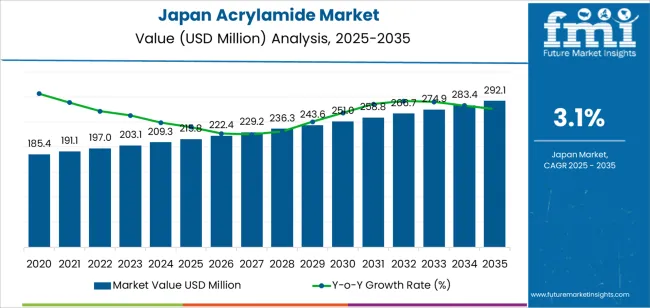

The demand for acrylamide in Japan is projected to grow from USD 215.8 million in 2025 to USD 292.1 million by 2035, reflecting a compound annual growth rate (CAGR) of 3.1%. Acrylamide is used in a variety of industrial applications, including water treatment, food processing, and in the production of polymers and chemicals. As industries continue to expand their use of acrylamide for these purposes, the demand is expected to increase steadily. The growing need for effective wastewater treatment and the continued demand for polyacrylamide in various sectors, including agriculture and oil extraction, will drive market growth over the forecast period.

Year-over-year (Y-o-Y) growth will be steady, with the market increasing from USD 215.8 million in 2025 to USD 222.4 million in 2026, and USD 229.2 million in 2027. By 2029, demand will reach USD 243.6 million, with continued growth expected through 2030, reaching USD 251.0 million. By 2035, the demand for acrylamide is forecasted to reach USD 292.1 million, reflecting long-term, steady growth across the key industries that rely on this chemical.

The acrylamide industry in Japan is expected to grow steadily over the next decade. Starting at USD 215.8 million in 2025, the market will gradually increase, reaching USD 222.4 million in 2026 and USD 229.2 million in 2027. By 2029, the demand for acrylamide will grow to USD 243.6 million, continuing upward to USD 258.8 million by 2030. By 2035, the market is forecasted to reach USD 292.1 million, driven by increasing demand in water treatment, industrial applications, and food processing.

The half-decade weighted growth analysis highlights steady and consistent growth over the next five years. From 2025 to 2030, the market will experience gradual increases in demand, with the compound weighted growth reflecting an overall steady market expansion. The growth rate will remain relatively consistent, with demand rising incrementally year by year. By the end of this period, the weighted growth will reflect the continued application of acrylamide in various sectors, contributing to a stable and predictable market trajectory over the next half-decade.

| Metric | Value |

|---|---|

| Industry Sales Value (2025) | USD 215.8 million |

| Industry Forecast Value (2035) | USD 292.1 million |

| Industry Forecast CAGR (2025-2035) | 3.1% |

Demand for acrylamide in Japan is rising due to its crucial role as a raw material for polyacrylamide (PAM), which is widely used in water and wastewater treatment, paper and pulp processing, and oil and gas applications. Japan's increasing water treatment needs, driven by stringent regulatory standards and environmental concerns, contribute to the rising demand for acrylamide. Polyacrylamide, derived from acrylamide, is essential for treating municipal and industrial wastewater, helping to remove suspended solids and improve water quality.

Similarly, in the pulp and paper industry, acrylamide-based polymers are used to enhance paper strength, improve the efficiency of the production process, and boost overall yield. These industrial applications remain key drivers of acrylamide demand in Japan, particularly as industries focus on meeting environmental standards and improving operational efficiency.

The demand for acrylamide in Japan is also supported by broader global trends. As industries around the world continue to expand, the need for water treatment, paper production, and oil extraction processes requiring acrylamide-based products continues to grow. Additionally, the increasing focus on cleaner water, wastewater management, and efficient industrial processes is further boosting the demand for acrylamide in Japan. With strong applications across various sectors and the growing need for environmental management, the market for acrylamide is expected to see continued growth in Japan over the coming years.

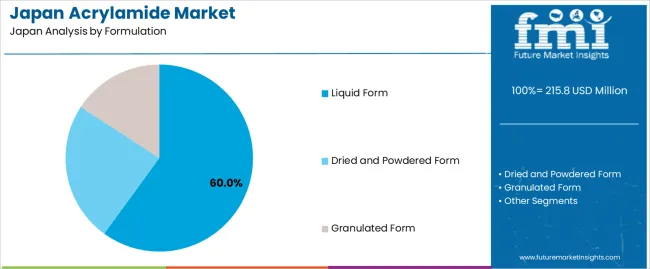

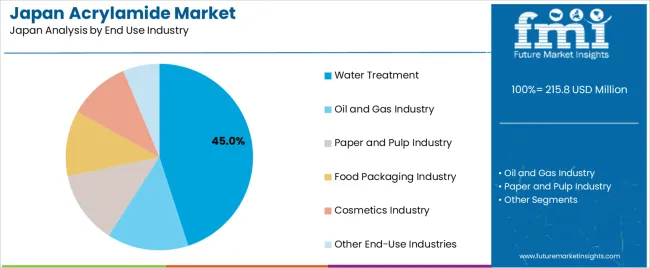

The demand for acrylamide in Japan is primarily driven by formulation and end-use industry. The leading formulation is liquid form, accounting for 60% of the market share, while water treatment is the dominant end-use industry, capturing 45% of the demand. Acrylamide is widely used in various industrial applications, particularly in water treatment, paper production, and oil recovery, where its properties as a flocculant and polymerization agent are highly valued. As industries continue to focus on sustainability and process optimization, the demand for acrylamide in Japan is expected to grow.

Liquid form acrylamide leads the demand in Japan, holding 60% of the market share. The liquid formulation of acrylamide is preferred for its ease of use and efficient application in various industrial processes. In its liquid state, acrylamide is commonly utilized in water treatment, where it is used as a coagulant and flocculant to remove impurities and improve water quality. Liquid acrylamide is also used in oil and gas recovery, paper production, and the creation of polyacrylamide, which has applications in wastewater treatment and soil conditioning.

The demand for liquid form acrylamide is driven by its convenience and versatility in industrial applications. The liquid form allows for easier handling, quicker dissolution in water, and more precise dosing, which enhances its effectiveness in large-scale operations. With increasing emphasis on efficient water treatment and industrial process optimization in Japan, the liquid form of acrylamide remains the preferred choice in various industries, ensuring its continued dominance in the market.

Water treatment is the leading end-use industry for acrylamide in Japan, accounting for 45% of the demand. Acrylamide is crucial in water treatment applications, particularly as a key ingredient in polyacrylamide-based flocculants, which are used to remove suspended solids, organic material, and other contaminants from water. The compound plays a critical role in both municipal water treatment and industrial wastewater treatment processes, where it helps improve water clarity and quality.

The demand for acrylamide in water treatment is driven by the growing need for effective and sustainable solutions to manage water resources. As environmental regulations become more stringent and industries continue to seek ways to reduce their environmental impact, the demand for acrylamide-based flocculants is expected to rise. This trend is especially evident in Japan, where water treatment processes are a priority in maintaining clean water sources and ensuring efficient wastewater management. As Japan focuses on improving water quality and sustainability, the demand for acrylamide in water treatment will continue to grow.

Demand for Acrylamide in Japan is shaped primarily by its role as a precursor to Polyacrylamide (PAM), which is extensively used in water treatment, pulp and paper production, and industrial wastewater handling. Water treatment and paper sectors remain the principal users of PAM, generating consistent baseline demand for acrylamide. As wastewater management standards and industrial effluent treatment requirements evolve, need for effective flocculants and coagulants persists, supporting steady consumption of acrylamide.

At the same time existing industrial processes relying on resin or polymer intermediates maintain demand for acrylamide supply. Overall demand appears stable rather than rapidly expanding, driven by ongoing maintenance, replacement and steady industrial activity rather than large scale new industrial buildouts.

A key driver is the demand for effective water and wastewater treatment. Polyacrylamide derived from acrylamide serves as a flocculant and coagulant, enabling efficient removal of suspended solids, sludge dewatering, and separation of contaminants. As industrial plants and municipal facilities seek reliable treatment chemicals, acrylamide remains essential in supplying PAM. Another driver is the pulp and paper industry, which uses acrylamide based resins or binding agents to strengthen paper and improve quality during pulp processing.

This provides a stable industrial stream of demand. Additionally, industrial processes in sectors such as mining, minerals processing, and possibly oil field chemical applications support demand for acrylamide as an intermediate. Domestic production capability in Japan helps ensure supply reliability for these industrial users, which supports continued consumption.

Use of acrylamide faces constraints related to health and regulatory scrutiny. Acrylamide is known to be reactive and potentially hazardous; concerns about toxicity and safety may limit applications, especially where human exposure or environmental discharge is possible. This can discourage some industries from using acrylamide derived polymers or prompt shifts toward alternative chemicals or treatment methods.

Another restraint arises from availability of alternate flocculants or treatment chemicals that may reduce reliance on acrylamide based PAM. Where those alternatives offer comparable performance with fewer regulatory hassles, users might switch. Additionally, fluctuations in feedstock costs or raw material availability (for example, precursors needed to produce acrylamide) can raise production cost of acrylamide, making it less attractive. Finally, sectors with declining output for example a shrinking paper industry can erode base demand.

A continuing trend is sustained reliance on acrylamide based polymers for water treatment and wastewater management, given stricter effluent standards and rising demand for clean water treatment. As industrial and municipal wastewater handling remains important, acrylamide remains a core chemical input. In pulp and paper processing, demand persists for binding resins and retention aids derived from acrylamide, though overall paper demand may shape volume.

Another trend involves cautious re evaluation of chemical safety and regulatory compliance; this may push manufacturers toward higher purity acrylamide grades or alternate polymer chemistries in sensitive applications. In industrial sectors such as minerals or chemical processing, acrylamide may continue to serve as an intermediate where performance and cost align with requirements. As supply chains evolve, domestic production and quality control may support stable supply, which influences demand maintenance rather than growth.

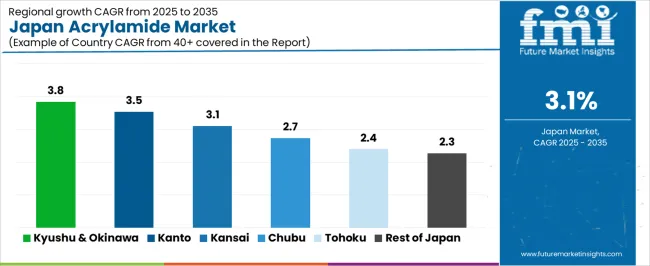

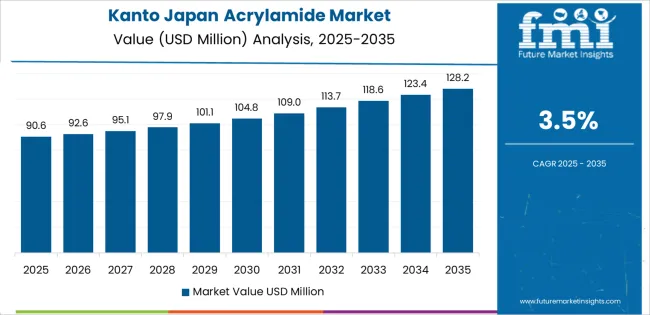

The demand for acrylamide in Japan shows steady growth across regions. Kyushu & Okinawa lead with a CAGR of 3.8%, driven by the region’s focus on industrial growth and sustainable water management. Kanto follows closely with a CAGR of 3.5%, supported by strong industrial and chemical production. The Kinki region’s CAGR is projected at 3.1%, reflecting stable growth driven by its manufacturing sector. Chubu, Tohoku, and the Rest of Japan show more moderate growth, with CAGRs of 2.7%, 2.4%, and 2.3% respectively. These variations reflect differing industrial demands, water treatment requirements, and regional environmental regulations.

| Region | CAGR (%) |

|---|---|

| Kyushu & Okinawa | 3.8 |

| Kanto | 3.5 |

| Kinki | 3.1 |

| Chubu | 2.7 |

| Tohoku | 2.4 |

| Rest of Japan | 2.3 |

In Kyushu & Okinawa, the demand for acrylamide is expected to grow at a CAGR of 3.8%. The region’s diverse industrial base, which includes agriculture, manufacturing, and water treatment, is a key driver. Acrylamide is primarily used in polyacrylamide production, which serves as a flocculant in wastewater treatment and industrial processes. As environmental regulations become more stringent, industries are increasingly turning to acrylamide-based solutions for more efficient water purification.

The growing demand for clean water and sustainable practices, particularly in the agricultural and industrial sectors of Kyushu & Okinawa, is further contributing to the demand for acrylamide. The region’s focus on improving infrastructure and its strong emphasis on environmental preservation ensure steady growth in demand for acrylamide.

In Kanto, the demand for acrylamide is projected to grow at a CAGR of 3.5%. Kanto’s strong industrial presence, particularly in chemical production, electronics, and automotive manufacturing, is a primary driver for acrylamide use. Polyacrylamide, derived from acrylamide, is widely used in these sectors for water treatment, wastewater management, and as a thickening agent in various industrial processes.

The region’s ongoing efforts to meet environmental regulations and improve waste management systems further boost demand for acrylamide. Additionally, Kanto’s large urban population increases the need for wastewater treatment and water purification systems, which rely on acrylamide-based compounds for effective treatment. As industrial production scales up and regulations continue to tighten, Kanto’s demand for acrylamide will likely remain strong.

The demand for acrylamide in Kinki is expected to grow at a CAGR of 3.1%, supported by the region’s well-established industrial base. Kinki, home to cities like Osaka and Kyoto, has a strong manufacturing sector, particularly in the chemical, textile, and food industries, which are major users of acrylamide-based products. Polyacrylamide is used extensively in water treatment applications to manage industrial wastewater and improve water quality.

The growing focus on sustainability and stricter environmental standards in Kinki is contributing to the increased use of acrylamide in both industrial and agricultural sectors. Additionally, Kinki’s emphasis on improving manufacturing efficiency and reducing pollution further supports the demand for acrylamide-based water treatment solutions. While the growth rate is more moderate than in other regions, Kinki’s industrial diversification ensures steady demand for acrylamide.

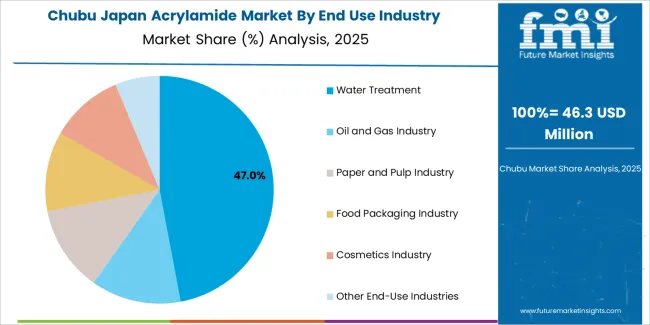

In Chubu, the demand for acrylamide is expected to grow at a CAGR of 2.7%, driven by the region’s diverse industrial activities. Chubu is home to Nagoya, a major industrial hub, where acrylamide is primarily used in manufacturing processes such as water treatment, paper production, and textile processing. As industries in Chubu continue to adopt environmentally sustainable practices, the demand for acrylamide in water treatment and wastewater management is increasing.

The region’s focus on improving industrial processes and reducing chemical waste contributes to this trend. While Chubu’s demand for acrylamide is growing, it is relatively slower compared to regions like Kyushu & Okinawa and Kanto due to the more traditional nature of some industries. Nonetheless, as industrial modernization continues, the adoption of acrylamide in Chubu’s manufacturing sector is expected to rise gradually.

In Tohoku, the demand for acrylamide is projected to grow at a CAGR of 2.4%, reflecting slower growth compared to other regions. Tohoku’s industrial base is smaller, and its manufacturing and agricultural sectors have historically been less reliant on acrylamide-based products. However, as environmental concerns grow and the region’s agricultural practices evolve, there is increasing demand for acrylamide in water treatment and soil conditioning applications. Additionally, Tohoku’s focus on sustainable agricultural practices and improving water quality in rural areas is contributing to the gradual rise in acrylamide use. While Tohoku lags behind more industrialized regions, the increasing adoption of eco-friendly farming techniques and water treatment solutions ensures steady growth in demand for acrylamide.

In the Rest of Japan, the demand for acrylamide is expected to grow at a CAGR of 2.3%. This region, which encompasses less industrialized and more rural areas, shows slower growth in acrylamide demand. However, the adoption of acrylamide-based products is increasing in agriculture, wastewater treatment, and small-scale manufacturing. As environmental sustainability becomes a key focus nationwide, the Rest of Japan is gradually shifting towards more efficient water treatment solutions, which include acrylamide-based flocculants. While the demand is growing slowly, the push for cleaner and more efficient industrial processes and water management is expected to contribute to steady, if modest, growth in the region’s acrylamide demand over the coming years.

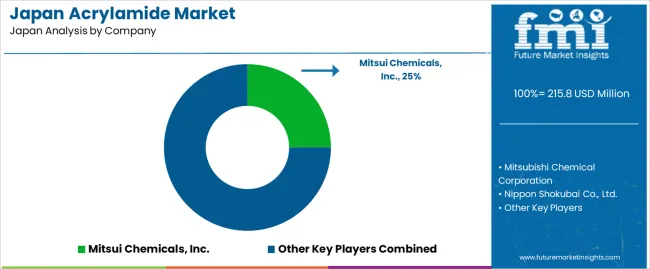

Demand for acrylamide in Japan remains significant due to its use in water treatment chemicals, wastewater treatment, paper processing, and industrial polymer production. Leading suppliers in the Japanese market include Mitsui Chemicals, Inc. (estimated 25% share), Mitsubishi Chemical Corporation, Nippon Shokubai Co., Ltd., Dia Nitrix Co., Ltd., and Showa Denko K.K. These companies supply monomer grade acrylamide and polymer grade derivatives used in flocculants, soil conditioning agents, and specialty polymers. The demand is supported by industrial growth in sectors such as construction, water management, and manufacturing.

Competition in this industry is primarily based on product purity, quality control, and supply reliability. Firms emphasize high purity acrylamide suitable for sensitive water treatment and polymer synthesis processes, ensuring minimal contaminant levels and consistent batch quality. Another important factor is regulatory compliance and safety standards, since acrylamide is a hazardous chemical. Companies offering comprehensive safety documentation, secure transport, and handling support gain preference with industrial buyers.

Supply chain stability also matters because many applications depend on consistent imports or domestic production to avoid production interruptions. Marketing and technical documentation typically highlight monomer purity, residual monomer levels in polymers, batch traceability, and compliance with Japanese industrial regulations. Providers that meet these technical and compliance requirements maintain stronger positions in Japan’s acrylamide market.

| Items | Details |

|---|---|

| Quantitative Units | USD Million |

| Regions Covered | Japan |

| Formulation | Liquid Form, Dried and Powdered Form, Granulated Form |

| End-Use Industry | Water Treatment, Oil and Gas Industry, Paper and Pulp Industry, Food Packaging Industry, Cosmetics Industry, Other End-Use Industries |

| Key Companies Profiled | Mitsui Chemicals, Inc., Mitsubishi Chemical Corporation, Nippon Shokubai Co., Ltd., Dia-Nitrix Co., Ltd., Showa Denko K.K. |

| Additional Attributes | The market analysis includes dollar sales by formulation, end-use industry, and company categories. It also covers regional demand trends in Japan, driven by the increasing use of acrylamide in water treatment, oil and gas, paper and pulp, and food packaging industries. The competitive landscape highlights key manufacturers focusing on innovations in acrylamide formulations for various industrial applications. Trends in the growing demand for acrylamide in cosmetics and other specialized industries are explored, along with advancements in the production and safety standards related to its use in manufacturing processes. |

The demand for acrylamide in Japan is estimated to be valued at USD 215.8 million in 2025.

The market size for the acrylamide in Japan is projected to reach USD 292.1 million by 2035.

The demand for acrylamide in Japan is expected to grow at a 3.1% CAGR between 2025 and 2035.

The key product types in acrylamide in Japan are liquid form, dried and powdered form and granulated form.

In terms of end use industry, water treatment segment is expected to command 45.0% share in the acrylamide in Japan in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Japan Faith-based Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Sports Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Respiratory Inhaler Devices Market Size and Share Forecast Outlook 2025 to 2035

Japan Halal Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Automated People Mover Industry Size and Share Forecast Outlook 2025 to 2035

Japan Automotive Load Floor Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Japan Food Cling Film Market Size and Share Forecast Outlook 2025 to 2035

Japan Polypropylene Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Acrylamide Market Growth - Trends & Forecast 2025 to 2035

Japan Probiotic Yogurt Market is segmented by product type, source type, nature type, flavor type, fat content, sales channel and key city/province through 2025 to 2035.

japan Tortilla Market - Growth, Trends and Forecast from 2025 to 2035

Japan Cosmetics ODM Market Analysis - Size, Share & Trends 2025 to 2035

Japan Automotive Turbocharger Market Insights – Demand, Size & Industry Trends 2025–2035

Japan Yeast Market Insights – Demand, Size & Industry Trends 2025–2035

Japan Green and Bio-based Polyol Market Insights – Demand, Size & Industry Trends 2025–2035

Japan Natural Food Color Market Trends – Growth, Demand & Forecast 2025–2035

Japan Coated Fabrics Market Growth – Trends, Demand & Innovations 2025–2035

Japan Barite Market Growth – Trends, Demand & Innovations 2025–2035

Japan 1,4-Diisopropylbenzene Market Growth – Trends, Demand & Innovations 2025–2035

Japan Compact Construction Equipment Market Insights – Demand, Size & Industry Trends 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA