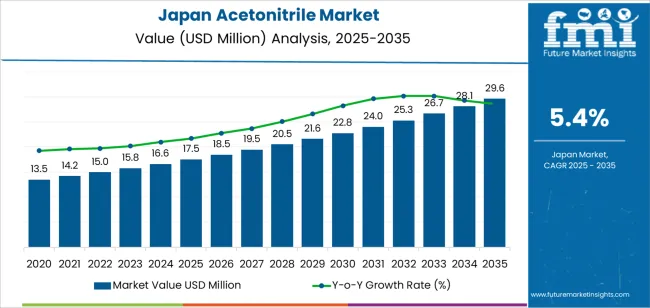

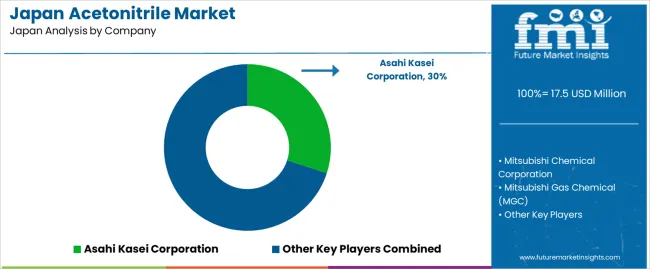

The demand for acetonitrile in Japan is valued at USD 17.5 million in 2025 and is projected to reach USD 29.6 million by 2035, reflecting a compound annual growth rate of 5.4%. Growth originates from pharmaceutical manufacturing expansion, biotechnology research acceleration and analytical laboratory testing volumes. Chemical manufacturers, research institutions and pharmaceutical companies continue procuring acetonitrile for workflows requiring high-purity solvents in liquid chromatography, drug synthesis and nucleotide production.

Laboratory managers now prioritize solvent quality that ensures reproducible analytical results, while pharmaceutical producers require consistent purity levels that meet stringent regulatory standards for injectable drug manufacturing. These procurement patterns, combined with Japan's robust pharmaceutical industry and growing biotechnology sector, fuel steady year-on-year increases throughout the projection window.

Historical trajectory shows values climbing from USD 14.3 million in baseline periods to USD 17.5 million in 2025, then advancing toward USD 29.6 million by 2035. Intermediate checkpoints include USD 18.2 million in 2026, USD 19.0 million in 2027, USD 23.2 million in 2032 and USD 26.2 million in 2034.

This progression stems from pharmaceutical production cycles maintaining stable solvent consumption, biotechnology startups increasing R&D spending, and quality control laboratories expanding testing capacity to meet regulatory inspection frequencies. The curve demonstrates continuous momentum powered by structural factors: Japan's position as a global pharmaceutical manufacturing hub, growing investment in precision medicine research, and regulatory frameworks that demand rigorous analytical verification across drug development stages.

Japan's acetonitrile consumption trajectory points upward from USD 17.5 million in 2025 to USD 29.6 million by 2035, registering a compound annual growth rate near 5.4%. Historical baseline sits at USD 14.3 million in 2020, followed by USD 15.5 million in 2022, USD 16.8 million in 2024 and the 2025 anchor of USD 17.5 million. Mid-decade figures approach USD 21.4 million around 2030, with the terminal value of USD 29.6 million materializing a decade later. This upward march reflects Japan's pharmaceutical sector maintaining global competitiveness through continuous investment in high-value drug manufacturing, biotechnology firms scaling up oligonucleotide synthesis for gene therapies, and analytical laboratories servicing industries from petrochemicals to food safety where acetonitrile serves as the preferred HPLC mobile phase component.

The USD 12.1 million increment between 2025 and 2035 represents substantial sector deepening. Initial years witness volume expansion as existing pharmaceutical plants optimize production schedules and contract research organizations multiply testing runs to support accelerated drug approval timelines.

Later in the decade, value accrual intensifies: high-purity grades commanded by biopharmaceutical applications, specialty acetonitrile formulations stabilized for specific analytical methods, and just-in-time delivery services that minimize inventory holding costs for laboratory customers all push average transaction values higher. Suppliers embedding quality assurance systems that trace every production batch, offering technical support for method development, and maintaining strategic inventory buffers to hedge against supply disruptions position themselves to harvest disproportionate returns from this prolonged expansion cycle.

| Metric | Value |

|---|---|

| Industry Value (2025) | USD 17.5 million |

| Forecast Value (2035) | USD 29.6 million |

| Forecast CAGR (2025 to 2035) | 5.4% |

Japan's acetonitrile consumption historically centered on pharmaceutical manufacturing clusters around Tokyo, Osaka and Shizuoka, where multinational drug companies established production facilities leveraging skilled labor and proximity to Asian export channels. Post-1990s, these plants consumed acetonitrile primarily as a reaction solvent for active pharmaceutical ingredient synthesis, particularly in antibiotics and cardiovascular drugs where the solvent's aprotic nature facilitated specific chemical transformations.

Analytical laboratories emerged as a second major demand source after 2000, driven by Japan's food safety scandals that triggered regulatory crackdowns requiring pesticide residue testing in agricultural products. High-performance liquid chromatography became the gold standard method, and acetonitrile's UV transparency and low viscosity made it indispensable as a mobile phase component. University research labs and government testing centers added incremental volume, creating steady baseline demand tied to pharmaceutical production schedules and agricultural harvest cycles.

Looking forward, two distinct growth engines will propel consumption. First, Japan's strategic push into biopharmaceuticals, especially oligonucleotide therapeutics for rare diseases and personalized cancer treatments, requires acetonitrile in RNA and DNA synthesis processes where ultra-high purity prevents nucleotide damage. Government subsidies for regenerative medicine research, channeled through institutions like RIKEN and academic medical centers, translate into laboratory purchases of research-grade acetonitrile. Second, environmental monitoring intensifies as Japan confronts legacy industrial contamination and emerging micropollutants in water supplies.

Prefectural environmental research centers expand testing protocols that rely on acetonitrile-based extraction and chromatography methods. Challenges do surface: volatile feedstock costs linked to global acrylonitrile pricing, environmental regulations scrutinizing solvent emissions from pharmaceutical plants, and potential substitution by greener solvents in select applications. Yet the overall trajectory tilts upward, supported by Japan's commitment to maintaining pharmaceutical self-sufficiency, expanding domestic biotech capabilities, and upholding stringent quality standards that necessitate rigorous analytical testing across multiple industrial sectors.

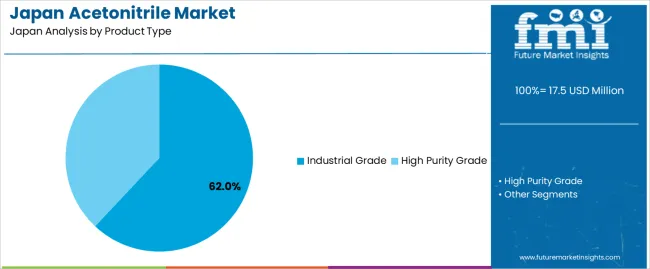

Japan's acetonitrile landscape divides along purity specifications and end-use contexts. Product types split between industrial grade containing trace impurities acceptable for bulk synthesis and high-purity grade meeting stringent specifications for analytical applications where even parts-per-million contaminants skew chromatographic results.

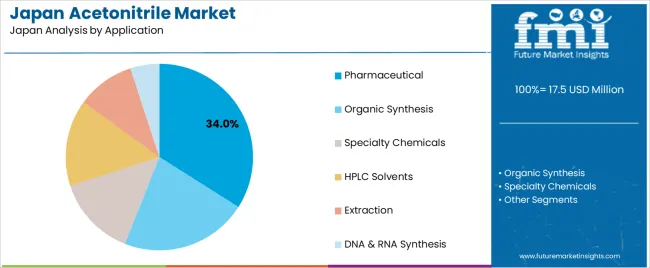

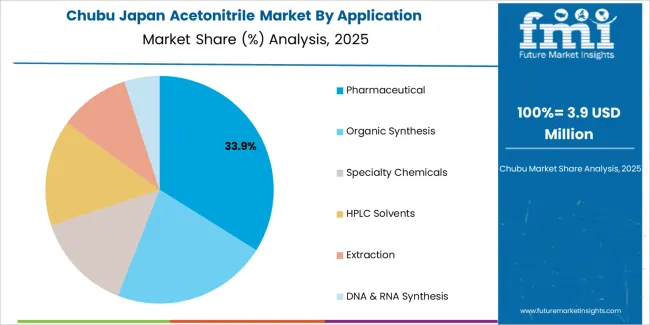

Application contexts span pharmaceuticals where acetonitrile functions as both reaction medium and purification solvent, organic synthesis encompassing fine chemicals and agrochemical intermediates, specialty chemicals including electronics materials and polymer additives, extraction processes targeting natural products and environmental samples, HPLC solvents dominating analytical laboratories, and DNA/RNA synthesis critical for biotechnology research. Each application imposes distinct quality requirements and volume patterns, influencing procurement strategies across Japan's chemical supply chains.

Industrial grade captures 62% of product type volume, reflecting large-scale pharmaceutical manufacturing's appetite for cost-effective solvents. Japanese pharmaceutical plants running continuous production campaigns for blockbuster drugs consume industrial-grade acetonitrile in multi-kiloliter batches, where slight impurities prove inconsequential given subsequent purification steps that remove all solvent traces from final drug substances.

Economic logic favors industrial grade: pharmaceutical manufacturers negotiate annual supply contracts that lock in favorable pricing, while the modest purity premium they sacrifice matters little when downstream crystallization and drying operations eliminate solvent completely. These plants also implement solvent recovery systems that recycle used acetonitrile, further incentivizing bulk industrial-grade purchases since recycling processes inherently reduce purity, making starting material purity less critical.

Demand expands as generic drug manufacturers proliferate across Japan following patent cliffs on major pharmaceuticals. These generic producers optimize costs aggressively, selecting industrial-grade acetonitrile wherever process chemistry permits. Contract manufacturing organizations servicing global pharmaceutical clients similarly prioritize industrial grade for synthesis steps, reserving high-purity variants only for final purification stages when necessary.

Chemical toll manufacturers producing agrochemical intermediates and specialty chemical precursors add incremental industrial-grade volume, their processes valuing solvent performance over ultimate purity. This cost-conscious procurement philosophy, deeply embedded in Japan's competitive chemical manufacturing sector, sustains industrial-grade dominance even as analytical applications grow.

Pharmaceutical application commands 34.0% of consumption, anchored by Japan's position hosting global pharmaceutical production for Asian supply chains. Acetonitrile participates in synthesis routes for diverse therapeutic classes: beta-lactam antibiotics where it solubilizes reactive intermediates, cardiovascular drugs involving multi-step condensation reactions, and oncology agents requiring precise stereochemical control that acetonitrile's properties facilitate.

Japanese pharmaceutical R&D labs consume additional volumes during drug discovery screening and process development, where chemists evaluate numerous synthetic routes before scaling to manufacturing. Pharmaceutical quality control laboratories represent another demand stream, using acetonitrile in HPLC methods that verify drug purity, test for impurities and assay active ingredient content in finished dosage forms.

Growth accelerates as Japan's pharmaceutical sector pivots toward high-value biologics and small-molecule specialty drugs treating rare diseases. These complex therapeutics involve more synthesis steps than traditional drugs, each potentially requiring acetonitrile as solvent or reagent. Regulatory environments demanding extensive analytical documentation for new drug applications drive additional HPLC testing, multiplying solvent consumption per drug candidate.

Contract development and manufacturing organizations expanding capacity in Japan to serve biotech startups increase pharmaceutical-grade acetonitrile purchases. Meanwhile, generic drug production sustains baseline volumes as Japan's aging population requires steady supplies of cardiovascular, diabetes and pain medications. This pharmaceutical application mix combining innovation-driven specialty drugs with volume-driven generics creates resilient demand insulated from economic cycles that might affect other chemical sectors.

Acetonitrile consumption in Japan responds to pharmaceutical production cycles, regulatory testing mandates and research funding allocations. Japan's pharmaceutical manufacturing benefits from advanced infrastructure, skilled workforce and robust intellectual property protection, positioning the country as a preferred location for high-value drug production despite higher labor costs versus emerging Asian economies. This manufacturing base creates consistent solvent demand insulated from short-term economic fluctuations, since pharmaceutical production runs on multi-year planning horizons.

Regulatory testing demand follows predictable patterns tied to agricultural seasons when food testing spikes, environmental monitoring campaigns scheduled by prefectural governments, and pharmaceutical batch releases requiring quality control analysis. Research consumption tracks academic and corporate R&D budgets, which in Japan show remarkable stability due to government policies supporting life sciences research through dedicated funding mechanisms like AMED grants.

Acetonitrile benefits indirectly from Japan's pharmaceutical policies encouraging domestic production of essential medicines. Following COVID-19 supply chain disruptions, Japanese government identified active pharmaceutical ingredients and key excipients requiring domestic manufacturing resilience, catalyzing investment in pharmaceutical chemical plants that consume solvents like acetonitrile. Pharmaceutical companies receiving these subsidies expand production capacity, directly translating into higher solvent procurement.

Japan's regenerative medicine legislation, among the world's most progressive, accelerates clinical trials for cell therapies and gene therapies, many requiring oligonucleotide synthesis where acetonitrile functions as essential reagent. Research institutions conducting these trials purchase high-purity acetonitrile for cGMP-compliant manufacturing suites producing clinical trial materials.

Environmental regulations paradoxically support demand despite targeting solvent emissions. Stricter volatile organic compound controls force pharmaceutical plants to install solvent recovery systems, but recovered acetonitrile typically cannot meet high-purity specifications, requiring continuous purchase of virgin material for critical applications. Food safety regulations mandating pesticide residue testing create non-cyclical laboratory demand, as testing labs must analyze samples year-round regardless of agricultural production seasons. These regulatory tailwinds compound over time, progressively raising acetonitrile consumption floors even as efficiency improvements might otherwise reduce unit consumption per drug manufactured or sample analyzed.

Biopharmaceutical manufacturing represents the highest-growth channel. Japanese biotech firms developing oligonucleotide therapeutics for genetic diseases require research-grade acetonitrile in development phases and pharmaceutical-grade material for commercial manufacturing. Unlike traditional small-molecule drugs, oligonucleotides demand acetonitrile throughout synthesis, deprotection and purification steps, consuming multiples of solvent per kilogram of product versus conventional pharmaceuticals. Contract manufacturing organizations building oligonucleotide production capacity anticipate this demand, negotiating long-term acetonitrile supply agreements before facilities come online.

Environmental and forensic testing laboratories offer incremental growth. Emerging contaminants like PFAS compounds require sensitive analytical methods where acetonitrile's chromatographic properties prove superior to methanol alternatives. Forensic labs supporting criminal investigations increasingly rely on acetonitrile-based methods for drug testing and toxicology screens.

Industrial quality control expanding beyond pharmaceuticals into electronics materials, where semiconductor manufacturing cleanliness standards demand rigorous analytical verification, adds niche but high-value consumption. Food and beverage companies implementing voluntary testing programs exceeding regulatory minimums, driven by brand protection concerns, purchase acetonitrile for in-house laboratories rather than outsourcing all testing, diffusing demand across broader customer bases.

Cost sensitivity limits consumption in price-competitive industries. Generic pharmaceutical manufacturers facing margin pressure from national health insurance reimbursement cuts seek solvent alternatives or implement aggressive recycling to reduce virgin acetonitrile purchases. Environmental laboratories operating on constrained prefectural budgets delay equipment upgrades that would enable more efficient solvent use, instead maintaining older HPLC systems with higher per-sample consumption. Supply concentration creates vulnerability: Japan imports significant acetonitrile volumes, and disruptions in overseas production or shipping can cause spot shortages that force customers to curtail non-essential testing or reformulate processes temporarily.

Regulatory approvals constrain new application adoption. Pharmaceutical manufacturers cannot simply substitute acetonitrile into established drug manufacturing processes without regulatory filings demonstrating equivalent product quality, deterring switches even when acetonitrile offers technical advantages. Laboratory testing methods codified in Japanese Pharmacopoeia or official food testing protocols specify exact solvent grades and suppliers, limiting market entry for new acetonitrile producers or alternative solvents.

Waste disposal costs increasingly burden users: spent acetonitrile requires treatment as hazardous waste, with disposal fees rising as Japan tightens environmental standards, making some low-margin testing applications economically marginal and incentivizing method development using less problematic solvents where feasible.

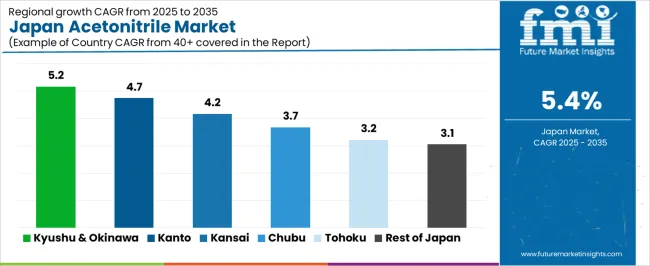

| Region | CAGR (%) |

|---|---|

| Kyushu & Okinawa | 5.2% |

| Kanto | 4.7% |

| Kinki | 4.2% |

| Chubu | 3.7% |

| Tohoku | 3.2% |

| Rest of Japan | 3.1% |

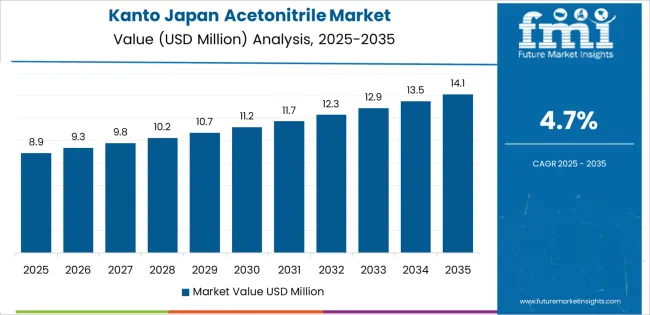

Regional acetonitrile consumption mirrors pharmaceutical manufacturing footprints and research institution density. Kyushu & Okinawa leads at 5.2%, propelled by pharmaceutical plant expansions and Fukuoka's emerging biotech cluster. Kanto posts 4.7%, reflecting Tokyo's concentration of pharmaceutical headquarters, university research labs and contract research organizations. Kinki registers 4.2%, anchored by Osaka's pharmaceutical manufacturing legacy and Kyoto University's life sciences research strength. Chubu records 3.7%, sustained by Shizuoka and Aichi pharmaceutical plants. Tohoku reaches 3.2%, supported by Sendai's Tohoku University research activities. Rest of Japan grows at 3.1%, comprising regional university labs, prefectural testing centers and dispersed pharmaceutical facilities serving local needs.

Kyushu & Okinawa's 5.2% CAGR through 2035 originates from strategic pharmaceutical investments capitalizing on the region's improving infrastructure and availability of trained scientific workforce. Fukuoka attracted multiple pharmaceutical companies establishing contract manufacturing operations targeting Asian export opportunities, these facilities consuming industrial-grade acetonitrile in kiloliter quantities for API synthesis.

Kumamoto and Oita host pharmaceutical plants producing generic drugs and over-the-counter medications requiring regular solvent procurement. Kyushu University's biomedical research programs, particularly in regenerative medicine and cancer biology, generate academic demand for high-purity analytical-grade acetonitrile. Regional testing centers analyzing agricultural products from Kyushu's extensive farming regions consume acetonitrile year-round for pesticide residue analysis.

Logistics improvements enhance the region's attractiveness: new port facilities in Fukuoka and Kagoshima streamline acetonitrile imports from South Korea and Southeast Asia where major production capacity exists, reducing delivered costs versus inland Japanese regions dependent on domestic rail transport. Prefectural governments offer investment incentives targeting life sciences sectors, attracting biotech startups that, while individually small consumers, collectively increase regional acetonitrile demand. Okinawa's marine biotechnology research institutes studying coral-derived pharmaceuticals add niche consumption. This ecosystem of pharmaceutical manufacturing, academic research and agricultural testing creates diversified demand resistant to single-sector downturns.

Kanto's 4.7% growth reflects Tokyo's status as Japan's pharmaceutical industry command center and life sciences research nucleus. Pharmaceutical company headquarters in Tokyo procure acetonitrile through centralized purchasing departments, distributing to plants nationwide but maintaining strategic inventory in Kanto to supply company research labs located near corporate offices.

Contract research organizations densely clustered around Tokyo Bay consume acetonitrile supporting drug discovery screening for pharmaceutical clients, these CROs running hundreds of analytical samples daily across parallel drug development programs. University research labs affiliated with University of Tokyo, Keio University and Tokyo Institute of Technology generate steady academic demand, their professors' research grants explicitly budgeting for chromatography solvents including acetonitrile.

Government testing facilities concentrated in Tokyo perform reference method development and inter-laboratory comparison studies that establish acetonitrile purity specifications adopted nationwide, these institutions requiring ultra-high-purity grades as reference standards. Private testing laboratories servicing food manufacturers, cosmetics companies and pharmaceutical firms operate throughout Kanto's industrial belt, their HPLC systems running near-continuously during business hours. Ibaraki's pharmaceutical manufacturing cluster and Saitama's chemical plants add industrial-grade consumption. This concentration of research, testing and pharmaceutical activities makes Kanto Japan's largest regional acetonitrile consumer, though growth rates lag more dynamic peripheral regions experiencing net investment inflows.

Kinki's 4.2% trajectory balances Osaka's established pharmaceutical manufacturing base with Kyoto's research excellence and Kobe's emerging medical clusters. Osaka's pharmaceutical district hosts legacy plants of major Japanese and foreign pharmaceutical companies, these facilities maintaining decades-long solvent supply relationships with chemical distributors. Shionogi, headquartered in Osaka, operates multiple plants consuming acetonitrile for antibiotic and antiviral production.

Takeda's formulation plants in the region use acetonitrile in quality control laboratories verifying finished product specifications. Kyoto University's pharmaceutical sciences department and associated research institutes generate academic consumption, particularly in natural product chemistry where acetonitrile facilitates extraction and purification of bioactive compounds from plant and microbial sources.

Kobe's medical innovation cluster, supported by prefectural initiatives following the 1995 earthquake reconstruction, attracts medical device and biopharmaceutical startups. While individually small, these ventures collectively increase regional demand for analytical-grade acetonitrile supporting product development and quality testing. Osaka and Kyoto prefectural research centers testing environmental samples and food safety consume acetonitrile year-round. Kinki's chemical industry base, though less pharmaceutical-focused than Kanto, includes fine chemical manufacturers using acetonitrile in specialty synthesis. This mature yet diversified demand profile generates steady growth, with limited volatility compared to regions dependent on single large pharmaceutical facilities.

Chubu's 3.7% growth centers on Shizuoka's pharmaceutical manufacturing cluster and Aichi's chemical industry complex. Shizuoka hosts numerous pharmaceutical plants, including major facilities producing cardiovascular drugs and antibiotics, these operations consuming industrial-grade acetonitrile in synthesis and purification processes. Nagoya's universities and research institutes contribute academic demand, though less concentrated than Tokyo or Osaka. Aichi's chemical manufacturers producing fine chemicals and electronic materials use acetonitrile in specialty applications requiring aprotic solvents. Gifu's pharmaceutical formulation plants employ acetonitrile in analytical labs verifying product quality.

Agricultural testing in Chubu's productive farming regions generates seasonal demand spikes during harvest periods when regulatory authorities and agricultural cooperatives intensify pesticide residue testing. Tea cultivation in Shizuoka specifically requires extensive testing since tea destined for export faces stringent foreign residue limits. Private food testing labs servicing these agricultural sectors maintain year-round acetonitrile inventory despite seasonal workload fluctuations. This combination of pharmaceutical manufacturing, agricultural testing and industrial chemistry creates balanced demand less susceptible to pharmaceutical industry consolidation or research funding cycles affecting regions more dependent on single demand sources.

Tohoku's 3.2% growth emerges from academic research strength at Tohoku University in Sendai and dispersed pharmaceutical manufacturing. Tohoku University's medical school and pharmaceutical sciences programs conduct research requiring analytical-grade acetonitrile, their government and corporate research grants supporting continuous procurement. Pharmaceutical plants scattered across Miyagi, Fukushima and Iwate prefectures produce both prescription drugs and over-the-counter medications, consuming acetonitrile in API synthesis and quality control.

Post-2011 reconstruction included pharmaceutical plant investments supported by government subsidies, these newer facilities incorporating modern solvent recovery systems that, while reducing per-unit consumption, maintain stable virgin acetonitrile purchases for applications where recycled material cannot meet specifications.

Prefectural environmental research centers throughout Tohoku expanded water quality monitoring following tsunami-related contamination concerns, implementing protocols requiring acetonitrile-based analytical methods for detecting industrial chemicals and pharmaceuticals in water supplies. Agricultural testing laboratories analyzing rice, fruit and seafood exported from Tohoku maintain acetonitrile stocks supporting year-round operations. While regional demand remains modest compared to metropolitan regions, stability characterizes Tohoku's consumption: academic budgets, pharmaceutical production schedules and regulatory testing mandates create predictable procurement patterns appealing to distributors seeking reliable order volumes in regions where demand concentration cannot support dedicated inventory.

Rest of Japan's 3.1% growth aggregates Hokkaido, Chugoku, Shikoku and other regions lacking major pharmaceutical concentrations. Hokkaido University in Sapporo generates academic demand supporting research in natural product chemistry and agricultural biotechnology, faculty purchasing analytical-grade acetonitrile through university procurement systems. Regional pharmaceutical plants scattered across smaller cities produce generic drugs and traditional Japanese medicines, these facilities consuming modest acetonitrile volumes for quality control. Prefectural testing laboratories throughout these regions perform mandated environmental monitoring, food safety testing and public health screening, all requiring acetonitrile as a chromatography solvent.

Marine research institutes studying fisheries and aquaculture use acetonitrile extracting compounds from seafood samples for contaminant analysis and nutritional profiling. Agricultural research centers evaluating crop protection chemicals employ acetonitrile in field trial sample analysis. While individual facilities consume small volumes, geographic dispersion necessitates regional distribution networks, enabling suppliers to serve customers economically despite low density. This widely distributed base-load demand creates stability that buffers national consumption against regional economic fluctuations or facility closures affecting concentrated industrial regions.

Japan's acetonitrile demand synthesis reveals pharmaceutical manufacturing anchoring baseline consumption, analytical testing providing steady incremental volume, and research activities generating growth tied to biotechnology investment. Pharmaceutical applications prove relatively price-insensitive: manufacturers absorb solvent cost fluctuations rather than risk production delays from seeking alternative suppliers, since regulatory compliance costs of changing solvent sources far exceed potential savings from commodity arbitrage.

Laboratory testing demand responds to regulatory mandates more than economic cycles, as government inspection schedules and safety protocols proceed regardless of GDP growth rates. Research consumption alone shows meaningful elasticity, contracting during budget cuts but expanding robustly when government prioritizes life sciences funding.

Competitive dynamics feature distinct supplier segments. Domestic producers Asahi Kasei Corporation and Mitsubishi Chemical Corporation manufacture acetonitrile as byproduct from acrylonitrile production, their cost structures benefiting from integration with larger petrochemical complexes. Mitsubishi Gas Chemical Company operates dedicated acetonitrile production optimized for high-purity grades, positioning itself for pharmaceutical and analytical applications.

Global producer INEOS Nitriles imports acetonitrile from overseas plants, competing on price in industrial-grade segments while offering supply security through diversified production geography. Fujifilm Wako Pure Chemical Corporation, specializing in laboratory chemicals, provides ultra-high-purity analytical-grade acetonitrile through Japan's research supply channels, bundling technical support and documentation that laboratory customers value. This structure integrated petrochemical producers, dedicated manufacturers, global importers, and specialty laboratory suppliers ensures product availability across all purity grades and volume requirements, sustaining growth through comprehensive addressability rather than exclusive positioning that might limit adoption.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD million |

| Product Type | Industrial, High Purity Grade |

| Application | Pharmaceuticals, Organic Synthesis, Specialty Chemicals, Extraction, HPLC Solvents, DNA & RNA Synthesis |

| Region | Kyushu & Okinawa, Kanto, Kinki, Chubu, Tohoku, Rest of Japan |

| Countries Covered | Japan |

| Key Companies Profiled | Asahi Kasei Corporation, Mitsubishi Chemical Corporation, Mitsubishi Gas Chemical Company, INEOS Nitriles, Fujifilm Wako Pure Chemical Corporation |

| Additional Attributes | Dollar sales by product type and application, regional CAGR trends, and value-volume shares are evaluated with pharmaceutical vs. analytical adoption, industrial vs. high-purity penetration, supply chain structure, purity compliance, growth opportunities, feedstock-related constraints, and competition among petrochemical producers, specialty chemical firms, and global importers in Japan. |

The demand for acetonitrile in Japan is estimated to be valued at USD 17.5 million in 2025.

The market size for the acetonitrile in Japan is projected to reach USD 29.6 million by 2035.

The demand for acetonitrile in Japan is expected to grow at a 5.4% CAGR between 2025 and 2035.

The key product types in acetonitrile in Japan are industrial grade and high purity grade.

In terms of application, pharmaceutical segment is expected to command 34.0% share in the acetonitrile in Japan in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Japan Faith-based Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Sports Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Respiratory Inhaler Devices Market Size and Share Forecast Outlook 2025 to 2035

Japan Halal Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Automated People Mover Industry Size and Share Forecast Outlook 2025 to 2035

Japan Automotive Load Floor Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Japan Food Cling Film Market Size and Share Forecast Outlook 2025 to 2035

Japan Polypropylene Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Acetonitrile Market Growth - Trends & Forecast 2025 to 2035

Japan Probiotic Yogurt Market is segmented by product type, source type, nature type, flavor type, fat content, sales channel and key city/province through 2025 to 2035.

japan Tortilla Market - Growth, Trends and Forecast from 2025 to 2035

Japan Cosmetics ODM Market Analysis - Size, Share & Trends 2025 to 2035

Japan Automotive Turbocharger Market Insights – Demand, Size & Industry Trends 2025–2035

Japan Yeast Market Insights – Demand, Size & Industry Trends 2025–2035

Japan Green and Bio-based Polyol Market Insights – Demand, Size & Industry Trends 2025–2035

Japan Natural Food Color Market Trends – Growth, Demand & Forecast 2025–2035

Japan Coated Fabrics Market Growth – Trends, Demand & Innovations 2025–2035

Japan Barite Market Growth – Trends, Demand & Innovations 2025–2035

Japan 1,4-Diisopropylbenzene Market Growth – Trends, Demand & Innovations 2025–2035

Japan Compact Construction Equipment Market Insights – Demand, Size & Industry Trends 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA