The demand for acaricide in Japan is valued at USD 15.6 million in 2025 and is projected to reach USD 24.0 million by 2035, reflecting a compound annual growth rate of 4.4%. Growth stems from persistent mite pressure in agricultural production, livestock health management requirements and evolving resistance patterns that demand novel active ingredients. Farmers, veterinarians and greenhouse operators continue applying acaricides across crops vulnerable to spider mites, orchard systems affected by rust mites, and livestock facilities managing ectoparasite infestations.

Agronomists now confront mite populations exhibiting tolerance to legacy chemistries, compelling rotation toward products with distinct modes of action. Veterinary practitioners treating cattle tick burdens and poultry red mite infestations require efficacious formulations that satisfy withdrawal period constraints for meat and egg production. These biological realities, combined with Japan's high-value agriculture and stringent food safety expectations, sustain continuous demand throughout the forecast window.

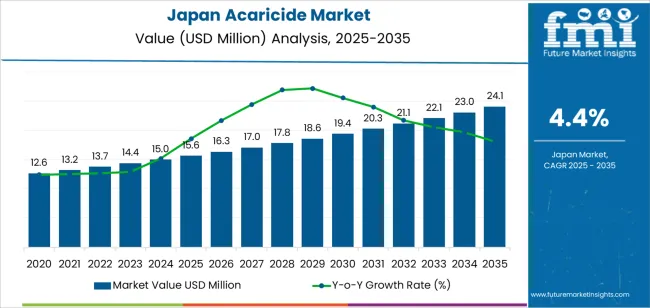

Values trace an upward path from USD 13.2 million in earlier periods, ascending to USD 15.6 million in 2025 before reaching USD 24.0 million by 2035. Intermediate markers include USD 16.2 million in 2026, USD 16.7 million in 2027, USD 19.7 million in 2032 and USD 21.8 million in 2034.

This progression originates from agricultural intensification maintaining pest pressure, climate patterns extending mite activity seasons, and regulatory withdrawals of older acaricides forcing adoption of alternatives. The trajectory illustrates steady momentum driven by biological imperatives rather than discretionary spending, since unchecked mite infestations devastate yields in strawberries, ornamental crops and citrus production while livestock parasites directly impair animal welfare and productivity.

Japan's acaricide sector is set to advance from USD 15.6 million in 2025 to USD 24.0 million by 2035, registering a compound annual growth rate near 4.4%. Historical baseline rests at USD 13.2 million in 2020, followed by USD 14.2 million in 2022, USD 15.1 million in 2024 and the 2025 anchor of USD 15.6 million. Mid-decade figures approach USD 18.5 million around 2030, with the terminal value of USD 24.0 million materializing a decade later.

This upward march reflects Japan's agricultural sector confronting intensifying mite challenges in protected cultivation systems where spider mites reproduce rapidly under controlled temperatures, orchardists battling rust mites that blemish fruit surfaces and reduce marketability, and livestock producers managing tick and mite infestations that compromise animal health certifications required for premium meat exports.

The USD 8.4 million increment between 2025 and 2035 represents meaningful sector evolution. Initial years witness volume expansion as growers increase application frequencies responding to resistance development in mite populations, veterinarians prescribe more acaricide treatments as livestock intensification concentrates parasite pressures, and greenhouse operations expand square footage requiring routine mite management.

Later in the decade, value accrual accelerates through distinct mechanisms: novel acaricide chemistries with favorable toxicological profiles command premium pricing despite lower application rates, combination products blending multiple modes of action to delay resistance development fetch higher per-hectare costs, and integrated pest management services bundling acaricide applications with biological control agents increase transaction values. Suppliers embedding agronomic expertise that guides resistance management strategies, offering rapid technical response when mite outbreaks threaten high-value crops, and navigating Japan's pesticide registration complexities position themselves to capture disproportionate returns from this sustained expansion cycle.

| Metric | Value |

|---|---|

| Industry Value (2025) | USD 15.6 million |

| Forecast Value (2035) | USD 24.0 million |

| Forecast CAGR (2025 to 2035) | 4.4% |

Japan's acaricide consumption historically concentrated in greenhouse vegetable production and citrus orchards, sectors where mite infestations directly determine commercial viability. Greenhouse tomato and strawberry growers around Shizuoka and Tochigi faced relentless two-spotted spider mite pressure, these pests thriving in warm, dry greenhouse environments and rapidly developing resistance to available chemistries. Satsuma mandarin growers in Ehime and Wakayama battled citrus rust mites that cause fruit scarring, rendering produce unsaleable in Japan's appearance-obsessed retail channels.

Tea cultivation in Shizuoka required acaricide applications against tea red spider mites that reduce leaf quality and harvest yields. Livestock sectors added incremental demand, dairy operations treating cattle for mange mites and poultry farms combating red mites that infest layer hen facilities. Agricultural cooperatives coordinated acaricide purchasing, negotiating volume discounts with agrochemical distributors while providing technical guidance on application timing and resistance management.

Looking forward, three distinct dynamics will propel consumption. First, climate warming extends mite activity seasons in northern Japan, regions historically spared severe infestations now require acaricide inputs as milder winters enable mite populations to survive and establish earlier in growing seasons. Hokkaido greenhouse operators, previously relying on cold winters to suppress mite populations, now implement chemical control programs mirroring southern Japanese practices.

Second, regulatory phase-outs of older, broad-spectrum acaricides under revised Food Safety Law provisions force growers toward newer chemistries that, while more selective and environmentally favorable, often cost more per treatment and require multiple applications due to narrower activity spectra. Third, export-oriented agriculture expands as Japan pursues food export targets, demanding acaricide use patterns that satisfy importing countries' maximum residue limits, particularly stringent European and North American standards that restrict certain active ingredients.

Challenges do surface: organic certification growth in select crop sectors eliminates synthetic acaricide use, biological control agent adoption in some greenhouse systems reduces chemical dependence, and generic active ingredient competition from Chinese manufacturers pressures pricing. Yet the overall vector trends upward, supported by biological imperatives where mite control failures trigger catastrophic economic losses that dwarf input costs, regulatory environments that demand pristine produce appearances that only acaricide protection can reliably deliver, and livestock welfare standards that increasingly classify parasite infestations as unacceptable husbandry failures.

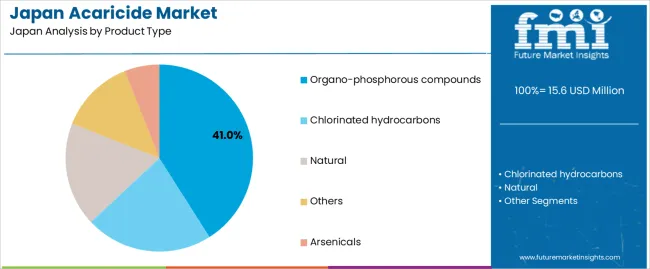

Japan's acaricide landscape fragments across chemical classes and usage contexts. Product types divide into organo-phosphates with broad-spectrum activity and decades of use history, arsenicals now largely restricted but maintaining niche applications, chlorinated hydrocarbons facing severe regulatory constraints, natural-derived products appealing to sustainable agriculture segments, and other chemistries encompassing modern targeted molecules.

Application contexts span agriculture where crop protection drives volume, animal husbandry addressing livestock parasite burdens, and other uses including turf management and household pest control. Each product class carries distinct toxicological profiles, efficacy spectra and resistance management implications, while application contexts impose different regulatory oversight intensities and price sensitivity thresholds, collectively shaping procurement patterns across Japan's diverse agricultural and veterinary sectors.

Organo-phosphate chemistry captures 41% of product type volume, reflecting decades of established use, broad-spectrum mite efficacy, and agricultural familiarity. Japanese farmers trust organo-phosphate acaricides because performance history spans generations, application protocols are well-documented in prefectural extension service recommendations, and price points remain accessible to cost-conscious growers.

These products kill mite eggs, nymphs and adults through cholinesterase inhibition, providing comprehensive life-stage control that simplifies treatment decisions. Citrus growers particularly value organo-phosphates for controlling rust mites and red mites simultaneously, reducing total application numbers compared to narrow-spectrum alternatives. Veterinary organo-phosphates treat cattle grubs and lice, conditions that often co-occur with mite infestations, enabling single-treatment multi-parasite control.

Demand persists despite environmental concerns and resistance issues because economic realities favor proven tools. Small-scale farmers operating on tight margins cannot afford crop failures that might result from experimenting with untested chemistries, defaulting to organo-phosphates with predictable outcomes. Agricultural cooperatives stock organo-phosphates in bulk, offering credit terms and application advice that facilitate adoption.

Resistance management programs recommend rotating organo-phosphates with other chemical classes rather than abandoning them entirely, sustaining steady consumption. Veterinary practitioners familiar with organo-phosphate pharmacokinetics and withdrawal periods prescribe them confidently, avoiding newer products requiring additional training. This institutional inertia, reinforced by regulatory familiarity where organo-phosphates have decades of safety data supporting maximum residue limit decisions, ensures these legacy chemistries maintain dominant positions even as innovation introduces alternatives.

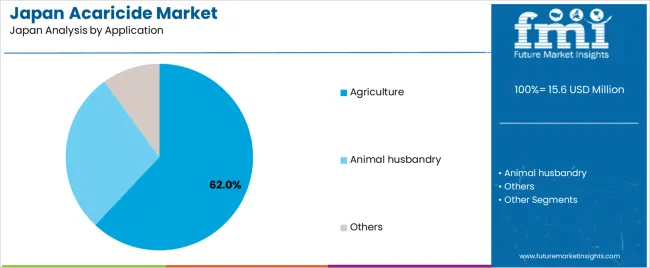

Agricultural application commands 62.0% of consumption, anchored by Japan's intensive production systems where mite control determines economic viability. Greenhouse vegetable production demands routine acaricide inputs because enclosed environments concentrate pest populations while humidity management practices create conditions favoring mite reproduction. Strawberry cultivation, commanding premium retail prices, tolerates zero mite damage since consumers reject blemished fruit, compelling growers toward preventive acaricide programs rather than reactive treatments.

Ornamental flower production for domestic and export channels requires pristine appearances that only comprehensive mite suppression can deliver. Apple orchards manage European red mites that damage fruit finish, tea fields combat tea red spider mites reducing leaf quality, and pear growers control rust mites affecting fruit marketability.

Growth accelerates as agricultural intensification increases per-hectare pest pressure. Continuous cropping in greenhouses provides year-round mite habitat, eliminating the population reductions that crop-free winter periods historically provided. Plastic tunnel adoption in field crops creates microclimates favoring mite proliferation. Monoculture expansion in export-oriented agriculture concentrates host plants that support explosive mite population growth once infestations establish.

Organic agriculture's expansion paradoxically supports conventional acaricide demand because non-organic growers must control mite reservoirs in adjacent organic fields to prevent re-infestation, intensifying chemical use on conventional acreage. Maximum residue limit compliance for export crops demands documented acaricide application timing and dosage, professionalizing usage patterns and often increasing per-hectare expenditures compared to domestic-only production where enforcement proves less stringent. This agricultural application dominance, rooted in economic stakes where mite damage erases seasonal income, creates resilient demand that weathers price volatility and regulatory pressures affecting more discretionary pesticide categories.

Acaricide consumption in Japan responds to biological pest dynamics, weather patterns influencing mite reproduction rates, and regulatory frameworks governing product availability. Mite populations develop resistance to chemical controls faster than most insect pests, their short generation times and high reproductive rates accelerating selection pressure, compelling continuous rotation among acaricide classes with distinct modes of action.

Warm, dry conditions favor spider mite outbreaks, making annual demand somewhat weather-dependent, though greenhouse agriculture's controlled environments stabilize consumption versus field crops where climatic variability exerts stronger influence. Regulatory oversight under Japan's Agricultural Chemicals Regulation Law mandates rigorous efficacy and safety documentation for acaricide registrations, limiting product introductions but ensuring that approved chemistries meet high performance standards once commercialized.

Acaricide selection in Japan balances efficacy requirements against resistance management imperatives. Agricultural cooperatives and prefectural extension centers publish annual recommendations guiding chemical rotations to delay resistance development, these protocols explicitly specifying which acaricide classes to use during which growth stages and prohibiting repeated use of single products within seasons.

Farmers generally comply because resistance failures devastate yields, creating strong economic incentives for stewardship. Greenhouse operators increasingly adopt integrated pest management incorporating predatory mites like Phytoseiulus persimilis that consume spider mites, reserving acaricides for rescue treatments when biological control agents prove insufficient. This IPM adoption paradoxically sustains acaricide demand by enabling premium pricing for selective chemistries compatible with beneficial insects, compensating manufacturers for volume losses through value capture.

Veterinary acaricide use follows distinct patterns. Livestock producers treat animals on fixed schedules dictated by parasite life cycles rather than waiting for infestation symptoms, creating predictable seasonal demand spikes when cattle are treated before summer grazing or poultry facilities are sanitized between flock cycles. Veterinarians prescribe based on herd health protocols rather than individual animal diagnoses, generating bulk orders through agricultural cooperatives.

Regulatory requirements that acaricide-treated animals undergo withdrawal periods before slaughter or eggs can be sold create strong compliance incentives, since violations trigger product recalls and export bans that dwarf treatment costs. These regulatory guardrails, enforced through routine residue testing of meat and eggs, ensure consistent veterinary acaricide consumption aligned with livestock production volumes.

Protected horticulture expansion represents the highest-growth channel. Government subsidies supporting greenhouse construction to boost food self-sufficiency create new cropping area requiring mite management from establishment. High-value crops like strawberries, tomatoes and cut flowers cultivated in these facilities justify premium acaricide expenditures given crop values. Export-oriented vegetable production targeting Southeast Asian industries where Japanese food safety reputation commands premiums demands documented pest control programs using acaricides approved in destination countries, often necessitating newer, more expensive products than domestic-only producers use.

Livestock intensification offers incremental growth. Dairy consolidation concentrating cattle in larger operations increases ectoparasite pressure, requiring more rigorous acaricide treatment protocols. Layer hen facilities expanding to meet domestic egg demand face red mite challenges that intensify with flock size, driving preventive acaricide applications. Veterinary acaricides formulated as sustained-release ear tags or injectable formulations capture value by reducing labor versus traditional spray applications, appealing to farms facing rural labor shortages. Companion animal acaricides treating mite infestations in pet dogs and cats add small but growing consumption as pet ownership rises and owners increasingly seek veterinary dermatological care, though this segment remains minor compared to agricultural volumes.

Regulatory restrictions limit product availability. Japan's pesticide registration process requires extensive domestic trial data demonstrating efficacy under Japanese conditions, deterring global manufacturers from registering products with modest Japanese revenue potential, leaving farmers with fewer chemical options than counterparts in larger countries. Acaricide withdrawals under revised toxicological assessments remove established products, forcing growers toward alternatives that may prove less effective or more costly. Maximum residue limits occasionally set below levels achievable with labeled use rates effectively prohibit certain acaricide-crop combinations, shrinking addressable applications.

Biological control competition erodes acaricide consumption in specific niches. Greenhouse tomato and sweet pepper production increasingly relies on predatory mites and insects that provide season-long mite suppression without chemical inputs, reducing acaricide demand in these crops. Organic certification prohibits synthetic acaricides, and while organic acreage remains small, growth rates exceed conventional agriculture, progressively shrinking the treatable area base.

Economic pressures constrain usage: generic active ingredients from Asia undercut branded products, compressing margins and deterring manufacturer investment in education programs that historically drove adoption. Rural depopulation reduces farming populations, and remaining farmers skew elderly, some exhibiting resistance to new technologies and continuing with familiar products whose efficacy may be compromised by resistance, inadvertently limiting demand for innovative alternatives.

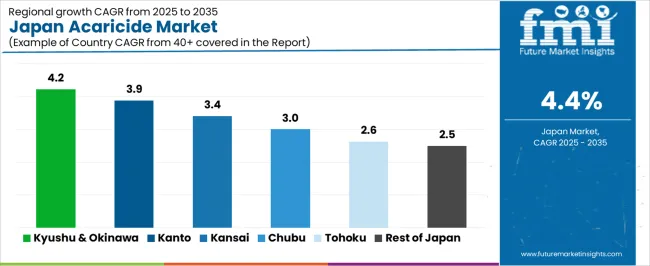

| Region | CAGR (%) |

|---|---|

| Kyushu & Okinawa | 4.2% |

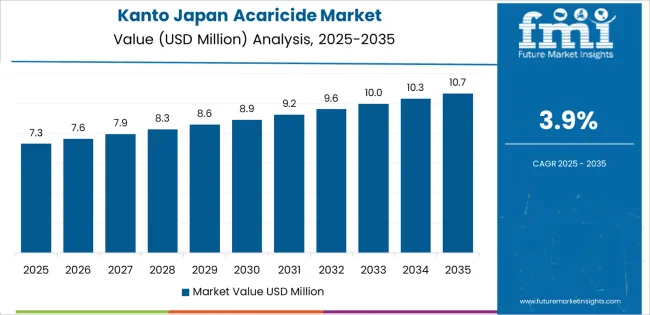

| Kanto | 3.9% |

| Kinki | 3.4% |

| Chubu | 3.0% |

| Tohoku | 2.6% |

| Rest of Japan | 2.5% |

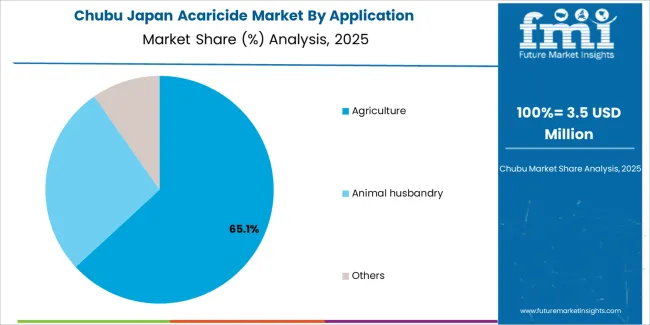

Regional acaricide consumption correlates with agricultural intensity and crop portfolios vulnerable to mite damage. Kyushu & Okinawa leads at 4.2%, propelled by intensive greenhouse vegetable production, livestock density and warm climates extending pest pressure seasons. Kanto posts 3.9%, reflecting suburban greenhouse clusters and orchard production despite urban encroachment. Kinki registers 3.4%, sustained by vegetable production near Osaka and Kyoto's urban industries. Chubu records 3.0%, anchored by Shizuoka's tea and citrus cultivation. Tohoku reaches 2.6%, where shorter growing seasons limit but do not eliminate mite pressure. Rest of Japan grows at 2.5%, comprising Hokkaido's expanding greenhouse sector and Chugoku's fruit production.

Kyushu & Okinawa's 4.2% CAGR through 2035 originates from subtropical conditions that enable year-round agricultural production and continuous mite generation cycles. Kumamoto's greenhouse tomato industry battles two-spotted spider mites requiring multiple acaricide applications annually. Miyazaki's cucumber and sweet pepper production faces similar challenges. Fukuoka's strawberry cultivation demands pristine fruit appearance, driving intensive acaricide use. Kagoshima's cattle operations treat tick infestations that transmit bovine diseases. Okinawa's tropical climate supports exceptionally high mite reproduction rates, compelling farmers toward aggressive control programs.

Agricultural cooperatives in Kyushu maintain sophisticated pest monitoring networks, issuing outbreak warnings that trigger coordinated acaricide applications across member farms, preventing regional infestations. Prefectural research centers breed mite-resistant crop varieties but acknowledge that resistant cultivars still require chemical backup when pest pressure exceeds tolerance thresholds.

Export-oriented agriculture targeting Hong Kong and Singapore industries for premium produce follows stringent spray schedules to ensure residue compliance. Livestock density in Kyushu concentrates parasite pressures, with cattle feedlots and intensive poultry operations requiring regular veterinary acaricide inputs. This combination of climatic favorability for pests, high-value crop portfolios, and export orientation creates conditions where acaricide expenditures represent rational economic decisions rather than discretionary inputs.

Kanto's 3.9% growth reflects peri-urban agriculture serving Tokyo's massive consumer base with fresh produce commanding premium prices that justify intensive pest control. Ibaraki's melon production, Chiba's pear orchards, and Tochigi's strawberry cultivation all face significant mite pressure. Greenhouse vegetable clusters near Tokyo supply daily harvests to metropolitan wholesale outlets where produce appearance determines auction prices, incentivizing preventive acaricide use. Ornamental flower production for Tokyo's florist trade tolerates zero pest damage, compelling comprehensive chemical control.

Veterinary acaricide consumption stems from Kanto's dairy industry supplying Tokyo's fluid milk demand, dairy cattle requiring routine ectoparasite management to maintain milk quality. Companion animal acaricides treating pet dogs and cats concentrate in Kanto's affluent urban areas where pet ownership rates and veterinary care utilization exceed national averages.

Agricultural extension services in Kanto prefectures actively promote integrated pest management incorporating acaricide rotations, biological controls and cultural practices, sustaining chemical demand while reducing per-hectare usage rates through improved timing and targeting. This sophisticated approach, combining intensive production economics with technical pest management, creates stable demand that grows modestly with production area expansion rather than through increased per-hectare application intensities.

Kinki's 3.4% trajectory balances peri-urban vegetable production near Osaka and Kobe with traditional agricultural regions in Hyogo and Wakayama. Osaka's eggplant and green onion production uses acaricides controlling spider mites and rust mites respectively. Wakayama's satsuma mandarin orchards require acaricide applications for citrus rust mites and citrus red mites that damage fruit cosmetics. Hyogo's greenhouse vegetable production and Nara's strawberry cultivation add agricultural consumption. Livestock sectors remain modest compared to Kyushu, limiting veterinary acaricide volumes.

Kinki's proximity to major urban centers shapes usage patterns. Farmers access agrochemical retailers easily, enabling responsive purchasing when pest outbreaks occur rather than relying on pre-season buying through cooperatives. This retail channel orientation creates demand volatility tied to pest pressure fluctuations, with warm, dry years triggering consumption spikes and cool, wet seasons depressing sales. Agricultural research centers in Kinki investigate biopesticide alternatives to conventional acaricides, their demonstration trials influencing farmer adoption of reduced-risk products. While these alternatives capture modest usage, they coexist with conventional chemistries that remain dominant due to proven performance and lower costs.

Chubu's 3.0% growth centers on Shizuoka's tea cultivation and citrus production. Tea red spider mites directly damage leaf quality, reducing tea's industry grade and price, compelling routine acaricide applications during growing seasons. Shizuoka's satsuma mandarin and navel orange production requires rust mite control preserving fruit appearance for fresh consumption outlets. Aichi's greenhouse horticulture contributes vegetable crop demand, while Nagano's apple orchards treat European red mites affecting fruit finish. Livestock sectors add modest veterinary acaricide consumption.

Chubu's agricultural cooperatives wield significant influence over acaricide purchasing. Tea cooperatives negotiate bulk contracts with manufacturers, securing volume discounts passed to member growers. These cooperatives also coordinate application timing across member farms, reducing resistance development risk through synchronized rotations among chemical classes. Prefectural governments in Chubu subsidize integrated pest management adoption, partially offsetting costs when farmers incorporate biological controls alongside reduced acaricide usage. While these programs modestly reduce chemical consumption, tea's vulnerability to mite damage and the economic importance of premium grades sustain robust acaricide demand regardless of IPM promotion.

Tohoku's 2.6% growth emerges from apple and pear production vulnerable to mite damage plus expanding greenhouse vegetable cultivation. Aomori and Iwate apple orchards treat European red mites that cause leaf bronzing and fruit russeting. Yamagata's pear production controls rust mites affecting fruit cosmetics. Greenhouse tomato and strawberry production around Sendai faces spider mite challenges similar to southern regions, though shorter growing seasons limit generation numbers. Livestock operations in Tohoku's rural areas require acaricide treatments for cattle ticks and lice.

Climate change effects manifest in Tohoku through earlier spring pest emergence and extended fall activity periods, lengthening the window requiring chemical control. Previously, harsh winters reliably killed overwintering mite populations, reducing spring infestations. Milder recent winters enable more mites to survive, increasing first-generation population sizes and necessitating earlier intervention. Farmers adapting to these shifts purchase acaricides earlier in seasons and sometimes add fall applications that historically proved unnecessary. This climate-driven demand expansion, while modest compared to southern regions with severe pest pressure, creates steady growth trajectory for Tohoku's acaricide consumption.

Rest of Japan's 2.5% growth aggregates Hokkaido, Chugoku, and Shikoku. Hokkaido's greenhouse vegetable production, expanding due to favorable summer growing conditions, encounters spider mite challenges once greenhouses close for season extension, the enclosed environments enabling mite buildup. Chugoku's citrus production in Hiroshima and pear cultivation in Tottori consume acaricides controlling rust mites and red mites. Shikoku's citrus production concentrated in Ehime requires extensive rust mite management. Livestock operations dispersed across rural areas generate baseline veterinary acaricide demand.

These regions exhibit lower agricultural intensity than core production zones, creating smaller addressable applications. Distribution networks prove less developed, with farmers traveling longer distances to agricultural retailers or relying on cooperative delivery services that occur less frequently than in intensive production regions. This logistical friction encourages farmers toward fewer, larger purchases when acaricides are procured, potentially contributing to suboptimal timing where applications occur for convenience rather than optimal pest pressure windows. Despite these constraints, fundamental biological drivers sustain modest demand growth as climate warming and agricultural intensification progressively increase pest pressures even in historically less-affected regions.

Japan's acaricide demand synthesis reveals biological imperatives dominating consumption decisions. Mite infestations in high-value crops like strawberries and ornamental flowers trigger economic losses vastly exceeding input costs, making effective control non-negotiable. Regulatory frameworks constraining available chemistries paradoxically support pricing power for approved products, since limited competition and high registration barriers allow manufacturers to maintain margins. Resistance evolution ensures continuous turnover in active ingredient popularity, with older chemistries declining as efficacy wanes and newer molecules capturing share. This turnover sustains innovation incentives despite modest absolute volumes compared to major insecticide or herbicide categories.

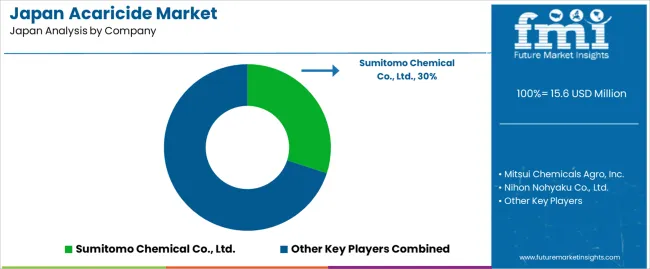

Competitive dynamics feature Japanese agrochemical incumbents leveraging domestic registration expertise. Sumitomo Chemical Company commands 30.0% share through broad acaricide portfolio spanning legacy organophosphates to modern chemistries like cyenopyrafen, their extensive field trial networks generating data that accelerates regulatory approvals. Mitsui Chemicals Agro, Inc. focuses on miticide specialization, developing products like fenothiocarb specifically for Japanese pest complexes and cropping systems.

Nihon Nohyaku Co., Ltd. maintains strong positions in greenhouse vegetable acaricides through close relationships with cooperative purchasing networks. Global players Syngenta Japan K.K. and Bayer CropScience Japan leverage parent companies' R&D capabilities, introducing innovative molecules like spiromesifen and spirodiclofen that offer novel modes of action valuable for resistance management. This structure combining domestic industry knowledge with global innovation pipelines ensures continuous product availability across chemical classes and price points, sustaining growth through comprehensive resistance management options rather than single-product dependencies that would prove vulnerable to biological selection pressures.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD million |

| Product Type | Organo-phosphate, Arsenicals, Chlorinated Hydrocarbons, Natural, Others |

| Application | Agriculture, Animal Husbandry, Others |

| Region | Kyushu & Okinawa, Kanto, Kinki, Chubu, Tohoku, Rest of Japan |

| Countries Covered | Japan |

| Key Companies Profiled | Sumitomo Chemical Company, Mitsui Chemicals Agro, Inc., Nihon Nohyaku Co., Ltd., Syngenta Japan K.K., Bayer CropScience Japan |

| Additional Attributes | Dollar sales by product type and application, regional CAGR trends, and value-volume share are assessed with agricultural vs. veterinary uptake, organophosphate vs. modern chemistry penetration, rotation and resistance dynamics, regulatory hurdles, growth opportunities, and competition between Japanese incumbents and global innovators. |

The demand for acaricide in Japan is estimated to be valued at USD 15.6 million in 2025.

The market size for the acaricide in Japan is projected to reach USD 24.1 million by 2035.

The demand for acaricide in Japan is expected to grow at a 4.4% CAGR between 2025 and 2035.

The key product types in acaricide in Japan are organo-phosphorous compounds, chlorinated hydrocarbons, natural, others and arsenicals.

In terms of application, agriculture segment is expected to command 62.0% share in the acaricide in Japan in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Japan Faith-based Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Sports Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Respiratory Inhaler Devices Market Size and Share Forecast Outlook 2025 to 2035

Japan Halal Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Automated People Mover Industry Size and Share Forecast Outlook 2025 to 2035

Japan Automotive Load Floor Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Japan Food Cling Film Market Size and Share Forecast Outlook 2025 to 2035

Japan Polypropylene Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Acaricide Market Growth & Trends 2025 to 2035

Japan Probiotic Yogurt Market is segmented by product type, source type, nature type, flavor type, fat content, sales channel and key city/province through 2025 to 2035.

japan Tortilla Market - Growth, Trends and Forecast from 2025 to 2035

Japan Cosmetics ODM Market Analysis - Size, Share & Trends 2025 to 2035

Japan Automotive Turbocharger Market Insights – Demand, Size & Industry Trends 2025–2035

Japan Yeast Market Insights – Demand, Size & Industry Trends 2025–2035

Japan Green and Bio-based Polyol Market Insights – Demand, Size & Industry Trends 2025–2035

Japan Natural Food Color Market Trends – Growth, Demand & Forecast 2025–2035

Japan Coated Fabrics Market Growth – Trends, Demand & Innovations 2025–2035

Japan Barite Market Growth – Trends, Demand & Innovations 2025–2035

Japan 1,4-Diisopropylbenzene Market Growth – Trends, Demand & Innovations 2025–2035

Japan Compact Construction Equipment Market Insights – Demand, Size & Industry Trends 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA