are investing in biorefinery infrastructure to produce bio-based acids sustainably, presenting additional growth avenues. Companies providing high-purity, cost-effective, and application-specific itaconic acid solutions can capture untapped demand, especially in fast-growing industrial segments where environmentally compliant and functional materials are prioritized. Strategic partnerships with polymer manufacturers enhance market penetration and long-term adoption.

A key trend in the itaconic acid market is the shift toward fermentation-based production using renewable feedstocks such as sugars, molasses, and lignocellulosic biomass. This approach reduces carbon footprint and aligns with increasing industrial interest in bio-based chemical alternatives. Innovations in microbial strains and bioprocess optimization improve yield, scalability, and cost-efficiency, making itaconic acid competitive with petrochemical-derived counterparts. Additionally, integration with downstream polymer and resin manufacturing processes is becoming common. These trends reflect the market’s emphasis on greener production, economic viability, and functional versatility, driving broader industrial adoption and encouraging investment in sustainable chemical manufacturing.

The market faces challenges due to relatively high production costs of itaconic acid compared to conventional petrochemical acids. Fermentation-based processes require precise control, specialized infrastructure, and energy inputs, which can limit profitability. Price volatility in raw materials such as sugars and feedstock availability also affects supply stability. Moreover, competition from other bio-based and conventional acids for similar applications can constrain growth. Manufacturers must focus on process optimization, cost reduction, and differentiation through high-purity or application-specific products to maintain competitiveness and ensure steady market adoption across diverse industrial sectors.

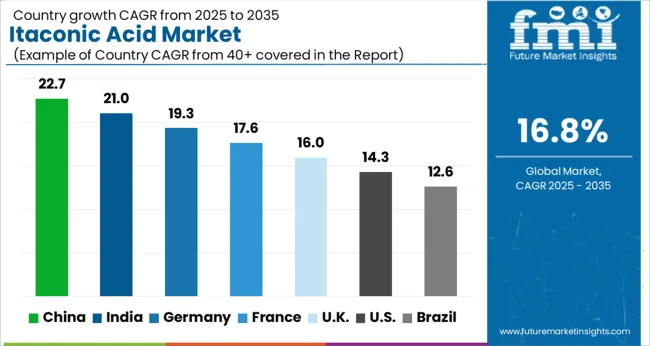

| Country | CAGR |

|---|---|

| China | 22.7% |

| India | 21.0% |

| Germany | 19.3% |

| France | 17.6% |

| UK | 16.0% |

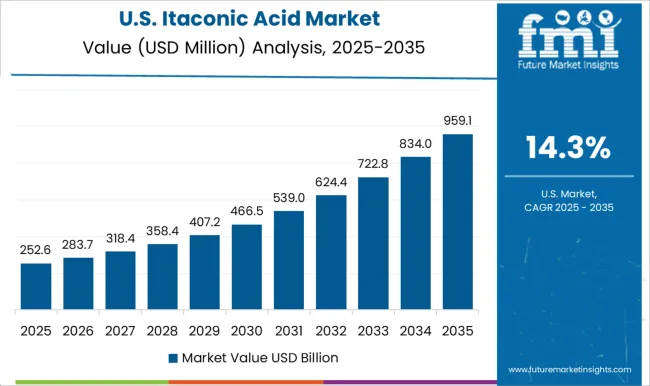

| USA | 14.3% |

| Brazil | 12.6% |

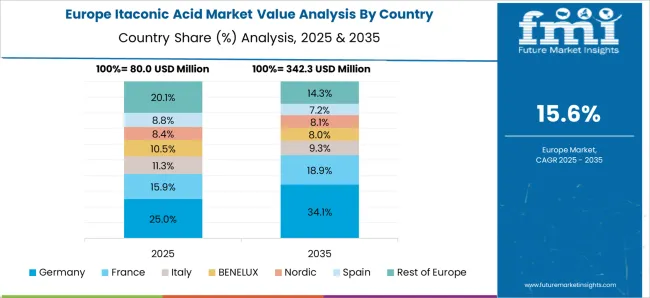

The global itaconic acid market is projected to grow at a CAGR of 16.8% from 2025 to 2035. China leads with a growth rate of 22.7%, followed by India at 21% and Germany at 19.3%. The United Kingdom records a growth rate of 16%, while the United States shows the slowest growth at 14.3%. Expansion is driven by rising demand in biopolymers, specialty chemicals, and eco-friendly materials for industrial applications. Emerging markets such as China and India experience higher growth due to increased chemical manufacturing, biobased polymer adoption, and government support for green chemistry initiatives. Developed markets like Germany, the UK, and the USA maintain steady growth through high-quality production standards, regulatory compliance, and integration of itaconic acid in diverse industrial and consumer applications. This report includes insights on 40+ countries; the top markets are shown here for reference.

The itaconic acid market in China is projected to grow at a CAGR of 22.7%. Growth is primarily driven by rising adoption in biopolymers, resins, and specialty chemicals. Expanding chemical manufacturing infrastructure and increasing industrial production contribute to strong demand. Government initiatives promoting eco-friendly materials and green chemistry indirectly support market expansion. Rising use in coatings, adhesives, and biodegradable plastics further accelerates adoption. Domestic manufacturers focus on high-purity production and scaling up capacity to meet industrial requirements.

The itaconic acid market in India is expected to grow at a CAGR of 21%. Demand is fueled by increasing use in biopolymers, coatings, and adhesives across industrial applications. Rising chemical production capacity and the growing specialty chemical sector accelerate market expansion. Government programs supporting sustainable and eco-friendly chemical production indirectly contribute to adoption. Manufacturers focus on developing high-purity itaconic acid and scaling production to meet industrial and commercial requirements. Growth in packaging, pharmaceuticals, and biodegradable plastic applications also strengthens the market outlook.

The itaconic acid market in Germany is projected to grow at a CAGR of 19.3%. Demand is driven by established chemical and industrial manufacturing sectors focusing on high-quality and eco-friendly chemicals. Adoption in biopolymers, resins, and biodegradable plastics is increasing steadily. Manufacturers emphasize compliance with EU regulations and production of high-purity products for industrial and specialty applications. Research and development initiatives and collaborations with global chemical companies ensure product innovation and improved performance, supporting steady market growth.

The itaconic acid market in the United Kingdom is expected to grow at a CAGR of 16%. Adoption is supported by the chemical manufacturing industry and increasing use in eco-friendly polymers, coatings, and adhesives. Manufacturers focus on high-quality and standardized production processes that comply with international regulations. Growing demand from specialty chemical applications and biodegradable plastics supports steady expansion. Additionally, research collaborations and industrial innovation initiatives help improve production efficiency and broaden the market for itaconic acid in the UK

The itaconic acid market in the United States is projected to grow at a CAGR of 14.3%. Demand is fueled by industrial adoption in biopolymers, specialty chemicals, and eco-friendly materials. Manufacturers focus on high-purity itaconic acid for applications in coatings, adhesives, and biodegradable plastics. Stringent regulatory compliance and quality standards ensure consistent adoption. Additionally, increasing investments in green chemistry and industrial R&D initiatives contribute to steady growth. Use in pharmaceutical formulations and emerging biobased products further strengthens the market outlook in the USA

The itaconic acid market is shaped by chemical and biochemical producers competing on purity, production efficiency, and application versatility. Itaconix Corporation, Lucite International, and DSM lead with brochures highlighting high-quality itaconic acid for polymers, coatings, and specialty chemicals, emphasizing consistent performance, regulatory compliance, and process scalability. Chengdu Jinkai Biology Engineering, Jinan Huaming Biological Technology, and Zhejiang Guoguang Biochemistry differentiate through fermentation-based production, promoting brochures that stress sustainable feedstocks, high yield, and cost-effectiveness. Shandong Kaison Biochemical, Qingdao Langyatai, and Alpha Chemika focus on specialty grades and formulation flexibility, with marketing materials highlighting compatibility with adhesives, resins, and bioplastics. Brochures are central to communicating product reliability, handling safety, and technical support, serving as the primary medium for influencing industrial buyers.

Other regional players, including Hefei Tianfeng Enterprises, Shandong Zhongshun Science & Technology, Iwata Chemical, FUSO Chemical, Qingdao Kehai Biochemistry, Qingdao Abel Technology, and Zhejiang Kedao Chemicals, emphasize localized supply chains and custom product formulations. Brochures highlight high-purity itaconic acid, consistent particle size, and ease of integration into downstream processes. Competitive strategies focus on blending cost efficiency, regulatory adherence, and application-specific performance. Marketing narratives consistently stress product stability, technical support, and operational reliability. Across the market, brochure-driven communications are crucial for differentiating suppliers, establishing credibility, and ensuring trust with formulators, manufacturers, and industrial users seeking high-performance itaconic acid for diverse applications.

| Item | Value |

|---|---|

| Quantitative Units | USD 0.4 billion |

| Application | Synthetic Latex, Superabsorbent Polymers, Chelant Dispersant Agents, Unsaturated Polyester Resins, Methyl Methacrylate, and Detergent Builders |

| Downstream Derivatives | Polyitaconic Acid, Unsaturated Esters, 2-methyl-1,4-BDO, and 3-methyl-THF |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Itaconix Corporation, Lucite International, Chengdu Jinkai Biology Engineering Co., Ltd, Jinan Huaming Biological Technology Co., Ltd, Zhejiang Guoguang Biochemistry Co., Ltd., Shandong Kaison Biochemical Co., Ltd., Qingdao Langyatai (Group) Co., Ltd., Alpha Chemika, Hefei Tianfeng Enterprises Limited, Shandong Zhongshun Science & Technology Development Co., Ltd, Iwata Chemical Co. Ltd., FUSO Chemical Co. Ltd, DSM, Qingdao Kehai Biochemistry Co., Ltd, Qingdao Abel Technology Co., Ltd, and Zhejiang Kedao Chemicals Co., Ltd |

| Additional Attributes | Dollar sales by product type (powder, liquid, granules) and application (biodegradable plastics, coatings, adhesives, pharmaceuticals) are key metrics. Trends include rising demand for bio-based and sustainable chemicals, growth in environmentally friendly polymer formulations, and adoption in industrial and consumer products. Regional adoption, regulatory support, and technological advancements are driving market growth. |

The global itaconic acid market is estimated to be valued at USD 0.4 billion in 2025.

The market size for the itaconic acid market is projected to reach USD 1.7 billion by 2035.

The itaconic acid market is expected to grow at a 16.8% CAGR between 2025 and 2035.

The key product types in itaconic acid market are synthetic latex, superabsorbent polymers, chelant dispersant agents, unsaturated polyester resins, methyl methacrylate and detergent builders.

In terms of downstream derivatives, polyitaconic acid segment to command 29.4% share in the itaconic acid market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Acid Resistant Pipe Market Forecast and Outlook 2025 to 2035

Acid Coil Cleaner Market Size and Share Forecast Outlook 2025 to 2035

Acid Filling and Leveling Machine Market Size and Share Forecast Outlook 2025 to 2035

Acid Chlorides Market Size and Share Forecast Outlook 2025 to 2035

Acid-Sensitive APIs Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Acidified Whey Protein Market Analysis - Size, Share & Trends 2025 to 2035

Acid Dyes Market Growth - Trends & Forecast 2025 to 2035

Acidity Regulator Market Growth - Trends & Forecast 2025 to 2035

Acid Proof Lining Market Trends 2025 to 2035

Acid Citrate Dextrose Tube Market Trends – Growth & Industry Outlook 2024-2034

Acid Orange Market

Antacids Market Analysis – Size, Trends & Forecast 2025 to 2035

Lead Acid Battery Market Size and Share Forecast Outlook 2025 to 2035

Lead Acid Battery Recycling Market Size and Share Forecast Outlook 2025 to 2035

Feed Acidifier Market Analysis Size Share and Forecast Outlook 2025 to 2035

Food Acidulants Market Growth - Key Trends, Size & Forecast 2024 to 2034

Boric Acid Market Forecast and Outlook 2025 to 2035

Folic Acid Market Size and Share Forecast Outlook 2025 to 2035

Oleic Acid Market Size and Share Forecast Outlook 2025 to 2035

Dimer Acid-based (DABa) Polyamide Resin Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA